LINK Rally Cools Off — Next Long Opportunity at $20LINK has awakened with strength, rallying +60% in just 10 days. Price completed a clean 5-wave Elliott impulse, topping at the 1.0 trend-based Fib extension, which aligned with:

0.702 Fib retracement

Pitchfork upper resistance line

Key resistance zone

This perfect confluence marked the 5th wave top, followed by a -13% correction.

🔴 Short Opportunity

The current structure is forming a Head & Shoulders pattern.

➡️ Resistance zone: $23 – $23.5

🧩 Confluence factors:

Anchored VWAP (red line) from the 5th wave top

Fib speed resistance fan – Golden Pocket

➡️ Target: $20 support zone.

🟢 Long Opportunity Zone

The $20 zone offers the strongest confluence for a long entry:

Yearly Open (yOpen): $20.02

0.5 Fib retracement: $20.09 (of the 5 Elliott waves)

Pitchfork golden pocket

Anchored VWAP (green line): $20.28 (swing high)

Fair Value Gap (FVG) / imbalance fill

Liquidity pool

$20 psychological level

Trade Plan:

Entry: $20.5 – $19.5

Stop Loss: Below $19

Take Profit: $25

Potential gain: +25%

R:R: ~1:5

🔍 Indicators used:

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find them on my profile under “Scripts” and apply them directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

LINKUSDT trade ideas

Chainlink (LINK/USDT) – Two Key Scenarios AheadChainlink is currently trading at $24.9, right below a major resistance zone around $27.3. The price has been moving within a long-term ascending channel since mid-2022, and right now it’s at a decisive point.

🔹 Scenario 1 (More Probable – Bearish Rejection)

If LINK fails to break $27.3, we could see a rejection that triggers a correction towards the lower boundary of the ascending channel, around $15–17 (SC1). This aligns with the overextended move and prior rejection patterns.

🔹 Scenario 2 (Bullish Breakout)

A successful breakout above $27.3 with strong volume could fuel a rally toward the channel top, targeting the $45–52 zone (SC2).

📊 Technical Notes:

• Current resistance: $27.3 (critical decision point).

• Support levels: $18–19, then $15–17 (channel support).

• Next resistance above $27.3: $34, then $45–52.

• Structure: Ascending channel since mid-2022.

✅ Conclusion

While both scenarios are valid, the bearish rejection (Scenario 1) seems more likely unless LINK breaks $27.3 with conviction. Traders should watch for rejection signals at current levels before committing.

Chainlink LINK price analysis#LINK – Possible Breakout Setup?

🔹 Recent news indicates rising institutional interest in #Chainlink

🔹 The rally on OKX:LINKUSDT has been nearly correction-free

🔹 Next short-term targets: $28–31

🔹 Ideal pullback zone: $17–18, above the long-term blue trendline (since 2019)

🔹 If the trend holds, we could see a new impulse wave — possibly with ATH retest

🔍 What's your #LINKUSD target by end of 2025? 👇

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud.

Chainlink 2025 All-Time High Price Projection At $130 & $82Chainlink market bottom after the last bull market happened June 2023. The orthodox end of the bear market was June 2022. Chainlink is a very strong project.

After reaching bottom in mid-2022, the pair immediately started trading sideways. LINKUSDT went sideways for an entire year—bottom consolidation/accumulation/opportunity buy zone—and finally entered a new uptrend. This uptrend is what we are witnessing up close.

After the rise in late 2023 ending March 2024 LINKUSDT settled for a wide consolidation channel with a bullish bent, with higher highs and higher lows. LINKUSDT has been moving in this channel for more than a year and we are seeing the unfoldment of a new higher high.

The way the chart is drawn, the candles and the patterns, the way the market is behaving and the rising volume are all pointing towards a major advance. It is already happening, but everything is about to speed up. It is already good, great, but it is about to get better.

The first target and immediate resistance is $35. This would produce the highest prices since November 2021 and open up the last stage of the 2025 bull market for this pair. Remember, each pair is different.

Then $82 is a strong target and very likely to be a troublesome resistance point. There can be a stop here... If my thinking is right, LINKUSDT can hit $130 in this cycle. The final target is between $82 and $130 but these might be conservative numbers.

Thank you for reading.

Namaste.

Chainlink is up 160% since early April —What now?This is the perfect chart. This chart is perfect proof of where the market is at as a whole and where it is headed. Chainlink is moving higher and now trades at the highest price since January 2025.

Go a bit higher, a target of $32, and we have the highest prices since November 2021, the previous bull market. And LINKUSDT will achieve this target easily and move higher. I also predict that we are going to see a new all-time high in 2025. And this is a high probability prediction, there is just too much data in favor of.

It all starts with a low in April and then we have a higher low in June. The market goes sideways for at least four months (120 days) without any significant growth before turning extremely bullish. By the time we reach this week, the market has been green for an entire month, since 16-June.

Ethereum did something similar. A low in April followed by a small recovery then sideways consolidation. When the sideways consolidation ended the advance is still on going today and ETHUSDT almost hit a new all-time high.

Chainlink is moving forward and becoming stronger. Cardano is moving forward and many more projects are doing great. Slowly but surely, the altcoins market is starting to heat up and everything will change so fast, for the better.

One day we are buying, waiting, sharing, learning, holding and trading, the next day the entire market is up 300-500%. Then it keeps on growing.

Chainlink (LINKUSDT) is up more than 160% since its 7-April 2025 low. There is room for plenty of additional growth.

We will look at this pair again soon with 2025 all-time high projections. Make sure to follow to receive a notification when the post goes live.

Namaste.

LINK: The Sleeping Giant About to Wake Up...Hello Traders 🐺

In this idea I want to talk about LINK price targets, because I really believe that in the next 3 months we’re going to see a massive pump in the Altcoin section — and Chainlink will be one of those coins that surprises a lot of people. Let’s talk about it 👇

As you can see on the chart, LINK has formed a gigantic Triangle pattern over the years, and right now the price is sitting around the triangle resistance line. In my opinion, there’s a high chance to finally break above it — especially because ETH is currently pushing against its ATH around $4,900. If ETH manages to break above, the top 20 altcoins will most likely follow ETH as a leading indicator for the whole altcoin section.

🔑 Price Targets:

Using the Fibonacci trend-based tool (which works perfectly for triangle breakouts, especially on the log chart), we can clearly spot the most important levels for LINK.

First target: The current ATH around $53 → potential first take-profit zone.

But in my opinion, it’s too early to fully exit here. A much better target is around the 0.786 Fib level, where I would personally consider closing around 75% of my long positions, moving stop-loss to the ATH ($53), and letting the rest ride for even higher targets.

And as always, my friends, remember our golden rule:

🐺 Discipline is rarely enjoyable, but almost always profitable. 🐺

🐺 KIU_COIN 🐺

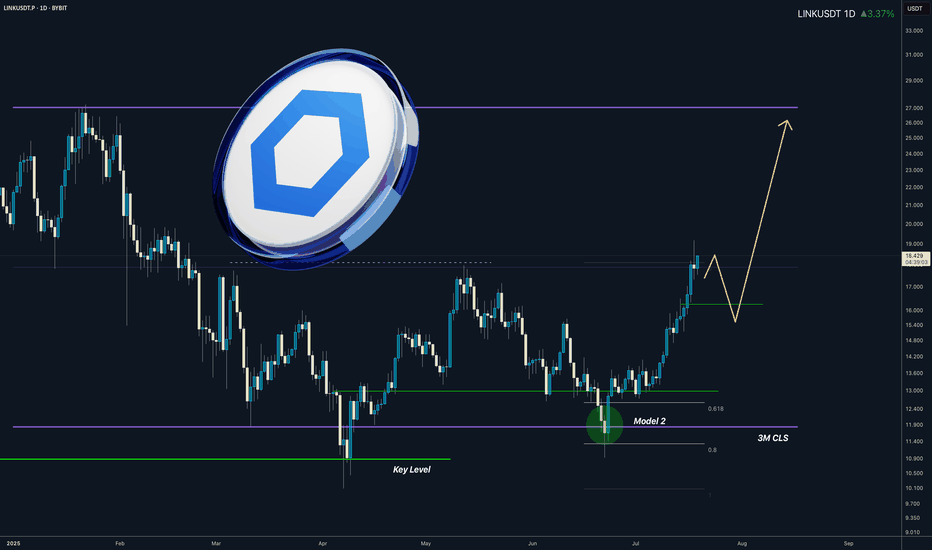

LINK I 3M CLS I Model 2 In the Motion I Target Full CLS rangeYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Comment any Coin I ll give you my quick view

ATH coming for LINK?!LINK has been in existence since the 2017 cycle and is also part of the OG cryptos. I expect to see a new ATH as LINK rises in dominance especially during the 'utility' alt coin run with stable coins and oracles being a key narrative for Chainlink.

LINK.D is currently at c. 0.45% of the total crypto market. I expect this to surge to 1.5-2% of the crypto market when LINK is to top out in its cycle. Moonshots would be anything above 2%.

Key Targets for Take Profits:

1. $67-80

2. $110-128

3. $195-210 (Moonshot)

Is LINK Heading for a New ATH?⚡️ It’s been about a month since I said you don’t want to miss LINK. Many didn’t believe it, I suppose. And now LINK is being recognized by the White House as a key project. Surprising, isn’t it?

This is one of those projects where you don’t even need to look at the chart — it’s simply technologically essential for the crypto ecosystem, on the same level as Ethereum.

But let’s still look at LINK from a technical perspective — does it have room to grow further?

➡️ First: LINK is one of the very few tokens currently sitting at its local peak, while even ETH is still in correction.

➡️ Second: it’s also one of the only tokens where we see harmony in buying volume. Buyer interest is rising together with price, which signals the market considers LINK undervalued at current levels.

➡️ Third: there’s a clear inflow of fresh liquidity, and it’s actually increasing — while liquidity is flowing out of most of the rest of the crypto market.

➡️ And importantly — with this move LINK has now closed one of the upper gaps. That means the road higher won’t be as smooth. Right now, it’s already testing resistance at $25.95 and approaching its 5-year descending resistance line.

📌 Conclusion:

If LINK manages to hold above this level, we could very well see a run to a new ATH — and possibly beyond.

However, more and more gaps are forming below, and the overall market is weakening, which is definitely something to be cautious about.

LINK 1D – Pullback Toward Demand Zone in UptrendLINK has pulled back from descending resistance after an aggressive rally, with price now approaching the $19–$20 demand zone that aligns with ascending trendline support. A bounce here could set up another attempt at the $24–$25 descending resistance, where a breakout would open targets toward $28+. Failure to hold the demand zone risks a deeper retracement toward the $16–$17 area. Stoch RSI remains elevated but is beginning to roll over, signaling that momentum could cool before the next leg.

LINK Retest in Play — Watching Fib SupportsLINK recently broke above a key resistance level, which has now turned into support. The price is currently retesting this zone, and a reversal to the upside may follow from here.

If the price dips further, additional support lies at the 0.618 and 0.5 Fibonacci retracement levels, where another potential reversal could occur. Let’s watch how price action develops around these levels.

LINK/USDT 20% CONFIRM MOVEBullish bias is strong: All major indicators (RSI, MACD, MAs) are aligned, pointing to continued upward movement.

Watch key zones: Holding above $24.7 would support further upside, while a drop to $19–$20 might offer a better entry point.

Realistic target range: $26–$28 in the short term; sustained momentum could open a path toward $30+

LINK IS ALREADY TESTING MAJOR FIB LEVEL WATCH OUT FOR RETEST ANND BUY WITH POTENTIAL TARGET of 31$ PREVIOUS HIGH. COULD MOVE UPTO $45+

Chainlink Holding Strong Support, Targeting 20% Rally to $26Hello✌️

Let’s analyze Chainlink’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Chainlink’s onchain reserve uses smart contracts to turn half of its fees and revenue into LINK buys. Since July 2025, over $1M in LINK has been saved, with no plans to sell soon.

This steady buying creates strong demand, like earning about 4.32% yearly staking rewards, which lowers available LINK. In the past, similar actions (like stock buybacks) have helped prices go up when usage grows.

📊Technical analysis:

BINANCE:LINKUSDT is holding key Fibonacci levels near strong daily support and a solid trendline. If it holds, a 20% rally toward $26 is likely 📈🔒

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

Check if it finds support around 23.98-25.17 and rises

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

Chainlink is one of the coins connected to many ecosystems.

Therefore, I believe it's worth holding for the medium to long term.

(LINKUSDT 1M chart)

The key is whether the price can find support around 23.98-25.17 and rise along the uptrend line.

If not, caution is advised as it may touch the lower uptrend line.

-

(1W chart)

If the price finds support around 23.98-25.17 and rises,

1st: 35.28-40.67

2nd: Fibonacci ratio 1.618 (49.01)

It is expected to rise to the 1st and 2nd levels above.

After that, a bearish turn appears likely.

Based on the current price, if it falls below the 19.52-20.51 range, it is recommended to stop trading and wait and see how the situation develops.

-

(1D chart)

Ultimately, the key is whether the price can break above the uptrend line (1).

If not, you should check for support within the circled area marked on the chart.

However, if the price falls below the M-Signal indicator on the 1M chart, you should stop trading and wait and see how things turn out.

-

Thank you for reading.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain in more detail when the bear market begins.

------------------------------------------------------

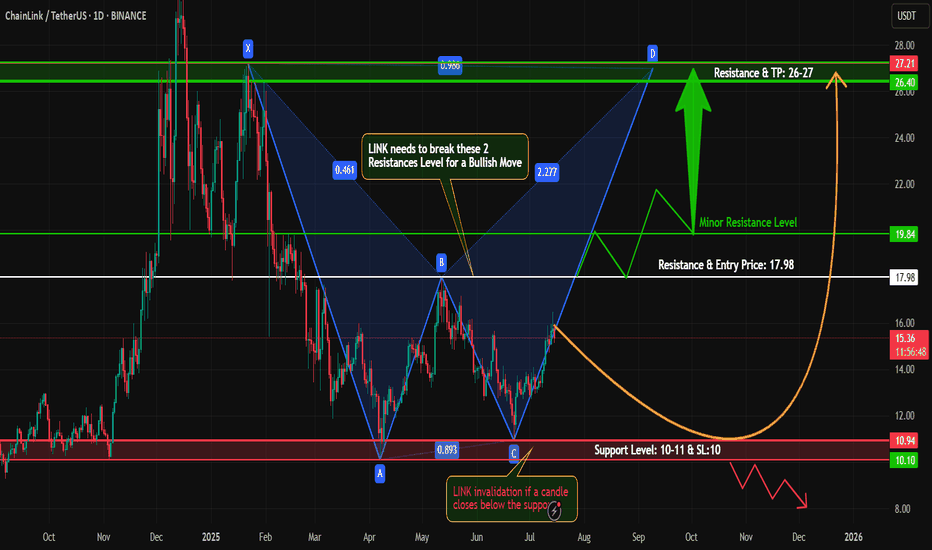

#LINKUSDT – Bullish Harmonic Pattern in Play!Hey Traders!

#LINK is currently trading near the bottom and forming a potential harmonic pattern, suggesting a possible move towards the D-point completion.

Technical Outlook:

Price action is respecting the harmonic structure.

We're watching closely for a break above key minor and major resistance levels.

A successful breakout and retest could confirm a bullish reversal.

Entry on retest with tight risk management and SL as marked on the chart.

Caution: Stay alert for fake breakouts, bearish divergence, or any signs of rejection near resistance. Patience is key — wait for confirmation!

What are your thoughts on #LINK? Are you bullish or bearish? Drop your analysis below!

If you found this setup helpful, like, comment, and follow for more high-probability trading setups every week!

#Crypto #LINK #HarmonicPattern #Altcoins #ChartAnalysis #CryptoTrading #TradingView #BullishSetup #BreakoutTrade #RiskManagement

LINK LONG set upLINK has pulled back into a key demand zone (24.1–24.5) which also aligns with the ascending trendline support from mid-August. This confluence provides a strong technical base for a potential bounce.

Setup details:

✅ Entry: Demand zone retest + trendline support

✅ Stop-loss: Just below demand (~24.0)

✅ Target: Previous resistance zone around 26

✅ R:R: 1:1.5

Reasoning:

Structure is still bullish with higher lows intact.

Price consolidating at demand, looking for signs of strength.

Risk is defined — invalidation below demand zone.

⚠️ If demand breaks with volume, setup becomes invalid. Otherwise, looking for a clean move back toward 26.3 resistance.

Link shows clear bearish divergenceIf we look closely at LINK/USDT right now, the charts are flashing a clear bearish divergence. This setup usually acts as a warning sign, and the price action is already hinting at a potential correction. The first important zone to watch is around 19.5 – it lines up with the golden pocket as well as a previous resistance that can now flip into support.

But if Bitcoin dominance continues climbing, there’s a risk of LINK moving deeper into correction territory. In that case, the 17.5 zone becomes a realistic target, and a move into that range would confirm a stronger bearish dump.

So the play here is simple: keep an eye on 19.5 as the first defense zone. If it holds, bulls might get some relief. If it breaks, prepare for the possibility of LINK sliding down toward 17.5.