Will Japanese Yen get stronger?NZD/JPY - Price is above the SMA 30 CLOSE for the last 19 days. 12.2.2025 - 17.2.2025 price reject the last demand zone and fall more than 2% in range. Now price is in the newest demand zone. We can expect price move between the demand zone before falling to the lowest price of 5.8.2024 at 83.032.

New Zealand Dollar / Japanese Yen

No trades

Market insights

NZDJPY On The Rise! BUY!

My dear followers,

This is my opinion on the NZDJPY next move:

The asset is approaching an important pivot point 87.373

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 87.611

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZD/JPY BEST PLACE TO BUY FROM|LONG

NZD/JPY SIGNAL

Trade Direction: long

Entry Level: 86.841

Target Level: 87.466

Stop Loss: 86.425

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZDJPY: Oversold Market Confirmed 🇳🇿🇯🇵

There is a high chance that NZDJPY will pullback from the

underlined horizontal daily demand zone.

A formation of a bullish imbalance candle on an hourly time frame

suggests a strong buying pressure from that.

Goal - 83.3

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDJPY to find sellers at the current market price?NZDJPY - 24h expiry

The bearish engulfing candle on the daily chart is negative for sentiment.

Previous resistance located at 87.80.

87.70 has been pivotal.

Short term oscillators have turned negative.

We look for a temporary move higher.

We look to Sell at 87.67 (stop at 88.00)

Resistance: 87.66 / 87.88 / 88.13

Support: 87.32 / 87.16 / 86.80

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bearish drop off?NZD/JPY has rejected off the resistance level which is a pullback resistance and could potentially drop from this level to our take profit.

Entry: 87.72

Why we like it:

There is a pullback resistance level.

Stop loss: 88.32

Why we like it:

There is a swing high resistance level.

Take profit: 86.76

Why we like it:

There is a pullback support that is slightly below the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZD-JPY Local Long! Buy!

Hello,Traders!

NZD-JPY is trading in a

Local uptrend and the pair

Will soon retest a horizontal

Support level around 87.200

From where we will be expecting

A local rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish bounce?NZD/JPY is falling towards the pivot which acts as an overlap support that aligns with the 61.8% and the 38.2%Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 87.24

1st Support: 86.76

1st Resistance: 88.06

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDJPY: Move UP is Expected! 🇳🇿🇯🇵

One of the setups that we discussed on the today's live stream

is on NZDJPY.

The price formed an inverted head and shoulders pattern

and violated its neckline after London session opening

on an hourly time frame.

With a high probability, the price will continue rising

and reach 87.95 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDJPY to continue in the upward move?NZDJPY - 24h expiry

Our short term bias remains positive.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

The sequence for trading is higher highs and lows.

Offers ample risk/reward to buy at the market.

20 4hour EMA is at 87.80.

We look to Buy at 87.81 (stop at 87.48)

Our profit targets will be 88.81 and 89.01

Resistance: 88.13 / 88.50 / 89.00

Support: 87.75 / 87.48 / 87.16

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Applying the Nx BIAS indicator to NZDJPY After my latest thread about the 🛡️ Nx BIAS 🛡️ indicator for determining market bias, I decided to take a scalp trade as a backtesting exercise on the NZDJPY pair.

Entry details:

Defined the DOL and Invalidation levels using the Nx Bias indicator on the 1H timeframe.

Identified the area of interest and executed the entry on the 5m - 1m timeframe for the same pair.

Next steps and forward testing:

I will be testing this indicator more extensively. The main goal is to rely solely on it for bias determination under live market conditions to evaluate its real-time performance, moving beyond backtesting results.

Disclaimer: Do Your Own Research (DYOR).

Best regards,

Note: The indicator is not yet available and will be released soon under the name Nx Candle Bias.

NZDJPY Will Go Higher! Buy!

Please, check our technical outlook for NZDJPY.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 87.897.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 88.123 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

NZD/JPY - Bearish Momentum Aligned with HTF SupplyPair: NZD/JPY

Bias: Bearish

HTF Overview (4H+):

• Price cleared buy-side liquidity into a higher-timeframe order block.

• Momentum shifted bearish as supply held, giving us downside intent.

MTF (30M–1H):

• From that supply zone, we waited for a shift in structure (CHoCH).

• Momentum aligned bearish, with price taking out previous buy-side liquidity.

• A refined OB above was mitigated, reinforcing continuation downside.

LTF Execution (5M):

• Dropping to the lower timeframes, we caught an initial shift in trend to align with the dominant bearish flow.

• Both HTF + MTF + LTF now in sync → direction is confirmed.

• Next focus: wait for a clean buy-side liquidity sweep + OB mitigation to attend the next sell entries.

• Targets staged: 5M lows → 30M lows, depending on delivery.

Mindset Note: The flow is clear — bearish momentum is in control. No forcing; let price sweep liquidity, mitigate, and then ride with smart money direction.

NZD_JPY Will Grow! Buy!

Hello,Traders!

NZD-JPY is trading in a

Strong uptrend and the

Pair made a confirmed

Bullish breakout of the

Key horizontal level

Of 87.700 so we are

Bullish biased and a

Further bullish continuation

Is to be expected on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

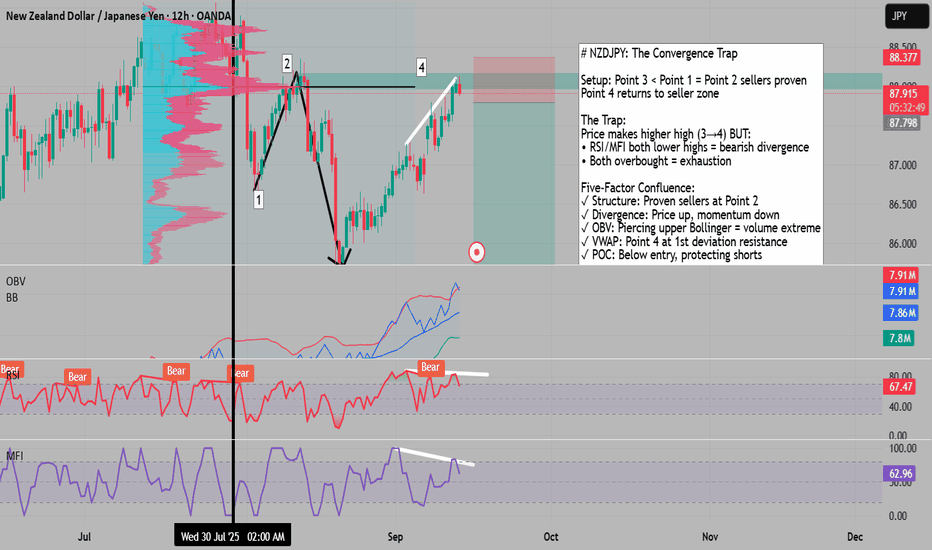

The Convergence Trap: NZDJPY's Five-Factor Reversal# The Convergence Trap: NZDJPY's Five-Factor Reversal

## Seller Territory Established (Points 1→3)

The market structure reveals clear seller dominance: Point 3 closed below Point 1 , confirming Point 2 as proven seller territory . This isn't just resistance - it's a level where sellers previously demonstrated their power to drive price lower. Point 4 marks the critical return to this battleground.

## The Higher High Deception

Price created a higher high on the 3→4 swing , but this apparent strength masks underlying weakness:

• RSI: Lower high (bearish divergence)

• MFI: Lower high (bearish divergence)

• Both oscillators: Overbought territory

This combination reveals the trap: price pushed higher but with exhausted momentum . Buyers are trying harder but achieving diminishing results - the hallmark of distribution.

## The OBV Warning Signal

Using Bollinger Bands on OBV reveals a critical signal: price is piercing the upper border . This rare occurrence suggests:

• Volume exhaustion at resistance

• Imminent selling pressure increase

• Shift from accumulation to distribution

When OBV hits extremes while price struggles at resistance, it typically precedes sharp reversals.

## VWAP Standard Deviation Analysis

Using the next major high as anchor:

• Point 2: Falls under 1st standard deviation

• Point 4: Precisely at 1st standard deviation

This alignment shows price repeatedly respecting the same mathematical boundary - a sign of algorithmic and institutional participation at these levels.

## The POC Advantage

The Point of Control sits below current price , meaning:

• Highest volume node supports short positions

• Buyers must push through heavy resistance to reach stops

• Institutional algorithms defend POC levels

Additionally, Bollinger Bands on price mark Point 4 as a potential extreme - another layer of resistance.

## Chaos Theory Timing

The Chaos Theory indicator identifies this exact point in price and time as optimal for entry. When mathematical models align with technical analysis, probability shifts dramatically in favor of the trade.

## Risk Management Framework

Entry: 87.914 (current level)

Stop Loss: 88.377 (0.66% risk)

Target: 85.051 (3.13% reward)

Risk/Reward Ratio: 1:4.74 (nearly 1:5)

Position Advantages:

• Five independent factors confirming reversal

• POC protection below entry

• Mathematical boundaries (VWAP, Chaos Theory) aligning

• Tight stop above proven resistance

## The Confluence Stack

This isn't just resistance - it's a convergence trap where:

1. Structure: Proven sellers at Point 2

2. Momentum: Dual bearish divergence + overbought

3. Volume: OBV extreme warning

4. Mathematics: VWAP deviation + Chaos Theory alignment

5. Market Profile: POC support for shorts

When this many unrelated indicators converge at one point, it creates what I call a "convergence trap" - buyers walk into a zone where every technical factor favors sellers.

---

Key Takeaway: The combination of exhausted momentum (divergences), volume extremes (OBV Bollinger pierce), mathematical resistance (VWAP/Chaos Theory), and market structure (proven sellers + POC) creates a high-probability reversal setup with nearly 1:5 risk/reward potential.

NZDJPY On The Rise! BUY!

My dear followers,

This is my opinion on the NZDJPY next move:

The asset is approaching an important pivot point 86.786

Bias - Bullish

Safe Stop Loss - 86.701

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 86.936

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDJPY Massive Bullish Breakout !

HI,Traders !

#NZDJPY is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

NZDJPY to find sellers at previous swing high?NZDJPY - 24h expiry

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

88.36 has been pivotal.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Selling spikes offers good risk/reward.

We look to Sell at 88.25 (stop at 88.58)

Our profit targets will be 87.25 and 87.05

Resistance: 87.89 / 88.20 / 88.36

Support: 87.50 / 87.17 / 86.63

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZD_JPY MOVE UP AHEAD|LONG|

✅NZD_JPY broke the key

Structure level of 87.760 while

Trading in an local uptrend

Which makes me bullish biased

And I think that after the retest

Of the broken level is complete

A rebound and bullish

Continuation will follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅