Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.01 USD

5.81 B USD

85.44 B USD

About ZURICH INSURANCE N

Sector

Industry

CEO

Mario Greco

Website

Headquarters

Zurich

Founded

1872

FIGI

BBG000D3Q205

Zurich Insurance Group AG is a holding company, which engages in the provision of insurance products and related services. It operates through the following segments: Property and Casualty Regions, Life Regions, Farmers, Group Functions and Operations, and Non-Core Businesses. The Property and Casualty Regions segment provides motor, home, and commercial products and services for individuals, as well as small and large businesses on both a local and global basis. The Life Regions segment includes comprehensive range of life and health insurance products on both an individual and a group basis including annuities, endowment and term insurance, unit-linked and investment-oriented products, as well as full private health, supplemental health, and long-term care insurance. The Farmers segment focuses on non-claims administrative and management services to the Farmers Exchanges, which are owned by policyholders. The Group Functions and Operations segment is involved in group’s holding and financing and headquarters activities. The Non-Core Businesses segment offers insurance and reinsurance businesses. The company was founded in 1872 and is headquartered in Zurich, Switzerland.

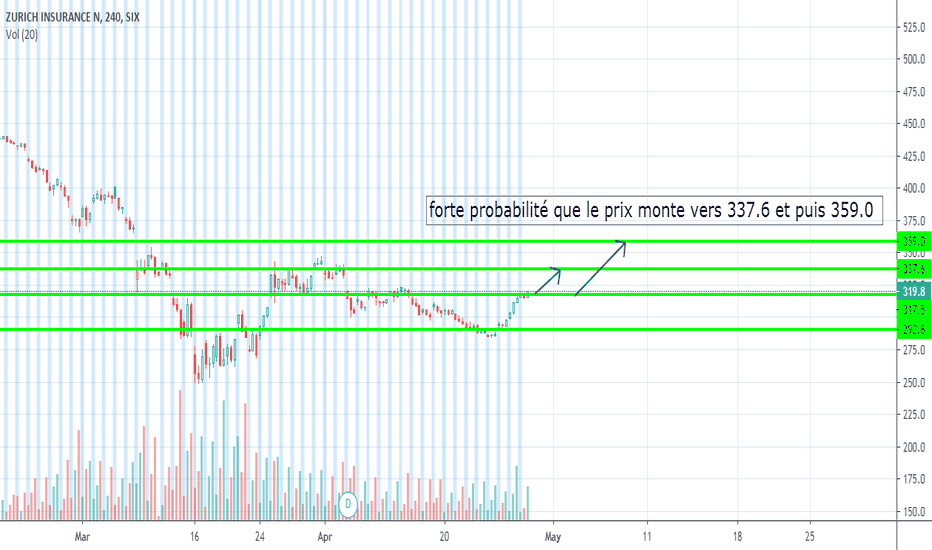

$ZURVY - Growing stock$ZURVY - Zurich Insurance Group AG is a holding company that provides insurance products and related services.

What's attractive about the schedule is.

1. Being close to ATH,

2. Moves in a rising channel

3. Trades above the 30W EMA

4. Last 2 weeks the volume is significantly higher than the average

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ZFSVF5909255

Farmers Insurance Exchange 7.0% 15-OCT-2064Yield to maturity

7.09%

Maturity date

Oct 15, 2064

ZFSVF4552452

Farmers Insurance Exchange 4.747% 01-NOV-2057Yield to maturity

6.61%

Maturity date

Nov 1, 2057

FFXC4171138

Farmers Exchange Capital III 5.454% 15-OCT-2054Yield to maturity

6.42%

Maturity date

Oct 15, 2054

XS2523960719

ZurFinIr 5.125% 52Yield to maturity

5.49%

Maturity date

Nov 23, 2052

XS2538360087

ZurFinAu 5.324% 29Yield to maturity

5.32%

Maturity date

Sep 28, 2029

DEMQ4623892

Argentum Netherlands BV (Zurich Insurance) 5.125% 01-JUN-2048Yield to maturity

5.31%

Maturity date

Jun 1, 2048

ZFSVF5854570

Zurich Holding Company of America, Inc. 2.3% 25-FEB-2030Yield to maturity

5.12%

Maturity date

Feb 25, 2030

DEMQ5854559

Argentum Netherlands BV (Zurich Insurance) 4.875% 02-OCT-2048Yield to maturity

4.93%

Maturity date

Oct 2, 2048

XS2416978190

ZurFinIr 3.5% 52Yield to maturity

4.64%

Maturity date

May 2, 2052

XS1859337849

ZurichFinanAust 4,5% 26/07/2038Yield to maturity

4.50%

Maturity date

Jul 26, 2038

FFXC4066132

Farmers Exchange Capital II 6.151% 01-NOV-2053Yield to maturity

4.46%

Maturity date

Nov 1, 2053

See all ZURVY bonds