USD/JPY IS CURRENTLY EXHIBITING A BEARISH TREND STRUCTUREThe USD/JPY currency pair is currently exhibiting a bearish trend structure on the daily timeframe, signaling potential further declines in the upcoming trading sessions. Price action is trading near a lower high, reinforcing the bearish outlook as sellers appear to be gaining control. This downward momentum follows the recent formation of a bearish engulfing candlestick pattern near a significant resistance level, which often serves as a strong reversal signal. The presence of this pattern near resistance suggests that bullish momentum is weakening, increasing the likelihood of a sustained bearish move.

On the downside, the pair is expected to target the 142.00 level, which could act as a key support zone. A break below this level may accelerate selling pressure, opening the door for further declines. Traders should monitor price reactions around this level for potential consolidation or continuation of the downtrend. Conversely, if the pair attempts a recovery, the 151.300 price level stands as a major resistance barrier. Any bullish retracement towards this zone could attract renewed selling interest, reinforcing the bearish bias.

The overall technical structure suggests that USD/JPY remains vulnerable to additional downside, with bearish momentum likely to persist unless key resistance levels are convincingly breached. Traders may consider short positions on rallies towards resistance or breakdowns below key support levels, while maintaining tight risk management strategies. Given the current market dynamics, the path of least resistance appears to be downward, with 142.00 as the immediate target and 151.300 acting as a critical resistance to watch for any potential trend reversals.

JPYUSD trade ideas

USDJPY a reduction in the density of long tradesWe analyzes the structure of market behavior and identifies a class of typical weak patterns: a reduction in the density of long trades, a gradual downward shift in volume, and a lack of dominant driving logic in the market. The currency pair has shown a pattern of "not deep enough to fall, not high enough to bounce" around several key psychological levels, which is a reflection of the gradual dominance of short-side funds.

We scored semantic models on multiple social media platforms and found that investors are experiencing a shift in sentiment from "neutral wait-and-see" to "pessimistic risk aversion". At the same time, the spread of short positions identified by the system has increased, implying that not only professional investors, but also some small and medium-sized traders have begun to be bearish.

The long-short momentum distribution curve shows the cumulative advantage of the short side, and the lack of substantial positive catalyst, the probability of reversal in the short term is low.

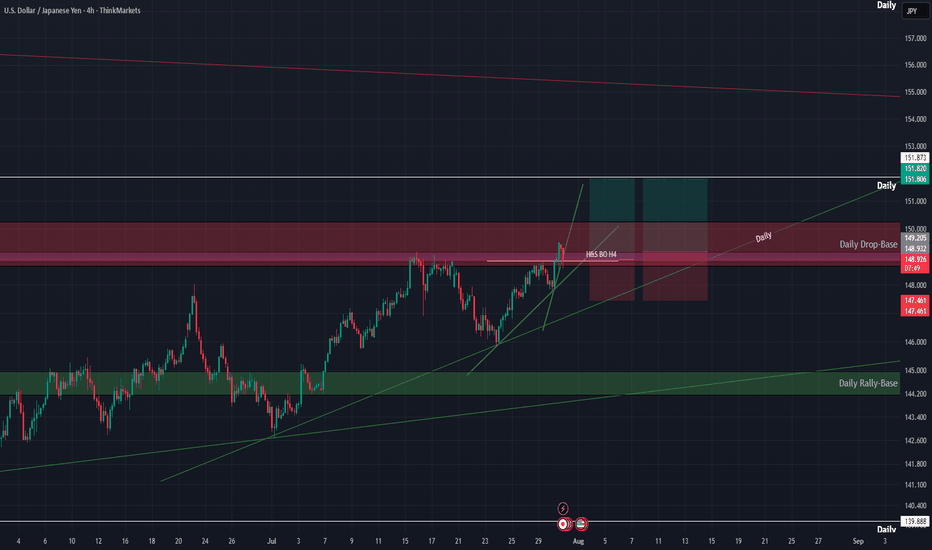

USDJPY 4Hour TF - August 3rd, 2025🟦 USDJPY 4H Analysis Bullish Idea

📅 August 3, 2025

🔹 Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bearish

• Daily – Bullish

• 4H – Bearish

USDJPY has retraced sharply from local highs, breaking down into prior support near 147.50. Short term structure has shifted bearish, but higher timeframes still lean bullish making this a key reaction zone to monitor.

🔍 Key Zone: 147.00 – 147.50

This zone sits at a prior key support zone. How price reacts here will determine whether the pair resumes its bullish leg or continues deeper.

✅ Scenario A: Bullish Rejection (Blue Path)

1.If price holds above 147.00–147.50 and prints bullish confirmation

2.Look for continuation toward 151.50

Target: 151.50 (next clean resistance zone)

This setup aligns with the HTF bullish trend. Clean break of structure and bullish reactions are needed for confirmation.

⚠️ Scenario B: Bearish Breakdown (Orange Path)

1.If price breaks and closes below 147.500 zone

2.Watch for lower high + retest rejection

Target: 145.00 support zone

This is a lower probability counter trend continuation but is possible if price action presents the needed confirmations.

🧠 Final Notes

• Price is at a decision point, wait for Price action confirmation

• HTF bias leans bullish, but 4H structure must shift back up

• Trade with structure, not against it

USDJPY The Week Ahead Key Support and Resistance Levels

Resistance Level 1: 148.90

Resistance Level 2: 149.70

Resistance Level 3: 150.20

Support Level 1: 146.12

Support Level 2: 145.40

Support Level 3: 144.60

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

304-PIP Move on USDJPY in One Day - Trading NFP ProfitablyOn August 1st, USDJPY experienced a massive 304-pip drop after a strong impulse into the daily order block. From there, the daily order block was respected, and the retracement was induced by the USD Non-Farm Payrolls news release, leading to a sharp move down to a four-hour liquidity void, hitting the 75% Fibonacci retracement level.

This move highlights the precision of combining institutional levels with news catalysts, capturing a significant move in a short timeframe.

This is Outlier Trading Folks.

Second Part ANALYSIS

Part 2: USD/JPY Chart Analysis

It seems that, due to the upcoming NFP news (which will be released shortly), the price is in a state of uncertainty. If the downtrend or price correction continues, this is one possible scenario we could see. However, it might also be better to stay risk-free or even close the trade here.

Dollar-yen seems to have made a decisive breakoutBoth the Fed and the BoJ reaffirmed their cautious approaches to changing rates in recent days, but the dollar had the larger boost. The next cut by the Fed isn’t expected until the end of October. While the BoJ upgraded its expectations for inflation this fiscal year, the impact of trade wars on both sides is still developing. Havens haven’t had significant inflows after new tariffs came into force on 1 August.

¥150 is a key psychological area which still hasn’t been clearly broken, so it’d be possible to see consolidation rather than continuation in the near future depending on the results of the upcoming NFP, especially considering overbought signals from the slow stochastic and Bollinger Bands. February and March’s high around ¥151 looks like a possible area of resistance.

The 38.2% weekly Fibonacci retracement definitely seems to have been broken so it might now flip to being a support. Dynamic support could also come from the 200 SMA around ¥148.90. As for euro-dollar, the next immediate movement (or lack thereof) depends mainly on the NFP. Some degree of positive surprise might be priced in since the consensus of 110,000 for total nonfarm seems low relative to the last several months of stronger results.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

USD/CHF

This is a trade setup for USD/CHF, based on volume and trend analysis.

Entry Price: 0.81473

Stop-Loss (SL): 0.81293

Take-Profit (TP): 0.81673

The trade is intended to be executed instantly at the mentioned price, following confirmation from both volume behavior and the current trend direction.

Disclaimer: This setup is shared purely for backtesting purposes and to document trade ideas. It is not financial advice. Always perform your own analysis before making any trading decisions.

USDJPY – Buy Scenario & Sell Setup After Rise (Aug 1, 18:00)📌 Current Situation

At this point, entering a buy trade immediately is difficult from a trend-following perspective, since the price has already made a significant upward move.

✅ Buy Scenario 1

Overview:

Looking to follow a bullish move triggered by a rebound from the moving average and the previous resistance-turned-support area.

Conditions:

Formation of a higher low (according to Dow Theory)

Price supported by the moving average (Granville’s Rule)

Clear reversal pattern on a lower timeframe: either a double bottom or a higher low followed by a higher high

Caution:

There is resistance above. Even if price continues upward, it might have limited room to break higher, so expect possible weakening of momentum.

Plan:

Aim to enter as close as possible to the support area near the resistance zone, at a lower price level.

🔻 Sell Scenario 1 (after an upward move)

Overview:

Anticipating a bearish reversal from around the 151.500 resistance zone, which has previously acted as a strong ceiling.

Conditions:

Formation of a lower high (Dow Theory)

At least a flat or downward-sloping moving average, or a move that breaks below the MA and gets rejected from it (Granville)

Clear reversal on a lower timeframe: either a double top or a lower high followed by a lower low

→ This confirms a trend reversal on the lower timeframe

Caution:

If price drops before forming a clear lower high, there's a risk of a rebound due to the upward-sloping MA.

It’s important to wait for both the lower high and MA rejection structure.

Also, the daily MA is rising from below, which may support price.

Plan:

Ideally enter from as close as possible to the resistance area (around 151.500) after confirmation.

USD/JPY: Fifth Wave Target in SightUSD/JPY is painting a textbook five-wave impulse structure from the recent lows, and we're now positioned for what could be the final act of this motive sequence.

Current Wave Count

✅ Waves 1-3 Complete: Clean impulsive structure with wave 3 showing strong extension

✅ Wave 4 in Progress: Currently correcting from the 150.94 high

🎯 Wave 5 Setup: Targeting completion around 151.95 - 152.20

Key Levels to Watch

Support Zone: 150.00 area (ideal wave 4 retracement)

This aligns with wave principle fourth-wave correction parameters

Provides a healthy pullback without threatening wave 1 overlap

Target: 151.95 - 152.20 zone for wave 5 completion

Classic 5 vs 1+3 projection

Trade Strategy

Monitor for supportive price action near 150.00

Look for an impulsive price action to confirm wave 5 beginning

Structure suggests one more leg higher before a larger correction

The beauty of Elliott Wave: when the count is this clean, the roadmap becomes crystal clear. Let's see if USD/JPY delivers this final push to complete the sequence.

USD/JPY USD/JPY – Bullish Setup in Line with the Prevailing Trend

As the overall trend remains bullish, we are considering a potential long setup on USD/JPY. The structure suggests continued upside momentum, and we aim to close the trade by the end of the European session.

📍 Entry: 149.400

🎯 Target: 150.600

🛑 Stop-loss: 148.600

This idea aligns with current market direction and intraday trend strength. Traders should watch for supportive price action to confirm the move.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk appropriately.

USDJPY Analysis : Key Reversal Zone After Parabolic Rally🧠 Market Psychology & Structure

The USDJPY 4-hour chart reveals a classic parabolic curve pattern signifying an acceleration phase in bullish momentum. This phase typically occurs during the final stages of a bullish move, where price action becomes increasingly steep due to aggressive buyer participation.

The rounded curve drawn on the chart reflects momentum compression—where pullbacks become shallower, and higher highs are formed rapidly. However, this pattern often ends in a blow-off top or a sharp correction, especially when approaching key supply zones.

🧩 Key Technical Highlights

Major Break Zone: The previous resistance around 148.80–149.00 (now flipped to support) was clearly broken with strong bullish candles, confirming trend continuation.

Break Out Demand : Price retested the breakout zone (around 149.80–150.00) before launching higher, validating this level as a new demand zone.

Current Price Action: The pair is currently hovering around 150.50 after a powerful rally, showing early signs of exhaustion with smaller bullish candles and slight upper wicks.

🔍 Target Area – Next Reversal Zone (151.80–152.30)

The green highlighted zone marks a strong supply area / reversal zone, identified from:

Previous price rejections in historical data.

Overbought conditions due to vertical rally.

Completion of the parabolic structure (climax zone).

We can expect price to reach this zone in the coming sessions, where it may:

Face strong selling pressure.

Trigger short positions from institutional sellers.

Lead to distribution or reversal back toward the demand area near 150.00.

🔄 Forecast & Trade Plan

Scenario 1 (High Probability): Price taps into 151.80–152.30, forms bearish engulfing or rejection wick, then pulls back to 150.00 or lower.

Scenario 2 (Invalidation): Strong breakout above 152.30 with momentum—bullish continuation towards 153.00+ possible.

🧠 Trader’s Mindset (MMC Insight)

This chart suggests a matured bullish trend nearing exhaustion. As smart traders, we anticipate rather than react. Wait for the price to reach the supply zone, then observe for confirmation (bearish structure, divergence, candlestick pattern) before shorting.

Avoid chasing longs at these highs—risk-to-reward is no longer favorable. Patience will offer a much cleaner entry if the reversal unfolds as expected.

#USDPJPY BUY#USDJPY currently facing this rejection on the Daily.

Our Expectation; we expect price to a lower level after this week’s rally, gather momentum and break this ceiling. From here, we will have a free run 🏃 to 154 and money will be made. Wait for our next sniper to swing signal next @tspsignals

USD/JPY - Potential TargetsDear Friends in Trading,

How I see it,

Let me know if anything is unclear.

NFP TODAY - BE SAFE

1) 151.150 holds the key to broader upside at this time.

2) 1st resistance @ 150.730

3) Key support/Strong Demand @ 148.850

Keynote:

In case of a short correction of the previous day candle-

If price can hold above 149.500, potential for more upside remains high.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time study my analysis.

USDJPY Wave Analysis – 31 July 2025- USDJPY broke resistance zone

- Likely rise to resistance level 152.00

USDJPY currency pair recently broke the resistance zone located between the resistance level 148.85 (which stopped earlier waves A and i) and the 50% Fibonacci correction of the downward impulse from January.

The breakout of this resistance zone accelerated the active impulse wave c, which belongs to medium-term ABC correction (2) from April.

USDJPY currency pair can be expected to rise further to the next resistance level 152.00 (target price for the completion of the active impulse wave C).

JPY/USD — Long-Term Technical Setup & Market Outlook💱 JPY/USD — Long-Term Technical Setup & Market Outlook

1. 🧭 Market Context & Catalysts

US-Japan monetary divergence: The Fed remains rate-tight while the BoJ maintains ultra-loose policy, putting persistent downside pressure on the yen.

Economic drivers: Strong US economic data (growth, labor, inflation) supports USD strength; Japan’s macro data remains soft.

Sentiment signals: Hawkish Fed tone continues; safe-haven flows may limit further USD gains in geopolitical risk shifts.

2. 🧱 Technical Structure (Daily Timeframe)

Break of structure (BOS) below 0.00700 signaled the dominant bearish regime.

The price retraced into the 0.786–0.886 Fibonacci zone (~0.00676–0.00679), then resumed selling—textbook re-entry into areas of liquidity (Equilibrium).

Current price sits near 0.006631, just below BOS and equilibrium zone—suggesting continuation of bearish order flow.

Fibonacci extensions show projected targets at 0.006632 (1.236), 0.006588 (1.382), 0.006517 (1.618), and potential support area at ~0.006400.

A stronger support zone exists near 0.006276 (Weak low / domain demand zone).

3. 📝 Trade Plan & Risk Controls

Continuation Setup: Look to enter on a clean bearish candle close near ~0.00665. Target the Fibonacci extensions at 1.236, 1.382, and 1.618—approximately 0.006632, 0.006588, and 0.006517 respectively. A deeper extension into the 0.006400 zone is also possible. Place the stop-loss just above 0.00670, as this level invalidates the recent break of structure and implies rejection of downside continuation.

Pullback Re-entry Setup: If price retraces higher, consider a re-entry short near ~0.00680. Use the same Fibonacci targets as above. Invalidate the setup if price breaks above 0.00680, which would suggest a shift toward bullish structure or absorption of the prior supply zone.

4. ⚠️ Watch Key Risks & Signals

If price breaks above the 0.786 zone or creates a higher high above equilibrium, bearish thesis fails.

Monitor US data releases: FOMC minutes, inflation or jobs data—shifts could accelerate USD momentum.

Geopolitical shocks or risk-off flows could trigger yen strength reversal.

✅ Summary Outlook

JPYUSD remains firmly bearish with technical integrity intact.

Valid corrective levels now become sell zones toward continuation targets.

Extended downside toward 0.00640 area is plausible, with further drop to 0.006276 zone if trend continues strongly.

USD/JPY - Bearish Idea on H1USD / JPY sell idea on H1.

Price broke out of the ascending channel after a divergence was formed.

Price also starting making Lower Lows & Lower Highs.

We will wait for the price to retrace back to the 0.5 - 0.618 Fib retracement to take the entry.

Stop loss above the last high formed