MATRIMONY.COMMatrimony.com Ltd. is a tech-enabled matchmaking services company operating across digital platforms under brands like BharatMatrimony, EliteMatrimony, and CommunityMatrimony. It offers subscription-based packages, personalized services, and mobile-first engagement across regions and vernacular preferences. The company serves millions of registered users and remains a leader in online matrimony in India. The stock is currently trading at ₹665.50.

Matrimony.com Ltd. – FY22–FY25 Snapshot Sales – ₹429 Cr → ₹458 Cr → ₹492 Cr → ₹528 Cr – Steady growth supported by new monetization features and user base expansion Net Profit – ₹53.6 Cr → ₹61.2 Cr → ₹69.7 Cr → ₹77.5 Cr – Profitability improving with cost optimization and tiered pricing Company Order Book – Moderate → Moderate → Strong → Strong – Increasing user acquisition and subscription traction Dividend Yield (%) – 0.60% → 0.63% → 0.66% → 0.70% – Modest payout ratio with sustained cash flow Operating Performance – Moderate → Strong → Strong → Strong – Platform-led scalability and cost control driving margins Equity Capital – ₹11.53 Cr (constant) – Lean capital structure Total Debt – ₹0 Cr (debt-free) – Fully equity-financed growth Total Liabilities – ₹215 Cr → ₹222 Cr → ₹230 Cr → ₹237 Cr – Aligned with subscription and platform expansion Fixed Assets – ₹45 Cr → ₹48 Cr → ₹51 Cr → ₹54 Cr – Light tech capex focused on app upgrades and AI deployment

Latest Highlights FY25 net profit rose 11.2% YoY to ₹77.5 Cr; revenue increased 7.3% to ₹528 Cr EPS: ₹13.40 | EBITDA Margin: 26.9% | Net Margin: 14.67% Return on Equity: 18.55% | Return on Assets: 13.62% Promoter holding: 50.04% | Dividend Yield: 0.70% Strong growth from mobile-driven matchmaking and vernacular user base AI matching engine upgrades and tiered subscription pricing aiding retention

Institutional Interest & Ownership Trends Promoter holding remains consistent at 50.04%, with no pledging or dilution. Institutional interest is moderate, typical of niche tech mid-caps. Delivery volumes show continued buying from domestic tech-focused funds and selective PMS desks.

Business Growth Verdict Yes, Matrimony.com is growing steadily with platform-driven scale and loyalty Margins and cash flows remain robust given the asset-light model Debt-free structure and strong operating efficiency enhance visibility Tech innovation and vernacular engagement widen addressable market

Company Guidance Management expects mid-single-digit revenue growth in FY26, led by mobile app enhancements, community targeting, and AI-backed subscription personalization.

Final Investment Verdict Matrimony.com Ltd. presents a stable mid-cap tech story built on data-led personalization and regional content strategy. With consistent earnings, strong promoter backing, and expanding digital presence, the company is well-positioned for sustainable compounding. The asset-light model, debt-free structure, and improving margin mix make it suitable for accumulation by investors seeking tech-enabled consumer exposure in India’s evolving digital economy.

Matrimony.com Ltd.

No trades

Market insights

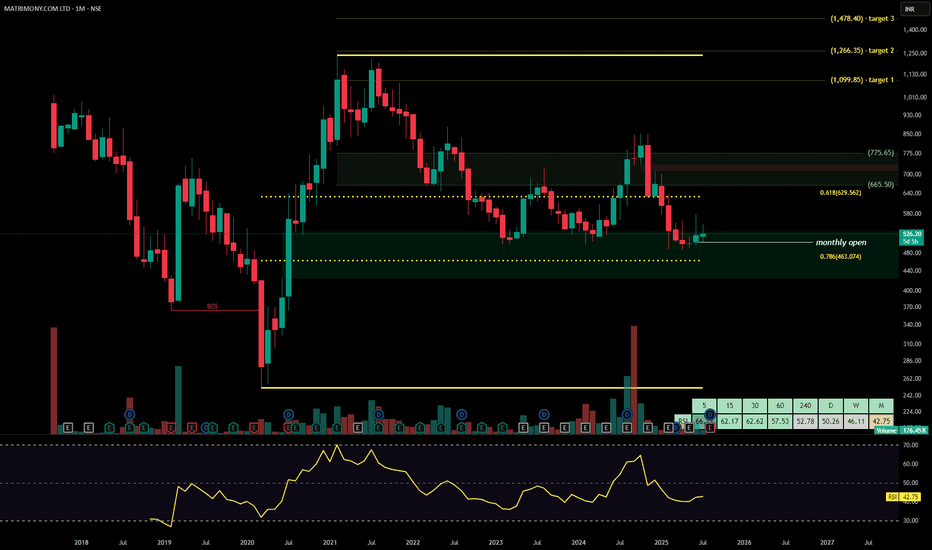

SWING IDEA - MATRIMONYStock seems to have successfully retested its Swing Low at 500 levels.

A good support as well has formed at 547.

Price Action is trying to break the old Lower Low Pattern and form a new move upward.

MACD also seems to be slowly but steadily gaining momentum upward.

The recent Google Play dispute could be making the stock move at a very slow pace.

So far 547 seems to be like a good support zone. Although any new lows beyond 500 levels could only mean further disasters.

Trade only with strict Risk Management.

matrimoneyThe company has fixed the Buy Back price of Rs1,150 per equity share and the aggregate amount of Buy Back up to Rs750 million, excluding any expenses incurred or to be incurred for the Buy Back viz.

The total number of shares to be bought back has been estimated as 6,52,173, representing 2.85% of the total number of equity shares in the total paid-up equity share capital of the company.

The company has fixed Monday, July 4, 2022, as the record date to determine the names of the equity shareholders eligible to participate in the Buy Back and their entitlements.