New Zealand Dollar / U.S. Dollar

No trades

Market insights

September 28, Forex Outlook: What Can Traders Expect This Week?Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

#NZDUSD Short tradeSince we are looking for TVC:DXY longs, this means we’re automatically looking for /USD shorts.

I’m looking for NZDUSD to retrace back into daily demand.

By doing this, we will take liquidity above the high that brought us to the recent low. The only thing that remains after this is a CHoCH on the 1H–4H.

The main objective is continuing the bearish swing trend on the 4H timeframe.

NZDUSD - Bearish Bias

🔹 Pair: NZDUSD

🔹 HTF Overview: Price showing bearish intent, respecting higher-timeframe structure.

🔹 MTF Outlook: Waiting for a sweep of liquidity in the midterm OB. This will highlight smart money interest and refine continuation.

🔹 LTF Setup: Once the sweep occurs, I’ll drop to the lower timeframe to refine entries into premium OB areas for optimal short positions.

🔹 Targets: Higher liquidity zones aligned with bearish momentum.

🔹 Mindset Note: Patience is key—let smart money guide before taking the trade.

I STILL BELIEVE IN THE BEARS.NZD/USD remains bearish with lower highs/ lower lows intact.

Current move is a retest of broken support around 0.5770–0.5780

ENTRY: sold NZD/USD below 0.5810, targeting 0.5750 and 0.5720

With the current analysis continuous sell on NZDUSD

TAKE A LOOK.

SHARE IDEAS

I LOVE SHARING TRADING IDEAS.

NZD/USD chart (3H timeframe).NZD/USD chart (3H timeframe) with Ichimoku, structure markings (BOS, CHoCH), and target zones already drawn.

Based on the chart:

Price is currently around 0.5865.

The structure shows a bearish break of support and retest (previous demand turned supply near 0.5880–0.5900).

My marked two target points below current price:

1. First target ~0.5800

2. Second target ~0.5760

So, the short-term bearish targets are:

TP1: 0.5800

TP2: 0.5760

KIWI DOLLAR to Break 55From 2009 - 2011 the Kiwi Dollar appreciated from 48 to 88. Since the 2014 double top price has moved down.

We can see clear support coming in at 55. This price has held on 3 separate occasions -

a. March 20 - Covid stress

b. October 22 - Fed rates liftoff

c. March 25 - Trump stress

Note the amplitude of price rejection from this support zone has decreased in each instance. Some refer to this pattern as a bouncing ball or descending triangle.

It appears as though a lower high has been made in June 25 and price is retracing with current levels at 57.50.

IF price moves to the 55 level, this will be the 4th test of support , which invariably has a greater chance of breaking to the downside.

Looking lower the obvious demand zone is from 2009 at 48-50. The Kiwi is reflecting on this longer time frame a weakness to the downside.

A break of 55 confirms a bias short to 50.

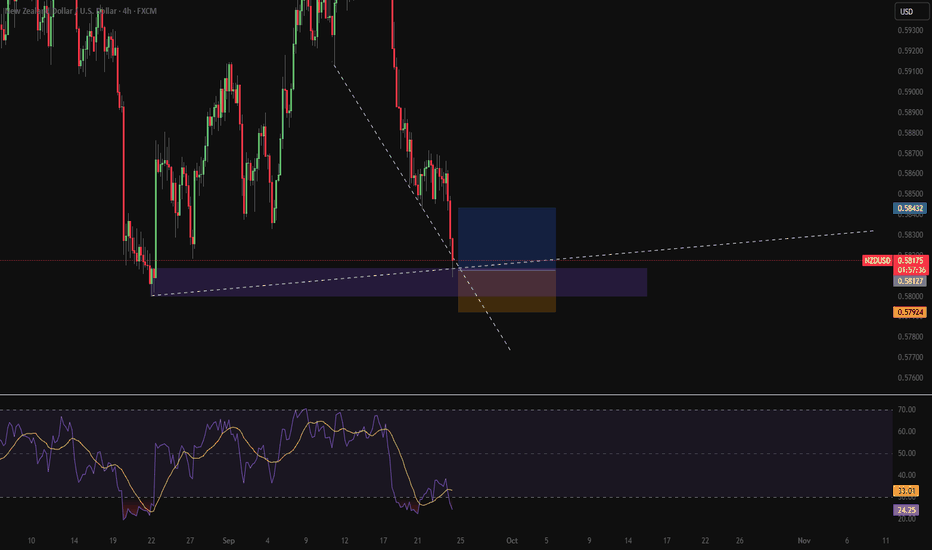

NZDUSD Long

Entry 0.58127

SL 0.57924

TP 0.58432

NZD/USD has been in a clear downtrend, forming lower highs and lower lows.

Price action has recently broken down sharply and is now testing a well-defined demand zone around 0.5792–0.5812.

Broader USD strength has pressured NZD, but this zone historically acts as a reaction level for buyers.

Technical Confluences

Demand Zone Support: Price is sitting inside a previously tested demand zone, offering potential for a corrective bounce.

RSI Oversold: On the 4H chart, RSI dipped below 30, signaling oversold conditions, and is starting to recover — suggesting exhaustion in selling momentum.

Trendline Reaction: Price is interacting with a long-term ascending support line (dashed white), adding structural confluence.

Fundamentally, the asset is currently undervalued against the Dollar index and Treasury Bond.

This trade is a short-term, tactical long position aimed at capitalizing on oversold conditions and demand zone support. The setup offers a favorable R:R if managed tightly, but traders should remain aware of the prevailing bearish trend and treat this as a retracement play, not a trend reversal.

Continuation of bearish momentum?The Kiwi (NZD/USD) is rising towards the pivot which acts as a pullback resistance and could reverse to the 1st support.

Pivot: 0.5883

1st Support: 0.5804

1st Resistance: 0.5914

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

LIFE ITSELF IS PATIENT.Been keeping a close eye on the chart since last 30days, actually not knowing what to do at this point but its had been all lower-highs, lower lows, downtrend happen to stay intact.

Knowing price could be rejected heavily i went in to dip @ 0.5980 and twas great decisive step to take.

CPA @ 0.5810 – 0.5820.

Price is consolidating around support

If buyers defend this zone, we may see a short-term bounce back toward 0.5850 – 0.5890, if it breaks below, the next downside target could be 0.5840-0.5800.

KEEP AN EYE ON THE CHART

NZDUSD In Bearish MomentumOn the daily chart, NZDUSD is bearish and sits at significant support level. If the price breaks below this support, it will decline to around 0.58. At that point, a bullish reversal might occur, driving the price up to approximately 0.61473.

The level at 0.55917 serves as a target for a further bearish move, representing an area of extreme selling pressure. These support and resistance levels define the next key price movements; monitoring will be required.

Happy Trading

K.

Not trading advice

NZDUSD FIB RETRACEMENT AND EXPANSIONDaily TF reached into yearly lows, and had a strong reaction creating point A and B of Fib retracement, reaching for 50% which coincides with a structural low and pivot point, extensions also match with structural highs and pivot points at 27% and 61.8%, look for possible deeper retracements in dialy FVG into 61.8% retracement or further, look for change in the state of delivery along those levels