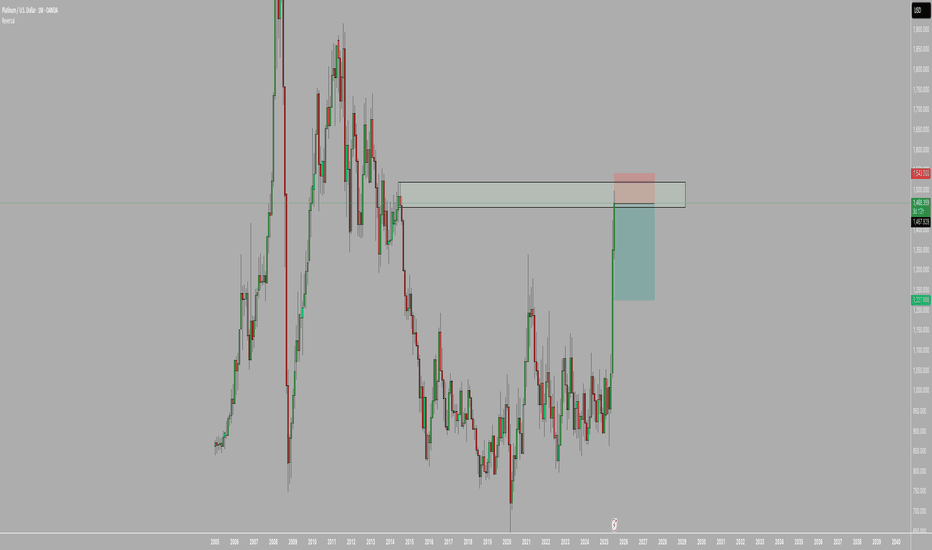

XPTUSD 1D HVF forming - cont. of the triggered macro patternPlatinum has triggered a macro HVF out of a FW. It is too early to know, but it seems like we're winding up on T2 for a continuation to the final target of 1620.

Plan:

1. Accumulate a small position at RL2 (box shown) - less than 1% risk.

2. Wait for the STF HVF to complete and enter at JIT to complete to the T3 of the larget pattern for a healthy RRR.

3. Set a reminder to see if we see a reversal that makes this a new RH2 for the larger pattern for which the FW was the first impulse. This may become a decade pattern - it seems more likely that we overperform on this pattern as the central bank printing machines do their thing

Trade ideas

Platinum prepares for the takeoffPlatinum is positioned near the dynamic support area, and may climb higher as rotation in the metals market continues.

Platinum moved toward $1,410/oz, the highest this month, supported by persistent supply deficits. The World Platinum Investment Council projects a structural shortfall of about 850 koz in 2025, with supply near a five-year low. Despite elevated prices, output is unlikely to recover soon. While industrial demand faces pressure from the global slowdown, investment and jewelry demand—especially in China—remains strong. Platinum also looks attractive versus gold, with Fed rate-cut expectations, a weaker dollar, and geopolitical tensions adding further support.

Don't forget - this is just the idea, always do your own research and never forget to manage your risk!

DON'T MISS a potential CRAZY RUN!!! Unfolding RIGHT NOW!!!When I m opening this chart I m always seeing hudge potential and upside.

This, right here, is a key moment in it's development: it either goes crazy or starts ranging some more.

Let's see!

Let me know if, and why, you agree or disagree with this!

PLATINUM Sell Signal triggered.We couldn't have had a more timely signal on Platinum (XPTUSD) last time we looked at it (April 08, see chart below) as we made a buy call exactly at the bottom of the Descending Triangle with the immediate rebound that followed, quickly hitting our $985.00 Target:

This time, the price has triggered a Sell Signal as the 1D MA50 (blue trend-line) broke and a Lower High potentially initiates a Channel Down similar to those of 2024. Both declined to their 1.236 Fibonacci extensions before breaking upwards.

As a result, we treat this as a sell opportunity, targeting 1220.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

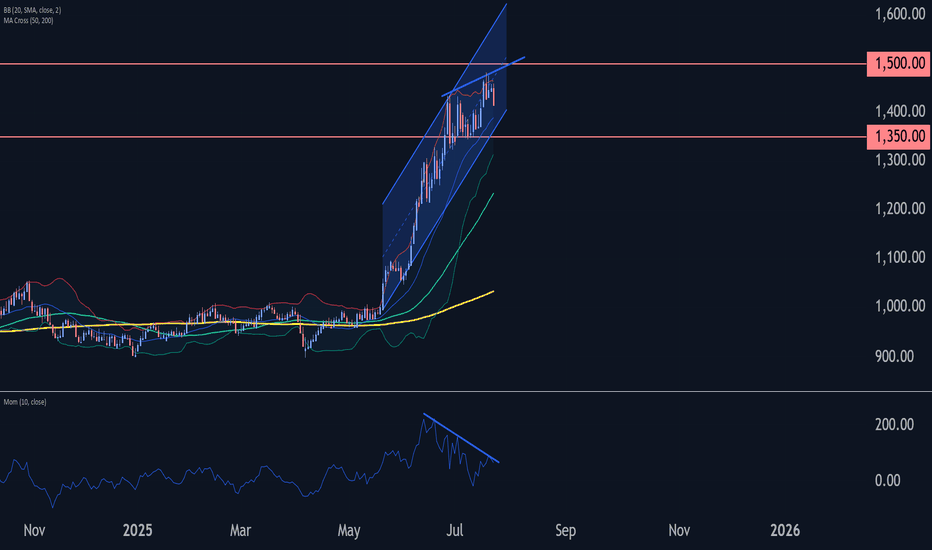

Platinum Wave Analysis – 3 September 2025- Platinum rising inside impulse wave 3

- Likely to reach resistance level 1480.00

Platinum continues to rise inside the impulse wave 3, which started earlier from the support zone between the support level 1300.00 (which has been reversing the price from July), lower daily Bollinger Band and the 38.2% Fibonacci correction of the upward impulse form June.

The price earlier broke above the resistance level 1370.00 (which stopped waves 1 and i) – which accelerated the active impulse wave 3.

Given the sharp daily uptrend, Platinum can be expected to rise to the next resistance level 1480.00, target price for the completion of the active impulse wave 3.

The GOLD RALLY is happening AGAIN... BUT this time on PLATINUMBig time momentum for platinum on daily. It seems to be so powerful at the moment. At this moment, I m expecting either an aggressive up continuation move, or some more consolidation.

If my set-up condition will be meet I'll take a trade instantly.

What you think about this market?

Precious Metals in No Man’s Land: Waiting for September SignalsFeel free to skip a trade if your account is in drawdown or if you’re not ready to take on more risk than usual.

There are days when trading opportunities exist, and days when they simply don’t. Right now is not the best time to trade. Precious metals are stuck in no man’s land — no clear signs for movement in either direction. The same goes for oil, gas, and cryptocurrencies.

Platinum looks relatively decent. My expectation is that the dollar will weaken, which should fuel growth in metals. Still, it’s better to wait a bit, preserve capital, and keep it for high-quality trades — which, I believe, will show up in September.

There is some support around 1305, but it’s very weak. Last time it acted as support was back in June 2013, and later in December 2020 it flipped into resistance. So we can’t really call it a strong level.

As I write this, I realize that according to my trading system, there’s simply no setup here. On top of that, over the past few sessions I haven’t managed to secure any meaningful results. Maybe I’m trying to squeeze a trade where it doesn’t exist. But that burning desire to go long on metals is still here.

So:

I’ll take a very small position.

If I get stopped out — I’ll take a break from metals. I’m already getting mentally stuck on them.

📝Trading Plan

🟢Entry: 1305

🔴Stop: Stop under today’s low at 1290

🎯Target: 1340 / 1370 / 1415 / 1500 and beyond

Platinum Breakout Stalk: Thief Entry Only After Confirmed🧠 Thief's Heist Plan Activated!

Asset: XTI/USD (PLATINUM) 💎

Strategy: Bullish Pullback + Breakout Play 💥

🔍 We stalking platinum's neutral zone… waiting for that clean breakout!

No early entries, no premature SLs. Discipline = Profits. 🎯

🎯 Entry: After breakout confirmed. Use multiple DCA limit orders to layer in like a ghost.

🔐 Stop Loss: ONLY after breakout – Place at 1280.00 🛡️

💎 Target: 1560.00 – Vault unlock point! 💰

📵 DO NOT place SL or orders before breakout – patience is the thief’s edge. 🧘♂️

This isn’t gambling... this is precision trading. Breakout = green light 🚦

Get ready to raid the platinum vault!

#ThiefTrader #BreakoutStrategy #PlatinumHeist #XTIUSD #BullishSetup #SmartMoneyMoves

⤷ XPT/USD Metals Alert | Breakout Heist Mode Engaged ⤶🔐💎 XPT/USD “The Platinum Heist” — MA Breakout Bullish Robbery Plan! 💰🚀

💼 Asset: XPT/USD "The Platinum"

📊 Market Plan: BULLISH

🕵️♂️ Thief Entry: Breakout of MA 🔓 (Above 1350.00)

🛑 Stop Loss: Hidden Vault 🔐 (1300.00)

🎯 Target: Getaway Car 🚗💨 (1420.00)

🎯 Style: Layered entries using thief-style limit orders

🗣️ Platinum is not just metal — it’s MONEY waiting to be stolen!

We’re loading up our duffel bags 🎒 and stacking limit orders right behind the breakout door 🚪 at the 1350.00 MA line. Once that door bursts open — robbery in progress! 📈💥

💣 Plan Execution

Place buy-stop above the moving average, or stack limit buys on pullbacks near breakout candles. Timing is king 👑 — watch the 15m or 30m candles like a hawk 🦅. MA breakout = 🔑 Entry trigger.

🚨 Stop Loss Strategy

SL isn’t just a number — it’s your insurance against the market police 🚓. Our default vault is hidden below 1300.00, but adjust according to your order stack + risk level. This is a heist, not a charity.

🔓 Thief Target Locked

Getaway zone at 1420.00 🎯, but you’re free to vanish early with profits if the market gets hot 🔥 or volatile ⚡. Trailing SL recommended for slick exits 🎿💸.

🧠 Day & Swing Robbers Note

Whether you’re scalping a few bars or riding the swing wave — only trade in the LONG direction here. Don't get greedy, get clever 😼.

📢 News Alert & Risk Control

Don’t enter during news explosions 💣! Set alerts, use trailing SL, and don’t fall asleep on the job 😴.

🏴☠️ Boost the Gang

Tap that 💥Boost Button💥 and power up our global Thief Trader crew 💹🌍. Every click = another silent alarm disabled 😎. Share, Like, Follow — help us fund the next mission.

Stay Ready. Stay Robbing. See you at the next Heist. 🤑⏳

#ThiefTrader #PlatinumPlan #BreakoutBoys #XPTUSD #MetalMoneyMoves #LayeredEntry #HeistStyle

XPTUSD Platinum will hit 1370 - Long TradeOANDA:XPTUSD Long trade, with my back testing of this strategy, XPTUSD need to touch 1370

This is good trade

Don't overload your risk like Greedy gambler,

Be Disciplined Trader, what what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

XPTPlatinum Price Analysis Idea:

It appears that platinum has the potential for further upside. On the 4H , we are seeing price pullbacks from previous resistance levels, which now seem to be acting as support. Additionally, the price is forming higher lows, suggesting the beginning of a possible uptrend.

If the price manages to break above the 1360, we could expect a move toward the 1398

Platinum Still Has Room to RunJust like with silver, the potential for further growth in gold remains, despite the setbacks of recent days.

It seems the precious metals market didn’t mourn the Fed’s decision and subsequent press release for long.

The uptrend remains intact, and the previously supportive factors are still in play.

Even amid the negative news, there was no sharp sell-off — everything stayed within the trend. This clearly signals that rate cuts are on the horizon, and metals are likely to continue their upward move.

I’m in favor of continued upside.

Stop-loss is placed below yesterday’s low — now we wait for higher levels.

Platinum Wave Analysis – 31 July 2025- Platinum broke support zone

- Likely to fall to support level 1200.00

Platinum recently broke the support zone located between the key support level 1340.00 (low of the previous minor correction iv) and the support trendline of the daily up channel from May.

The breakout of this support zone accelerated the c-wave of the active ABC correction 4.

Given the bearish sentiment across the precious metals markets, Platinum can be expected to fall to the next support level 1200.00 (target for the completion of the active wave c).

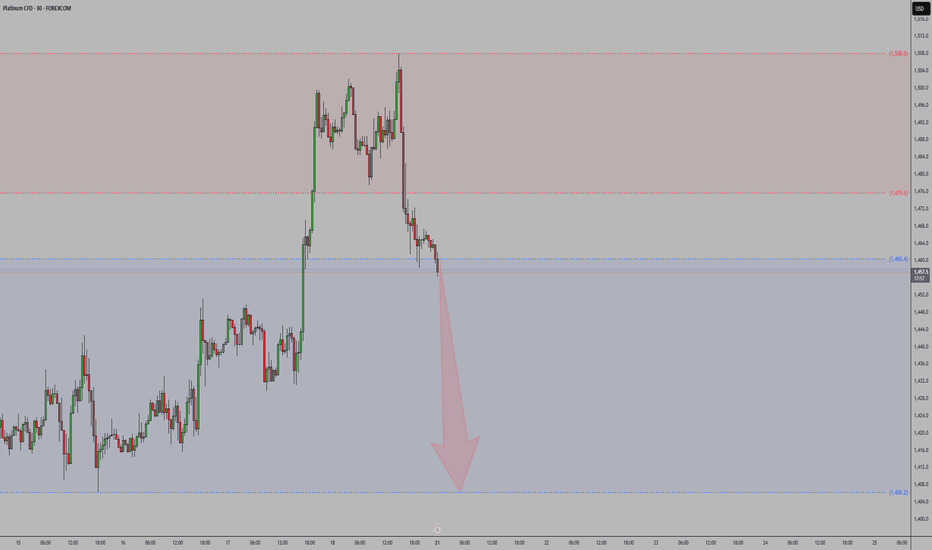

Platinum Wave Analysis – 23 July 2025- Platinum reversed from resistance zone

- Likely to fall to support level 1350.00

Platinum recently reversed down from the resistance zone located between the round resistance level 1500.00, upper daily Bollinger Band and the resistance trendline of the daily up channel from May.

The downward reversal from this resistance created the daily Japanese candlesticks reversal pattern Bearish Engulfing.

Given the weakening daily Momentum (showing bearish divergence), Platinum can be expected to fall to the next support level 1350.00 (low of the previous correction 4).

Platinum SellI'm taking this sell trade on platinum because, after a strong three-month rally, the price has now reached a key resistance zone that has historically seen significant selling pressure—most notably back in August 2014. Given the extended bullish move and the fact that we're approaching a major supply area, I anticipate potential profit-taking or a retracement from this level. That makes it a favorable zone for a short setup.

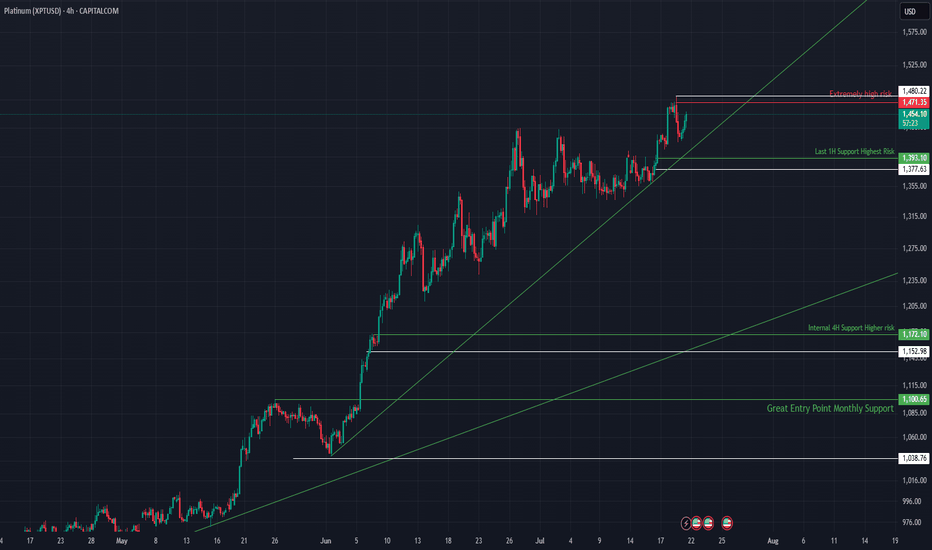

XPTUSD Consolidates Below Light Resistance Within Bullish Struct📈 XPTUSD Hovering Below Light Resistance, Structure Remains Bullish

Platinum is consolidating beneath a relatively light resistance zone after an extended rally, maintaining a strong bullish structure supported by rising trendlines and stacked demand zones. With price action still above key support, bulls are in control unless structure breaks. This publication outlines the levels to watch and the broader market context.

🔍 Technical Analysis:

XPTUSD is currently trading just under $1,471, a mild resistance zone marked on the chart. While price has yet to break through decisively, the rejection so far lacks strong volume, suggesting the resistance may not hold for long.

The overall trend remains bullish, with higher lows forming along the ascending trendline. As long as the structure remains intact and price holds above the key 1H and 4H supports, bulls can aim for a breakout continuation.

🛡️ Support Zones (if pullback occurs):

🟢 $1,385.84 – Last 1H Support (Highest Risk)

Quick-response zone. Valid for scalps or short-term setups.

Stop-loss: Below $1,375

🟡 $1,172.10 – Internal 4H Support (Higher Risk)

Good structural base. Aligned with ascending support trendline.

Stop-loss: Below $1,150

🟠 $1,105.05 – Monthly Support (Great Entry)

Strong macro demand zone. Ideal for long-term swing positioning.

Stop-loss: Below $1,085

🔼 Resistance Levels:

🟥 $1,471.35 – Light Resistance Zone

Currently capping price but lacks strong rejection. Break above could accelerate trend.

🧭 Outlook:

Bullish Case:

Hold above $1,385 and break through $1,471 leads to a renewed bullish impulse.

Bearish Case:

Break below $1,385 may trigger correction into the $1,170 or $1,105 zones before resumption.

Bias:

Bullish while price holds above $1,385 and trendline remains unbroken.

🌍 Fundamental Insight:

Platinum remains supported by constrained supply and robust industrial demand. Expectations of rate cuts and softer inflation also add tailwinds. However, rising dollar strength or sudden shifts in risk appetite could challenge short-term momentum.

✅ Conclusion:

XPTUSD is consolidating below mild resistance, maintaining a healthy bullish structure. A break above $1,471 could confirm trend continuation. Bulls are in control unless $1,385 and the ascending trendline are lost.

Not financial advice. Like & follow for more structure-based insights on FX and commodities.

Platinum drops after NFP beat: Is it time to buy the dip or waitPlatinum bounced after a sharp correction but it is not sitting at a major support level. With NFP data stronger than expected and unemployment dropping, the dollar could rise—but momentum in platinum is still holding. We explore two setups: early dip buying and a safer breakout trade above the recent highs. Watch the full analysis and share your view in the comments.

Possible target ~$1800Platinum is breaking out on weekly and daily time scale our of ascending triangle and channels with big volumes.

multiyear breakout possible with high certainty as geopolitical situation will change the things for long as low trust environment (which is not new) but now with attack on Iran, and Ukrain Russian prolonged war and support to Ukraine by many big countries will change the relation for long, specially high tech items, metals and minerals.

Target based on rounding bottom pattern for multiyear breakout. In future it can surpass gold given its ornamental value and almost zero metal loss due to scratching over time.

Fatty Platty PattyPlatinum

Is it time, Sir?

bodl and hodl thx

Look, Sir, chart description must be satisfying some certain minimum character limit. Therefore I tell you, buy Sir, buy. Based on this one descending line, Sir. We are in breakout mode, Sir, with confluence of averages most beautiful, Sir. The time for acquiring shiney metal is coming, Sir. This is not financial advice, Sir.