Market insights

Wipro limited Buy 253-255

SL 250

Target 270-285

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful?

How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

Wipro: Breakout & Boom!This is the daily timeframe chart of Wipro.

Wipro has been forming a falling wedge pattern, and the stock has given a breakout near the ₹250 level.

The breakout has also occurred above the long-term support zone of ₹225–₹240, which strengthens the bullish structure.

If this momentum continues, then any dips from the current levels may offer strong risk-reward opportunities and potentially lead to a bigger rally.

In the shorter timeframe, the potential upside target for Wipro stands near the ₹280 level..

Thank you.

WIPRO FALLING WEDGE CHART PATTERN BREAKOUT [ BUY SIDE ]The latest price chart highlights a Falling Wedge pattern, a classic bullish formation that often signals the downtrend is losing strength and a breakout to the upside could be near. The stock has been consolidating within the wedge, and a breakout above the resistance line could confirm a strong upward move.

WIPRO 1D Time frame📊 Wipro Daily Snapshot

Current Price: ₹256.50

Change: Up 2.97% from the previous close

Volume: 804,499 shares traded, significantly higher than the 50-day average of 369,496

MarketWatch

🔎 Key Levels

Resistance: ₹253.70 (short-term)

Support: ₹239.55 (short-term)

52-Week High: ₹324.55 (January 23, 2025)

52-Week Low: ₹239.55 (recent support level)

📈 Technical Indicators

RSI (14): Approximately 75 — indicates overbought conditions

MACD: Positive — suggests upward momentum

Moving Averages: Trading above 5-day (₹255.97), 50-day (₹248.47), and 200-day (₹247.12) SMAs — bullish trend

Stochastic Oscillator: Indicates overbought conditions

ADX: Approximately 17.49 — suggests a weak trend strength

Top Stock Research

📌 Market Sentiment

Catalysts: Positive market sentiment, with Wipro outperforming key competitors like HCL Technologies and Tata Consultancy Services in recent sessions

MarketWatch

Sector Performance: IT sector showing strength, with Wipro leading gains among peers

📅 Outlook

Bullish Scenario: Sustained trading above ₹253.70 could lead to a push toward ₹277.65 (long-term resistance)

Bearish Scenario: A drop below ₹239.55 may test support around ₹234.20 (mid-term support)

WIPROWIPRO- Weak structure

Market Cap

₹ 2,50,596 Cr.

Current Price

₹ 239

High / Low

₹ 325 / 225

Stock P/E

18.6

Book Value

₹ 79.1

Dividend Yield

2.51 %

ROCE

19.5 %

ROE

16.6 %

Face Value

₹ 2.00

Price to book value

3.02

Intrinsic Value

₹ 141

PEG Ratio

8.13

Price to Sales

2.81

Debt

₹ 19,204 Cr.

Debt to equity

0.23

Int Coverage

12.8

Reserves

₹ 80,736 Cr.

Promoter holding

72.7 %

Pledged percentage

0.00 %

EPS last year

₹ 12.5

Net CF

₹ 2,502 Cr.

Price to Cash Flow

14.8

Free Cash Flow

₹ 15,651 Cr.

OPM last year

20.2 %

Return on assets

10.8 %

Industry PE

28.0

Sales growth

0.41 %

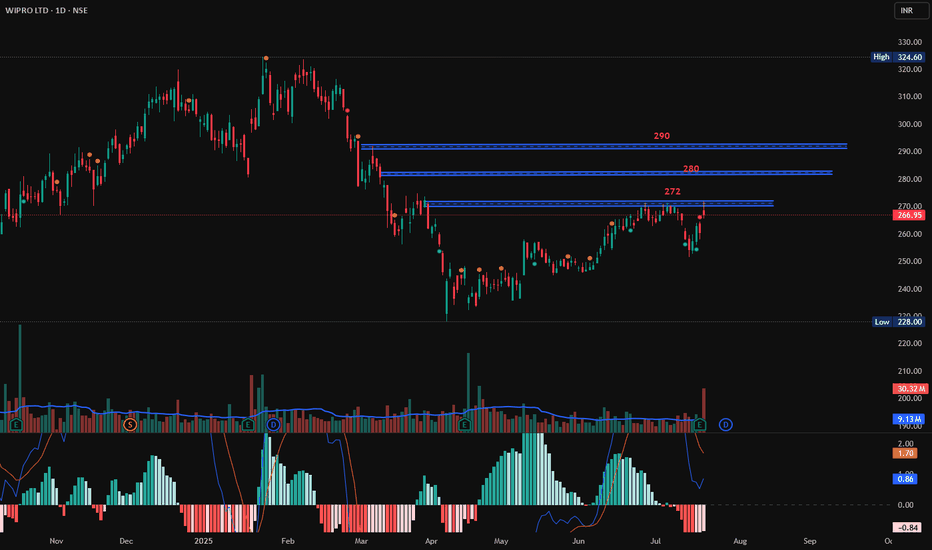

Wipro at Resistance, Long, 1DWipro has shown huge volume traded today however it has not broken a resistance which is at 272. If it breaks 272 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then enter at 272 with small targets of 280 and 290.

Entry: 272 (only at Bullish candlestick pattern)

Target1: 280

Target2: 290

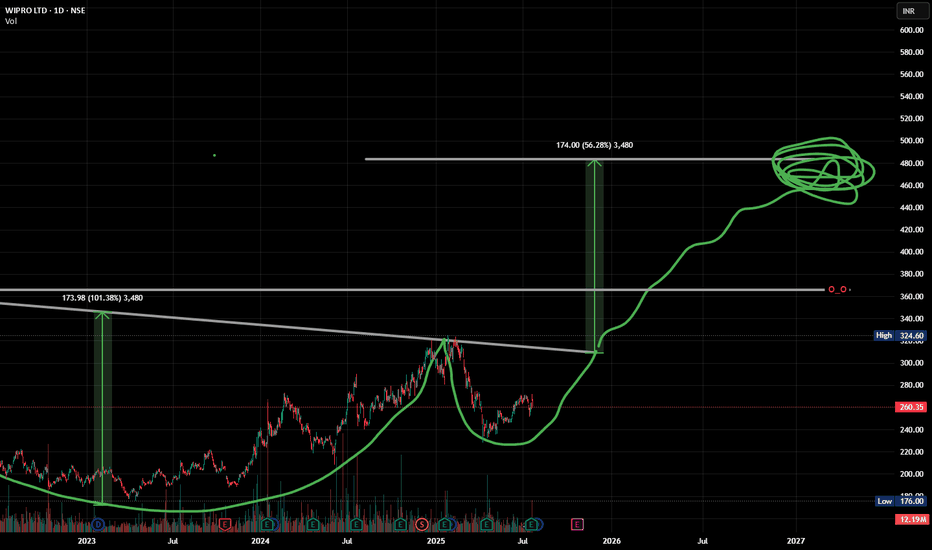

WIPRO & the Squiggle Prophecy Drew this green curve a year ago just for vibes… and WIPRO said “bet.”

Now it’s casually forming a monstrous cup, heading toward the ₹320 neckline.

If that breaks, we might see ₹370+, and maaaybe ₹480-ish… ish. Idk. Don’t ask me. Ask the squiggle.

Hopefully the squiggle squiggle prophecy holds true and I make more money lmao 💸

📈 When price action meets prophecy.

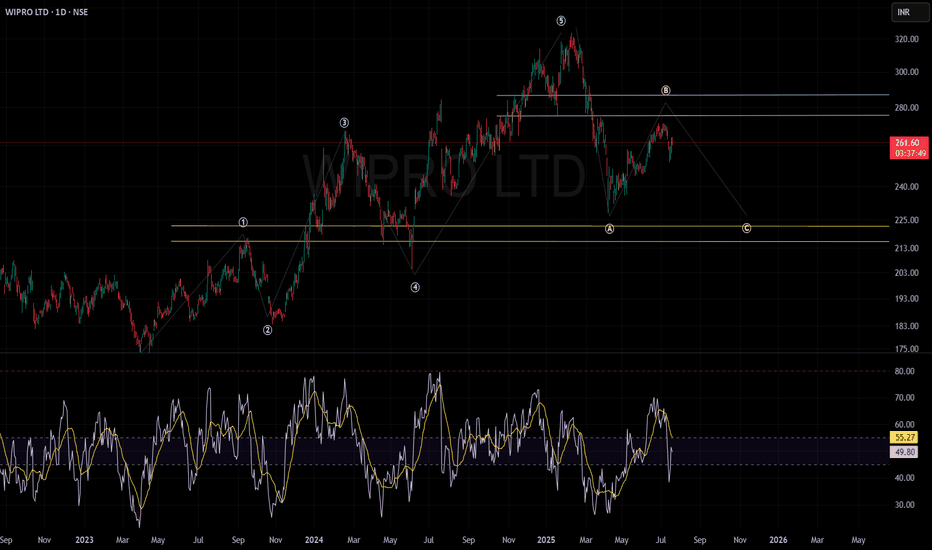

WIPRO CAN STILL FACE SOME PRESSUREWIPRO LTD.

Wave Structure:

The chart depicts a well-defined Elliott Wave pattern, illustrating a completed five-wave impulse sequence succeeded by a classic ABC corrective phase.

Wave B retracement appears to be underway, with resistance anticipated around the ₹275–₹285 zone.

Support & Resistance:

Key resistance levels are established at ₹275–₹285, which historically coincided with selling pressure and reversal zones.

Major support zones are highlighted between ₹210–₹225, a region with repeated buying interest and robust price recovery in the past.

Technical Outlook:

The current price structure suggests continued corrective bias, with a probable move towards the lower support band (₹210–₹225), barring any decisive reversal above the key resistance.

Unless momentum breaks out above ₹285 with conviction, the base scenario remains cautious to bearish.

My analysis is anchored in classical price action and Elliott Wave theory to identify potential market inflection points.

Sentiment:

The prevailing market sentiment remains neutral to negative as the price fails to breach significant resistance and is trading below the Wave B peak.

A shift in momentum can only be confirmed if there is sustained price action above resistance with increased volume.

Disclaimer:

This analysis is strictly for educational and informational purposes, not intended as trading or investment advice.

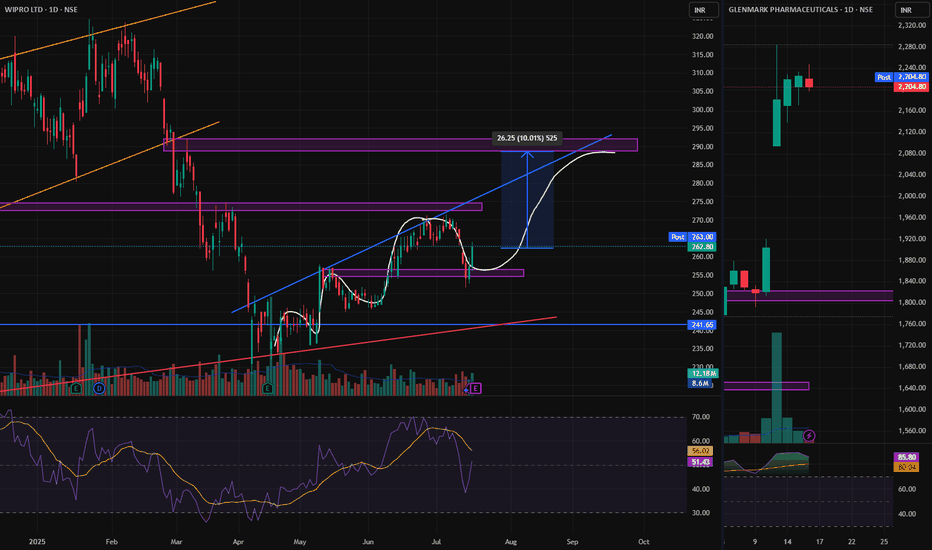

Wipro AT Best Support Zone These are two daily timeframe charts of Wipro .

In the first chart : Wipro is trading within an ascending parallel channel, with the lower boundary positioned around the ₹251–₹254 zone.

Wipro has previously respected the Fibonacci golden zone, and the stock is once again approaching this key retracement area. A potential bounce from this zone is likely if the level is respected again around 254 near .

If this level is sustain , then we may see higher Prices in Wipro.

Thank You !!