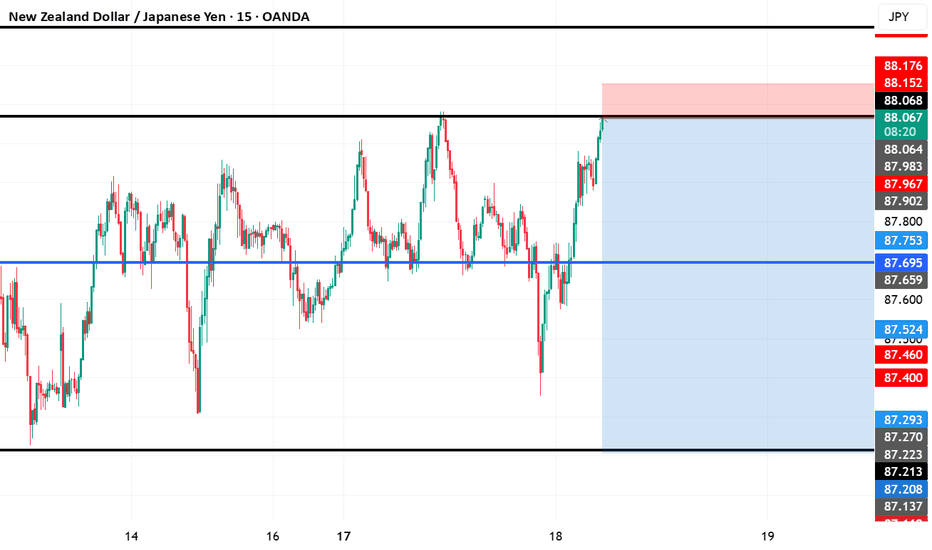

NZDJPY Poised To Start a Bearish Wave- BOJ Verbal InterventionNZDJPY Poised To Start a Bearish Wave- BOJ Verbal Intervention

NZDJPY completed a bearish harmonic pattern at 88.50

Price has already reacted and chances are for a short-term bearish move.

Despite this, the bearish pattern is clear, this move today is more attributed to the Japanese government’s top spokesman, Kihara, who signaled increased urgency to closely monitor FX markets adding to the possibility of intervention.

We can clearly see that many JPY pairs are moving lower and this move could continue further into the day. However, it remains a high-risk trade.

Main targets:

87.95

87.70

87.45

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

New Zealand Dollar / Japanese Yen

No trades

Market insights

Bearish drop off key resistance?NZD/JPY is rising towards the pivot, which aligns with the 61.8% Fibonacci retracement and could reverse to the 1st support.

Pivot: 88.17

1st Support: 87.55

1st Resistance: 88.48

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party.

NZDJPY: Premium Short Setup Below 89.00 – Seasonality + COT1. Macro Outlook

NZDJPY remains a cross strongly driven by risk dynamics: NZD typically behaves as a risk-on currency, while JPY is a classic risk-off safe haven. The current global environment — characterized by slowing economic momentum, yield volatility, and speculative position rotation — generally supports downside pressure on the cross, although with less linearity compared to the previous quarter.

2. COT (Commitments of Traders)

JPY

Non-commercial traders remain clearly net-long JPY, reflecting a structural preference for Yen strength.

However, weekly changes show:

• –8,589 long contracts closed

• +9,446 new short contracts added

→ This indicates profit-taking and a reduced bullish aggressiveness on the Yen.

NZD

Speculators remain heavily net-short NZD (44k shorts vs 23k longs).

But last week’s flows show:

• +11,287 new longs

• +10,792 new shorts

→ A rebalancing phase rather than a trend reversal; signals uncertainty.

COT Conclusion:

The structural bias remains bearish for NZDJPY, but the pro-Yen speculative impulse is slowing. This increases the likelihood of a short-term bullish retest before further downside continuation.

3. Seasonality

JPY

Historically strong in November–December.

NZD

Neutral-to-weak in November; slightly positive in December but unstable.

The seasonal differential favors NZDJPY weakness between late November and early December, consistent with a move back toward autumn lows.

4. Retail Sentiment

• 83% short

• 17% long

This extreme bearish clustering among retail traders increases the probability of a short-term upside squeeze before macro-consistent downside resumes.

Implication:

⚠️ Avoid selling in the middle of the range

✔️ Only sell from premium levels and with confirmation

5. Price Action

Since August, the pair has been trading inside a structural 84.8–89 range, with highs losing quality and repeated lows — a classic distributive profile.

The recent bounce into 88 pushed price back into upper supply without breaking bullish structure, creating an ideal setup for selling rallies.

RSI remains neutral/slightly bullish but fails to confirm a new high, suggesting a potential bearish divergence that supports the short bias.

🔻 Primary Bias: SHORT below 88.70–89.00

NZDJPY Buyers In Panic! SELL!

My dear subscribers,

My technical analysis for NZDJPY is below:

The price is coiling around a solid key level - 88.787

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 88.343

My Stop Loss - 89.041

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDJPY SELL SETUP1. Price tapped into supply.

(Top red zone)

2. It swept the previous high.

(Liquidity grab)

3. It broke structure down.

(Shift bearish)

4. Price pulled back into the same supply.

(This is your entry)

5. Stop goes above the sweep high.

6. Target the next demand zone below.

(Green zone)

NZDJPY the target hit now more gain cookingOur previous trading signal with a 1:3 risk-reward ratio has successfully reached its profit target.https://www.tradingview.com/chart/NZDJPY/Rr7VWeT9-NZDJPY-near-major-daily-support-zone/

The price has now conclusively broken through the noted resistance level and is currently consolidating within a defined range. The critical technical development is that this former resistance has now demonstrated supportive characteristics, having been tested and held firmly on two separate occasions. This successful retest suggests the completion of the validation phase, increasing the probability of continued upward momentum. The technical structure now supports a bullish continuation scenario, with the established support zone expected to serve as a foundation for the next potential advance.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Market Snapshot: US100, US500 & XAU/USD – Key Levels to Watch ThUS100 (Nasdaq 100) – Bearish Momentum Persists

The US100 continues to trade below the key 25,626 gap, confirming the Island Top formation. Bulls are struggling to reclaim territory as sellers maintain pressure.

Key Levels

Support: 24,980 – 24,720

Resistance: 25,350 – 25,620

Bias: Bearish below 25,626

Technical Outlook

Price is forming lower highs, and momentum remains weak. A break below 24,720 opens room for a deeper correction toward 24,300.

📈 US500 (S&P 500) – Sideways but Vulnerable

The S&P 500 is consolidating within a tight range, showing indecision as traders await U.S. data releases later this week.

Key Levels

Support: 5,220

Resistance: 5,310

Bias: Neutral → Bearish if 5,220 breaks

Technical Outlook

A clean break below 5,220 could trigger a sharper pullback toward 5,150, while recovery above 5,310 would strengthen bullish momentum.

🟡 XAU/USD (Gold) – Still Under Pressure Below $4,100

Gold has slipped below the $4,100 mark, with uncertainty around U.S. data and Fed rate expectations weighing on sentiment.

Key Levels

Support: 4,040

Resistance: 4,120

Bias: Bearish below 4,100

Technical Outlook

As long as gold stays below 4,100, sellers are favored. Watch for a retest of 4,040, where a bounce or breakdown will determine the next sharp move.

NZDJPY Reverse in Short positionReversal Pattern: Rising Wedge

A rising wedge reversal pattern has formed with clear divergence on the last two Higher Highs (HHs).

Price has already broken the previous Higher Low (HL) and created a Lower Low (LL) ,confirming bearish momentum and signaling a potential short entry setup.

Additionally, the latest monetary policy outlook and CFTC positioning data support JPY strength, which further strengthens the bearish bias.

NzdJpy Trade IdeaNJ is currently in a clean range. With price respecting the resistance level and crashing back below I'll personally be looking for price to continue that trend to the downside. At the moment price is bullish after pulling back so I'm personally waiting on that bullish pullback to flip back to bearish. If all goes well I'll look to get into a 1:3rr set up. If price is gonna continue ranging then we could expect price to tap back into 85.600.

NZDJPY – Bullish Momentum Building Up NZDJPY – Bullish Momentum Building Up

NZDJPY continues to climb higher after reclaiming the 87.30 support area, showing strong bullish momentum.

The pair is likely forming a bullish continuation structure, suggesting further upside in the short term.

A small pullback toward the 87.30–87.40 zone could offer buyers a chance to rejoin the move before price targets the next resistance zones at 88.00 and 88.60.

📈 Key Targets:

Target 1: 88.00

Target 2: 88.60

Momentum remains in favor of the bulls as long as the price stays above the support zone

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

NZD/JPY BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

NZD-JPY uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 86.923 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the NZ/JPY pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZDJPY - The Wall of Sellers Awaits!⚔️NZDJPY is once again approaching a massive resistance zone highlighted in red, an area that has rejected price multiple times in the past, acting as a strong supply wall.

📉As the pair nears this level , I’ll be looking for potential short setups, expecting a bearish rejection that could drive price back toward the lower support zone around the previous lows.

This range has defined the market for months, and until a clear breakout occurs, playing the range remains the optimal strategy, sell high, buy low.

Will the bears defend this zone one more time? 👀

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📊All Strategies Are Good; If Managed Properly!

~Richard Nasr

NZD/JPY BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

NZD/JPY is making a bearish pullback on the 10H TF and is nearing the support line below while we are generally bullish biased on the pair due to our previous 1W candle analysis, thus making a trend-following long a good option for us with the target being the 87.304 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Potential bullish rise?NZD/JPY is falling towards the pivot, which acts as a pullback support and could trigger a bounce toward the 1st resistance.

Pivot: 87.25

1st Support: 86.83

1st Resistance: 88.51

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDJPY to find buyers at market price?NZDJPY - 24h expiry

Prices have reacted from 85.89.

Short term oscillators have turned positive.

A break of the recent high at 87.32 should result in a further move higher.

Offers ample risk/reward to buy at the market.

The bias is to break to the upside.

We look to Buy at 87.01 (stop at 86.59)

Our profit targets will be 88.27 and 88.47

Resistance: 87.32 / 87.70 / 88.34

Support: 86.84 / 86.66 / 86.30

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDJPY the buy signal is still open now tp can hitAs observed, the price retraced from our entry zone near 86.30, testing our stop-loss level around 85.80. However, this area aligns with a historically significant support cluster for NZDJPY, as previously outlined in our analysis. We anticipate that the defense of this support level could catalyze a robust bullish reversal, providing the necessary momentum to drive the price toward our initial profit target.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Bullish bounce off pullback support?NZD/JPY has bounced off the support level, which serves as a pullback support that aligns with the 38.2% Fibonacci retracement and could rise from this level to our take-profit target.

Entry: 86.64

Why we like it:

There is a pullback support that aligns with the 38.2% Fibonacci retracement.

Stop loss: 86.64

Why we like it:

There is a pullback support level that aligns with the 61.8% Fibonacci retracement.

Take profit: 87.40

Why we like it:

There is a support level that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.