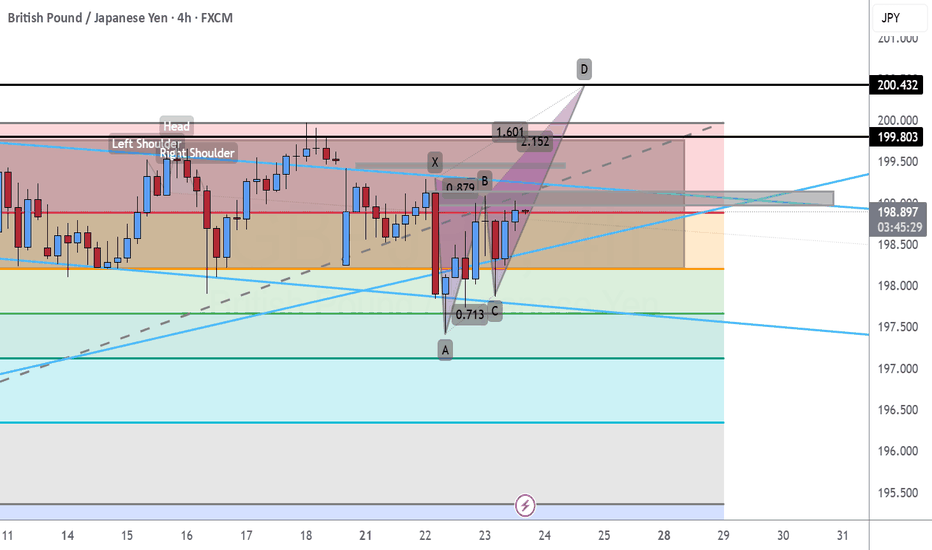

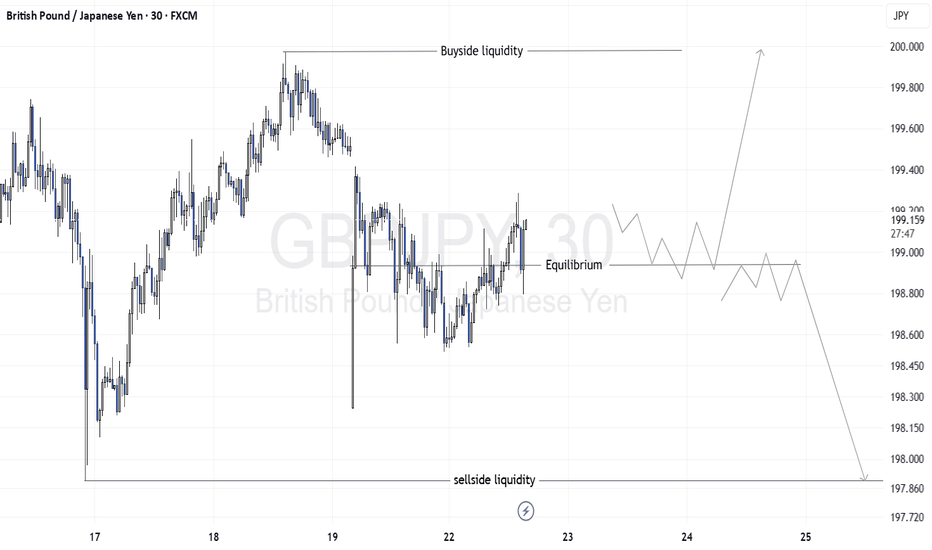

GBPJPY| Bullish Bias - Range Play Before The SweepPair: GBPJPY

Bias: Bullish

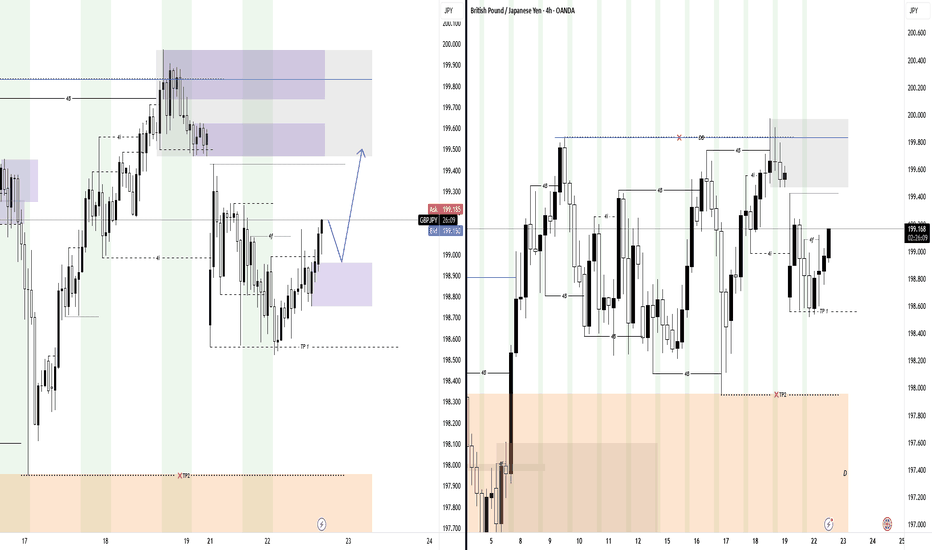

HTF Overview (4H):

Structure remains bullish, but price is currently sitting inside a tight top-of-range formation. No clear breakout yet — still waiting on a deeper sell-side liquidity sweep to fuel the next leg. Until then, the focus is on how price dances within mid-range liquidity.

LTF Confirmation (30M):

Still watching for a clean sweep of previous internal lows from last week. 30M OB is refined and marked — once it’s mitigated, I’ll wait for LTF confirmation.

Entry Zone: Will monitor for 5M shift and intent after OB mitigation.

Targets: Initial target = 5M highs; extended = 30M highs depending on price delivery.

Mindset Note: Sitting on hands until Smart Money shows its hand. No rushing range plays. Patience = precision.

JPYGBP trade ideas

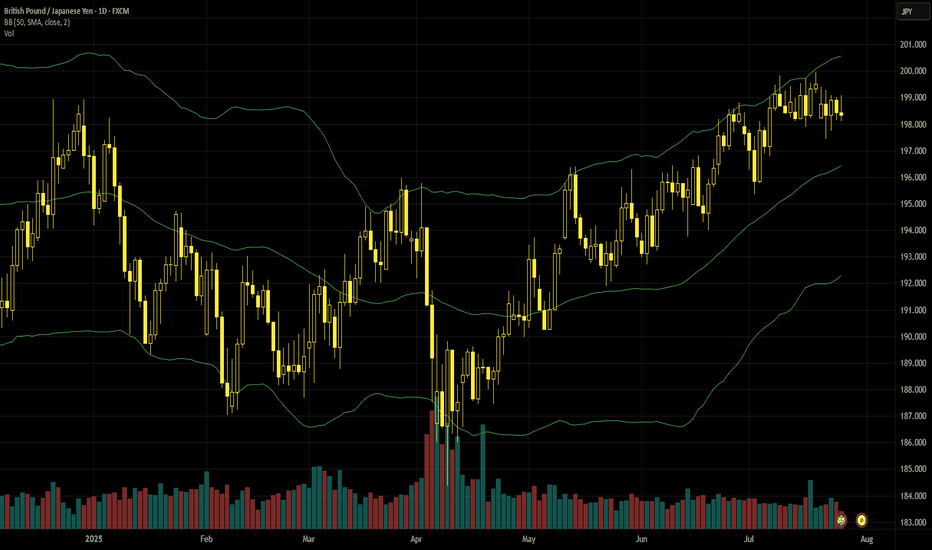

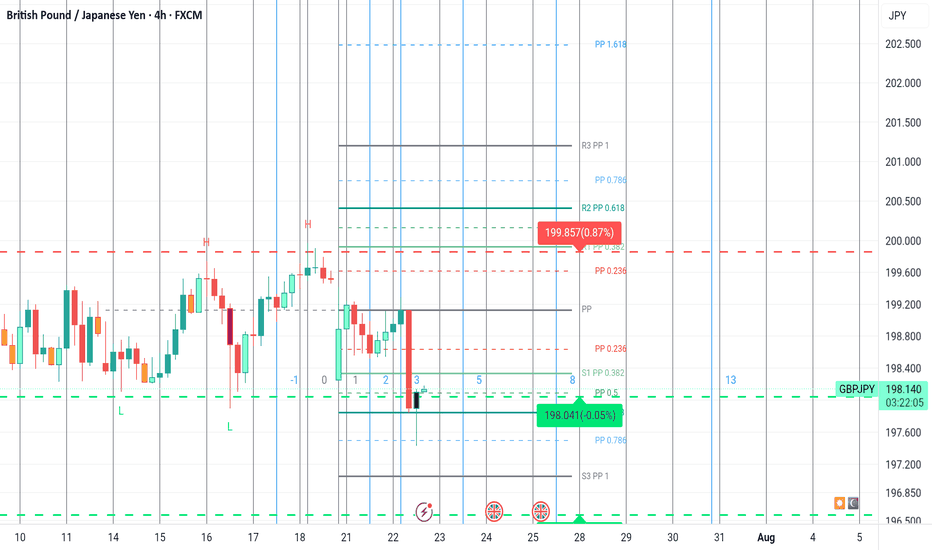

Pound-yen consolidates below critical resistanceWeaker retail data and concerns about fiscal policy which affected the pound negatively and caused it to decline against various other major currencies don’t seem to have had a big impact on GBPJPY. Several recent trade deals between the USA and other countries including Japan have reduced demand for havens like the yen and gold. The big shift recently was a significant decline in expectations for the BoJ to hike at its upcoming meeting on 31 July: a hold at 0.5% now seems much more likely.

¥200 would normally be a strong area of psychological resistance and this seems to be likely based on unsuccessful tests in the fourth quarter of 2024. Above there, the next likely area of resistance might be ¥207 around last summer’s highs. Another attempt to push above ¥200 might be more technically likely to succeed because there’s no longer an overbought signal from the slow stochastic. ATR at new lows though could indicate a retracement lower rather than a new upward wave.

There’s no obvious candidate for short-term static support but dynamic support would probably come from the 50 SMA from Bands. British credit and mortgage data on 29 July might increase intraday volatility somewhat but the next strong catalyst is much more likely to come from news about tariffs and/or the BoJ’s press conference on 31 July.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

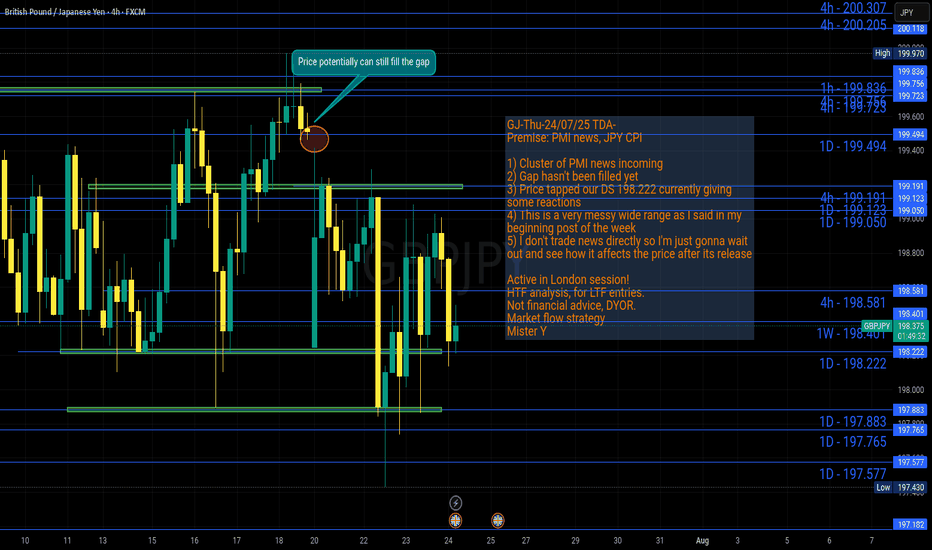

GJ-Thu-24/07/25 TDA-Messy wide range, gap hasn't been filled yetAnalysis done directly on the chart!

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

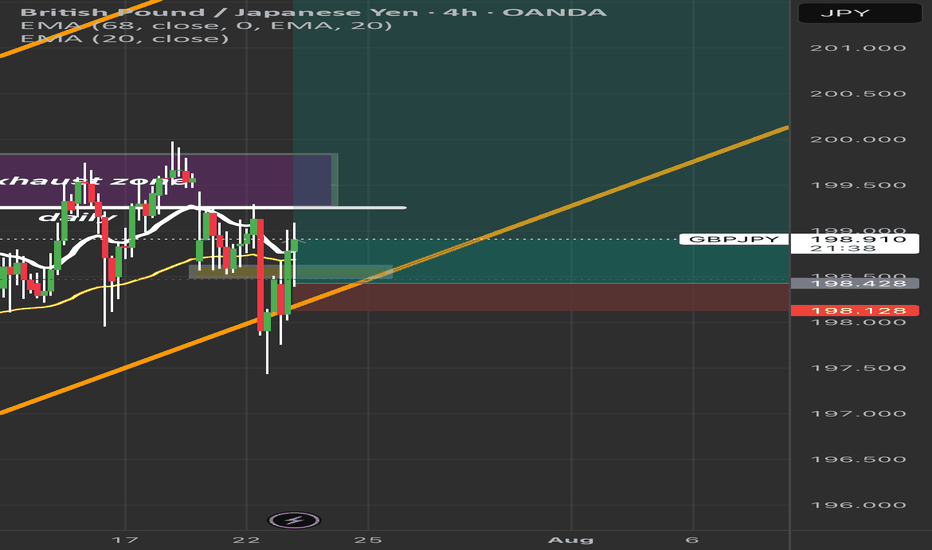

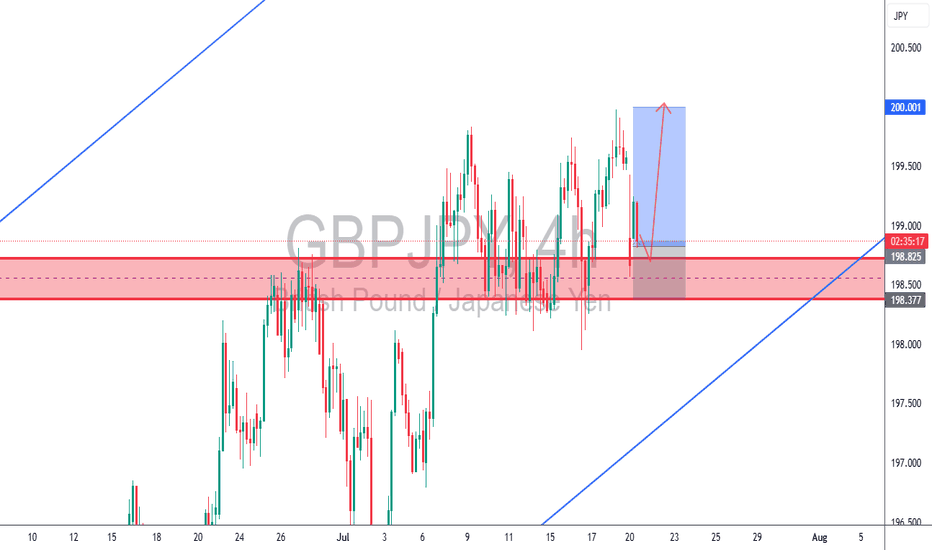

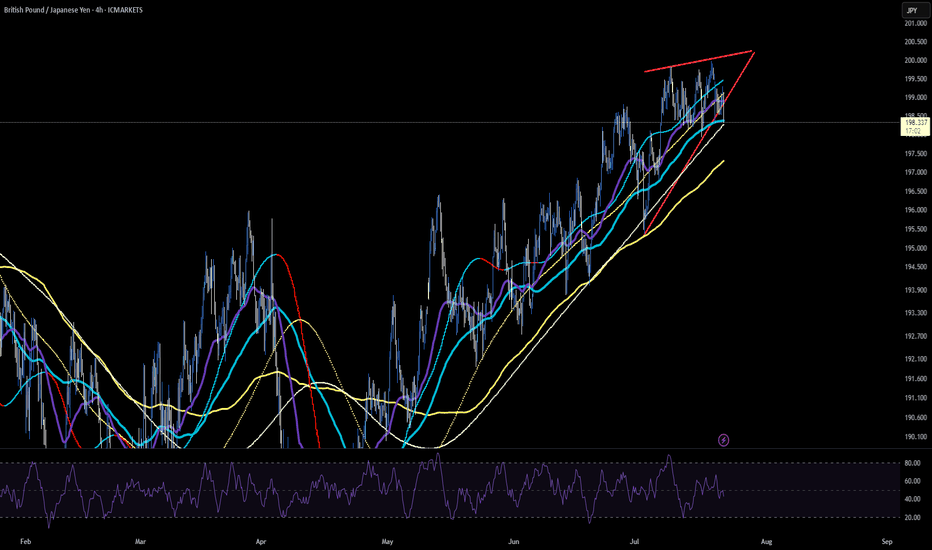

GBPJPY Breakout or Trap? Price in Key Exhaustion Zone | 4H ChannGBPJPY is sitting at a critical point inside an ascending channel. After rejecting the exhaustion zone multiple times, price is trying to reclaim bullish momentum. Key levels to watch:

✅ Bullish Bias: Hold above 198.400 and break past 199.200 for continuation toward 200.000+.

⚠️ Bearish Risk: A break below 198.400 could signal a deeper correction.

The 20 EMA and 68 EMA are converging—expect a strong move soon!

Question: Do you think we break out or fake out? Comment below! 👇

#GBPJPY #ForexTrading #PriceAction #ForexSignals #GBPJPYAnalysis #TradingView #ForexSetup #TechnicalAnalysis #ForexStrategy #SwingTrading #ForexEducation #ForexMarket #DayTrading

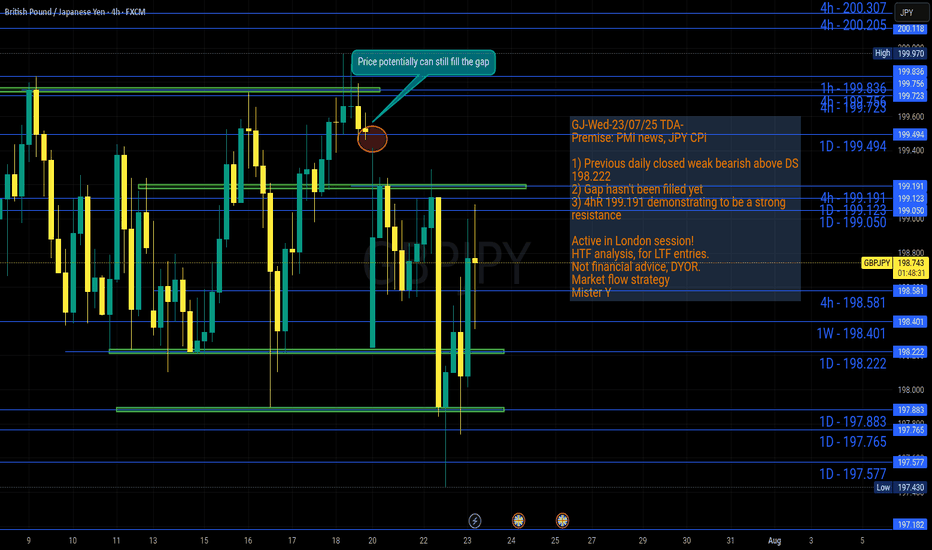

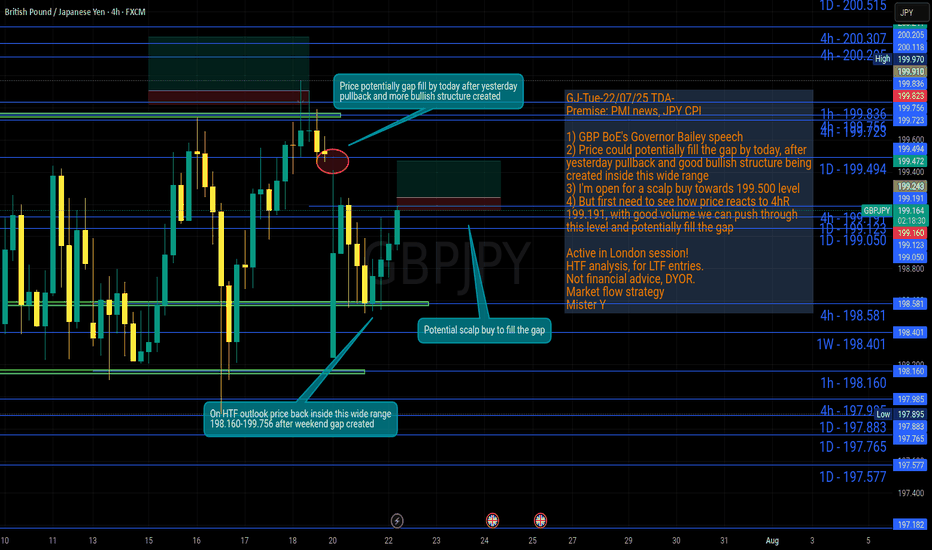

GJ-Wed-23/07/25 TDA-Gap hasn't been filled yet!Analysis done directly on the chart!

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

Bullish Continuation Setup: Reacting from Daily StructureHey Traders, hope you’re having a great day! 👋

GBPJPY is making a sharp bullish reaction after sweeping the Sell-Side Liquidity (SSL). Although price is currently at an external structure supply zone, this move originates from the daily structure, so the dominant daily bullish continuation bias remains intact.

I’m watching key Points of Interest (POIs) for potential buy trades, planning to enter only with Lower Timeframe (LTF) confirmation and after a clean liquidity sweep. This method combines smart liquidity hunting with structural alignment, increasing the probability of successful trades.

Patience and proper confirmation will be key to trading this setup effectively.

GBPJPY 4H – A+ Setup Using TCB Strategy, Bullish continuation

📈 GBPJPY 4H – A+ Setup Using TCB Strategy 🔥

Bullish continuation setup unfolding with precision.

✅ Trend Phase:

Higher highs and higher lows confirm uptrend

Price bounced from ascending trendline and demand zone

EP1 already triggered on bullish rejection from key support

✅ Countertrend Phase:

Falling wedge (countertrend channel) broken to the upside

Early confirmation for continuation from breakout

✅ Breakout Phase (Pending):

Clean structure at 199.00 acting as resistance

EP2 will be activated after bullish breakout + successful retest of 199.00

Targeting major resistance around 202.000

📍 SL below demand (~197.70)

🎯 TP: 202.000

⚖️ RRR: ~1:3

🧠 Confluences:

Bullish trendline support

Demand zone reaction

Falling wedge breakout

Upcoming key level breakout (199.00)

Price action confirmation

📌 Watch closely for the breakout-retest of 199.00 before engaging EP2.

Manage risk, move SL to breakeven at 1:1.

🔖 Hashtags:

#GBPJPY #ForexSetup #TCBStrategy #TechnicalAnalysis #BreakoutTrade #SwingTrading #SmartMoneyConcepts #FXSignals #TrendTrading #PriceAction #TCBFlow

🗣️ Drop your comment if this setup adds value or aligns with your bias! 👇

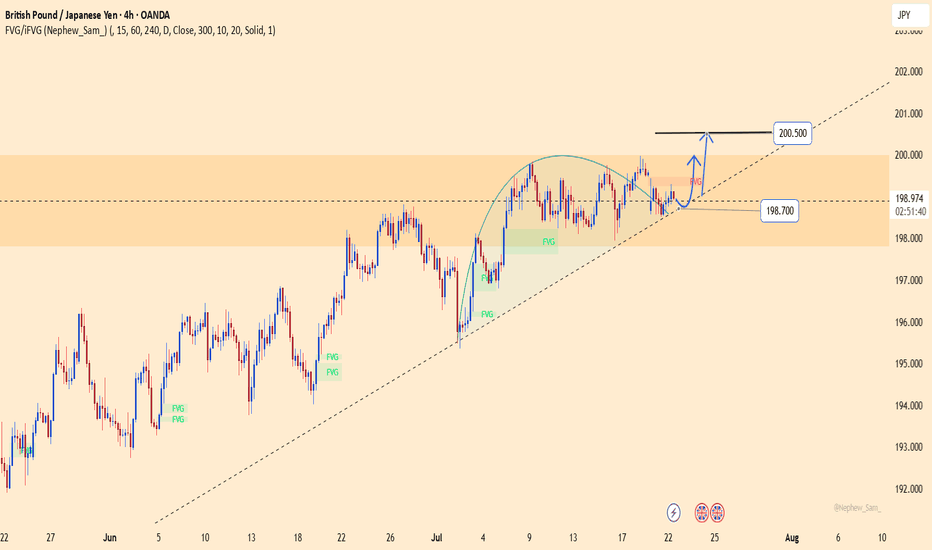

GBPJPY – breakout loading: final leap to 200.500?After days of compression, GBPJPY is flashing clear signs of an explosive breakout.

Price is holding firmly above the ascending trendline and consolidating right at the top of the FVG zone – a strong signal that buyers are preparing to punch through the 200.500 resistance in one decisive move.

Meanwhile, the JPY continues to lose ground as the BoJ shows no clear intention to hike rates, while GBP gains support on expectations that the BoE will maintain its hawkish stance longer due to persistent core inflation.

Trade setup (reference):

Buy limit: 198.900

SL: below 198.500

TP: 200.500

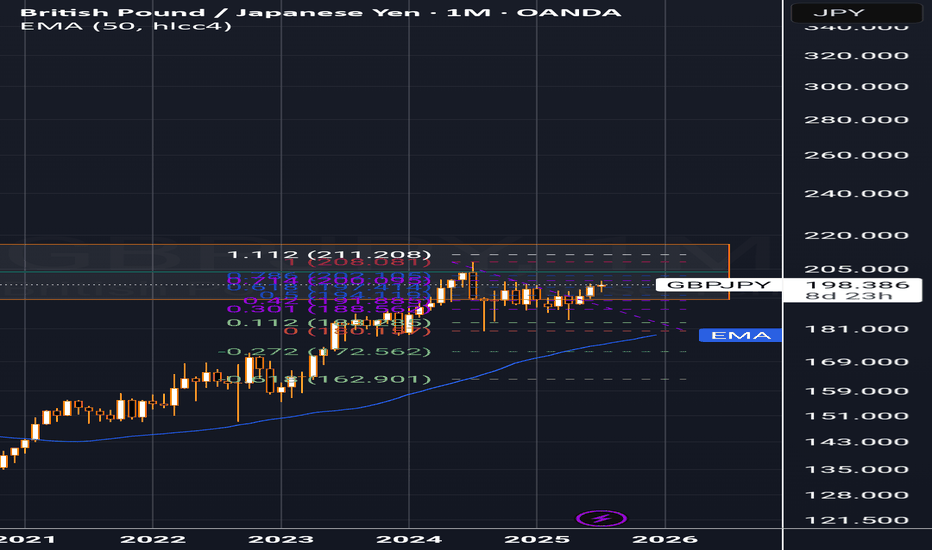

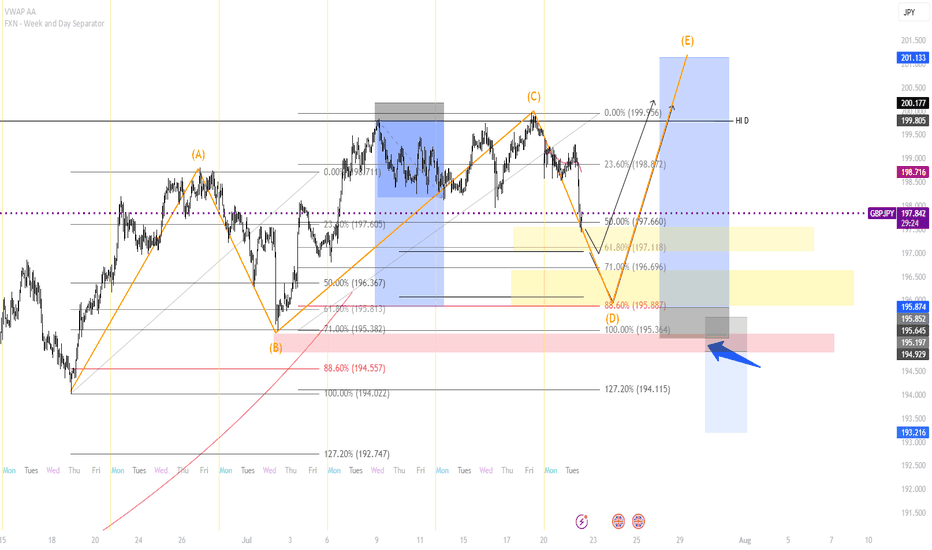

MAJOR MONTHLY SUPPLY ZONE ON GBP/JPY SELLERS INBOUNDRegarding the monthly supply zone, my technical analysis indicates that the price has historically failed to breach this area over several years. I anticipate a potential reversal and recommend waiting for confirmation, such as a double top or harmonic pattern, before initiating a sell position. Furthermore, i will consider selling opportunities upon the .618 Fibonacci level being reached.

Entry: 199.0

Take Profit: 183.3

Overall Price Target: 163.0

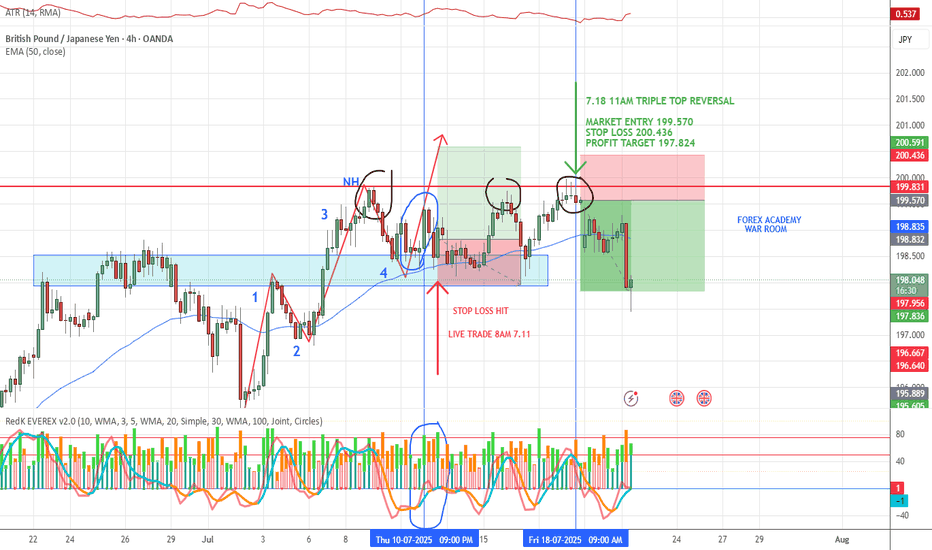

GBP/JPY WIN📈 VMS Strategy – GBP/JPY Triple Top Win

Another clean triple top reversal, this time on GBP/JPY, using the VMS strategy.

This trade checked every box:

✅ Clear triple top structure

✅ Strong engulfing candle

✅ Volume + momentum aligned perfectly

✅ Entry near the 50EMA with patience and confirmation

Price made a solid move in our favor and hit the profit target earlier this morning.

If you’re finding value in the VMS system, consider sharing it with someone who needs structure, patience, and a real edge.

📌 The trade either fits the rules—or it doesn’t. That’s what makes this work.

GBPJPY is in the Down Trend From Resistance LevelHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPJPY 4H – Demand Zone Rejection | Bullish Continuation🏹 GBPJPY 4H – Demand Zone Rejection | Bullish Continuation

GBPJPY tapped into a key 4H demand zone with a strong rejection wick, respecting both horizontal support and trendline structure. With bullish momentum building, price is likely to push toward the psychological 200.000 level.

✅ Demand zone + trendline confluence

✅ Bullish rejection after liquidity sweep

✅ Clean 1:3+ RRR setup

✅ Clear HTF bullish structure

Strategy: TCB – Trend Phase (Pullback Entry)

Entry Zone: 198.800

Stop Loss: 198.370

Take Profit: 200.000

Checklist Score: ✅ 100% A+ setup

#GBPJPY #ForexSetup #SmartMoney #PriceActionTrading #DemandZone #TrendTrading #ForexAnalysis #TCBStrategy #LiquiditySweep #SwingTrade #JapaneseYen #BullishMomentum #ForexChart #TradingViewIdeas #GBPJPYAnalysis

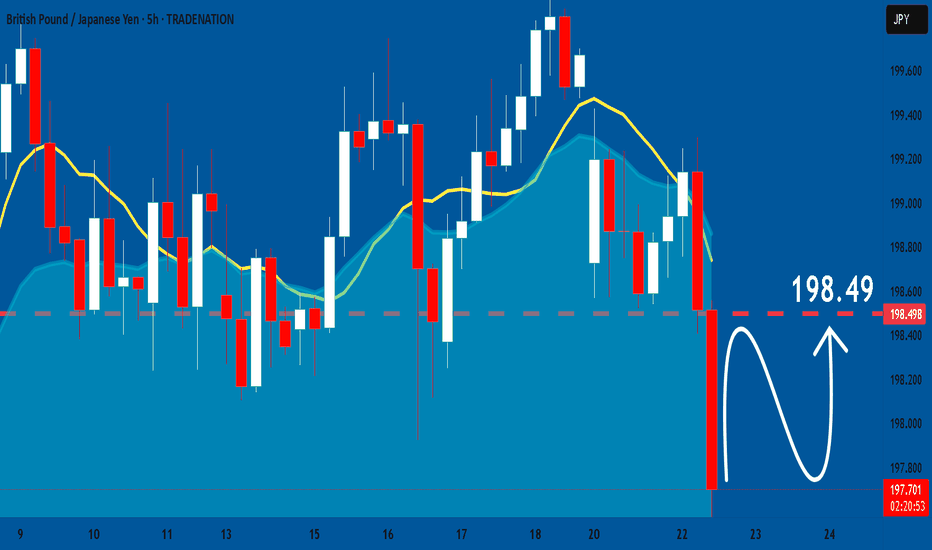

GBPJPY: Swing Trading & Technical Analysis

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current GBPJPY chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPJPY Reversal SetupFundamentals in Politics:

Japan's ruling coalition (Liberal Democratic Party and Komeito) has lost its majority in the upper house of parliament in recent elections. This is a significant setback for Prime Minister Shigeru Ishiba, though he has stated he will remain in office to combat inflation and continue trade talks with the US.

The election results indicate a surge in support for right-wing populist parties, fueled by public frustration over economic challenges like soaring rice prices and inflation exceeding wage growth. This weakened position for Ishiba's government could lead to legislative gridlock and impact future policy decisions, including those related to trade and the Bank of Japan's monetary policy.

JPY has been experiencing notable fluctuations, largely influenced by the recent election results and their potential implications for monetary policy:

Initial Yen Strength Post-Election: Following the weekend election results where Japan's ruling coalition lost its upper house majority, the Japanese Yen showed significant strength, gaining nearly 1% against the USD. This was somewhat counter-intuitive for some analysts who expected political uncertainty to be yen-negative.

However, technicall DRAGON ( GBPJPY) seem to make a correction after testing 200.000 line.

Closing below 197.000s will trigger a deeper bearish correction.

Good Luck!

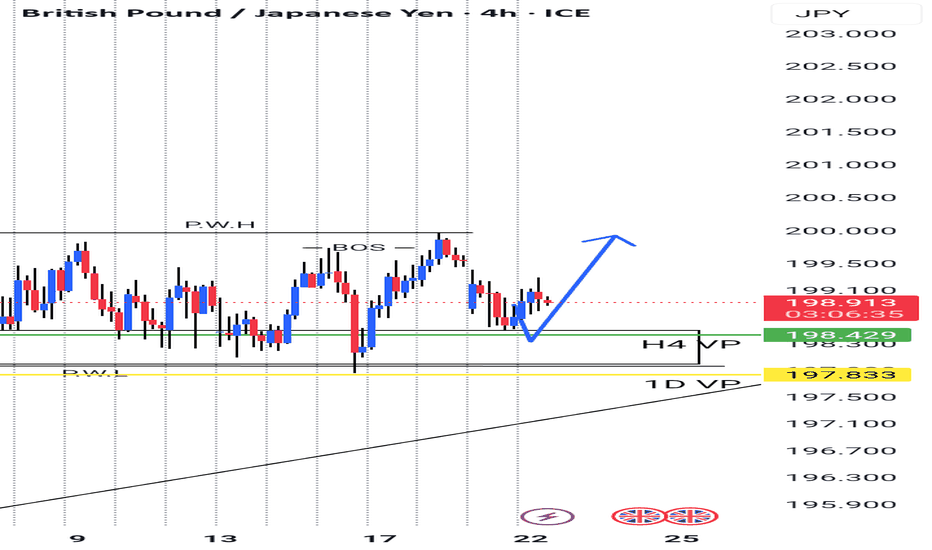

GJ-Tue-22/07/25 TDA-Potential scalp buy to fill the gap!Analysis done directly on the chart!

Weekend gaps in the majority of times (if not all the time) at some point

will be filled.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

Bullish Shift After Liquidity Sweep – Eyes on BSL & Weekly GapHello Traders,

As per yesterday’s analysis, price successfully swept the weak internal lower low (LL), but failed to close below structure. Instead, price has shifted bullish, indicating that sellers were overpowered by buyers at that level.

Before considering any trading decisions, I would like to see price take out the Buy-Side Liquidity (BSL) to confirm the bullish intent. Additionally, note that the new weekly gap on the 4-hour timeframe remains unfilled, which could act as a magnet for price in the short term.