Okta (NASDAQ: $OKTA) Stock: Earnings Beat & Key Support TestOkta (NASDAQ: NASDAQ:OKTA ) delivered a strong fiscal Q3 performance, beating expectations on both revenue and earnings as demand for identity security continues to grow. The company reported non-GAAP EPS of $0.82, ahead of the $0.75 consensus, while revenue climbed 12% to $742M, exceeding forecasts of $730.3M. Subscription revenue — Okta’s core driver — rose 11% to $724M, helping push RPO up 17% to $4.29B, signaling durable long-term demand.

Cash generation also strengthened. Operating cash flow reached $218M, up sharply from $159M a year ago, while free cash flow came in at $211M, reflecting improving operational efficiency and disciplined spending. CEO Todd McKinnon highlighted strong traction with large enterprises and growing adoption of Okta Identity Governance and new AI-security features, including Auth0 for AI Agents, which positions Okta in the fast-emerging segment of identity protection for autonomous systems.

Profitability also expanded, with GAAP net income rising to $43M and non-GAAP operating income hitting $178M for a 24% margin. Guidance trended slightly higher as well. For fiscal 2026, Okta now expects $2.906B–$2.908B revenue and $3.43–$3.44 EPS, both modestly above expectations.

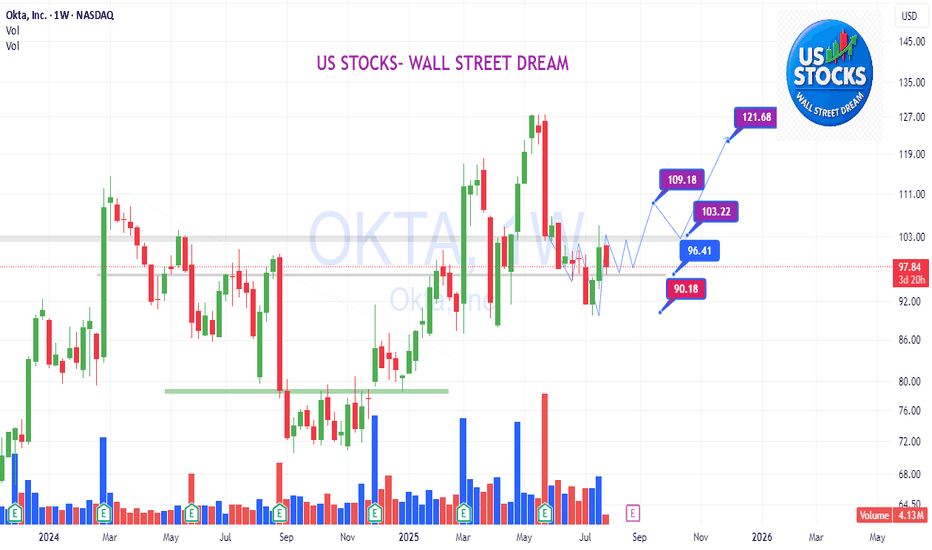

TECHNICALS (Chart-Based)

The chart shows OKTA trading at major multi-year support, aligned with the lower boundary of a long-forming bearish flag channel. Price recently bounced near $78–$80, a level tested multiple times since 2023. Holding this zone keeps the structure constructive for a rebound toward $127

A breakdown below the trendline would invalidate the structure and expose $65. Volume remains moderate, and RSI is oversold-leaning, suggesting potential for a short-term bullish reaction if buyers step in.

Market insights

OKTA Explosive Post-Earnings Trade – Don’t Miss Out!OKTA QuantSignals V3 – Earnings Trade Alert (2025-12-02) 🚨

Trade Direction: BUY CALLS (Bullish)

Confidence: 65% | Conviction: Medium

Recommended Strike: $83.00

Entry Range: $4.28

Target 1: $6.30 | Target 2: $8.40

Stop Loss: $3.15

Expiry: 2025-12-05 (3 days)

Position Size: 2% of portfolio (moderate conviction)

⚠️ Risk & Conflict Notes

Katy AI shows neutral/bearish trend from $81.68 → $80.96 (-0.9%), 50% confidence.

Composite guidance & options flow strongly bullish (PCR 0.51), supporting call entry.

Moderate-high implied volatility (IV 165%) → rapid price swings possible; monitor closely.

Critical Risk: Katy predicts gradual decline → a move below $79 could trigger losses.

Moderate Risk Warning: Consider scaling in rather than full position due to medium confidence.

💡 Trade Insight

Bullish earnings beat history (100% consistency) + strong options flow provide superior risk/reward despite Katy conflict.

Entry post-earnings avoids binary event risk and captures potential momentum.

Tight stop loss mitigates downside if Katy’s bearish prediction materializes.

Jade Lizard expiring 11/28 (just prior to earnings on 12/2...)CALL CREDIT SPREAD, above price:

Buy $96 Call 11/28

Sell $95 Call 11/28

SHORT PUT, below price:

Sell $85 Put 11/28

Credit to open: $265

END RESULT SCENARIO #1: Share price between $85 and $95 @ expiration = $265 credit to open is max profit (best case scenario).

END RESULT SCENARIO #2: Share price above $96 @ expiration = Credit to open minus $100 (no risk to upside), ($165 profit), (In hindsight, I regret selling the call credit spread so far from the share price).

3) END RESULT SCENARIO #3: Share price at or below $85 on 11/28 = Assigned to purchase 100 shares. The result is now I own 100 shares at an avg cost of $82.35 per share.

Clean Support and consolidation - Support buy Swing setup Weekly/Monthly Chart looking constructive with clear consolidation since may 2022 up till now

Key Levels $115 / $87 / $70 and $100(just adding this to pay my respect for Psych levels :D)

VRVP clearly crossed above that $87 in Jan 2025 and then held it even though 6 months touched it but never broke it.

Pros-

Earnings were good !!

Price Targets raised by 4 Analysts !!

$100 psych is a magnet to pull us up !!!

Relative strength showing the love is coming anyday now

I dont see no Baggies between 115 to 87, PA is constructive here.

How il play

+added first tranch

+next adds will be once 21 ema crosses 50 and on that Pull backs

-Cutting if 87 gives up !! But ready to re add WHY?

They are in the IAM bussiness and top 3 next to microsft and ibm, industry will grow to $73 billion in 2035 and currently $33 billion but room to grow But more importantly

Fed is ready to cut and market has liquidity. Its a Bull market unless proven otherwise so lets make that money but Risk Management first, its atleast a 2R trade so for novice traders - DO NOT EVERSIZE, I am a swing trader and not investor

OKTA - =======

Volume

=======

-Decreasing

==========

Price Action

==========

- Bearish flag noticed

- Broken downtrend line but buying pressure is not strong

=================

Technical Indicators

=================

- Ichimoku

>>> price within cloud

>>> red kumo noticed

>>> Tenken + Chiku - below clouds

>>> Kijun - below clouds

=========

Oscillators

=========

- MACD turning bearish

- DMI neutral

- StochRSI, neutral

=========

Conclusion

=========

- short to long term breakout swing

- price may reverse at current level, to enter spot or wait for pullback at entry 2.

$OKTA wants to "secure" the bag NASDAQ:OKTA 's upward momentum is still in play in this long channel. Just take a look at it's weekly chart. Showing the daily chart here to show gap above. This chart is just pure technicals. For a side note, their high level clientele will need to keep upgrading their security and OKTA is ready to provide that for them.

Watch it break that Traderdaddy Triangle then first PT is at $102 then $111 then runners left to fill the gap. Let me know what you think

$OKTA Breakout and Triangle : Bullish Setup Toward $127Given a breakout and sustained consolidation above both the 50MA and 100MA, there is potential for a bullish continuation pattern, possibly forming a "horseshoe" structure targeting the $127 area.

This is a technical observation and does not constitute a recommendation to buy or sell.

8/28/25 - $okta - Post mortem8/28/25 :: VROCKSTAR :: NASDAQ:OKTA

Post mortem

- solid 2q beat w enterprise traction and pipeline is a thumbs up

- their go to mkt and the panw m&a in the last q def don't help the market's ability to trade this cleanly

- AI not yet pushing the story and i suspect this takes a bit longer (generally not company specific) but will be great tailwinds esp on mgn

- that being said, of all my oppties in the tape today (where there are few if i'm being honest that are "obvious" - not many at all), this is defn not super clean

- so if it just works from here, god bless

- stock is objectively a LT buy, IMHO here

- but i'd think it becomes more obvious if we get a dip in mkt beta and sends this in the low 80s, that's where i can look for a longer term parking spot and not have to babysit. i don't like babysitting.

- rn i'm just buying OTC:OBTC and hedging that spread w/ ibit puts. seems like a fairly clean way to capture 15% by year-end

- gl to all

V

OKTA Earnings Setup | \$100C Aug 29 | 200–300% Potential

# 🚀 OKTA Earnings Setup | \$100C Aug 29 | 200–300% Potential 🔥

📊 **Bias**: Moderate Bullish (75% confidence)

✅ **Beat streak**: 8/8 last quarters, avg surprise +23%

✅ **Analyst upgrade**: Canaccord highlights AI/security tailwinds

✅ **Cash-rich**: \$2.7B balance, strong FCF buffer

✅ **Options flow**: Heavy OI at \$100 calls (1,508) → institutional attention

⚠️ **Risk**: Technicals weak (<50/200MA), guidance could underwhelm, IV crush risk

---

### 💡 Trade Setup

* 🎯 **Instrument**: OKTA

* 🔀 **Direction**: CALL (long)

* 💵 **Strike**: \$100.00

* 📅 **Expiry**: 2025-08-29 (weekly)

* 💰 **Entry**: \$2.55 (ask, from chain)

* 🛑 **Stop**: \$1.28 (−50%)

* 🎯 **Profit Targets**:

• 200% → \$7.65 (take partials)

• 300% → \$10.20 (full exit)

* ⏰ **Timing**: Enter **pre-earnings close (Aug 28 AMC)**, exit within 2h post-open

---

### ⚡ Execution Rules

* Use limit order near ask for entry.

* Max size ≤2% portfolio risk (≈1–4 contracts).

* Quick exits only — don’t hold past Friday close.

* Manage IV crush: profits must be realized fast.

---

🔥 **Bottom Line**: OKTA has the fundamentals + beat streak to deliver a positive surprise. The \$100C Aug 29 gives clean, asymmetric upside if stock gaps on earnings. Risk tightly managed at −50%.

---

### 📌 Tags

\#OKTA #EarningsPlay #OptionsTrading #SwingTrade #TechStocks #AIStocks #CyberSecurity #Bullish #CallOptions #StockMarket #TradingSignals #MomentumTrading 🚀💎📈🔥

8/12/25 - $okta - When r we buying this again?8/12/25 :: VROCKSTAR :: NASDAQ:OKTA

When r we buying this again?

- mid singles EV/sales

- DD growth

- great opex flex

- super lucrative mkt and big lock in

- not competing against bignames NASDAQ:ZS , NASDAQ:PANW etc.

- fcf gen is healthy 2-3% if we ex SBC, closer to HSD if we incl. SBC (i.e. take it out)

- seems like we're eventually entering some good buy territory?

- will this get taken out?

V

PS - traveling this week, so will be spotty on thoughts

$OKTA Gen AI tailwinds are not materializing as of now!- I'm a seller of NASDAQ:OKTA at $124 . Company was undervalued at 70s but has run so much without tangible materializing Gen AI tailwinds.

- Theoretically, Agentic AI should have been a great tailwind for SSO but it appears that industry is not yet focussed on security aspect of it when it comes to agentic AI.

- Even on application level, companies are struggling with developing orchestration framework and deploying them at Scale.

- Risk/Reward is not suitable for me to stay long. Short or Avoid/sell $OKTA.

- I might change my mind if they prove themselves today May 27, 2025.

Picked Up More OKTATraders,

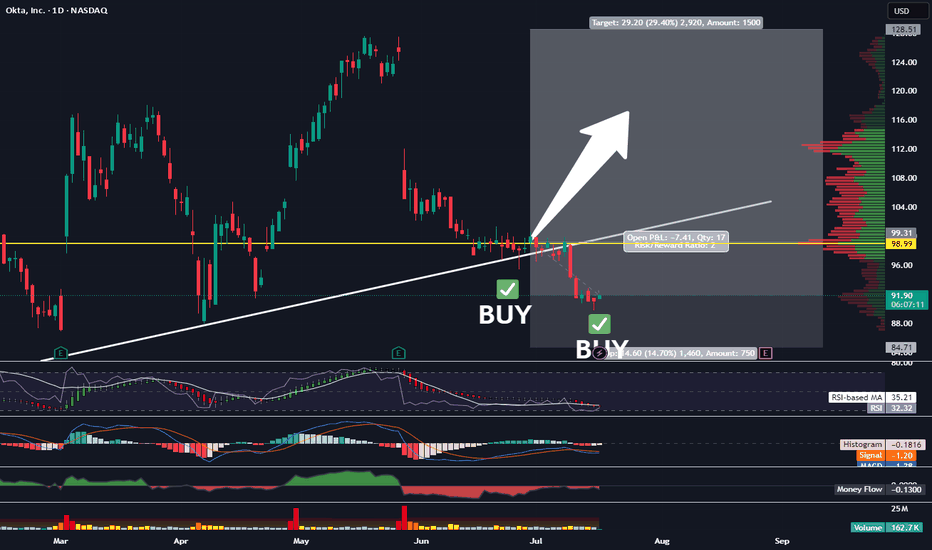

We’re nailing it in the stock division. Our portfolio has gained nearly 30% since the inception of our new indicator in Sept. of last year. And we’ve done that with 50% of our cash on the sidelines nearly the entire time, further reducing risk. It is amazing how I stumbled upon this new trade strategy purely by accident. Not by following anyone else on Youtube or TradingView or X. But simply by doing what I love to do and spotting trends and patterns. The combo of the indicators I have been utilizing is truly working, outbesting SPY hodl’ers by 3-to-1 since implementation.

At times, my indicator gives us more than one signal. This usually indicates that the move up will be stronger and more aggressive than previously indicated. Such is the case with our OKTA entry. We’ve got another BUY signal that has been given, and so, I am DCA’ing in. The target and SL will remain the same as our previous entry. All data can be found on the tracker.

Best,

Stew

Long OKTA To 128.50 For Nearly 30% PP. 1:2 RRR.Good Afternoon Trading Fam,

We are nailing it with our stock trades since implementing my new liquidity indicator. I've got another buy signal given here on OKTA with a 1:2 rrr ratio and potential profit of nearly 30%.

On the technical side, you can see that we are just above a large liquidity block where buyers have stepped in en masse in the past. Additionally, we have nice support being offered by our trendline. And finally, we have a large gap which often acts as a magnet and will most likely be filled sooner rather than later. The MACD has just crossed up, and our RSI is doing the same near oversold territory. All of these indications make this an easy choice for me, with an excellent opportunity to profit yet again.

More details on this trade and all of the others can be seen on my public portfolio, as always.

Best,

Stew

OKTA Trade Analysis | Technical Swing Setup with ~9% UpsideEntry: $104.43

Target: $114.76

Stop: $100.90

Risk/Reward: 2.93

This swing trade in OKTA was initiated following a pullback to key technical support levels. Price action has stabilized near the top of the Ichimoku cloud (Senkou Span A), which aligns with the daily Pivot Point around $100.58. The bullish cloud structure remains intact, and the Kijun-sen is flat—both signs that the broader trend is still constructive.

While the MACD histogram is negative, the deceleration in selling pressure suggests potential for momentum to reverse. Previous setups with similar MACD behavior in April led to a strong move higher. The target aligns with R1 resistance at $112.71, giving the trade a clearly defined technical ceiling. Candlestick action over the past few days has shown lower wicks and rejection of downside, pointing to early signs of buyer interest.

This is a trend-continuation setup with a tight stop below the cloud. If price closes under $100.90, the trade will be exited to manage risk. Until then, the structure supports a move higher. This trade follows a strict risk/reward framework and fits within a broader strategy focused on technical precision and disciplined execution.

OKTA - DAY TRADE IDEAOKTA is setting up for a day trade scalp long...perhaps an aggressive swing trade as well. The day trade is a much higher probability of success around the $98.50-$99.30

Okta's stock has seen some volatility recently. After a strong rally earlier this year, it pulled back following cautious guidance from the company. Despite beating expectations on sales and earnings for Q1 fiscal 2026, investors were concerned about slowing growth, leading to a 14.6% drop in its stock price.

Okta reported $688 million in revenue, a 12% year-over-year increase, and positive free cash flow of $238 million, but its GAAP earnings were significantly lower than its adjusted earnings. The company maintained its full-year revenue forecast of $2.85 billion to $2.86 billion, reflecting 9% to 10% growth, but analysts tempered their optimism due to macroeconomic uncertainties.

Technicals

- Multiyear Support

- 50 % Fib Retrace

- Upsloping Trendline

- Positive Divergence building on 1/ 4 hour chart.

$OKTANASDAQ:OKTA reports earnings post-market tomorrow.

📉 Expecting intraday pressure down to the $118 zone.

➡️ Potential continuation toward $112 over the next two weeks.

🛑 Watching for support to form between $110 – $112.

30-minute chart attached for context.

#Stocks #Trading #OKTA #Earnings #TechnicalAnalysis

$OKTA is ready to RIP! 58% UpsideNASDAQ:OKTA was a big name I was talking about end of last year before we took a big dip in the markets...well we are back at the CupnHandle breakout level now and this trade looks ready to RIP!

Warning earnings on May 27th!

- Looking for a close on Friday above the breakout level for an entry here

- Green H5_L inidcator

- CupnHandle breakout

- Volume shelf launch

- Bullish Wr%

$139 First target

Measured Move is $186 for the cupnhandle

Not financial advice

Okta: Strong In a Weak Market?Okta has been quietly fighting higher, and some traders may see opportunity in its latest pullback.

The first pattern on today’s chart is the series of higher weekly lows since November. That contrasts sharply with the S&P 500 and Nasdaq-100, which have made lower weekly lows.

Second, the 50-day simple moving average (SMA) began the year by rising above the 100-day SMA. A “golden cross” above the 200-day SMA followed in February. The next month, the 100-day SMA rose above the 200-day SMA. That sequence, with the faster SMAs above the slower ones, may reflect a positive long-term trend. (See the circles.)

Speaking of the 100-day SMA, OKTA is trying to hold that line this week.

Finally, bullish price gaps following the last two quarterly reports may reflect improved fundamental sentiment in the cybersecurity company.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Stock Of The Day / 03.04.25 / OKTA03.04.2025 / NASDAQ:OKTA #OKTA

Fundamentals. Earnings report exceeded expectations.

Technical analysis.

Daily chart: Uptrend, update of the previous high.

Premarket: Gap Up on increased volume.

Trading session: The price has been trading in a wide range of 101.50 - 104.50 for a long time after the initial impulse at the opening of the session. Volumes for buying appeared after 2:00 p.m. and the price confidently broke the high of the day 104.50. We are considering a long trade in case a retest and holding the price above the level.

Trading scenario: #breakout of level 104.50

Entry: 105.13 when exiting upwards from the range above the level 104.50

Stop: 104.38 we hide it behind the level 104.50 with a small reserve

Exit: We observe a pure trend movement after entering the position. Close the position at a price of 108.35 before the session closes.

Risk Rewards: 1/4

P.S. In order to understand the idea behind the Stock Of The Day analysis, read the following information .