Ticker: $SAR Timeframe: DailyTicker: NYSE:SAR

Timeframe: Daily

Price is coiling inside a broad compression structure with rising demand from the lows. This is a classic volatility contraction environment.

Key Observations

Higher lows since November → buyers defending structure

Descending resistance still intact → patience required

No breakdown despite market volatility → relative strength

Levels

Demand: ~25–25.5

Acceptance zone: ~28.5–29

Break & hold above resistance opens path toward measured expansion (~38–39)

VolanX Protocol Read

Compression regime detected

Liquidity sweep already printed

Waiting for acceptance, not first breakout

Risk defined structurally, not emotionally

This is not about predicting.

It’s about being prepared when volatility returns.

#technicalanalysis #priceaction #marketstructure #defense #wavervanir #volanx #tradingview

Market insights

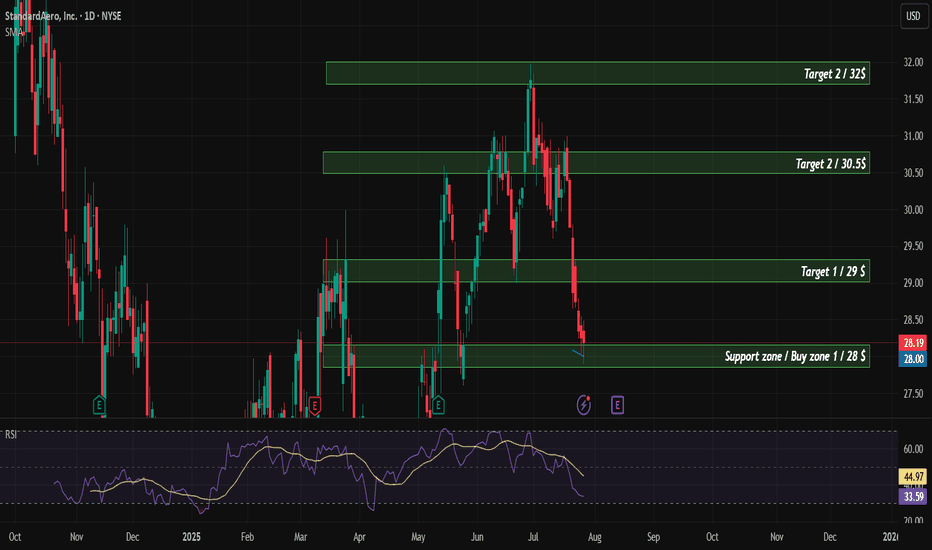

SARO STOCK - Is it heading for new highs ? Good Morning Everyone,

As of October 22, 2025, analysts have a consensus rating of "Moderate Buy" for StandardAero, Inc. (SARO)

. The average 12-month price target is $34.42, with a potential upside of 24.85% from the current price of $27.57. A more recent average brokerage recommendation (ABR) is 1.85, up from 1.75 a month ago, based on 13 brokerage firms. Insider trading activity shows that on October 10, 2025, an insider sold a significant number of shares, which could be a point of concern for investors.

Personal target set at 34.05$

Trade safely!

Enjoy

Bullish - StandardAero (SARO)📈 Why I’ve started building a position in StandardAero (SARO)

Some of you have been asking what I’m buying next for my long-term portfolio, so here’s one I’m quietly excited about.

I’ve started accumulating SARO, a relatively new listing (IPO’d Oct 2024) that specialises in aircraft engine and airframe maintenance — known as MRO (maintenance, repair & overhaul). These guys are one of the largest independent MRO providers in the world, with military, commercial, and business aviation clients.

So why SARO?

▶️ First: They’re starting to win serious defence contracts.

They’ve recently secured:

A $315M U.S. Navy engine contract (E-2D Hawkeye)

An $80M turbine engine contract for the U.S. surface fleet

And they’re in line to build Black Hawk helicopters in the UK if the NMH programme goes ahead. That deal alone would create 600+ jobs in Gosport.

▶️ Second: They’re small, but not unknown.

At a $10B market cap, SARO is still tiny compared to defence giants like BAE ($78B). But big money is already circling. The reason I found this opportunity in the first place, is due to monitoring closely 'Theleme Partners' (a hedge fund co-founded by Rishi Sunak before politics) - they just opened a position. So did T. Rowe Price, Two Sigma, and Vanguard.

▶️ Third: Macro tailwinds.

UK and global defence spending is rising rapidly. The UK has pledged to hit 2.5% of GDP by 2027, with a fresh £15B aimed specifically at submarines and nuclear support. If SARO lands even one meaningful UK MoD contract, which is very possible through its UK-based Vector Aerospace arm... it could seriously pay off.

💡 How I’m playing it:

This is a long-term hold for me personally and I’ll look at dollar-cost averaging into my position.

Short-term, I’ve marked targets around $32, $35 and $38 for potential profit-taking zones for those trading shorter holds.

Long-term, I’m holding a big chunk in case we see SARO grow into something much bigger.

It’s not without risk:

🔴 High post-IPO debt

🔴 Execution risk on current contracts

🔴 ... and the gamble that they secure government defence work all need to be considered.

But that’s part of the calculated upside here.

I’m sharing this because I think SARO is an early-stage contender worth watching and one that fits well into a defence-heavy decade ahead.

Curious to know if anyone else is looking at this one?

#LongTermInvesting #DefenceStocks #SARO #MarketInsights #DCA #MRO #UKDefence #InvestingStrategy