Merger canceled?Will some news push CORZ upward? It’s currently a laggard in the sector and just needs some fundamental catalyst to gain momentum. The downside seems protected in my view, as most holders are either waiting for the buyout or for the merger to fall through, which would likely trigger a bullish re-pricing.

Market insights

CORZ daily resistance breakout!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

$CORZ | Cup & Handle Breakout – Key Levels Ahead🔹 Technical Setup

Clean Cup & Handle formation confirmed above 17.50–18.10 resistance.

RSI hot (74.5) but still supportive of trend continuation.

Volume expansion aligns with breakout structure.

Fib extensions project 21.0 → 22.7 → 25.6 as upside targets.

🔹 Diverging Forecasts

WaverVanir DSS projects strong bullish momentum:

15-Day: 19.84 (+10.6%)

30-Day: 23.59 (+31.5%)

Institutional Model flags near-term weakness:

Target: 14.73 (-17.9%), signal = Strong Sell, confidence low (16%).

🔹 Key Zones

Bullish Continuation: Hold EQ at 15.95, sustain demand above breakout zone.

Bearish Risk: Failure to hold EQ → retrace into 14.7 → 12.7 discount zones.

📌 Summary

NASDAQ:CORZ is at a critical juncture: breakout continuation points toward 25+, while a rejection could send price back into discount. Traders should watch EQ at 15.95 as the pivotal decision level.

CORZ Earnings Alert — Bearish Setup Ahead of BMO Report****⚠️ CORZ Earnings Alert — Bearish Setup Ahead of BMO Report**

Core Scientific (CORZ) faces heavy fundamental headwinds with declining revenue (-55.6%) and negative margins, despite some bullish options flow and technical support near \$14.

**📉 Market Sentiment:**

* Moderate bearish conviction (75%)

* Mixed signals: cautious optimism from options flow vs. weak fundamentals

* Watch M\&A uncertainty and regulatory risks

**🛠 Trade Setup:**

* **Instrument:** CORZ

* **Direction:** PUT (SHORT)

* **Strike:** \$14

* **Entry Price:** \$0.16

* **Profit Target:** \$0.48 (200-300% gain)

* **Stop Loss:** \$0.08

* **Expiry:** 2025-08-08

* **Size:** 1 contract

* **Entry Timing:** Pre-earnings close

**🔑 Key Levels:**

* Support near \$14

* Resistance at \$15

* Expected Move: -\$2.50

**⚠ Risk Management:**

* Cut losses at 50% premium decline (\$0.08)

* Exit by market open next day if no target hit

---

**#CORZ #CoreScientific #EarningsTrade #PutOptions #BearishSetup #OptionsTrading #CryptoStocks #MAndA #RiskManagement #TechnicalAnalysis #TradingView #StockMarket #Volatility #ShortSetup**

7/2/25 - $corz - Have we forgotten...?7/2/25 :: VROCKSTAR :: NASDAQ:CORZ

Have we forgotten...?

- there's a possible deal happening here

- btc is ripping and so your downside beta is probably somewhat stagnant from the deal bid

- and then you just have natural rip on all energy/ hpc-btc complex stuff beta ripping

- nevermind the actual announcement potential

- bankers like to not work in july and especially august

- so *if* there is a deal here, my guess is it's probably communicated one way or the other sooner v later

- how quickly the market is ready to bid other chitco miners and not the one w/ the most tangible deal potential in the ST

but you do you. keep buying qubt and sym... enjoy

i'll stick to the high signal, better r/r on s/t like this

and for the degen stuff... well i've written about a few others today that are interesting setups far superior to the softbank and retail memes i denote above in this para.

check out $btcs... lmk what u think

but in the meanwhile. i still like this bitcoin beta w/ a deal backstop

V

Core Scientific: Getting ready for a move higherCore Scientific is forming a bull flag in the $9-$10 range. These bitcoin miners tend to follow bitcoins price movements on a grand scale, while bitcoin has dropped 20% since June 6th from a high of $71,000, down to Fridays close of $56,600, miners like Core Scientific have stayed steady. It cannot be over emphasized how insanely bullish this is. Core is coming out of bankruptcy which is the only reason it is so cheap to begin with and it has had quarter after quarter of negative net income. On May 8th, they finally reported positive net income for the first time since bankruptcy, beating estimates by over 400%. This resulted in a buying frenzy by institutions, sending the price from $3.50 per share all the way up to almost $11 per share. It has been consolidating since, while bitcoin has been collapsing 20%. In addition, they also announced they signed 12 different AI computing contracts. They are getting into the AI space because it's getting harder and harder to mine bitcoin and eventually, they know they will have to branch out if they wish to remain profitable. They have been using their profits in bitcoin mining to fund operating costs while other miners are simply issuing more shares, diluting the value of their stocks, the list goes on. As you can see in the chart, there is a massive negative divergence forming on the daily timeframe, if Core Scientific contracts downward, I expect a bounce in the highlighted golden pocket zone but this may not happen, it may breakout to the upside but I am very bullish on this stock either way.

CORZ : Long Position with 2.5 Risk Reward RatioOur stock is trading on 50 and 200 period moving averages. (Timeframe : 1H)

Our first target level could be the level where the gap closes.

Stop - Loss can be placed around the 200 period moving average. Summary in light of this brief information:

Risk/Reward Ratio : 2.51

Stop-Loss : 15.95

Take Profit Level : 11.745

Edit : Sorry, I couldn't pull down the end of the trend line, so it was a slightly crooked trend line, but it doesn't ruin the main idea.

Regards.

6/26/25 - $corz - Probably6/26/25 :: VROCKSTAR :: NASDAQ:CORZ

Probably

- NASDAQ:CRWV take private?

- we know a few things

- they haven't upgraded their btc fleet in over a year, which says "we're really not in that biz anymore and really only HPC"

- we know there's a mispriced stake in NASDAQ:CRWV embedded

- we know NASDAQ:CRWV needs power and NASDAQ:CORZ has a power portfolio

- we have seen many take privates in the last 6 months

- NASDAQ:CRWV stock is good acquisition currency at the moment esp as nvda/ semis/ narrative remains hawt.

so i'd say this is probably an 80/20

- usually these things take a few weeks to play out

- but given this industry, the px as it stands today

- and "if" it's going to happen and cat "is" out of the bag... my guess is the px is likely in the $20-25/shr region (an educated guess) and it's smart for the acquiring team/ bankers to communicate sooner vs. later.

alas who knows. but this seems like a cheap bi weekly option for what i think could be a 5-10x to 1 in a matter of a week or two (posisson distribution sounds about right for this type of comms) for what it's pricing rn. even a run into the close and perhaps tmr might allow for a take-half-off-ride-for-free. the $15 level is probably unlikely unloosed in the immediate term unless there's "no deal", and again hence the calls (not buying shares).

flagging for those who decide to play the tape

V

Core Scientific (CORZ) – Mining Bitcoin to Powering AICompany Snapshot:

Core Scientific NASDAQ:CORZ is evolving from a crypto miner into a high-density colocation provider, strategically pivoting into the explosive AI infrastructure space.

Key Catalysts:

Strategic Shift to AI Infrastructure 🧠📡

$1.2B agreement with CoreWeave expands AI compute colocation footprint

Signals institutional validation of CORZ’s infrastructure capabilities

Massive Power Footprint ⚡

1,300 MW capacity across North America

Ideal for power-hungry AI training and inference workloads

AI & HPC Market Tailwinds 🚀

AI infrastructure demand is surging; CORZ is positioned as a first-mover

Colocation demand outpacing supply = pricing power & revenue upside

Transformation Narrative 📈

Transitioning from volatile crypto dependence to stable, high-margin AI hosting

Increased diversification and enterprise appeal

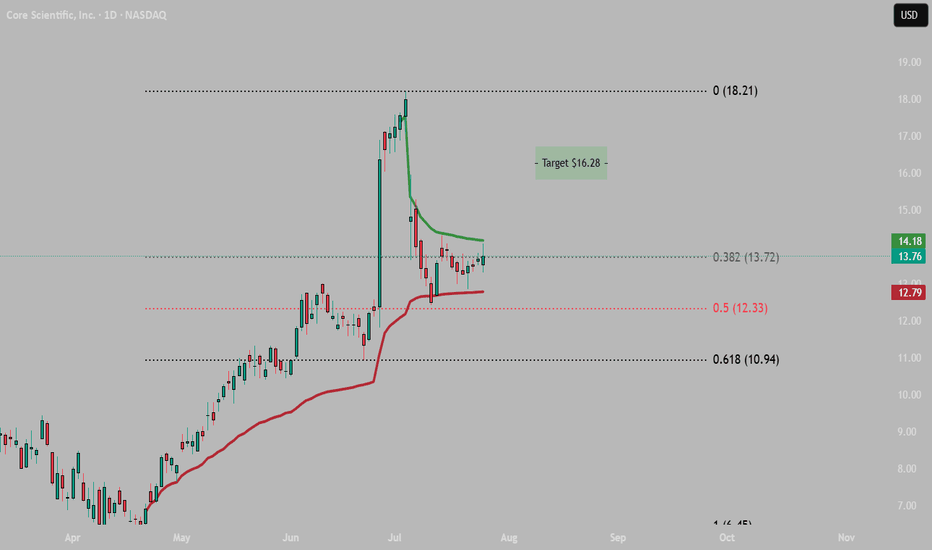

Investment Outlook:

✅ Bullish Above: $8.75–$9.00

🚀 Upside Target: $15.00–$16.00

📈 Growth Drivers: Strategic AI pivot, large-scale power assets, and long-term demand for compute

💡 Core Scientific – No longer just mining blocks, now powering breakthroughs. #CORZ #AIInfrastructure #DigitalTransformation

CORZ / 4hNASDAQ:CORZ has continued to advance to 70% total, very close to the first Fib-target >> 10.75, so it would be considered as wave a(circled) of the ongoing Minor degree sequence of A.

Now >> Turning to correcting down in the same degree wave b(circled) of A is expected.

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC

CORZ / 4hNASDAQ:CORZ continued to advance >> 6% today, as anticipated.

Wave Analysis >> The 60% rising tide since the mid-April low has revealed a five-wave impulse, and it's gone beyond the first target >>9.45, which together highly confirms continuing the advance towards the expected Fib-targets >> 10.75 >> 12.24.

It would be almost a 100% gain of a countertrend rally at the end!!

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC

CORZ / 4hNASDAQ:CORZ has continued to rise to 55%, as anticipated. It reached well beyond the first anticipated target >> 9.45, suggesting that the countertrend rally of wave A is halfway now.

Wave Analysis >> The rising tide since the mid-April low has been revealed in a five-wave sequence that highly confirms continuing the advance towards the expected Fib-targets >> 10.75 >> 12.24.

It would be a total 97% gain of a countertrend rally at the end!!

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC

CORZ / 4hThe wave structure of NASDAQ:CORZ 's advance >> 45% suggests that the countertrend rally of Minor degree wave A is underway.

The price might initially reach the origin of the diagonal wave ((v)) >> 9.45. In this case, the rising tide since mid-April will be thoroughly revealed in a five-wave impulse and highly confirmed, continuing the rise towards the anticipated Fib-targets >> 10.75 >> 12.24.

And so it would be a total 97% gain of a countertrend rally!

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC

CORZ / 4hThere is no change in the prior NASDAQ:CORZ 's analysis in this frame. The wave structure of the 34% advance would suggest that the countertrend rally of Minor degree wave A should be underway.

The price might reach the origin of the diagonal wave ((v)) >> 9.45. In which case, the rising tide since mid-April will be revealed in a thorough five-wave impulsive sequence and highly confirmed, continuing the advance towards the anticipated Fib-targets >> 10.75 >> 12.24.

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC

CORZ / 4hThere is no change in the prior NASDAQ:CORZ 's analysis in this frame. The wave structure of the 34% rising tide suggests that the countertrend rally of Minor degree wave A is underway.

The price might reach the origin of the diagonal wave ((v)) >> 9.45. In which case, it will confirm continuing the advance towards the expected targets >> 10.75 >> 12.24

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC

CORZ / 4h#CoreScientific closed the week with a 31% rising tide. So, the wave structure of impulsive advance quite well suggests adjusting a differing analysis on the prior wave C, in which its wave ((v)) diagonally could have ended last week, so the trend in Minor-degree should have turned upward.

>> Technically, continuing to advance towards the origin of the ending diagonal wave ((v)) will highly confirm the trend change( in Minor degree ).

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC

CORZ / 4h#CoreScientific has developed an ABC correction in zigzag as wave (W), which started in late November with an expanding diagonal as wave A and a running flat in wave B. Now, the decline in its wave C seems to be ending diagonally quite as well.

As illustrated on this NASDAQ:CORZ 4h frame, an expected Minute-degree 5th wave will conclude the diagonal wave C in the coming few days.

>> A final decline of 23% would likely lie ahead.

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC

$CORZ / 2hThe strong rally by 34% in NASDAQ:CORZ indicates turning the trend to the upward, as anticipated on Friday last week. And it's expected now, in retracement of 61.8% in an expanded flat correction as Minor degree wave B the countertrend rally in its wave ((c)) will continue to rising towards 14.88!

Expanded Flat >> Quiet often, wave C ends more substantially beyond the ending level of

wave A, as illustrated well on this case.

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC

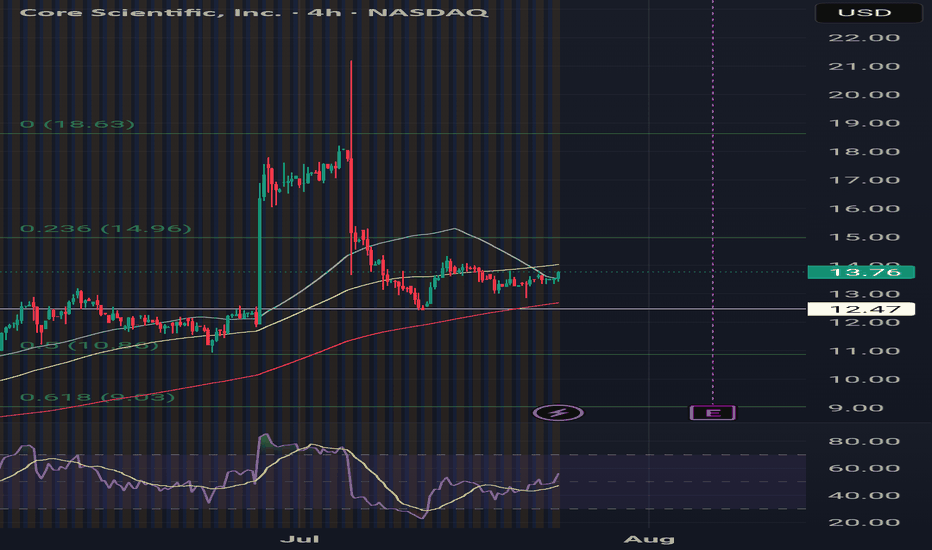

$CORZ / HourlyThe sharp selloff in NASDAQ:CORZ today, as the anticipated decline in an impulsive wave (c) should be likely an ending of entire correction in wave b(circled).

And also the wave structure of one larger degree trend implies to turning to uptrend that might be starting as early as next week.

Fib expansion targets >> 14.88 >> 16.42

#CryptoStocks #CORZ #BTCMining #Bitcoin #BTC