NZDUSD trade ideas

NZDUSD H4 | Bullish riseThe Kiwi (NZD/USD) has bounced off the buy entry which is a pullback support that aligns with the 23.6% Fibonacci retracement and could rise from tis level to the upside.

By entry is at 0.5926, which is a pullback support that lines up wit he 23.6% Fibonacci retracement.

Stop loss is at 0.5900, which is a pullback support that align with the 38.2% Fibonacci retracement.

Take profit is at 0.5984, which acts a a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

NZD/USD - Break And RetestNZD/USD – 4H Analysis

Price has broken out of the descending channel and is now retesting the breakout zone. If buyers hold this level, we could see bullish continuation toward the 0.6100 resistance zone.

🔹 Entry: 0.5957

🔹 SL: Below 0.5900

🔹 TP: 0.6100

Bias: Bullish 📈 – Looking for momentum toward next resistance.

💡 What do you think — continuation higher or another rejection? Drop your thoughts below 👇

#NZDUSD #Forex #Trading #PriceAction #FX #TechnicalAnalysis #SwingTrading

NZDUSD H4 | Potential bearish reversalNZD/USD is rising towards the sell entry which has been identified as a swing high resistance.

Sell entry is at 0.5983, which is a swing high resistance.

Stop loss is at 0.6027, which is a pullback resistance.

Take profit is at 0.5913, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Risky NZDUSD Trade RecapThis setup wasn’t the cleanest, but sometimes calculated risk pays off.

📉 Setup:

Price was in a clear downtrend, making this buy counter-trend.

Demand zone around 0.5818 offered a possible bounce.

Break of the descending trendline gave early confirmation.

✅ Entry: 0.58189

❌ SL: 0.57964

🎯 TP: 0.59420 – 0.59490 supply zone

📊 Outcome:

Despite the risk of fading the trend, price respected demand, broke structure, and ran straight into my supply target at 0.5940+ for full profits.

⚠️ Not every trade will be textbook perfect — but with proper risk management, even the risky ones can pay off.

#NZDUSD #ForexTrader #RiskManagement #RiskyTrade #PriceAction #SmartMoneyConcepts #ForexJourney #MarketStructure

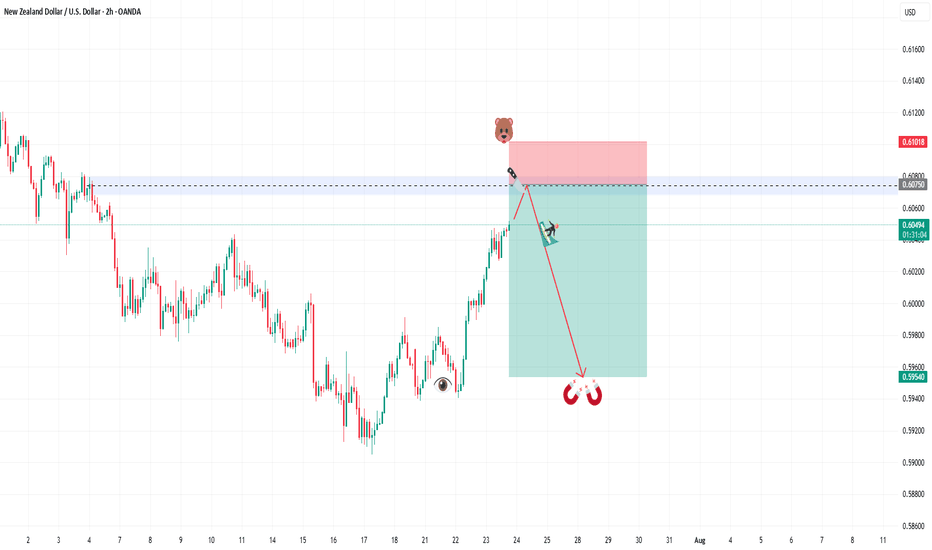

SELL NZDUSDIn todays session we are actively monitoring NZDUSD for selling opportunity. Our first entry in ASIA session is at 0.60478 we anticipate a short rally up to our second re-entry at 0.60750. Our stops are above 0.6100 and our targets are at 0.59540. Use your own risk management and entry criteria and best of luck.

New algo entry model is under testing.

NZD/USD 4HThe 4-hour chart suggests a bullish fractal continuation on the daily chart, accompanied by a sweep of the buy-side liquidity. While a valid 4-hour high has not yet been established, the 1-hour chart has. There is a possibility of another sweep of the highs, or a structural decline towards the 4-hour demand. We will maintain a sell position until demand is met, at which point we will monitor the 1-hour or 30-minute chart for any structural shifts within the order block.

NZD/USD D CHARTThe bearish price range, as observed on the daily chart, is currently in a pullback phase, presenting potential trading opportunities for both buy and sell entries. The 4-hour chart indicates a favorable order block, suggesting potential buy opportunities targeting liquidity within the daily order block.

NZDUSD Technical & Order Flow AnalysisOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!

NZDUSD Will Go Lower! Short!

Take a look at our analysis for NZDUSD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.589.

Considering the today's price action, probabilities will be high to see a movement to 0.577.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZDUSD: Short Trade Explained

NZDUSD

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short NZDUSD

Entry - 0.5911

Sl - 0.5924

Tp - 0.5884

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDUSD Expect A Long BreakoutNzdusd; this pair have been moving within this region of lower highs and lower lows,in regards to the NFP news we await a long breakout within the major resistance level with a target above 0.5994.for the moment we are likely to buy and keep a close eye within this tight region of support and resistance.

Possible outline

Bullish scenario: buy with a target near 0.5950 as first Tp and 0.5994 as second Tp

Meanwhile a confirmed reversal at this point will trigger move below 0.5785 as the next support.

What is your idea on this my fellow traders.?

follow up thanks

Long trade

1Hr TF overview

📘 Trade Journal Entry

Pair: NZD/USD

Date: Thu 4th Sept 25

Time: 11.40 am

Session: London to NY AM

Timeframe: 1H

🔹 Trade Details

Direction: Buyside Trade

Entry 1: 0.58548

Profit Target: 0.58974 (+0.38%)

Stop Loss: 0.58451 (–0.16%)

Risk-Reward Ratio (RR): 2.9

Entry 2: 0.58719

Profit Target: 0.58974 (+0.42%)

Stop Loss: 0.58622 (–0.17%)

Risk-Reward Ratio (RR): 3.3

🔹 Technical Context

Market showing bullish continuation after liquidity sweep below 0.5840.

EMA (0.5849) and VWAP (0.5847) are acting as intraday support.

Two scaling entries executed to capture continuation flow.

Targets placed just below the liquidity pool around 0.5897 (daily high).

Fair Value Gaps (FVGs) provided additional support zones.

🔹 Trade Narrative

NZD/USD gave a structured scaling long opportunity, with the first entry positioned after the liquidity sweep and the second on pullback confirmation. Stops are placed tight below VWAP/EMA structure to minimise risk. Profit targets aligned with prior daily highs, with strong confluence from volume and FVGs, reinforcing the continuation trade idea.

NZDUSD SHHORT Market structure bearish on HTFs 3

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Weekly EMA retest

Previous Weekly Structure Point

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Round Psych Level 0.59500

H4 Candlestick rejection

Levels 4.46

Entry 110%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

NZDUSD oversold bounce support at 0.5800The NZDUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.5800 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.5800 would confirm ongoing upside momentum, with potential targets at:

0.5900 – initial resistance

0.5940 – psychological and structural level

0.5980 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.5800 would weaken the bullish outlook and suggest deeper downside risk toward:

0.5766 – minor support

0.5730 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the NZDUSD holds above 0.5800 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

NZD/USD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

Bearish trend on NZD/USD, defined by the red colour of the last week candle combined with the fact the pair is overbought based on the BB upper band proximity, makes me expect a bearish rebound from the resistance line above and a retest of the local target below at 0.584.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Long Trade

5min overview

📘 Trade Journal Entry

Pair: NZD/USD

Date: Tue 2nd Sept 25

Time: 9.25 am

Session: New York AM

Timeframe: 5m

🔹 Trade Details

Direction: Buyside Trade

Entry: 0.58576

Profit Target: 0.58887 (+0.65%)

Stop Loss: 0.58479 (–0.16%)

Risk-Reward Ratio (RR): 12.19

🔹 Technical Context

Trade executed at the session low after a liquidity sweep under the Asian range.

VWAP (0.58671) reclaimed, supporting bullish continuation.

Stop placed below intraday rejection wick at 0.58479.

Target set at prior session liquidity zone 0.58887, aligning with ADR extension.

EMA (0.58624) and WMA (0.58627) are both trending upward, confluence for long bias.

🔹 Trade Narrative

NZD/USD provided a high R: R intraday long opportunity, with entry positioned at liquidity grab below Asian session low. Quick recovery above VWAP signalled strong bullish order flow.

NZDUSD: Bearish. Clean Setup For Potential Sells!Welcome back to the Weekly Forex Forecast for the week of Sept 1 - 5th.

In this video, we will analyze the following FX market: NZDUSD

NZDUSD is currently showing the cleanest setup for the FX pairs.

- it's in a downtrend on the HTFs

- D1 shows the LH. LL, low and the -BOS clearly

- the retracement is contacting a decent -OB

- the Descending Channel is only an added bonus as a confluence for resistance.

I like the probabilities for a potential rejection downward from the -OB.

The caution here is that it would require the USD to show strength, pulling the NZD down. That part is still iffy. The DXY has not shown its hand just yet.... but it will very soon.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

NZD/USD Snaps Bullish Price SeriesNZD/USD snaps the series of higher highs and lows from last week after struggling to push above the 0.5920 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) region, and lack of momentum to hold above 0.5830 (38.2% Fibonacci retracement) may push the exchange rate toward the August low (0.5800).

A move/close below the 0.5740 (78.6% Fibonacci retracement) to 0.5760 (100% Fibonacci extension) area brings 0.5700 (23.6% Fibonacci retracement) on the radar, but NZD/USD may retrace the decline from the weekly high (0.5915) should it defend the rebound from the August low (0.5800).

Need a move/close above the 0.5920 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) region to open up the August high (0.5996), with the next area of interest coming in around 0.6040 (61.8% Fibonacci retracement) to 0.6070 (61.8% Fibonacci extension).

--- Written by David Song, Senior Strategist at FOREX.com