Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.75 CNY

23.60 B CNY

135.61 B CNY

2.17 B

About Baidu, Inc.

Sector

Industry

CEO

Yan Hong Li

Website

Headquarters

Beijing

Founded

2000

FIGI

BBG01GXJWMV7

Baidu, Inc. engages in the provision of internet search and online marketing solutions. The firm’s products and services include Baidu App, Baidu Search, Baidu Feed, Haokan, Quanmin, Baidu Post Bar, Baidu Knows, Baidu Encyclopedia, Baidu Input Method Editor or Baidu IME, Baidu AI Cloud and Overseas Products. It operates through the following segments: Baidu Core and iQIYI. The Baidu Core segment provides search-based, feed-based, and other online marketing services. The iQiyi segment is an online entertainment service provider, which offers original, professionally produced and partner-generated content on its platform. The company was founded by Yanhong Li and Xu Yong on January 18, 2000 and is headquartered in Beijing, China.

Related stocks

BIDU Daily Outlook – Smart Money Play in Motion🔹 Key Observations:

Clear Break of Structure (BOS) to the upside, signaling bullish intent.

Volume spikes confirm institutional activity around recent lows.

Fib extension targets align with supply zones at $95.23 – $105.19.

If $105 breaks, the liquidity pocket toward $115.73 opens up.

🔹 Levels

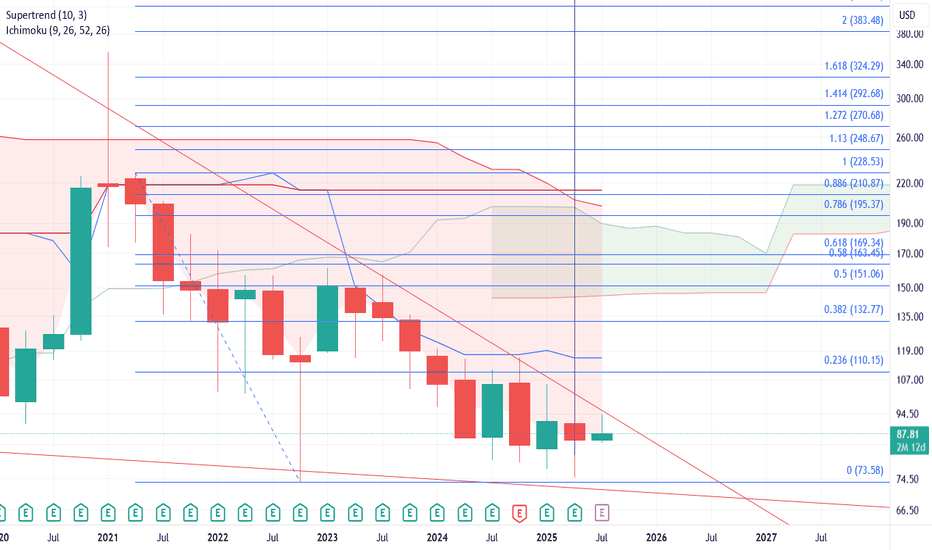

Baidu (BIDU) Long-Term Technical Outlook📊 Baidu (BIDU) Long-Term Technical Outlook

BIDU is testing a critical demand zone between $74 – $82, holding firm after years of consistent decline.

🔹 Price Action:

The long-term downtrend (red trendline) from the 2021 peak is being challenged.

Current monthly candles show compression near histo

$biduyieahhh

awesome risk vs reward.

This is a monthly time frame.

A mix of gann, elliot, noodle soup etc. Take the Gann with a grain of salt as I am new to this.

Elliot a bit weird. Wave 2 seems to have halted right at .78 fib and looks ready to start wave 3 of wave 3. MACD and RSI curving. MACD no

Baidu Wave Analysis – 21 August 2025- Baidu reversed from the support area

- Likely to rise to resistance level 93.20

Baidu recently reversed from the support area between the support level 84.40 (which is the lower border of the sideways price range inside which the price has been trading from April) and the lower daily Bollinger Ba

Baidu (BIDU) –AI Upgrades + Open-Source Strategy Powering GrowthCompany Snapshot:

Baidu NASDAQ:BIDU is cementing its position as a top AI platform leader in China, combining core search dominance with cutting-edge AI innovations and strategic open-source moves.

Key Catalysts:

Next-Gen AI Infrastructure ⚙️

Major Qianfan platform upgrades and PaddlePaddle 3.0

BAIDU 63.6% cash & short term inv., P/E 8.7,possible rotation TABaidu largest search engine in china but way less monopoly in china, there is also bing.

Baidu invests heavily in AI and autonomous driving by apollo go.

China economy is in deleveraging and seems to start growing again.

China devlation problems comapnies sitting on cash.

Baidu advertisment income w

BIDU 1D: triangle breakoutBIDU 1D: triangle breakout + real-world AI deployment boosts bulls

Baidu (BIDU) breaks out of a triangle within a falling channel on the daily chart, with solid volume, reclaim of the 50MA, and approach to the 200MA. $90.09 flips into support. Targets stretch to $105.47 / $113.68 / $124.06 (Fibo l

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 89888 is featured.

Frequently Asked Questions

The current price of 89888 is 78.65 CNY — it has increased by 0.64% in the past 24 hours. Watch BAIDU INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on HKEX exchange BAIDU INC stocks are traded under the ticker 89888.

89888 stock has fallen by −1.07% compared to the previous week, the month change is a −5.24% fall, over the last year BAIDU INC has showed a −1.13% decrease.

We've gathered analysts' opinions on BAIDU INC future price: according to them, 89888 price has a max estimate of 118.46 CNY and a min estimate of 63.79 CNY. Watch 89888 chart and read a more detailed BAIDU INC stock forecast: see what analysts think of BAIDU INC and suggest that you do with its stocks.

89888 reached its all-time high on Aug 1, 2023 with the price of 143.00 CNY, and its all-time low was 70.00 CNY and was reached on Apr 9, 2025. View more price dynamics on 89888 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

89888 stock is 0.96% volatile and has beta coefficient of 1.19. Track BAIDU INC stock price on the chart and check out the list of the most volatile stocks — is BAIDU INC there?

Today BAIDU INC has the market capitalization of 217.52 B, it has increased by 4.23% over the last week.

Yes, you can track BAIDU INC financials in yearly and quarterly reports right on TradingView.

BAIDU INC is going to release the next earnings report on Nov 25, 2025. Keep track of upcoming events with our Earnings Calendar.

89888 earnings for the last quarter are 1.69 CNY per share, whereas the estimation was 1.64 CNY resulting in a 2.50% surprise. The estimated earnings for the next quarter are 1.35 CNY per share. See more details about BAIDU INC earnings.

BAIDU INC revenue for the last quarter amounts to 32.49 B CNY, despite the estimated figure of 32.72 B CNY. In the next quarter, revenue is expected to reach 31.54 B CNY.

89888 net income for the last quarter is 7.21 B CNY, while the quarter before that showed 7.70 B CNY of net income which accounts for −6.31% change. Track more BAIDU INC financial stats to get the full picture.

No, 89888 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 24, 2025, the company has 41.3 K employees. See our rating of the largest employees — is BAIDU INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BAIDU INC EBITDA is 25.06 B CNY, and current EBITDA margin is 27.00%. See more stats in BAIDU INC financial statements.

Like other stocks, 89888 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BAIDU INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BAIDU INC technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BAIDU INC stock shows the neutral signal. See more of BAIDU INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.