Trade ideas

#KDA Kadena: Scalable PoW Layer 1 Setting Up for 10x+?📌 Coin: KDA (Kadena)

💰 Buy Levels:

✅ First Entry: $0.53

✅ Second Entry: $0.46

✅ Third Entry: $0.39

🛑 Panic / Invalidation: Weekly close below $0.33

🧠 Fundamental Analysis (FA) – In Short

*️⃣ Sector: Layer 1 blockchain / Scalable PoW

*️⃣ Use Case: Kadena is a high-throughput Proof-of-Work blockchain designed for scalable smart contracts and industrial-grade apps.

*️⃣ Tech: Unique braided PoW with up to 20 chains in parallel for scaling. Built for security + speed without compromising decentralization.

*️⃣ Smart Contracts: Runs on Pact, a secure and human-readable smart contract language with formal verification.

*️⃣ Narrative Fit: Kadena positions itself as the only scalable PoW chain, blending Bitcoin’s security model with Ethereum’s contract functionality.

📊 Tokenomics & Market Data

(As of mid-July 2025)

🪙 Current Price: ~$0.50

🧾 Market Cap: ~$130M

🔢 Rank: #230–260 range

🧮 Circulating Supply: ~260M KDA

🔒 Max Supply: 1B KDA

⛏️ Emissions: Mining-based (PoW), inflationary but decreasing

📦 Unlock Schedule: Gradual over 120 years; team and ecosystem share unlocking ongoing

🎯 Bull Market Target (Realistic)

Target Range: $1.60 – $2.20

*️⃣ A return to former range highs from early 2023 before breakdown, reflecting growing ecosystem and rediscovery of undervalued L1s.

🚀 Mega Bullish Target (Speculative Top)

Target Range: $5.00 – $7.50+

*️⃣ Would require mass recognition of Kadena as a scalable PoW solution, and a strong narrative rotation into energy-secure and decentralization-focused chains.

✅ Final Take

🧠 Kadena is a technically unique L1 with solid fundamentals and huge upside if the PoW vs PoS narrative reignites.

we ask Allah reconcile and repay

#KDA Poised for a 281% Upswing! GETTEX:KDA #KDAUSDT is setting up for a potential breakout from a long-term falling wedge pattern. Currently trading at $0.450, the technicals suggest a remarkable 281.16% gain, with a target price of $1.265. This could be the perfect moment to enter before the rocket takes off!

⚠️ All trading ideas are published with a time delay. If you want to follow the trading in real-time, please follow the link:

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.0800, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.0876

First target: 0.1016

Second target: 0.1160

Third target: 0.1321

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

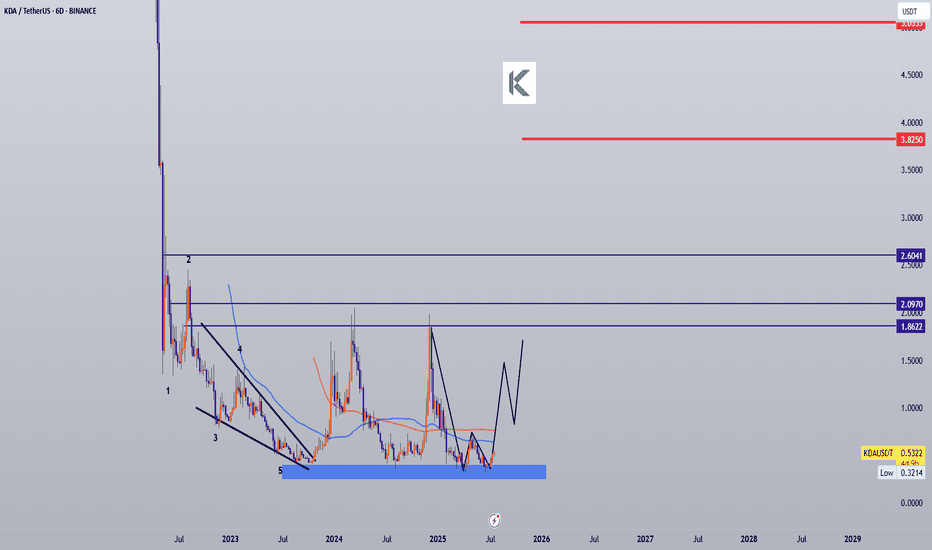

KDA Macro Bottom Forming? Wave 3 Ending, Reversal Setup Brewing🚨 KDA/USDT - Approaching the End of Macro Wave 3 – Reversal Imminent?

After nearly 2 years of consistent decline, Kadena (KDA) appears to be in the final stages of its macro corrective structure. Using a blend of Elliott Wave Theory , Smart Money Concepts (SMC) , Fibonacci tools , and Price Action analysis , there is compelling evidence that we may be forming a generational bottom .

The chart outlines a clean 5-wave Elliott impulse to the downside. With Wave 3 nearing completion in a historically strong demand zone ($0.06–$0.03), the probability of a long-term trend reversal is increasing.

This zone also aligns with:

A full 2.618 Fibonacci extension,

Prior accumulation levels,

A potential liquidity sweep below Wave 3,

Oversold market conditions likely visible on higher timeframes (RSI/MACD divergence).

On the fundamentals side, Kadena continues to innovate with its high-throughput PoW Chainweb architecture , human-readable smart contracts via Pact , and growing DeFi infrastructure. It remains one of the most undervalued layer-1s in the market with zero major security exploits since launch.

🔮 If the reversal confirms , long-term targets lie at:

$1.25 (0.5 Fib Retracement)

$7.97 (prior high)

$222 (1.618 macro extension, multi-year projection)

This setup may not play out overnight, but it's the type of structure that smart money patiently builds positions into , while retail fears the bottom.

📊 1. Elliott Wave Theory Confluence

Looking at the macro Elliott Wave structure:

🔹 A clear 5-wave impulsive decline appears to be forming:

Wave 1 & 2 have already played out.

Wave 3, being the most aggressive, is complete or near completion.

Wave 4 retracement was shallow and corrective (possibly a bear flag/pennant).

Wave 5 is projected to complete with a final leg lower— potential bottom expected before a strong reversal.

🔹 Post wave 5, an ABC corrective wave or a larger impulsive reversal is projected (labeled on chart), suggesting a macro trend shift .

🧠 2. Smart Money Concepts (SMC)

💰 Accumulation Zones:

Price is hovering in a demand zone (between $0.06 - $0.25).

This area has high probability of institutional accumulation as retail sells into fear.

📉 Liquidity Sweeps:

Recent price action shows a sharp move down, likely a liquidity grab below previous swing lows (a classic SMC manipulation before reversal).

The anticipated "spring" move from this zone aligns with Wyckoff accumulation patterns.

🔄 Break of Structure (BoS):

A break above the corrective structure post-wave 5 would confirm a bullish market structure shift .

🌀 3. Fibonacci Retracement & Extension

🔹 Fibonacci Extension:

Wave 3 extension seems to have reached the 2.618% level , which is a textbook Elliott wave projection level.

This provides high confluence that Wave 5 bottom may be close.

🔹 Fibonacci Retracement Targets:

Retracement to 0.5 - 0.618 Fibonacci zone (~$1.25 - $7.97) expected in post-wave rally.

The ultimate 1.618 extension target (~$222) could play out if a macro bull cycle aligns , possibly by 2029.

🕵️♂️ 4. Price Action Analysis

📉 Bearish Channel Breakdown :

Price has followed a descending channel and is nearing the lower boundary.

False breakdowns often result in violent reversals .

📈 Bullish Divergence (likely on RSI) :

If RSI or other momentum indicators show divergence, this adds confirmation for a reversal setup .

📌 Key Levels to Watch :

Resistance : $0.3439, $1.25, $7.97

Support : $0.13, $0.06, $0.03

A break and hold above $1.25 could signal the start of a macro uptrend .

🔮 Final Thoughts

🔁 We're likely nearing the end of a macro bearish cycle (Wave 3) .

💼 With institutional accumulation signs , Fibonacci confluence , and solid fundamentals **, KDA presents a strong asymmetric opportunity .

🧨 If Wave 5 completes near $0.06 - $0.03, the upside potential toward $7.97 (first macro target) and possibly $222 (1.618 extension) offers high R/R (risk/reward) for long-term investors.

⚠️ DISCLAIMER: This analysis is educational and not financial advice. Always DYOR (Do Your Own Research).

#KDA #KDAUSDT #Kadena #CryptoAnalysis #ElliottWave #SmartMoney #Wyckoff #TechnicalAnalysis #CryptoReversal #AltcoinAnalysis #PriceAction #Fibonacci #Layer1 #CryptoFundamentals #TradingSetup #LongTermHold #Accumulation #CryptoMacro #TradingEducation #WaveTheory #Cryptocurrency

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.2170, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.2184

First target: 0.2245

Second target: 0.2294

Third target: 0.2364

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.2400, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.2534

First target: 0.2607

Second target: 0.2694

Third target: 0.2780

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

KDA/USDT – 10x Setup Loading 🔍 1. Elliott Wave Theory – Wave Confluence

From the chart:

We can clearly observe a complex corrective pattern forming a WXYXZ or triple three structure.

The wave labels (A, B, C in red/blue) suggest that the market may have completed a macro correction.

The current price action is showing a potential start of an impulsive wave, marking the beginning of Wave 1 of a new bullish cycle 📈.

🧩 Key Confluences:

Final leg (C wave) seems to have ended with a falling wedge pattern, a classic reversal signal.

Bullish divergence likely present on momentum indicators (not shown but inferred), supporting wave completion.

💹 2. Price Action Analysis

Price action is forming a base structure around $0.32 - $0.34 with:

Multiple retests of the demand zone (highlighted around $0.3214 and $0.3439).

A strong bullish engulfing candle near the low, suggesting institutional accumulation.

Current price ($0.3704) has already broken out of a descending wedge pattern (D wave to E), which often precedes explosive moves.

📌 Short-Term Structure:

Breakout above minor resistance at $0.41 would confirm a bullish reversal pattern.

Targets based on historical PA zones are set at $1.14, $1.24, $2.48, and $3.51 📍.

📐 3. Fibonacci Retracement & Extension

Let’s bring in some Fibonacci magic ✨:

If we take the high of Wave (B) and the low of Wave (C), potential retracement levels align with:

0.618 Fib at ~$1.14 ✅

1.0 Fib at ~$2.48 ✅

1.618 Fib at ~$3.51✅

These Fibonacci levels align beautifully with price structure resistance zones, showing confluence between fibs and market structure.

📊 Fibonacci Extension Target:

A minimum 5x-10x move is projected from current price, which takes us close to $3.50+, aligning with the major 1.618 extension.

🧠 4. Smart Money Concept (SMC)

Let’s talk about what the "big money" might be doing 🧠💰:

✅ Accumulation Phase Identified:

Price is ranging after a prolonged markdown.

Liquidity sweeps below previous lows suggest smart money engineered a bear trap to fill orders.

Break of structure (BoS) pending above $0.41, which would confirm smart money shift from accumulation to mark-up phase.

🎯 Ideal Smart Money Entry: Sub-$0.40 range.

📈 Next Liquidity Target: $1.24 (equal highs formed during mid-2024).

🌐 5. Fundamentals of Kadena (KDA)

Kadena is a layer-1 blockchain featuring a hybrid PoW (proof-of-work) model with scalability via Chainweb.

📌 Bullish Fundamentals:

Scalability: Can process 480k+ TPS across multiple chains.

Security: PoW-based, making it more secure than many PoS chains.

Smart Contracts: Uses Pact, a readable and secure smart contract language.

Ecosystem Expansion: Increasing DeFi, NFT, and DAO involvement.

Recent Funding: If there's been recent VC or foundation investment (check latest news), it would support a bull case.

🚀 Catalysts to Watch:

New partnerships or major DApps launching.

Exchange listings or ecosystem grants.

Rising sentiment in broader altcoin market.

📈 Final Thoughts & Outlook

🔥 Technical + SMC + Fundamentals are aligning for a potential major move.

🧭 Strategic Outlook:

🎯 Buy Zone: $0.32 - $0.38 (Accumulation Range)

🚨 Breakout Confirmation: Above $0.41

🚀 Targets:

$1.14 ✅ (0.618 Fib + structure)

$2.48 ✅ (1.0 Fib + structure)

$3.51 ✅ (1.618 Fib + macro resistance)

"The bigger the base, the higher the space" — and Kadena seems to be building a strong one 👷♂️🧱

⚠️ DISCLAIMER: This is for educational purposes only. Not financial advice. Always do your own research (DYOR) and manage risk appropriately. Crypto is volatile 🔥.

#KDA #KDAUSDT #Kadena #Altcoins #CryptoAnalysis #ElliottWave #WaveTheory #PriceAction #SmartMoneyConcepts #SMC #Fibonacci #TechnicalAnalysis #CryptoTrading #CryptoCharts #BullishSetup #AccumulationPhase #BreakoutTrade #10xPotential #CryptoFundamentals #LongTermInvesting #SwingTrading #TradingViewCommunity

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3540, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3735

First target: 0.3813

Second target: 0.3916

Third target: 0.4045

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

KDA/USDT – Critical Support: Major Rebound or Final Breakdown?🔍 Market Overview

Kadena (KDAUSDT) is currently testing a major historical support zone between 0.31 and 0.37, a demand area that has repeatedly absorbed heavy selling since 2021.

This yellow region on the chart represents a long-term accumulation zone — a critical area where sellers usually exhaust and buyers begin to regain control.

Since peaking in late 2021, KDA has been in a macro downtrend, printing consistent lower highs and lower lows.

However, recent price action shows a flattening structure — suggesting a potential base formation phase, often the prelude to a new macro uptrend if confirmed.

---

🧭 Key Technical Levels (Weekly)

Main Support Zone (highlighted): 0.31 – 0.37 → the final line of defense for long-term buyers.

Major Resistances:

R1 = 0.6277

R2 = 0.8354

R3 = 1.3567

R4 = 1.7615

R5 = 5.5285

R6 = 7.6381

R7 = 15.3227

These resistance zones represent potential retracement targets if a new bullish cycle begins from the current base.

---

📉 Pattern & Structural Context

Macro structure: long-term downtrend but transitioning into possible sideways accumulation.

Likely pattern: accumulation range / double bottom forming near historical demand.

Candle behavior: multiple long lower wicks signaling strong buying pressure and rejection from the lower boundary.

If the range continues to hold, a macro reversal base could be forming — a structure typical before the start of a sustained bullish trend.

---

🟩 Bullish Scenario

1. A strong rejection from 0.31–0.37 with a bullish engulfing or marubozu candle on the weekly timeframe would mark the beginning of a rebound.

2. Initial confirmation: weekly close above 0.6277 (R1) opens the path toward 0.8354 (R2).

3. If price forms higher lows and higher highs above R2, bullish momentum could extend toward 1.3567 – 1.7615, the next key supply area.

4. In a macro bullish cycle, long-term upside targets remain around 5.5 – 7.6, but such levels depend on the broader crypto market recovery (BTC & ETH performance).

Technical confirmations:

Weekly RSI escaping oversold territory → potential early signal of momentum reversal.

Increasing volume on dips → suggests institutional accumulation behavior.

---

🟥 Bearish Scenario

1. A weekly close below 0.31 would confirm a breakdown, exposing price to a decline toward 0.20–0.22, and potentially 0.10–0.12 in extreme conditions.

2. Failure to reclaim the 0.31–0.37 zone quickly after a breakdown would confirm a continuation of the macro bearish trend.

3. Rising sell volume during breakdown phases would indicate strong distribution and exit from long-term holders.

---

⚖️ Strategic Outlook

Aggressive swing approach:

Buy entries between 0.34–0.37, stop below 0.29–0.30, targets 0.63–0.83 (R1–R2).

→ Risk/Reward ratio exceeds 3:1 if support holds.

Conservative confirmation approach:

Wait for a weekly close above 0.63, then buy on retest, targeting 1.35–1.76 (R3–R4).

Short opportunity:

If 0.31 breaks down with strong volume, short rallies toward 0.35–0.40 with stops above 0.45, aiming for 0.20.

> This area is the “make-or-break” zone for Kadena — either it becomes the foundation for a macro reversal, or the start of a deeper bearish continuation.

---

📊 Conclusion

KDAUSDT is now at its most critical support since 2022.

The 0.31–0.37 zone acts as the “last stand” for buyers.

If this level holds, it could mark the beginning of a long-term accumulation phase that precedes a new bullish cycle.

However, a weekly close below 0.31 would likely confirm further macro downside, pushing KDA into deeper territory.

Broader crypto sentiment and BTC’s trend will play a key role in validating whichever direction KDA takes next.

---

#KDAUSDT #Kadena #CryptoAnalysis #TechnicalAnalysis #PriceAction #SupportResistance #WeeklyChart #CryptoTrading

KDA / USDT : Momentum building after a successful breakoutKDA / USDT has confirmed its breakout with strong potential. If momentum sustains, we can expect a bullish rally towards $0.50 – $0.60.

Always manage risk wisely and avoid entering without proper confirmation.

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3284, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3518

First target: 0.3626

Second target: 0.3752

Third target: 0.3917

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3772, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3800

First target: 0.3875

Second target: 0.3937

Third target: 0.4020

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3772, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3800

First target: 0.3875

Second target: 0.3937

Third target: 0.4020

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT Stay Adaptive ?#KDA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.3517, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.3480.

Entry price: 0.3610.

First target: 0.3687.

Second target: 0.3768.

Third target: 0.3866.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

KadenaKda usdt daily analysis

Time frame daily

Risk rewards ratio >4.2 👈👌

Target 0.58$

I have a short time long position for kadena with same Risk rewards ratio

Entrance = 0.36$

Target = 0.45$

LS =0.34$

KDA/USDT — Accumulation or Annihilation? Key Decision Zone!🧩 Big Picture

Kadena (KDA) is still trapped in a long-term consolidation phase after its sharp decline from the 2021 peak. Currently, price is holding at the 0.31–0.42 USDT support zone, which has acted as a “last fortress” for buyers for over 3 years.

The structure is intriguing: despite the dominant macro downtrend (a series of lower highs), this yellow zone has consistently rejected breakdowns. This suggests silent accumulation from long-term market participants.

---

🔍 Pattern & Price Structure

Key support: 0.31–0.42 (yellow box) → tested multiple times since 2022.

Extended sideways: market in a narrow range, signaling a phase of capitulation → distribution → accumulation.

Supply zones (resistance): 0.6277 → 0.8354 → 1.3567.

Momentum: though weak, repeated wicks near 0.31 show buyers still defending the level.

In short, KDA now sits at a psychological pivot between survival and collapse.

---

🚀 Bullish Scenario

If demand remains strong, a mid-term reversal could emerge:

1. Initial rebound: weekly close above 0.42 → potential rally toward 0.6277 → 0.8354.

2. Reversal confirmation: weekly close above 0.8354 with rising volume → targets 1.3567 → 1.7615.

3. Extended targets: if broader crypto sentiment improves, a recovery toward 5.5285 → 7.6381 is possible.

👉 Bullish Key: KDA must reclaim and hold above 0.6277 to “come back to life.”

---

🩸 Bearish Scenario

If buyers fail to hold 0.31, the consequences are severe:

1. Strong breakdown: weekly close below 0.31 → opens the door toward 0.20 or even 0.10 (no strong historical support).

2. Retest as resistance: once broken, 0.31–0.42 flips into distribution zone → sellers gain control.

3. Market psychology: losing this support could trigger panic selling, as it’s been the foundation since 2022.

👉 Bearish Key: Safe as long as 0.31 holds. If it breaks, expect continuation of the bearish trend.

---

📌 Key Levels

Major support: 0.31 – 0.42

Near resistances: 0.6277 → 0.8354 → 1.3567 → 1.7615

Bullish targets: 5.5285 → 7.6381 → 15.3227 → 21.9739

Breakdown zone: 0.20 → 0.10

---

🎯 Extra Insight

The yellow zone = “the battleground of long-term investors.”

Current pattern resembles an extended bottoming phase → could be a golden accumulation opportunity, or a trap if support collapses.

Best described as: “accumulation or annihilation.”

Waiting for a weekly confirmation is crucial to avoid false breakouts or breakdowns.

---

📢 Conclusion

KDA/USDT is at a critical balance point.

Bullish case: breakout above 0.6277 opens the path to 0.8354–1.3567.

Bearish case: breakdown below 0.31 risks further decline to 0.20–0.10.

📌 For investors: this zone may offer high-risk accumulation with high potential reward.

📌 For traders: watch 0.31 support and 0.6277 resistance for entry/exit signals.

#KDA #KDAUSDT #Kadena #CryptoAnalysis #PriceAction #SupportResistance #Altcoins #CryptoSignals #TechnicalAnalysis

#KDA/USDT Stay Adaptive ?#KDA

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 0.3848.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area (in green) at 0.3820, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3888.

First target: 0.4020.

Second target: 0.4182.

Third target: 0.4370.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT Stay Adaptive ?#KDA

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.4300.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.4280, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4690.

First target: 0.4474.

Second target: 0.4570.

Third target: 0.4690.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

KADENA UPDATEKadena is currently in a strong position in the crypto space. The token has been trading around US $0.44–0.46 with healthy 24-hour volumes and signs of renewed traction. Its unique multi-chain Proof-of-Work architecture, Chainweb, allows the network to remain scalable, energy-efficient, and ready for enterprise-grade adoption. Recent developments, such as new EVM compatibility and tokenization partnerships, further strengthen its growth potential. Overall, Kadena appears well-positioned thanks to its price recovery and solid technical roadmap.

#KDA/USDT Stay Adaptive ?#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.4260.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4186, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4530

First target: 0.4625

Second target: 0.4754

Third target: 0.4932

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

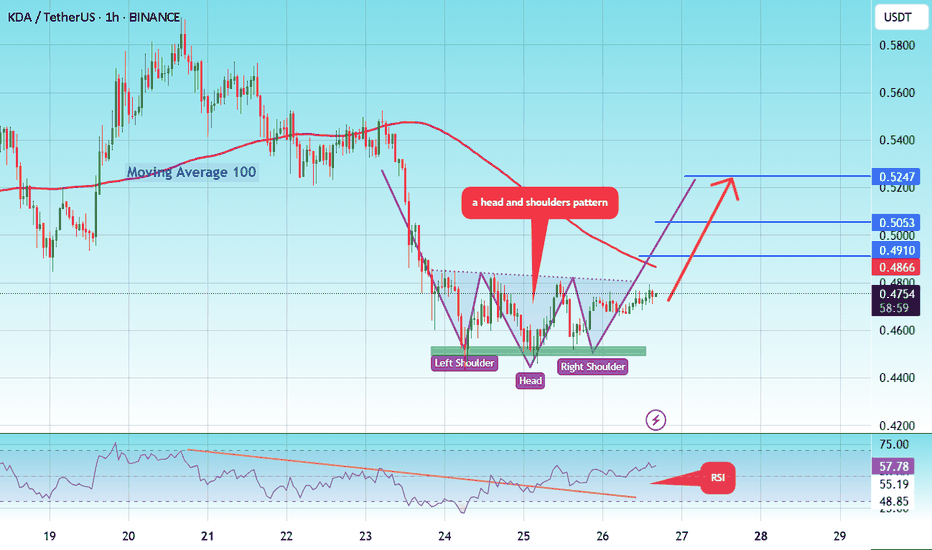

#KDA/USDT Stay Adaptive ! #KDA

The price is moving in a head and shoulders pattern on the 1-hour frame and is expected to break and continue higher.

We have a trend to stabilize above the 100 moving average once again.

We have a bearish trend on the RSI indicator, supporting the upward move with a break above it.

We have a support area at the lower boundary of the head and shoulders at 0.4545, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 0.4490.

Entry price: 0.4747

First target: 0.4910

Second target: 0.5053

Third target: 0.5247

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.