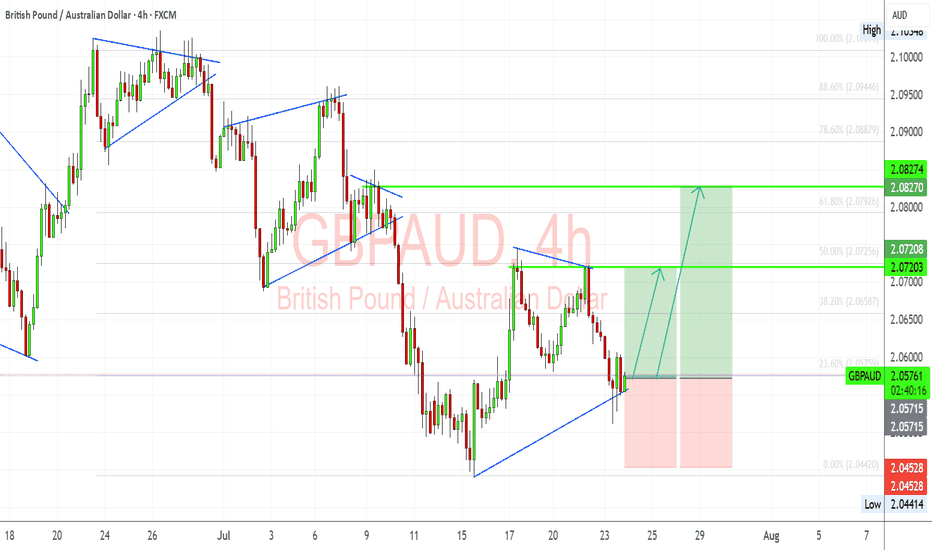

GBPAUD: Consolidation is Over?!The 📈GBPAUD pair appears to have completed a consolidation phase within a broad horizontal parallel channel on a 4H chart.

The recent formation of a higher high suggests potential upward movement.

Confirmation of this trend requires the market to close above the identified resistance level, establishing a higher close.

A buying opportunity may present itself following a pullback, with a target price of 2.0937.

British Pound / Australian Dollar

No trades

Market insights

GBPAUD: Bullish Wave Will Continue 🇬🇧🇦🇺

On a today's live stream, we discussed GBPAUD.

The price successfully violated both a falling trend line

and a strong horizontal resistance on a daily.

The next historic resistance is 2.095.

It will be the next goal for the bulls.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD Buy Opportunity!Trend Direction

Price is currently bullish overall (uptrend).

We can see higher highs (HH) and higher lows (HL) forming until the recent consolidation.

Market Structure

After creating a strong impulsive move up to the marked Supply H1 zone (2.0850–2.0870 area), price got rejected and entered sideways movement.

Currently, price is pulling back but hasn’t yet broken the previous higher low → trend is still bullish.

Supply Zone (H1)

Around 2.0850–2.0870.

Price reacted strongly here before dropping. This zone may act as resistance if retested.

Demand Zone (H1)

Around 2.0660–2.0700.

This is where the previous impulse started; strong buy orders likely remain here.

Price expected to drop into the demand zone, possibly sweeping liquidity below 2.0700.

Then a strong bullish rally towards new highs (above 2.0960+).

GBPAUD – 4H FVG Rejection Could Trigger Bearish Move

On the 4H chart, GBPAUD is approaching a Fair Value Gap (FVG) zone near 2.0900 , where I expect sellers to step in. Price has already shown exhaustion signs, and if rejection happens, the downside path looks more probable.

With the 200 EMA still hovering below, a clean rejection from FVG could open the way for a move down to 2.0610 (expected target). If bearish momentum extends, the next level to watch will be around 2.0472 (Fib extension support) .

📉 Bias – Bearish from FVG rejection

📍 Key Resistance – 2.0900 FVG zone

🎯 Target Levels – 2.0610 → 2.0472

GBPAUD BUY TRADE PLAN**PAIR & DATE:** GBPAUD – Aug 18, 2025

**PLAN ID:** GA-180825-V4

---

### PLAN OVERVIEW

* **Category:** Intra-Day / Swing candidate

* **Trade Type:** Pullback to HTF OB / Intra-Day Play

* **Direction:** Buy (primary bias)

* **Confidence:** 74% (valid)

* **Min R\:R:** 1:3

* **Status:** ✅ VALID

---

### LEVELS CARD (Quick Action)

**Primary Setup (Higher Probability)**

* **Entry:** 2.0740–2.0760 (H4 demand / OB + prior structure)

* **Stop Loss:** 2.0685 (below OB low / liquidity sweep pocket)

* **TP1:** 2.0835

* **TP2:** 2.0890

* **TP3:** 2.0950 (stretch target, unmitigated daily imbalance)

* **Order:** Market after confirmation (H1/H4 engulf/pin rejection)

* **Session:** London / London–NY overlap

**Alternate Setup (Secondary Zone)**

* **Entry:** 2.0640–2.0660 (deeper discount zone, daily demand overlap)

* **Stop Loss:** 2.0575 (below swing low)

* **TP1:** 2.0740

* **TP2:** 2.0830

* **TP3:** 2.0890

* **Order:** Market after confirmation

* **Session:** London / NY

---

### EXECUTION CHECKLIST

1. Red-news filter: BoE/AUD events.

2. Zone tap inside London or NY session.

3. Confirmation: H1 bullish engulf / pin rejection / BOS minor high.

4. Enter on trigger.

5. Take partial at TP1 → SL BE → trail.

6. Exit if invalidation break.

7. ❌ Skip if no confirmation or zone already mitigated to TP1.

---

### FUNDAMENTALS & NEWS

* **CB Bias:** BoE hawkish tilt (inflation still sticky); RBA neutral/dovish lean.

* **Key Data (7d):** UK CPI + PMI (high impact), AU jobs + China PMIs (AUD proxy).

* **Cross-Asset Sentiment:** GBP relatively firm; AUD tracking commodities (iron ore weak tone).

* **Macro Lean:** Mild GBP+ tailwind vs AUD.

---

### MARKET MAP

* **D1:** Bullish structure; pullback after breakout, still above July lows.

* **H4:** Trend intact, last BOS up; now correcting into demand.

* **H1:** Consolidation after drop; early rejection candles forming.

* **Liquidity Pools:** PDH 2.0835, cluster of equal highs near 2.0890; PDL 2.0680.

* **Value Areas:** H4 OB at 2.0740–60 (fresh); deeper daily OB at 2.0640–60.

* **Play Type:** Pullback → Continuation.

---

### RISK & MONEY MANAGEMENT

* Risk: 1% per setup (staggered if both zones considered).

* Basket cap: ≤2%.

* ATR H1 check: SL ≥0.5×ATR.

* Spread filter: skip if >1.5× normal.

---

### CONFIDENCE (One Sentence)

74% — HTF bullish structure intact, strong H4 demand confluence, macro GBP support, valid liquidity targets overhead.

---

### FINAL EXECUTION STRATEGY / PERSONAL NOTE

* **Primary Zone (2.0740–60):** Fresh, first touch pending. I will execute if H1 gives bullish engulf/pin.

* **Alternate Zone (2.0640–60):** Deeper backup only if price clears Primary, same trigger rules apply.

* **Stay Flat:** If price breaks below 2.0575 or zones mitigated without trigger.

**Closing:** Will act only on confirmation, no blind entries.

---

### POST-TRADE JOURNAL

* To be filled after execution outcome.

---

👉 This is a **two-zone structured plan**: Primary = H4 demand closer to current price (preferred), Alternate = deeper daily demand if market extends lower. Both validated, but priority remains with Primary unless invalidated.

GBPAUD Will Go Lower! Sell!

Here is our detailed technical review for GBPAUD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 2.079.

Taking into consideration the structure & trend analysis, I believe that the market will reach 2.059 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPAUD oversold bounce backs capped at 2.0870The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 2.0870, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 2.0870 could confirm the resumption of the downtrend, targeting the next support levels at 2.0660, followed by 2.0590 and 2.0540 over a longer timeframe.

Conversely, a decisive breakout and daily close above 2.0870 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 2.0930, then 2.0970.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 2.0870. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPAUD I Technical Analysis and Opportunity for This WeekWelcome back! Let me know your thoughts in the comments!

** GBPAUD Analysis - Listen to video!

We recommend that you keep this on your watch list and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

GBPAUD LONG GPB aud have few resons that will go up.

We have still strong up trend line that did hold levels past week.

we have change of a short term trend and Counter trend line brake (orange).

So i belive we will go up from here.

The B plan is to buy more on the suport levels if we retrace more.

We have 2 patterns to trade.

Original daily fibonacci

or we can trade Market wave (yellow).

Trade according to your strategy and be safe.

GBP/AUD Trade Setup – Bullish Flag Breakout in PlayGBPAUD has formed a clean bullish flag structure after a significant impulsive move upward. Following the correction, we’re now testing breakout levels with clear Fibonacci confluence and bullish structure support around 2.0560. I'm anticipating a push toward the next resistance levels if buyers defend this trendline.

🔎 Technical Highlights (My View):

Bullish Flag Pattern: The corrective flag has broken to the upside and is being retested. This suggests a possible continuation of the bullish trend.

Fibonacci Support: Price bounced near the 23.6% retracement of the previous bullish leg, which acts as a minor but effective support in trending moves.

Bullish Trendline Holding: The ascending trendline from the July lows continues to act as dynamic support. This shows sustained buyer interest.

Target Zones:

TP1: 2.0720 – aligns with 50% retracement and recent structure.

TP2: 2.0827 – aligns with 78.6% retracement and past resistance.

SL: Below 2.0450 to invalidate the setup.

🏦 Fundamental Context:

GBP Strength: The Bank of England remains more hawkish than the RBA. UK inflation data remains sticky, and traders are still pricing in the potential for another hike if services inflation remains elevated.

AUD Weakness: AUD is under pressure due to soft labor market data and declining commodity demand from China. RBA minutes also struck a cautious tone, which weighs on the Aussie.

China Risk: AUD is sensitive to Chinese sentiment. Current trade and tariff tensions are adding indirect bearish pressure to the AUD.

⚠️ Risks to My Setup:

If Aussie labor or CPI data surprises to the upside, AUD could regain strength.

UK economic data deterioration (e.g., services PMI, wage inflation) could weaken GBP.

Break below 2.0450 would invalidate the bullish setup and suggest potential range continuation.

📅 Upcoming Catalysts to Watch:

UK Retail Sales – A strong print supports GBP continuation.

AU CPI (Trimmed Mean) – Any upside surprise could limit AUD downside.

China Industrial & Services PMI (if released soon) – indirect AUD mover.

⚖️ Summary – Bias & Trade Logic

I’m currently bullish GBP/AUD, expecting a continuation of the prior uptrend now that price has broken and retested the flag structure. Fundamentally, GBP is supported by relatively hawkish BoE expectations, while AUD remains pressured by RBA caution and China-linked macro weakness. My bias stays bullish as long as the trendline holds and Aussie data doesn’t surprise significantly.

GBPAUDHello Traders! 👋

What are your thoughts on GBPAUD?

The GBP/AUD pair has reached a significant resistance zone.

We anticipate some consolidation or choppy movement in this area, followed by a potential bearish reversal toward lower support levels.

As long as price remains below the resistance, the bias remains bearish.

Don’t forget to like and share your thoughts in the comments! ❤️

GBPAUD → Attempt to break through resistance. Rally?FX:GBPAUD is preparing to accelerate its growth within the global bullish trend. A breakout of the local channel resistance is forming...

Against the backdrop of the falling dollar, GBP is taking advantage of the opportunity and entering a phase of active growth. GBPAUD is emerging from local consolidation. The movement is accompanied by bullish momentum and a breakout of the upward channel resistance. Technically, after retesting (forming) the upper channel boundary at point 2, consolidation is forming. There is no decline, which indicates the bullish potential of the market. The breakout of the overall figure's resistance confirms the buyer's intentions...

Resistance levels: 2.0698, 2.0756, 2.085

Support levels: 2.06658, 2.06537, 2.0593

If the bulls keep the price above the specified zone after the breakout, then in the short and medium term, the price may continue to rise to the resistance of the trading range...

Best regards, R. Linda!

SELL SETUP GBPAUDEntry Reason: Price rejection near recent swing high with formation of lower high structure. Bearish engulfing candle formed at resistance zone, confirming potential downside move. RSI showing bearish divergence and crossing down from overbought area, indicating loss of bullish momentum.

Entry Level: 2.08180

Stop Loss: 2.08519 (Above resistance)

Take Profit: 2.07540 (Near previous support level)

Risk Management: Risk-to-Reward ratio aligned with trade plan. Position size adjusted according to account risk percentage.

GBPAUD, will the Aussie be strong enough?In the higher timeframes, the pair is bullish, very, and that's where the problem is, that there aren't recent structures to break to signify a trend shift.

In the weekly timeframe, the pair is still bullish, facing the same monthly situation of lacking recent structures.

In the daily timeframe though, the outlook is different, although there aren't any near trend ending structures, but there are retracement broken structures which we can use to define the trends, with which we are currently in the daily validation level.

In the lower timeframes we are bearish while confluence with the daily level we get a low risk high probability entry.

We are risking as low as 25 Pips, while targeting a potential RRR of 1:10+.

DISCLAIMER: Trade with caution.

GBPAUD Formation Local Uptrend Level GBPAUD Against the backdrop of a weaker U.S. dollar, GBP is capitalizing on the momentum, entering an active growth phase. After retesting the trendline, the subsequent rebound signals strong bullish potential in the market.

Resistance Levels: 208.00 and 205.50 remain key confirmation zones for buyers.

The price continues to respect the local uptrend formation, with higher lows supporting upward momentum Sustained demand from buyers could push GBPJPY toward the top resistance area in the short term.

You May find more details in the chart.

Trade wisely Best of Luck.

Ps; Support with like and comments for better analysis.