NZDUSD trade ideas

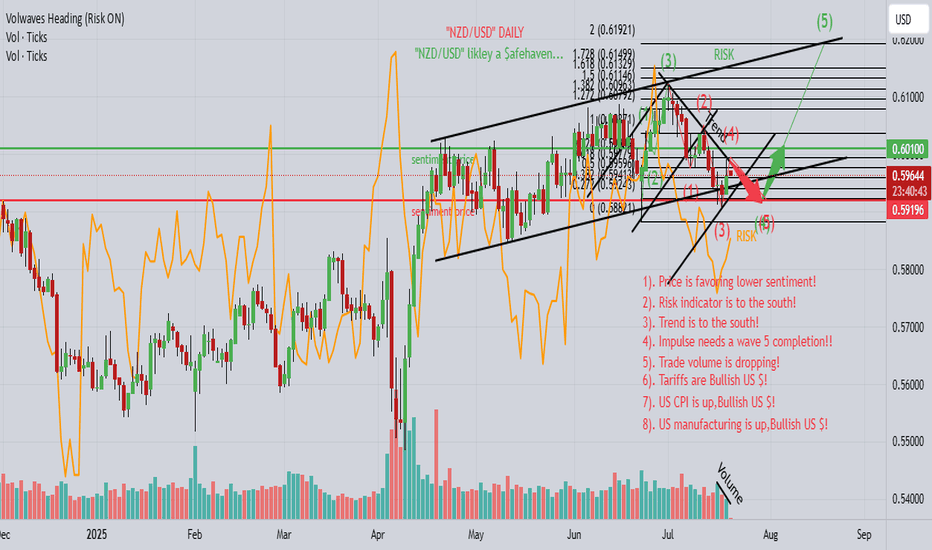

Broken up trend on NSDUSD Bearish continuation.Price has recently broke through the bottom of a diagonal up trend channel on the 4 hour chart. Price is also at a convergence with the 4 hr and 1Day time frame that signal a continuation of the down trend. After the 4hr trend line was broken, price retraced back to the uptrend line, consolidated and is showing signs of a continuation on the new down trend on the 4hr and 1 day time frame. Leading me to believe price will remain bearish today.

Set stops above 4hr diagonal trend line and let Profits run.

NZDUSD H4 | Bullish reversal for the KiwiBased on the H4 chart analysis, we can see that the price has bounced off the buy entry, which is a pullback support and could rise from this level to the take profit which aligns with the 61.8% Fibonacci retracement.

Buy entry is at 0.5896, which is a pullback support.

Stop loss is at 0.5845, which is a swing low support.

Take profit is at 0.5979, which is a pullback resistance that lines up with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

BUY : NZD/USD ( 3 wave pullback ) to continue the trend higher.I cancelled my last NZD/USD trade ( 5 pips profit ) due to NO follow through after NFP.

Another great chance to buy at better entry due to Daily AB=CD equal legs at 0.58436 and lower trend line also acts as resistance.

Buy : 0.5850

Stop : 0.5792

Profit : 0.5995 ( just before 78.6% Fib retracement )

Risk : 1/2.5

NZDUSD to find sellers at current market price?NZDUSD - 24h expiry

The bearish engulfing candle on the weekly chart is negative for sentiment.

Daily signals are mildly bearish.

20 1day EMA is at 0.5956.

Offers ample risk/reward to sell at the market.

The sequence for trading is lower lows and highs.

We look to Sell at 0.5959 (stop at 0.5984)

Our profit targets will be 0.5885 and 0.5875

Resistance: 0.5967 / 0.5986 / 0.6000

Support: 0.5943 / 0.5920 / 0.5900

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSD to continue in the downward move?NZDUSD - 24h expiry

There is no clear indication that the downward move is coming to an end.

Our short term bias remains negative.

50 4hour EMA is at 0.5931.

We look for a temporary move higher.

Risk/Reward would be poor to call a sell from current levels.

We look to Sell at 0.5920 (stop at 0.5941)

Our profit targets will be 0.5858 and 0.5848

Resistance: 0.5905 / 0.5930 / 0.5950

Support: 0.5881 / 0.5857 / 0.5830

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Ready to Rob the Kiwi? NZD/USD Bullish Breakout Plan🥝💚 NZD/USD Bullish Breakout Heist Plan 🟢💰 (Thief Trader Style)

🎭 Robbery Mission Activated – Code: Kiwi Uprising 💣📈

💥 Asset: NZD/USD

📍 Entry: 0.59400 (Breakout confirmed – the vault door’s open!)

🔐 Stop Loss: 0.58300 (Thief exit point – avoid the trap zone)

🎯 Target: 0.60500 (Cash-out point – grab the bags and vanish!)

🧠 Strategy: Layered Limit Orders a.k.a “Precision DCA Infiltration”

🧤 The Thief Trader is sneaking into the forex vaults once again — this time with eyes locked on Kiwi (NZD/USD). The bulls are loading up, and the breakout zone is showing green flags 🟢 — time to strike hard and clean 💰

🔥 Operation Details:

We’re stacking multiple limit orders like a pro thief would place decoys – distraction + precision = execution! Entry at 0.59400 is our main gate breach. Orders set in layers to trap liquidity zones below.

🚨 Stop Loss @ 0.58300 – tight enough to avoid getting caught, but wide enough to dodge fake traps.

🏆 Target: 0.60500 – that’s where the loot vault is sitting. Clean exit once we’re loaded with profits!

👀 Swingers & Scalpers Alert!

Only look LONG – no short robbing here!

🔁 Use trailing SL once in profit – protect your gold like a pro.

💡If cash is low – no panic, join the swing gang and glide in with patience & alerts. Smart robbers wait 🧠💼

📣 News Risk ⚠️

Avoid jumping during major news blast-offs.

Lock profits with trailing SL.

No panic entries — only sniper moves.🕵️♂️💥

❤️ Smash That BOOST Button 💥💪

Support the squad! More boosts = more heist plans, more clean money from the market streets 🚀📈

🎭 Stay sharp, rob smart — see you in the next plan, robbers 🤑🐱👤🎯

~ Thief Trader

NZDUSD H4 | Bullish reversalThe price is falling towards the buy entry, which is a pullback support level, and could bounce from this level to the upside.

Buy entry is at 0.5896, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 0.5845, which is a swing low support.

Take profit is at 0.5998, which his a pullback resistance that is slightly above the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

NZD/USD Holds Above May LowNZD/USD halts the decline from earlier this week to hold above the May low (0.5847), with a move/close above the 0.5920 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) region bringing the 0.6040 (61.8% Fibonacci retracement) to 0.6070 (61.8% Fibonacci extension) zone on the radar.

Next area of interest comes in around the July high (0.6120), but the rebound in NZD/USD may turn out to be temporary if it struggles to trade back above the 0.5920 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) region.

A breach of the May low (0.5847) opens up 0.5830 (38.2% Fibonacci retracement), with the next area of interest coming in around 0.5740 (78.6% Fibonacci retracement) to 0.5760 (100% Fibonacci extension).

--- Written by David Song, Senior Strategist at FOREX.com

NZDUSD What Next? SELL!

My dear subscribers,

This is my opinion on the NZDUSD next move:

The instrument tests an important psychological level 0.5920

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.5899

My Stop Loss - 0.5932

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDUSD The Target Is DOWN! SELL!

My dear friends,

NZDUSD looks like it will make a good move, and here are the details:

The market is trading on 0.5932 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 0.5903

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDUSD - M30 Bias LongThis trading plan carries a bullish bias aimed at capitalizing on a probable upward continuation after a well-defined pullback zone. The core idea is to wait for a pullback into a high-probability entry area derived from the Golden Ratio level of the Fibonacci retracement. This Fibonacci zone acts as a natural retracement level where institutional buyers may seek to accumulate positions.

Within this Fibonacci pullback zone lies a Fair Value Gap (FVG) — a price imbalance indicating an area that price tends to revisit and fill during corrections. This FVG acts as an additional confluence factor, strengthening the demand and support within this zone.

The overall expectation is that after this pullback and order flow confirmation, price will resume the upward trajectory toward the Base 1 supply zone at the higher price level marked on the chart. This Base 1 zone represents a strong resistance zone or target where traders can plan their exit or partial profit-taking.

From a fundamental perspective, the trade is supported by a weakening USD, which generally favors NZD/USD strength. This fundamental factor complements the technical Smart Money Concepts setup, increasing the confidence in a bullish continuation.

Key Points:

Bias: Long, targeting upward momentum continuation after pullback.

Entry Zone: Pullback zone at Golden Ratio Fibonacci level with FVG inside

Confluence: FVG provides demand zone strength and better entry quality.

Target: Move to Base 1 supply/resistance zone.

Fundamental Support: Weak USD supports NZD strength.

Trading Concept: Smart Money Concepts focusing on institutional order blocks, Fibonacci retracement, and liquidity gaps.

New Zealand's unemployment rate rises to 4½ high, Kiwi pushes hiThe New Zealand dollar continues to have a quiet week. In the European session, NZD/USD is trading at 0.5923, up 0.37% on the day. The kiwi has been under pressure, falling 3.4% against the US dollar in July.

New Zealand's employment report for Q2 was pretty much as expected, but the news wasn't good. The unemployment rate rose to 5.2% from 5.1% in Q1, below the consensus of 5.3%. This marked the highest unemployment rate since Q3 2020. Employment Change declined by 0.1%, down from a 0.1% gain in Q1 and matching the consensus. This was the third decline in four quarters.

The weak figures point to growing slack in the labor market as the economy continues to struggle. Global trade tensions remain high and New Zealand's export-reliant economy has taken a hit from softer global demand.

The Reserve Bank of New Zealand will be paying close attention to the weak job numbers, which support a rate cut in order to provide a boost to the economy. The RBNZ maintained rates in July after lowering rates at six consecutive meetings. The conditions for a rate cut at the Aug. 20 meeting seem ripe and the markets have priced in a quarter-point reduction at around 85%.

We'll get an updated look at the inflation picture on Thursday. Inflation Expectations rose to 2.3% in the second quarter, the highest in a year. This is the final tier-1 release prior to the August rate meeting.

Three FOMC members will speak later today and investors will be hoping for some insights regarding the Federal Reserve's rate plans. The Fed hasn't lowered rates since December but is widely expected to hit the rate trigger at the September meeting.

NZD/USD edges higher, NZ inflation expectations inch lowerThe New Zealand dollar showed some strong gains earlier but couldn't consolidate. After rising as much as 0.50%, NZD/USD has retracted and is trading at 0.5939 in the North American session, up 0.17% on the day.

New Zealand's inflation expectations for the next two years ticked lower in the third quarter, falling to 2.28% from 2.29% in Q2. As well, one-year inflation expecations dipped to 2.37% from 2.41%.

These are not large decreases by any stretch, but the updated figures indicate that businesses expect inflation to ease slightly. The readings are within the Reserve Bank of New Zealand's inflation target band of 1%-3%.

Actual inflation rose by 2.7% in the second quarter, up from 2.5% in Q1. Again, this level is within the central bank's target band, where it has remained for a fourth consecutive quarter. Inflation may be a bit high for the Reserve Bank's liking, but it has made clear that it plans to continue lowering rates. The RBNZ held the benchmark rate at 3.25% last month but this was a "dovish hold" as the central bank said it expected to loosen policy if medium-term inflation continued to ease as expected.

NZD/USD tested resistance at 0.5950. Next, there is resistance at 0.5971

0.5921 and 0.5900 are providing support

Could the Kiwi bounce from here?The price is falling towards the pivot, which is a pullback support and could potentially rise to the 1st resistance which aligns with the 61.8% Fibonacci retracement.

Pivot: 0.5926

1st Support: 0.5882

1st Resistance: 0.5979

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDUSD BUY TRADE PLAN (PULLBACK)📋 TRADE PLAN – NZDUSD (SHORT-TERM BUY SCENARIO)

📅 Date Issued: August 4, 2025

🔍 1. TOP-DOWN STRUCTURAL CONTEXT

🟣 D1 TIMEFRAME

Price has printed a strong rejection wick near 0.5885 support zone.

Structure: Currently in a D1 pullback phase within broader bearish context.

Reaction: First clean bullish candle printed after 3 consecutive bearish days.

🔵 H4 TIMEFRAME

Bullish engulfing printed (August 2, 12:00) from support at ~0.5880.

Price is now consolidating above this reaction zone, respecting structure.

Micro higher low formed; potential to extend pullback toward 0.5950–0.5975 range.

🟢 H1 TIMEFRAME

Retest structure forming between 0.5895 – 0.5908.

Multiple wick rejections showing buyers defending liquidity pocket.

Price forming tight intraday range post bullish impulse.

🧠 2. INSTITUTIONAL ZONE CLASSIFICATION

Type Level Status Freshness RR Quality Origin Timeframe

Demand (Primary) 0.5880–0.5890 ✅ Mitigated Clean Good H4

Supply (Target Zone) 0.5950–0.5970 🟡 Pending Fresh High H4

Demand (Backup) 0.5850 🟡 Untapped Fresh Moderate D1

✅ 3. TRADE PLAN STATUS:

🟢 ACTIVE – Confirmation Printed

H4 Bullish Engulfing confirmed on August 2 (12:00 candle) from 0.5880 zone.

H1 is consolidating post-impulse, showing compression + wick defense.

Structure supports short-term pullback upside.

🧭 4. EXECUTION DETAILS

Parameter Value

Entry Zone 0.5900 – 0.5908 (H1 compression)

Stop Loss 0.5875 (below H4 demand wick)

TP1 0.5950 (first H4 supply)

TP2 0.5970 (full imbalance fill)

Risk Model 0.5–1.0% per entry

Trade Type Pullback Continuation (Intraday)

🔁 5. CONFIRMATION DETAILS

Candle Type: H4 Bullish Engulfing

Candle Time: H4, August 2 @ 12:00

Behavior: Large rejection wick + body close above previous structure

Volume Context: Expansion candle → first impulsive buy leg from demand

🧠 6. RISK NOTES

This is not a long-term reversal, but a pullback trade.

Invalidation on clean close below 0.5875.

Failure to break 0.5950 decisively may indicate early reversal or range continuation.

🔄 7. ZONE ESCALATION REMINDER

📌 High-Probability Sell Zone (Future Conditional Setup)

Zone: 0.5975–0.5995 (D1–H4 origin supply)

Status: 🟡 Conditional – Awaiting price arrival

Setup Type: HTF Mean Reversion (probability increase if compression into zone)

✅ FINAL TRADE LABEL

🟢 NZDUSD INTRADAY BUY PLAN

Entry: 0.5900–0.5908 | SL: 0.5875 | TP1: 0.5950 | TP2: 0.5970

Status: ACTIVE – H4 Bullish Engulfing confirmed

Context: Short-term continuation from demand. Risk managed pullback play.

Heading into 50% Fibonacci resistance?The Kiwi (NZD/USD) is rising towards the pivot, which is an overlap resistance that lines up with the 50% Fibonacci retracement and could reverse to the 1st support.

Pivot: 0.5999

1st Support: 0.5941

1st Resistance: 0.6030

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.