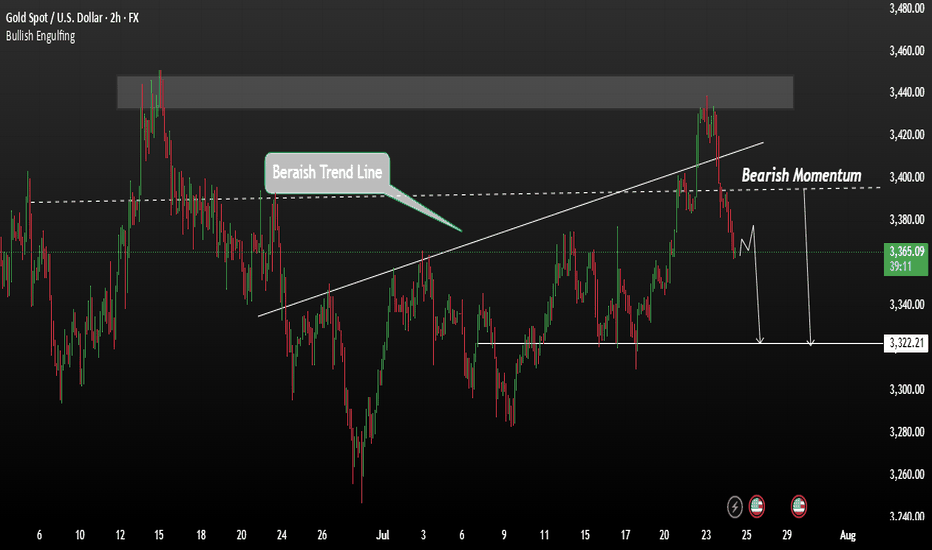

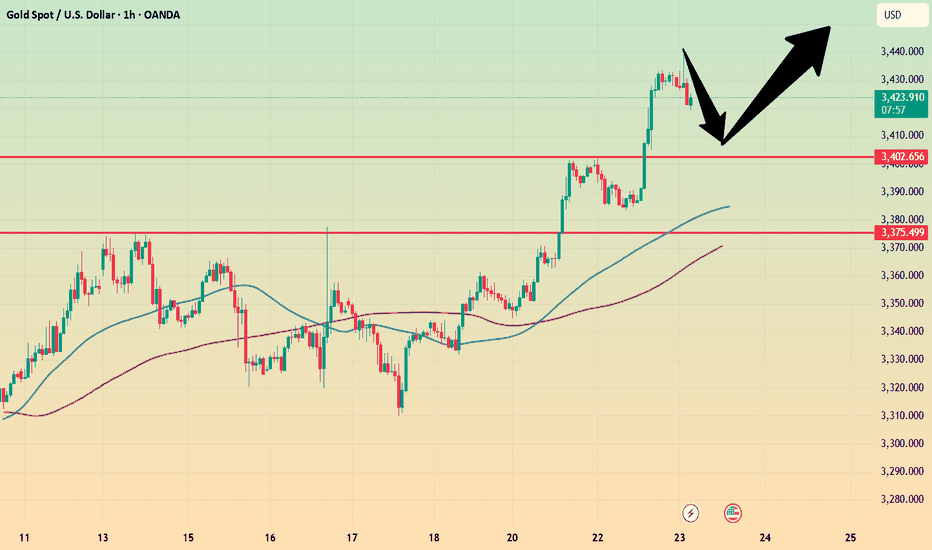

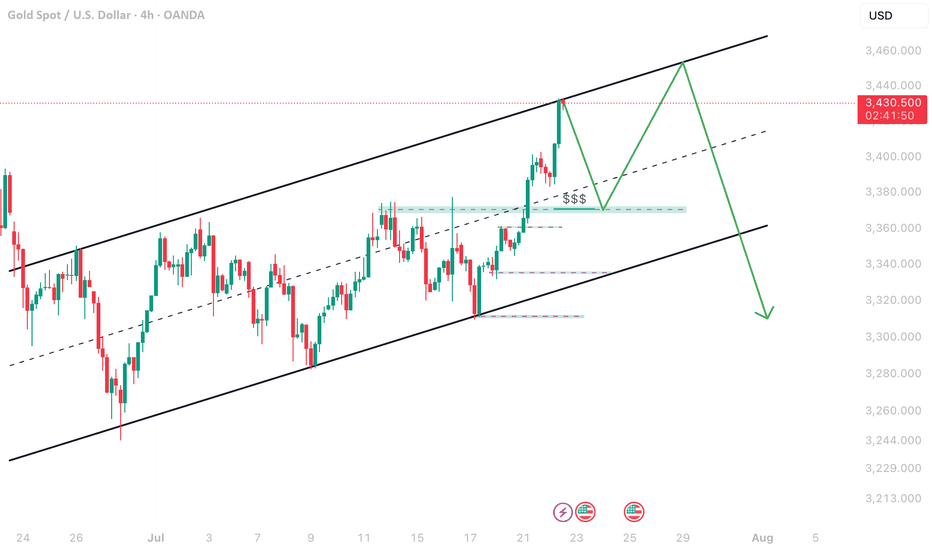

Gold remains in a bearish trendGold followed our previous analysis closely, rejecting from the strong resistance level at $3430, confirming bearish momentum. This rejection has opened the door for a potential move toward the 3400 level, and further downside is likely.

Gold remains in a bearish trend. A temporary pause or minor consolidation may occur, but the overall direction remains to the downside. This week, markets are watching the outcome of the ES–US agreement closely. If a resolution is reached, it could strengthen the USD and increase risk appetite—potentially pushing gold even lower.

We expect gold to remain under pressure unless major market sentiment shifts. A break below 3400 could accelerate the drop toward 3322.

You May find more details in the chart.

Ps Support with like and comments for better analysis Thanks.

GOLD trade ideas

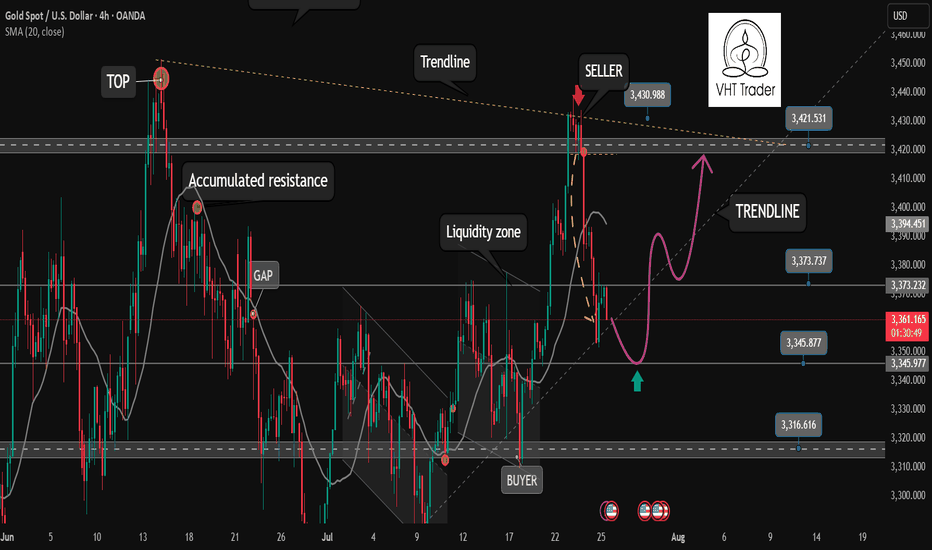

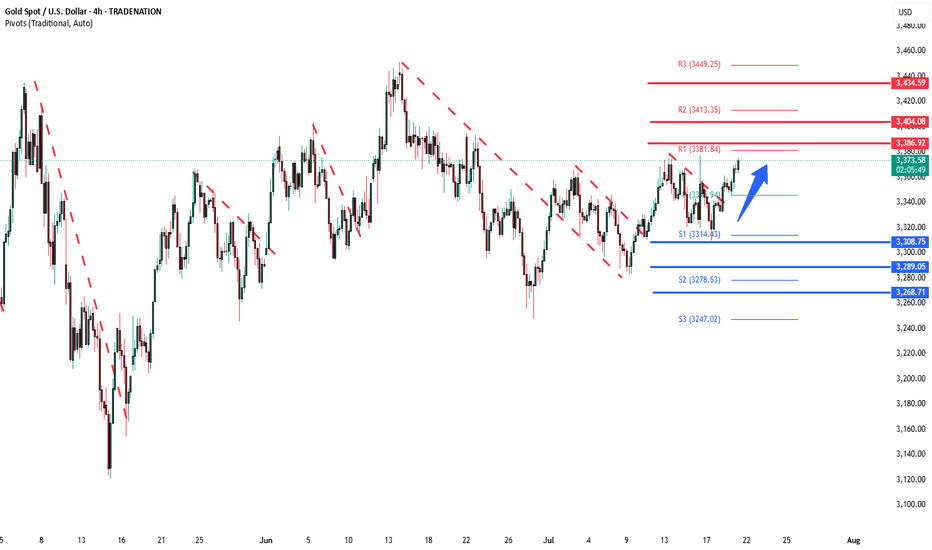

Is the gold correction over?✏️Yesterday's D1 candle closed above the Breakout 3363 zone. This shows that the buyers in the US session are still strong. There is a possibility of a liquidity sweep in the Tokyo and London sessions, then in the New York session, Gold will recover and increase again. The uptrend is really broken when Gold confirms a close below 3345. In this case, we have to wait for 3320 to confirm the BUY point. The gold uptrend at this time also needs new momentum to be able to move towards ATH 3500.

📉 Key Levels

Support: 3345-3320

Resistance: 3373-3418

Buy zone: 3345 (bullish wave structure maintained); BUY DCA break 3373

Buy zone: 3320 (Strong support zone)

Target: 3417

Leave your comments on the idea. I am happy to read your views.

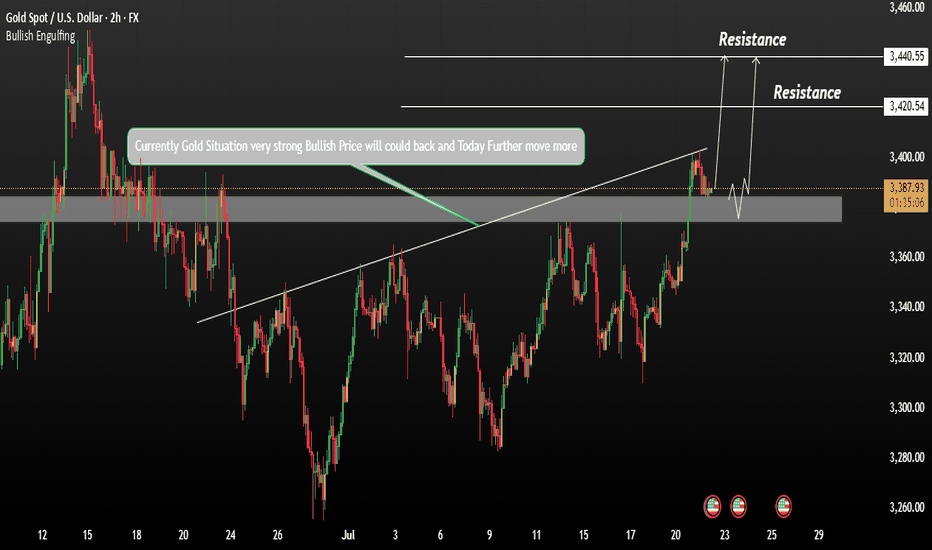

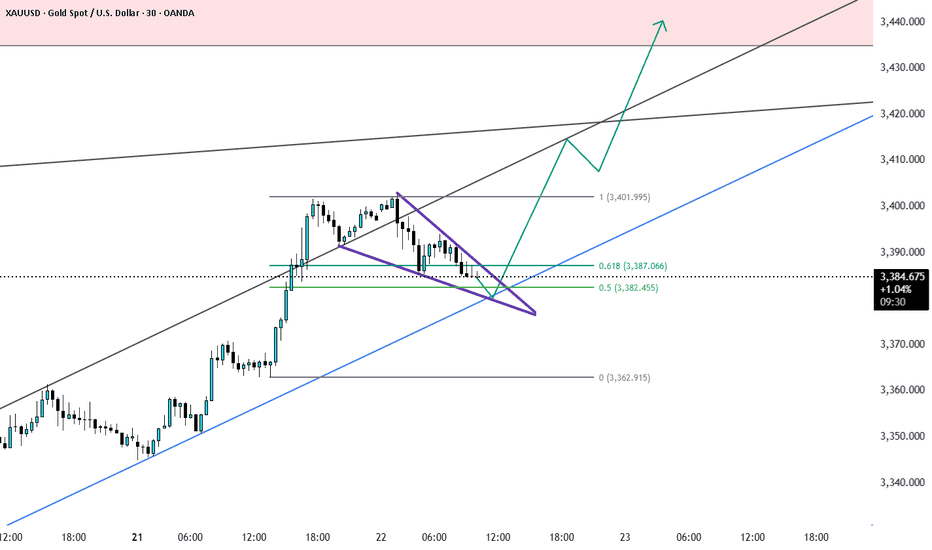

GOLD Price Can rise catch the ResistanceGold is currently showing strong underlying momentum, although it is undergoing a short-term correction from the 3400 level. This pullback appears to be driven by profit-taking ahead of Fed Chair Jerome Powell’s upcoming speech, as well as uncertainty around U.S. trade negotiations with the EU and Japan expected to conclude before August 1.

Resistance Levels: 3420 / 3440

Immediate Support: 3375

A false breakout below resistance could result in a retest of 3375 before resuming upward momentum.

You can see more details in the chart.

Ps support with like and comments for better analysis Thanks.

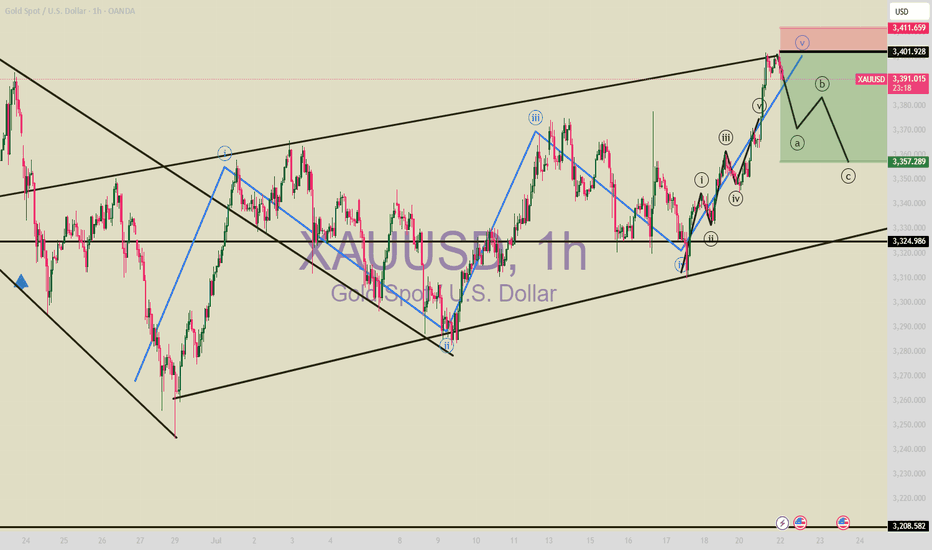

Hellena | GOLD (4H): LONG to resistance area of 3397 (Wave 3).Dear colleagues, my previous forecast remains valid, but I have decided to update it.

At the moment, I still think that wave “3” of the medium order continues its upward movement.

At the moment, I think that the small correction in wave “2” is ending and we will see a continuation of the trend. I see the resistance area of 3397.94 as the target. The main thing is to overcome the local level of the small wave “1” at 3366.37.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

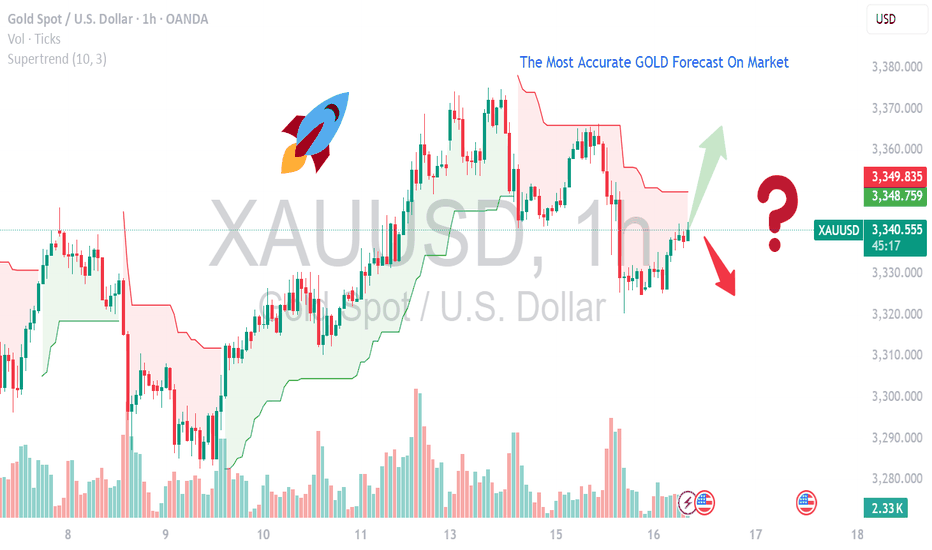

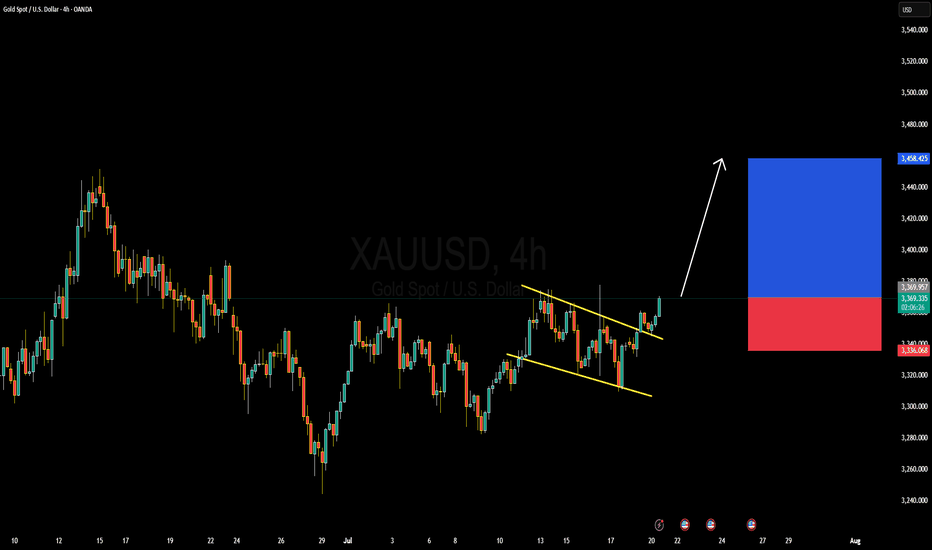

MOST ACCURATE XAUUSD GOLD FORECAST ANALYSIS MARKETCurrent Setup & Technical Outlook

Consolidation & Pennant Formation: Gold is building a bullish pennant and trading above its 50‑day MA — a classic continuation pattern suggesting a breakout toward new highs if momentum resumes .

Key Levels:

Support: $3,330–3,340 — confirmed by multiple technical sources .

Resistance/Breakout Zone: $3,360–3,375 — clearing this could trigger a rally toward $3,400+ .

Upside Targets: $3,390, then possibly $3,500–$3,535 per weekly forecast .

Alternate Bearish Scenario: A failure around the 0.618 Fibonacci resistance (~$3,374) and overbought RSI could spark a pullback to $3,356 or lower .

---

🧠 Fundamental Drivers

Inflation & U.S. Macro Data: Market awaits June CPI/PPI and Fed commentary — cooler inflation could boost gold via dovish expectations, while hotter data may strengthen the USD and weigh on bullion .

Geopolitical & Safe-Haven Demand: Trade tensions (e.g., tariffs) are keeping gold elevated near $3,350–$3,360 .

Central Bank & Real Yields Watch: Continued gold purchases and lower real rates are supportive, although mid-term easing in risks (like global trade) could curb momentum .

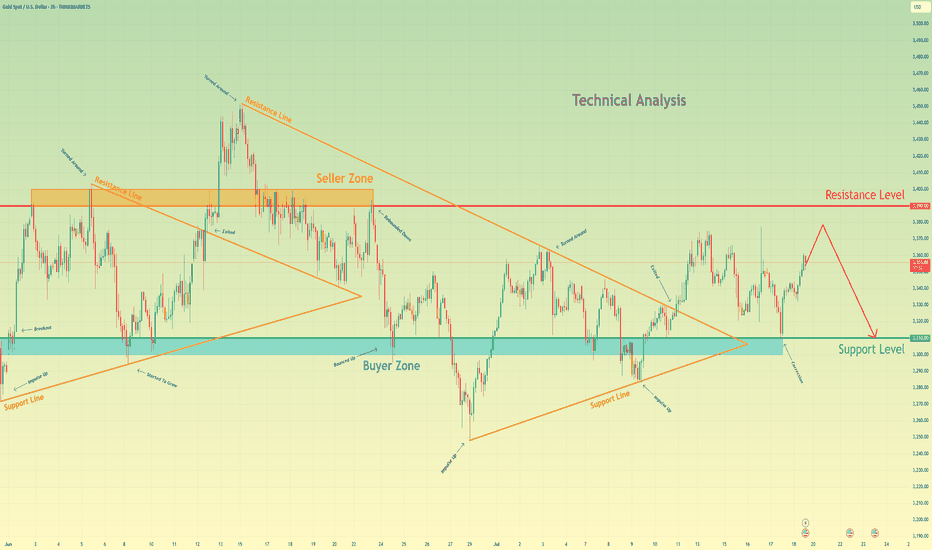

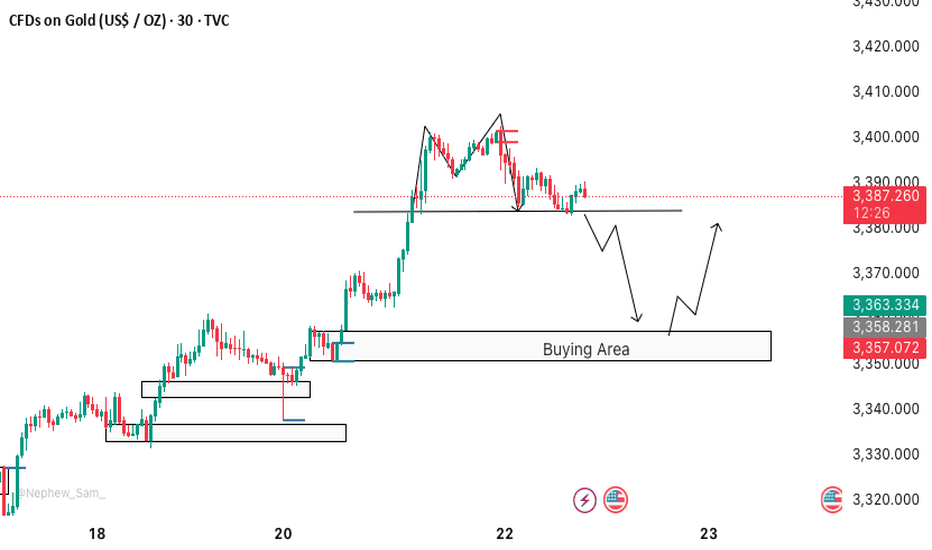

Gold may rise a little and then drop to support levelHello traders, I want share with you my opinion about Gold. Initially, gold was trading within a large consolidating pennant, showing both upward and downward impulses as it moved between the converging trend lines. The price eventually saw a breakout from this pattern, followed by a strong impulse up, but this momentum stalled as it approached the major horizontal resistance level at 3390. This level, which corresponds with the upper seller zone, has proven to be a significant barrier for buyers, rejecting the price and confirming a strong seller presence in that area. Currently, the market is in a corrective phase after being rejected from the highs. The price is drifting upwards once again in what appears to be a final retest of the aforementioned seller zone. This slow upward movement lacks the impulsive strength of the previous trend, suggesting that buyers are losing control and sellers are preparing to defend the 3390 resistance level once more. I expect this corrective move to fail upon reaching the seller zone around 3390. After this retest, I anticipate a sharp reversal and the beginning of a new downward trend. The logical target for this move is the major support level at 3310, an area that has historically acted as a strong buyer zone. That is why my TP is set at 3310. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

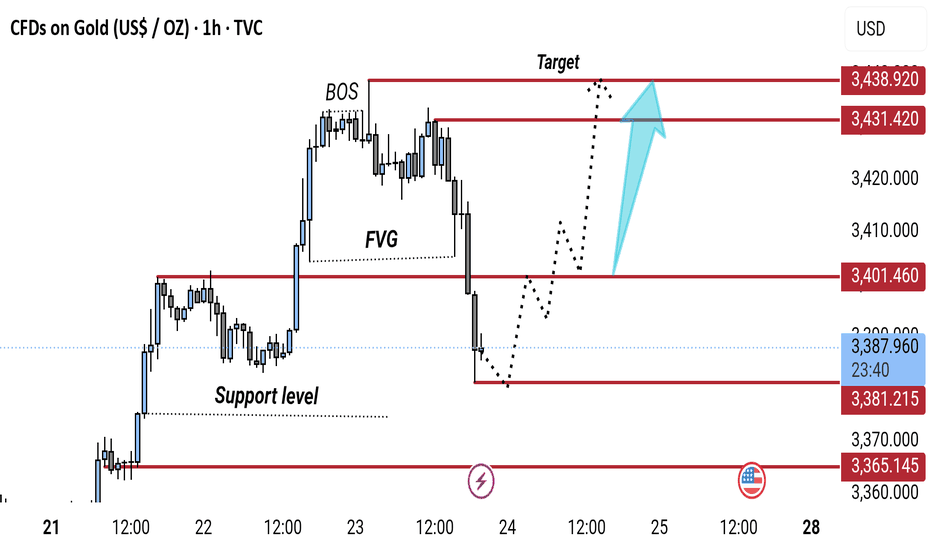

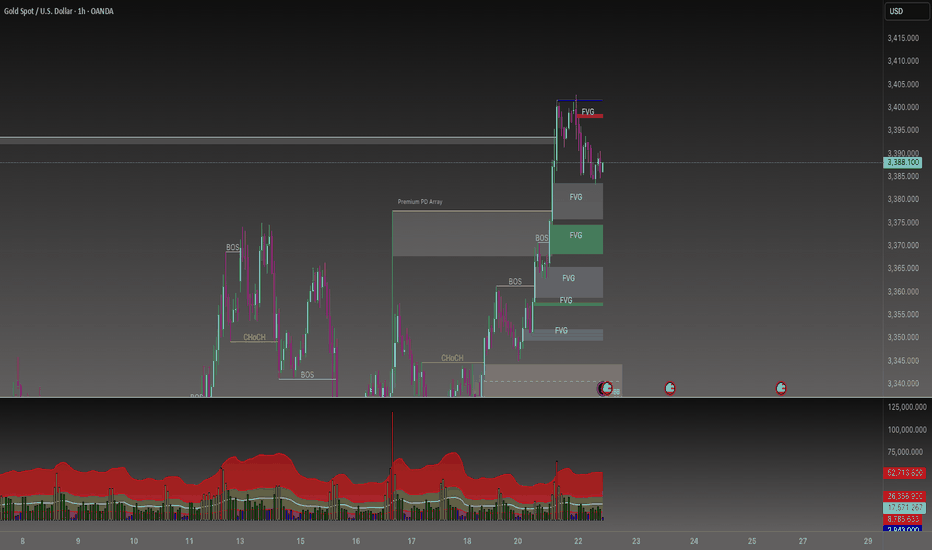

"Gold Price Reversal Setup: Targeting Bullish Recovery After BOSThis 1-hour gold (XAU/USD) chart shows a potential bullish setup. After a Break of Structure (BOS) and a drop into a support level, price may rebound through the Fair Value Gap (FVG) toward the target zone around 3,431.42–3,436.92. The dotted line outlines a projected bullish move.

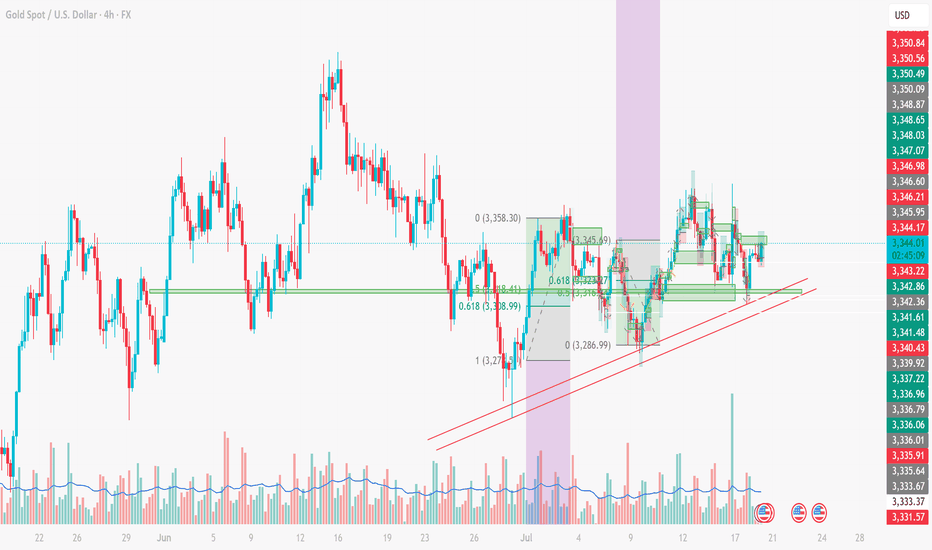

XAUUSD ANALYSIS – JULY 18XAUUSD ANALYSIS – JULY 18: STRATEGY BASED ON FIBONACCI, TRENDLINE & STRUCTURE

1. XAUUSD Technical Overview (4H Chart)

Gold (XAUUSD) is currently trading around 3,343 USD, showing signs of a slight rebound from key support. On the 4H timeframe, the price structure is forming higher lows, maintaining above a short-term rising trendline – a technically bullish signal.

2. Key Support & Resistance Zones

Immediate Supports:

3,338 USD: aligning with the 0.618 Fibonacci retracement – a zone tested multiple times.

3,333 – 3,335 USD: strong support, overlapping with EMA and rising trendline.

3,327 USD: previous swing low – last defense for the bullish structure.

Immediate Resistances:

3,345 – 3,346 USD: frequently rejected zone in recent sessions.

3,350 USD: psychological and technical resistance.

3,358 USD: recent swing high – breakout confirmation level.

3. Price Action & Fibonacci Confluence

Price is currently hovering between Fibo 0.5 (3,343 USD) and Fibo 0.618 (3,338 USD) – a potential bounce zone if bullish momentum holds.

The pullback from 3,358 to 3,286 has respected standard Fibonacci retracement levels, confirming technical price behavior.

4. Trendline Analysis

The ascending trendline from the 3,275 USD low remains intact, providing solid dynamic support.

If the price continues to bounce from this trendline, it may form a bullish continuation pattern (flag/pennant).

5. Suggested Trading Strategies

Long

Entry: 3,338 – 3,340 USD

SL: 3,327 USD

TP: 3,345 – 3,350 – 3,358 USD

Note: Buying the dip near Fib & trendline

Short

Entry: Below 3,327 USD (breakdown)

SL: Above 3,340 USD

TP: 3,310 – 3,298 USD

Notes: Only if price breaks trendline & support

6. Supporting Technical Indicators

EMA20/EMA50 show slight upward momentum – early bullish bias.

RSI (14) hovers near 50 – neutral zone, awaiting breakout confirmation.

Conclusion:

Gold is consolidating around a critical support zone. The short-term bias leans bullish if the 3,338 – 3,333 USD region holds and price breaks above 3,346 – 3,350 USD.

This is a key moment to position early using Fibonacci and trendline confluence.

👉 Follow for more strategies in upcoming sessions. Save this if you find it useful!

Do you have a different view? Share your thoughts in the comments below!

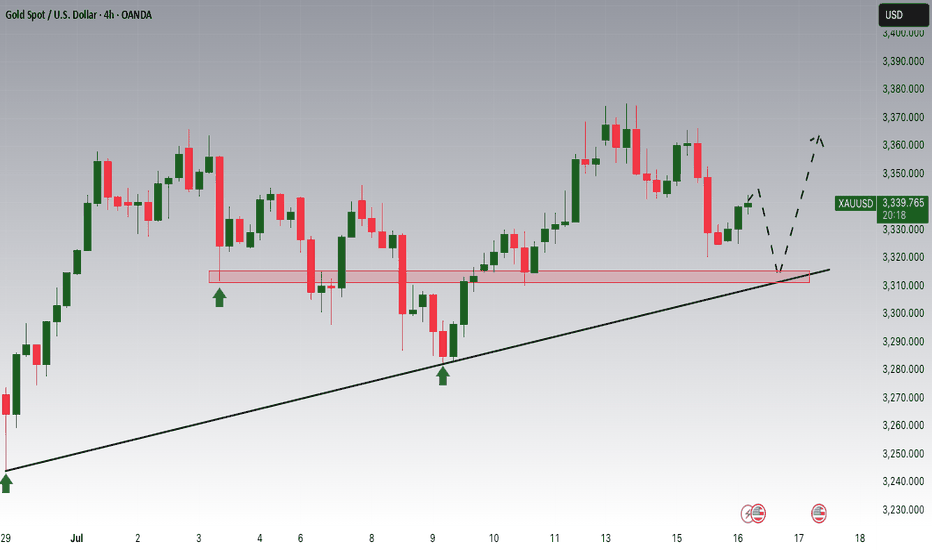

XAUUSD Forming descending ChannelXAUUSD Gold has just broken out of a descending wedge formation and is now building bullish momentum. The daily chart shows a clear breakout above the upper channel line, confirming that buyers have taken control. Across the 4‑hour and daily charts, price is holding above key moving averages (20/50/100) and recently formed a bullish hammer—classic signals of fresh upside potential. A fib retracement off the wedge low would likely find support around $3,300–3,320, which already held strong. With immediate resistance in the $3,342–3,350 range, I'm expecting a firm push toward the $3,400 zone next, positioning for a possible continuation to $3,450+.

Fundamentals continue to steer price in our favor. In Q3 2025, gold remains elevated as the U.S. dollar loses steam and rate‑cut expectations rise. The market is pricing in a possible Fed move as early as next month, while tariff and trade uncertainty continues to dominate headlines. Central bank gold purchases remain strong, and investors are seeking safe‑haven shelter amid economic jitters—supporting gold’s role as a defensive asset. With YTD gains nearing 26%, momentum remains firmly bullish.

Looking ahead over the next couple of weeks, the risk/reward remains favorable. If gold holds above the $3,330–3,340 zone, we can remain bullish toward targets $3,400–$3,450. A dip toward that zone would present an attractive long entry, reinforcing our position. However, a breakdown below $3,300 would warrant caution and could introduce a deeper correction.

Given current technicals, fundamentals, and macro backdrop, this setup offers a strong opportunity. With proper risk management and support confirmation, another significant bullish leg toward $3,450–$3,500 is well within reach. Have a profitable trade.

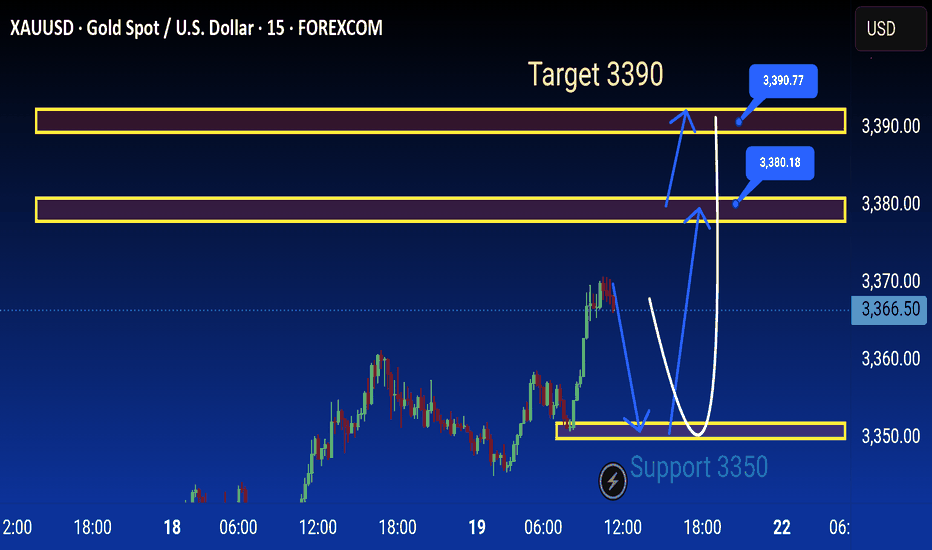

Xauusd Analysis is Ready technical analysis of XAUUSD (Gold Spot vs. US Dollar) on the 15-minute timeframe using support and resistance levels, with projected price movements annotated.

Key Levels:

Support Zone: Around 3350 USD (labeled as "Support 3350")

Resistance Zones:

Minor resistance: Around 3380.18 USD

Major resistance: Around 3390.77 USD

Target: 3390 USD, highlighted as the ultimate bullish goal.

Current Price:

Price at the time of analysis: ~3368.30 USD

Analysis Summary:

1. Support Retest Scenario:

Price may pull back to the 3350 support zone.

If this support holds, a bullish reversal is expected.

The anticipated move is a rebound back toward the resistance zone at 3380, and possibly to the target at 3390.

2. Immediate Bullish Continuation:

Alternatively, price could continue upwards from the current level without revisiting support.

Resistance around 3380 may act as a minor barrier.

If broken, the price could reach the target at 3390.

3. Bearish Risk:

If 3350 fails to hold as support, further downside may occur, invalidating the bullish setup.

Strategy Implication:

Buy positions could be considered on a successful retest and bounce at 3350.

Take-profits might be set near 3380 and 3390.

Traders should watch for price action confirmation at key levels before entering trades.

This is a classic support-resistance trading setup with short-term bullish bias aiming for a breakout toward higher resistance levels

Gold surges! Gold prices soar!Market news:

In the early Asian session on Wednesday (July 23), spot gold fell slightly and is currently trading around $3,422/oz. Supported by the increasing uncertainty in global trade, the downward trend in U.S. Treasury yields and the weakening of the U.S. dollar, spot gold rose strongly, hitting a five-week high. The market's tension over the August 1 deadline for the implementation of U.S. President Trump's tariffs has intensified, driving safe-haven funds to continue to flow into the international gold market. Investors are focusing on the progress of the U.S. multilateral trade negotiations and the new round of tariffs that the Trump administration is about to launch: while the demand for safe-haven assets has increased, the U.S. 10-year Treasury yield has fallen to a two-week low, further enhancing the attractiveness of non-interest-bearing gold. The global economic slowdown, expectations of loose monetary policy and geopolitical risks will continue to support gold's status as a safe-haven asset. Looking ahead to the market this week, the market focuses on: the Fed's FOMC policy meeting will be held next week. Although the meeting is expected to keep interest rates unchanged, investors have begun to bet on the possibility of a rate cut in October; Fed Vice Chairman Bowman reiterated on Tuesday that the central bank should maintain policy independence, and Powell's upcoming policy meeting may release further signals; in terms of inflation, as signs of tariff costs being transmitted to consumer goods emerge, Powell has previously warned that inflation may accelerate again in the summer.

Technical Review:

Gold maintained its expected bulls and hit a new high yesterday. The daily line maintained a long-term structure of consecutive positive bulls. The MA10/7-day moving average opened upward, and the RSI indicator ran above the central axis. The Bollinger Bands of the hourly and four-hour charts opened upward, the price maintained the middle and upper track channel, and the moving average system opened upward. The idea of gold trading remains unchanged, and the layout is mainly based on buying at a low price and selling at a high price. After a sharp rise last night, gold began to fluctuate at a high level in the second half of the night, and the adjustment was very small, which means that the market is still the strong market. The recent pattern of gold price fluctuations and rises remains. Since it is fluctuating upward, the overall trend of gold today is still biased towards buying, but we need to be alert to the risk of short-term corrections. It is recommended to arrange buy orders based on technical support levels, and pay attention to trade policies and the Fed's trends!

Today's analysis:

Gold buying has been as strong as a rainbow in the past two days, and it is also a buying carnival. Gold is now buying strongly and the momentum is winning. Once the trend is formed, it is necessary to follow the trend. Now the trend of gold buying is very obvious, constantly refreshing the recent highs, so continue to buy gold to the end, and continue to buy if it rises. Continue to buy if it falls during the day!

The gold 1-hour moving average continues to form a golden cross upward buying arrangement. The gold buying power is still there, and gold continues to exert its strength. Gold has risen step by step in the past two days. As long as there is no sharp decline, it is accumulating momentum to attack. The gold support continues to move up. Now it has broken through and stabilized at the 3400 line. If gold falls back to 3400, it can still be bought at low prices.

Operation ideas:

Short-term gold 3400-3403 buy, stop loss 3392, target 3420-3440;

Short-term gold 3438-3441 sell, stop loss 3450, target 3400-3380;

Key points:

First support level: 3412, second support level: 3403, third support level: 3390

First resistance level: 3438, second resistance level: 3450, third resistance level: 3468

Gold bullish run continuation supported at 3308The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at:

3387 – initial resistance

3400 – psychological and structural level

3435 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3308 would weaken the bullish outlook and suggest deeper downside risk toward:

3290 – minor support

3268 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Gold holds above 3308. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

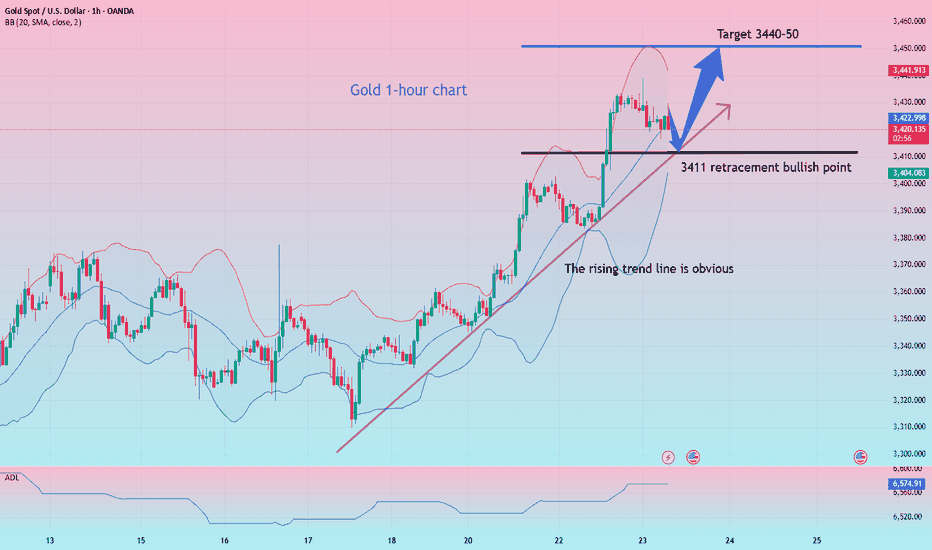

Gold safe-haven retreat? It will continue to rise!

Why did gold return to 3,400? Reasons explained!

1 As investors continue to focus on US President Trump's August 1 tariff deadline, trade uncertainty and weaker US Treasury yields have pushed gold prices to a five-week high. At the same time, trade uncertainty is also triggering some safe-haven demand.

2 At the same time, investors are also preparing for the Federal Reserve meeting next week. Although the Fed is expected to keep interest rates unchanged, the market expects that the Fed may cut interest rates in October. Gold is traditionally seen as a hedge tool in uncertain times and tends to perform well in a low-interest rate environment.

Views on today's gold trend!

After two consecutive days of rising this week, the sentiment of gold bulls has basically been ignited. There has been basically no obvious retracement in the past few days. Either it is a slow rise in a row, or it is a direct acceleration of the rise after sideways fluctuations. After the first wave of highs at the opening today, the market is still at a rising node!

The watershed of the retracement on the hourly chart is still the break point of 3403, but it is too far from our current position to enter the market at this position. In addition, the current continuous rise of gold and the turning of the moving average have made the market bulls more aggressive, which means that the previous short-term downward trend has ended. The point of today's retracement layout can focus on the vicinity of 3412!

Gold: Long near 3411, defend below 3403, and target 3440-50!

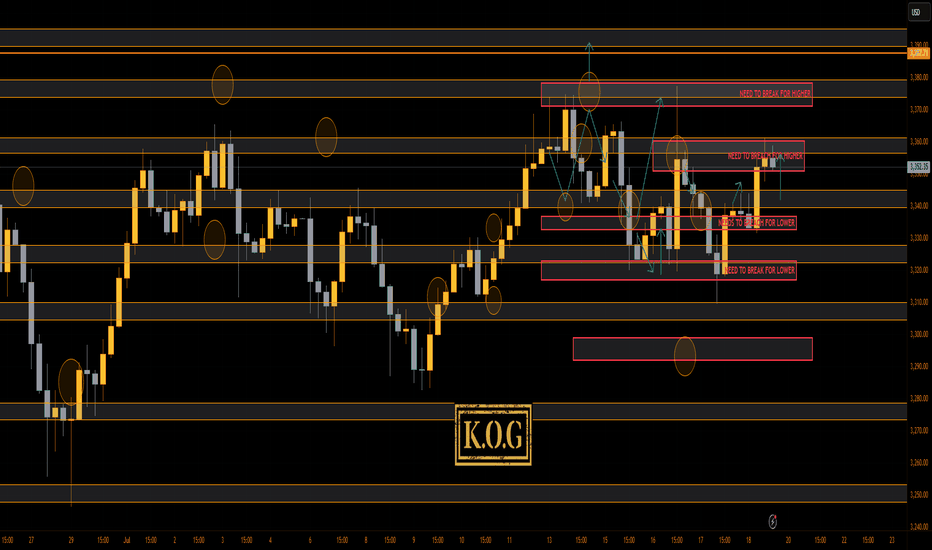

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

What a week on the markets with our KOG report plan working well, the red boxes moving with price, the Excalibur targets being completed and then most of the bias level targets completing as well.

Have a look at Sundays report and compare the move and levels shared, you'll see how well we've managed to track this. Only thing we haven't got (yet) is that curve ball, so let's see how we close today and open on Sunday.

For now, support below is at the 3340 level with resistance 3370. We may just see a late session move here so play caution.

KOG’s bias for the week:

Bullish above 3350 with targets above 3360✅, 3373✅, 3375✅ and 3383 for now

Bearish below 3350 with targets below 3340,✅ 3335✅, 3329✅, 3320✅ and 3310✅ for now

RED BOX TARGETS:

Break above 3365 for 3372✅, 3375✅, 3382, 3390 and 3406 in extension of the move

Break below 3350 for 3340✅, 3335✅, 3329✅, 3322✅ and 3310✅ in extension of the move

Wishing you all a great weekend and we'll see you on Sunday for the KOG Report. Please do take some time to hit the boost button, it's very much appreciated.

As always, trade safe.

KOG

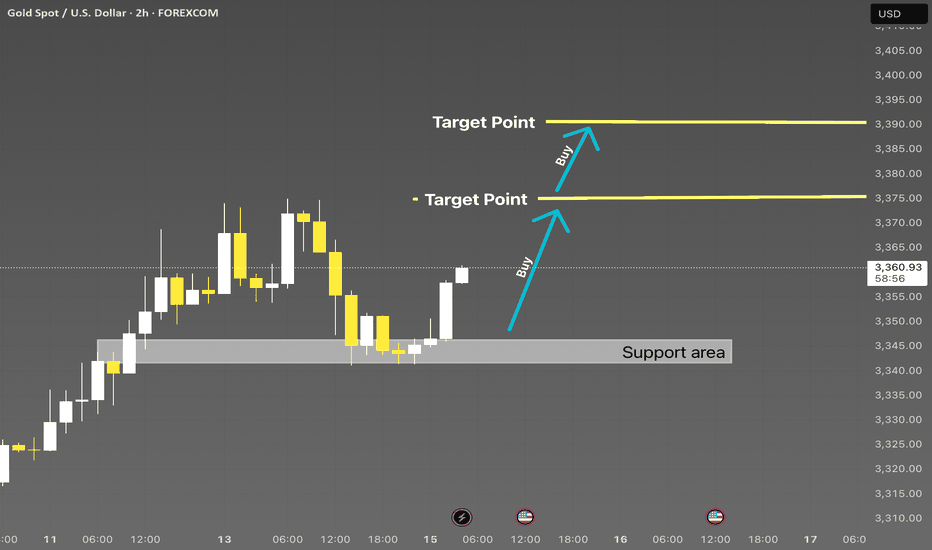

XAUUSD 2H | Smart Money Buy from Strong DemandXAUUSD 2H | Support Rejection with Upside Targets 🎯

Price respected the key support zone and is now showing bullish momentum. Two clear target levels are marked above. Ideal buy opportunity after rejection confirmation from demand zone. Watch for clean continuation toward 3370 and 3390.

#XAUUSD #GoldAnalysis #SmartMoneyConcepts #SMC #Forex #PriceAction #BuySetup

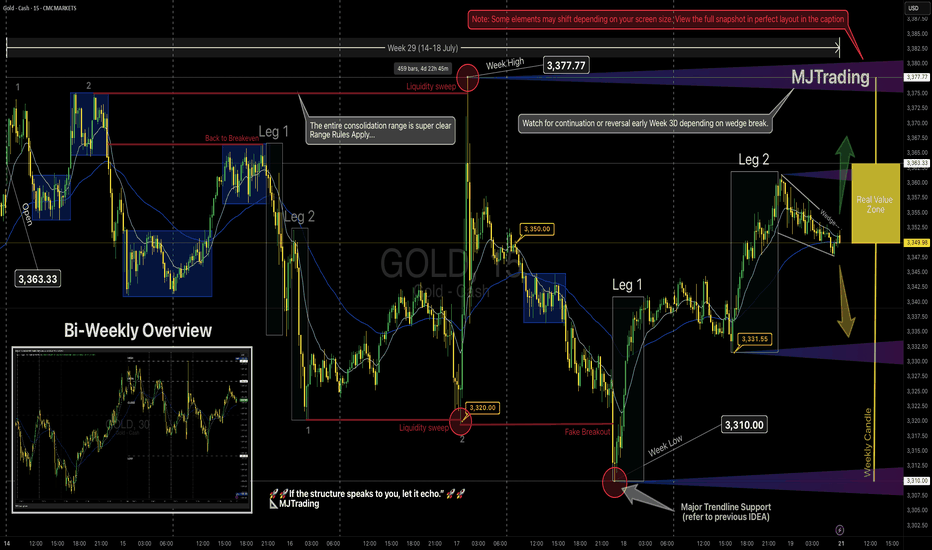

GOLD Weekly Recap (Week 29) – MJTrading View📸 Viewing Tip:

🛠️ Some layout elements may shift depending on your screen size.

🔗 View the fixed high-resolution chart here:

Now that you have got the perfect layout let's dive in...

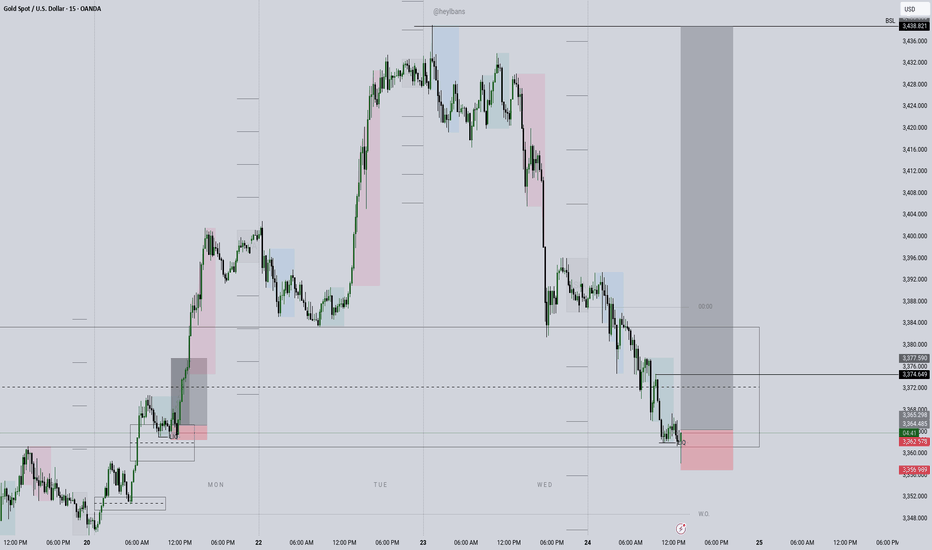

📈 GOLD Weekly Recap (Week 29) – MJTrading View

🕰 Timeframe: 15min chart with bi-weekly perspective

📅 Period Covered: July 14–18 (Week 29)

🎯 Visual Framework: Leg structure, range boundaries, liquidity sweeps, trendline holds, and Real Value Zone.

🔹 Weekly Summary

Open: 3,363.33

High: 3,377.77 (🔴 sweep: trapped buyers)

Low: 3,310.00 (🔴 sweep into key demand + touching the main ascending trendline )

Close: 3,349.98~3350 (lovely round level)

Structure: Entire week played inside a broad consolidation range, with sharp but failed breakouts on both extremes.

Range rules applied: traps, sweeps, compression — everything aligned for responsive trading.

📌 Key Observations

Early Week:

A double-top structure led to rejection from ~3,375 → slid into 3,350.

Price returned to breakeven but then flushed hard toward 3,320 via a clean 2-leg drop.

Midweek:

After forming a double bottom, price created a tiny liquidity sweep, then exploded to the weekly high.

The move above 3,377.77 was a textbook liquidity grab, immediately rejected.

This led to a slide toward the weekly low, tagging both the trendline and consolidation floor — forming a false breakout + reversal.

Late Week:

The low at 3,310 was swept cleanly (🔴), followed by a leg-based reversal:

Leg 1: Up to 3,331

Leg 2: Extended to ~3,360 before fading back inside the range.

Compression:

Price closed inside the Real Value Zone (weekly candle body) — just under the open, forming a tight wedge, hinting at breakout conditions for Week 30.

🟨 Weekly Candle Body

Open → Close of weekly candle reflects Real Value Zone .

Highs and lows were swept, but real commitment stayed within the body.

🧭 Key Levels to Watch – Week 30

Level Role

3,377.77 Weekly High / Liquidity Sweep (🔴 rejection)

3,363.33 Weekly Open (break & hold = bullish bias) / Previous Weekly High

3,350.00 Micro resistance / Mid-structure cap / Round Level

3,331-3 Leg 2 low & first reaction zone / Round Level

3,320.00 Breakdown support / Flush origin

3,310.00 Weekly Low / Major Demand (🔴 sweep)

3,400.00 Next possible main target

3,282.00 Previous Weekly Low

Dynamics: Both Uptrend and Downtrend Lines...

🧠 MJTrading Notes

Bias remains neutral inside the range.

A break & acceptance above 3,363 could trigger a re-test of the sweep zone (3,377+).

A breakdown below 3,331 puts 3,320 → 3,310 back on the map then 3,282.

Don’t force direction — let expansion confirm itself.

🧭 “If the structure speaks to you, let it echo.”

– MJTrading 🚀

#MJTrading #ChartDesigner #GOLD #LiquiditySweep #PriceAction #StructureTrading #Weekly #Chart #Consolidation #2legs

🧠 Psychology always matters:

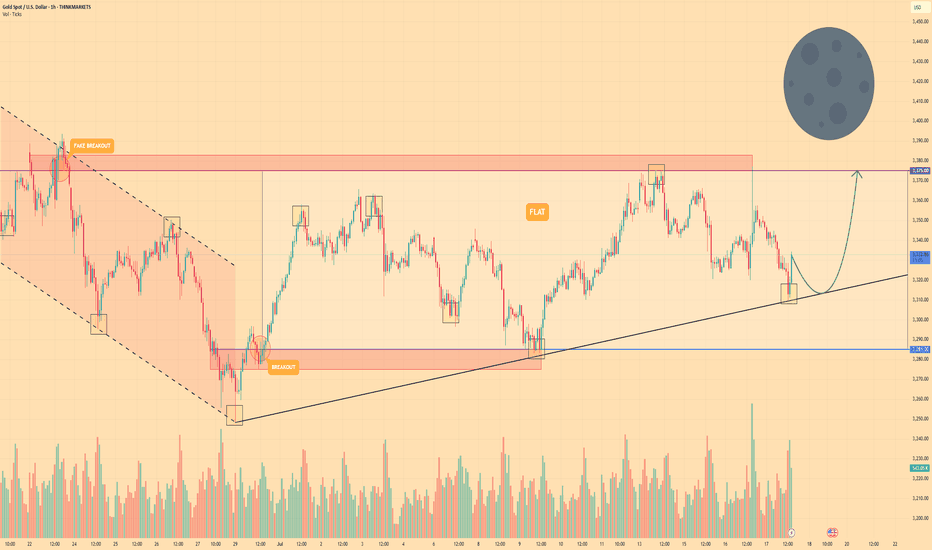

GOLD - Price may bounce up to $3375 level from support lineHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Initially, the price action was confined within a descending channel before a decisive bullish breakout occurred.

This first breakout triggered a strong upward impulse, setting the stage for the current market structure.

The price is now consolidating in a wide flat range, bounded by support near the $3285 level and resistance at $3375.

An ascending support line is providing dynamic support within this consolidation pattern, indicating underlying buying pressure.

I expect a brief retest of this support line, which should act as a launchpad for the price to move higher.

The primary target for this long setup is the $3375 resistance level, marking the top of the current flat range.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

XAUUSD M30 BEST SETUP FOR TODAY📉 Gold Analysis:

🔸 Gold is forming an M-pattern – a potential bearish setup.

➡️ We can look for a sell opportunity if we get a strong candle closing below the M-pattern structure.

📈 Buying Setup (Support Zone):

🔹 There's a strong buy zone at the bottom, marked by:

✅ Fair Value Gap (FVG)

✅ Order Block (OB) confirmation

🕵️♂️ Wait for clear price action confirmation before entering any trades.