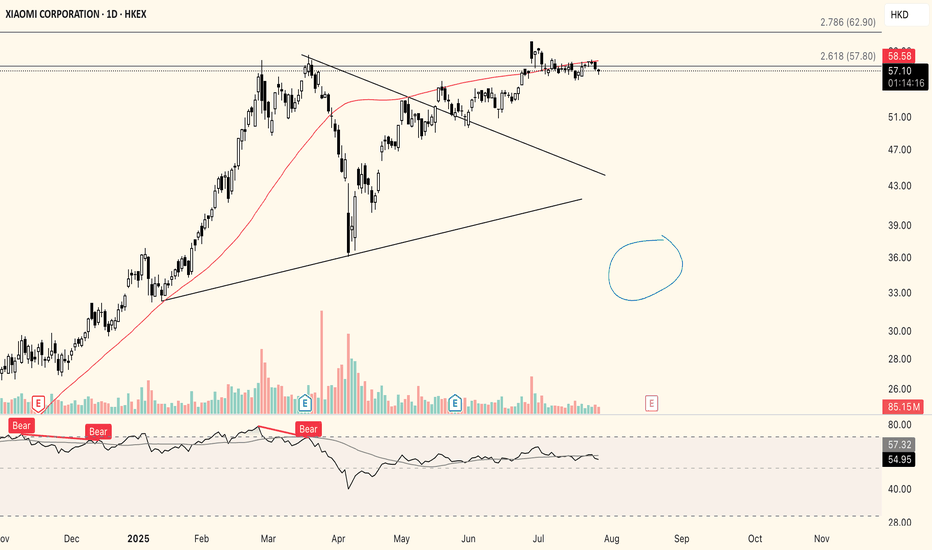

Xiaomi is going to get a fresh haircutAs you can tell by looking at the chart, there seems to be a distribution at play here. After hitting a HTF 2.618 extension, there was quite a steep retracement that resulted in what looked like a bull flag. With recent sweep of that same high at the 2.618 extension, it now looks like Xiaomi will br

Key facts today

Xiaomi's stock fell nearly 10% in the last three months due to worries about electric vehicle output and smartphone profits, yet shares are still up 18% this year.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.58 HKD

25.65 B HKD

396.72 B HKD

17.16 B

About Xiaomi Corporation Class B

Sector

Industry

CEO

Jun Lei

Website

Headquarters

Beijing

Founded

2010

ISIN

KYG9830T1067

FIGI

BBG00KVTBY91

IPO date

Jul 9, 2018

IPO offer price

2.17 USD

Xiaomi Corp. engages in the design, manufacture and sale of smartphone, hardware and software products. Its business covers power bank, audio, camera and lifestyle. Xiaomi doing business through three business segments-Hardware, E-commerce & New Retail and Internet services. Its products include power bank pro, headphones, in-ear headphones pro, bluetooth headset basic with dock, bluetooth speaker, sphere camera, home security camera, action camera, robot builder, electric scooter, bedside lamp, and body composition scale. The company was founded by Jun Lei, Bin Lin, Wan Qiang Li, Feng Hong, De Liu, Chuan Wang, and Jiang Ji Huang on March 3, 2010 and is headquartered in Beijing, China.

Related stocks

Xiaomi is offering a discount soon, are you ready ?I was talking to my wife who does not quite like this company for basically copying what the western brands are doing. Haha, a different perception from me.

Imo, this is a smart move instead of reinventing the wheel. It has already proven it works and people like it so tweaking the products from sm

Xiaomi 1810 HK LongXiaomi reports revenue of RMB 111.3 billion in Q1 2025, up 47% YoY

Adjusted net profit up 64% YoY to RMB 10.7 billion

Operating profit margin and net margin improved to 11.8% and 9.6%, respectively

Xiaomi became the leader in China's smartphone market in Q1 2025 with an 18.8% share (up 4.7 p.p. Y

XIAOMI (1810): Another All-Time High Surpassed!A new all-time high has been reached 🎉

XIAOMI has been surging non-stop since August 2024, with our position now up 180% since our entry back in March. We are taking our next profit here and letting the rest run.

Xiaomi experienced significant growth in 2024, bolstered by China’s economic developm

Correction StartedI'bve just sold some Xiaomis. Not that I would no be convinced of the company. I think that they have a great future.

But for over 2 months we saw a parabolic rise that has not been completely corrected yet.

I think that the market has to be cleared before new rises and that there is still room fo

Xiaomi (1810): Major Gains, Next Targets and Updated StrategyThe Hang Seng Index and its constituent stocks have been surging higher, with Xiaomi leading the charge 🚀. The setup we had on Xiaomi was quite similar to the one for Alibaba, featuring a tight stop-loss and a high risk-to-reward ratio, which, just like NYSE:BABA , worked out perfectly. Although we

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

USY77108AF8

Xiaomi Best Time International Ltd. 4.1% 14-JUL-2051Yield to maturity

5.48%

Maturity date

Jul 14, 2051

USY77108AD3

Xiaomi Best Time International Ltd. 2.875% 14-JUL-2031Yield to maturity

4.51%

Maturity date

Jul 14, 2031

XIAO4979273

Xiaomi Best Time International Ltd. 3.375% 29-APR-2030Yield to maturity

4.28%

Maturity date

Apr 29, 2030

XIAO5092059

Xiaomi Best Time International Ltd. 0.0% 17-DEC-2027Yield to maturity

—

Maturity date

Dec 17, 2027

See all 1810 bonds

159792

Wells Fargo China Securities Hong Kong Stock Connect Internet ETFWeight

15.27%

Market value

1.04 B

USD

Explore more ETFs

Curated watchlists where 1810 is featured.

Frequently Asked Questions

The current price of 1810 is 40.78 HKD — it has decreased by −1.76% in the past 24 hours. Watch Xiaomi Corporation Class B stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on HKEX exchange Xiaomi Corporation Class B stocks are traded under the ticker 1810.

1810 stock has fallen by −3.33% compared to the previous week, the month change is a −13.29% fall, over the last year Xiaomi Corporation Class B has showed a 43.09% increase.

We've gathered analysts' opinions on Xiaomi Corporation Class B future price: according to them, 1810 price has a max estimate of 80.22 HKD and a min estimate of 40.11 HKD. Watch 1810 chart and read a more detailed Xiaomi Corporation Class B stock forecast: see what analysts think of Xiaomi Corporation Class B and suggest that you do with its stocks.

1810 reached its all-time high on Jun 27, 2025 with the price of 61.46 HKD, and its all-time low was 8.28 HKD and was reached on Sep 2, 2019. View more price dynamics on 1810 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1810 stock is 3.55% volatile and has beta coefficient of 1.25. Track Xiaomi Corporation Class B stock price on the chart and check out the list of the most volatile stocks — is Xiaomi Corporation Class B there?

Today Xiaomi Corporation Class B has the market capitalization of 1.10 T, it has increased by 2.98% over the last week.

Yes, you can track Xiaomi Corporation Class B financials in yearly and quarterly reports right on TradingView.

Xiaomi Corporation Class B is going to release the next earnings report on Nov 18, 2025. Keep track of upcoming events with our Earnings Calendar.

1810 earnings for the last quarter are 0.49 HKD per share, whereas the estimation was 0.40 HKD resulting in a 22.58% surprise. The estimated earnings for the next quarter are 0.41 HKD per share. See more details about Xiaomi Corporation Class B earnings.

Xiaomi Corporation Class B revenue for the last quarter amounts to 127.06 B HKD, despite the estimated figure of 125.82 B HKD. In the next quarter, revenue is expected to reach 125.64 B HKD.

1810 net income for the last quarter is 12.85 B HKD, while the quarter before that showed 11.68 B HKD of net income which accounts for 9.98% change. Track more Xiaomi Corporation Class B financial stats to get the full picture.

No, 1810 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Nov 18, 2025, the company has 43.69 K employees. See our rating of the largest employees — is Xiaomi Corporation Class B on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Xiaomi Corporation Class B EBITDA is 40.15 B HKD, and current EBITDA margin is 7.61%. See more stats in Xiaomi Corporation Class B financial statements.

Like other stocks, 1810 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Xiaomi Corporation Class B stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Xiaomi Corporation Class B technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Xiaomi Corporation Class B stock shows the neutral signal. See more of Xiaomi Corporation Class B technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.