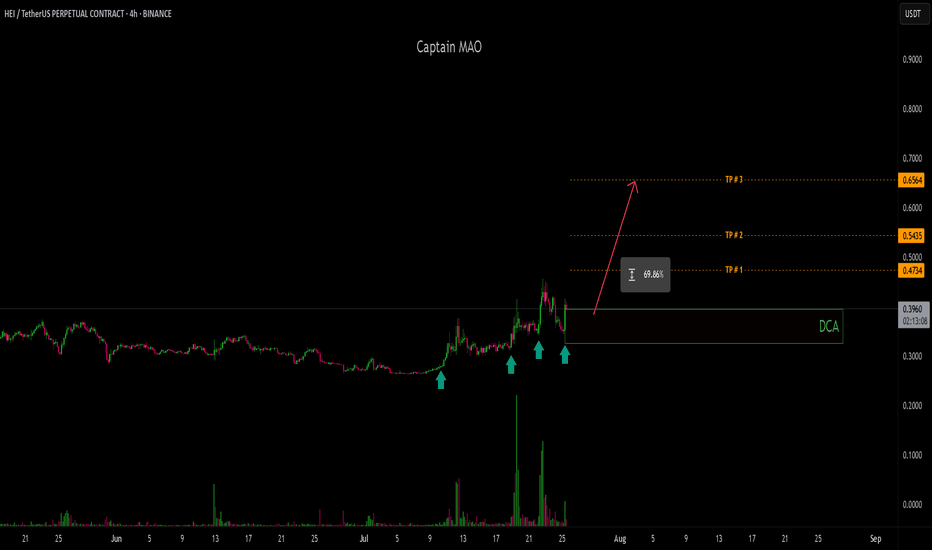

HEI/USDT - Higher !!showing strong bullish price action, consistently printing higher highs and higher lows with aggressive buyer pressure. The structure indicates sustained momentum, and the current consolidation above recent support suggests strength.

marked the green box as a buy zone starting from the current market price, as this area aligns with previous S/R flip zone turned support. This provides a favorable entry for continuation toward the next key resistance levels.

SL : 0.32

HEIUSDT.P trade ideas

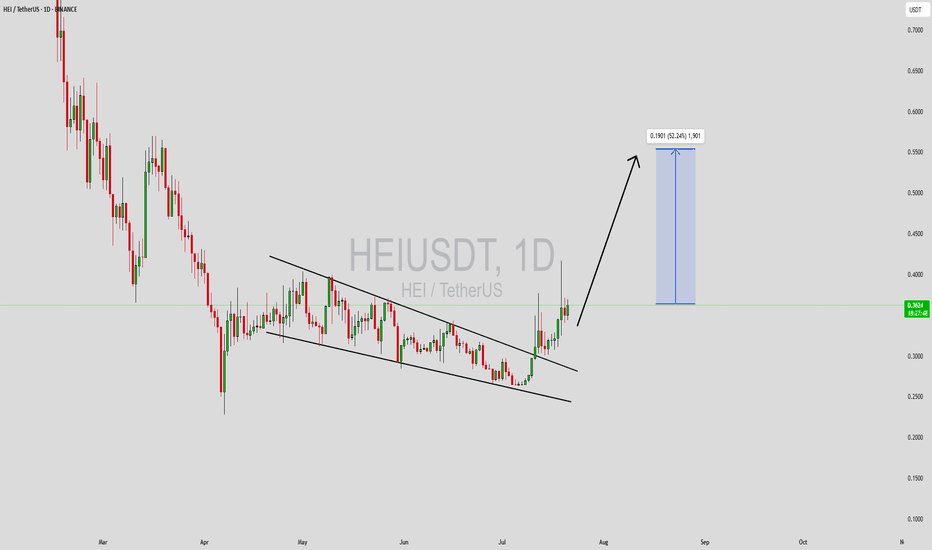

HEIUSDT Forming Falling WedgeHEIUSDT is currently showing a textbook falling wedge pattern—a bullish reversal setup that often precedes sharp upside breakouts. This formation is defined by converging downward-sloping trendlines, signaling weakening selling pressure and the potential for a trend reversal. As HEI trades closer to the wedge’s apex with rising volume, market participants are beginning to anticipate a breakout that could lead to significant upward momentum. A confirmed breakout above the upper trendline would validate this bullish outlook and trigger renewed interest from traders.

Technically, falling wedge patterns are known for offering high-probability setups, especially when backed by volume growth and strong investor sentiment. HEI’s recent price action suggests accumulation at support zones, with bulls defending key levels repeatedly. This behavior indicates that smart money could be positioning for a move higher. Based on historical breakouts from similar wedge structures, a price gain of 40% to 50%+ is a realistic target in the short to mid-term.

Investor interest in HEI is gradually increasing, as seen through improving volume metrics and social media buzz. As more traders recognize this setup, the potential for a breakout rally becomes stronger. HEI’s fundamentals and potential utility within its ecosystem further support a bullish case, making it a coin to watch closely in the coming weeks. If the breakout confirms, it could attract significant trading volume and price momentum.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

HEI/USDT – Bullish Breakout Confirmed, More Upside Ahead?

Date: July 19, 2025

HEI/USDT has just broken out of a prolonged accumulation phase with strong volume confirmation. The price is showing strength as it reclaims key moving averages and breaches horizontal resistance, suggesting a potential shift in trend.

🔍 Technical Overview:

Current Price: $0.3681

EMA Analysis:

4EMA: $0.3234

50EMA: $0.3048

100EMA: $0.3267

Price is trading above all short-term and mid-term EMAs, indicating a confirmed bullish momentum.

📊 Structure & Price Action:

A solid base was formed between $0.25–$0.35, marked by accumulation and higher lows.

The recent breakout above the $0.36–$0.38 resistance zone is significant, especially backed by high volume.

The structure appears to be a rounded bottom / cup-shaped pattern, hinting at a shift from a downtrend to an uptrend.

📉 Key Support Zones:

$0.3545 (immediate support / previous resistance now turned support)

$0.25–$0.30 (accumulation demand zone)

📈 Key Resistance & Target Zones:

$0.4018: Minor resistance just ahead, being tested

$0.4380: Local horizontal resistance

$0.5704: Final mid-term target if bullish momentum continues

📊 Indicators:

RSI: 71.25 – Strong bullish momentum, now in overbought territory. Could lead to short-term consolidation before next leg up.

Volume: Strong breakout candle with a surge in volume – confirms genuine demand and institutional participation.

🎯 Bullish Outlook:

Breakout confirmed with clean structure and momentum

Short-term target: $0.4018

Mid-term targets: $0.4380 and $0.5704

Pullbacks to the $0.35–$0.36 zone may present buying opportunities

📉 Invalidation:

A breakdown below $0.3545 (with volume) would weaken the bullish thesis

Falling back into the accumulation zone below $0.30 would invalidate the breakout setup

Good Trading!!

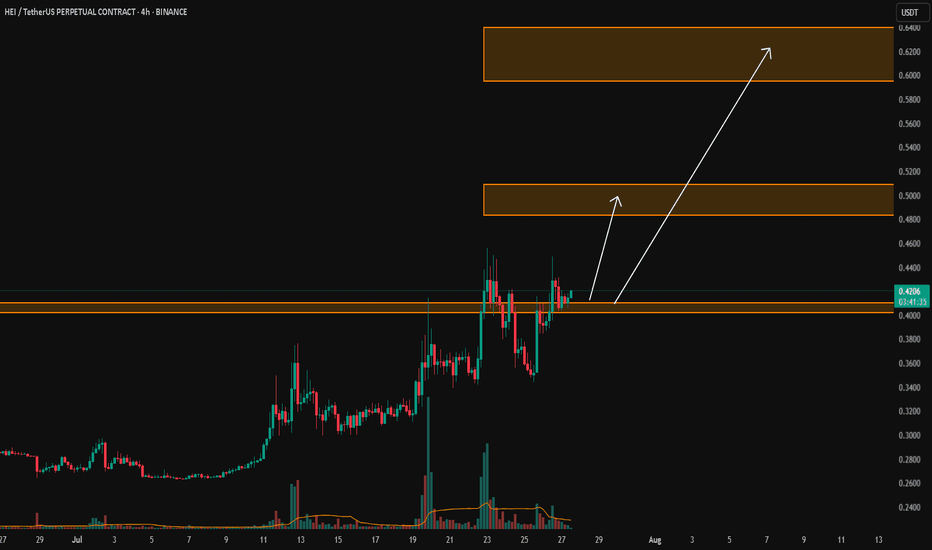

Breakout Strategy for HEI/USDT: Key Resistance TestedBreakout Strategy for HEI/USDT: Key Resistance Tested

The HEI/USDT chart is currently consolidating under a clear descending trendline, signaling a potential breakout. As price approaches this key resistance, the market is poised for a critical move. Will HEI break higher or continue lower? Let’s break down the potential scenarios.

Bullish Breakout Opportunity

If the price breaks above the 0.3500 resistance level, it could trigger a bullish breakout. A strong move above this resistance would signal increased buying momentum, with target levels at 0.3700, 0.4000, and possibly even 0.4400. Placing a stop loss just below 0.3200 will help protect against a failed breakout. Always monitor volume during the breakout, as an increase in volume confirms the strength of the move and validates the breakout.

Bearish Breakdown Risk

If the price fails to break above 0.3500 and drops below the 0.3200 support, it could signal a bearish breakdown. In this case, shorting the market may be considered, with target levels around 0.3100 and 0.2900. A stop loss just above 0.3350 will provide a safety net. Again, volume plays a key role—low volume on the breakdown may indicate a false move, so keep an eye on it.

Pro Tip

Volume is the most reliable indicator to validate the strength of both breakouts and breakdowns. A surge in volume during either move adds confidence to your trade. Make sure to manage your risk with well-placed stop losses and adjust your position size according to the market conditions.

Focus on price action, and be prepared to act quickly as HEI/USDT nears its breakout point. Whether the price breaks higher or lower, this strategy will help you stay ready for either outcome.

HEI/USDTKey Level Zone: 0.4020 - 0.4100

LMT v2.0 detected.

The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align.

Introducing LMT (Levels & Momentum Trading)

- Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL.

- While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones.

- That insight led to the evolution of HMT into LMT – Levels & Momentum Trading.

Why the Change? (From HMT to LMT)

Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by:

- Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork.

- Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup.

- Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively.

- Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets.

Whenever I share a signal, it’s because:

- A high‐probability key level has been identified on a higher timeframe.

- Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent.

- The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry.

***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note: The Role of Key Levels

- Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer.

- Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance.

My Trading Rules (Unchanged)

Risk Management

- Maximum risk per trade: 2.5%

- Leverage: 5x

Exit Strategy / Profit Taking

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically sell 50% during a high‐volume spike.

- Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R.

- Exit at breakeven if momentum fades or divergence appears.

The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

From HMT to LMT: A Brief Version History

HM Signal :

Date: 17/08/2023

- Early concept identifying high momentum pullbacks within strong uptrends

- Triggered after a prior wave up with rising volume and momentum

- Focused on healthy retracements into support for optimal reward-to-risk setups

HMT v1.0:

Date: 18/10/2024

- Initial release of the High Momentum Trading framework

- Combined multi-timeframe trend, volume, and momentum analysis.

- Focused on identifying strong trending moves high momentum

HMT v2.0:

Date: 17/12/2024

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

Date: 23/12/2024

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

Date: 31/12/2024

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

Date: 05/01/2025

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

Date: 06/01/2025

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

LMT v1.0 :

Date : 06/06/2025

- Rebranded to emphasize key levels + momentum as the core framework

LMT v2.0

Date: 11/06/2025

- Fully restructured lower timeframe (LTF) momentum logic

Heima Bullish Breakout, Easy 179% PP Short-Term (L-HL)The chart isn't giving us much so I will not go into technical analysis; but this is a bullish setup, one that has the potential to break-up just as Hyperlane did. If you are unaware, HYPERUSDT just grew ~200% in a matter of hours... The altcoins market is starting to heat up.

Here we have Heima, a new project.

There is a big A&E bottom formation. The 7-April low is very pronounced. There is also the classic L vs HL. The ending diagonal is a bullish pattern as well and the action is reaching the apex, a breakout can happen anytime.

179% profits potential short-term.

Try to avoid using your rent money to trade, it can lead to disaster. Just a friendly reminder. Use only money that you can afford to lose.

This chart setup is low risk. Everything spot is very low risk. The risk is only as much as you define or allow. You can cap it at 5%, 10%, 20% or any amount you want. Easy buy and hold. The expectation is for a fast-strong move. Buy, sell, collect profits move on to the next trade. That's what we mean by short-term.

Loses are inevitable. Wins as well.

Win big, lose small. It will lead to success.

Follow a plan. Develop the habit of winning. If you can win, win, win. Win small; eventually you will win big. Step by step. Persistence and consistency.

Thank you for reading.

Namaste.

HEI/USDT – Symmetrical Triangle Squeeze Ahead of Big MovePair: HEI/USDT 💱

Timeframe: 6H ⏱️

Pattern: Symmetrical Triangle Consolidation 🔺

HEI has been coiling tightly inside a symmetrical triangle since April, with price nearing the apex. This setup usually precedes a strong breakout or breakdown. Momentum is building — a major move looks imminent 🔍🔥.

Bullish Breakout Scenario ✅

A 6H candle close above 0.36 confirms breakout:

🎯 Target 1: 0.45

🎯 Target 2: 0.55

🛑 SL: below 0.29 (recent swing low)

Bearish Breakdown Scenario ❌

A 6H candle close below 0.31 confirms breakdown:

🎯 Target 1: 0.20

🎯 Target 2: 0.12

🛑 SL: above 0.35 (recent swing high)

⚠️ Wait for confirmation with strong volume — this move could be sharp and decisive.

HEIUSDT Falling Wedge Pattern Targets 150%-160% Gains!HEIUSDT is currently forming a strong falling wedge pattern, a classic bullish reversal signal. The price has been consolidating within this wedge for some time, and we are now starting to see a breakout attempt with good supporting volume. This setup is gaining attention among investors who are looking for promising opportunities in the altcoin market.

Volume has notably increased, suggesting strong buying pressure is building up. Historically, falling wedges often lead to explosive upward moves once a breakout is confirmed. In this case, the projected gain is around 150% to 160%, which makes HEIUSDT a very interesting pair to watch in the coming days and weeks.

Many traders are keeping a close eye on HEIUSDT due to the solid technical pattern and growing market interest. If momentum continues and broader crypto sentiment remains positive, this breakout could lead to substantial price appreciation. Risk management is key, but the potential reward here looks highly attractive.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!