RealReal, Inc.On the above bi-weekly chart price action has corrected over 90% since the sell signal (not shown) at $30. Now is an excellent long moment. Why?

1) A strong buy signal (not shown).

2) Price action and RSI resistance breakouts.

3) Bullish divergence. Multiple oscillators are printing positive divergence with price action.

Is it possible price action falls further? Sure.

Is it probable? No.

Ww

Type: investment

Risk: <=6% of portfolio

Timeframe: Don’t know.

Return: Don’t know

Stop loss: <= 90 cents

REAL trade ideas

REAL Is So Strong! I Have To Find A Low Risk Way Into ItA 250% earnings reaction in seven weeks shows incredible strength for REAL.

I was looking for a buyable pivot to form in the shaded flag area but it took off without me. I may not get the pivot I want, and if that's the case I may resort to buying it on support off the 10 day moving average.

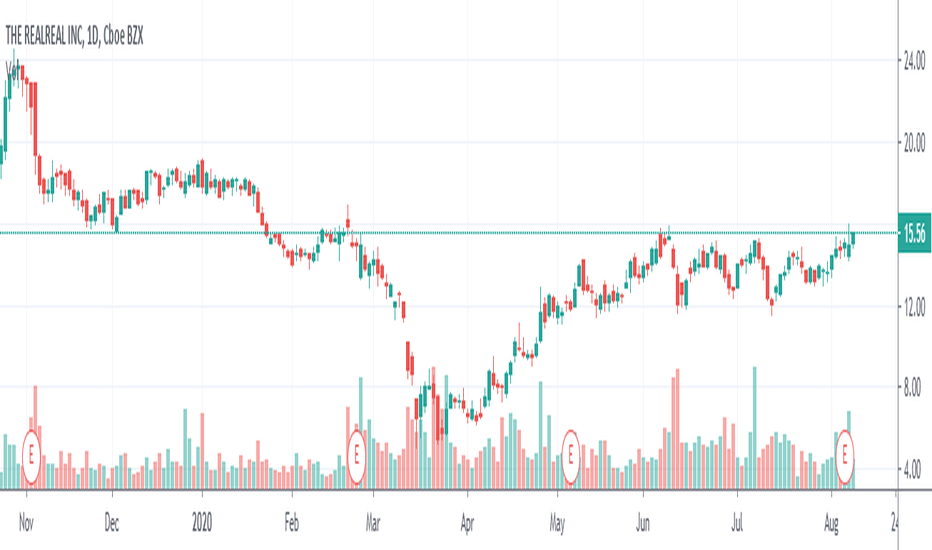

The RealReal, Inc - 150% gain waiting for collectionOn the above 2 week chart price action has corrected around 50% since May. A number of reasons now exist to consider a long position. They include:

1) Price action and RSI resistance breakouts.

2) Support confirms past resistance (blue arrows).

3) The trend, higher highs higher lows.

4) The Bull Flag, 2nd impulsive wave imminent.

Is it possible price action continues correcting? Sure.

Is it probable? No.

Ww

Type: trade

Risk: You decide

Timeframe for long: Yesterday

Return: 150%

Stop loss: Say elsewhere

REAL - The gift that keeps on giving Pt 2!Was muted in the first video accidentally - but focus here on the controlled selling algorithms magenta, green, and blue - when we start to see tapering from magenta to green and ultimately to blue, we are preparing for a breakout. Coincide that with a buying continuation algorithm still proving control (like purple or yellow) and you have yourself a target!

Happy Trading :)

- TraderDaddyOG

REAL - Updated analysis as we continue to build liquidityStocks > $5 are extra risky so proceed with caution.

Now I love this company for many fundamental reasons in addition to the obvious technical analysis that I've been showing you all.

This is a longer term hold forsure but I am looking at the bottom of this blue tapered selling channel as a bounce area and an opportunity to add to my existing swing position. Would be best if we can prove green tapering asap for a break out of this magenta selling channel.

Happy Trading :)

- TraderDaddyOG

REAL - Why I love this (super cheap) company. LOADING UPI will forever be a holder of my REAL stock. It's the largest position in my personal investment account with a basis in the very low $1 range from early 2023.

You can see why as we have positive earnings reports quarter after quarter and it's only a matter of time until Wall Street starts to notice.

There is a huge short float position on this so I'm just happy to see that our selling has been in a controlled manner and I'm excited for the future of it!

See you all at market open!

Happy Trading :)

Potential Upside of REAL with acceptable RiskRealReal has plunged almost 95% from the top of Feb2021 at price of around 27-28 to recent low of 1 dollar

only in my own opinion, i see a mid term upside trade of holding about 6-12 months

entry price will be 5Jun23 market open, with a stop loss of 0.90 and eyeing target of 5.50

Research made easy

*NOT a buy or sell call, just for opinion exchange purpose

CITRON is giving a GREAT LONG opportunity with $REALCitron following swing trading strategy idea

The share price is rising and gonna continue this trend today after the new Citron report publishing. The stock has very much short float and insiders purchases near prices much higher than current.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $13,25;

take-profit — $14,60/MOC;

stop-loss — $12,80.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

$REAL can rise in the next daysContextual immersion trading strategy idea.

The RealReal, Inc. operates an online marketplace for consigned luxury goods. It offers various product categories, including women's, men's, kids', jewelry, and watches, as well as home and art products.

The demand for shares of the company still looks higher than the supply.

This and other conditions can cause a rise in the share price in the next days.

So I opened a long position again from $25.60;

stop-loss — $22.82.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

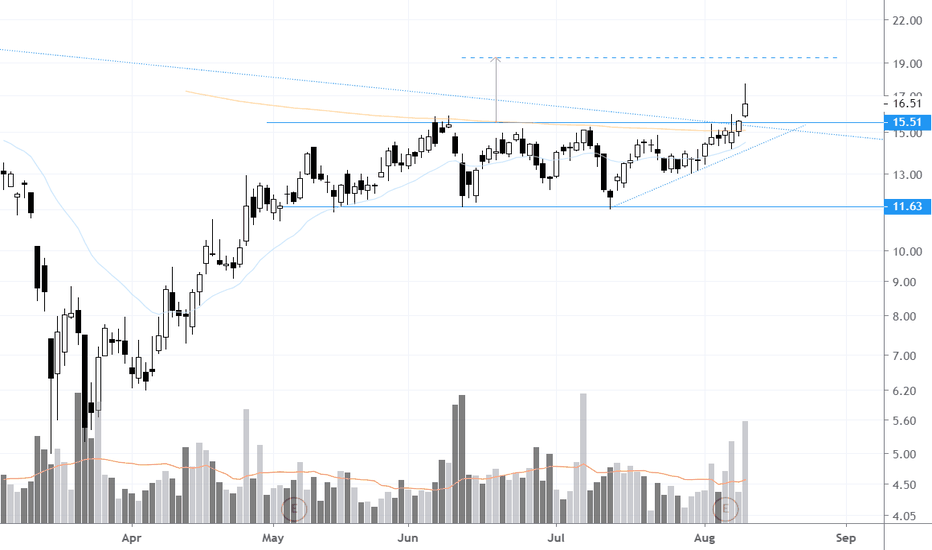

$REAL #Breakout Just got REAL :)and there goes REAL. Breaking out of its 3+ months rectangle chart pattern. Rectangle chart pattern price target added to the chart. i have alerted to this stock twice before. here is the latest chart i posted right before the breakout explaining why this setup is very promising and high probability trade.

Real Matters almost doubles YoY consolidated incomeReal Matters almost doubles YoY consolidated income

themarketsignal.com

Real Matters Inc. (TSX:REAL) is also another stock with a short interest ratio of 1.0 implying that investors think the price is to increase in the near-term. This means the sentiments are bullish on the stock. The company reported its Q3 2020 results in which it posted a consolidated adjusted income of $20.9 million which is almost 100% growth from Q3 2019. US title adjusted income was $13.3 million exceeding the Appraisal segment for the first time which delivered $10.8 million. CEO Jason smith stated that the US mortgage market showed resilience in Q3 even amid the COVID-19 pandemic.

Smith added that the low-interest-rate environment has created a huge opportunity for the company. However, the ability of lenders to enhance underwriting capability during the pandemic still remains a challenge to growth. Consolidated revenue for the quarter was $118.1 million.

REAL forming 3 month #rectangle #chartPattern #breakoutNASDAQ:REAL has been trading in a trading range for the last 3+ months forming a rectangle pattern. The stock price is stilling right under 3 resistance confluences (200 MA, Weekly downsloping trend line, and rectangle resistance). A breakout above these 3 levels will set the stage to a leg higher and a trigger of a long trade. REAL reported earning this evening 08/06.

REAL setting up a #Rectangle #BreakoutNASDAQ:REAL setting up a nice rectangle, one of my favorite chart patterns. There is no indication yet on the breakout direction. Volume pattern balanced and not showing a bias yet. Put it on your watch list and wait for a breakout signal. The breakout to the upside could catch momentum quickly if it happens as rectangle resistance merging with 200 day MA. Promising chart setup that will get underway in the next few days.