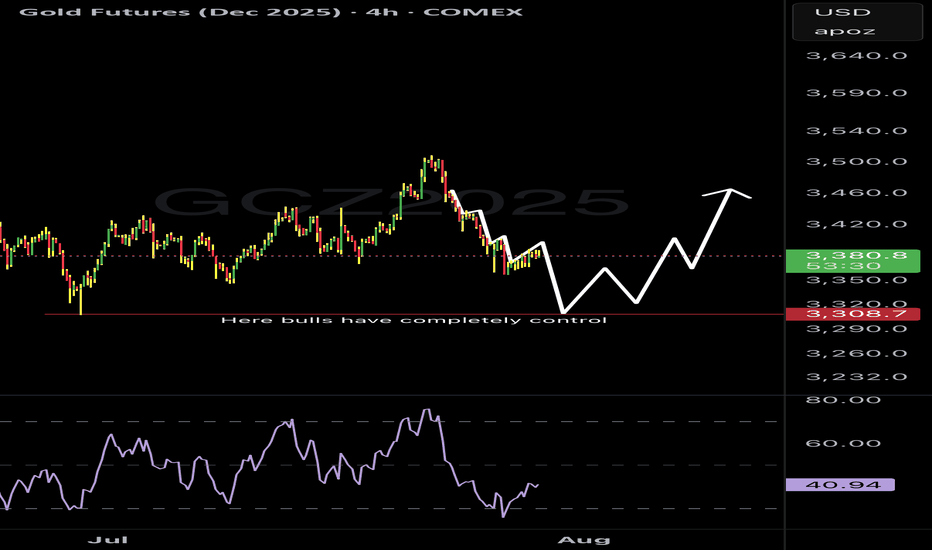

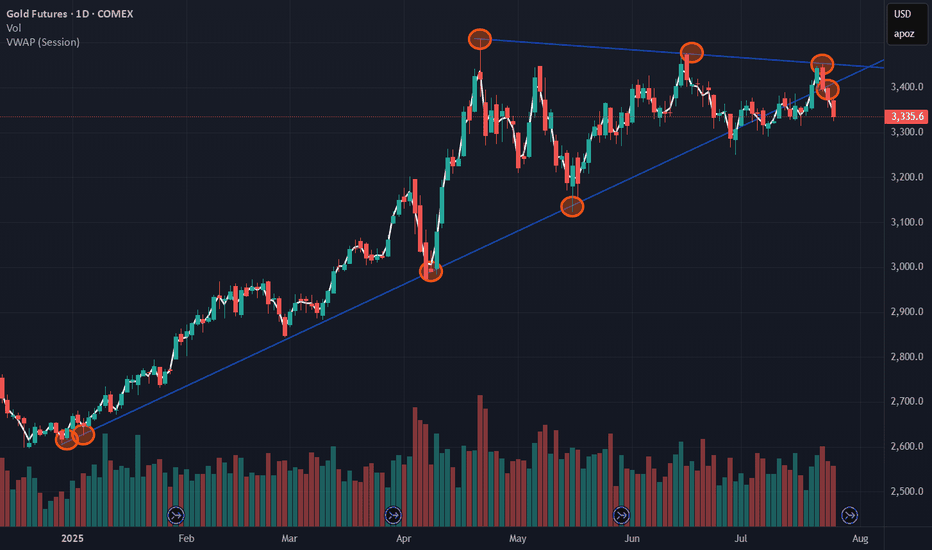

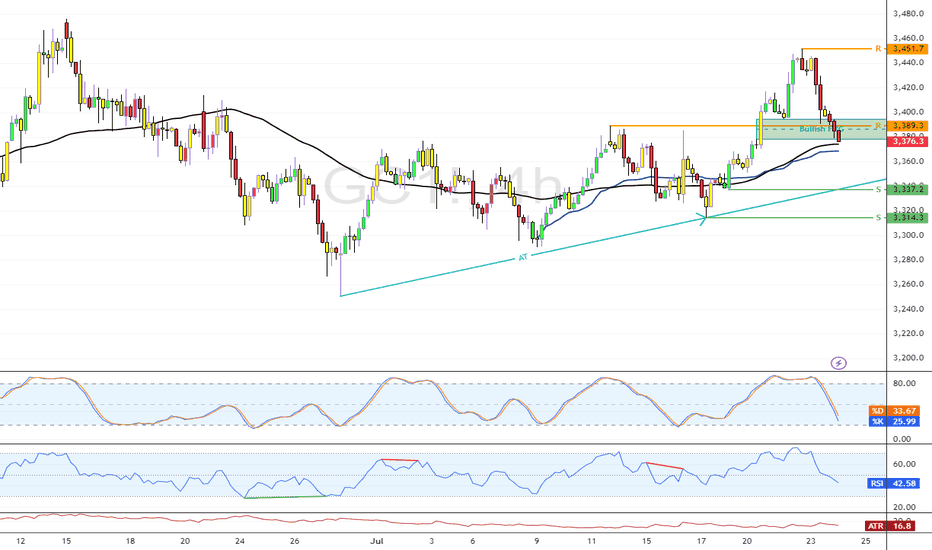

Gold Holds Trendline Amid Rising MomentumFenzoFx—Gold remains above the ascending trendline, trading around $3,386.0. Technical indicators like RSI 14 and Stochastic show rising momentum, reinforcing the bullish bias.

Immediate support lies at $3,347.0. If this holds, XAU/USD may climb toward the monthly VWAP at $3,412.0.

The bullish outlook is invalidated if Gold closes below $3,347.0, which opens the door for further downside toward the next support at $3,307.7.

GDF1! trade ideas

Gold loading up on buys but first, more drops!Gold is in a place where many are loading up on buys and I understand why. Gold has been taking some significant drops since pushing all time highs but check my charts and reason with me.

In the large timeframes gold still has some movement down to complete the cycle before going back for all time highs again.

Additionally it’s holding the $3388 resistance level (futures price) pretty strong on the 15 minute chart. It’s gonna be an interesting week for gold to say the least.

Gold Contract Rolled!Now that the contract rolled We might get a bit more movement. Yesterday was nothing but a giant flag. I want to see price go sweep levels before turning full on bullish. We must keep in mind that we are at the end of the month as well. so price can end up stalling till next week. but tomorrow there is a lot of News pending. So that can really shake things up.

Gold’s in the Chop Shop. Tokyo’s Got the KeysGold has entered a key decision zone ahead of Tokyo. After a controlled retracement off the 3332 swing high, price has now compressed into a high-probability confluence pocket:

- 50% Fibonacci retracement (3316.3)

- VWAP acting as dynamic support (~3317)

- Trend line support holding from prior structure lows

- Compression below 3332.1 the breakout gate

If Tokyo volume engages, this could trigger a clean structural breakout into higher liquidity zones.

Primary Entry:

- Trigger: 15M or 1H candle close above 3332.1

- Entry Range: 3333.0 – 3334.5 on retest confirmation

- Stop Loss: 3312 (below trend line + VWAP)

Aggressive Entry (Mean Reversion):

- Bounce off VWAP/Fib zone (3316–3317.5) with bullish reaction

- Tighter SL: 3312–3314

- Lower R:R, but better pricing

Target Zones:

- TP1 3340 Minor resistance & round number

- TP2 3365 Prior breakdown zone / supply

- TP3 3390–3400 Extended Tokyo move + trend reversal territory

If I'm Wrong:

A breakdown below 3312 invalidates the bullish thesis. That would signal VWAP failure, trend line break, and potential reversion to 3300 or lower.

Technical Confluence Checklist:

- VWAP support holding - Complete

- 50% Fib bounce attempt - Complete

- EMAs compressing for potential crossover - Complete

- Clean trend line structure intact - Complete

- Low volume chop zone between 3312–3332 - Caution

Tokyo often fakes the initial move. Ideal trigger confirmation comes 30–60 mins after Tokyo open, once liquidity builds. Watch for manipulation wicks around VWAP before committing.

This is a classic quant compression setup, price is coiled into structure, and all major intraday tools align. If we see a clean move above 3332 with volume, the breakout could unfold fast. But lose VWAP and trend line, and the bias flips instantly.

Stay reactive, not predictive. Let price prove direction.

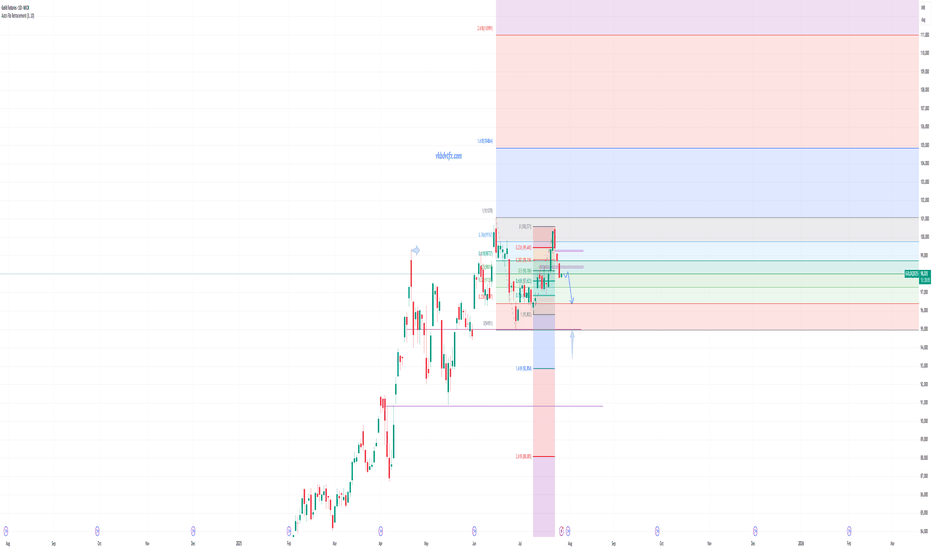

GOLD - GC Weekly Recap & Outlook | 27.07.2025🧾 Weekly Recap:

• Price tapped into the 1H Demand Zone (red box) and ran the 4H swing liquidity before bouncing to clear internal range liquidity.

• This move was followed by a retracement which led to a break of the bullish trendline.

This may signal the beginning of a broader accumulation phase. Expect choppy price action targeting internal liquidity both above and below, before a clear trend resumes.

📌 Technical Analysis:

Price has closed below the bullish trendline, leading to two possible scenarios:

1. Bullish scenario (black path):

– Price runs the W C DOL (3313$) →

– Finds rejection →

– Retests broken trendline →

– Breaks above the trendline →

– Continues toward 3444$ and potentially 3474$

2. Bearish scenario (orange path):

– Price runs W C DOL (3313$) →

– Rejects from the broken trendline →

– Fails to reclaim it →

– Continues downward to target M C DOL (3256$)

📈 Setup Trigger:

Wait for clear 1H–4H supply/demand zone creation and structure shift before initiating a trade.

🎯 Trade Management:

• Stoploss: Above/below relevant supply-demand zone

• Targets:

– Bullish: 3444$, 3474$

– Bearish: 3256$

🟡 If you liked the idea, feel free to drop a like & comment — and don’t forget to follow for more weekly updates.

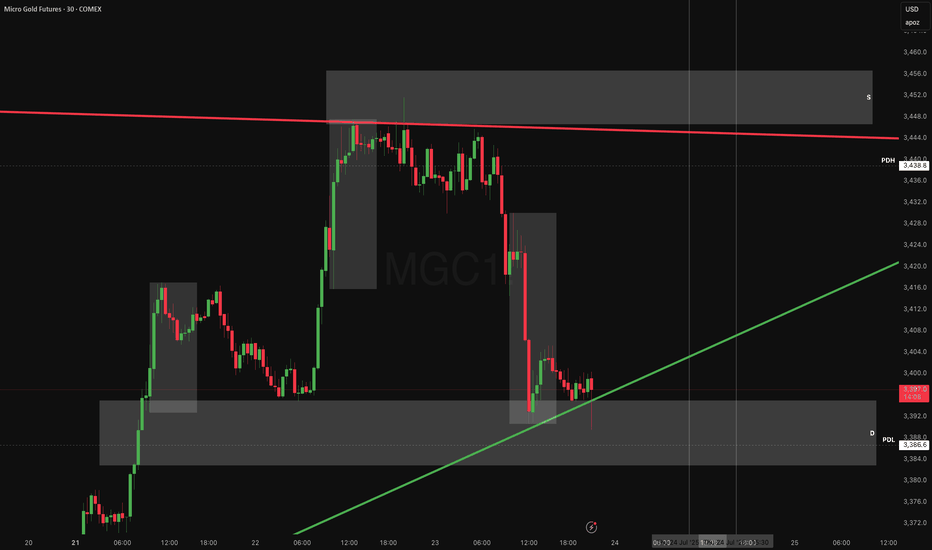

MGC Tokyo Fade: If It Rejects, It DiesThis one was a request from someone asking for a breakdown of MGC heading into the Tokyo session so here’s the full quant review.

After Friday’s clean liquidation, gold found temporary footing around 3330. But the bounce is stalling under VWAP (3344) and Friday’s POC both stacking resistance like a ceiling of bricks. EMAs are fanned and directional, suggesting sellers still control the structure.

VWAP + POC = kill zone for a potential Tokyo fade.

Quant Review:

- Friday Session POC: 3341.9 — currently acting as resistance

- VWAP (Session): 3344.6 — unclaimed on the bounce

- 9 & 21 EMAs: Bearishly stacked, aligned with VWAP

- Volume Profile: Value area is lower; price is rejecting acceptance higher

- Microstructure: Weak bounce into resistance without reclaim of structure

Trade Plan (Short Bias):

- Entry Zone: 3340–3344 (VWAP/POC cluster)

- Trigger: Bearish engulfing or LTF rejection off VWAP shelf

- TP1: 3332 (prior low)

- TP2: 3322 (thin node sweep)

- TP3: 3305 (session low extension)

- Stop Loss: Above 3346 (structure + shelf break)

- R:R: 1.5–5 depending on scaling

- Probability of rejection and drop to 3332: 65%

- Probability of full leg to 3322–3305: 30%

- Risk of breakout above VWAP: 5%

If I’m Wrong

The Sunday open is always a wildcard sometimes you get pure trend continuation, other times it’s total chop or liquidity grabs before the real move unfolds in London.

If price cleanly reclaims 3346, closes above with strength, and holds the short idea is off. At that point, I’d expect a sweep toward 3355–3360, potentially tagging the high-volume node from mid-Friday.

In that case: Flip bias to bullish retrace into early London.

Bonus:

If you ever want a quant-style breakdown or session analysis like this just reach out. We break it down with structure, stats, and setups.

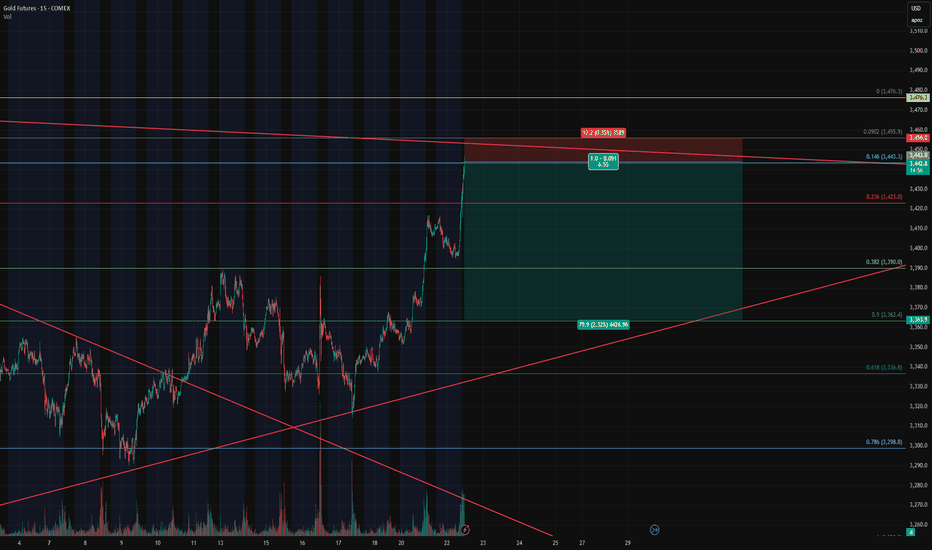

Near Term Bearish Development on Gold?The three bearish days in a row could be a potential near term bearish development on Gold. If a retest somewhere between 3370 and 3400 happens relatively soon and rejects it could potentially be in for a bearish extension. 3373 would be the 0.618 and 3388 would be the 0.5 retracement area. With a potential target down toward 3248 area

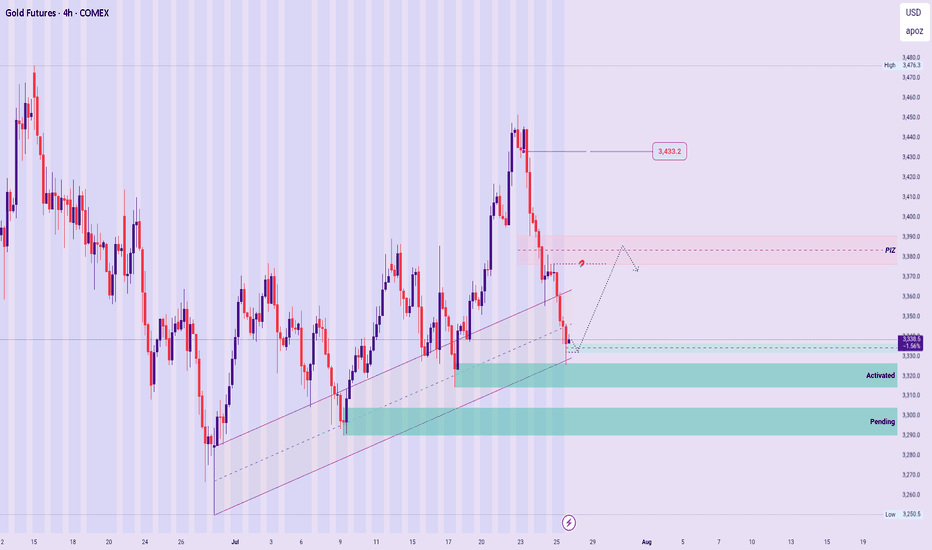

GOLD – New Week Technical Bias (Market Open)

Structural Outlook:

The broader bullish sequence remains valid, with no structural breach confirmed yet.

However, price is currently reacting at a sensitive level, warranting measured caution.

Zone Dynamics :

▪︎ A recently activated Rejection Zone is expected to support a gradual impulse toward the PIZ.

▪︎ From the PIZ, two scenarios unfold:

a. If it becomes a Price Base, we may see a continuation rally toward the 3433.2 region.

b. If the PIZ acts instead as a Price Cap, price may reject lower, targeting the pending Rejection Zone beneath or deeper, should the current zone fail to hold. Thereby presenting a Bearish structural formation.

Summary:

The directional bias remains bullish unless a clear Structure Breach (SB) occurs below key support levels.

Stay adaptive, and observe the PIZ reaction closely for directional confirmation.

🛑 Disclaimer:

This is not a trade signal. These are high-level technical insights meant for educational and analytical purposes. Always validate with your system and trade with discipline and risk awareness.

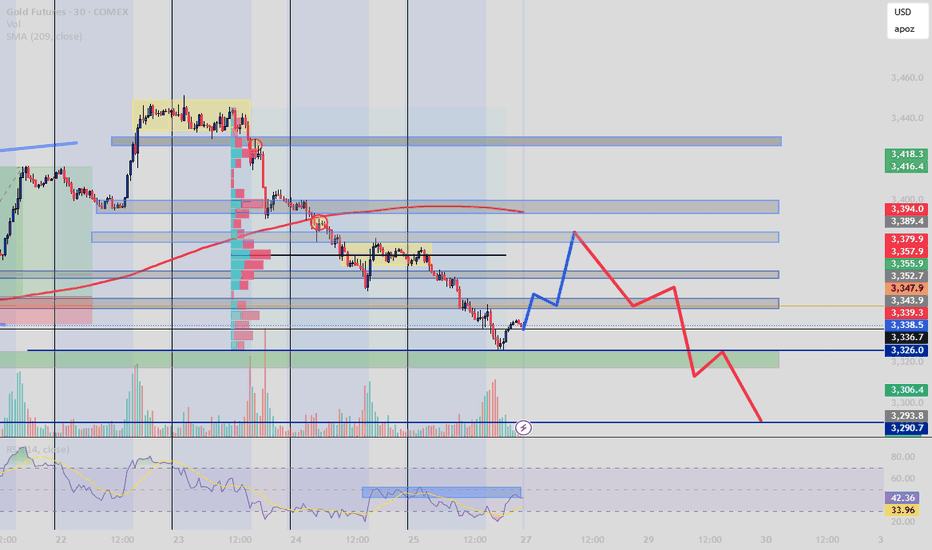

Gold Futures and the BOS Brearish Movement Steps In?After a clear break of structure and consistent rejection below the 209 EMA, price is retracing toward a key zone of confluence between 3347–3379.

This area aligns with:

Former demand turned supply (OB)

Volume cluster (high activity zone)

RSI hidden bearish divergence

Fair Value Gap (inefficiency fill target)

My expectation: a short-term bullish correction (blue) into that zone, followed by a high-probability sell-off (red) toward 3306–3290.

Bias : Bearish unless price reclaims 3394+

Strategy: Smart Money + Volume Profile + RSI Confirmation

Follow @GoldenZoneFX For more content and valuable insights.

Is GC1! GOLD At A Turning Point - Idea On Short DirectionProbably Gold is not going to be cheaper in the near future but we have seen some points that hold in the past break recently...

This is a view on the Gold chart that is explanatory by itself.

Probably tracing some support horizontally under the price at key level with the idea of, if it break follow the trend in short direction side...

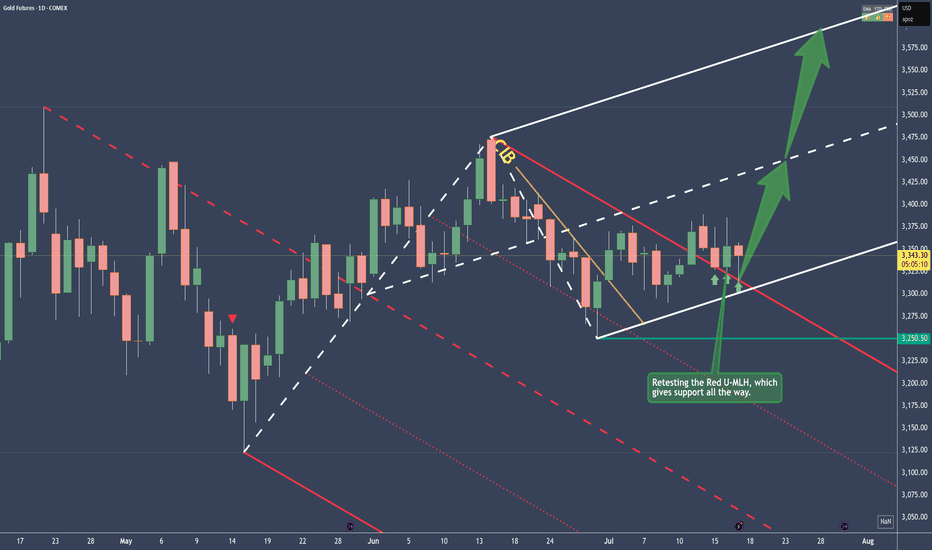

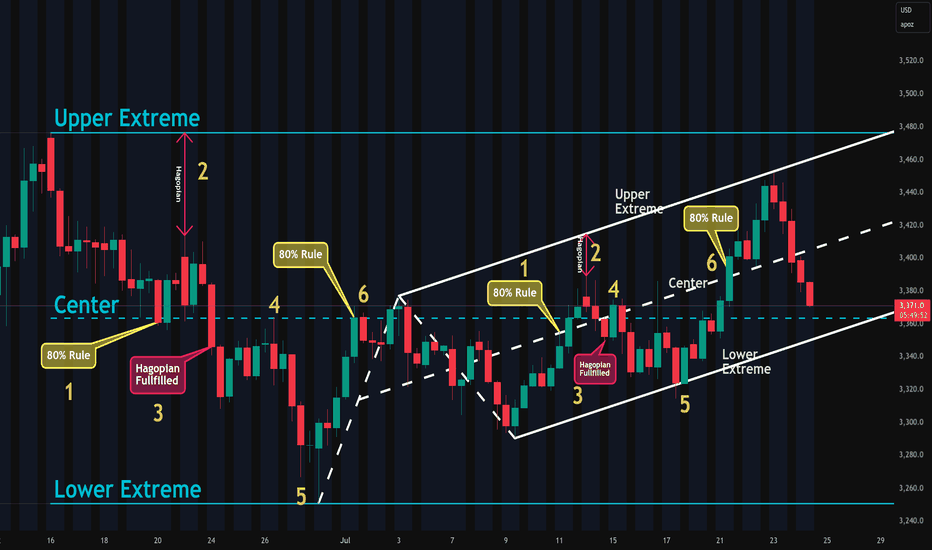

Gold - Bullish and here's whyPrice traveled within the Red Fork, until it broke the CIB Line, which is indicating a Change In Behavior.

From there on, sideways action, until the break of the Red U-MLH happened.

After the close above the Red U-MLH, price has tested it the 3rd time now. At the time of writing, the Bar looks like a PinBar. So it has good sepparation from the bottom, or a long Down-Wick. That's indicates good strenght.

To me this looks like a good long trade, but as everytime, play it save and don't let greed eat your brain ;-)

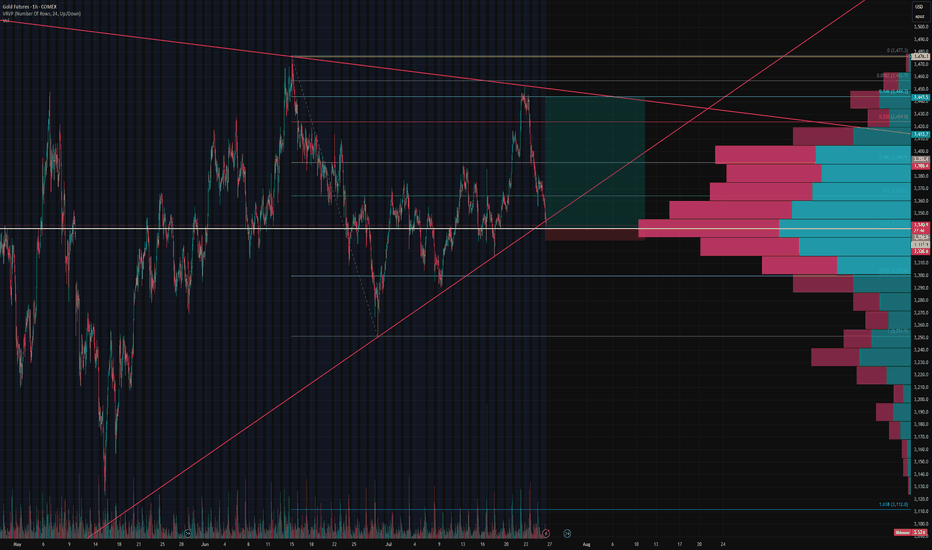

Gold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 ConfluenceGold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 Confluence

Our initial long setup at the 0.5 Fibonacci retracement level has been stopped out, but the structure remains constructive.

Price is now approaching a key confluence zone at $3,336 , where:

The 0.618 fib retracement from the recent swing low to high aligns perfectly,

The ascending trendline support (respected multiple times since May) intersects, and

The oint of Control (POC) from the visible volume profile shows dominant volume transacted.

This area represents a high-probability support level where bulls may attempt to defend again. We’re monitoring for reaction and potential entry signals around this level. A break below would invalidate the rising wedge structure and shift bias toward lower fib extensions.

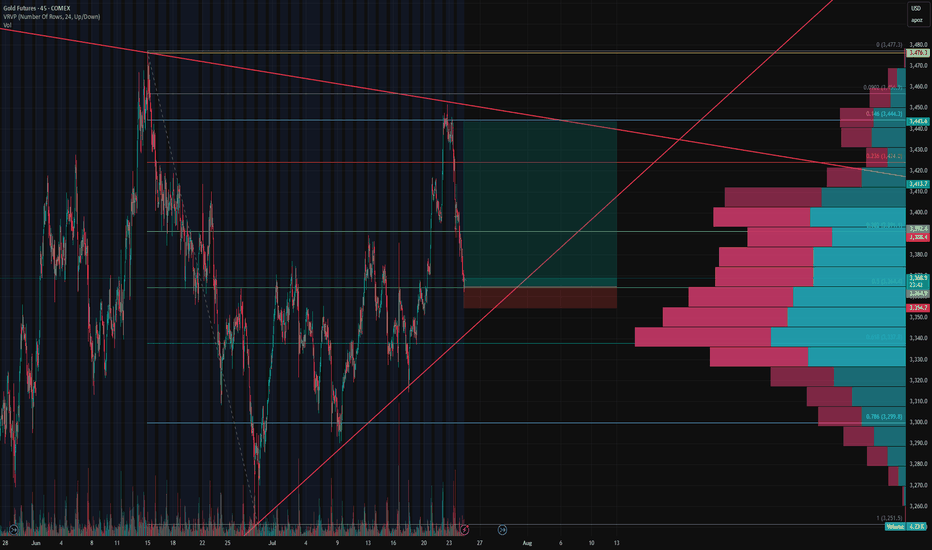

Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce

After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move.

📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on the Volume Profile.

📈 Entered long at 3,365 with a tight stop below 3,354 (0.3% risk), targeting the descending trendline near 3,444 for a clean 7.7R setup.

🧠 Context:

Price reacted hard at resistance, but volume support and structure still lean bullish.

Clear invalidation if we break trend and lose 3,350 support cluster.

Let’s see if this bounce gets legs. 🚀

The Edge Of The Fork - The Joker In Your PocketWOW!

\ \ First of all, I want to say THANK YOU for all the boosts, follows, and comments. You guys & gals give me the energy to continue this journey with you.\ \

Today, I want to show you that what we’ve learned with horizontal lines can also be applied to "Medianlines," or Forks.

Listen, I don’t want you to blow your brain with all the rules.

Not at the beginning of this journey, and not later on either.

Don’t ask yourself:

* when to use which Fork

* which swing to measure

* when to trade

* where to set your stop

* what if... bla bla bla

That’s not fun — that’s stress.

I don’t like stress — nobody does.

So let’s just chill and have fun here.

That’s my personal reason for doing all this Trading thing. I want to have fun — the money will take care of itself, just like the destination of a trail takes care of itself, as long as I keep putting one foot in front of the other. And that’s simple, right?

So let’s do it exactly the same way.

Just simple steps, connecting some dots, and BAM! — You’re there before you even know it §8-)

\ Let’s jump to the chart:\

Today, you’ll find out why Medianlines/Forks are a cousin of the horizontal Channel — but NOT the same.

Where are they different?

Forks are different because they’re capable of projecting the most probable path of price. And that’s a HUGE difference.

Yes, you can apply the full rule set of Forks to a horizontal Channel.

But the Channel CANNOT project the most probable path of price.

I hear you, I hear you: "No one and nothing can foresee the future. How is it even possible that Forks can?"

\ Here’s why:\

There’s a thing called "Statistical Importance." And it means that if something happens very often in the same way, we have a higher chance of seeing the same behavior again in the future.

And that’s what the inventor, Allan Andrews, discovered — and he created the rules around his findings.

\ A high probability that price will move in the direction of the projected path, as long as it stays within the boundaries of the Medianlines/Fork.\

That’s the whole "magic" behind Medianlines/Forks.

And the same applies to the "Behavior of Price" within and around Medianlines. That’s really all there is to it.

Look at the chart and compare the Channel and the Fork:

1. Price reaches the Centerline about 80% of the time

2. HAGOPIAN → price goes farther in the opposite direction than where it came from

3. HAGOPIAN’s rule fulfilled

4. Price reaches the Centerline again

5. Price reaches the other extreme

6. Price reaches the Centerline about 80% of the time

You’ll see the same behavior inside the Fork!

That’s beautiful, isn’t it? §8-)

And here’s a little Joker in your pocket — if you know the difference between the Channel and the Forks!

Do you know what it is?

Yep! You’d automatically know the direction to trade — giving you another 10% edge right out of the box — LONG TRADES ONLY. Because the Fork projects the most probable path of price to the upside, not down.

That's all folks §8-)

Like this lesson?

With a simple boost and/or a little comment, you load my Battery so I can continue my next step on the trail with you.

Thank you for spending your time with me §8-)

Gold Tests Bullish Zone Near $3,380.0Gold dipped from $3,451.0 and is now testing a bullish FVG near $3,380.0, supported by the 50-period SMA and anchored VWAP.

Immediate resistance sits at $3,389.0. A close and hold above this level may trigger a move back to $3,451.0. Conversely, a break below VWAP could extend the downtrend toward $3,337.0, backed by the ascending trendline.

Gold Buyers Barely Holding. Sellers Licking Their Lips.The move on gold over the last two sessions has been clean, aggressive, and very telling. Price rallied hard into a well-defined supply zone between 3452 and 3460, which has acted as a sell-side magnet for the past three rotations.

We got five separate stabs into that zone, all failing to close with strength above 3444, a key breakdown level from earlier structure. Every wick above that line was absorbed classic signs of exhaustion and seller control. That was our trigger. Once price failed to hold above 3440, the sellers unloaded. And they didn’t nibble they dumped.

What followed was a single-leg, high-momentum liquidation straight into demand at 3386–3392, wiping out all intraday longs and resetting the board. Price tagged the PDL (3386.6) to the tick, then bounced not with strength, but with stability. No strong reversal candle, no V-bottom just a hold. What that tells us is: the market’s not ready to trend yet. It’s testing intent.

Now we’re coiling between key structural levels:

- Support below: 3386 (PDL), backed by previous demand zone

- Resistance above: 3405–3410 (micro range breakdown) and 3440 (PDH)

We also have a rising trend line support running up from the July 21 low price is currently sitting right on it. That’s your structural “last chance” for bulls. Break that with volume, and the entire bullish thesis collapses short term.

My Bias Breakdown

Bullish: If we get a reclaim above 3410, then I’d target a move back to 3430, with extension toward 3444 (PDH rejection area). That’s the clean rotation if bulls can generate follow-through.

Bearish: If 3385 breaks on strong momentumbthat opens up 3355–3360, which was the last untested demand from the July 18–19 base.

Neutral (Reactive) right now. This is a trap-heavy zone. Volume is thinning out, the trendline is being tested, and both sides are probing. You don’t want to front-run here. This isn’t trend continuation yet it’s a chop filter before the next directional leg.

Key Contextual Notes

3455–3460 supply was the origin of the last two major reversals this isn’t a random level. Expect traps and stop hunts up there again if price rotates back.

3386–3392 demand has been respected across multiple sessions but it's getting tested more frequently, which means it's weakening. If it breaks clean, the unwind could accelerate.

This is a two-sided market right now. It’s not breakout season, it’s reactionary playbook time. Let the levels guide the setup, not emotion.

Trade Plan (for experienced hands only)

- Long bias: Only on 30m close above 3410 with decent volume target 3430–3444. Stop under 3385. Risk tight; momentum must confirm.

- Short bias: Rejection candle or sweep/failure at 3440–3445 OR breakdown and retest of 3385 target 3355. Invalidation on reclaim above 3410.

This is where traders get chopped to pieces, in the middle of a post-liquidation coil sitting between unfinished business above and fragile demand below. Don’t be that trader. This is where you observe, wait for intent, then strike. Trading is about timing, not guessing. Let the next move come to you. We’re ready either way.

Gold Futures – Closing Longs and Flipping Short at Key Fib🔴 Gold Futures – Closing Longs and Flipping Short at Key Fib Confluence

Instrument : Gold Futures – COMEX ( COMEX:GC1! )

Timeframe : 15-Minute

New Position : Short

Entry Zone : ~3442

Target : ~3362

Stop Loss : ~3458

Risk/Reward : Approx. 6.5+

Setup Type : Reversal from Overextension / Fib Resistance

💡 Trade Recap & Strategy Shift

We’ve officially closed both our recent long entry and our larger swing long position, locking in substantial profit on this move off the 0.618 retracement.

Now, we’re flipping short based on the following:

Price reached the 0.146 Fib extension from the previous retracement leg, a level often overlooked but powerful when confluence lines up.

Trendline resistance from the upper channel has been tagged.

Momentum is showing early signs of stalling after a strong vertical push — textbook overextension.

The rally into this level lacked divergence or structural buildup, increasing the chance of a snapback.

🛠️ Short Setup Details

Entry: 3442 (after signs of exhaustion near Fib confluence)

Target: 3362 (prior structure + 0.382 retracement)

Stop Loss: 3458 (just above high / resistance zone)

Risk/Reward: 6.5:1 — excellent profile for a countertrend play.

📌 Watch For

A break below 3390 will be key confirmation of momentum shifting back down.

Failure to hold 3442 on a retest will invalidate the short and re-open the door for a squeeze higher to 3476/3480.

With trend exhaustion in sight and high confluence resistance overhead, we’re taking the opportunity to pivot short — fully aware of the volatility this region can bring.

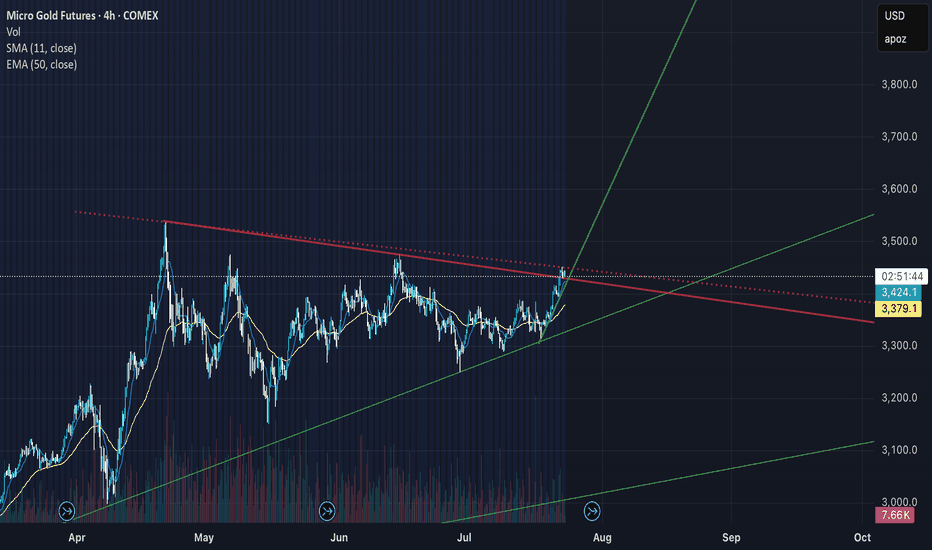

Gold to $3700 - $3800the price of gold has finally broken out of a long standing symmetrical triangle and an established 2 touch point trendline. It is currently consolidating above the broken trendline. If a 4H candle closes above the red dotted trend line we could see a massive pump up. If price closes below green upwards trendline then strategy is invalidated and reassessment needed. This is a long hold trade idea