GBPUSD trade ideas

GBP/USD - H1- Bearish Flag (07.07.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.3520

2nd Support – 1.3460

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD Will Explode! BUY!

My dear friends,

My technical analysis for GBPUSD is below:

The market is trading on 1.3409 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.3535

Recommended Stop Loss - 1.3347

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

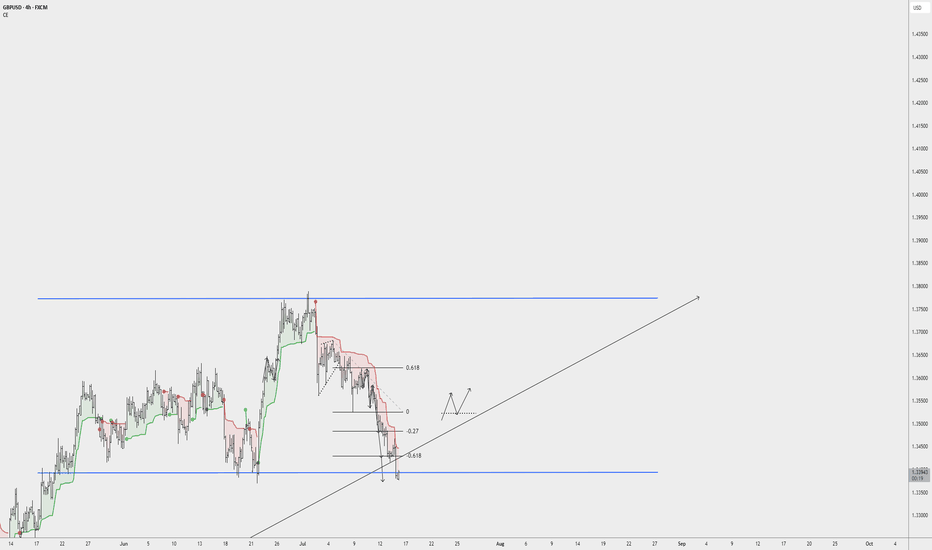

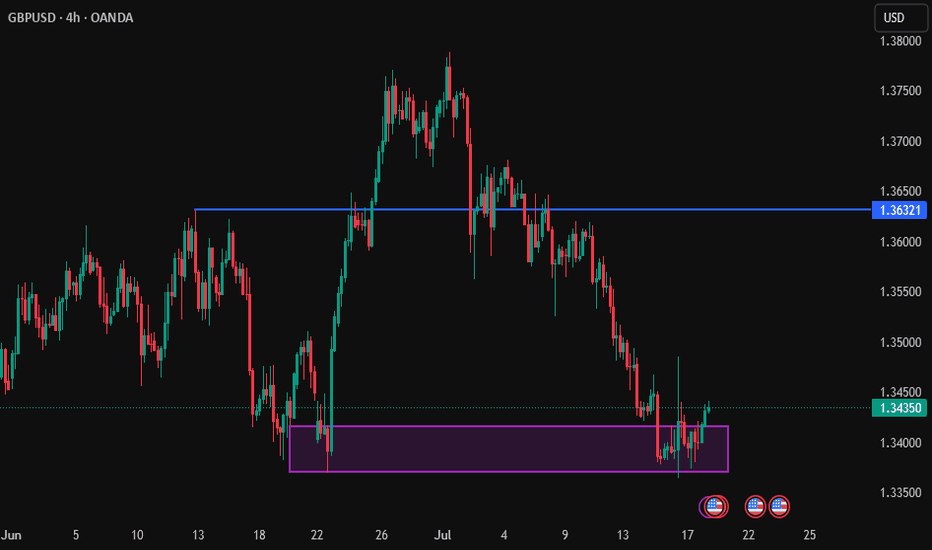

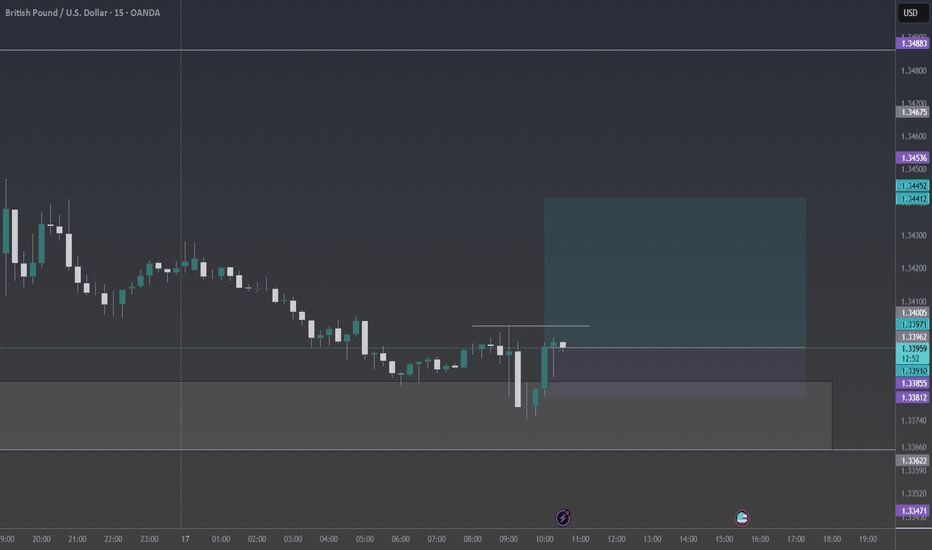

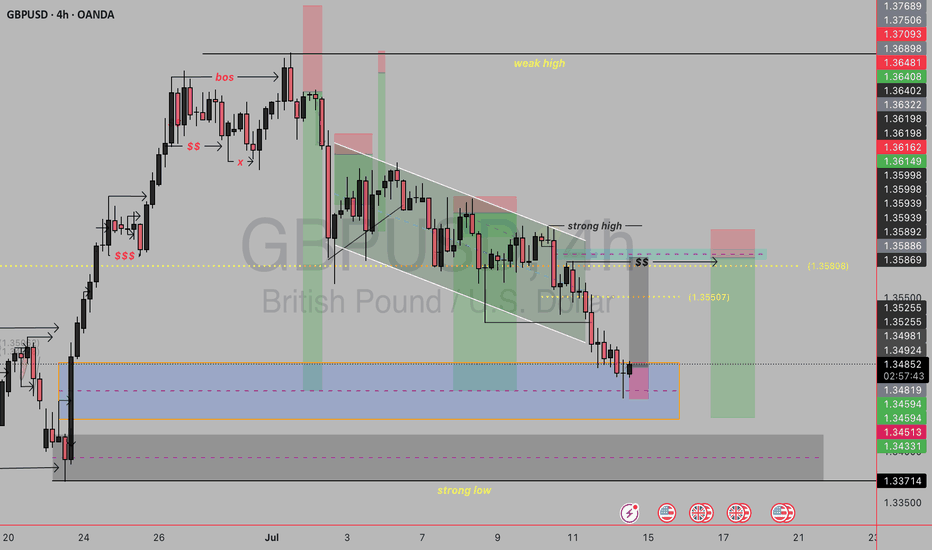

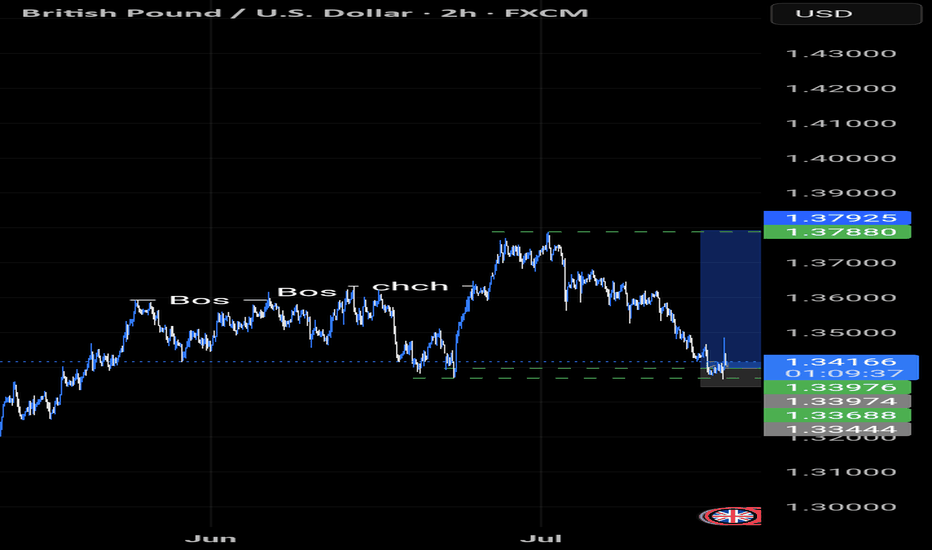

LONG ON GBP/USDGU is currently in its pullback phase of its uptrend.

We have a nice sell side Liquidity sweep being completed at this moment.

Price should now tap into previous demand that broke a high to repeat history and rise again.

Very Nice Setup over 300 pips on the table to the previous high/supply zone.

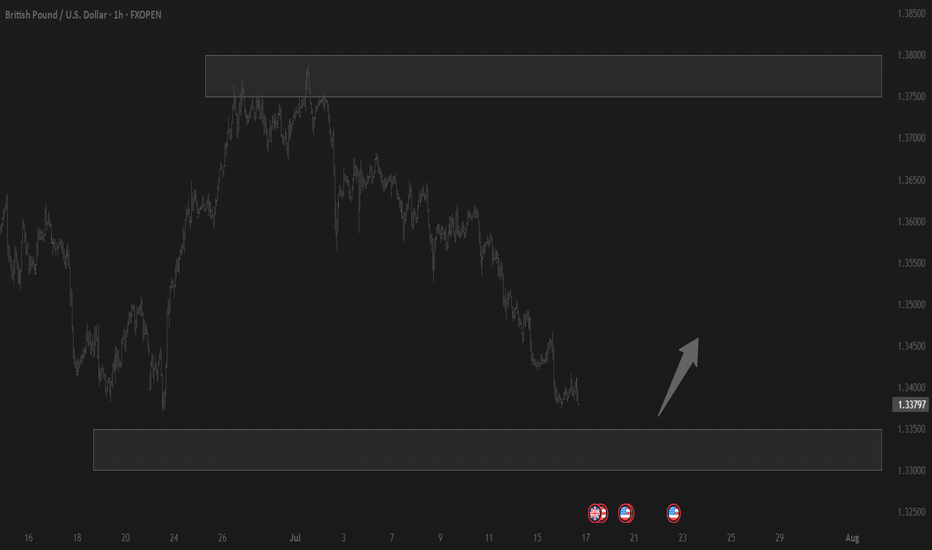

GBPUSD Pullback Another Bullish PatternThe GBPUSD recently closed around 1.33750, testing a key support zone. Although there are signs of potential further decline, the broader outlook depends significantly on the strength of the US Dollar.

A corrective move against the backdrop of a strong overall trend is within normal expectations, and bullish sentiment remains intact.

If buyers are able to defend the 1.33750 – 1.33600 support zone, a pullback or reversal could be expected then next resistance would be 1.36004 / 1.37001.

You can find more details in the chart Ps Support with like and comments for more better analysis Thanks for Supporting.

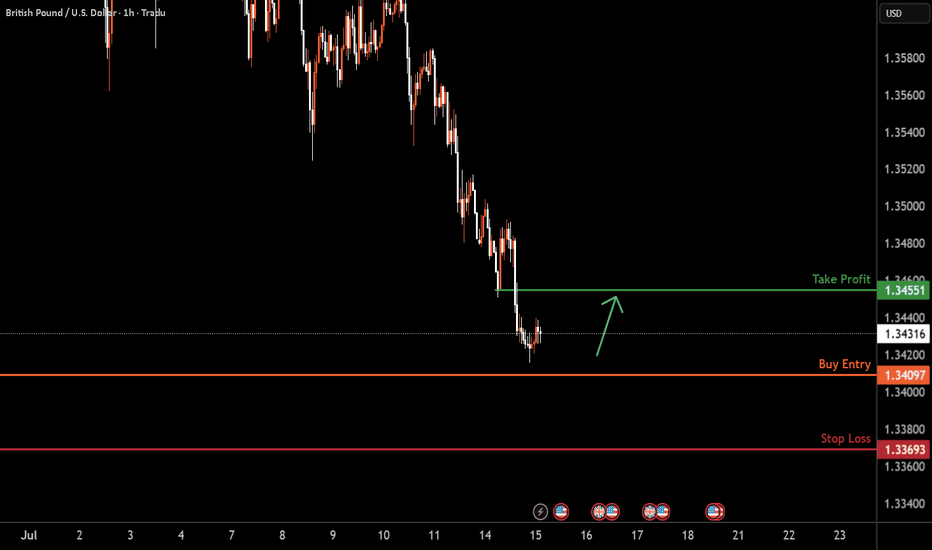

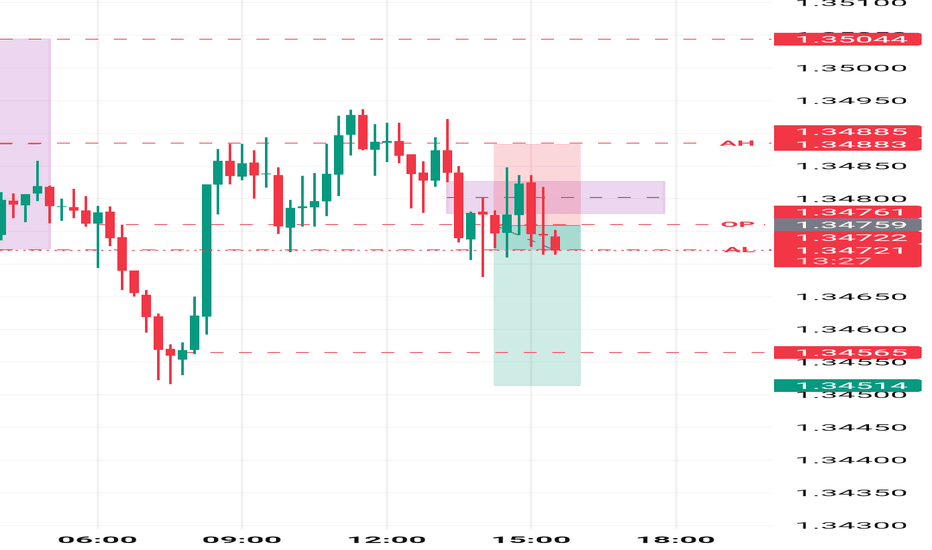

GBPUSD H1 I Bullish Reversal Based on the H1 chart analysis, we can see that the price could fall toward our buy entry at 1.3409, which is a pullback support.

Our take profit will be at 1.3455, which is a pullback resistance level.

The stop loss will be placed at 1.3369, a swing low support

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

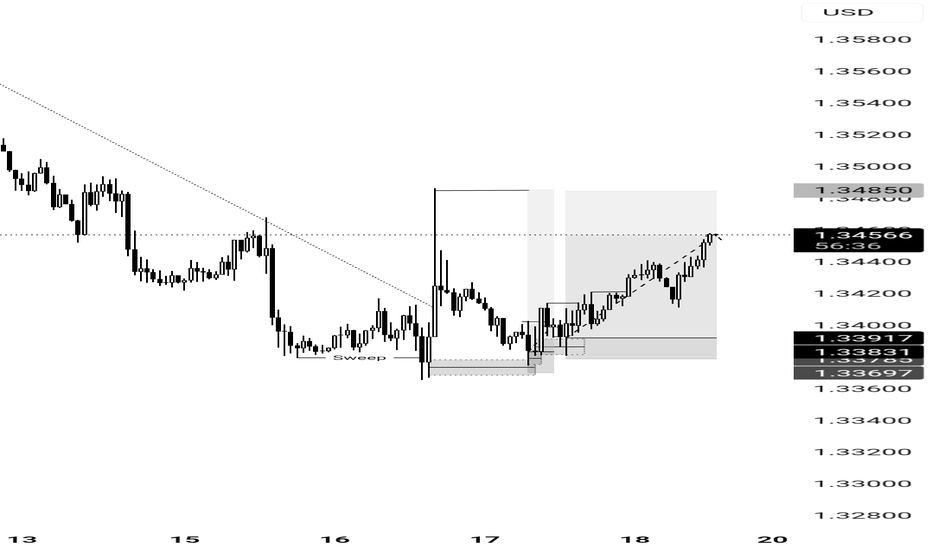

GBPUSD bullishThe price just tapped into a valid order block.

This suggests a potential long (buy) opportunity.

We may see bullish momentum from this zone.

Watch for confirmation like bullish engulfing or BOS or CHOCH.

Place stop loss just below the order block.

Target the next resistance or liquidity zone.

Wait for entry confirmation on lower timeframe.

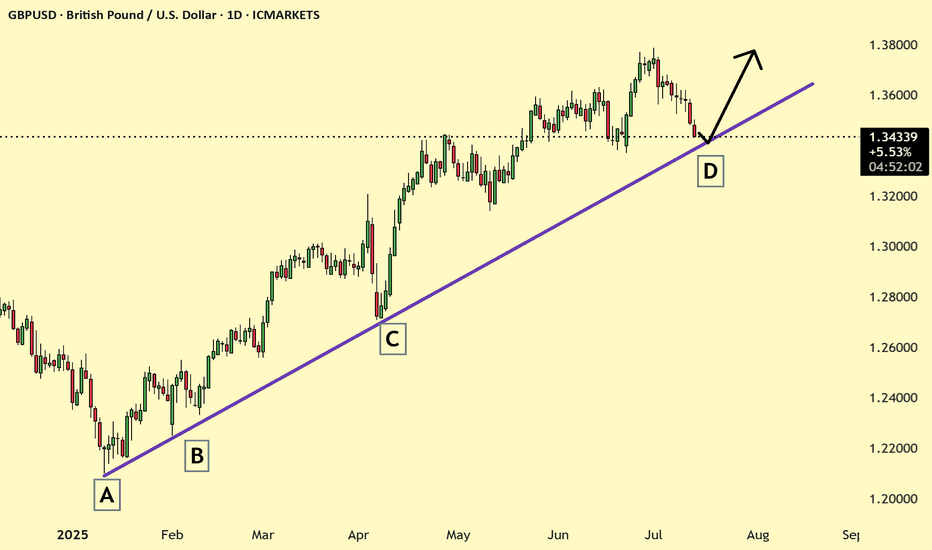

Falling towards major support?The Cable (GBP/USD) is falling towards the pivot which has been identified as an overlap support that lines up with the 61.8% Fibonacci retracement and could reverse to the 1st resistance.

Pivot: 1.3400

1st Support: 1.3319

1st Resistance: 1.3594

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

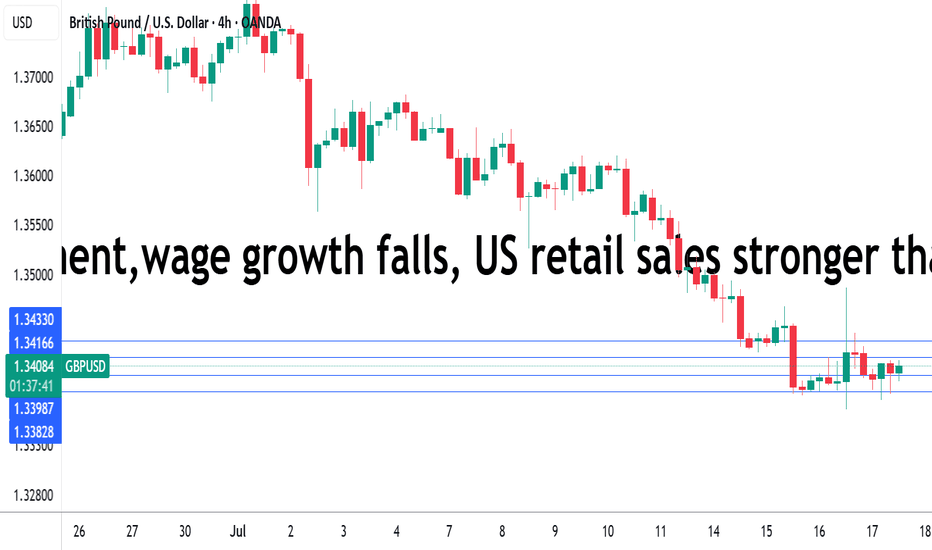

UK employment,wage growth falls, US retail sales shineThe British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day.

Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly revised from 109 thousand, easing concerns of a significant deterioration in the labor market.

Wage growth (excluding bonuses) dropped to 5.0% from a revised 5.3%, above the market estimate of 4.9%. The unemployment rate ticked up to 4.7%, up from 4.6% and above the market estimate of 4.6%. This is the highest jobless level since the three months to July 2021.

The latest job data will ease the pressure on the Bank of England to lower rates, as the sharp revision to the May payroll employees means the labor market has not deteriorated as much as had been feared. Still, the employment picture remains weak and the markets are expecting an August rate cut, even though UK inflation was hotter than expected in June.

US retail sales bounced back in June after back-to-back declines. Consumers reacted with a thumbs-down to President Trump's tariffs, which took effect in April and made imported goods more expensive.

The markets had anticipated a marginal gain of just 0.1% m/m in June but retail sales came in at an impressive 0.6%, with most sub-categories recording stronger activity in June. This follows a sharp 0.9% decline in May.

The US tariffs seem to have had a significant impact on retail sales, as consumers continue to time their purchases to minimize the effect of tariffs.

Consumers increased spending before the tariffs took effect and cut back once the tariffs were in place. With a truce in place between the US and China which has slashed tariff rates, consumers have opened their wallets and are spending more on big-ticket items such as motor vehicles, which jumped 1.2% in June.

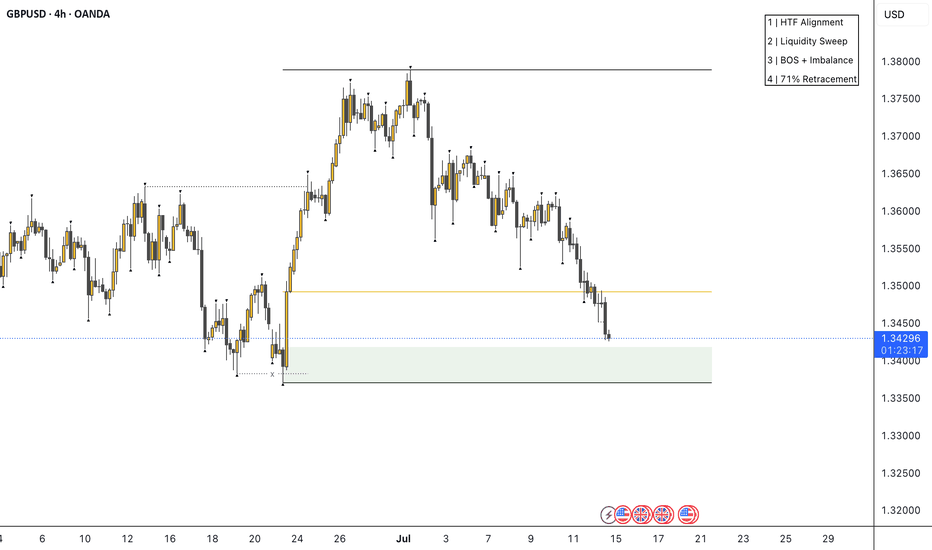

Key level for GBPUSDKey level for the bulls highlighted in green. We've pulled deeeep into the discount of the daily bullish leg, which is ideal. We're more than likely going to see the sentiment reports flip to majority bearish, which again, further confluence (for me at least). Waiting for a clear 1-4h bullish BOS, liquidity sweep and imbalance. Only then will I look for a long term swing trade to the upside.

Lots of news this week which coincide well with level. From my experience, we may see a nice range created around this level, and then when news hits we'll start the move higher. That's my take at least, let me know your thoughts.

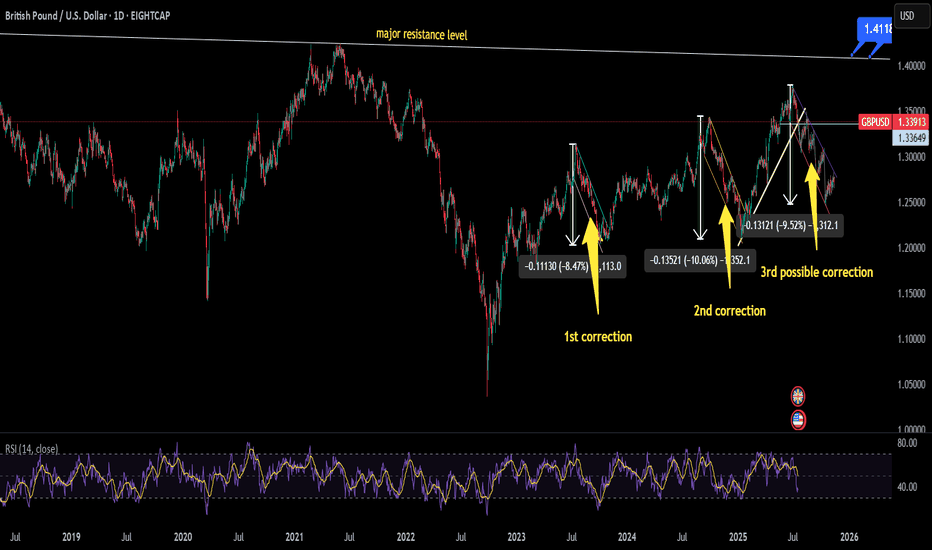

will GBPUSD make its 3rd correction???currently price is testing marked trendline which is acting as support level for a decent time if this level price will reverse its trend from here and will hit major resistance level which also has been drawn but if price action follows what it has done twice in the past then chances are that trend will enter in correction phase which is 3rd phase. In all this movement of DXY will play major role if DXY will continue to move upward pair will follow bearish trend and vice versa

GBPUSD reversal to the upsideGBPUSD has been in a downtrend for about a week. Yesterday showed bullish momentum but the price was pushed back to near yesterday's low. Price couldn't break it. We could see a strong reversal in the coming days/start of next week. I think today's daily candle will be bullish with a long wick to the downside showing bullish momentum. I will take a 3:1 trade following that analysis.

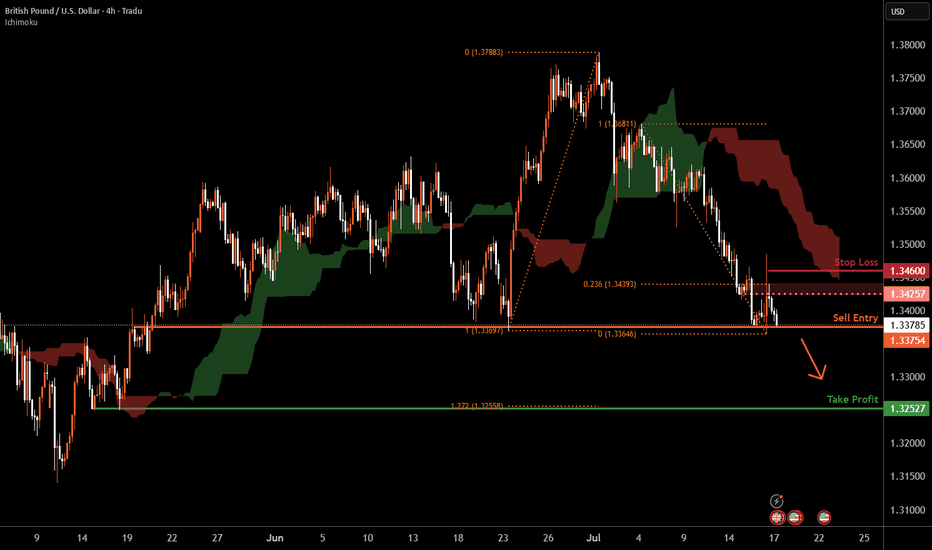

Cable H4 | Potential bearish breakout?Cable (GBP/USD) is falling toward a potential breakout level, where the bearish momentum could cause the price to drop lower from this level.

Sell entry is at 1.3375 which is a potential breakout level.

Stop loss is at 1.3460 which is a level that sits above the 23.6% Fibonacci retracement and an overlap resistance.

Take profit is at 1.3252 which is a multi-swing-low support that aligns with the 127.2% Fibonacci extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GBPUSD InsightWelcome to all our subscribers.

Please feel free to share your personal thoughts in the comments.

Don't forget to like and subscribe!

Key Points

- According to CBS and other U.S. media outlets, former President Trump asked Republican lawmakers during a closed-door meeting whether they supported removing Federal Reserve Chair Jerome Powell. It was reported that many lawmakers showed support for the idea. However, in a meeting with the Prime Minister of Bahrain, Trump stated that unless Powell is involved in a scandal related to renovations of the Federal Reserve building, the likelihood of his dismissal is very low.

- President Trump is actively lobbying lawmakers to pass three stalled cryptocurrency bills in the House of Representatives. Optimism about the bills' passage has resurfaced. In particular, the potential strategic use of stablecoins to strengthen the dominance of the U.S. dollar and boost demand for U.S. Treasuries has brought renewed attention to these legislative efforts.

- The U.K.’s Consumer Price Index (CPI) for June came in at 3.6%, exceeding the market expectation of 3.4%. As a result, the possibility of a Bank of England rate cut in July has significantly diminished.

Key Economic Schedule This Week

+ July 17: Eurozone June Consumer Price Index (CPI)

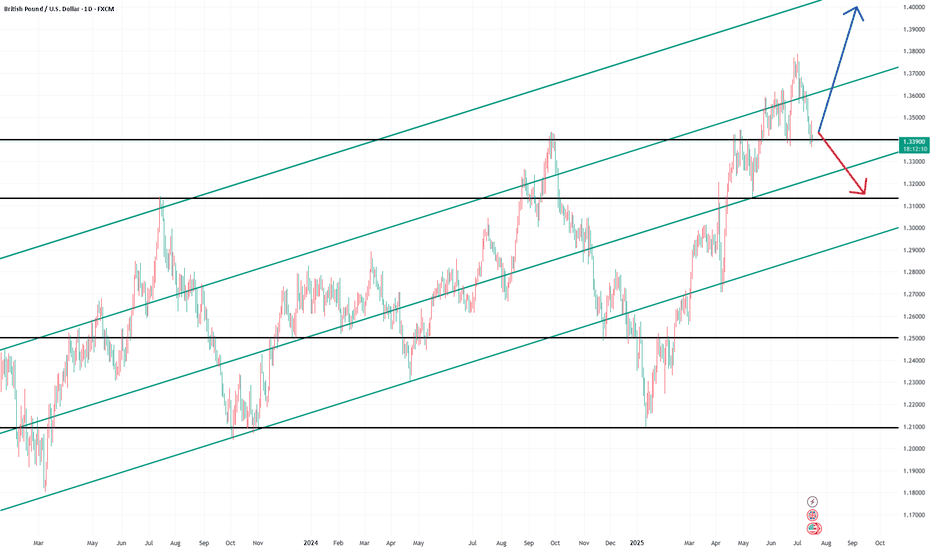

GBPUSD Chart Analysis

The GBPUSD pair failed to break above the 1.38000 level and fell through the trendline after facing resistance in that zone. Currently, it is testing support near the 1.34000 level. If the pair successfully rebounds from this area, we could expect another potential rally toward the 1.40000 level. However, if the support is broken, a further decline toward the 1.31500–1.32000 range is likely.

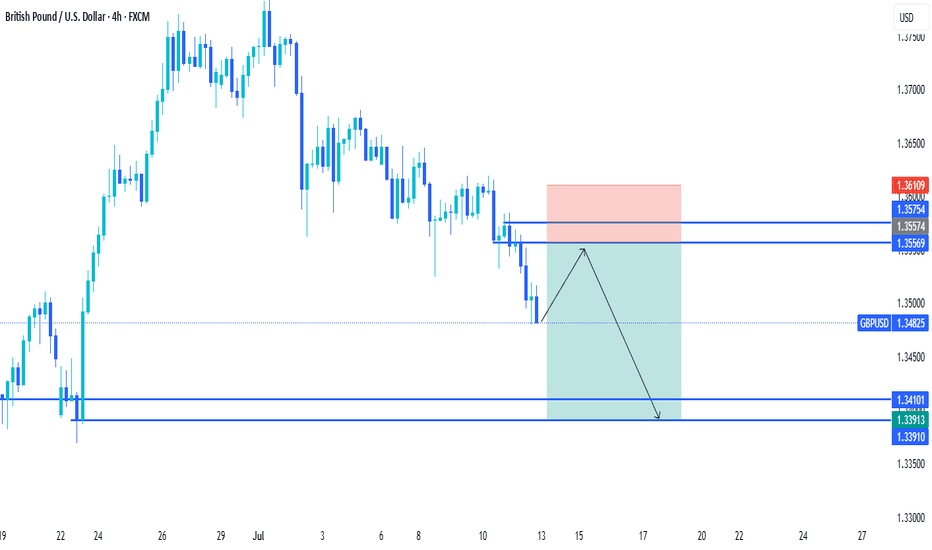

GBPUSD SELL SETUPTimeframe: 4H

Current Price Area: 1.3485

Price Structure: Bearish trend → possible reversal zone

Tools Used: LuxAlgo SMC, Market Structure Breaks (BOS), Supply & Demand zones, Liquidity zones, and internal trendlines

🔧 Structure Breakdown

🟥 1. Break of Structure (BOS) at the top:

There was a bullish BOS earlier (left side of chart), but now the structure shifted bearish.

A clear trendline channel formed as price moved down — showing controlled selling (a descending wedge).

🔻 2. Supply Zone at the top:

Marked in red box — this represents the last bearish order block before the sharp move down.

Acts as a strong supply or re-entry point for sellers if price retraces back.

🔺 3. Current Price at Demand Zone (Reversal Area):

Price is currently sitting inside a demand zone (highlighted in orange + blue).

This zone aligns with previous inefficiency (fair value gap) and a strong low at 1.3451, suggesting a possible buy opportunity for a retracement or reversal.

🧱 4. Strong High / Weak High Logic:

The chart marks a strong high (protected by supply), and a weak high at the top that could be targeted later if bullish continuation happens.

This implies the short-term goal is to grab liquidity from sell-side traders and reverse toward the weak high.

🎯 Entry Logic & Trade Setup

Entry:

Around current demand zone (1.3450–1.3480) after price showed reaction/wick rejection.

Stop Loss (SL):

Just below the strong low (~1.3371) to protect against deep sweep/liquidity grab.

Target 1 (TP1):

Return to supply zone or imbalance area near 1.3507–1.3580.

Target 2 (TP2):

A more aggressive target would be a run toward the weak high (~1.3661).

📉 Bearish Possibility?

If price fails to hold this demand zone and closes strongly below 1.3450 → it would break the strong low → bearish continuation becomes likely.

That would invalidate this reversal and re-open downside targets.

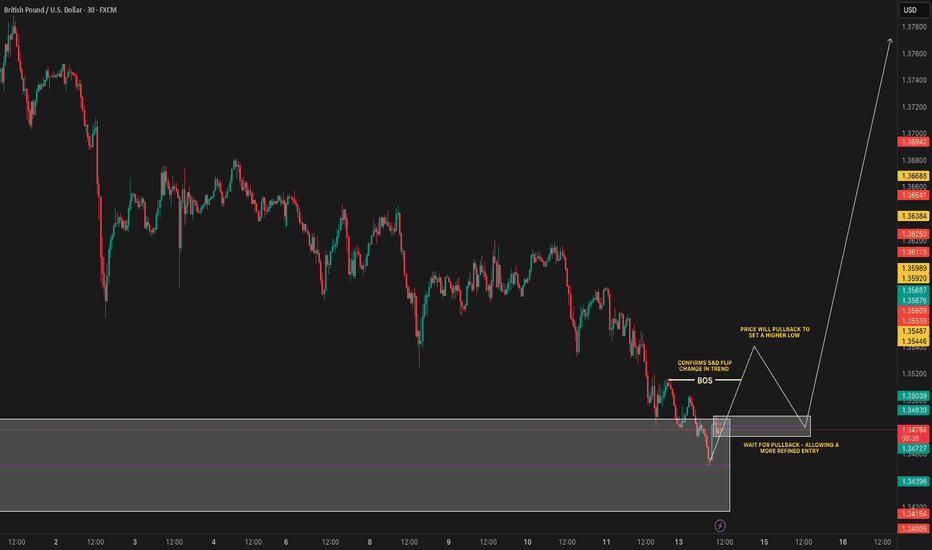

THOUGHTS ON GBP/USD GBP/USD 30M - As you can see above price has traded us down and into an area of interest we have marked out from this weeks Sunday Sessions video.

Now price has traded us down and into this zone we are expecting enough Demand to be introduced to encourage price to flip balances and instigate the new higher timeframe Impulse.

As you are all aware this market is predominantly bullish and up to now has been putting in a bearish corrective wave, this could be the point of reversal and somewhere I feel we could go long from.

Its a case of waiting for a break in structure to confirm this reversal, once we have this break, price tells us that now Demand is in power and we can expect longer term bullishness, giving us the opportunity to buy in.