Related indices

The Battle to Defend 3800 on the Shanghai CompositeThe Battle to Defend 3800 on the Shanghai Composite

The current time is 11:00 PM on September 28, 2025, in Toronto, which is 11:00 AM on September 29 in Beijing. I’m providing a real-time update on my views regarding the Shanghai Composite Index.

Overall, the uptrend line that has been in place s

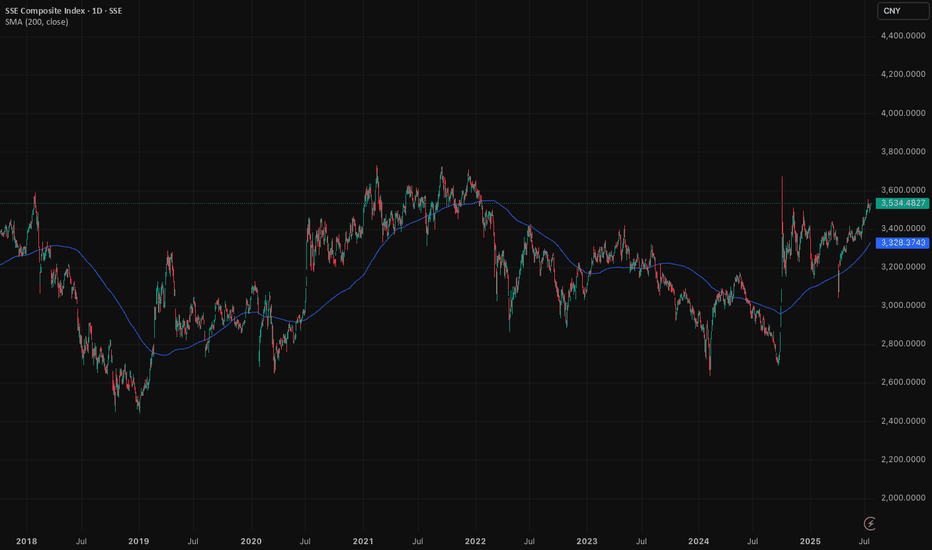

Shanghai Composite: Double bottom signals potential upsideChinese stocks are not for the faint-hearted. It's a market with a lot of volatility, swings, and roundabouts. Despite this, we've been keeping a close eye on the Shanghai Composite Index over the past few weeks and like the pattern we are seeing emerge.

As of the time of writing, the Shanghai Com

Shanghai Composite Index (SSE) To Hit 6,124 First, Then 8,660SSE had a rally from 2005 to 2007 establishing the all-time high of CNY 6,124.

After that, the price had built a weird corrective structure with ups and downs fading in magnitude over a very long period of time.

It took 17 years to complete the giant contracting triangle (white ABCDE marks).

The p

Who Gets Rich in China's Market Rally?On September 24th, China announced an unprecedented fiscal stimulus, aiming to rescue its ailing economy. As soon as the news got out, China’s stock market staged a huge rally. The Shanghai Stock Exchange (SSE) index moved from below 2,800 on September 24th to close at 3,336.5 on September 30th, up

Shanghai Stock Exchange - MACRO OUTLOOK DANGER!!SSE Composite Index

Macro timeframe has just confirmed a bearish trend incoming.

Expiry set for October 2026 with macro targets of $2,000 - $1,700.

Short term we may take the lows of $2,600's followed by a dead cat bounce toward $3,000's and macro bearish structure will remain the same. Macro

Shanghai Composite. 'Arctic Fox' leaps on Shanghai street cornerReal estate has made China rich in recent years and decades. Now it looks more like radioactive kryptonite from the DC Comics universe - the birthplace of Superman.

Three months earlier, China's house prices fell 0.4% in a month, according to official statistics released in November 2023, the ste

See all ideas

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

SSE COMPOSITE INDEX is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy SSE COMPOSITE INDEX futures or funds or invest in its components.