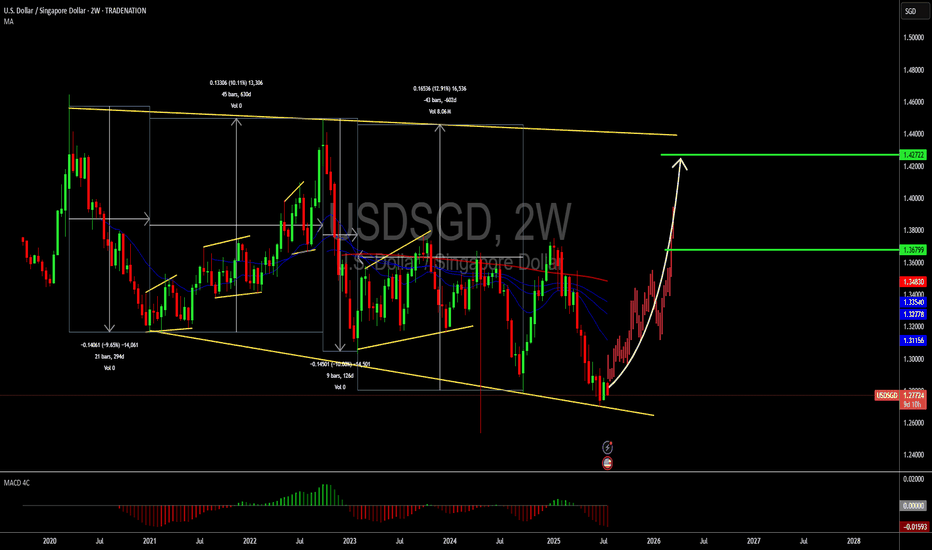

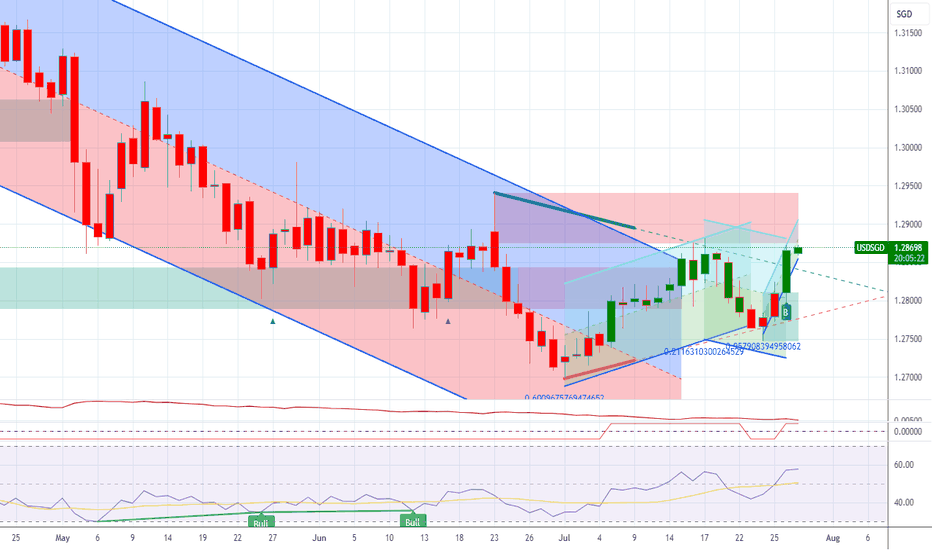

USDSGD: A long-term buyHello,

The USDSGD is trading at the bottom of the corrective wave. As at today USD/SGD remained pressured, edging down 0.13% as markets awaited more clarity on both US trade policies and monetary policy outlooks in Asia, keeping SGD slightly firmer. The price of this pair is currently trading below the moving averages.

We see an opportunity for buys on this pair with targets at the middle and the top. A weaker US dollar is expected over the next 6-12 months as the Federal Reserve likely resumes rate cuts and interest rate differentials narrow. This should translate into further SGD strength and downside pressure on the USD/SGD pair, as investors capitalize on higher yields and potential capital gains from EM currencies like the Singapore Dollar. The Expected bullish zero crossover on the MACD is a further confirmation of the projected bullish move.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SGDUSD trade ideas

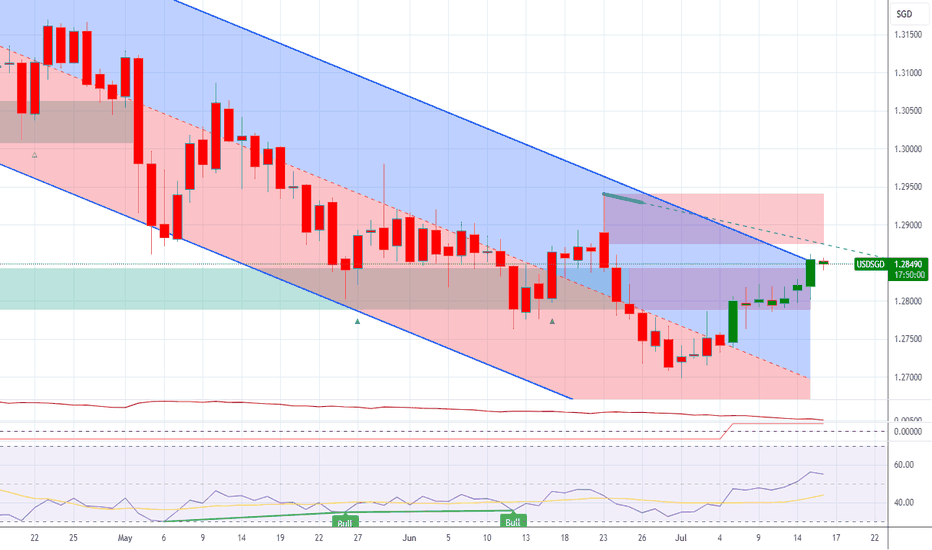

#014: USD/SGD SHORT Investment Opportunity

In recent days, an extremely interesting window has opened on the USD/SGD exchange rate, a pair often overlooked by retail traders but highly sensitive to Asian institutional flows. I decided to open a short position, betting on a decline in the US dollar against the Singapore dollar, for a series of structural, real, and measurable reasons.

The US dollar has begun to show clear signs of weakness. Recent macroeconomic data releases have been below expectations, particularly those related to inflation and consumption. At the same time, market expectations regarding interest rates are shifting in the opposite direction from a few months ago: the probability of a rate cut by the Fed by the end of the year is growing. Added to this is a visible decline in open interest on dollar-linked futures contracts, a clear sign that many institutional long positions are being closed. The market simply no longer believes in a strong dollar.

While the US dollar is losing momentum, the Singapore dollar is quietly but solidly strengthening. The Monetary Authority of Singapore has maintained an extremely prudent and conservative monetary policy, and capital flows into Asian markets continue to grow. The Singapore dollar has historically been seen as a regional safe-haven currency, and in an environment where the US dollar is weakening, it becomes an ideal candidate to accommodate new relative strength.

One of the most significant factors in this decision, however, is retail sentiment. Currently, over 80% of retail traders are long USD/SGD. This imbalance is striking. Typically, when the vast majority of non-professional traders are aligned on one side, the market ends up moving in the opposite direction. Institutions, on the other hand, patiently build short positions, taking advantage of excessive retail euphoria. Conventional sentiment is often the best counter-indicator.

Chart and volume analysis perfectly confirm this scenario. In recent candles, we have seen an anomalous spike above resistance, followed by a sharp rejection. This is classic behavior: institutions push the price above a key zone, trigger long retail traders' stops, raise liquidity, and then let the price fall. No news, no macro trigger: just pure manipulation. The structure now has all the characteristics to unload downwards.

The chosen take profit level is not random. It is positioned in an area historically defended by institutions, specifically between 1.27680 and 1.27720. In that range, there are volume gaps, representing the classic unloading zones where banks close positions. Furthermore, FX options show a high concentration of put strikes in that same zone, confirming that options desks are also working to defend a bearish move.

All these elements combined—macroeconomic, behavioral, volumetric, and positioning—lead to a single logical conclusion: shorting USD/SGD at this precise moment is a rational, concrete trade, and consistent with institutional flows. No gambles. No forcing. Just chance, balance and timing.

Singapore Dollar: Asia’s Quiet Safe Haven with Eyes on ParityThe Singapore dollar has quietly emerged as one of the strongest performers in Asia, gaining over 7% against the US dollar this year.

While much of the FX world fixates on the yen or franc in times of uncertainty, the SGD is carving out a niche as a regional safe-haven, driven not by size or liquidity, but by credibility.

The strength in the SGD isn’t just about USD weakness. Singapore's macro fundamentals

budget surpluses,

robust reserves, and

deep-rooted investor confidence

offer a kind of quiet strength that traders tend to overlook until it becomes obvious.

This makes the SGD a compelling hedge against both regional turmoil and global dollar decay.

As more global capital looks for stable homes outside of the traditional, Singapore’s financial system and currency are set to benefit.

The idea of SGD hitting parity with the USD, once dismissed as unrealistic, is now getting serious attention.

Analysts have suggested that it could happen within five years, but I wouldn’t be surprised if it comes sooner!

The greenback’s structural issues of twin deficits, political gridlock, and de-dollarization headwinds are no longer theoretical.

That said, liquidity is still a constraint. The SGD makes up just 2% of global FX turnover, and the MAS actively manages the currency to avoid excessive volatility.

This means that while the long-term trend favors SGD appreciation, traders betting on a rapid sprint to parity may be left waiting.

In my view, the SGD is one of the most underappreciated macro trades in FX.

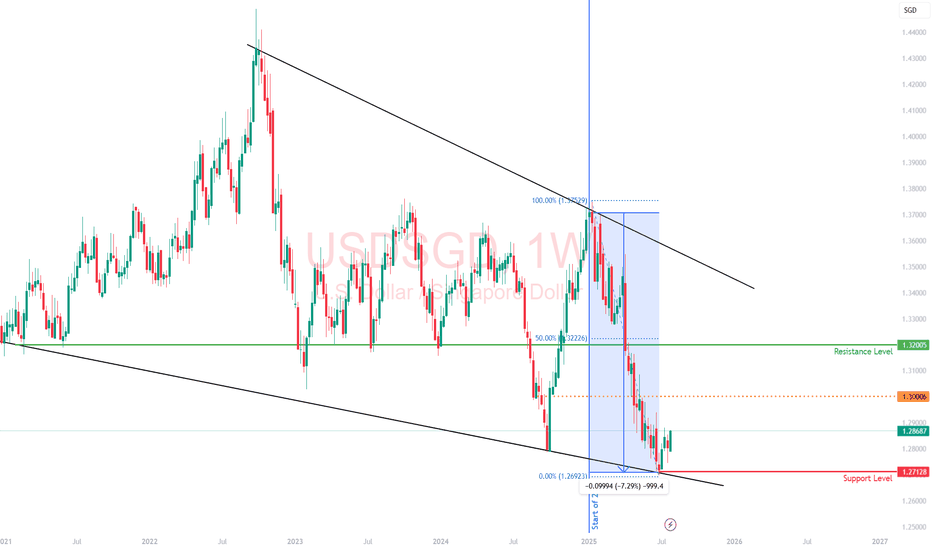

Usd/Sgd LongI expect DXY to get stronger. If it will happen Usd pairs should move up including this one.

Usd/Sgd has currently been testing falling trendline from 2021 and 2024 and under

current price at 1.275 there is a FVG, seen on 4h chart. This point is good for entry.

For TP look for unfilled FVG up at 1.325 area. For SL 1.2700 area and under.

For this trade to work DXY must show that it's able to move and stay higher. Usd is stil weak

and nobody knows if it's at bottom or it may reverse from here in upcoming days. If it will

reverse there is high probability that it will reverse strongly. There is lot of fear in market

right now around Usd and fear often tells you that bottom is close or in and with that reversals.

Time to plan a trip to the USA ?We have now breached the support level at 1.28288 and if nothing goes wrong, it should goes south towards 1.23684, a level supported since 2013.

This is also good for those based in Singapore but are buying US assets - stocks, ETFs, crypto, etc as you would need less Sing dollars for the equivalent of US dollars.

That means US dollars depreciate, Sing dollars appreciate.

USDSGD likely to reach level 1.33643USDSGD was trending bearish as USD weakened due to multiple decisions and trade war.

Look for zones for reversal and once USD starts strengthening, the price is likely to reach level 1.33643.

This is for educational purpose only. Not an investment or financial advise.

Singapore dollar price increaseIf the Monetary Authority of Singapore (MAS) tightens monetary policy (e.g., by allowing SGD appreciation or raising interest rates) or if Singapore’s economic growth improves, the SGD could strengthen. Additionally, if the U.S. Federal Reserve stops raising rates or signals cuts, pressure on the SGD may ease.

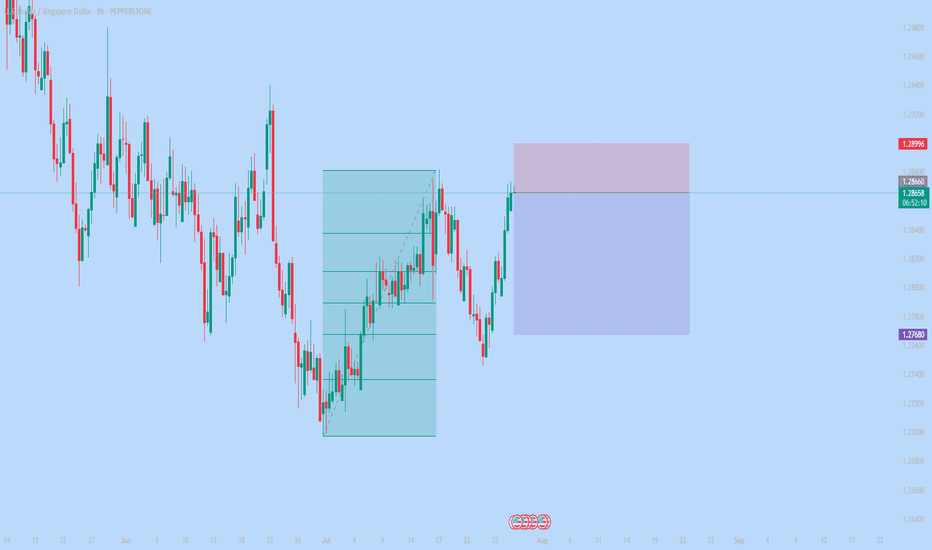

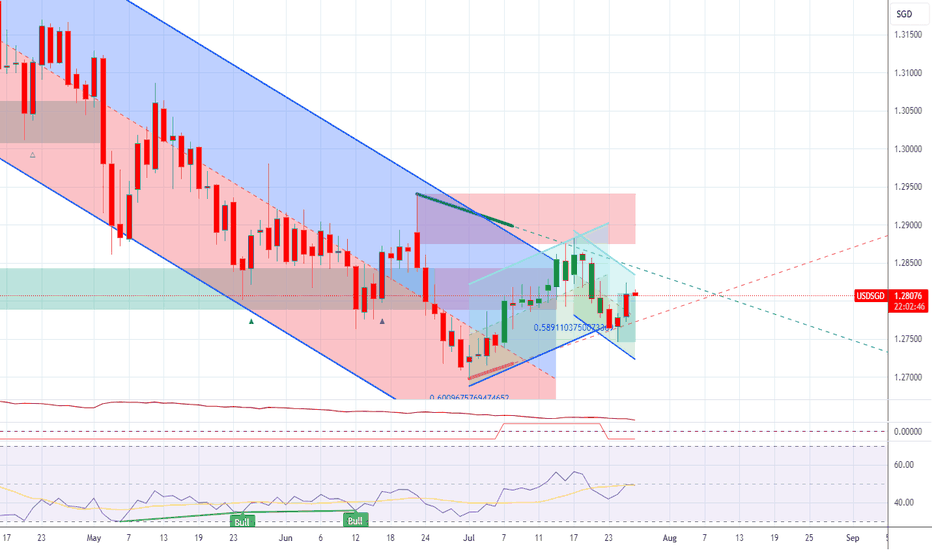

Playing the middle-sectionNews was left out of the equation. Price action is forming a short-term bullish structure, with a clear inversed head and shoulders supported by strong expansion. Entry criteria are aligned with short-term HTF context and confirmed by the break of the inflection point, marked by the ray line.

From that level, we saw a strong impulse with full PA participation, followed by a healthy correction. I won’t move to breakeven until current noise is cleared.

Execution was according to plan, and I’m fully content—even with a potential loss. Risk was predefined, and that’s what matters most.

Trade safe chads!

TVC:DXY

OANDA:EURUSD

OANDA:USDSGD

Currency exchange and US assets - stock marketI am blessed to live in Singapore , a country well known for its stability and peace.

Assuming I had invested 100K SGD dollars in US stock market - SPX in Jan 2016 at exchange rate of 1.44 to 1 USD.

That means I would have only 69,444 USD available to invest. And if I stayed in the game long enough and say I decide to cash out half of my positions, I am winning on both ends - profits from the SPX , from the low of 2000+ to 5000+ now , a difference of 3000+ points profits.

Also, the exchange rate is now in my favour, 1.29 to 1 USD as compared to 1.44 to 1 USD back then.

I am of the opinion for a very long time, at least in my generation, I would not be able to witness the US dollar being replaced by any currency. The whole world borrows in USD dollars and invest in their assets - stocks, gold, treasury bonds, etc. This appreciation of the currency wars we are seeing now is temporary and whilst it last, I would be investing more in US assets like stocks and gold.

I suggest you DYODD and not listen to gurus/experts telling you that the US market is collapsing, inflation is coming and overvalued or use WB holding 1/3 of his position in cash to get you out of the market. Yes, you can trim your position to take some money off the table but to quit completely is foolish.

Let's put things in context, WB is reducing his positions and not liquidating all his positions , considering he has billions of cash as capital to play the game. If your capital is 10k , you probably need 8% to make 800 bucks for the year. In WB case, just say he used 100 million to invest in the same SPX and at conservative 8% returns, he would have made 8 million in profits.

See, the position size matters a lot ! The smaller your capital base, you either need a longer time frame to ramp up your returns on compounded basis or choose to invest in riskier assets to gain higher returns (20-50%) eg. picking individual stocks, crypto, etc.

Do not neglect the exchange rates profit and loss over the years, it eats into your returns slowly but surely.........

Trade Analysis for Week 16 (14Apr25 onwards)Hello fellow traders , my regular and new friends!

Over here I will be sharing my analysis for this week.

Mainly On:

EURUSD

EURAUD

EURNZD

BTC

USDSGD

Moving forward I will separate both the Trade review and Coming week trade analysis for easy viewing!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

Thu 10th Apr 2025 USD/SGD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/SGD Sell. Enjoy the day all. Cheers. Jim

USDSGD – Technical Analysis (1D)USDSGD has broken out of a descending trendline on the daily timeframe – signaling a potential shift in short-term momentum. Price has held above 1.3510, confirming the breakout and opening the door to resistance zones at 1.3565–1.3638 (aligned with 0.382 and 0.236 Fibonacci levels).

If bulls stay in control, next targets lie at 1.3723 and 1.3750. However, a short pullback toward the 1.3450–1.3480 support zone (0.618 Fibo) is also possible.

🔹 Main scenario: continuation to 1.3565 → 1.3638 → 1.3723.

🔹 Alternative scenario: drop below 1.3450 toward 1.3376 or 1.3274.

Fri 4th Apr 2025 USD/SGD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/SGD Sell. Enjoy the day all. Cheers. Jim

Buy USDSGD: Great buy set up forming.Hello,

A high-probability buying opportunity is unfolding for the USD/SDG pair, with potential to ride momentum toward the upper range. Since mid-2020, this pair has been locked in a broad sideways consolidation, now carving out a textbook expanding triangle pattern on the weekly chart. This formation—characterized by widening highs and lows—signals increasing volatility and an impending breakout. The price recently staged a decisive rebound from the triangle’s lower trendline, a critical support zone, and has been in a corrective upswing since mid-January 2025.

Adding weight to this setup, the weekly MACD is approaching a bullish zero-line crossover, a reliable indicator of strengthening momentum that often precedes significant moves.

Together, these factors point to a low-risk entry for buyers, targeting the upper trendline—potentially yielding a 5-8% move, depending on execution. This setup suggests an attractive entry for buyers, with a target at the upper trendline of the triangle.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Tue 25th Mar 2025 USD/SGD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/SGD Buy. Enjoy the day all. Cheers. Jim

USDSGD: Target for c) of (B) is 1.2788 below.DISCLAIMER : All labelling and wave counts done by me by manually and i will keep change according to the LIVE MARKET PRICE ACTION. So don't bias, hope on my trade plans...try to learn and make your own strategy...Following is not that much easy...I AM NOT RESPONSIBLE FOR ANY LOSSES IF U TOOK THE TRADE ACCORDING TO MY TRADE PLANS....THANKS LOT..CHEERS