JPYUSD trade ideas

USDJPY UPSIDE The dollar index (DXY00) on Tuesday rose by +0.22% and posted a 5-week high. The dollar has carryover support from Monday following the EU-US trade deal that is seen as favoring the US. Also, expectations for the Fed to keep interest rates unchanged at the end of Wednesday's 2-day FOMC meeting are supportive of the dollar. The dollar extended its gains after the US Jun advance goods trade deficit unexpectedly shrank, a supportive factor for Q2 GDP, and after July consumer confidence rose more than expected.

USDJPY Confirmed that the currency pair has been dominatedConfirmed that the currency pair has been dominated by the short side in the short term through high-frequency aggregated reasoning on the time-sharing K-line pattern, capital turnover bias, and short-cycle public opinion winds, especially suggests that under the current market conditions, investors need to be wary of what appears to be a mild rebound but is actually a long-drawn-out trap.

The trading spectrum chart tracked by the system shows that short high-frequency accounts have continued to maintain a steady increase in positions in recent trading cycles, while long transactions have shrunk significantly, with an obvious structural imbalance. Words like "conservative", "position reduction" and "trend risk" have proliferated in the public opinion platform, and the dominant market sentiment has shifted to defense.

What's more, multiple signals have formed a "negative resonance", including: macro pressure, net outflow of capital, weakening of technical rebound, and investors' mentality turning cold.

BIASOne thing i will tell you for free is that, you should stop worrying about entries, and always focus on the market direction, of the current leg of price that you find yourself paired with the HTF perspective, that way even if your entry is wrong, you can always find another entry and join in the given direction.

#USDJPYDate: 29-07-2025

#USDJPY Current Price: 148.53

Pivot Point: 148.049 Support: 146.177 Resistance: 149.932

Upside Targets:

Target 1: 151.264

Target 2: 152.597

Target 3: 154.303

Target 4: 156.008

Downside Targets:

Target 1: 144.839

Target 2: 143.501

Target 3: 141.796

Target 4: 140.090

#TradingView #Stocks #Equities #StockMarket #Investing #Trading #Forex

#TechnicalAnalysis #StockCharts #Currency

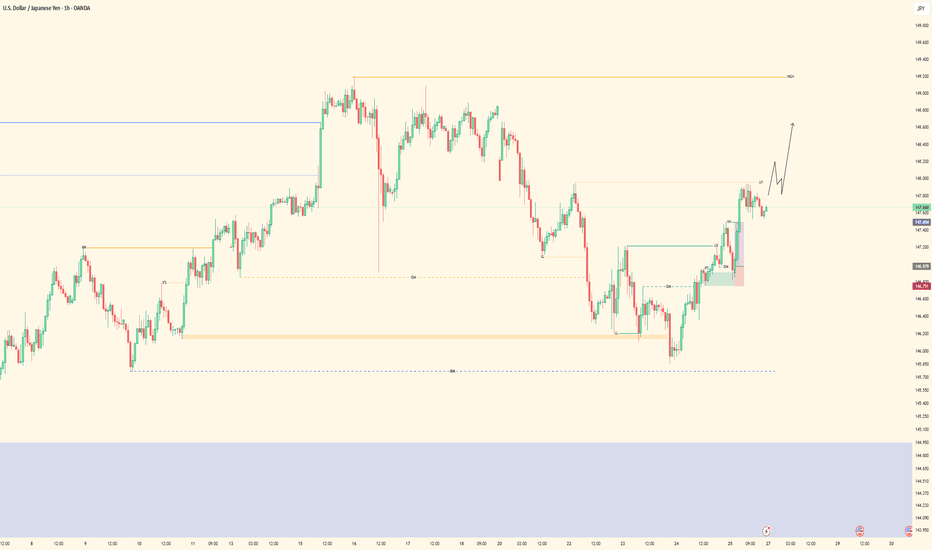

Eyes on the Break USDJPY Approaches Key Resistance with Bullish.USDJPY Technical Outlook Bullish Momentum Gaining Strength

USDJPY is currently displaying a strong bullish structure, having taken a clean bounce from the ascending trendline support. This upward movement was further validated as the pair successfully broke through a significant resistance level, triggering a Market Structure Shift (MSS) a clear signal that the prior trend has potentially reversed or evolved.

Following the MSS, a Break of Structure (BoS) to the upside has confirmed the continuation of this bullish momentum. The price action is now navigating above the previous demand zone, indicating strong buying interest in that area.

Notably, the market retraced slightly to retest the bullish engulfing zone, reinforcing the strength of buyers at that level. After this healthy retest, price action is once again pushing upward.

Now, all eyes are on the next key resistance zone. If USDJPY manages to decisively break above this level and prints a valid bullish confirmation (such as another structure break, strong candlestick pattern, or liquidity sweep followed by a reversal), it would open the door for an extended upside move, potentially targeting higher time frame liquidity pools.

Traders should closely monitor price behavior around this resistance zone. A confirmed breakout with volume or institutional candle formations could provide an excellent opportunity for continuation buys, in alignment with the prevailing bullish sentiment.

USDJPY InsightHello to all our subscribers.

Please feel free to share your personal thoughts in the comments. Don’t forget to hit the boost and subscribe buttons!

Key Points

- Prime Minister Shigeru Ishiba reaffirmed during a party meeting held at the LDP headquarters that he has no intention of resigning, stating, "I will do my utmost to ensure there is no political vacuum for the nation and the people."

- Following the U.S.-EU trade agreement, concerns have arisen that it could negatively impact the EU economy, with negative sentiment spreading across Europe.

- On July 28, the third high-level meeting between the U.S. and China began in Stockholm, Sweden. The market widely expects the current “tariff truce” to be extended by another 90 days.

Major Economic Events This Week

+ July 29: U.S. Department of Labor – JOLTS

+ July 30: Germany Q2 GDP, U.S. July ADP Nonfarm Employment Change, U.S. Q2 GDP, Bank of Canada rate decision, FOMC meeting results

+ July 31: Bank of Japan rate decision, Germany July CPI, U.S. June PCE Price Index

+ August 1: Eurozone July CPI, U.S. July Nonfarm Payrolls, U.S. July Unemployment Rate

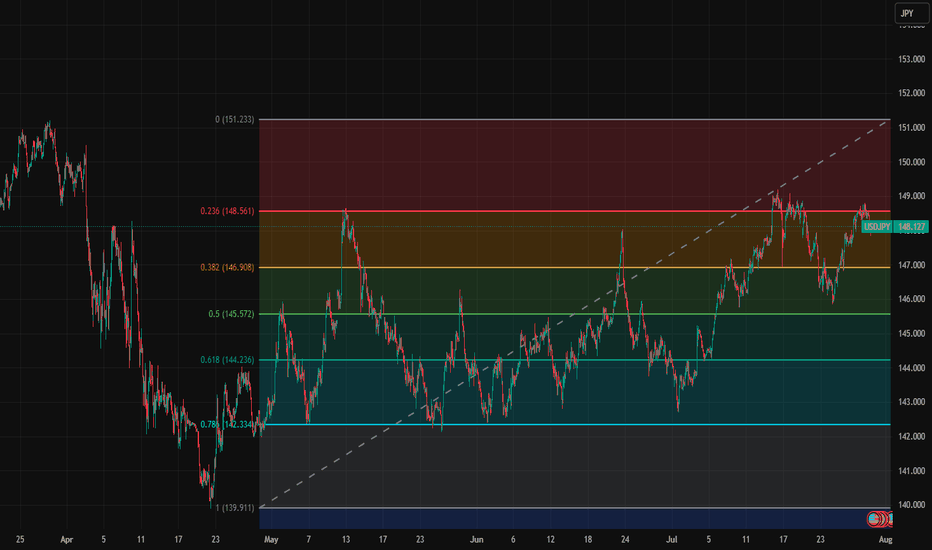

USDJPY Chart Analysis

After facing resistance near the 149 level, USD/JPY pulled back but found support around 146, and is now climbing again toward 149. In the long term, a rise toward 151 seems possible. Two potential scenarios are in play:

- The pair hits resistance again at 149, finds support at 146, and then moves up toward 151.

- The pair maintains its current upward momentum and continues climbing directly to 151.

We will determine our strategy based on the price action near the 149 level.

USD/JPY(20250729)Today's AnalysisMarket news:

After gold prices soared to an all-time high of more than $3,500 an ounce in April, the latest report from the Commodity Futures Trading Commission (CFTC) showed that fund managers have increased their bullish bets to the highest level in 16 weeks.

Technical analysis:

Today's buy and sell boundaries:

148.19

Support and resistance levels:

149.23

148.84

148.59

147.78

147.53

147.14

Trading strategy:

If the price breaks through 148.59, consider buying, the first target price is 148.84

If the price breaks through 148.19, consider selling, the first target price is 147.78

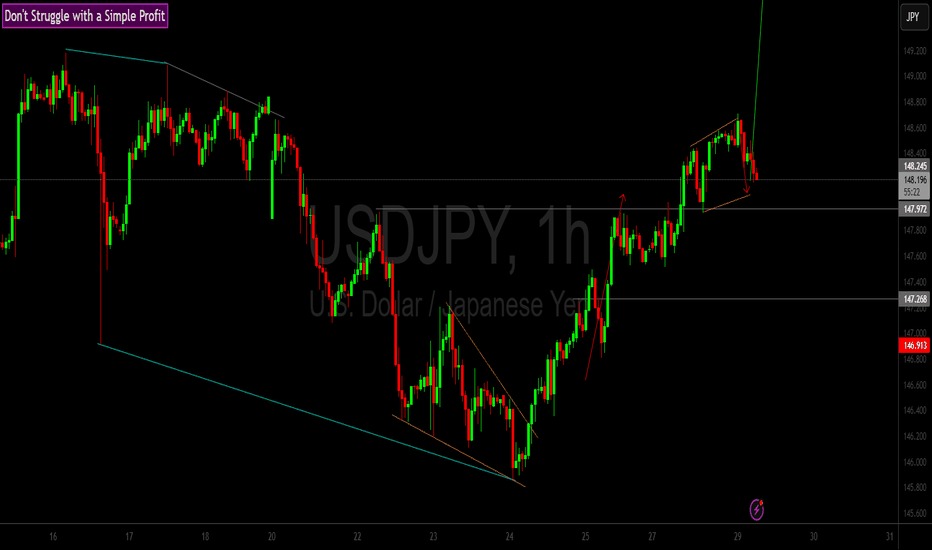

Temporary SELL then BUYAs we said, BIG picture BUY.

Yesterday temporary sell since H1 range was still SELL.

Today H1 range is BULLISH.

We expect temporary SELL from 147.22/42 (After confirmation we will get Snip entry)

TP1: 146.45 (BUY ZONE)

Note: If It will go to BUY ZONE (146.45) first before SELL ZONE (I wont sell)

USD/JPY Forecast — GANN DAILY PIPP STRATEGYAccording to my GANN-based time analysis, this month is divided into 2 major intervals, and each third is further split into 1 secondary zone, then into 6 micro zones.

Each of these micro-zones is divided into 3 equal slices, and each slice into 2 smaller zones — like cutting a cake into precise pieces.

This granular structure helps anticipate key reversal points based purely on time.

Open chart and click "make it mine" to and travel through the timeframes to understand

🔓 witness the art.

🎯 Every candle tells a story.

⏱️ Every line marks a time-based turning point.

💥 This is not just analysis — it’s precision timing.

🖼️ Click the chart and explore the masterpiece.

Let the market reveal its rhythm.

---

🎯 Key Levels

Pivot Point of the Week: 148.014

If price stays below, I expect a decline toward 145.098

My main time anchor to start measuring from is the price level 139.266

---

🧠 Strategy Note:

We don’t predict where the price "might go."

We react only when the price meets a defined time interval — because in most cases, price reacts precisely at those time moments.

if the price reach 148.743 and a 15min candle break it or closed completely above it then we may watch usd/jpy near 150.201

---

🟡 Live Setup:

On the chart below, we already had several reactions around key time intervals (highlighted). I’m monitoring closely to ride any impulsive move post-time-crossing.

No indicators. No clutter. Just price + time + behavior.

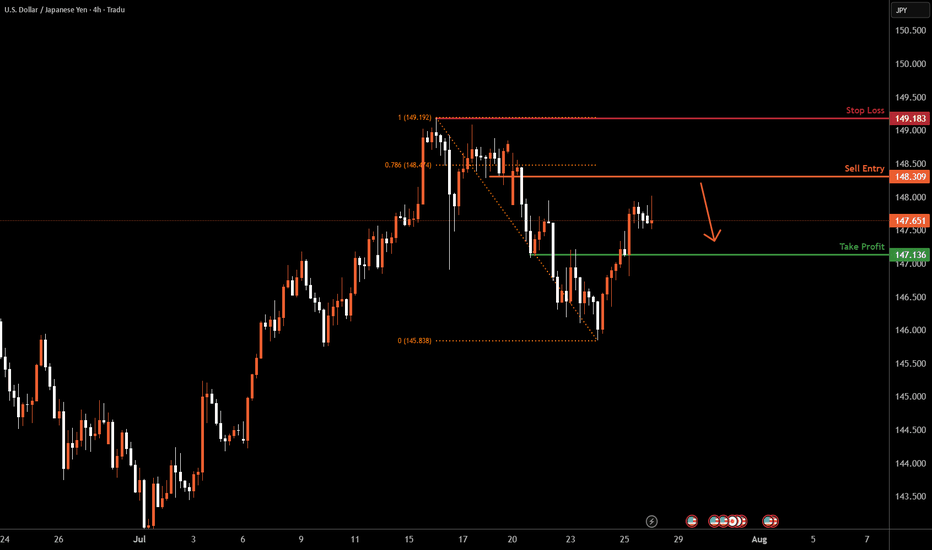

USDJPY H4 I Bearish Reversal off the 78.6% Based on the H4 chart analysis, we can see that the price is rising toward our sell entry at 148.30, which is a pullback resistance that aligns closely with the 78.6% Fibo retracement.

Our take profit will be at 147.13, a pullback support level.

The stop loss will be placed at 149.18, a swing-high resistance level.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

usdjpy

📌 Trade Idea: Sell USDJPY (U.S. Dollar / Japanese Yen)

Current Market Action: Based on recent technical analysis and price behavior, a selling opportunity in USDJPY has been identified.

Entry Zone: 147.90 – This is the ideal level where traders can initiate a sell position. It aligns with recent price rejection levels and shows early signs of bearish momentum.

Stop Loss (SL): 148.50 – A well-placed stop just above a key resistance zone ensures risk is controlled if price reverses against the trade idea.

Take Profit (TP) Levels:

🎯 TP1: 147.490 – This level offers a quick short-term target and serves as the first point for partial profit booking.

🎯 TP2: 147.190 – A mid-range target based on previous support zones, allowing for a stronger reward.

🎯 TP3: 147.000 – Final take-profit level, representing a significant move within the prevailing downtrend structure.

USD/JPY(20250728)Today's AnalysisMarket news:

Trump announced that the US and Europe reached a trade agreement: 15% tariffs on the EU, $600 billion in investment in the US, zero tariffs on the US by EU countries, the EU will purchase US military equipment, and will purchase US energy products worth $750 billion. However, the US and Europe have different opinions on whether the 15% tariff agreement covers medicines and steel and aluminum. Von der Leyen: 15% tariff rate is the best result that the European Commission can achieve.

US Secretary of Commerce: The deadline for tariff increase on August 1 will not be extended. The United States will determine the tariff policy on chips within two weeks.

Technical analysis:

Today's buying and selling boundaries:

147.47

Support and resistance levels:

148.58

148.17

147.90

147.04

146.77

146.35

Trading strategy:

If the price breaks through 147.90, consider buying, the first target price is 148.17

If the price breaks through 147.47, consider selling, the first target price is 147.04

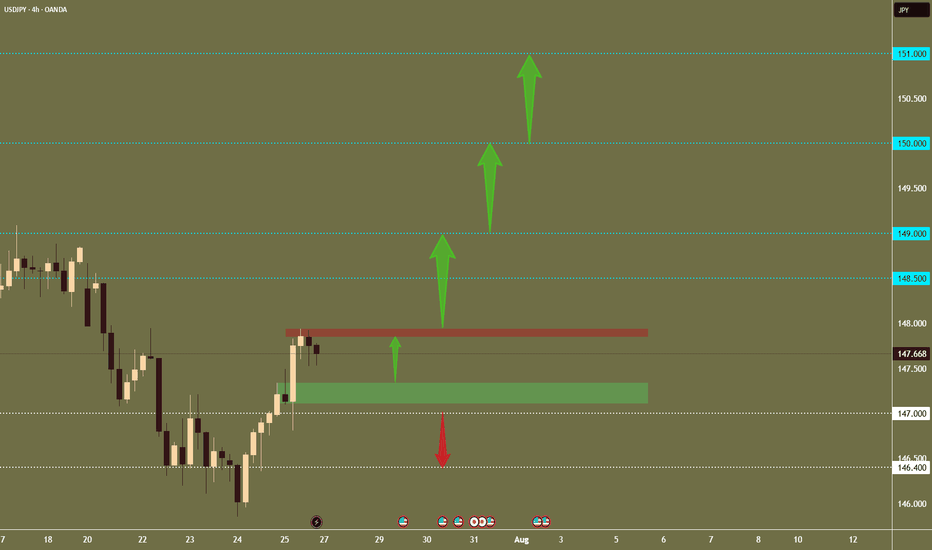

USDJPY - W30📉 USD/JPY Weekly Plan

Current Price: ~147.65

Bias: Neutral to Bullish while above 147.00

🔑 Key Levels

Resistance: 147.94 → 149.17

Support: 147.00 → 145.90 (55-day EMA)

🔧 Trade Setups

1. Buy Breakout

Entry: Above 147.94

SL: 147.50

TP: 149.17 → 151.43

2. Buy on Dip

Entry: 147.00–147.20

SL: 146.80

TP: 147.94

🗓️ Key Events

Wed: Fed meeting

Fri: US NFP

BOJ: Possible comments affecting JPY

USD/JPY Daily AnalysisPrice has rejected 146.00 for the second time this month as buyers currently regard this as a high value area.

Next stop could be 149.00 which was the last daily resistance zone, rejected this month.

If you agree with this analysis, look for a trade that meets your strategy rules.

USD/JPY - Potential TargetsDear Friends in Trading,

How I see it,

Let me know if anything is unclear.

Keynote:

My personal point of view is that the greenback will be like a

train @ full throttle (BULLISH) for the second half of 2025.

Specifically, from the 1st of August...

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

UJ| Bullish Structure Ride | 5M Demand ExecutionPair: USDJPY

Bias: Bullish

HTF Overview: 4H structure stayed bullish with clean intent. Internal liquidity resting above prior highs, and price is still pushing through the 30M range toward those 4H targets.

LTF Confirmation: 30M showed a clean continuation range with a lower high (LH) inside structure — price never broke character. I tracked it into 5M where the OB was sitting patiently.

Entry Zone: Tapped into the 5M OB with a short-term sweep right before — no need for extra confirmation. The move had structure, inducement, and momentum on its side.

Target: TP hit at the 5M highs, but overall I’m watching for the 30M LH to go first, then ultimately expecting price to run the 4H internal highs this upcoming week.

Mindset Note: When the story is clear on the HTF, all you need is one clean LTF entry to ride with conviction. I’m letting the higher timeframe breathe and staying ready.