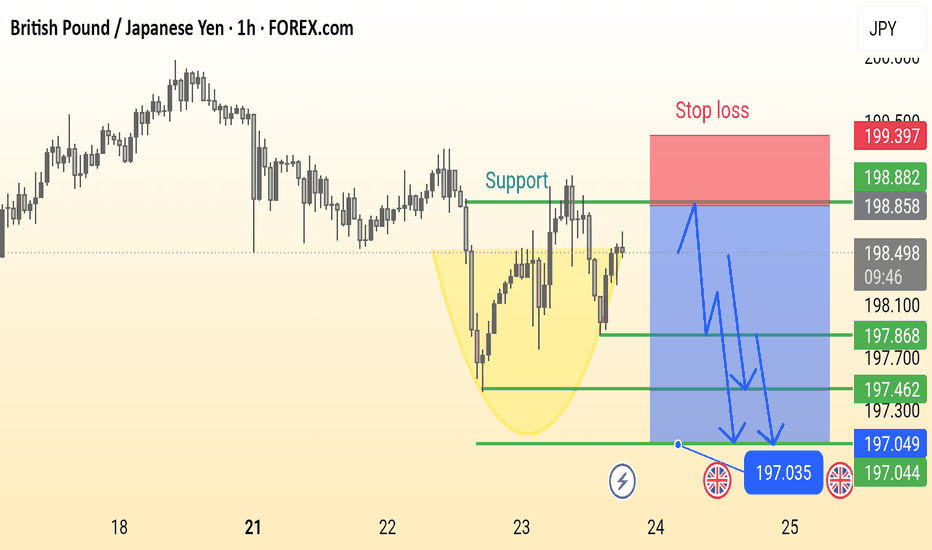

GBP/JPY Analysis is Ready This is a 1-hour chart of the GBP/JPY currency pair showing a potential bearish setup. Key elements include:

Support Zone: Around 198.000, previously tested multiple times.

Bearish Cup Pattern: Highlighted in yellow, suggesting a reversal.

Stop Loss: Marked above 199.397.

Sell Entry Zone: Near the support break at ~198.000.

Bearish Targets: 197.868 → 197.462 → 197.035 (with final support near 197.044).

Bearish Projection Arrows: Indicate expected price movement after breakdown.

This chart suggests a sell setup on breakdown, with well-defined risk and reward levels.

GBPJPY trade ideas

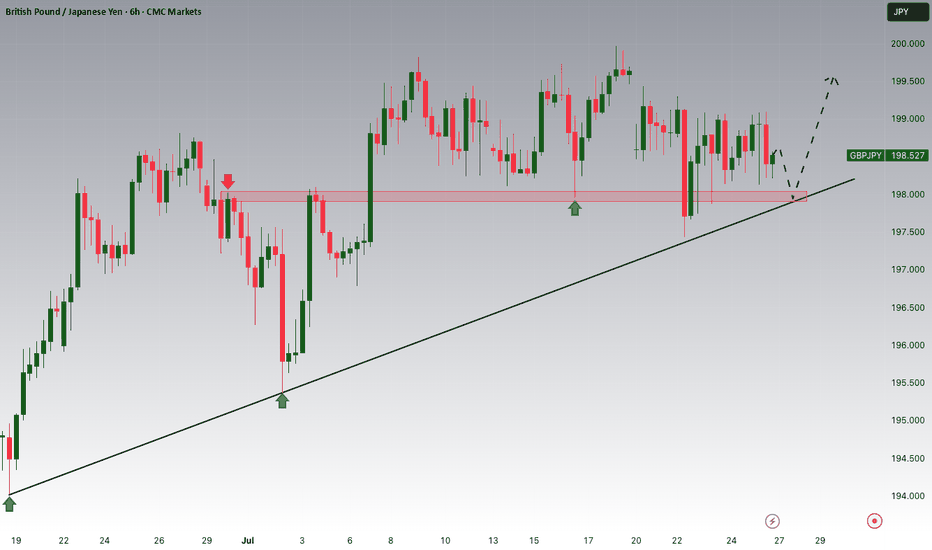

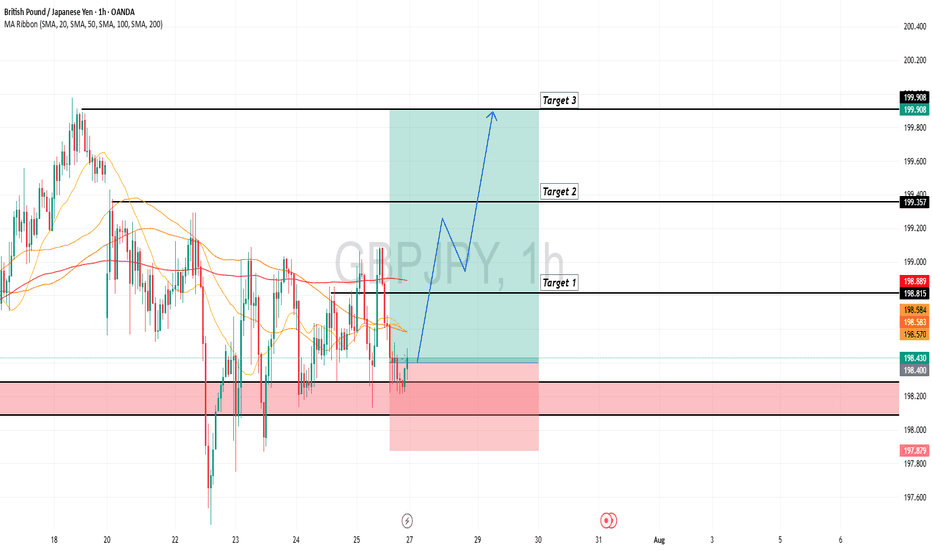

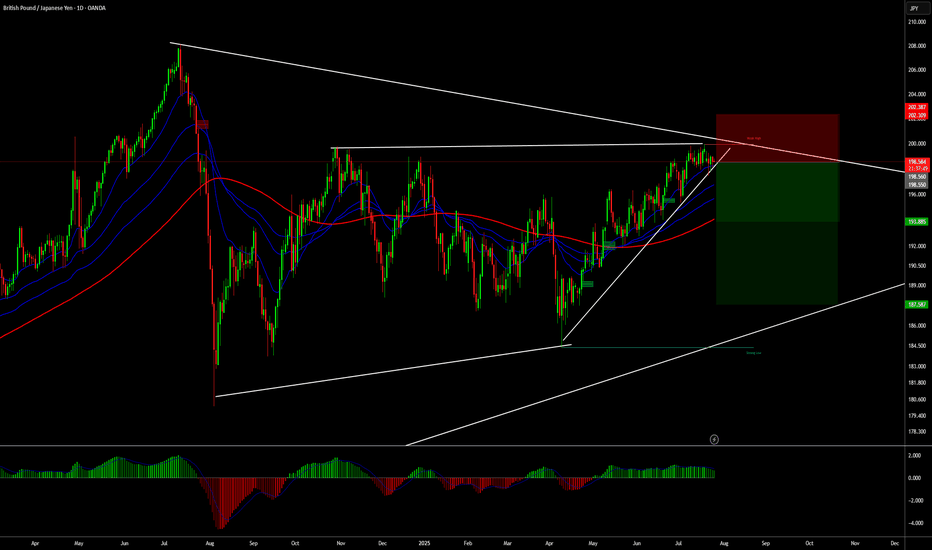

GBPJPY uptrend co0ntinuation support at 196.75Key Support: 196.75

This level marks the prior consolidation zone and serves as a critical pivot. A corrective pullback toward 196.75 followed by a bullish reversal would validate the uptrend, with upside targets at:

199.20 – Initial resistance and short-term target

199.70 – Minor resistance zone

200.40 – Longer-term breakout objective

However, a daily close below 196.75 would invalidate the bullish scenario, potentially triggering a deeper retracement toward:

195.80 – Near-term support

194.80 – Key downside level in a bearish reversal

Conclusion:

As long as 196.75 holds, the bias remains bullish, favoring continuation toward the 199–200 zone. A confirmed break below this support would shift momentum, opening the door for a broader corrective decline.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPJPY short From what I'm seeing

GBPJPY is not done yet

As buyers have tried to push price higher but pressure from the sellers still keeping price from going any further.

The battle continues

Causing the market to range

Next week tell who wins

For I'm seeing sellers with the upper hand

My thoughts 💭 on GJ 🤔

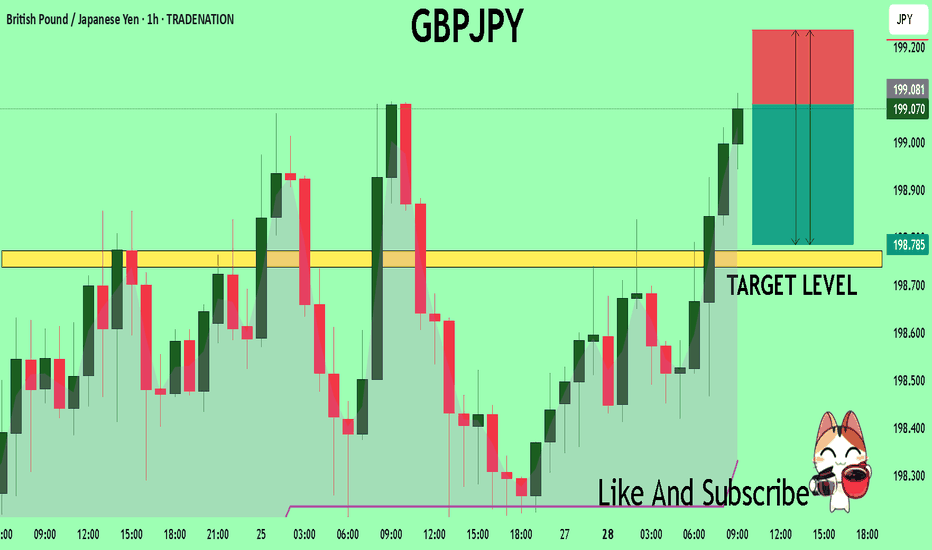

GBPJPY What Next? SELL!

My dear friends,

Please, find my technical outlook for GBPJPY below:

The price is coiling around a solid key level - 199.08

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 198.77

Safe Stop Loss - 199.23

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPJPY starts corrective downtrend. Ready to SELL✏️ OANDA:GBPJPY has broken the trendline structure and broken the disputed zone. Price is heading towards the support zone ahead around 197.000. This is considered a breakout zone for DCA rather than BUYing at this zone. The downtrend of GBPJPY may extend to the bottom of last week.

📉 Key Levels

SELL now GBPJPY 198.000

SELL trigger: Break support zone 197.000

Target 195.500

Leave your comments on the idea. I am happy to read your views.

GBPJPY is Holding above the SupportHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPJPY Daily chart analyses

Advanced Price Analysis with Timeframes

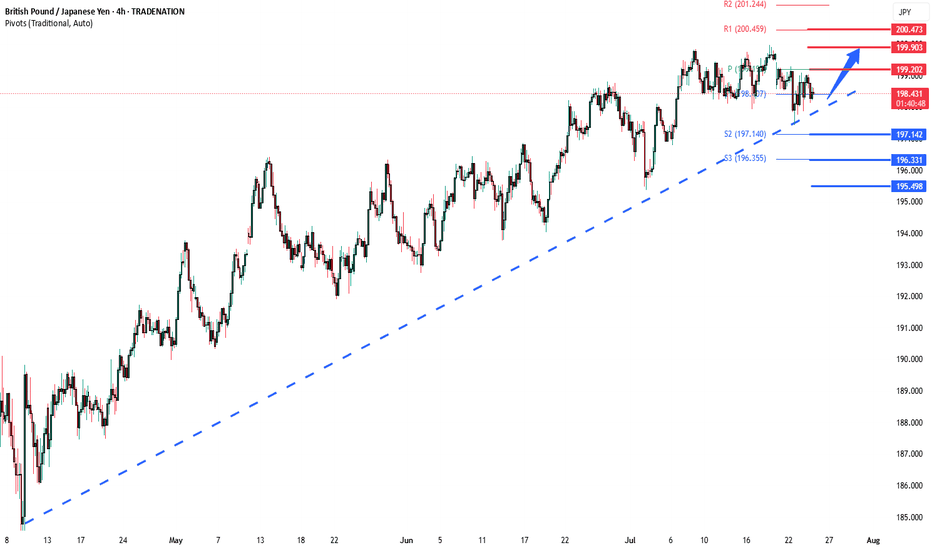

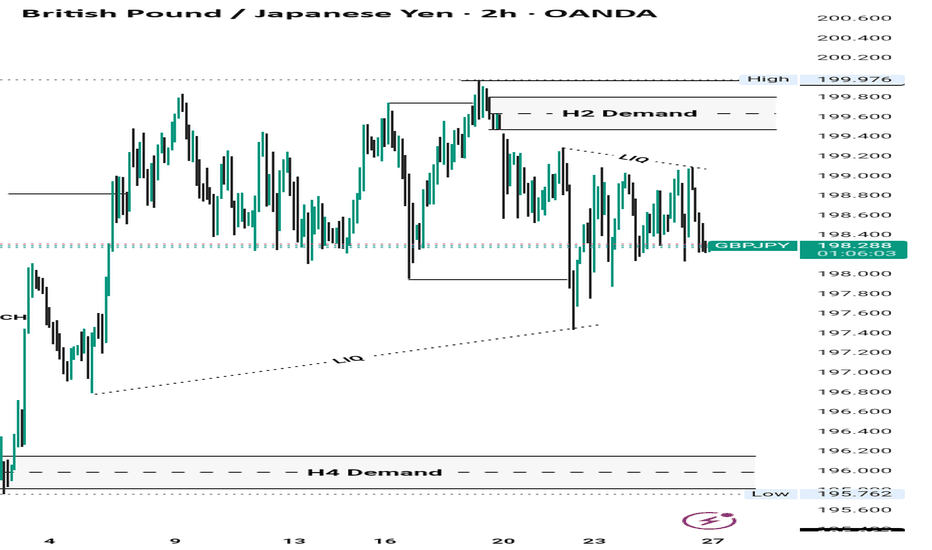

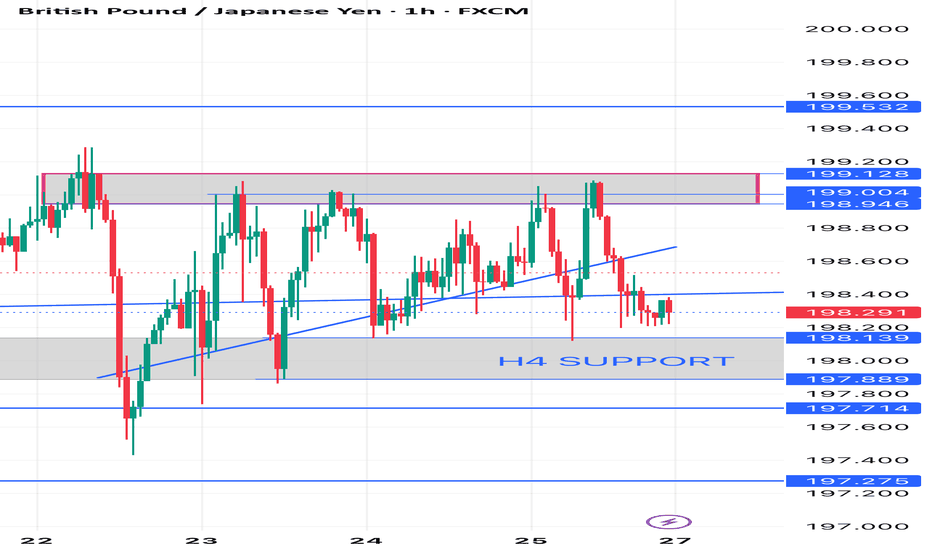

1. Key Observations from the Provided Data (H4 Chart)

Current Price197.800 testing the H4 SUPPORTlevel at 198.000

- Trend Downtrend (Lower Highs & Lower Lows).

- *Recent Structure

- Resistance ~199.600 (rejected multiple times).

- **Support -198.000 (critical level).

- If 198.000 breaks next support is 197.500–197.000

*a) Higher Timeframe (Daily/D1)

- If the **daily trend is bearish**, the H4 downtrend is likely to continue.

- If the **daily trend is bullish**, the H4 drop could be a retracement before a bounce.

- **Key Confirmation Needed**:

- Check if **198.000 aligns with a daily support level** (e.g., Fibonacci, moving averages).

**b) Lower Timeframe (H1/M15)

- **Breakdown Scenario**: If price stays below **198.000** with strong bearish candles, expect a drop to **197.500 → 197.000**.

- **Rebound Scenario**: If price holds **198.000** and forms a bullish reversal pattern (e.g., hammer, double bottom), a bounce to **198.600–199.000** is possible.

---

*3. Key Levels to Watch

| **Level** | **Importance** | **Scenario** |

|-----------------|-------------------------|--------------|

| **199.600** | Strong Resistance | Only break = Trend reversal |

| **198.600** | Minor Resistance | Re-test if bounce occurs |

| **198.000** | **H4 SUPPORT (Critical)** | Hold = Bounce / Break = Drop |

| **197.500** | Next Support | Target if 198 breaks |

| **197.000** | Psychological Support | Strong demand zone |

---

4. Trading Strategy Suggestions**

- **Bearish Bias (Down)**:

- Short if **198.000 breaks** with confirmation (e.g., closing below + high volume).

- Target: **197.500 → 197.000**.

- Stop Loss: **Above 198.300**.

- **Bullish Bias (Up)**:

- Long if **price bounces from 198.000** with a bullish pattern.

- Target: **198.600 → 199.000**.

- Stop Loss: **Below 197.800**.

---

5. Final Verdict**

- **Higher Probability**: **Downside** (unless 198.000 holds strongly).

- **Reversal Signal Needed**: Bullish engulfing, RSI divergence, or volume surge.

**Recommendation**: Wait for **confirmation at 198.000** before taking a trade.

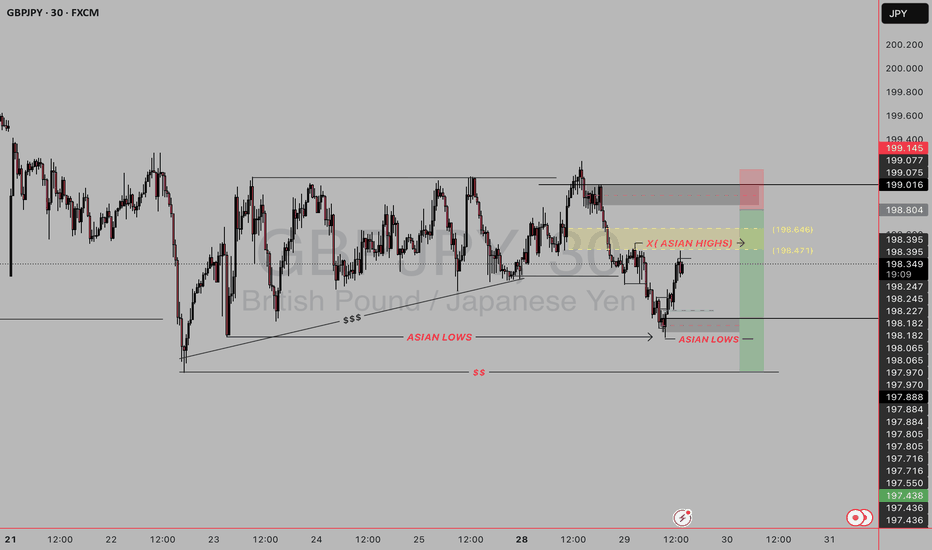

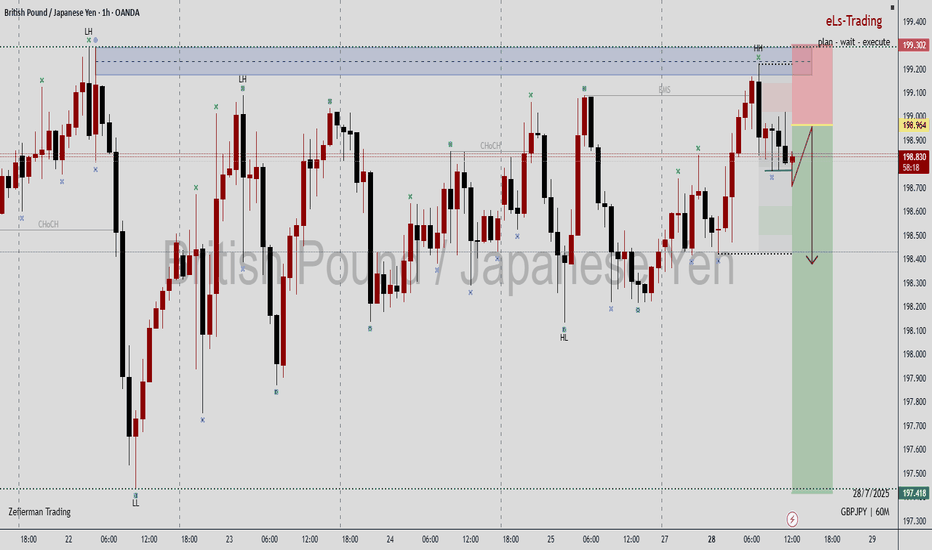

GJ SELL SETUP This GBP/JPY 30-minute chart shows a short trade setup based on Smart Money Concepts (SMC), liquidity sweep zones, and session highs/lows. Here's a breakdown of what’s happening:

1) Key Elements Identified in the Chart

Asian Session Range

Asian Highs (Yellow Zone at ~198.471–198.646): Marked as a key liquidity zone.

Asian Lows (Purple Line): Used for liquidity hunting and market structure context.

2) Market Structure

Prior to this setup, price had a bullish structure, forming higher highs.

Eventually, price broke structure to the downside, suggesting a shift to bearish momentum.

3)Liquidity Grabs

Price swept the Asian lows, tapping into sell-side liquidity.

The current move upward looks like a retracement into the Asian highs, likely aiming to grab buy-side liquidity.

4)Entry Zone

The entry is placed just around the Asian highs, targeting the idea that this area will act as a supply zone or breaker block.

Stop Loss (Red Box): Above the liquidity zone, where a breaker would be invalidated.

Take Profit (Green Box): Targeting the recent lows or continuation lower—likely the low around 197.438.

Risk-Reward Ratio

The R:R looks solid—about 2.5–3:1, suggesting a well-balanced trade.

Why This Is a Bearish Setup

Liquidity Sweep: Price ran below Asian lows, collected liquidity, and is now retracing.

Premium Zone: Current price is retracing into a premium zone (above equilibrium) where sellers are expected to re-enter.

Rejection Expected: The idea is that price will reject around 198.5–198.6 (where previous buy stops are likely stacked).

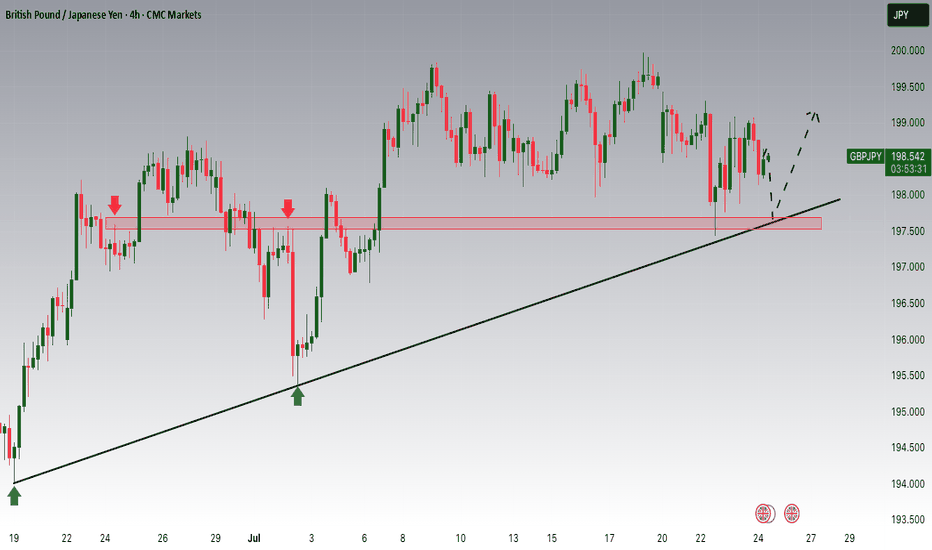

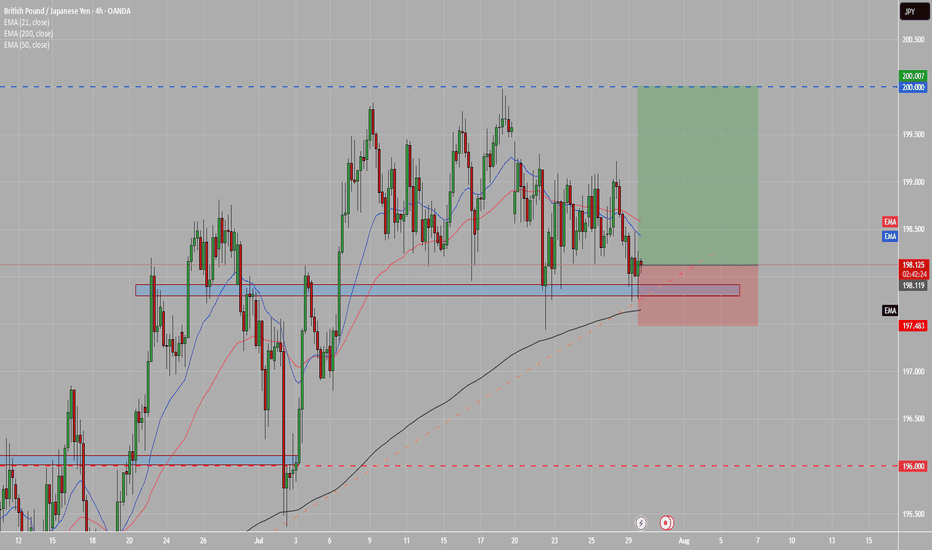

GBPJPY follow the ascending channel bullish now from key support📊GBPJPY Bullish Forecast

4H Timeframe Analysis

GBPJPY is currently trading inside an ascending channel and showing strong bullish momentum from the key demand zone at 198.100

Buyers are in control and pushing price higher

🎯 Technical Target:

🔹200.000 – Supply Zone / Bearish Order Block

Outlook:

As long as price holds above 198.100, we remain bullish toward the 200.000 OB zone.

Watching for price reaction at the supply level

#GBPJPY

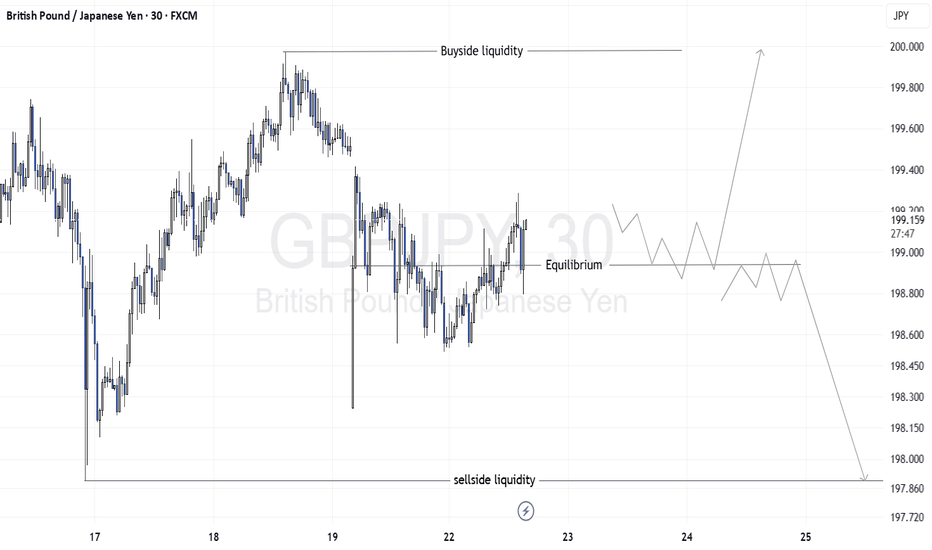

GBPJPY - How i see the market. WHAT DO YOU THINK?A channel within a channel .

Short-term bearish pressure to complete the 3-drives pattern, which ultimately suggests a long bullish setup. I'd only consider this setup if the trend continues to 198.000.

side note

198.000 I'll be looking for buying opportunities to the upside probably until we hit the red channel trendline. That should guarantee approx. 350pips.

You could take advantage of the current bearish move and rejoin when the bulls hit the ground running. Remember use your own trading plan and enjoy the ride . It can go either way but hopefully it respects PA and goes with this flow.

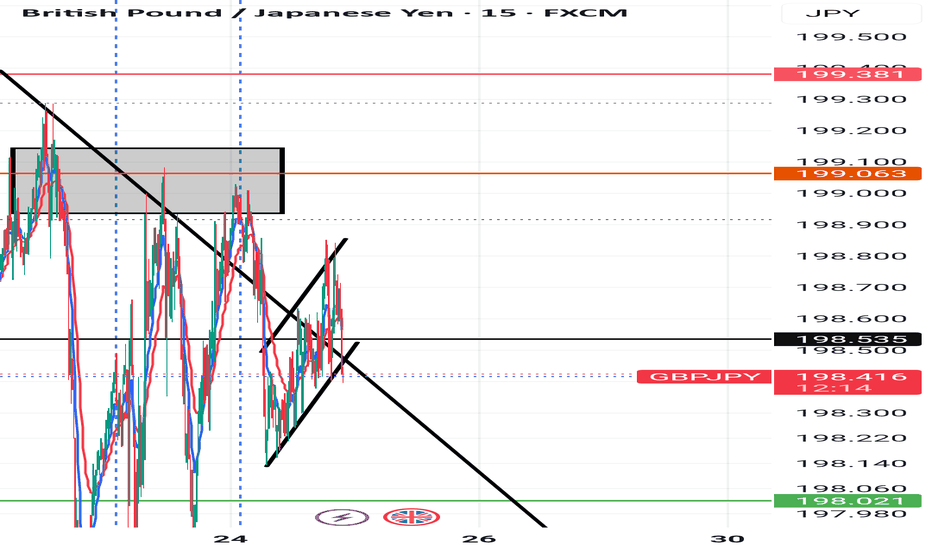

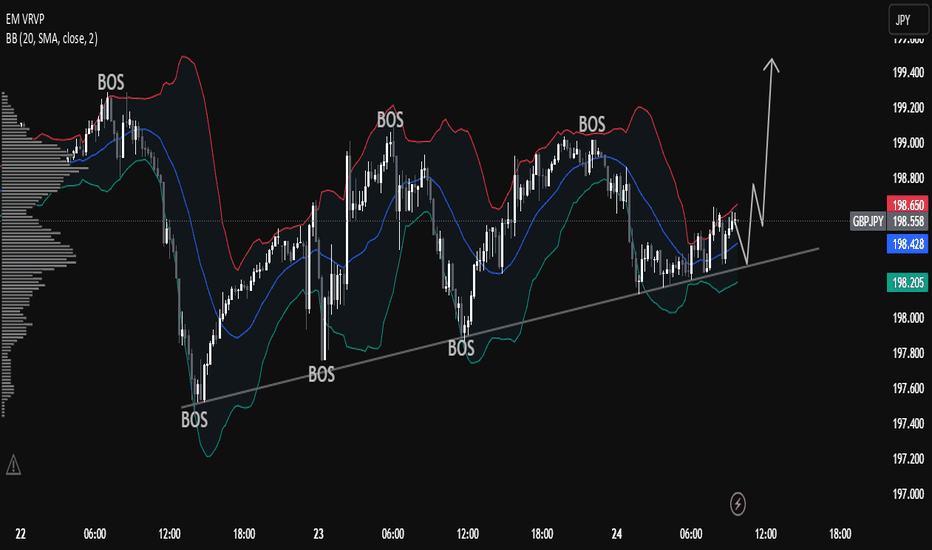

Understanding Market Structure: GBPJPY Trendline Support 📊 GBPJPY Technical Analysis — 15-Min Chart (As of July 24, 2025)

Trend Structure & Price Action

The chart shows a clear ascending trendline, connecting higher lows across the last sessions.

Multiple Break of Structure (BOS) points confirm bullish market behavior, with price consistently forming higher highs and higher lows.

The most recent BOS and price rejection from the lower boundary of the cloud band indicate bullish intent is still active.

Indicators Used

Custom Cloud Band (EMA Based 20, 1.5 settings):

Price is oscillating within and around the cloud band.

Recent candles are attempting to reclaim the upper band, suggesting building bullish momentum.

Volume Profile (VRVP) shows strong volume support around the 198.200–198.500 range, aligning with the trendline.

Support & Resistance

Support Zone: 198.200 (trendline confluence + volume shelf)

Immediate Resistance: 198.800–199.000

Major Resistance: 199.400 (next psychological level and prior high)

Forecast & Trade Idea (Educational Purpose)

If price continues to respect the ascending trendline and breaks above the recent local high (~198.750), we could see a bullish breakout toward 199.200+.

A bullish flag or small consolidation above the trendline before breakout is likely, as illustrated by the arrow.

Invalidation occurs if price breaks and closes below the trendline and 198.200, which may trigger a short-term correction.

✅ Conclusion

GBPJPY is currently in a bullish market structure with support from both trendline and volume profile. A clean breakout above 198.800 with volume confirmation could fuel continuation toward 199.200 and beyond. Risk management is crucial — watch for false breakouts or a shift in structure below the rising trendline.

GBPJPY: Get Ready to Buy 🇬🇧🇯🇵

GBPJPY is consolidating within a narrow horizontal range

on a daily time frame.

I am waiting for its bullish breakout and a daily candle close above

199.85 to confirm the next bullish wave.

A rise will be expected to 201 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPYGBPJPY price is near the main resistance zone 200.168. If the price cannot break through the 200.186 level, it is expected that the price will go down. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

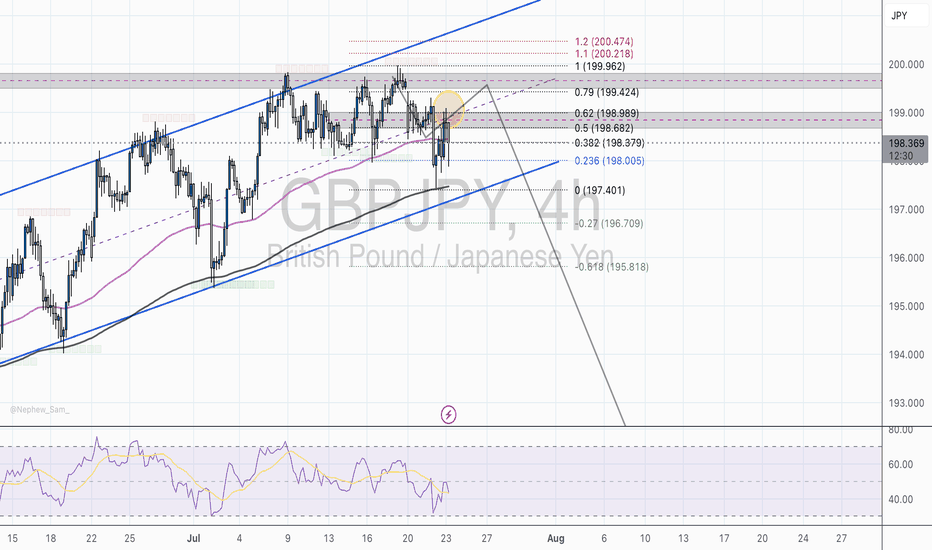

GBP/JPY 4H - Rejection from Supply Zone and Key Fib AreaOverview:

GBP/JPY is trading near 197.91, and recent price action suggests a potential short opportunity. The pair has been rejected from a key Fibonacci resistance zone, and bearish momentum appears to be building beneath a fading ascending channel. Let’s break down why this chart leans more bearish.

Market Structure Breakdown:

* Price action failed to sustain new highs above 199.90 and is now forming lower highs, a potential early sign of trend exhaustion.

* The recent bounce from 197.40 was muted and rejected near the 0.5 and 0.618 retracement levels, indicating strong supply around the 198.68–198.98 zone.

Fibonacci Confluence:

* The rejection occurred right at the 0.618 retracement of the prior downswing — a key Fibonacci level often used by institutional traders to re-enter in the direction of the trend.

* Price is now hovering below the 0.382 (198.38) and 0.5 (198.68) levels, which may now act as resistance.

* If the current rejection holds, downside targets are:

* 0.0 (197.40) – recent low

* -0.27 extension (196.70) – potential bearish continuation target

* -0.618 extension (195.81) – extended downside objective

Trendline & Channel Considerations:

* The ascending channel is losing momentum.

Moving Averages:

* Price is now below the 50 EMA, and testing the 200 EMA, which is at risk of breaking.

* A clear close below both EMAs would confirm bearish momentum.

RSI & Momentum:

* The RSI shows bearish divergence on recent highs and is struggling to break above the midline (50).

* Momentum is tilting to the downside and failing to build higher on bounces.

Key Zones:

* Resistance Zone: 198.60–198.98

* Strong Fibonacci confluence + previous supply

* Support Zone: 197.40

* Prior swing low and 0.0 Fib level

* Bearish Continuation Zone: Below 197.30

* Breakout would confirm downside acceleration toward 196.70 and 195.80

Conclusion:

GBP/JPY is showing signs of bearish pressure beneath key resistance. With the rejection from the 0.618 Fib level and weakening channel structure, the path of least resistance may be to the downside — especially if price breaks and holds below 197.40.

A confirmed breakdown opens the door toward 196.70 and possibly 195.80, as bearish continuation unfolds. Overall we can even see price hitting past historical levels at 189.50

GBP/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

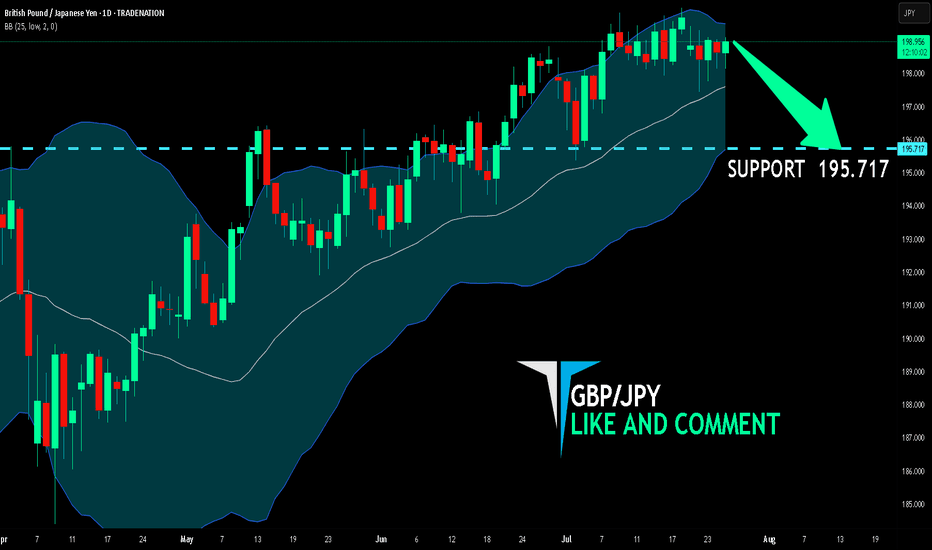

GBP/JPY pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 1D timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 195.717 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPJPY 4HOUR TIME FRAME ANALYISOn the 4-hour chart, GBP/JPY has been tracing out a clear up-trend over the past several weeks, marked by a sequence of higher highs and higher lows. Your proposed long entry at 198.632 neatly coincides with two layers of support:

Trendline support: A rising trendline drawn off the last two significant swing lows intercepts right around 198.6, suggesting the pair is catching a bid as it back-tests that line.