Intel The Next Nvidia? Intel, once synonymous with cutting-edge computing power, has long been recognized for its innovation in processor technology. In the early 2000s and 2010s, the release of Intel’s i5 and i7 chips marked significant milestones in consumer and enterprise computing. These products were benchmarks of performance and efficiency, and for many—including myself—each release felt like a leap forward in personal computing.

However, over the past decade, Intel has lost significant ground to its primary competitors, notably AMD and Nvidia. AMD has emerged as a strong contender in both consumer and enterprise CPU markets with its Ryzen and EPYC series, while Nvidia has dominated the GPU space and positioned itself at the forefront of AI and machine learning applications. Intel, by contrast, has struggled with delays in adopting smaller nanometer process nodes and lost market share across multiple segments. To some, this decline signals the slow erosion of a once-great technology company.

Yet, despite its setbacks, it would be premature to dismiss Intel as a fading relic. In fact, recent developments suggest the company may be in the early stages of a significant turnaround.

Strategically, Intel remains a critical player in the global semiconductor supply chain. Unlike many of its competitors, Intel both designs and manufactures its own chips—a capability that gives it a unique position, especially in the context of increasing geopolitical tensions and growing concerns about dependence on overseas manufacturing, particularly in East Asia. In response, the U.S. government has demonstrated a growing interest in reviving domestic chip production. Rumoured reports suggest a potential 10% stake in Intel may be under consideration as part of a broader initiative to boost American-made semiconductors through subsidies, public-private partnerships, and national security-driven policy.

This kind of institutional backing—both from private capital and potentially the federal government—could provide Intel with the financial and political support necessary to accelerate its turnaround. CEO Pat Gelsinger’s renewed vision includes aggressive investments in leading-edge foundry services (Intel Foundry Services), AI, and advanced packaging technologies. If successful, these efforts could not only stabilize Intel's position but also allow it to reemerge as a technological leader.

From an investor’s perspective, Intel’s current valuation—trading close to book value—offers a compelling risk-reward ratio. While the company faces clear challenges, its intrinsic value, legacy infrastructure, and strategic importance create a margin of safety. If Intel is able to regain technological momentum and secure meaningful market share in AI or foundry services, the upside could be substantial.

In summary, while Intel is no longer the market darling it once was, its story is far from over. With strong institutional interest, potential government involvement, and a bold transformation plan underway, Intel represents an attractive long-term investment. At today’s prices, the risk appears asymmetric—with significant potential for recovery and growth. I am confident in taking this position and believe patient investors may be rewarded in the years to come.

0R24 trade ideas

Intel's Breakout Potential: Price Action Signals Upside

Current Price: $24.56

Direction: LONG

Targets:

- T1 = $26.00

- T2 = $28.50

Stop Levels:

- S1 = $23.50

- S2 = $22.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, using collective intelligence to uncover promising trade setups for Intel Corporation (INTC). The wisdom of crowds principle highlights how aggregated perspectives often outperform individual forecasts, minimizing biases and providing a consensus outlook critical in volatile market environments.

**Key Insights:**

INTC’s recent strategic direction and focus on semiconductor production signals potential tailwinds in the broader tech sector. Intel has ramped up efforts to increase manufacturing capacity in advanced nodes, aiming to rival competitors like TSMC and Samsung. Strengthening its position in the AI and data center markets has been a focal point. Additionally, the CHIPS Act funding allocations are starting to show tangible benefits, fostering optimism for long-term growth in domestic semiconductor development. From a technical perspective, Intel appears to be forming a higher-low setup in the daily chart, a bullish indicator often associated with upward momentum.

The stock is currently trading near oversold levels on the Relative Strength Index (RSI), suggesting substantial recovery potential as demand for value-oriented tech plays increases. Analysts are also noting improved financial guidance from Intel, with projected margin expansion as demand rebounds in key segments such as PCs and server processors.

**Recent Performance:**

The stock has experienced moderate volatility over the past month, hovering in the $23-$25 range. While Intel struggled in recent quarters due to declining PC shipments and competitive pressures, investor sentiment has improved amid new product roadmap updates and strategic partnership announcements. Year-to-date, INTC remains down, but the recent consolidation suggests buyers are stepping in at current levels, reducing downside risk.

**Expert Analysis:**

Across the board, professional analysts see Intel as a value-oriented recovery story. The recent improvements in gross margins and cost-cutting measures have garnered positive sentiment, given Intel’s transitional phase toward long-term profitability. Technical experts cite INTC’s successful defense of the $23 support level as crucial, providing a robust base for a potential breakout toward $26 and beyond. Furthermore, its price-to-earnings (P/E) ratio remains attractive compared to peers, particularly in the context of its innovation pipeline in high-performance computing.

**News Impact:**

Recent headlines have been supportive of Intel’s recovery narrative, including progress in its foundry services business and key launches in AI accelerator chips. Additionally, Intel has been in discussions regarding significant supply chain partnerships, bolstering confidence in its ability to stabilize revenue. The CHIPS Act funding and geopolitical emphasis on domestic semiconductor production help mitigate macro risks associated with excess reliance on international markets.

**Trading Recommendation:**

Intel appears poised for a bullish breakout as its strategic initiatives gain traction and technical indicators show signs of recovery. A long position is recommended, with an initial target at $26.00 and a secondary target at $28.50. Stops are prudently placed at $23.50 and $22.50 to mitigate potential risks. Positive news surrounding semiconductor manufacturing and easing macro concerns add justification for entry at current levels.

Do you want to save hours every week?

Intel - The bottom is in!🔮Intel ( NASDAQ:INTC ) forms a clear bottom:

🔎Analysis summary:

After a consolidation of about three decades, Intel is now creating a strong bottom formation. With the retest of a major horizontal support area, Intel is respecting clear market structure. Quite likely therefore that Intel will soon start its next major higher timeframe bullrun.

📝Levels to watch:

$25

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

INTC $26C Swing Play—Don’t Miss Out🔥🚀 **INTC Swing Options Play — Moderate Bullish Setup!** 🚀🔥

📊 **Swing Trade Breakdown (2025-08-22)**

* 🎯 **Ticker**: \ NASDAQ:INTC

* 🔀 **Direction**: CALL (LONG)

* 🎯 **Strike**: \$26.00

* 💵 **Entry Price**: \$0.80

* 🛑 **Stop Loss**: \$0.55 (-35%)

* 🎯 **Profit Target**: \$1.60 – \$2.00 (+100% to +150%)

* 📅 **Expiry**: 2025-09-05 (14DTE)

* 📈 **Confidence**: 70%

* ⏰ **Entry Timing**: Market Open

💡 **Why this trade?**

✅ **Momentum Rising**: Daily RSI at 65.0, 10D gain of +25.46% 📈

✅ **Low VIX (14.4)** = Safer holding, less decay risk ⚡

✅ **Bullish Bias Confirmed** across timeframes

⚠️ **Risks**: Weak volume (1.0x avg) & neutral options flow → breakout confirmation needed!

\#INTC #OptionsTrading #SwingTrade #CallOptions #StockMarket #MomentumTrading #BullishSetup #TradingStrategy #DayTrading

Intel in 2025: The Pre-Boom Echo of Early Nvidia?In 2018, Nvidia (NVDA) was trading at a fraction of its current valuation, largely overlooked despite its cutting-edge GPU tech and early AI involvement. Fast forward to 2023–2024, it became the poster child of the AI revolution, with exponential growth driven by massive demand for AI infrastructure. Intel (INTC) today mirrors that earlier phase: undervalued, undergoing strategic shifts (Gaudi AI chips, foundry expansion, AI PCs), and investing heavily in AI and semiconductor independence in the West. While NVDA had clear early tech leadership, Intel is positioning itself as the alternative > a comeback story with geopolitical tailwinds, untapped AI potential, and a lower price entry. If history rhymes, Intel might be where NVDA was , not in dominance, but in opportunity.

Easy words, BUY SOME AND HOLD!!!

Intel: From Rock Bottom to a Surprising Comeback?Intel looked like it had hit rock bottom just two weeks ago. For years the company was led by CEOs who made big mistakes. They were late to mobile, late to cloud, and most recently late to the AI boom. On top of that, Intel announced layoffs of around 20,000 workers, and then came a political storm: Trump said the CEO was in a serious conflict of interest and should resign immediately. It felt like the company was falling apart.

But then something unexpected happened. In the past two weeks the story completely flipped. The US government is considering buying about 10% of Intel’s stock. At the same time, SoftBank is in talks to invest around 2 billion dollars in the company. That kind of money and backing is not something you see every day.

From a market perspective, Intel’s stock is sitting near the bottom. For investors, this is often the point where the biggest opportunities show up. Some believe the stock could climb hundreds of percent if the turnaround succeeds.

Why does all this matter? Because Intel isn’t just another tech company. For the US government, it’s a matter of national security and keeping chip production inside America. For investors, it’s a chance to bet on a fallen giant that still has the talent, factories, and brand to rise again.

Two weeks ago, no one wanted to touch Intel. Today, there’s fresh hope and serious money on the table.

INTC on Fire! Swing Traders, Don’t Miss This Call!

🚀 **INTC SWING TRADE ALERT – 2025-08-15** 🚀

**Moderate Bullish Momentum – Calls in Play!** 📈

**🔍 Market Context:**

* **Daily RSI:** 72.2 (strong overbought thrust)

* **5-Day Gain:** +24.79% 💥

* **Volatility:** Low VIX – great for swing setups

* **Volume:** Weak (⚠️ watch for fakeouts)

* **Options Flow:** Neutral – institutions not leaning heavily yet

**📊 Consensus from 5 Models:**

✅ Bullish momentum across all timeframes

⚠️ Caution on weak volume & neutral sentiment

🏹 Perfect short-term swing environment if monitored closely

---

**💡 Trade Plan:**

* **Instrument:** INTC Aug 29 ’25 26C

* **Entry:** \$0.78 (at open)

* **Stop Loss:** \$0.55 (-30%)

* **Profit Target 1:** \$1.17 (+50%)

* **Profit Target 2:** \$1.56 (+100%) – let runners ride!

* **Confidence:** 75%

---

**⚠️ Risk Notes:**

* RSI > 72 = possible pullback

* Volume weakness could kill breakout

* Options sentiment neutral – watch for big money moves

📆 **Signal Time:** 2025-08-15 11:02 EDT

💎 **Execution:** Buy single-leg naked calls at open

---

💬 If you trade this, keep stops tight & scale out at targets. Momentum is hot, but the tape needs confirming volume.

\#INTC #SwingTrading #OptionsAlert #StockMarket #CallOptions #TradingSignals #NASDAQ #BullishMomentum

Intel Corp. $INTC ~ Bulls in Charge...Intel Corp. engages in the design, manufacture, and sale of computer products and technologies. It delivers computer, networking, data storage, and communications platforms. The firm operates through the following segments: Client Computing Group (CCG), Data Center and AI (DCAI), Network and Edge (NEX), Mobileye, Accelerated Computing Systems and Graphics (AXG), Intel Foundry Services (IFS), and All Other. The CCG segment consists of platforms designed for notebooks, 2-in-1 systems, desktops, tablets, phones, wireless and wired connectivity products, and mobile communication components. The DCAI segment delivers solutions to cloud service providers and enterprise customers, along with silicon devices for communications service providers and high-performance computing customers. The NEX segment offers computing system solutions from inflexible fixed-function hardware to general-purpose compute, acceleration, and networking devices running cloud native software on programmable hardware. The Mobileye segment develops driving assistance and self-driving solutions. The AXG segment provides products and technologies designed to help customers solve the toughest computational problems. Its products include CPUs for high-performance computing and GPUs targeted for a range of workloads and platforms, from gaming and content creation on client devices to delivering media and gaming in the cloud, and the most demanding high-performance computing and AI workloads on supercomputers. The IFS segment refers to full stack solutions created from the foundry industry ecosystem. The All Other segment represents results from other non-reportable segments and corporate-related charges. The company was founded by Robert Norton Noyce and Gordon Earle Moore on July 18, 1968 and is headquartered in Santa Clara, CA.

slow downtrend possible , but we theorize uptrend has power=BUY1. buyers push up to 2

2. sellers enter with good conviction ,

they push price down, and in fact push it BELOW

#1 buyers, defeating the genesis of the #1 buyers

3. interestingly, there is a lack of structure, due to

HIGH conviction and now we defeat the sellers from 2

what do I think will happen ?

* the break below #1 was not enough for me to say this

is an expanding formation and we will see HH and LL's

* for me the extreme and one sided move from 3-4 points

to liquidity being grabbed

* therefore, will we pullback or go higher ?

* I think we will spike the zone below briefly then go up

* or close in that zone and complete it and then go up

* it really depends on price action, we have to remember

high volitility moves are often followed by measured and

slow chart movements, the question is, is the high volitility

move over yet, due to the suspect liquidity grab, I think the

answer is no. a stop order above 4 is appropriate and logical

* over the pas 2500 bars we have had a 69% success rate in price following

through to the end for bullish moves, using chaos theory trading zones, if price closes in that zone, and it did here, so we have then 69% follow through success even without the logic of this trade, making it very good in my opinion. Plus we get to stop enter and avoid any

potential wick out stops.

Intel Set to Thrive Amid National Security Focus, Geop. shiftRecent meetings between Donald Trump and leaders in the semiconductor and defense sectors signal a renewed focus on national security as a key pillar of U.S. industrial policy and Intel ( NASDAQ:INTC ) is well-positioned to benefit.

Just as companies like Lockheed Martin ( NYSE:LMT ) and Northrop Grumman ( NYSE:NOC ) thrive in times of geopolitical tension, Intel is emerging as a strategic asset in the race for technological sovereignty. With tensions in the Taiwan Strait remaining high, the U.S. cannot afford to rely solely on overseas chip production especially from Taiwan’s TSMC.

If Taiwan were to move all its chip production to the U.S., it would lose a major piece of leverage in deterring Chinese aggression. The current dependency on Taiwan for high-end semiconductors is, paradoxically, part of what keeps the U.S. actively invested in Taiwan's security. If that dependency disappears, so might the urgency of a military defense. Taiwan knows this and so do American policymakers.

That’s where Intel comes in.

Unlike TSMC, Intel is American-owned, American-operated, and expanding its U.S. manufacturing footprint through CHIPS Act incentives. The company is central to creating a secure domestic chip supply chain — not just for consumer electronics, but for defense systems, AI infrastructure, and future-critical technologies.

As national security and economic policy continue to align, Intel is likely to receive more political backing, more investment, and more long-term contracts just like the big defense contractors.

On the weekly chart, NASDAQ:INTC has recently printed a lower low in price, but with a higher low on the RSI a classic bullish divergence on a high timeframe. The stock broke below its previous weekly low but quickly bounced, showing signs of demand at lower levels. The weekly RSI is climbing while price made a new low indicating weakening bearish momentum and potential for a trend reversal. First resistance lies at $38 (orange line), followed by a breakout level around $44. A weekly close above $44 could open up a move toward $50+.

The technical setup supports the bullish macro thesis. With a bullish divergence forming on the weekly timeframe, Intel may be setting up for a longer-term trend reversal. Combine this with its growing strategic importance to U.S. national security, and this could be a solid mid-to-long-term play.

Intel (INTC) Stock Price Rises 7% Amid White House RumoursIntel (INTC) Stock Price Rises 7% Amid White House Rumours

Intel (INTC) stock price surged more than 7% yesterday, making it the top performer in the S&P 500 index. The rally came on the back of a report in Barron’s stating that the US government is in talks to acquire a stake in Intel:

→ Intel declined to comment on Barron's report.

→ White House spokesperson Kush Desai stated: “Discussion about hypothetical deals should be regarded as speculation unless officially announced by the Administration.”

Meanwhile, Bloomberg reported that the Trump administration is negotiating with Intel over a potential US government stake in the company – a move aimed at boosting domestic manufacturing and supporting Intel’s plans to build a new facility in Ohio.

The prospect of state backing for the American chipmaker triggered a sharp bullish impulse yesterday, which could extend into today. In pre-market trading, INTC shares are hovering around $25 – their highest level since March.

Technical Analysis of INTC Shares

Previously, when analysing the INTC chart, we highlighted the significance of the $20 level, which appeared to act as strong support from major market participants. This may have reflected expectations that the government would not abandon a strategically important US company during challenging times – particularly in the context of technological rivalry with China.

For months, INTC shares had been in a downtrend (as shown by the 100- and 200-period moving averages). However, yesterday’s sharp rally now appears capable of reversing that trend:

→ Lower highs and lows at points A, B, and C had suggested a lower low at point D. Indeed, the price came close to setting it after a disappointing quarterly earnings report on 24 July, which led to a large bearish gap at the market open on 25 July.

→ Today, we may see the price break above point C’s high, signalling a potential end to the bearish market structure.

Candlestick analysis this week highlights strong bullish momentum:

→ On Monday (indicated by an upward arrow), trading opened with a bullish gap. However, sellers became active near the upper boundary of the aforementioned bearish gap (marked with a rightward arrow), causing the candle to close with a long upper wick – a sign of weakness.

→ The next two sessions demonstrated that buying pressure persisted – on Tuesday, the stock opened with a bullish gap and rose steadily throughout the day, with Wednesday’s strong candle further confirming buyer activity.

→ Yesterday, the price confidently broke through resistance at $22.25, moving towards the $23.75 level, which could be breached today.

→ The RSI indicator is now at its highest level since February.

The INTC share chart may be signalling that the prolonged bearish market, which began in 2021, is undergoing a significant shift in sentiment. This could mark the early stages of a rally – one that would be fundamentally justified if Intel does indeed secure government backing.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Intel poised for a breakoutIntel NASDAQ:INTC is quite possibly poised for a breakout, as we look at a triangle formation here on the 3W chart, roughly ten months in the making, beside consolidating momentum. Longer term timeframes are good for determining the main trend in a stock's price.

On the short term 4H timeframe, better suited for trade entry and exit signals, an inverted head & shoulders pattern has formed both in price and momentum.

Fundamentally, Intel shares are arguably cheap, with a discount to Net Asset Value that began in 3Q 2024. A stock trading at a discount to net asset value is selling for less than the per‐share value of its assets minus liabilities.

$INTC looks good for at trade to the upside? Targeting $34+?If we look at the chart, we can see INTC failed the breakdown of an H&S, retested the trendline breakout and seems to be heading higher.

Failed breakdowns are usually the most bullish patterns.

I could see the possibility of a large move here to go back and retest the $34 region, or potentially even go higher ($40+) if we can surpass that resistance.

Being price fell so quickly from March until now, I can see a sharp move higher (maybe on some news?).

Let's see what happens over the coming weeks.

Intel in Trouble or Ready for Redemption?There is growing potential for QUALCOMM Incorporated to acquire Intel.

I now believe that this development has advanced enough to warrant a fresh look at the stock

Qualcomm recently approached Intel about a takeover. According to WSJ , Qualcomm has expressed interest in acquiring Intel, which, if realized, would mark one of the most significant deals in recent history

Initially, this seemed like a long shot, with limited details emerging from the report. However, QCOM has continued to pursue the idea. Also QCOM has been in contact with Chinese antitrust regulators over the past month about this potential deal and is waiting until after the US presidential election to decide on making a formal offer. Since the election is just less than a month away, I believe this acquisition is becoming more of a possibility that investors should factor into their assessment of INTC. If a deal goes through, it’s likely that the acquisition will come at a premium to the current stock price, creating an opportunity for significant short term gains for investors

There is always a chance that no deal will occur. In that case, potential investors should evaluate whether the stock is worth holding as a long-term investment. My outlook here is not optimistic, and I’ll delve into INTC's competitive position, as indicated by its latest inventory data, in the next section

Given these two potential scenarios, I am upgrading my rating from "Sell" to "Hold." In summary, the possibility of QCOM acquiring INTC introduces a major upside catalyst that I hadn’t accounted for in my previous analysis. This potential acquisition helps offset some of the concerns about INTC as a standalone company.

Unlike many financial metrics that can be interpreted in different ways, inventory levels are more straightforward. He also explained that inventory trends can provide early indicators of business cycles. For cyclical industries, rising inventories can signal overproduction as demand wanes, while shrinking inventories can indicate strong demand

As shown in INTC’s most recent balance sheet, its inventory levels have generally been on the rise. For instance, in December 2014, inventory was valued at $ 4.273 billion, while the most recent figures show an increase to $ 11.244 billion. In some cases, rising inventory can signal business growth with increasing demand and production capacity, which was true for Intel in the early part of the last decade.

When inventory growth exceeds the pace of business growth, it becomes a red flag. In this scenario, rising inventory suggests weakened competitiveness and declining market position—an issue that Intel currently faces, in my opinion. The following chart helps illustrate this point, showing a comparison of days of inventory outstanding (DIO) for Intel and NVIDIA over the last five years, from 2020 to 2024. DIO is a measure of how many days it takes a company to sell its inventory

Given Intel's inventory buildup and declining competitive edge, I find its current valuation multiples hard to justify. Specifically, the chart highlights a comparison of price-to-earnings (P/E) ratios between Intel, NVIDIA, and AMD. Focusing on non-GAAP earnings estimates for fiscal years FY1 through FY3, Intel is currently trading with the highest P/E ratio for FY1 at 87.7 almost twice the multiple of NVIDIA and AMD, which are at 46.29 and 46.25, respectively

That said, the outlook changes somewhat when considering the years further ahead. For instance, in FY2, NVIDIA’s expected P/E ratio rises to the highest at 32.77, compared to Intel's 20.02 and AMD's 29.02. However, I want to emphasize the substantial uncertainty in Intel's earnings forecasts. As shown in the next chart, the consensus estimates for Intel's earnings per share (EPS) in FY 2024 range from a low of $0.15 to a high of $0.31 (a more than twofold variation) and from a low of $0.65 to a high of $2.1 (an almost fourfold variation). Given such uncertainty, I believe investors should be cautious about relying too heavily on forward P/E ratios too far into the future.

Both Intel and NVIDIA have experienced significant fluctuations in DIO over the years. Notably, both companies saw a spike in 2023 due to the COVID pandemic, which disrupted global supply chains. As the disruption faded, both firms saw a recovery (ie, a reduction in DIO). the difference in recovery is striking. Intel's DIO peaked at over 150 days in 2023 and has since decreased to 125 days a modest reduction but still above its historical average of 114 days. In contrast, NVIDIA's DIO surged to over 200 days but has rapidly dropped to 76 days, which is not only below its four-year average of 97.9 days but also near its lowest level in four years.

I expect Intel to face increasing competitive pressure as rivals like NVIDIA and AMD roll out their next-generation chips, particularly NVIDIA’s Blackwell chips. I recommend potential investors keep a close eye on inventory data, as it can signal changes in competitive dynamics for the reasons discussed here.

In addition to inventory issues and valuation risks, Intel faces a few other specific challenges. A significant portion of Intel’s current product lineup is concentrated in certain segments, such as PCs, which I believe are nearing market saturation plus a large share of Intel’s revenue comes from China. Given the ongoing trade tensions between the US and China, this heavy reliance on China poses a considerable geopolitical risk. These factors may limit Intel’s ability to adapt to technological advancements and shifting geopolitical conditions

The potential for a QUALCOMM acquisition has emerged as a new major upside catalyst. While my outlook on Intel’s business remains pessimistic based on the latest inventory data, the acquisition possibility partially offsets these negatives, leading me to upgrade my rating from Sell to Hold or if you are risk taker like Me, load the dip

Intel's $24.8 Stock Price Rebound: Strong Moves Ahead?

Current Price: $24.8

Direction: LONG

Targets:

- T1 = $26.5

- T2 = $28.0

Stop Levels:

- S1 = $23.5

- S2 = $22.0

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Intel.

**Key Insights:**

Intel has recently shown signs of stabilizing after experiencing a prolonged period of underperformance. Valuation levels are appealing as Intel trades near its 5-year lows on a forward P/E basis, making it an attractive option for long-term value investors. While there are concerns regarding competitive pressures from AMD and Nvidia, Intel's aggressive push toward re-establishing dominance in both server processors and AI-related chips has caught the attention of professional trading circles.

Another key driver is Intel’s capital expenditure slowdown, indicating better operational cash flows ahead. Investor focus has shifted toward the long-term growth engines, particularly Intel’s capacity expansion in pivotal segments such as foundry services and its evolving AI chip strategy. Traders see these structural shifts as reasons to take a bullish position, leveraging the company's ability to pivot and innovate amid industry headwinds.

**Recent Performance:**

Intel’s share price has consolidated near $24.8 after declining sharply in the past months. Volume analysis suggests steady accumulation from institutional investors, which aligns with a reversal scenario. Over the past week, the stock moved into a narrow trading range, highlighting resistance at $25.2 while maintaining strong support around $24—a range that professionals indicate could break upward soon. Intel’s year-to-date performance reflects a marginal recovery from its 2022 lows but remains weaker than broader semiconductor peers.

**Expert Analysis:**

Technically, Intel’s current price action demonstrates a developing bullish trend. RSI levels remain neutral, positioned at approximately 52, which suggests room for upward movement without overbought conditions. Additionally, MACD shows signs of divergence, hinting at potential momentum strength favoring long setups.

Fundamentally, analysts applaud Intel’s gradual recovery from its post-pandemic supply chain challenges and market share erosion. The management’s strategic pivot toward advanced manufacturing processes and competitive R&D investments may provide a compelling growth narrative. However, traders highlight the importance of monitoring quarterly earnings as a primary risk factor due to Intel’s thin margins.

**News Impact:**

Intel’s latest competitive move to release its next-generation AI chip products has garnered media attention. The commitment to enhancing its foundry business with new partnerships has improved sentiment across trading desks. Moreover, the U.S. government’s infrastructure and chip subsidies create an environment conducive to Intel’s long-term growth. While short-term news cycles around weakening PC sales remain a concern, traders see Intel's advancements in its high-margin segments as a buffer against macroeconomic uncertainties.

**Trading Recommendation:**

Intel’s current price of $24.8 presents a buying opportunity given its improving fundamentals and technical setups. The strategy is to go LONG, targeting $26.5 (T1) and $28.0 (T2) with stop-loss protection at $23.5 (S1) and $22.0 (S2). Traders should monitor momentum indicators closely, as any break above $25.2 resistance could trigger a quicker move toward higher levels. This trade setup leverages Intel’s ability to capitalize on structural changes in chip demand and its recent operational refinements.

Do you want to save hours every week? Register for the free weekly update in your language!

CryptoWolfy - Why you should all buy $Intel right now🔍 Why Intel Is a Good Buy Right Now

1. Strategic Leadership & Restructuring

Intel’s new CEO, Lip-Bu Tan, has initiated a bold turnaround strategy focused on financial discipline and operational efficiency 1.

The company is cutting unnecessary capital expenditures and streamlining its foundry operations, aiming to become a more agile and focused organization 2.

2. AI & Chip Innovation

Intel is investing heavily in AI accelerators and energy-efficient chips, positioning itself to compete with NVIDIA and AMD in emerging AI workloads 3.

Its Xeon 6 CPUs are already being used in NVIDIA’s DGX B300 systems, showing early traction in high-performance computing 2.

3. Domestic Manufacturing Advantage

With most of its chip-making facilities in the United States, Intel is better positioned to weather geopolitical tensions compared to competitors like TSMC and Samsung, which have exposure to China 3.

4. Financial Discipline & Cost Optimization

Intel is targeting $17 billion in non-GAAP operating expenses for 2025 and has already reduced its workforce by 15% 2.

It’s consolidating operations and slowing construction in less strategic areas to align spending with demand.

📈 Why Intel Could Rebound to $50–$60

1. Historical Valuation & Recovery Potential

Intel traded at $60 just a few years ago. A return to that level would require a combination of revenue growth, margin recovery, and improved investor sentiment 4.

2. Revenue Growth Scenario

If Intel can grow revenues by 12% annually, it could reach $65 billion by 2026, up from $52 billion in 2024 4.

This growth would be driven by new chip launches like Lunar Lake and Arrow Lake, which use advanced 3nm processes from TSMC.

3. Margin Expansion & P/E Multiple

Improving margins and a return to profitability could justify a higher price-to-earnings (P/E) multiple, potentially pushing the stock toward the $50–$60 range 4.

4. Analyst Optimism

Some analysts have set price targets as high as $62, reflecting a potential 200%+ upside from current levels 3.

$INTC - Best in the sector against Trump tariffsIntel is a semiconductor technology giant, renowned for its x86 processors that dominate the CPU segment, top revenue in Q2 2025 came from PC chips (Client Computing Group, ~$7.9B) and server/AI chips (Data Center & AI, ~$3.9B) . Other revenue includes foundry services ($4.4B) and legacy businesses ($1.1B).

But, for the last 4 years the company has experienced one disaster after another:

- Loss of Market Share & Intensified Competition vs AMDs Ryzen and NVIDIA AI GPUs has been major drivers for last 4 years of decline.

- Gross margin dropped to around 38–39% in 2024—a steep fall from pre‑pandemic levels above 60%, while NVIDIA maintained margins above 75%.

- Intel perpetually lagged in transitioning to advanced nodes (7 nm, 5 nm), resulting in costly delays and reduced competitiveness .

- Credit rating downgrade: In August 2025, Fitch downgraded Intel’s credit rating from BBB+ to BBB (negative outlook) due to weak demand and deteriorating profitability . S&P had already downgraded Intel to BB+, and Moody's also cut its rating in 2024 .

Recent events and price action show its time for a buy at these prices.

- Spin-off of Network & Edge (NEX) group: Intel announced the spin-off of its Network and Edge Group (NEX) into an independent entity focused on critical communications and networks, seeking external investors while retaining a major stake .

- Workforce reduction and factory cancellations: Intel confirmed layoffs of ~24,000 employees (~15% of workforce) and cancellation of chip plant projects in Germany and Poland . New CEO Lip-Bu Tan plans to cut the headcount to ~75,000 by year-end 2025 .

- Executive departures and internal reorganization: Three corporate VPs (Kaizad Mistry, Ryan Russell, Gary Patton) announced retirement from manufacturing operations amid deep restructuring . Intel also cut its manufacturing capacity planning and engineering teams as part of an efficiency-driven reorganization .

- Recent key products/services: Intel launched new Xeon 6 CPUs for AI workloads (e.g. Xeon 6776P) and is preparing Panther Lake CPUs (PCs) for 2025 . It also began 18A node production in Arizona and sold part of its Mobileye stake (~$922M) to boost liquidity .

Price/sales: Intel (0.80), AMD (10.3), NVIDIA (29.6), QCOM (3.68)

Wrap-Up

Intel's last four years have been marked by a series of structural, competitive, and strategic challenges—ranging from manufacturing delays to margin erosion and intense pressure from rivals like AMD and NVIDIA. Yet, the tide may be turning. With decisive actions like major cost-cutting initiatives, new AI-focused products, and progress in advanced node production, Intel is signaling a strategic pivot. Trading at a deep discount relative to peers based on the price-to-sales ratio, the stock reflects much of the past negativity. For investors seeking a long-term turnaround play in the semiconductor sector, now could be the moment to re-evaluate Intel’s potential.

Let’s see if this chip giant can turn the corner. Cheers!

Pablin

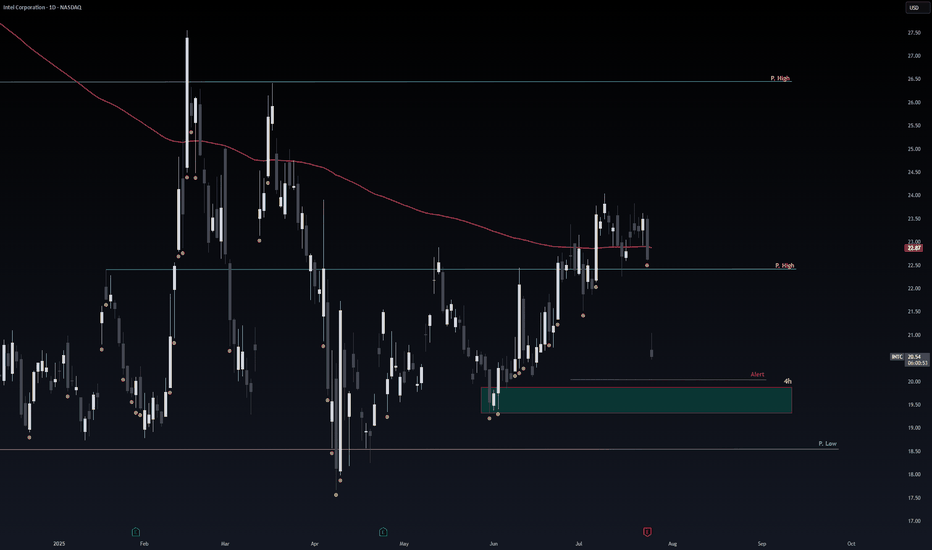

Safe Entry IntelThe 4h Green Zone is Safe & Strong Support for Intel.

If not respected the Pink Line is Second Strong support level.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock (safe way):

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the