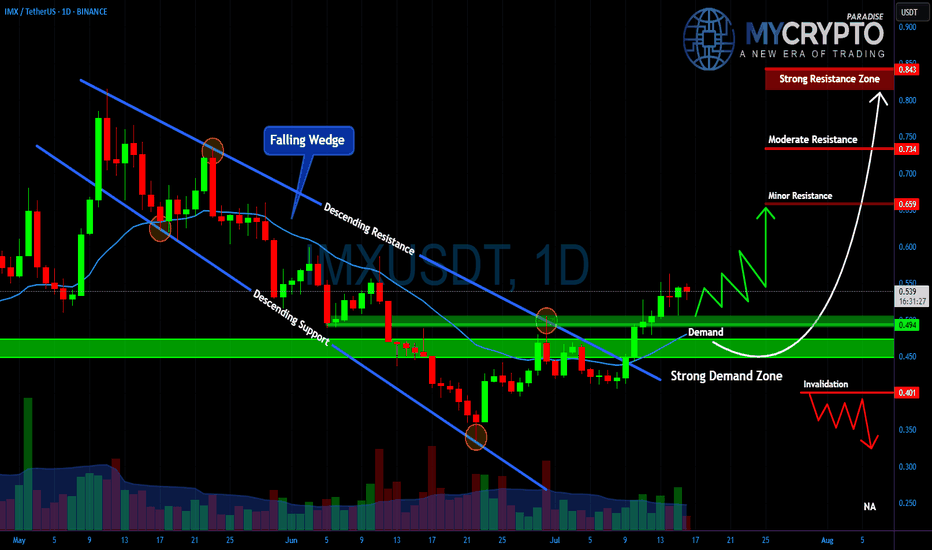

IMXUSDT – Major Breakout or Another Painful Trap Ahead?Yello Paradisers, is this the real start of a powerful bullish reversal on #IMX, or just another classic setup to liquidate impatient traders before the true move begins? The next few days will decide everything.

💎#IMXUSDT has broken out of a falling wedge, which is a typical bullish reversal struc

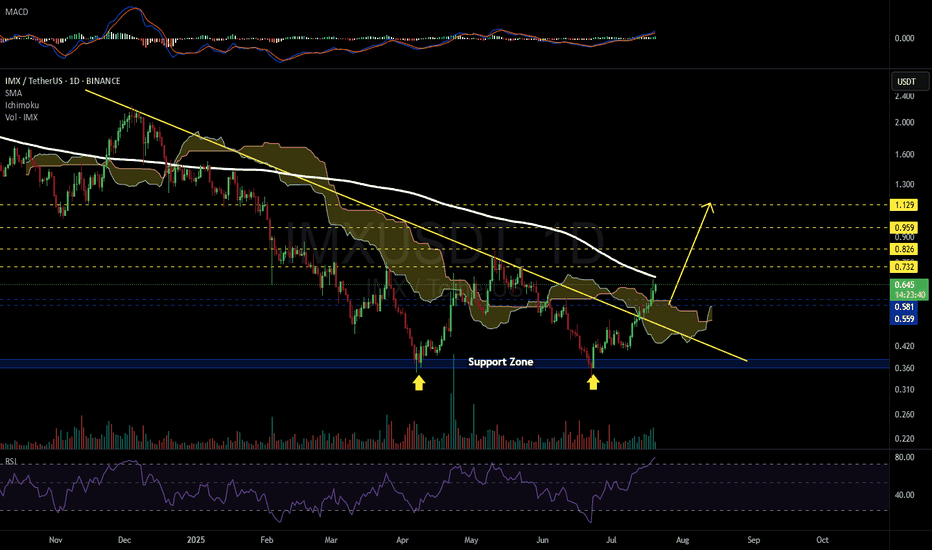

IMXUSDT 1D#IMX has broken above both the descending trendline and the Ichimoku Cloud on the daily chart — a strong bullish signal.

However, with RSI in the overbought zone and price nearing the daily SMA200, a rejection or short-term pullback is likely. A correction toward the $0.581–$0.559 range could offer

IMX Signals Reversal with RSI Bullish DivergenceIMX has shown a strong bounce from a demand zone, backed by clear bullish divergence on the RSI. Price printed a higher low on the oscillator while price action formed a lower low – a classic reversal signal. This area has acted as support multiple times in the past, and we can expect a reversal fro

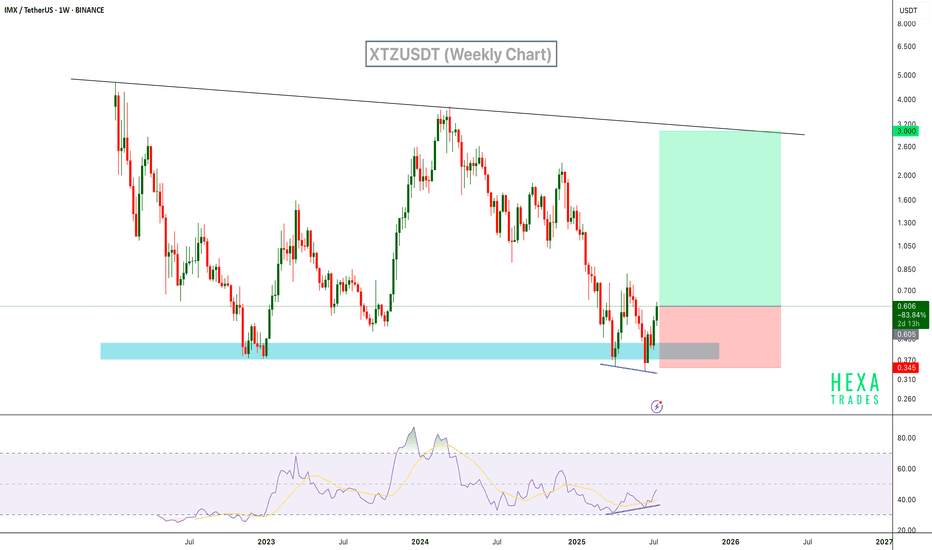

IMX – Range Low ReclaimedIMX has once again defended the $0.37–0.38 demand zone, bouncing sharply off the lows. This level has acted as a long-term accumulation base since late 2022, and price is now showing early signs of another range rotation.

Currently trading at $0.61, IMX is holding above the reclaimed support. As lo

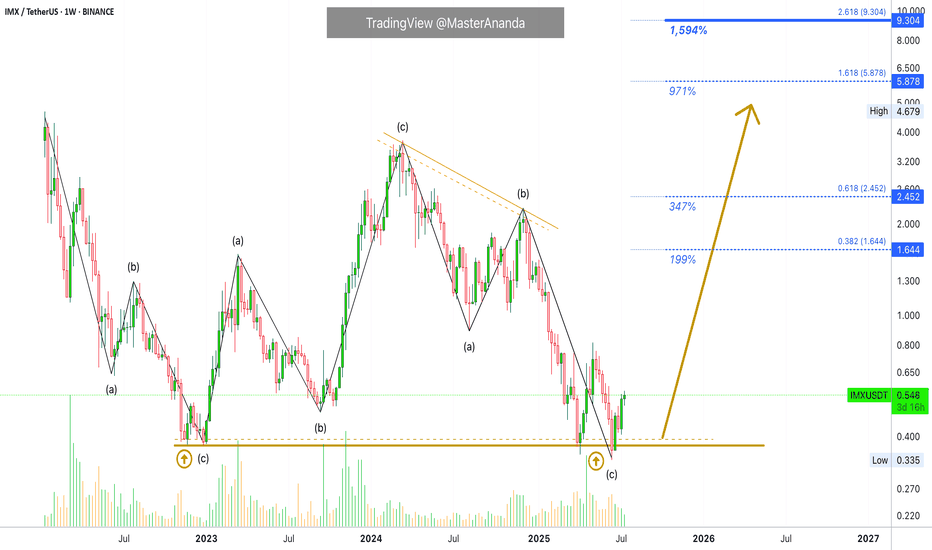

A New All-Time High Guaranteed for ImmutableX (1,600% PP)IMX produced a strong bullish cycle between December 2022 and March 2024. The entire bullish wave was corrected beyond 100%. This means that IMXUSDT hit a lower low. It went below the starting point of the last bullish wave. This is good in several ways.

The last move being deleted in its entirety

Next big target for IMX is 3$. IMX is setting its sights on the next big target at $3. It's currently trading within a large channel and showing a weekly hidden bullish divergence—an encouraging sign for upward continuation. A potential double bottom is forming, with the neckline around $0.71. If that breaks, the initial projecti

IMX IDEA FOR 2025🔥 SEED_DONKEYDAN_MARKET_CAP:IMX long setup (1 W) 🚀

✅ Entry Zone: $0.35 – $0.31 (multi-year demand)

🎯 Targets

• TP-1: $0.94 (Aug-23 supply)

• TP-2: $1.40 (Mar-24 breakdown)

⛔ Stop-Loss

Weekly close < $0.27

📊 Thesis

• #Immutable zkEVM mainnet live; Immutable X to merge → single Superch

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.