MOH Cup and Handle Pattern FormedMOH has had a cup and handle chart patterns form over the last couple of months while bouncing off resistance around 151. The handle portion looks to be complete and it might be primed for a breakout soon. Watching for entry on the options below.

19Dec2025 175c @ 22.4

MOH trade ideas

Molina Healthcare Stock Chart Fibonacci Analysis 081525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 164/61.80%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If you want to prefer long term range trading, you can set the time frame to 1 hr or 1 day

Bearish Breakdown or Oversold Rebound? MOH at Critical Level!

## 🧨 MOH Weekly Trade Alert: RSI 11.1?! Bearish Setup Unfolding 📉

Molina Healthcare (\ NYSE:MOH ) just hit **extreme oversold** levels:

🔻 **Weekly RSI: 11.1**

📉 **Daily RSI: 22.7**

📉 **Volume: Just 0.4x Last Week**

⚠️ Options Flow: Heavier **PUT action at \$150**

💡 VIX at 16.8 – great conditions for premium trades.

---

### 🔥 Trade Idea: Naked Put

🎯 Strike: **\$140**

💰 Entry: **\$0.90**

🎯 Profit Target: **\$1.80 (100%)**

🛑 Stop Loss: **\$0.45**

📅 Expiry: **2025-08-15**

**Sentiment**: 🐻 **Moderate Weekly Bearish**

**Confidence**: ⚙️ 65%

💬 RSI this low could mean a **dead cat bounce** – but weak volume says **more pain may come**...

---

## 🏷 Suggested Hashtags/Tags for TradingView:

```

#MOH #OptionsTrading #PutOptions #BearishSetup #RSI #Oversold #WeeklyAnalysis #HealthcareStocks #VolatilityPlay #StockSignals #PremiumSelling

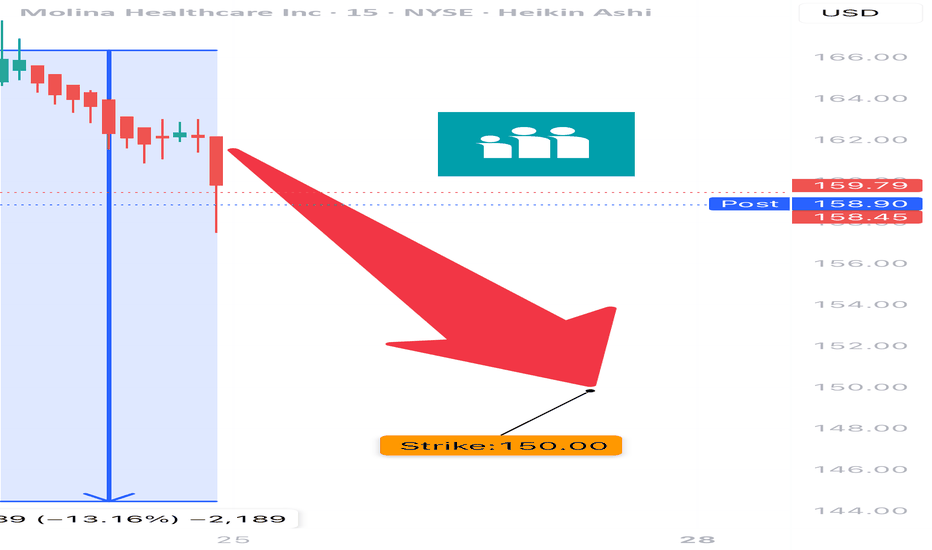

MOH PUT TRADE ALERT (07/24)

🚨 MOH PUT TRADE ALERT (07/24) 🚨

📉 Extreme Oversold. Institutional Selling. Setup is Real.

🧠 Key Stats:

• RSI: 13.2 = insanely oversold

• Volume: 🔺2.6x last week = institutions dumping

• Put/Call Ratio: 0.33 → heavy bearish bets

• VIX: Low → IV still cheap 💰

🔥 TRADE IDEA

🔻 Buy MOH $150 PUT exp 8/15

💰 Entry: $4.20

🎯 Target: $8.40

🛑 Stop: $2.50

📈 Confidence: 75%

📊 Why this works:

• Everyone’s selling, and the chart confirms it

• IV still low → great R/R for puts

• Only risk? Dead-cat bounce — use stop.

🧨 Execute at open — momentum is accelerating.

#MOH #PutOptions #BearishSetup #OversoldRSI #UnusualOptionsActivity #TradingView #InstitutionalSelling #SmartMoney #SwingTrade #WeeklyOptions #ShortTheBounce

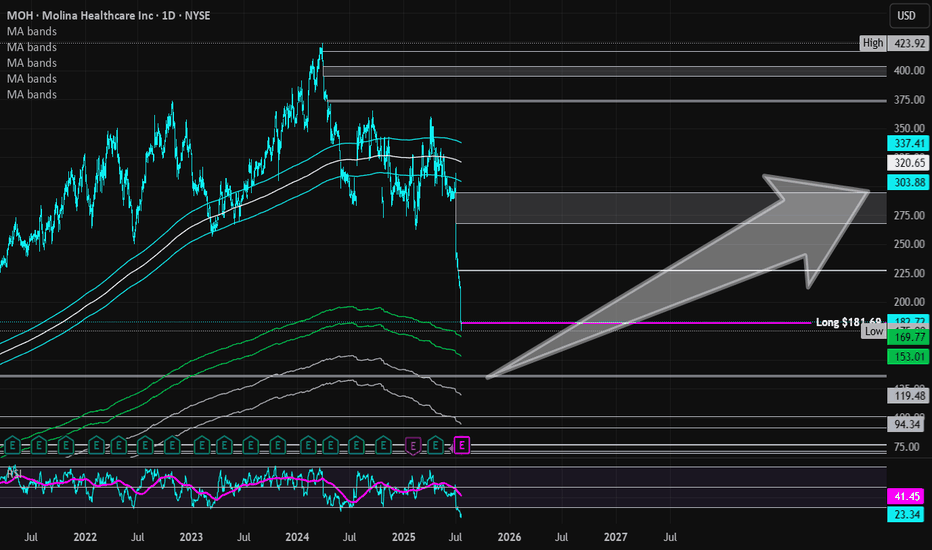

Molina Healthcare | MOH | Long at $181.69Healthcare providers and services are at a major discount right now: and may be discounted even more this year. I am personally buying and long-term holding the fear, knowing the baby boom generation is going to utilize our healthcare system at a rate unseen in modern times. While the price discounts are valid "right now" given the current political administration's cuts, long-term it is far from valid... The strategy I am using with healthcare stocks ( NYSE:MOH , NYSE:CNC , NYSE:UNH , NYSE:ELV , etc) is cost averaging: not buying one single large position in an effort to predict bottom but buying smaller positions over time to create a cost average "near" bottom. If you are a day trader or want a quick swing in healthcare, I don't think it's going to happen for a bit. But those not entering in the coming months / year will likely miss out on a very large healthcare boom - especially when AI truly enters the picture in this sector...

Fundamentally, Molina Healthcare NYSE:MOH is a very strong company. Low debt-to-equity (.9x), P/E of 8.8x, quick ratio of 1.7x, $41 billion in revenue in 2024. Yes, there will be issues in the near-term due to Medicaid and other funding cuts. But long-term, this sector is primed to benefit from an aging population.

So, while NYSE:MOH is in a personal buy zone at $181.69, I don't think this is necessarily bottom. I anticipate this stock to drop even further, eventually closing the daily price gap at $135.00. My next buys are in the $150's and $130's, thus cost averaging into a larger position. For true value investors, those prices and anything below is a steal. Today's negative healthcare sector noise is loud, but it does not represent the future.

Targets into 2028:

$226.00 (+24.3%)

$290.00 (+59.6%)

Oooh MolinaMolina has a safe and clean looking chart. I don't see price getting much below the marked level of ~$250, if it even goes there.

The longer it consolidates the lesser the chance of price going there which I think is already the case here (as the consolidation 'washes' out the strength of the downtrend).

From here to $250 is a ~17% drop, meaning low risk meaning higher position size.

As always no investment advice, but I see this platform a bit like my investment diary so you already now what I'm going to do.

Bullish continuation NYSE:MOH is looking at a bullish continuation after the stock saw a break above the falling wedge formation, confirming the upside continuation over the longer-term period. Strong bullish break above 340.00 further confirms the upside.

Long-term MACD is looking at a strong long-term bullish momentum after the MACD/signal line is rising and histogram is positive.

Stochastic has been rising and is in a steady state, indicating strong bullish momentum in the mid-term.

23-period ROC is rising and staying above the zero line. Directional movement index is strong bullish.

Ichimoku is strong and has confirmed a three bullish golden cross

MOH long term potentialMOH has corrected nicely after a huge run. This is a stock that a few legendary investors have added as of late. If you expect medicare/medicade expenses to increase by 7% on average, and more people to sign up over time, this stock will hugely benefit. I note a basing at the most recent fib level. The weekly stochastic is resetting and the BBWP is indifferent. I expect a retest of 370$ rather quickly. This stock will also perform well if we get recession fears or other macro negative news.

$MOH longCheck out the price action in this chart!

We’ve perfectly corrected the last upward impulse and landed at the 61.8% Fibonacci retracement.

The price is supported by a horizontal support cluster .

On the last trading day, the price tested the 50-day SMA precisely.

So, IF last day's high and the 30-day SMA are broken to the upside, I expect the next bullish impulse to begin.

MOH with a cup-with-handle patternFundamentals :

Not the best and not the strongest of my screens, but relatively ok.

Technicals :

The only reason why I am taking this trade is because of the cup-with-handle pattern. I am letting that guide me for now despite the not-so-good fundamentals.

The trend is up...

Only risking a tiny 0.1%...

Symmetrical Triangle/HealthCareNeutral until broken with a trend in that direction. The resistance/red or support line/green must be broken.

Orange type are targets for a beak to the downside and T1 in larger that T2 etc.

Green type are targets to the upside.

No recommendation.

Molina Healthcare, Inc. provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces. It operates in four segments, Medicaid, Medicare, Marketplace, and Other. The company served in across 19 states. The company was founded in 1980 and is headquartered in Long Beach, California.

52 Week Range

249.78

374.00

Day Range

287.43

295.51

EPS (FWD)

20.31

PE (FWD)

14.21

Div Rate (TTM)

-

Yield (TTM)

-

Short Interest

3.62%

Market Cap

$16.83B

Volume

258,605

MOH: steady healthy trend?A price action above 296.00 supports a bullish trend direction.

Increase long exposure for a break above 306.00, which is also its 50% Fibonacci retracement level.

The target price is set at 317.00.

The stop-loss price is set at 288.00 (support trendline).

Like the higher highs and higher lows.

Earnings BeatBut price was in a rising wedge.

Seems as if earnings will often break a rising wedge whether the company beats or misses the numbers.

Both trendlines slope up in this pattern and converge at the apex.

Rising wedges cause too much supply.

There are more rising wedges well below price in this chart.

No recommendation.

W pattern that was almost to the 1.272 when this pulled back. Valley 2 is lower than valley 1 and it was looking like a Nen-Star.

MOLINA HEALTHCARE INC bullish, broke the resistance levelComment:

MOLINA HEALTHCARE INC broke the resistance 361.46 level from August 2022.

Ichimoku Trend Analysis ( AFOBAY STRATEGY):

- Kumo (Senko span A and B) up

- Kijun sen up

- Tenkan sen up

- Chiko span above candles

Next Scenario:

411.78 level is also a monthly pivot point .

Symmetrical Triangle/PC Ratio Chart to Help with Market TimingThis triangle looked as if it would break to the downside. Now price is back inside the structure but a confirmed downtrend was never established.

This is an example of why it is important to wait for a confirmed downtrend or a confirmed uptrend after the break of a pattern.

Volume declining but this is not unusual in a triangle or a flag pattern.

I do think MOH will go down eventually, but it is almost impossible to know which way this triangle will break.

I learned something new about timing market rallies versus oversold status. The market was very oversold before this bounce so it was a bit obvious it was coming.

But this put/call ratio chart is something I will also look at in the future and I did not know it was on here. This is a Put/Call ratio chart and the ratio is over the bands.

Thank you for the info markrivest (o:

No recommendation

Is Healthcare a Safe Haven?Price is still well above the .382 and also above the .236 of the long trend up.

Looking a bit toppy.

W pattern that has possibly terminated at the 1.113. Valley 2 is lower than valley 1. Looks and smells like a Bearish Shark.

(I have never smelled a shark but you know what I mean)

Be safe/No recommendation.

I have not seen much of anything in this market that looks safe right now. For some reason it does feel like some of the stocks at key levels of support post pull back or close to bottoms may have some upside, even if just temporarily.

This is too close to the top although I do like the stock.

***There are Rising Wedges well below current price.

Pennant like structure on the end of a long pole. This pattern is neutral until a trendline is broken. Watching for now.

ATH 361.25/Yearly low is 249.78/3 year low 102.85/Earnings 10-25 AMC/Short interest is less than 2%