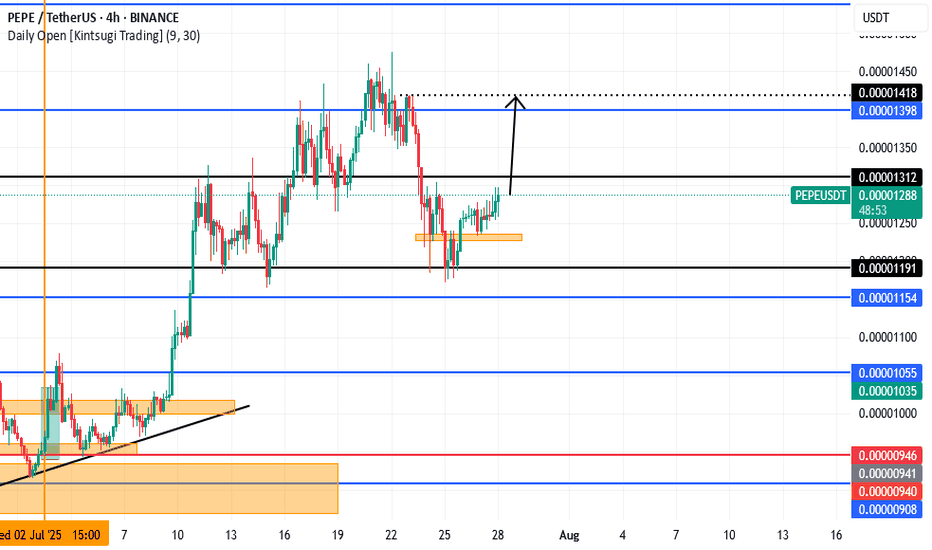

Pepe Coin Battles Last Defenses For 17% Move To $0.000013Hello✌️

Let’s analyze Pepe Coin’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Big holders own 43% of PEPE, which can make prices jump or drop fast. If price stays above $0.000010 it could hold steady, but selling near $0.000014 might slow gains.

📊Technical analysis:

BINANCE:PEPEUSDT has lost all major Fibonacci supports, with daily support and trendline as its final safeguards 📉. If these hold and volume remains steady, a 17% rally toward $0.000013 is expected 🚀.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

PEPEUST trade ideas

Pepeusdt trading opportunityPEPEUSDT remains in an uptrend, recently breaking above a bullish pennant structure, suggesting a strong potential to reach the current setup target. The plan now is to seek buy opportunities on a retest of the previous all-time high (ATH) level. An immediate demand zone is also marked in case of a deeper pullback, while the final target is provided to support informed decision-making.

Major trendline resistance is broken also retest completed One of the major resistances which was red trendline is now broken also retest is completed and market is ready to explode and pump to the upside if BINANCE:BTCUSDT hold strong.

major supports and resistances are also all mentioned on the chart.

First target is easy to hit now but for second one we need valid breakout to the upside near that(0.000017$) resistance zone for sure.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Potential SellPepe has an M formation that is clear as day. Price has dropped to a level 0.00000986, pushed upwards to 0.00001055 and has started to form a wick on the resistance which is an indication that price might push downwards to complete the M formation.

If price pushes upwards past the resistance then the sell setup would be invalidated.

Pepe Update · 5th Dimensional Technical Analysis & Rising PricesThe energy changes. Do we really have to look at a chart?

The market sentiment is so different when the market is trending compared to when the market is sideways. The energy is very different when the market is dropping compared to when it is rising. We can tell what is coming based on how the market feels, but it is a bit paradoxical.

Good feelings, greed and a high level of certainty doesn't necessary means that the market will move in your direction. These are your feelings but not necessarily the market sentiment, how the market is feeling.

The first step then is to learn to distinguish between the market sentiment, how the market and its participants are doing and our own feelings, intuitions, perceptions, ideas, impulses and emotions.

Well, maybe that is too hard. Since it is very hard to learn to be aligned with the market and interpret the correct meaning of the different feelings we get in relation to prices, we can just use a chart.

Pepe produced a rounded bottom followed by a bullish jump. Pepe now again produced a new bottom pattern but this time a rising triangle and has been moving up for months, five months to be exact.

Five months rising but there is no rise. This is a very strong accumulation phase. Accumulation leads to a massive bullish jump. How are you feeling? Are you feeling low or are you feeling great?

The calm before the storm. The market tends to become depressed before a major bullish run. If not in prices, people become depressed in feelings, that is because all of their bearish friends are gone. We suffer because they are getting liquidated but there is light at the end of the tunnel, our profits are going up.

Stay bullish. Choose wisely. Keep reading. Bet LONG.

There is no point in being bearish when the market is going up.

Only now we are preparing for a massive bullish run.

Join the wave and you will profit, have fun and grow. It is very simple, we all buy and hold.

Namaste.

PEPE Will Turn Bullish · Strong Chart StructureThe market is one. We are all one and the same.

Crypto is one, and all the pairs move in the same way. Not in the exact same manner but the broader direction always tend to be the same.

PEPE is great because it reveals that the market isn't likely to go much lower. Since they all move together, the fact that PEPE will recover reveals that the others will recover.

PEPE grew in late 2024 together with the rest of the market. The first part of 2025 was a correction and the lows started to come-in in March and April. The first high in May, exactly the same as the rest of the market. A higher low in June and another high in July. Now a new retrace.

PEPEUSDT is trading on a very strong structure. We have a higher low from June but also from March. This makes it very unlikely that PEPE will produce a new low in this correction, which means that even now the correction is reaching its end. Volume is very low. If it isn't over then one major flash crash and the next day full green. That's how close we are from change.

Technical analysis

The market downtrend ended in March this year. From a low point PEPEUSDT switched from bearish to bullish. The trading is now happening within a bullish chart.

The main move peaked in May and the market is consolidating before additional growth. The action stays kind of sideways, mid-range, which shows that we are seeing consolidation. Consolidation always precedes a wave of growth, specially when the action is happening across marketwide support.

Namaste.

PEPEUSDT AND LONGPOSITIONAnd Pepe is a lovely and popular cryptocurrency and a great buy trading opportunity for the next three to six months with a great risk to reward.

Follow me and boost my analysis for timely and very low risk purchases and great signals.

Contact me in the comments section or private message

$PEPE: the big picture, 1W analysis.August 1st, 2025 – A tough day for altcoins, hit once again by tariff concerns.

But let’s talk about CRYPTOCAP:PEPE , one of my favorite altcoins to track. Why? No VC backing, the entire supply is community-held, and volume is consistently strong—making it a reliable market sentiment indicator.

Weekly Outlook:

CRYPTOCAP:PEPE remains in a macro uptrend, riding above the 100 EMA.

- My Momentum indicator has triggered two buy signals: at 0.00000634 and 0.00001040

- RSI is rising but still mid-range—there’s plenty of room to move higher.

- MACD is gradually ramping up.

- Stochastic RSI is cooling off, but given the strength of the other signals, further downside looks limited.

Technically, we’re seeing a bullish flag pattern. Price is currently testing support at the lower range—likely setting the stage for a decisive move in the coming weeks.

Conclusion:

Based on the current indicators and structure, the odds favor a bullish breakout and continuation of the uptrend—though, as always, DYOR.

#PEPE/USDT or Breakdown? PEPE Eyes 0.00001166 Target !#PEPE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.00000980, acting as a strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.00000990.

Entry price: 0.00001030.

First target: 0.00001075.

Second target: 0.00001120.

Third target: 0.00001166.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Head And Shoulders Continuing to fall?Context 1:

Supply Zone: 00000400 - 00000970

Support: 00000975 - 00001075

Demand Zone: 0001798 - 00002850

Resistance: 00001550 -00001420

Psychological Levels: 00001500, 00001000

Context 2:

Technical Structure 1: Top Down Analysis shows us a Head and Shoulders pattern of which we are in the final stages of with bearish momentum.

Technical Structure 2: The overall trend has left us in a bearish wedge which has tested support 4 times and tested resistance 2 times.

FVG’s:

FVG Confluence 1: Theres a 1 hour FVG located just below price level. Also aligned with the POC. Strong confluence for return to this area.

FVG Confluence 2: Another 1 hour FVG inside of a 4 hour FVG that is also aligning with the bottom 0.618 Fib level of that move.

Golden Pocket Entry 1st Low (Bullish): Sits just above an FVG. Also engulfs the Point of Control.

Golden Pocket Entry 1st High (Bearish): Multiple TimeFrame FVG confluence. A key resistance point aligning with .00001300 Pschological Level.

Context 3:

Volume Insight: The most volume is located around .00001250 and .00001050 which show massive spikes in these key areas.

Bullish Scenario:

Price falls to the golden pocket- FVG- POC. Bounces off support to create a higher low.

Bearish Scenario:

Price rises to clear a 1H and 4H FVG- enters the golden pocket - sweeps liquidity around the .00001290 area.

PEPE Breakout Watch – Red Resistance Being Tested! 🚨 CRYPTOCAP:PEPE Breakout Watch – Red Resistance Being Tested! 🔴⏳

CRYPTOCAP:PEPE is testing the red resistance zone.

📊 If breakout confirms, next move could target:

🎯 First Target → Green line level

A breakout could trigger bullish continuation and upside momentum.

Crypto Trade: PEPEUSDT Long Swing Trade BINANCE:PEPEUSDT Long Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

this is good trade, lets see, don't be greedy, risk what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

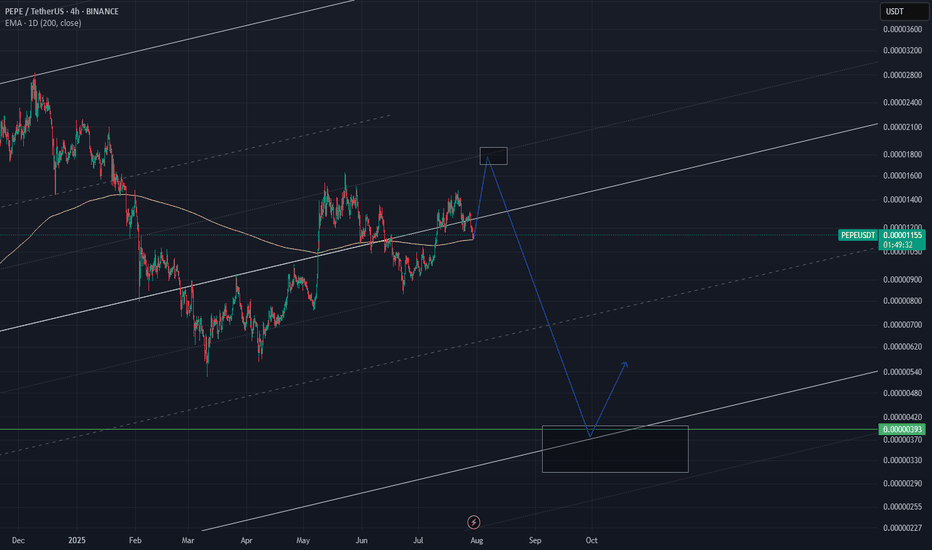

High R:R Play on PEPE — 3.2X Reward WaitingThe PEPEUSDT 4H chart clearly shows that the market has been in a downtrend since late July, forming consistent lower highs and lower lows. The trend indicator lines (red above price, blue below) suggest that bearish momentum has been dominant for several sessions.

From July 28 onwards, price tested the short-term moving average multiple times but failed to break above it, confirming that sellers remain in control. However, over the past few candles, we can see that price has started to slow its decline and is now consolidating near the 0.00001145 support zone. This is an area where buyers have previously stepped in, making it a potential pivot point for a short-term bounce.

The marked trade idea on the chart suggests a countertrend long trade. This makes sense because the market is oversold on lower timeframes and showing signs of accumulation. The upside target is set just below a prior reaction level at 0.00001289, which has historically acted as resistance. This creates an opportunity for a clean bounce if buying pressure increases.

Trade Setup

• Entry: 0.00001145 (at current support)

• Stop Loss: 0.00001100 (below recent swing low)

• Take Profit: 0.00001289 (targeting prior resistance)

• Risk-to-Reward Ratio: ~1:3.2

• Trade Bias: Short-term countertrend long

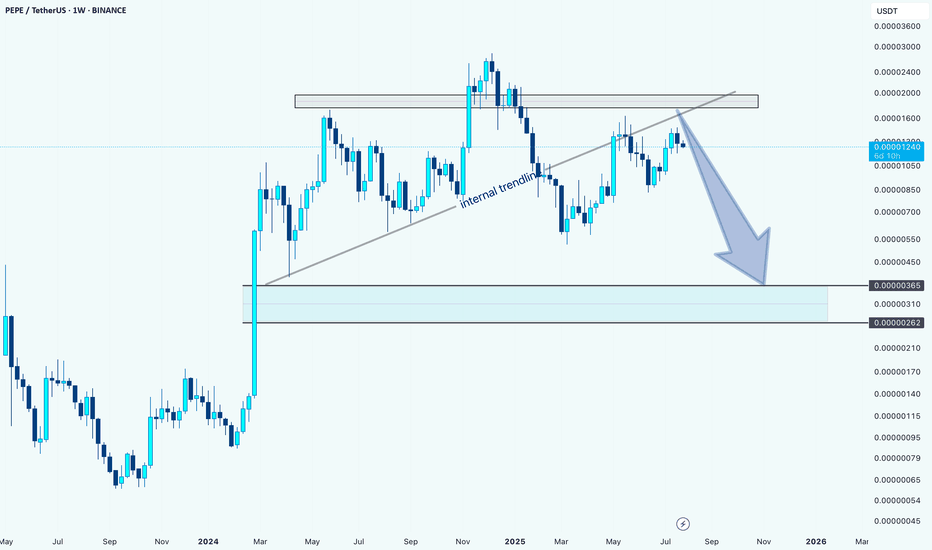

PEPEUSDT: Bearish Outlook After Internal Trendline BreakHello guys.

PEPE has tested the internal trendline multiple times and finally broke below it, signaling potential weakness. Price also failed to reclaim the key supply zone above.

Internal trendline broken

Rejection from a key supply zone

Potential move toward the demand zone around 0.00000262–0.00000365

Unless bulls reclaim the broken trendline and break above the recent highs, the bias remains bearish with a possible continuation to the downside.

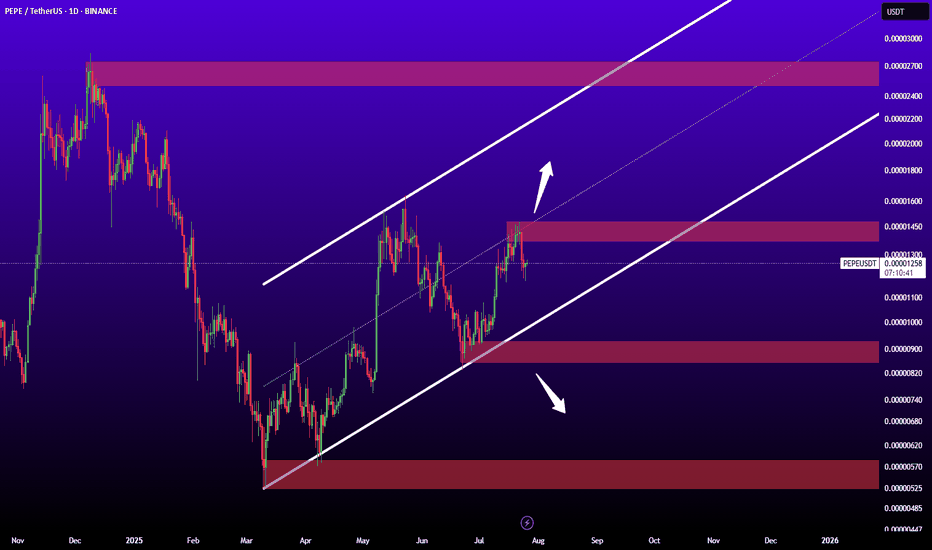

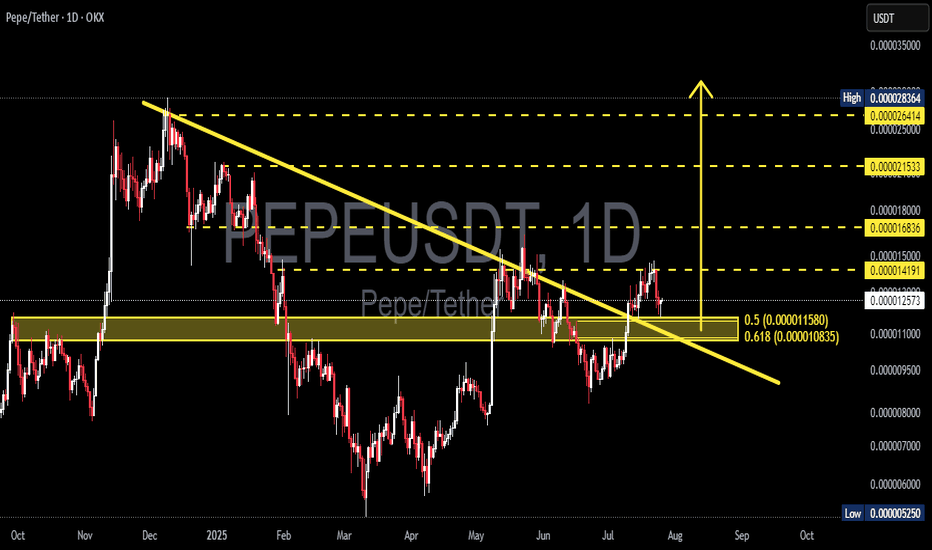

PEPEUSDT – Downtrend Breakout & Golden Zone Retest in Play!📊 Chart Analysis:

On this daily timeframe chart of PEPEUSDT, price has successfully broken above the descending trendline that had capped the price since late 2024. This breakout is a strong early signal that bearish momentum is weakening and a potential trend reversal may be underway.

After the breakout, the price is now performing a retest at a key confluence support zone, including:

Fibonacci Retracement levels 0.5 (0.000011580) and 0.618 (0.000010835) — the Golden Zone

Previous horizontal demand zone (highlighted in yellow)

Retest of the broken descending trendline

This retest area will be crucial for determining the next directional move.

---

🐂 Bullish Scenario:

If price holds above the Fibonacci Golden Zone and forms a bullish confirmation candle, we could see a continuation of the uptrend toward:

0.000014191

0.000015000

0.000016836

0.000021533 (medium-term target)

Possibly retesting the High at 0.000028364

This would confirm the start of a major trend reversal and renewed bullish momentum.

---

🐻 Bearish Scenario:

If price fails to hold above the 0.000010835 level and breaks down below the Golden Zone:

Expect a drop toward psychological support around 0.000010000

And potentially further down to the strong support near 0.000007000

Such a move would invalidate the breakout and put PEPE back into a consolidation or extended downtrend phase.

---

🧠 Chart Pattern Notes:

Descending Trendline Breakout

Golden Zone Retest (Fibonacci 0.5 & 0.618)

Potential formation of an Inverted Head & Shoulders pattern (in early stages)

---

🎯 Conclusion:

PEPEUSDT is at a critical turning point after breaking out of a long-term downtrend. If the support at the Golden Zone holds, there is strong potential for a sustained bullish rally. However, traders should remain cautious and apply proper risk management in case of a breakdown below key levels.

#PEPEUSDT #CryptoBreakout #GoldenZoneRetest #TechnicalAnalysis #FibonacciLevels #PEPECoin #AltcoinAnalysis #TrendReversal #BullishSetup #BearishRisk