GD1! trade ideas

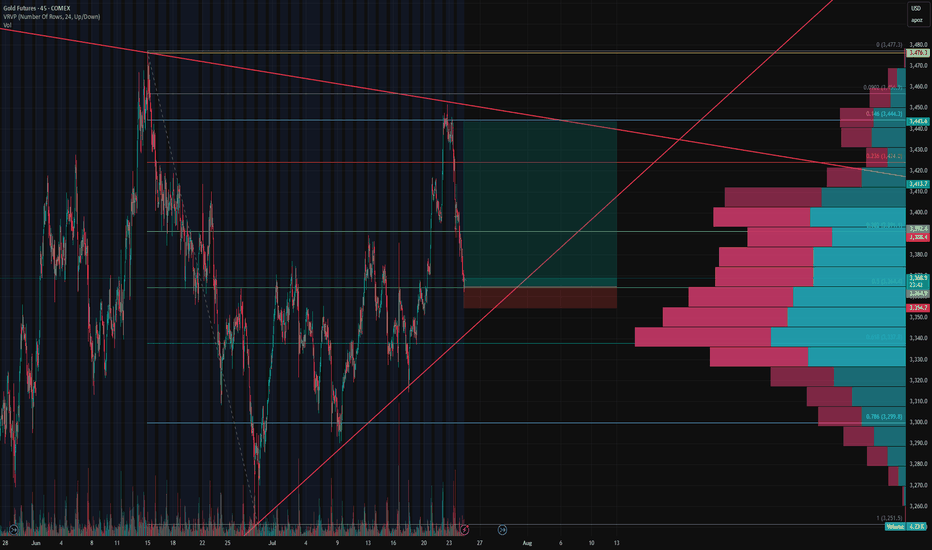

Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce

After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move.

📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on the Volume Profile.

📈 Entered long at 3,365 with a tight stop below 3,354 (0.3% risk), targeting the descending trendline near 3,444 for a clean 7.7R setup.

🧠 Context:

Price reacted hard at resistance, but volume support and structure still lean bullish.

Clear invalidation if we break trend and lose 3,350 support cluster.

Let’s see if this bounce gets legs. 🚀

Gold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 ConfluenceGold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 Confluence

Our initial long setup at the 0.5 Fibonacci retracement level has been stopped out, but the structure remains constructive.

Price is now approaching a key confluence zone at $3,336 , where:

The 0.618 fib retracement from the recent swing low to high aligns perfectly,

The ascending trendline support (respected multiple times since May) intersects, and

The oint of Control (POC) from the visible volume profile shows dominant volume transacted.

This area represents a high-probability support level where bulls may attempt to defend again. We’re monitoring for reaction and potential entry signals around this level. A break below would invalidate the rising wedge structure and shift bias toward lower fib extensions.

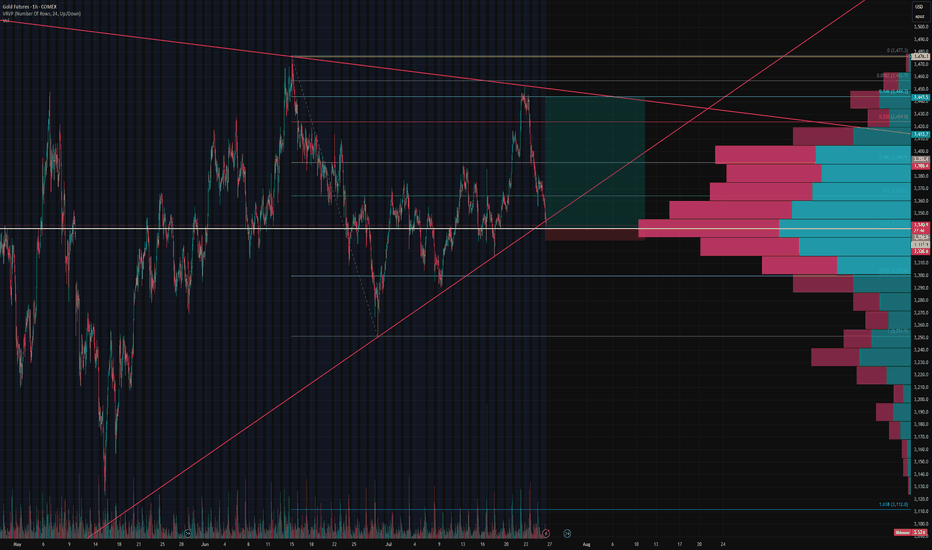

Potential breakout As we observe GC in the Daily timeframe, it's been consolidating in this sort of range for a while now. With the higher lows and 3442 level acting some sort of resistance, we may see some sort of breakout soon. If not, we can see it going back down and MAYBE creating another higher low

#GOLD #XAUUSD Seems to have ended the correction FX_IDC:XAUUSD Gold Spot might have completed the correction as a complex 3-3-5 FLAT, and is currently turning higher in wave (ii), however this get invalidated if THE LAST LOW OF 3268.19 BREAKS. Till the pivot 3268.19 stays strong, the move should be impulsive and take us to new high near term.

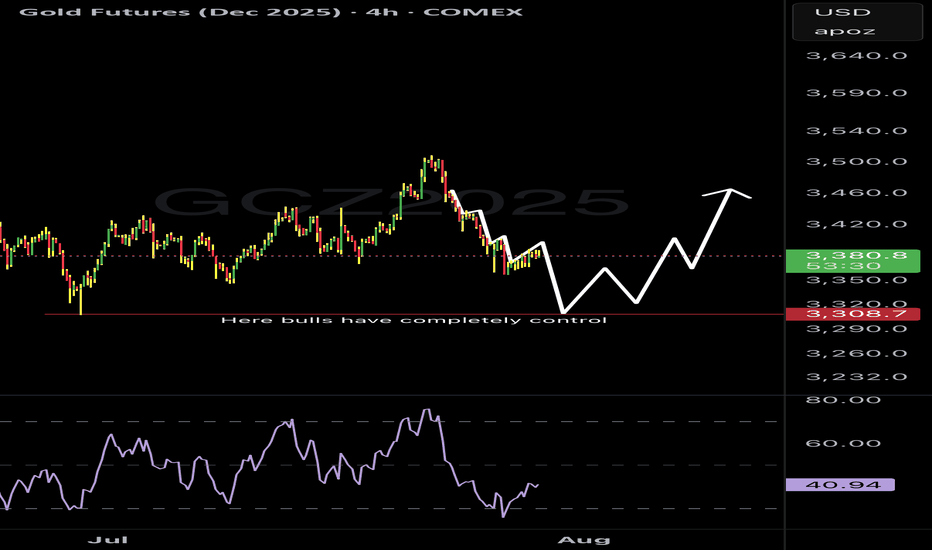

GOLD | XAU/GC - Weekly Recap & Gameplan - 03/08/25📈 Market Context:

Gold is currently trading within an accumulation zone as the market begins to price in a potential 0.25% rate cut by the Fed.

This macro expectation is supporting the broader bullish bias in the commodities market.

🧾 Weekly Recap:

• Price broke below the HTF bullish trendline — a key sign of weakness and potential structural shift.

• However, a sharp drop in the DXY (US Dollar Index) provided a bullish tailwind for gold, resulting in a mid-week bounce.

• This mixed action sets the stage for two potential outcomes next week.

📌 Technical Outlook & Game Plan:

I’m preparing for two possible scenarios:

1️⃣ Bearish Scenario (Red Path):

→ Price retests the broken trendline and rejects it

→ Continuation to the downside

→ Play: Short setup

2️⃣ Bullish Scenario (Green Path):

→ Price reclaims the broken trendline and closes above it

→ Continuation higher toward next resistance

→ Play: Long setup

🎯 Setup Trigger:

I will wait for a clear break of structure (BOS) on the 1H–4H timeframe to confirm directional bias.

📋 Trade Management:

• Stoploss: Below the demand zone (for longs) or above supply (for shorts) on the 1H–4H chart

• Target:

→ Bullish: $3,536

→ Bearish: $3,305

💬 Like, follow, and comment if this breakdown supports your trading! More updates, setups, and educational posts coming soon — stay tuned!

BULLISH ON GOLDLet's take a look at some key things happening with gold and why I decided to go long. The first and most convincing factor for me is the market structure shift after taking sell-side liquidity, followed by strong displacement to the upside. We also have equal highs. Additionally, there’s a 4-hour breaker, and if you look at DXY, it has broken down after running ITS buy-side liquidity. Bonds (ZBU2025) are also showing strength. Gold is still in a range market, and right now we are at the range lows. So, even if you're not bullish on gold, it doesn’t make sense to short. I also wouldn’t feel comfortable shorting because of the equal highs above.

INVALIDATION IS RECENT 4HR LOW.

Gold Futures Super Strong Resistance - Price Coming Back StrongGold Future has been very strongly pushing up without filling any gapes in the short side before pushing up more further.

One unique line is probably the target super strong resistance.

In a daily chart, probably better wait until it reaches that point to try to check for strong short entries maybe.

Still arriving there it would explode up even more further to transform that line into a super strong probable support.

Keep watching!

(Do we actually have to believe that gold is secretly targeting $10,000) in the Yearly Chart?... Since February 2022 it just went berserk!)

Gold Range-Bound and Ripe for Mean Reversion Plays?Gold has been locked in a sideways, range-bound regime for months, largely oscillating between the 3400 and 3160 levels. This lack of clear directional trend stems from conflicting fundamental forces: on one hand, sticky inflation and resilient U.S. data have bolstered the U.S. dollar and yields, weighing on gold. On the other, global growth concerns and geopolitical tensions continue to underpin demand for the metal as a safe haven. The push and pull of these opposing themes has created an environment of indecision and choppy price action.

While long-term investors may find this frustrating, range traders and mean reversion strategies are thriving. With technical boundaries so well-defined, short-term oscillations within the range are offering repeated opportunities for disciplined entry and exit.

Currently, XAUUSD is trading just under the 3296 level after a recent rejection from the 3350s. The bearish structure suggests a potential leg down toward the 3160–3180 support zone. However, absent any major economic surprises or geopolitical shocks, this could merely be another deviation from the mean rather than a true breakdown. Indicators like RSI and Stochastic Oscillator are already hinting at early signs of bullish divergence.

If price holds above or near 3160, the setup for another mean-reversion trade back toward the mid-range (around 3296 or higher) could unfold. In the current environment, fading extremes rather than chasing trends remains a strategy of edge, as depicted by the 14 period RSI.

Gold’s Compression Coil Looks Ready to DetonateMGC continues to reject the 50% Fibonacci retracement level from the $3,386.5 swing high, currently trading at $3,347.3. Price has now spent multiple candles trapped under this level, unable to reclaim $3,355, with clear upper wicks and no bullish follow-through.

This is classic midday NY session compression, often setting up a late-day directional move. All signs currently point to continuation lower toward $3,306.2, completing a textbook measured move.

Staakd Probability Model

Based on historical setups where MGC pulls back to 50% and stalls mid-NY:

Scenario Probability

- Continuation down to $3,306.2 68% High-probability path if $3,347 breaks

- Sweep to $3,355–$3,360 before drop. 26%. Possible liquidity grab

- Break and hold above $3,360 6% Invalidation of the short idea

Key Levels

Level

- 100% Fib High $3,386.5 - Swing high

- Supply Zone $3,347–$3,355 - Rejection area + equilibrium zone

- Current Price $3,347.3 - Compression below fib midpoint

- Target Zone $3,306.2 - Measured move / demand structure

- Invalidation $3,360.0+ - Break above this invalidates the short

Trade Idea (Pending Trigger)

- Bias: Bearish

- Entry Zone: $3,345–$3,350

- Target: $3,306.2

- Invalidation: Above $3,360

- Reward-to-Risk: 2.2R–2.5R depending on entry execution

This is shaping into a high-probability continuation setup. NY session has done the heavy lifting: a weak bounce, heavy rejections, and no reclaim of structure. Unless we see a sudden reclaim of $3,355 or a spike in late NY volume, this looks ready to break and expand lower. Keep it simple. Trust the structure. Let price walk itself to the target.

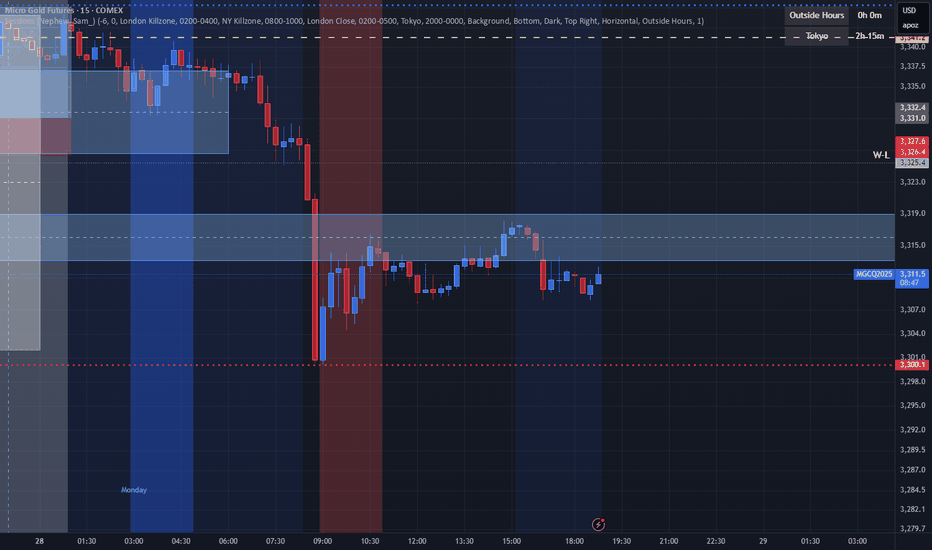

MGC Bear Flag or Dead Cat Bounce? Tokyo’s About to DecideClean structure forming on MGC after a heavy impulse sell during NY session. We’re now consolidating below VWAP in what looks like a textbook bear flag or descending wedge.

We had a sharp breakdown from the highs with no real attempt to reclaim the structure. Price is now compressing underneath the 9/21 EMAs and VWAP clear bear pressure. Volume POC from this range is sitting around 3,332.7, and price can’t even sniff it. Fibonacci 50% retrace off the sell leg aligns with POC stacked resistance.

Entry marked at 3,318.4, targeting a breakdown into 3,268.4 roughly the measured move from the flag.

Quant Confluence:

- Under VWAP

- Below 9 & 21 EMA

- Fib 50% rejection

- Bear flag structure

- POC rejection zone

If I'm Wrong:

If price closes above 3,332.7 (POC) or breaks and holds above VWAP, the bear thesis weakens significantly. Flip long only on a full structure reclaim.

Gold Holds Trendline Amid Rising MomentumFenzoFx—Gold remains above the ascending trendline, trading around $3,386.0. Technical indicators like RSI 14 and Stochastic show rising momentum, reinforcing the bullish bias.

Immediate support lies at $3,347.0. If this holds, XAU/USD may climb toward the monthly VWAP at $3,412.0.

The bullish outlook is invalidated if Gold closes below $3,347.0, which opens the door for further downside toward the next support at $3,307.7.

Gold loading up on buys but first, more drops!Gold is in a place where many are loading up on buys and I understand why. Gold has been taking some significant drops since pushing all time highs but check my charts and reason with me.

In the large timeframes gold still has some movement down to complete the cycle before going back for all time highs again.

Additionally it’s holding the $3388 resistance level (futures price) pretty strong on the 15 minute chart. It’s gonna be an interesting week for gold to say the least.

Gold’s in the Chop Shop. Tokyo’s Got the KeysGold has entered a key decision zone ahead of Tokyo. After a controlled retracement off the 3332 swing high, price has now compressed into a high-probability confluence pocket:

- 50% Fibonacci retracement (3316.3)

- VWAP acting as dynamic support (~3317)

- Trend line support holding from prior structure lows

- Compression below 3332.1 the breakout gate

If Tokyo volume engages, this could trigger a clean structural breakout into higher liquidity zones.

Primary Entry:

- Trigger: 15M or 1H candle close above 3332.1

- Entry Range: 3333.0 – 3334.5 on retest confirmation

- Stop Loss: 3312 (below trend line + VWAP)

Aggressive Entry (Mean Reversion):

- Bounce off VWAP/Fib zone (3316–3317.5) with bullish reaction

- Tighter SL: 3312–3314

- Lower R:R, but better pricing

Target Zones:

- TP1 3340 Minor resistance & round number

- TP2 3365 Prior breakdown zone / supply

- TP3 3390–3400 Extended Tokyo move + trend reversal territory

If I'm Wrong:

A breakdown below 3312 invalidates the bullish thesis. That would signal VWAP failure, trend line break, and potential reversion to 3300 or lower.

Technical Confluence Checklist:

- VWAP support holding - Complete

- 50% Fib bounce attempt - Complete

- EMAs compressing for potential crossover - Complete

- Clean trend line structure intact - Complete

- Low volume chop zone between 3312–3332 - Caution

Tokyo often fakes the initial move. Ideal trigger confirmation comes 30–60 mins after Tokyo open, once liquidity builds. Watch for manipulation wicks around VWAP before committing.

This is a classic quant compression setup, price is coiled into structure, and all major intraday tools align. If we see a clean move above 3332 with volume, the breakout could unfold fast. But lose VWAP and trend line, and the bias flips instantly.

Stay reactive, not predictive. Let price prove direction.