Will this stock skyrocket 500x to $700?Talk of the moment is tariffs and the impact they’ll have on business and individuals. Generally, nothing good. A zero sum game in WW opinion.

For a future preview, see Brexit for details. American citizens have chosen to impose economic sanctions upon themselves just like Brexit voters. As a result importers will be required increase their paperwork, add fees to raw materials prior to entering the country, impose checks and pass those costs onto the consumer. A consumer that is already weighted down on auto debt.

Ignoring the long term economic impacts one should appreciate the internal demand pressures from manufacturers now needed to replace expensive imports.

In my opinion a number of businesses now exist to reap this demand. The smaller the better.

“American Battery Technology” is one such business that stands to benefit from the surge in EV growth in the US. In particular on the topic of recycling. As tariffs take hold on the imports of raw material the recycling of old becomes an increasingly attractive alternative source.

The TA:

On the above 5 week chart price action has seen a 98% correction since January 2021. A number of reasons now exist for a bullish outlook, they include:

1) Price action and RSI resistance breakouts.

2) Regular bullish divergence, settings used the same as January 2020 impulsive wave.

3) Support on past resistance, look left.

4) No share splits since 2004, excellent.

5) Short interest 9%, after a recent 70% correction?!

6) The bull flag, should it confirm, forecasts a 50,000% move or 500x to $700 area by December 2026. That’s a market capital of $60b for the industry of car battery recycling. Still small potatoes.

Is it possible price action continues to correct? Sure. Sellers, they love it.

Is it probable? No.

Ww

Type: Investment

Risk: You decide

Timeframe for long entry: Now

Stop loss: will say elsewhere

Return: Lambo’s all round

ABAT trade ideas

ABAT - Will try to Re-Test ?Hello Everyone,

Another Sunday and i made a quick scanning on Stocks.

What ABAT Does?

- ABAT develops hydrometallurgical recycling technology for lithium-ion batteries, extracting critical metals like lithium, cobalt, nickel, and manganese

- It also explores and extracts lithium from claystone in Nevada using its proprietary extraction process

- The company has partnered with BASF, Siemens, Argonne Lab, and others to build domestic battery material supply chains

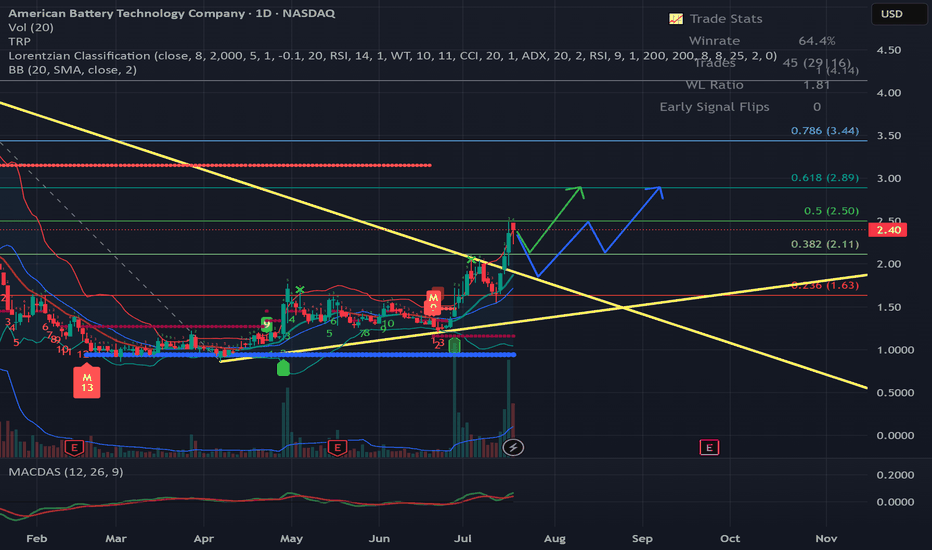

Technical Part:

It looks like it breaks out down trade and starts a new Up trend and i am expecting a Re-test to break level, that is between 1.96 to 2.10. If it will try to Re-Test then these points could be a good entry points.

Final price target TP for me 2.89 - 3.00 which is more than %40 gain.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday and good start a Week

ABAT Bullish Theory Can this mini stock pull off another 20,000% percent ? Lets analyze .

As we can see 0.91 cent support has always been respected heavily . Back in 2018 when it first made contact with support price rose 6x towards supply zone in which it was heavily rejected.. Rejection was so strong it dropped the price onto the bottom of the stocks channel in which activity brought price back to above 0.91 cents where once reclaimed, price rose 20,000% to $75.00

After 4 years, price now finds itself touching 0.91 cent level and bottom of channel .

Price reacted heavily towards demand in the area as a huge surge in volume confirmed interest. Price again dropped towards support along with the broader market and now finds itself possibly starting its new bullish trend towards the top of the channel .

This thesis aligns well with economic activity and demand for internal factors in the US as well.

…. and lets not forget, The biggest EV maker on the planet is gearing up for autonomy , newer ev’s , renewable energy , robots , etc.

BUT Only if supply zone is broken and confirmed as support can we really be sure price is headed to the moon..

Target $188.00

ABAT 100X Potential - $144 million grant ABAT received a $144 million contractual grant from the U.S. Department of Energy (DOE) in December 2024 for the construction of a second lithium-ion battery recycling plant. This new facility will have a processing capacity of approximately 100,000 tonnes per year of battery materials.

Mapped some simple S/R's for ABATThis is my chart overview for this stock. I manually exited back around $2.5 after not feeling it. I plan to reenter once the price touches $1.5ish. I expect that once the price moves past and holds above/below the mapped strengths and resistances, it will continue to the next.

ABAT: Triangle Breakout Setup with Key Levels!Entry Point:$2.46

Stop Loss (SL):$2.15

Take Profit Targets:

T1:** $2.86

T2:** $3.29

Trade Analysis:

- **Pattern: Triangle breakout forming strong support at $2.46.

- **Risk-Reward Ratio:** Favorable with clear downside protection and high upside potential.

- **Key Notes:** Monitor volume for confirmation of the breakout to ensure momentum.

ABAT poised for massive breakoutAmerican Battery Technology Company is primarily a Li-ion battery recycling company with goals to be a major U.S. provider of battery black mass and battery metals and compounds. They have been awarded many millions in federal funds and are growing rapidly. The company announced in September to increase available shares from ~80M to 250M, however no immediate share sales are anticipated. This stock rose to great heights amid the COVID stock market mania, and has since fallen quite far, particularly after September of 2023, when the stock had a 1/15 reverse split to meet requirements for listing on the NASDAQ.

The stock has been trading at ~$1 (the minimum requirement for NASDAQ listing) for approximately 3 months. This has built an exceptional level of resistance, above the pre-COVID mania stock price.

Shown here in the upper chart in red, white, and green lines are various moving averages on the 3-day chart. Lines will change colors from red to white, white to green, and vice versa, as the moving average increases or decreases and flips a neighboring moving average line. As you can see, following prolonged expansion of the total moving averages, large reversals tend to occur (effectively a reversion to the mean). The RSI chart shows a bottoming out and slight reversal, flashing bullish strength.

The bottom chart shows the same moving averages on the 1-day chart. You can see how the moving averages are converging (contracting), and this often signals a coming move. Following a Sept. 20 announcement of new federal grants, a blowoff stock sale occurred which was quickly absorbed by buyers. The volume of that event over 3 days was >100% greater than any other 3-day period in the stock history.

I believe ABAT is poised for a massive breakout and, at minimum, a 100-200% run in the very near future. Evidence:

Moving averages on high time frames have show over-expansion for a prolong period of time

Moving averages on low time frames show local contraction over recent weeks, a sign of a breakout move

Both RSI and CDV are bottoming out and flashing reversals on high time frames

The unprecedented selloff and failure to break below the ~$1 buy wall from Sept 20-25 indicates to me that a positive price reversal is the most favorable move

I don't know what will be the catalyst. The company, for all its strengths, is a bit quiet.

ABAT - LONGABTC has been on a roll, nailing down the purchase of a massive industrial facility for their battery recycling gig and getting their operations off the ground in no time. They're not just stopping there; they've cranked up their operations by adding another shift and are already eyeing up locations for another facility. The word is they've got some hefty feedstock deals in the pipeline, which could keep them busy for years. What's more, they've got the thumbs up from some of the big names in autos and batteries after passing some serious quality checks.

On top of all that, the U.S. Department of Energy is backing them up with some substantial grants, which just goes to show they're not just another player in the game. They've pulled in more grant money this year and are wisely using it to fuel their growth. Speaking of money, they smartly raised $25 million through convertible notes, showing they know how to keep the cash flowing for their ambitious plans.

All in all, as someone who's got a keen eye on the market, I'm pretty bullish on ABTC. They're pushing forward at full throttle, securing strategic partnerships, and getting that government nod, all while keeping their finances tight. This isn't just about riding the green wave; it's about being ahead of it. They're setting themselves up to be a major player in the battery recycling industry, and I'm here for it.

Id like to see us trade up into the $3 to even $4 range over the next few weeks to months.

ABAT long to 4.0Potential bull run mostlikely to the 4.0 mark.. A lot of downside in this stock but hopefully another bull run.

Starting to post again and hopefully more frequently to learn from my mistakes and sharpen my skills. Like and comment and I will give you a follow! Thanks for looking Traders!!