NGSUSD trade ideas

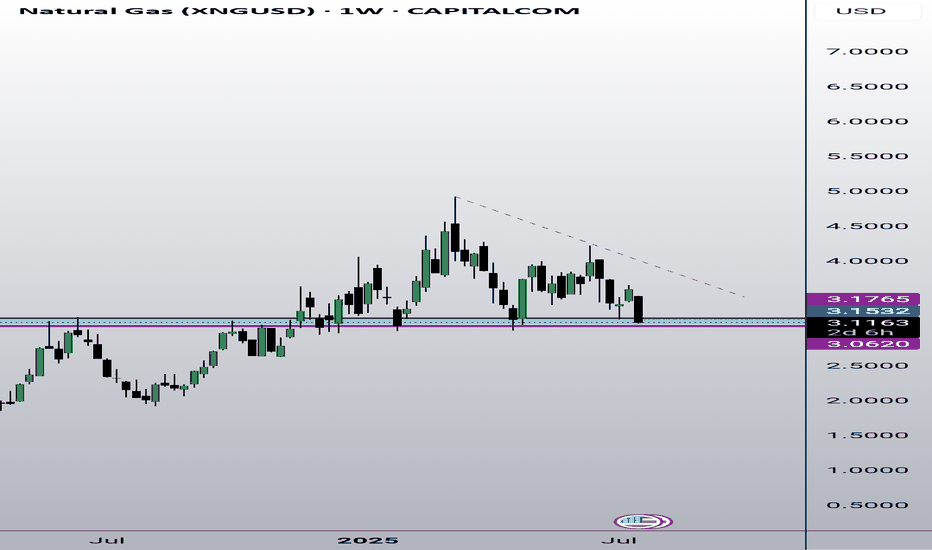

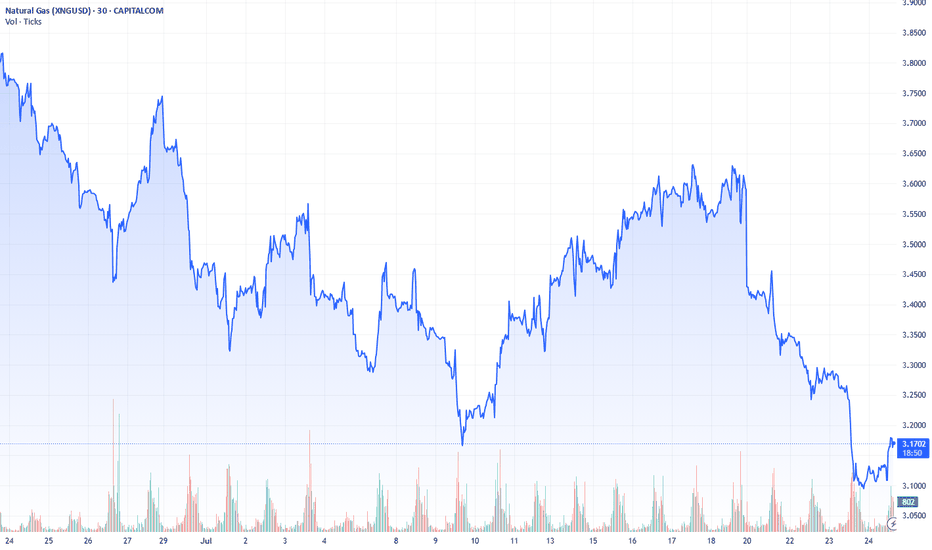

XNGUSD CONTINUES ITS DOWNWARD TREND. FOR HOW LONG?XNGUSD CONTINUES ITS DOWNWARD TREND. FOR HOW LONG?

Recent bearish impulse started at the beginning of this week may come to an end soon. Yesterday the U.S. Natural Gas Storage report came out. Numbers appeared to be lower than expected and lower than previous. (23b vs 28b vs 46b). This is bullish signal for the market participants. Minutes after the report came out, market reacted bullish, however, soon price went sideways.

Right now gas prices continue to decline. Still, the opportunity for short-sellers here is quite limited. Not so far below there is a level of 3.0000, form where I expect the price to rebound, supposedly to a 3.3000.

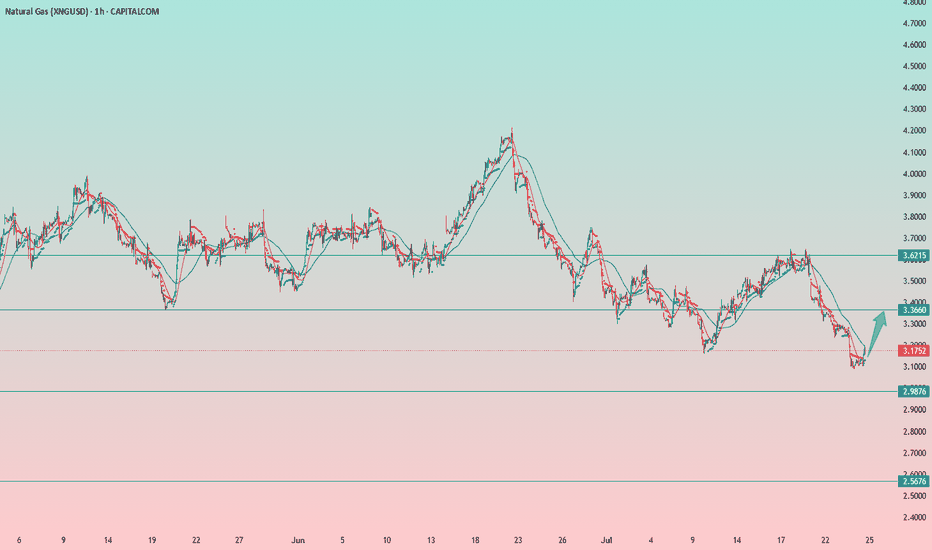

Natural Gas Price Drops by 7%Natural Gas Price Drops by 7%

As the XNG/USD chart shows today, natural gas is trading around $3.333/MMBtu, although yesterday morning the price was approximately 7% higher.

According to Reuters, the decline in gas prices is driven by:

→ Record-high production levels. LSEG reported that average gas output in the Lower 48 rose to 107.2 billion cubic feet per day so far in July, surpassing the previous monthly record of 106.4 billion cubic feet per day set in June.

→ Favourable weather forecasts. Although the peak of summer heat is still anticipated, forecasts indicate that temperatures over the next two weeks may be lower than previously expected.

As a result, today’s XNG/USD chart appears bearish.

Technical Analysis of the XNG/USD Chart

The chart indicates that since mid-May, natural gas prices have been fluctuating within a descending channel (marked in red), with July’s peak (E) highlighting the upper boundary of the pattern.

A key resistance area is now represented by a bearish gap, formed between:

→ the former support level at $3.525;

→ the $3.470 level – which, as the arrow suggests, is already showing signs of acting as resistance.

Under these conditions, it is reasonable to assume that the price may continue forming a downward market structure A-B-C-D-E, consisting of lower highs and lows, potentially moving towards the channel’s median – which approximately corresponds to July’s low (around the $3.200 level).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

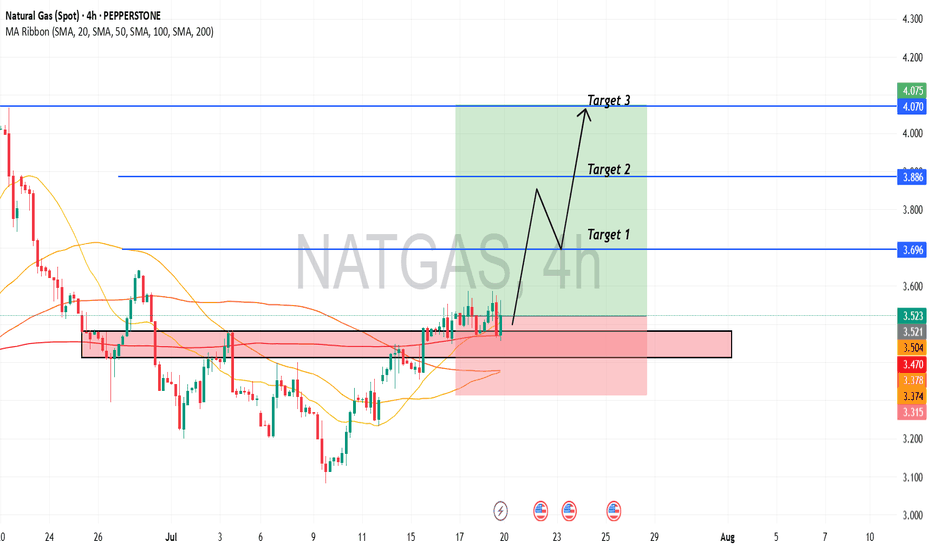

Natural Gas is in the Buying DirectionHello Traders

In This Chart NATGAS HOURLY Forex Forecast By FOREX PLANET

today NATGAS analysis 👆

🟢This Chart includes_ (NATGAS market update)

🟢What is The Next Opportunity on NATGAS Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

XNGUSD Technical Update – What the Chart Is Telling Us NowIn this video, I break down the current XNGUSD (Natural Gas) chart using pure price action analysis on the daily timeframe.

This update builds on my previous post, where I shared a comprehensive outlook supported by fundamentals, including supply/demand imbalances, geopolitical risks, and long-term LNG export growth.

In this video, I focus purely on the technical picture—highlighting key levels, market structure, recent consolidation, and where I see potential opportunities unfolding next.

📈 If you're trading or investing in Natural Gas, this is a must-watch update to stay in tune with the current market dynamics.

Remember: This is not financial advice. Always do your own research and manage risk appropriately.

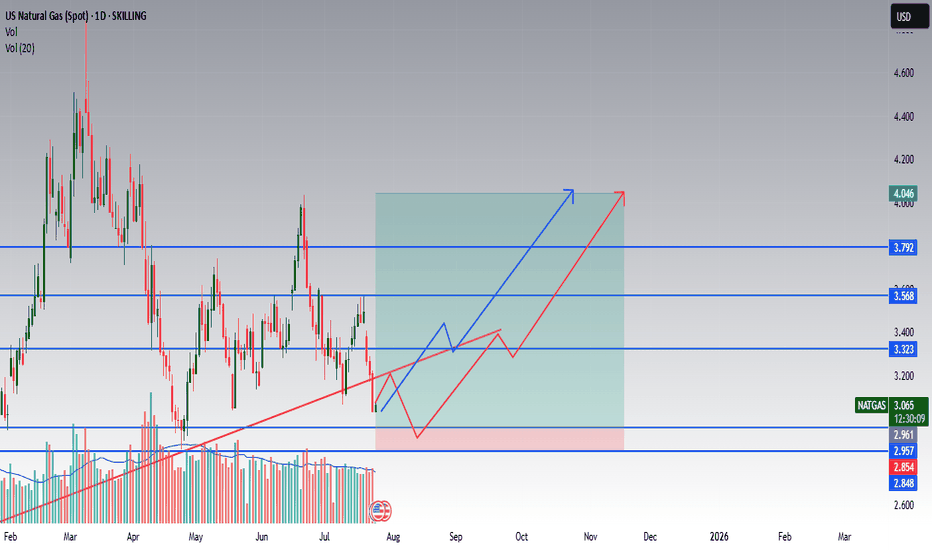

NATGAS Long Setup – Accumulation + Breakout OpportunityInstrument: US Natural Gas (Spot)

Timeframe: 1D

Published: July 24, 2025

By: @Rendon

📈 Idea Summary:

Natural gas is showing signs of accumulation after a corrective downtrend. Price recently tested key horizontal support around $2.96–$2.85 and is now attempting a recovery. Two potential bullish scenarios are outlined:

🧠 Bullish Scenarios:

🔵 Scenario A (blue path): Clean breakout above $3.32 with strong volume could lead to a continued push toward $3.56 → $3.79 → $4.05.

🔴 Scenario B (red path): Price may first retest the $2.96–$2.85 demand zone again before bouncing and gradually rallying toward $4.05.

🔍 Key Levels:

Support: 2.961 / 2.957 / 2.854

Resistance: 3.323 → 3.568 → 3.792 → 4.046

🛑 Invalidation:

A decisive close below $2.84 would invalidate the bullish thesis and suggest further downside risk.

📊 Volume Insight:

Volume has been drying up, which may indicate a potential spring or absorption before a breakout.

✅ Trade Plan (example):

Entry: On retest of $2.95 or break of $3.32

Stop Loss: Below $2.84

Target: First TP at $3.56, then trail toward $4.05

💬 Let me know in the comments how you see NATGAS developing and which path you’re betting on!

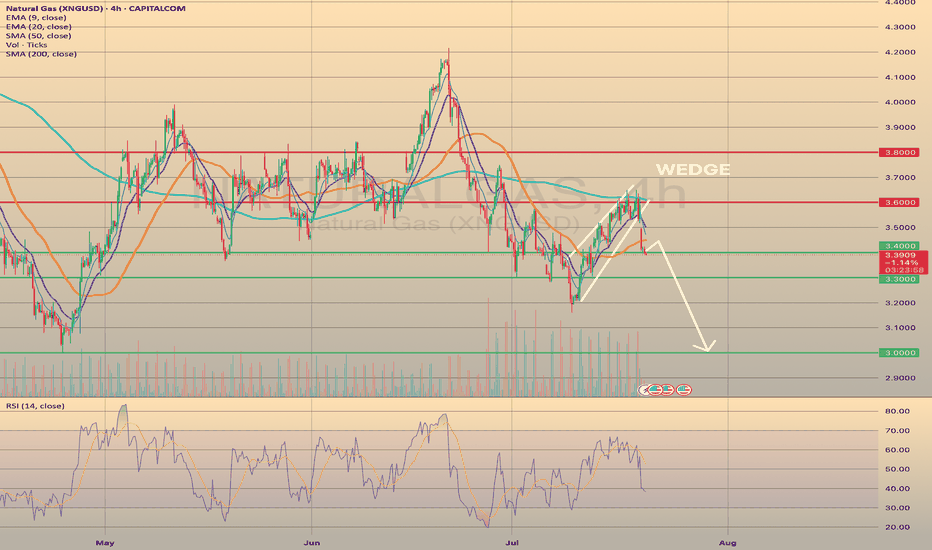

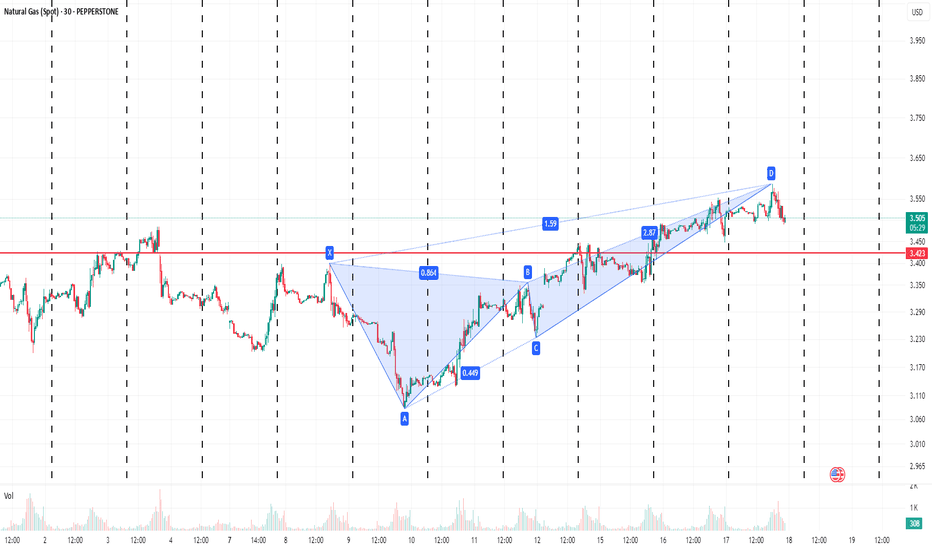

U.S. NATURAL GAS - BEARISH WEDGE WORKED OUT. WHAT'S NEXT?U.S. NATURAL GAS - BEARISH WEDGE WORKED OUT. WHAT'S NEXT?

Today, the market opened 2.66% below its closing price on Friday. The current price has already fallen on 4.8% since the closing on Friday, and it is now above the 3.400 support level. I expect further decline, however, with a possible rebound from the current level and pullback towards the SMA50, with a final target of 3.000.

Natural Gas is in the Buying DirectionHello Traders

In This Chart NATGAS HOURLY Forex Forecast By FOREX PLANET

today NATGAS analysis 👆

🟢This Chart includes_ (NATGAS market update)

🟢What is The Next Opportunity on NATGAS Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

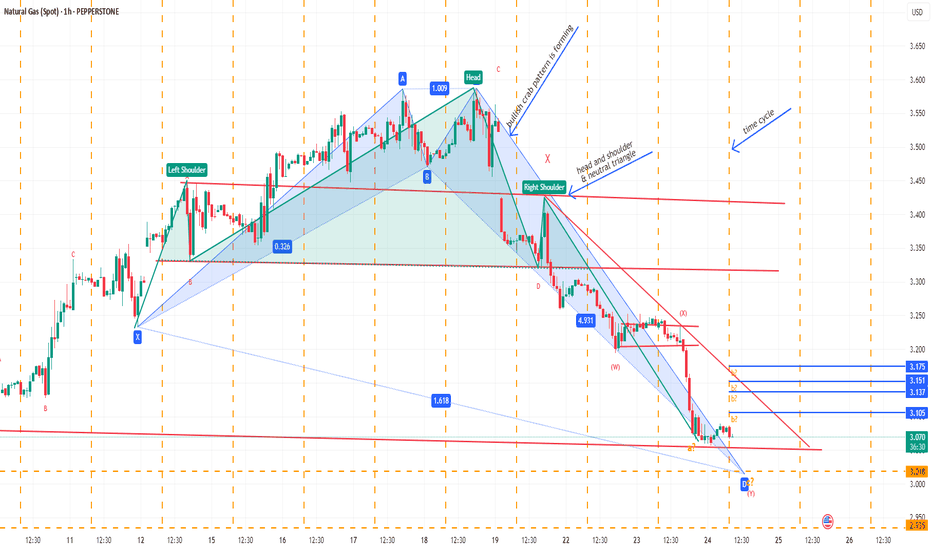

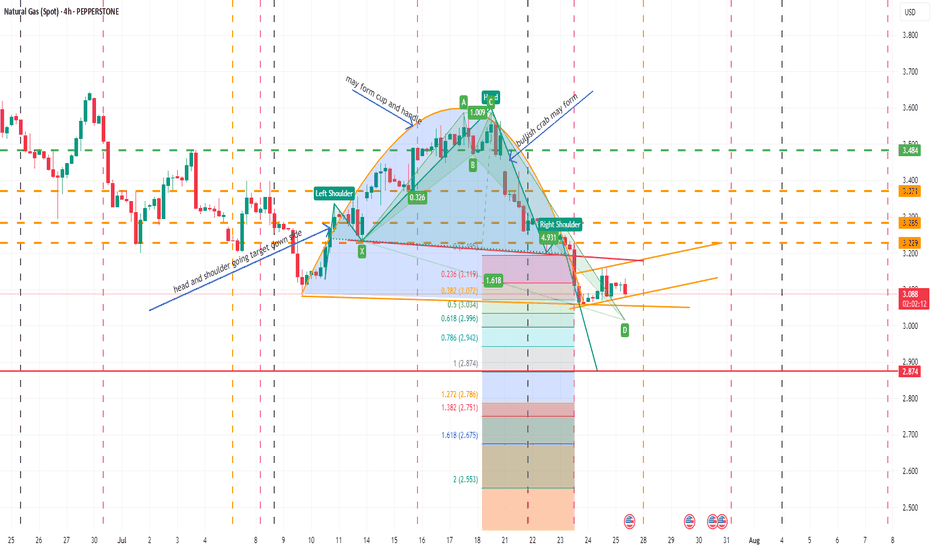

NATURAL GAS SPOTMay form inverse cup and handle, bullish crab also about to form , after completing one head and shoulder pattern already posted earlier new head and shoulder going on. In daily and 4 hr chart below ichimoku cloud. In weekly within cloud. Moving averages showing weakness in daily and weekly, monthly candle also no bearish. May be in such scenario bullish crab pattern may fail but need to be careful as over sold territory. Let see how all works in future though so far all as per analysis. I am not SEBI registered analyst.

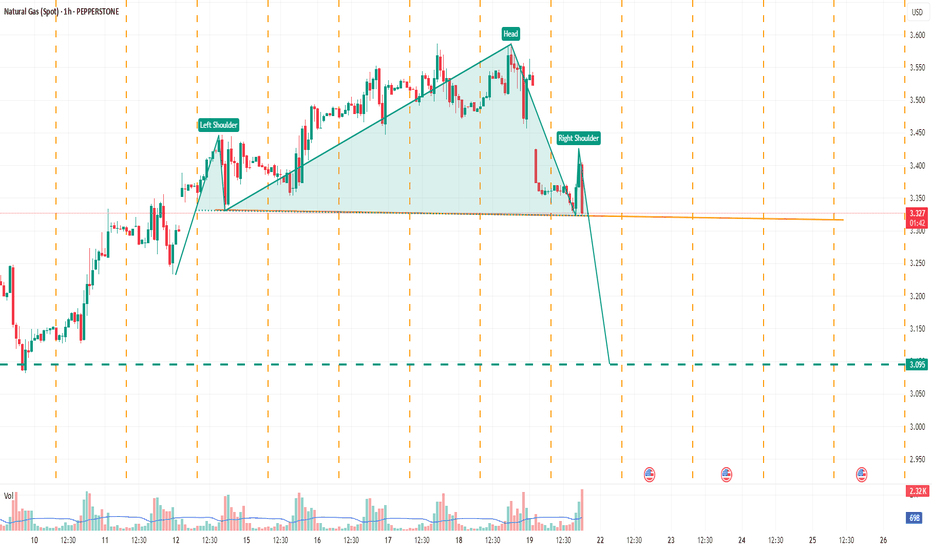

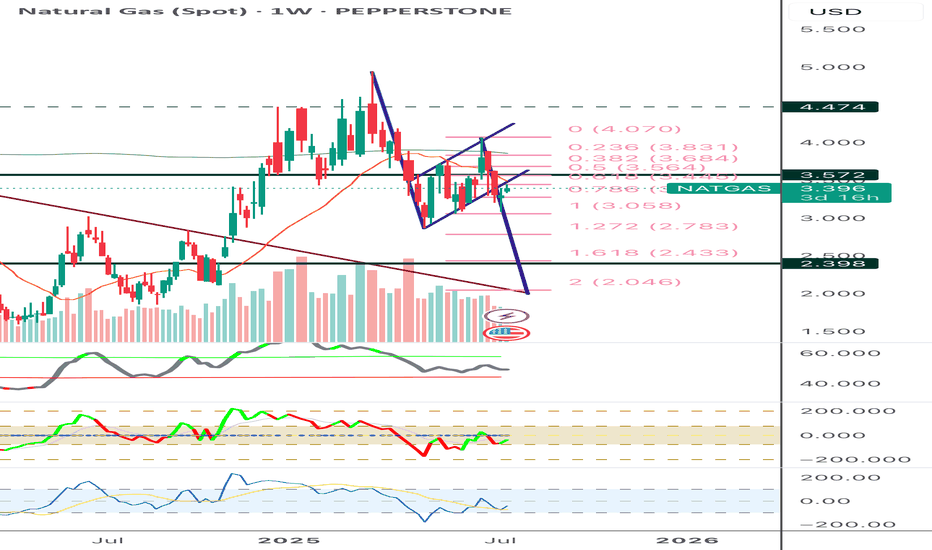

Sell NATGAS into OCT/NOVNatalie has fromed a H&S and has broke through all of the supporting EMAs leading to most of the indicators turning bearish.

My approach for the forseeable is seeling bounces until the winter season approaches.

Of course Natalie is extremely susceptible to trend changes due to economical data and has to be monitored closely. Currenlty I'm a bear.

Only selling once it breaks and retests, where I will once again reasses based on economics such as storage, production, imports and demand.

Target around $2.5 where interestingly a gap (red rectangle) sits from Nov - 24.

Elliot Wave (although not a great fan) kind of aligns as well as the 0.786 fib level which began forming at the beginning of 2024.

Storage | Volatility | Price Outlook

U.S. natural gas markets are stabilizing as volatility trends back toward seasonal norms.

📉 Volatility has dropped from 81% in Q4 2024 to 69% in mid-2025

🏪 Storage is currently at 3,075 Bcf,

🔻 4.7% lower YoY

🔺 5.9% higher than the 5-year average

🚢 LNG exports remain strong—up 22% YoY and 74% above the 5-year average

🔌 Domestic demand is seasonally weaker but steady

➡️ Despite being below last year’s levels, storage surplus vs. the 5-year average acts as a soft ceiling on price.

➡️ Historical analogs suggest a fair value range between $2.50–$3.20/MMBtu in the short term.

📊 Current price action around $3.00–$3.40 looks slightly overheated unless a fresh catalyst emerges (heatwave, export spike, etc.).

🧭 Watching for:

Injection trends over the next few weeks

Cooling demand in power sector

Resistance around $3.40

Support near $2.80

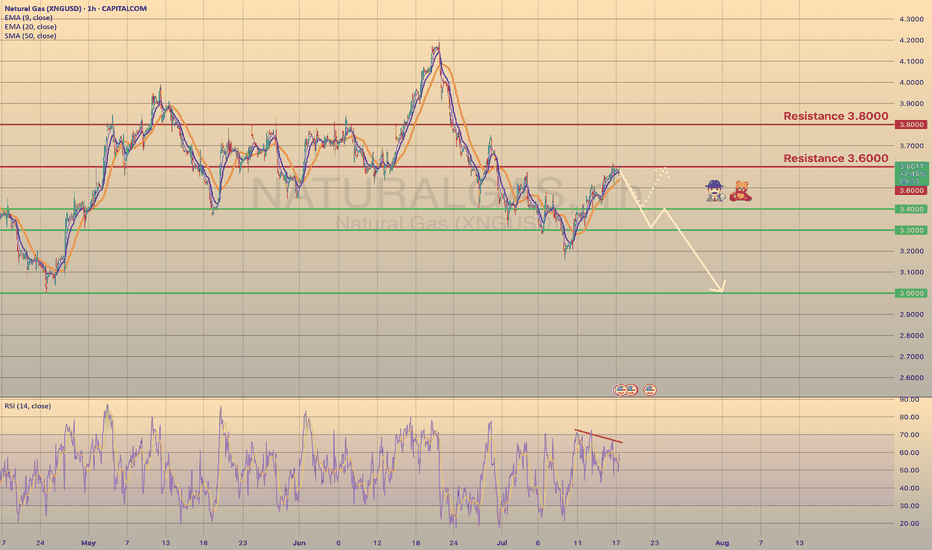

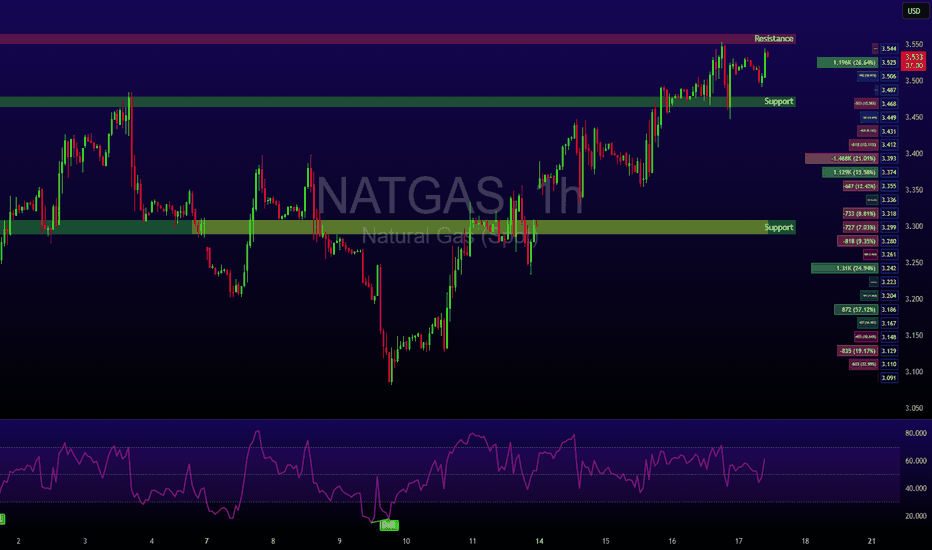

U.S. NATURAL GAS - BEARISH DIVERGENCE DETECTED

U.S. NATURAL GAS - BEARISH DIVERGENCE DETECTED🕵🏻♂️

The Natural gas has been trading bullish for 7 days in a row since last Wednesday, reaching the 3.6000 resistance level. Primarily this happened due to a warm weather in the U.S. states, that supports the demand on gas. Despite warmer-than-normal summer weather, analysts expect energy firms to inject more gas into storage than usual in coming weeks. Record-high output in June, likely to be surpassed in July, and reduced gas flows to LNG export plants since April's peak, support this trend.

Technically chart shows us a bearish divergence on 1-h timeframe. I suppose the price to slowly decline towards major support level of 3.0000 with minor rebounds. The 2nd option is the rebound from 3.4000 support level with a first target of 3.6000.

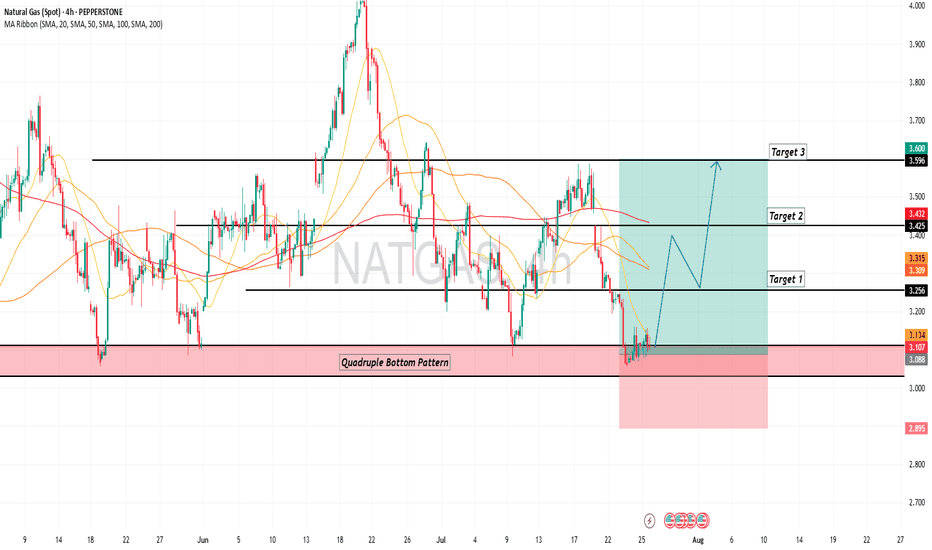

Natural Gas: Long Setup After Healthy PullbackNatural gas has made a decent pullback, and a solid long setup is forming here with a relatively tight stop-loss for gas.

If the stop gets hit, the second entry will be from the $3.00 level.

Entry is from current levels.

📝Trading Plan

Entry: Entry is from current levels.

Stop Loss: 3.0855

Target: 3.36

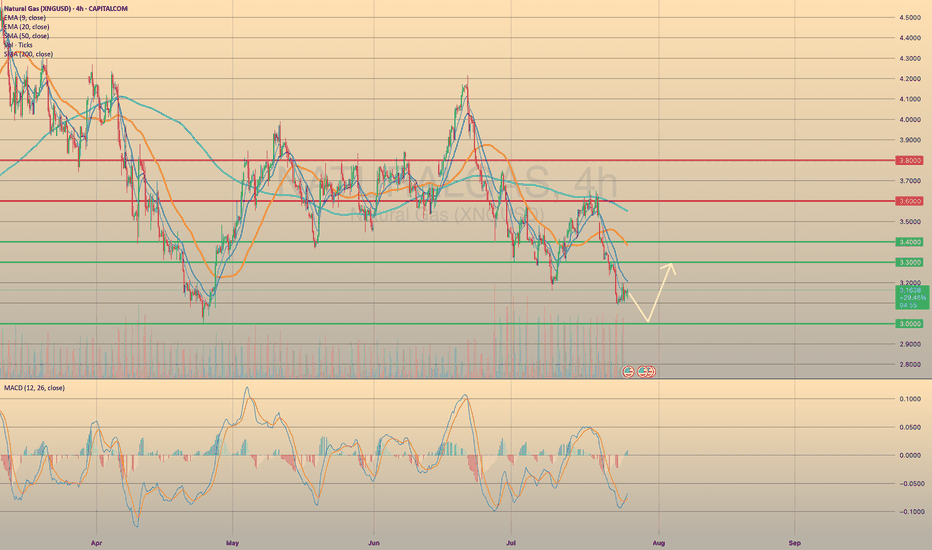

Natgas long term target 4Natural Gas (NATGAS) | 4H Chart Analysis

We are seeing a strong technical setup developing on Natural Gas. Price has recently bounced off a key ascending trendline support around the 3.00–3.10 area, with clear higher timeframe structure still intact.

Trade Plan:

Entry: Around 3.10, after confirming support at the rising trendline.

Stop Loss: Below 2.94 support (invalidates the bullish setup).

Targets:

TP1: 3.32 (first resistance, previous highs)

TP2: 3.57

TP3: 3.79

Final TP: 4.04

Trade Rationale:

Strong trendline support and recent bullish reaction.

Clear stepwise resistance levels to take profit along the way.

Risk well-defined below previous swing lows and support.

Things to Watch:

A daily close below 2.94 would invalidate this long setup.

Monitor for bullish volume on up-moves and news catalysts (storage data, weather, etc.).

Personal note:

This is not financial advice, just sharing my technical view for educational purposes. Please do your own research and manage your risk!

Heatwave Fuels Breakout as Fundamentals AlignNatural Gas has reclaimed the spotlight with a sharp move above $3.56, breaking through a key resistance level as a heatwave grips large parts of the United States. With above-average temperatures forecast to persist into late July, demand for cooling remains elevated, significantly boosting power consumption across the board.

Supply remains tight despite elevated production levels. Liquefied Natural Gas (LNG) feedgas volumes are rising as export demand holds strong, keeping domestic stockpiles in check. While some temporary relief in demand could arrive next week, the broader outlook remains bullish. Weather models suggest persistent heat, and traders are increasingly positioning for sustained tightness in the balance of supply and demand.

Technical Setup:

• Key level breached: $3.48 (100-day EMA) decisively broken

• Current price zone: Approaching $3.57, the next major pivot

• Momentum: If bulls secure a weekly close above $3.57, the market could enter a longer-term uptrend with $3.65 and $3.80 in sight.

Takeaway: Natural gas traders should monitor weather patterns and storage data closely. Sustained heat could keep the rally intact, but short-term pullbacks may offer entry points for trend-followers.

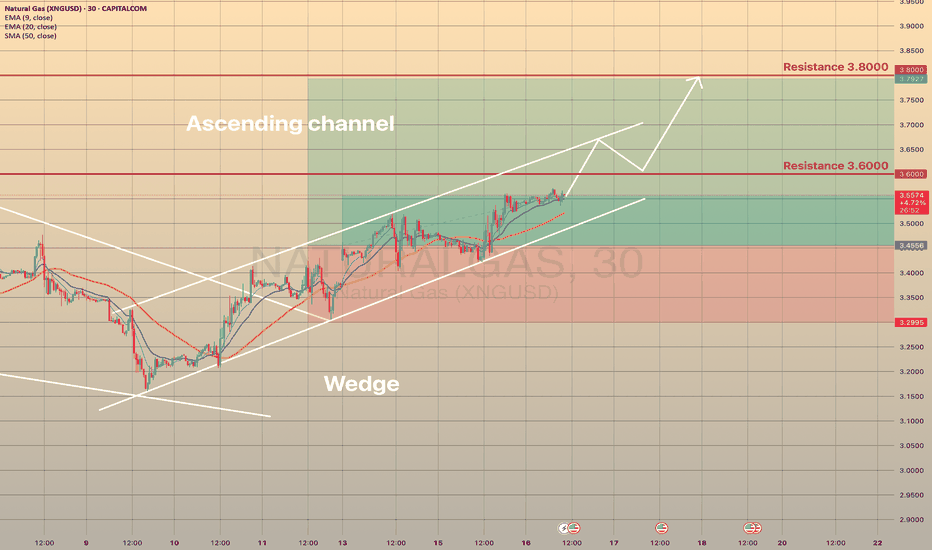

NATURAL GAS - STILL IN THE GAME TRADING IDEA UPDATE -

NATURAL GAS - STILL IN THE GAME🔥

The XNGUSD goes quite well, as predicted. It held the trendline and moving upwards slowly, but surely. Short-term support here is the EMA20 on 4h timeframe. The asset is just below 3.600 resistance level and sma200. Since the July 10, the asset seems to be moving within the ascending channel (pic 2). I expect that the price will break the 3.6000 resistance level, will go towards upper channel border and then, after quick retest, move towards 3.8000. Not a trading advice! Trade cautiously!

Natural Gas Spot Well trying to read this complex correction again and assuming this is larger x wave or f wave if diametric in intermediate degree and time confirmation yet to come if next high previous fall not passed with in that time, then new low again possible, Let see. Not a sebi registered analyst, just personal view

Gas Market Expectations: Seasonal Peaks, Storage MomentumNatural gas prices are largely aligned with historical norms, with the Q contract nearing its 15-year median as expiration approaches and summer-autumn 2025 contracts trading slightly above median levels but within the interquartile range. In contrast, winter 2026–27 contracts remain firmly above the upper quartile, pointing to persistent long-term risk pricing. Despite some normalization in 3-year forward pricing, the curve continues to show significant distortions at both short- and long-term horizons. On the fundamentals side, storage is projected to grow by +33 BCF in mid-July, with levels tracking well above the 5-year median. Weather-driven demand has begun to ease nationally, though regional deviations remain (especially in the Central and Mountain areas), highlighting the importance of localized heat trends in shaping market sentiment.

The expiration of the Q contract is approaching. Its price is now very close to the 15-year median on the expiration date. We expect high volatility in the near-term and upcoming U contracts. Prices for subsequent contracts have remained relatively unchanged. Autumn 2025 contracts are trading slightly above their historical median expiration values but remain within the interquartile range. Winter contracts for 2026 and 2027 continue to trade above the upper quartile.

Although 2025 contracts with three-year forward delivery have approached the price levels seen in comparable 2023 and 2024 contracts, the forward curve still shows a significant distortion in both the short-term (1–2 years) and long-term (5–6 years) delivery segments.

For Week 29 (July 14–20), a storage injection of 33 BCF is expected. The storage level remains confidently above the 5-year median. Injection rates continue on a positive trajectory. If the current supply-demand balance holds, peak 2024 levels may be reached. However, weather and seasonal patterns in late summer and early autumn remain a key limiting factor.

In the current Week 30, despite earlier expectations of a rise in HDD+CDD, weather conditions have stabilized around the 30-year median. Week 31 is forecast to be slightly above the median. The seasonal weather peak appears to have passed, with HDD+CDD values expected to decline further.

Looking at regional breakdowns for Week 30, there is a notable drop in HDD+CDD in the MOUNTAIN and PACIFIC regions, and a slight exceedance of the upper quartile in the Central regions. Other regions fall within the interquartile range for Weeks 30–31.

In the current Week 30, the supply-demand difference has dropped below the median. This is primarily due to decreased exports to Mexico and continued growth in domestic production. LNG exports remained stable.