RENDER Spot Re-add PlanAlready holding Render as my biggest spot bag. Just setting clean limit orders to compound on weakness.

📍 Limit Orders (laddered):

• 3.45 → Daily FVG top (40%)

• 2.95 → Weekly VAL zone (40%)

• 2.55 → Deep HTF discount (20%)

Long term hold. Pure add-on entries.

DISCLAIMER:

I am not providing finan

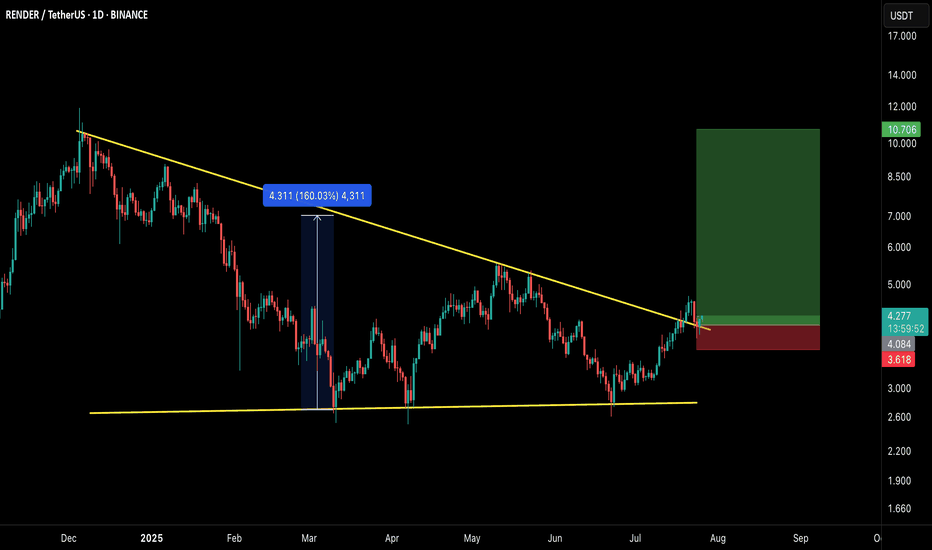

RNDR/USDT at a Critical Turning Point: Golden Pocket as the Key?✨ Overview:

Render Token (RNDR) is currently testing a crucial support zone — the Golden Pocket Fibonacci Retracement between 0.5 (3.616) and 0.618 (3.385). This zone not only represents a significant retracement level but has historically acted as a strong demand area, often serving as a springboa

$RNDR/USDT – Breakout Setup Alert!RNDR has officially broken out of the long-standing descending trendline, confirming a bullish reversal structure. This breakout comes after a sustained consolidation phase and successful retest, indicating strength in buyer momentum.

🔍 Technical Breakdown:

Descending triangle breakout confirmed

Pr

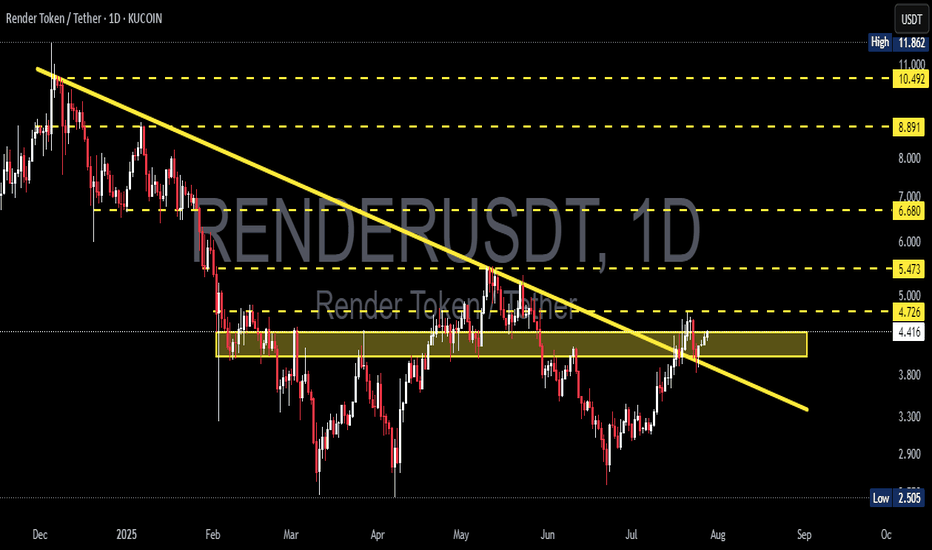

RENDERUSDT Breaks Major Downtrend – Will Bulls Sustain!🧠 Market Context & Structure:

RENDERUSDT is currently presenting one of the most technically compelling setups in recent months. After enduring a prolonged downtrend since late 2024, price action has finally broken above the major descending trendline that has acted as dynamic resistance for over 7

Crypto market review [UPD]: set-ups in BTC and alt-coinsMade a quick video going over some of the setups I see developing in Bitcoin and a few altcoins I personally track and trade.

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re following — feel free to ask in the comment

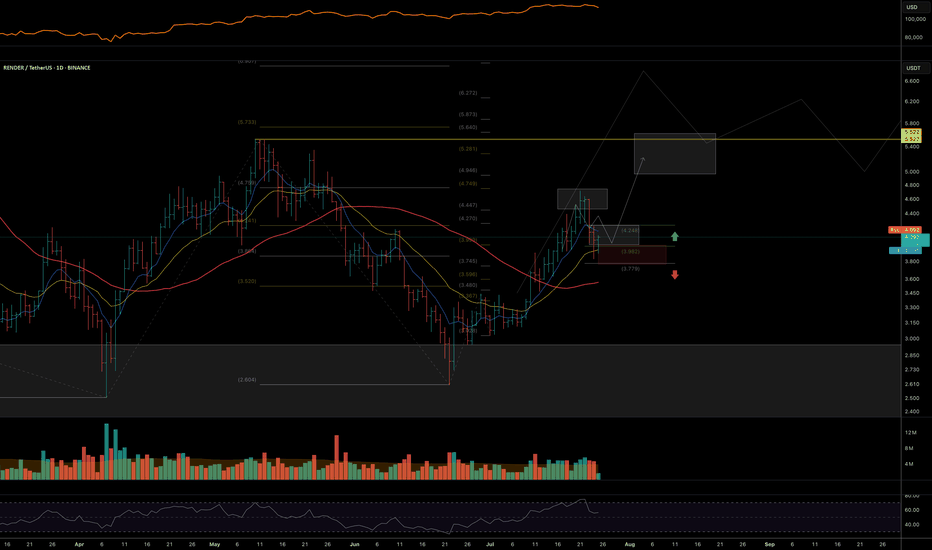

RNDR 1H – Post-Dump Range Established, Still Below Key MidpointRNDR has entered a clear consolidation range following a sharp 24.5% decline over 5 days. Price is currently holding above the range low at $3.35, but remains below the midpoint at $3.88 — a level that typically acts as a key decision point in range-bound markets.

The structure is well-defined:

– R

renderusdt slept onits down in the dumps but i just threw 4 bands in it

1its in a inverse head and shoulders its breaking out as we speak looks beautiful

bullish divergance

2 i love when no one is talking about a coin thats when i like to buy might bw 4 months before i really see some action

3ai is super hot right

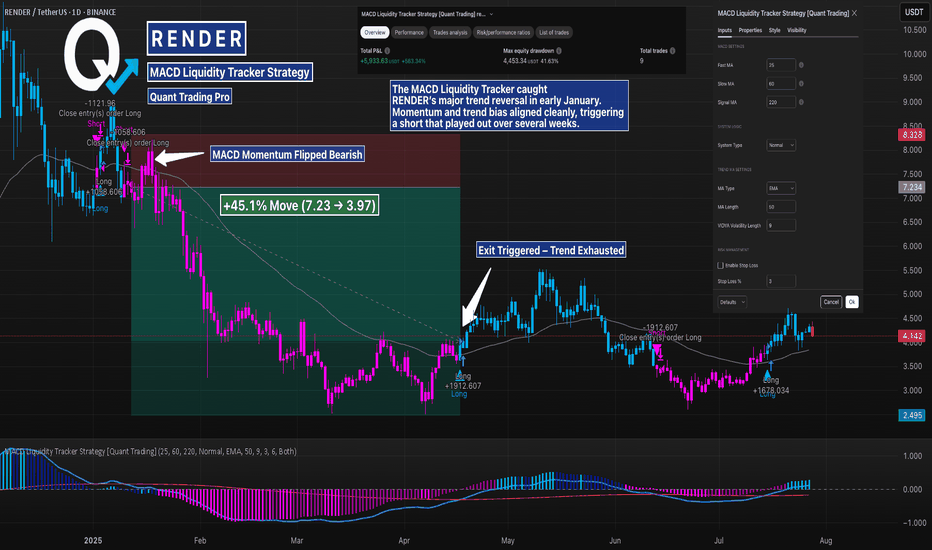

RENDER MACD Liquidity Tracker Strategy – Trend Reversal Catch 1DThis RENDER 1D chart highlights how the MACD Liquidity Tracker Strategy detected a major trend reversal in early 2025. A short was triggered around $7.23, right as MACD momentum flipped bearish and the 60/220 EMAs confirmed downside bias. The position was held until structure and momentum flattened

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.