Buy above $9If price drops back below $9, I'm going to be having a word with the charting gods. The technical setup here is very textbook.

White boxes on the chart may be fractals.

(Essentially, waves of momentum that ripple through like little mirror signatures after the initial wave.)

Tilray has a crazy awesome bullish setup over the next month or two, but oddly other markets I am seeing bearish signs. The only explanation I can think of is maybe Tilray is partly seen as a recessionary play due to their alcohol business and capital is switching sectors. One positive sign for Tilray is even though it is listed in the Nasdaq, even while the Nasdaq was red today (01/02/26), Tilray was UP +7%. Unexpected bullish divergence.

The other option is that this is all liquidity based and it's just the fact that rescheduling cannabis should lead to greater liquidity in the sector.

Who knows.

But!

IF the gods aren't completely screwing with us, Tilray should revisit $15 in the next few months. If Trump comes out and says, "Actually, I lied, and weed is bad." THEN the rally could end and we reverse the whole thing.

I love this stock long-term no matter what.

I think when the U.S. Treasury goes tits up, obviously everything will enter crisis, but they'll love cannabis once we peasants really get pissed and start banging on the doors. They'll legalize weed while we enter a lost decade and reshuffle the monetary system.

One day, cannabis will be a commodity again, like wheat, cotton, etc., but that's just my opinion and a bit of a historical cycle thing.

Tilray Brands, Inc.

No trades

Market insights

Buy the DipI am buying this dip. We've re-entered a good support area, but we need to watch the gap from Friday 12Dec2025. Gaps can be magnetic in that the market wants price discovery in those areas.

Entering the gap is fine, but if price starts to drag down to $9 then we are in caution mode. This December impulsive move up looks like a smaller fractal of the larger move up from July-October. IF that holds, it is mega-bullish.

For me, it all depends on what happens in that gap.

Best case, we hold above $10, build structure, and then launch up.

Worst case, we enter the gap, don't find buyers, and the smaller fractal fails when price closes below $9 and does not immediately gap back up on the next open.

Tilray: 80% gains!TLRY shares have made significant strides, boasting a gain of over 80%. Currently, the price continues to develop within orange wave iii, aiming to surpass the resistance at $23.20 in the next phase. A drop below the support at $3.51, however, would trigger our alternative scenario. In this case, it implies that the large beige wave alt.W is not yet complete (Probability: 33%).

Go TimeThis is the bounce we've been waiting for.

We have entered buy the dip mode on Tilray.

As long as we hold above $8.80, I'm bullish.

Biggest risk is that Trump 180's, but my longstanding theory has been and still is that the government is saving cannabis legalization for the next big downturn. Next depression? Legalize weed and then the working class won't revolt.

There are signs in the oil and debt markets that are saying this is beginning now. Just beginning.

Tilray Soars on Trump Policy Shift: Buy or Sell?Tilray (TLRY) shares jumped 30% following major political news. President Donald Trump announced plans to reclassify cannabis as a Schedule III drug. Additionally, a new pilot program may allow seniors to buy cannabis through Medicare. The stock has now doubled since its December lows. This analysis breaks down why this matters for your portfolio across key sectors.

Geopolitics and Strategy: The Policy Pivot

The U.S. government is changing its strategic stance on cannabis. President Trump’s potential executive order signals a massive shift in federal law. Moving cannabis to "Schedule III" lowers its legal severity. This aligns the U.S. with other progressive nations. For Tilray, this removes the constant fear of federal prosecution. It creates a safer environment for institutional investors to enter the market.

Economics: Tax and Banking Freedom

Reclassification solves two major economic problems for Tilray. Currently, cannabis companies pay extremely high taxes because of "Section 280E." This rule prevents them from deducting normal business expenses. Schedule III status removes this burden. It instantly improves cash flow and profitability. Furthermore, it opens access to traditional banking services, reducing the cost of doing business.

Business Models: The Senior Market

The proposed Medicare pilot program is a game-changer. It allows the government to subsidize cannabis for seniors. This creates a stable, guaranteed revenue stream for Tilray. Seniors often use these products for pain relief and health. This shifts the business model from recreational use to "medical necessity." A government-backed customer base is highly reliable and lucrative.

Science and Innovation: Research Growth

Strict laws previously blocked scientific research. Reclassification makes Research and Development (R&D) much easier. Tilray can now study cannabis compounds more freely. This accelerates the creation of new medical products. Patent analysis suggests this will lead to proprietary formulas. Owning exclusive medical patents creates a "moat" that protects Tilray from competitors.

Market Data: What Traders Are Betting

Options traders expect huge volatility. Data shows traders are pricing in a 50% move by March 2026. The target price in this bullish scenario is $21.22. This means investors are willing to bet money that the stock will rise significantly. Sentiment is aggressive and optimistic.

Technical Analysis: The Trend is Up

The stock chart confirms the positive news. Tilray is trading above its 50-day, 100-day, and 200-day moving averages. These are key lines that determine the trend direction. When the price is above them, the trend is "Bullish" (upward). The Relative Strength Index (RSI) is at 53, showing the rally has room to grow.

Conclusion: Wall Street’s Verdict

Analysts rate Tilray as a "Moderate Buy." Price targets reach as high as $25, suggesting a potential 75% gain. The combination of tax relief, new senior customers, and technical momentum makes a strong case. However, the move depends on the Executive Order becoming law. Investors should watch for official confirmation from the White House.

TLRY📌 TLRY: Why did the stock soar 65% and what's next?

Last week saw the biggest weekly gain in the company's history.

We won't go into too much detail on the fundamentals, but here's a quick overview:

Revenue breakdown by product for the quarter:

Canadian recreational cannabis: ~$59.1 million — the core of the Canadian business

Canadian medical cannabis: ~$6.7 million

International medical cannabis: ~$14.9 million — the key growth rate (+71% in the last quarter of 2025!)

At the same time, cash flows, and earnings are in negative territory on a TTM basis.

Net debt ~59 M

P/B ~0.9

Now to the most interesting part:

This share price increase is related to the likelihood of cannabis being reclassified in the US from Schedule I to Schedule III of controlled substances.

What does this mean:

1. Repeal of Section 280E of the US Internal Revenue Code

Currently, companies operating with cannabis in the US cannot deduct regular business expenses (rent, salaries, marketing) when calculating their income taxes. This severely compresses margins.

Reclassification will automatically remove this limitation.

2. Access to Capital and Banks

Breaking; Tilray Brands, Inc. (NASDAQ: TLRY) Spike 41% Today Shares of Tilray Brands, Inc. (NASDAQ: TLRY) saw a noteworthy uptick of 41% today defying market sentiment. For the past 2 days the stock has bounced from the $7 support zone eyeing the $15 resistant point.

Ascertaining the bullish thesis is the RSI at 56, giving room for further price uptick since the asset is not overbought.

In another news, Trump expected to sign executive order to reclassify marijuana as soon as Monday, source tells CNBC.

President Donald Trump is expected to issue an executive order as soon as Monday that would allow for reclassification of weed, a source familiar with the matter told CNBC. Such a move would allow cannabis companies to fall under different tax regulations and encourage investment.

Cannabis stocks took a leg up in Friday’s midday trading following CNBC’s report.

Tilray shares were recently trading at a little more than $10 after peaking at more than $2,140, adjusted for splits, in September 2018. The Amplify Cannabis ETF is still on track to lose more than 8% in 2025, its fifth straight down year.

Analyst Summary

According to 3 analysts, the average rating for TLRY stock is "Buy." The 12-month stock price target is $150.0, which is an increase of 1,259.93% from the latest price.

Tilray Brands, Inc., a lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Patience is KEYVery clear impulsive bullish price action from July-October.

We have pulled back currently 50%.

We're at a potentially good swing trade price, but I want to stack this stock for the long-term so I'm not buying yet. Before I buy, I want to see a shorter-term uptrend begin again and buy a pullback. Not looking to catch this falling knife.

***(Note: Since the bullish price action occurred around a news event where Trump talked about de-regulating cannabis, the bullish move may not last. This is why patience is key. This happened during Biden as well. Tilray 3-4x in weeks then bled back down to lower lows once people realized it was just talk.)

I am long-term bullish on this stock however.

I would love to buy sub-$1 on a little uptrend and hold for 5-10 years even.

Tricky Tilray When I am blazed out of my mind at 11pm, this is when I do my best analysis. If I wake up and remember my visions, it means something.

When the price action in the green box is mirrored, we basically have a possible blueprint to what comes next. First 3 waves match up pretty well.

Like and follow if you want more Tilray induced visions

TLRY Gap filled ?With the present catalysts and news that are out more and more bullish, that s what i expect from Tilray to do in the next few months.

Of course if the sch III gets approved my idea is worth nothing because we ll jump to 5$ in no time.

So keep holding in my opinion.....it look very bullish for me !

1.80 this week Posting this chart to show some obvious short term levels if your trading this is I was lucky enough to get Jan 26 1C for .21. I think TLRY could run to 2 pretty easily based on current momentum.

Trump said he was looking into declassification when asked today and has shown support before for rescheduling, decriminalization, and state rights to legalize cannabis.

"It could take a few weeks and is very complicated." he said

I grabbed safer calls to far out although 100% gain today. The closer dated 1.5 calls are cheap and ran 3x as hard ill be looking to load some tm if chart remains above daily MAs. IF weed actually somehow gets declassified $3 should be easy. Up at $1.09-1.16 overnight would be bullish to hold $1 for entry. 4hr RSI is at 90 so this meme like rally could end abruptly or maybe it wants 1.50 first.

Revenue has steadily been growing nothing crazy still not profitable and they have been diluting Gross margin is 29.49%, with operating and profit margins of -13.04% and -266.25%.

Plenty of risk 17% short float.

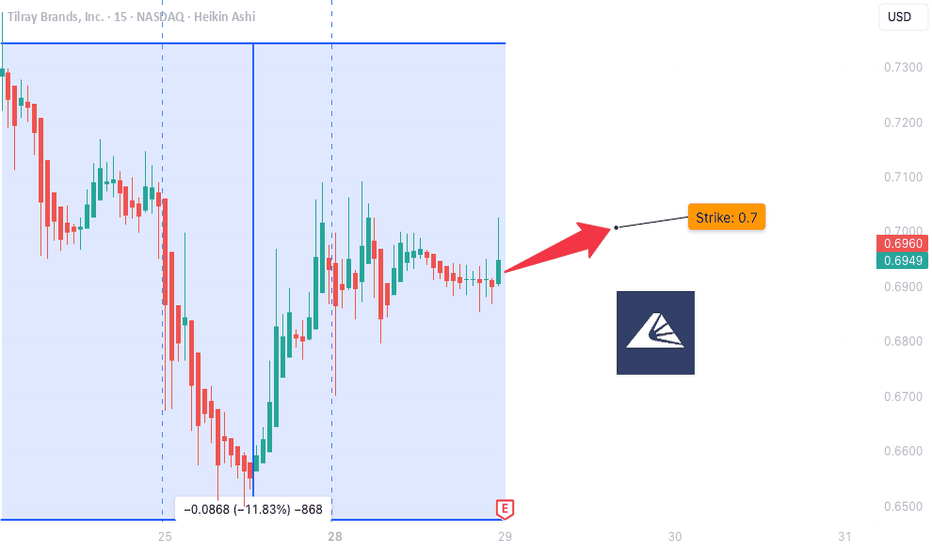

TLRY Earnings Play: Lotto-Style PUT Setup

📉 **TLRY Earnings Play: Lotto-Style PUT Setup**

*Tilray Brands (TLRY) - Earnings Due July 30 (AMC)*

🔻High risk. High reward. Possibly… nothing. But here's the setup:

---

### 🔬 Fundamental Breakdown:

* 💸 **TTM Revenue Growth**: -1.4% (🚩 declining)

* 📉 **Profit Margin**: -114.4%

* 🧾 **Operating Margin**: -16.8%

* 🧠 **EPS Surprise (avg 8Q)**: **-89.4%**, with only **12% beat rate**

* 🧯 **Sector Risk**: Cannabis = Over-regulated + Overcrowded

🧮 **Fundamental Score**: 2/10 → Broken business model.

---

### 📊 Technicals:

* 🔺 Above 20D MA (\$0.61) and 50D MA (\$0.49)

* 🔻 Well below 200D MA (\$0.91)

* 📉 Volume 0.72x = Weak institutional interest

* 📏 RSI: 57.69 (neutral drift)

**Technical Score**: 4/10 → Weak drift, low conviction.

---

### ⚠️ No Options Flow. No Big Bets Seen.

(But that’s exactly what makes this a clean lotto...)

---

## 🎯 Lotto Trade Idea:

```json

{

"Type": "PUT",

"Strike": "$0.70",

"Expiry": "Aug 1, 2025",

"Entry": "$0.10",

"Profit Target": "$0.50",

"Stop Loss": "$0.035",

"Confidence": "30%",

"Size": "2% portfolio max",

"Timing": "Pre-earnings close"

}

```

---

### 🧠 Strategy:

This is not a trade based on strength. It’s based on **TLRY’s consistent failure to deliver** — and if it disappoints again, we ride the downside. If not? Risk tightly capped.

---

⚖️ **Conviction**: 35%

💀 **Risk**: Total loss possible

🚀 **Reward**: 400%+ possible

---

📝 *Not financial advice — just one degenerate’s earnings notebook.*

💬 Drop your TLRY lotto plans below👇

TLRY Trade Update – Island Reversal in Play?🚨 TLRY Trade Update – Island Reversal in Play? 🚨

I’ve been tracking Tilray (TLRY) for a while now. While the company has struggled, it’s now trading well below book value and showing some life on the charts. Here’s what I’m seeing — and how I’m positioned.

My Position:

50 contracts Jan 2026 $0.50 Calls @ $0.11

50 contracts Jan 2027 $0.50 Calls @ $0.18

Defined risk, big potential. I’m playing both the short-term breakout and the long-term value thesis.

Why I Entered When I Did:

When I watch stocks, I’m always focused on the chart, not just the price. I zoom out — monthly, weekly, daily — then zoom in: hourly, even 5–10 min on high-volume names.

On June 25th, TLRY broke above the hourly trendline. That was a key technical shift. From there, it began forming a bullish flag-like pattern — right after hitting new lows. That setup caught my attention.

I debated buying shares or options. I chose long-dated calls to fully define my risk and selected a strike that I believed could end up in the money. Ultimately, I went out to 2026 and 2027 to give the pattern — and potential catalyst flow — time to work.

Because in the end:

👉 Time is more important than price.

📊 Technical Breakdown:

1-Hour Chart:

Clean breakout above $0.41–$0.44

Targeting a test of $0.64 (prior breakdown zone)

Solid momentum and volume

Daily Chart:

Potential island reversal forming

Gap fill potential to $1.34

Confluence with moving averages turning up

Fundamentals:

Trading at ~$0.48 with book value near $2.80

Market cap under $500M

Exposure to cannabis, beverages, CBD, and European growth

Possible M&A or policy tailwinds still on the table

🎯 TLRY Price Targets:

$0.64

Retest of breakdown zone

Short-term (1–2 weeks)

$0.80–$0.90

Previous consolidation/resistance

Medium-term (1–2 months)

$1.34

Gap fill zone

Long-term (3–6 months)

$2.80+

Return to book value

Tail event (6–18 months)

Risk is defined. Structure is forming. If price and fundamentals align, TLRY could have room to run. Keep an eye on volume at each level and how it handles the $0.64 test.

Let’s see if the reversal holds 🔄

P.S. Since writing this breakdown, TLRY has continued its move and closed strong. While short-term price action may vary, the core thesis remains intact: the structure, volume, and breakout levels are all part of the bigger setup I'm tracking. This is a long-term swing with defined risk, and I’ll continue to post updates as the trade unfolds.

TLRY BUYBUY TLRY at .10 to .06, riding it back up to 2.90 to 4.90 as Profit Targets, Stop Loss is at .01!

If anyone likes mumbo jumbo long useless analysis, than this is NOT for you.

Also, if you are afraid of risk, failure, and want only a 100% sure thing, than

run as fast as you can from here and from the markets,

because it is definitely NOT for you.

WARNING: This is just my opinion of the market and its only for journaling purpose. This information and any publication here are NOT meant to be, and do NOT constitute, financial, investment, trading, or other types of advice or recommendations. Trading any market instrument is a risky business, so do your own due diligence, and trade at your own risk. You can loose all of your money and much more.

$NASDAQ:TLRY Up in Smoke or Waiting for the Puff and Pump?NASDAQ:TLRY Up in Smoke or Waiting for the Puff and Pump?

Left for Dead or a Sleeper Rocket in the Making? 🚀

Alright, let’s talk about Tilray (TLRY). I know what you’re thinking: this thing’s been taken behind the woodshed, beaten, and then fed through the wood chipper—twice. Technically speaking, it’s been in a brutal downtrend. But here's where it gets interesting...

Since December, I’ve been noticing signs of quiet accumulation. Volume patterns are showing life. This isn’t just random noise... it looks like smart money nibbling while the rest of the market sleeps.

Fundamentally, it's trading at 0.68x sales and a crazy 0.17x price to book. That’s deep value territory... basically priced like it’s going out of business, which it’s not. Cannabis isn’t going anywhere, and when this sector comes back (and it will), I want to already be on the launchpad.

Now imagine a scenario: Trump leans on Musk-style libertarian logic, and pushes for federal legalization to fill the coffers with tax revenue (and their pockets as they and their friends will be ahead of the trend as all politicians at that level are). Boom. You think this thing trades at 65 cents for long? Me neither.

I’m not saying we’re going to $5 next week....but the risk/reward here feels very asymmetrical. Worst case? We chop sideways or retest lows. Best case? We get a face-melter rally that TLRY has shown it's capable of in the past.

This is precisely the kind of chart I look for. Beaten up, forgotten, but technically setting up... and fundamentally undervalued.

Not financial advice. Just sharing my thinking as someone who loves deep contrarian setups.

54% move completed. here's why this is the bottom.MARKETSCOM:TILRAY

we have just completed the 54% move down after the breakdown. you are supposed to take the highest move in the pattern and put it at the point of breakdown. the expected move after breakdown was 54% and we just hit that around 79 cents. this should be the local bottom. i have an average of .86 and am buying more

TLRY - A Last Gasp of a Dying Industry, Or?.....Cannabis stocks have been nothing short of annihilated lately.

The last administration failed to deliver on their hot air promises and now the current one has done nothing to help the industry. Yet.

We're headed either toward mass bankruptcy or the beginning of a new cycle.

TLRY around 25 on the weekly RSI, as low as it's ever been. Getting hammered.

I'm optimistic, probably foolishly...