Nvidia (NVDA) Shares Rise On Potential Chip Shipments to ChinaNvidia (NVDA) Shares Rise On Potential Chip Shipments to China

According to Reuters sources, Nvidia has informed Chinese clients of plans to begin shipments of its H200 chips by mid-February 2026. This has been made possible by a recent change in US export policy, which allows the sale of advanced

NVIDIA Corporation Units Thailand Depository Receipt Repr 0.01 Sh

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

131.75 THB

2.46 T THB

4.41 T THB

23.35 B

About NVIDIA Corporation

Sector

Industry

CEO

Jen Hsun Huang

Website

Headquarters

Santa Clara

Founded

1993

Identifiers

2

ISINTH0150121000

NVIDIA Corp. engages in the design and manufacture of computer graphics processors, chipsets, and related multimedia software. It operates through the following segments: Graphics Processing Unit (GPU) and Compute & Networking. The Graphics segment includes GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, Quadro and NVIDIA RTX GPUs for enterprise workstation graphics, virtual GPU, or vGPU, software for cloud-based visual and virtual computing, automotive platforms for infotainment systems, and Omniverse Enterprise software for building and operating metaverse and 3D internet applications. The Compute & Networking segment consists of Data Center accelerated computing platforms and end-to-end networking platforms including Quantum for InfiniBand and Spectrum for Ethernet, NVIDIA DRIVE automated-driving platform and automotive development agreements, Jetson robotics and other embedded platforms, NVIDIA AI Enterprise and other software, and DGX Cloud software and services. The company was founded by Jen Hsun Huang, Chris A. Malachowsky, and Curtis R. Priem in April 1993 and is headquartered in Santa Clara, CA.

Related stocks

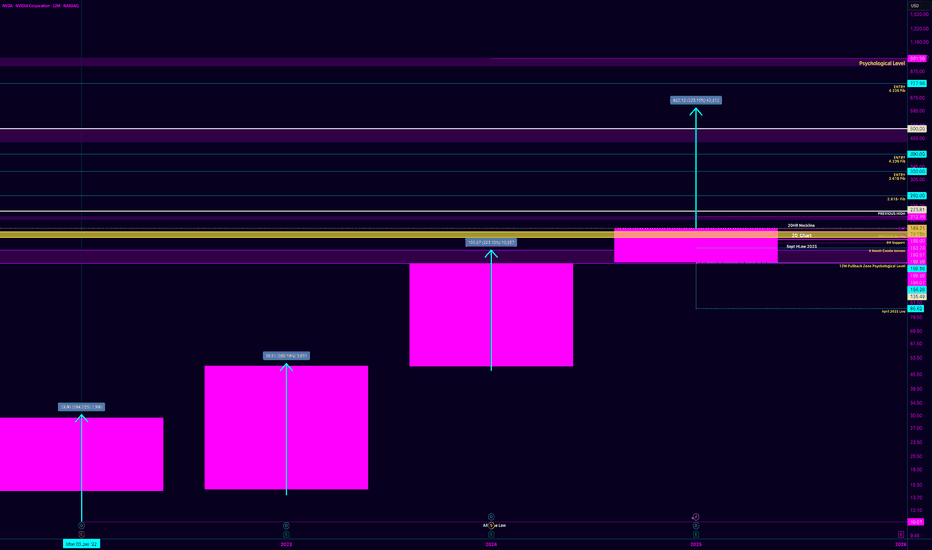

NVDIA ANALYSISFirst of all, my main focus in trading is Crypto but I also examine US stocks once in a time.

As I can understand from the chart in here, there is a high possibility that Nvdia is about to face a crash.

For the ones who comes to my profile for the first time, please here me out for a bit.

Technica

NVDA — Structure, Timing, and the 223.10% TheoryI want to expand on my NVDA thesis by adding one more layer that’s been on my mind — the 223.10% measurement — and how I’m viewing it strictly as a structural possibility, not a prediction.

Everything below is still rooted in market structure and timing.

Quick Recap: Where We Are

Price ran from t

NVDA reversed on the weekly chart. Here are my long scenarios.Last Friday closed with a strong green candle and a clear volume spike, which may confirm a structural shift to the upside.

Market today is up almost 1.5%, and price is gravitating toward the previous weekly high around the $188 area.

At this point, today’s session is unlikely to offer a clean ent

NVIDIA – When the Same Setup Appears Twice!NVDA - CURRENT PRICE : 188.61

NVDA – Technical BUY Call 📈

Price previously rallied steadily after breaking a minor downtrend line (refer orange circle).

Similar technical setup is forming again, suggesting a potential repeat of the prior upswing.

In both occurrences, price stayed above

NVDA Dec 22 – Holding the Highs as Gamma Builds for Next Push

1-Hour Chart Analysis (Primary Structure & Bias):

On the 1-hour timeframe, NVDA is clearly in trend continuation mode. Price has fully reclaimed the prior breakdown area and is now holding above the $178–$180 value zone, which previously acted as resistance. This shift from resistance to support is

Nvidia - This is all still expected!🥊Nvidia ( NASDAQ:NVDA ) is heading for another -20%:

🔎Analysis summary:

Just last month, Nvidia created a massive bearish engulfing candle. This clearly shows that buyers are not willing to accept higher prices. Together with the retest of the major resistance trendline, Nvidia is heading low

NVDA Daily Chart Breakdown: Trendline, Targets, and RiskNVDA remains in a strong long-term uptrend, but short-term price action shows a corrective / decision phase. Price is currently sitting on a major ascending trendline, near the 50-day SMA.

Current state:

• Primary trend: Bullish

• Price location: Key dynamic support

• Major resistance: 210 – 2

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NVDA4971918

NVIDIA Corporation 3.5% 01-APR-2050Yield to maturity

5.38%

Maturity date

Apr 1, 2050

NVDA4971919

NVIDIA Corporation 3.7% 01-APR-2060Yield to maturity

5.26%

Maturity date

Apr 1, 2060

NVDA4971917

NVIDIA Corporation 3.5% 01-APR-2040Yield to maturity

4.95%

Maturity date

Apr 1, 2040

US67066GAN4

NVIDIA Corporation 2.0% 15-JUN-2031Yield to maturity

4.09%

Maturity date

Jun 15, 2031

NVDA4971916

NVIDIA Corporation 2.85% 01-APR-2030Yield to maturity

3.96%

Maturity date

Apr 1, 2030

US67066GAE4

NVIDIA Corporation 3.2% 16-SEP-2026Yield to maturity

3.94%

Maturity date

Sep 16, 2026

NVDA5203204

NVIDIA Corporation 1.55% 15-JUN-2028Yield to maturity

3.66%

Maturity date

Jun 15, 2028

See all NVDA80 bonds

Curated watchlists where NVDA80 is featured.