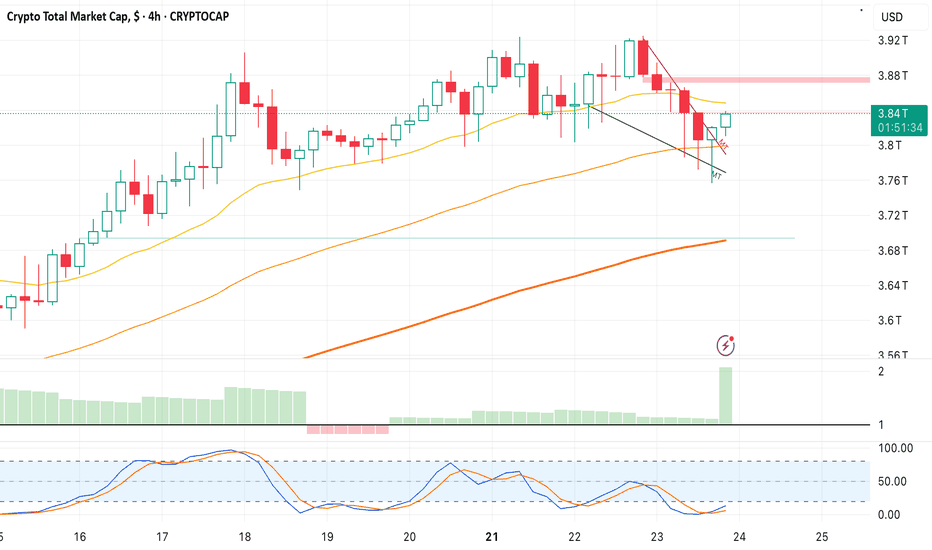

Don’t Panic — It’s Just a Healthy Crypto Correction!While the crypto market has seen some red this week, the bigger picture remains intact. Let’s zoom out and make sense of the current correction.

🔸 TOTAL Market Cap (left chart)

The structure remains overall bullish, trading inside the red rising channel.

After a solid rally, the market is currently pulling back toward a strong demand zone – perfectly aligned with the lower trendline. This area is likely to act as a major support, from which the next bullish impulse could kick off.

🔸 USDT Dominance (right chart)

USDT.D remains overall bearish, trading inside the red falling channel.

It’s currently pushing higher toward a well-defined supply zone, which also intersects with the upper red trendline. As long as this area holds, we expect sellers to take over again — giving altcoins the space they need to bounce back.

📌 In simple terms:

The market is in a healthy correction. Don’t let short-term dips shake your long-term view. The trend is still your friend.

➡️ As always, speak with your financial advisor and do your own research before making any investment decisions.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

TOTAL trade ideas

Crypto Market Slows Down For A Pullback Within A Bullish TrendGood morning Crypto traders! Cryptocurrencies are coming slightly lower on the intraday basis due to stock market decline yesterday, but we still see them approaching support, so still be aware of a bounce and recovery at the end of the week or maybe next week because of an upcoming weekend. Crypto TOTAL market cap chart can be trading in wave »y« of a complex w-x-y correction in wave 4, unless it's a flat correction, but support is the same at 3.6T – 3.5T area, from where we may see a bullish continuation within wave 5.

Alt-Season or Alt-Control-Delete.?🤖💣 Alt-Season or Alt-Control-Delete.? 🧠📉

The market looks like it's a bout to rug someone... and it might just be Trump.

While President Trump narrows down his Fed Chair shortlist, the real driver — Powell — is still at the wheel. But the car? It's swerving dangerously near the edge. BTC has lost a key S/R level, the S&P 500 is at major resistance, and Total Crypto Market Cap is stalling at a crucial decision point.

Despite the hype around altcoins and "recovery rallies," I’m deeply cautious. JP Morgan and Bank of America stocks might dip after Trump’s public accusations — signaling that institutions might already be repositioning. Capital tends to exit before the narrative shifts... and that shift could be incoming.

The chart says it best:

👀 BTC beneath S/R

🎲 S&P 500 gamblers partying at resistance

🧠 Meme coin mania while total crypto hits S/R

🧨 Trump’s signaling right, but Powell might yank the wheel left...

This could all be the calm before a liquidity flush.

Stay sharp, don’t follow the crowd — follow the capital.

That said , Bitcoin remains my favorite asset — especially in times of systemic risk. Remember what history shows us: when banks stumble or go bust, Bitcoin tends to rise. If there's one asset in the world I want to carry through a storm, it's Bitcoin. The decentralized antidote to centralized chaos.

One Love,

The FX PROFESSOR 💙

ps. we might see a breakout and Fomo for good reasons...why not? but for now my charts are screaming: CAREFUL!

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

$TOTAL at Key SupportThe crypto market cap has just bounced off a strong support zone around $3.67T, right where it aligns with the rising trendline.

This area has held firm before, and it's doing the same now.

If it continues to hold, we could see a nice recovery.

But if it breaks down, there’s a risk of more downside ahead.

ETH and TOTAL Short Term Profit OpportunityETH TOTAL

ETH wicked into higher liquidity above the previous peak just as TOTAL hit the sweet spot just below 0.85 (for retracement completion).

So, if you're into the short term game, then this is a great moment to take some profit on ETH.

Even if it goes higher there are decent odds that it will be lower or even very lower at some point.

And even if you miss out, you still locked in profits which can be used to buy things or increase capacity for next dip buy perhaps in some other chart 👍.

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

Money Flow - 2### Money Flow Spread from DJI to Cryptocurrency: A Fibonacci Perspective

The financial markets operate in an interconnected ecosystem where capital flows between asset classes based on macroeconomic trends, investor sentiment, and risk appetite. One such dynamic involves the movement of funds from traditional markets like the **Dow Jones Industrial Average (DJI)**—a barometer of blue-chip stocks—to emerging asset classes such as **cryptocurrencies**. This phenomenon can often be analyzed using **Fibonacci retracements and extensions**, which serve as powerful tools for identifying key support, resistance, and potential price targets during shifts in market momentum.

#### 1. **Market Sentiment and Capital Rotation**

- The DJI represents large-cap equities that are heavily influenced by institutional investors, central bank policies, and global economic conditions. When these factors trigger volatility or uncertainty in traditional markets, investors may seek alternative investments with higher growth potential or hedging properties.

- Cryptocurrencies, known for their decentralized nature and high volatility, attract speculative capital during periods when confidence in traditional assets wanes. For instance:

- During bearish trends in the DJI, characterized by falling prices and increased selling pressure, some investors might reallocate portions of their portfolios into cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH).

- Conversely, bullish trends in the DJI could signal improved risk appetite, prompting a portion of crypto gains to rotate back into equities.

#### 2. **Fibonacci Retracements: Identifying Key Levels**

- Fibonacci retracement levels are derived from the Fibonacci sequence and are widely used in technical analysis to predict areas of support and resistance. These levels (e.g., 23.6%, 38.2%, 50%, 61.8%) help identify potential turning points in price action.

- In the context of money flow from the DJI to cryptocurrencies:

- A significant decline in the DJI could lead to a pullback to Fibonacci retracement levels (e.g., 38.2% or 61.8%). At these junctures, traders may reassess their positions and consider diversifying into cryptocurrencies.

- Similarly, after a sharp rally in cryptocurrencies, prices might retrace to Fibonacci levels before continuing upward. Investors exiting equities due to underperformance might view these retracements as entry points for digital assets.

#### 3. **Fibonacci Extensions: Projecting Price Targets**

- While retracements focus on corrective moves within a trend, Fibonacci extensions project potential price targets beyond the initial move. Common extension levels include 127.2%, 161.8%, and 261.8%.

- In scenarios where money flows out of the DJI and into cryptocurrencies:

- If the DJI experiences a prolonged downtrend, its losses could coincide with outsized gains in cryptocurrencies. Fibonacci extensions can help forecast how far crypto prices might rise amid this influx of capital.

- For example, if Bitcoin breaks above a key resistance level following a surge in inflows from equities, traders might use Fibonacci extensions to estimate future price milestones (e.g., $100,000 or $200,000).

#### 4. **Psychological Drivers Behind the Transition**

- Fibonacci levels resonate with traders because they align with natural human tendencies toward symmetry and proportion. This psychological aspect amplifies their relevance when analyzing cross-market dynamics.

- As money exits the DJI and enters cryptocurrencies, Fibonacci-based trading strategies provide a framework for understanding how participants perceive value across different asset classes. For instance:

- Institutional investors exiting equities might anchor their decisions around Fibonacci-derived thresholds, ensuring disciplined entry and exit points in volatile crypto markets.

- Retail traders, who dominate much of the cryptocurrency space, also rely on Fibonacci tools to time their trades, creating self-reinforcing patterns that influence overall market behavior.

#### 5. **Case Study Example**

- Imagine a scenario where the DJI drops sharply due to rising interest rates or geopolitical tensions. The index falls from 35,000 to 30,000—a decline of approximately 14%. Traders observe Fibonacci retracement levels at 38.2% ($31,900) and 61.8% ($33,100), expecting temporary bounces at these levels.

- Simultaneously, Bitcoin rallies from $20,000 to $30,000 as investors seek refuge in digital gold. Using Fibonacci extensions, analysts project further upside to $38,200 (127.2%) or even $48,500 (161.8%), attracting additional capital from equity markets.

#### 6. **Conclusion**

- The interplay between the DJI and cryptocurrencies highlights the fluidity of modern financial markets. By leveraging Fibonacci retracements and extensions, traders can better anticipate shifts in money flow and position themselves strategically.

- Whether driven by macroeconomic headwinds, technological innovation, or evolving investor preferences, the migration of capital from traditional indices like the DJI to digital assets underscores the growing convergence of old and new finance. Fibonacci analysis serves as a bridge, offering insights into both the timing and magnitude of these transitions.

MARKETS week ahead: August 4 – 10Last week in the news

US macroeconomic data took center stage during the previous week, with major correction occurring on Friday, after the NFP July data were released. Investors fear of economic consequences of implementing trade tariffs pushed US equity markets to downside. The S&P 500 lost 1,5% on Friday, closing the week at the level of 6.238. On the same grounds the price of gold strongly gained 2,2% on Friday, reaching the last price at $3.362. Strong reaction also came from US Treasury yields, where the 10Y US benchmark dropped to the level of 4,22%. This time the crypto market was also affected, where BTCs price dropped sharply, closing the week around the $113K level.

The FOMC meeting was held during the previous week, without changes in the level of interest rates. As per Fed's view, the economy is growing at a solid pace, while they acknowledged increasing risks originating from implemented trade tariffs on inflation and potential slowdown in the future economic growth. There were no comments regarding potential rate cuts in September, except that the Fed will continue further to balance interest rates based on “the incoming data, the evolving outlook and the balance of risks”, as noted by Fed Chair Powell.

A macro data heavy week in the US included data on JOLTs in June of 7,437M, modestly below market forecast of 7,55M. The PCE Price Index in June was relatively steady with 0,3% for the month and 2,6% for the year, which was in line with market expectation. However, what shocked the market on Friday were posted non-farm payrolls data for July of only 73K, although the market estimate was standing at 110K. During Saturday, news was published that the US president Trump requested immediate release of a duty of a Commissioner of labor statistics, due to posts of inaccurate labor data and its frequent revisions. The US President also questioned the accuracy of the July NFP figure of 73K.

During the previous weekend the U.S. finalized the trade-tariffs deal with the European Union. Details of the deal are officially published at the website of the European Commission, and include, among other, tariffs of 15% on imports from the EU, establishment of tariff-rate quotas for imports of steel, aluminium and copper from the EU, cutting the current 50% current tariffs. EU companies will also invest at least $600B in different sectors in the US by 2029.

Interesting news for crypto enthusiasts was posted by Cointelegraph, noting that on July 4, 2025, eight dormant Bitcoin wallets from the Satoshi era collectively moved 80.000 BTC, with each wallet transferring 10.000 BTC. The Satoshi era, generally defined as the period from 2009 to 2011, was when Bitcoin could still be mined or transacted using standard computer processors. The sudden activation of these long-inactive wallets has sparked intense speculation, with some suggesting that emerging quantum computing threats may have prompted the transfers. Still, analysts with a knowledge of blockchain technology commented that coins were not transferred directly to cryptocurrency exchanges but instead moved to newly created SegWit addresses — a move that likely indicates a security upgrade.

CRYPTO MARKET

As the crypto market became part of mainstream markets, it needed to manage both ups and downs of the investors' sentiment, which was usually related to traditional markets. This occurred during the Friday trading session, when investors' fear of future consequences of implemented trade tariffs turned to the negative side. Total crypto market capitalization decreased by 6% on a weekly basis, losing a total $216B. Daily trading volumes were relatively flat on a weekly basis, moving around $304B on a daily basis. Total crypto market capitalization increase from the beginning of this year currently stands at +12%, with a total funds inflow of $384B.

This week BTC was leading the market cap drop, with an decrease in value of 4% w/w and outflow of almost $96B in funds. ETH also had a drop in value of 7,2%, with total funds outflow of $32B. The third coin by total market cap, XRP, was traded around 10% lower, closing the week with total fund outflow of $18,6B. Another coin with a significant drop in the market cap was Solana, of almost 13% w/w, and funds outflow of $13B. Both DOGE and ADA were on a losing side, where DOGE was traded 17,1% lower, losing $6,13B in the market cap, while ADA dropped by 14,6% with an outflow of $4,3B. The majority of other altcoins finished the week with a loss in value between 14% and 18%.

This week there has not been too much activity when circulating coins are in question. Algorand had an increase of coins on the market by 0,2% w/w, while Stellar's number of coins surged by 0,3%. This week Filecoin had a modest increase of 0,1% on a weekly basis, same as ZCash and DOGE.

Crypto futures market

The general drop in the value of crypto coins on the spot market was also reflected to some extent also in the futures market. BTC futures were traded lower by more than 3% for all maturities, while ETH futures had a weekly drop in value of more than 4%. However, it is important that the general levels of the value of futures remain at higher grounds.

BTC futures maturing in December this year closed the week at $116.390, and those maturing in December next year were last traded at $123.490. A similar situation is with ETH futures, which managed to hold grounds above the $3K. Futures maturing in December 2025 closed the week at $3.631, and those maturing a year later were last traded at $3.894.

$TOTAL: Crypto market signals long term upside pendingGM gents, most people in crypto circles (Crypto Twitter sphere of influence and former Tradingview posters who evolved into influencers there) seem to have the consensus view that the market has little time to rise from here, and appear to signal a wall of worry sentiment.

This resonates with variables observed in Pendle Finance implied vs realized yields for many stablecoins (trading below current yield signals that people are pessimistic), for example.

The chart signals I show here clash with people's meme/beliefs about market cycles duration (most think there are fixed time cycles that accurately predict bullish and bearish trends in BTC and also the timing for altcoins to outperform Bitcoin, a ridiculous notion).

What actually happens is that there are cycles of boom and bust as a feature of the fiat currency paradigm and capitalism the way we know it, which in turn cause the bullish and bearish trends in Bitcoin and Altcoins. Market data supports the idea that trends have some correlation with periods of consolidation (what Time@Mode patterns show) and the importance of not forcing arbitrary parameters or beliefs into the market, as it is an affair destined for failure (a sin very common in different degrees of market specialization: going from people spotting some pattern in hindsight obvious enough for them to develop a belief and market adage, to the quant systems trader figuring out how to trade the past well in backtests by curve fitting their algorithm with a specific data sample, to then fail in real trading of the present and future).

In short: expect the unexpected regarding time cycles, fixed time cycles don't work, and better obtain data from new market information to adjust your views as time goes by, if you make a prediction, verify it with post-pattern behavior to determine if it's still valid else your results will suck.

As for the crypto market, it seems that there's more upside left, if current monthly signals are not erased from here onwards:

A drop under 3.12T would mean monthly trend is dead.

A drop under 2.82T would mean quarterly trend is dead.

A drop under 787B would mean yearly trend is dead and we're all gonna die.

Best of luck!

Cheers,

Ivan Labrie.

Comprehensive Cryptocurrency Market Analysis: Top 10 Assets and Executive Summary

This analysis examines price data for the top 10 cryptocurrencies by market capitalization (BTC, ETH, BNB, SOL, ADA, XRP, TRX, USDT, USDC, DOGE) . The inclusion of stable coins (USDT, USDC) and meme coins (DOGE) provides a more complete picture of capital flows within the cryptocurrency ecosystem. The data reveals significant market trends, correlation patterns, and potential future price targets based on historical performance.

Market Overview

The total cryptocurrency market capitalization grew from approximately $2.06 trillion in July 2024 to $3.82 trillion by July 2025, representing an 85% increase. During this period, we observed several notable market-wide movements:

Major Growth Phase (October-November 2024): The market experienced substantial growth, with Total Market Cap increasing from $2.47T to $3.57T.

Market Correction (January 2025): A significant correction occurred with the Total Market Cap dropping to $2.81T, representing a 21% decline from its peak.

Recovery and Stabilization (February-July 2025): The market recovered and stabilized, reaching new highs around $3.82T by July 2025.

Stable coin Analysis

USDT (Tether)

Market Cap Range: $119.6B to $163.7B (July 2024 - July 2025)

Overall Growth: 36.9%

Key Insight: USDT's market cap grew steadily throughout the period, with accelerated growth during market uptrends, indicating increased demand for trading liquidity.

Correlation with Market Movements: USDT market cap expansion typically preceded major market rallies, suggesting capital inflows preparing to enter volatile assets.

USDC (USD Coin)

Market Cap Range: $34.7B to $65.1B (July 2024 - July 2025)

Overall Growth: 87.6%

Key Insight: USDC showed stronger percentage growth than USDT, potentially indicating institutional preference for this stable coin.

Usage Pattern: USDC market cap showed notable increases in October 2024 and April-May 2025, coinciding with periods of market volatility.

Combined Stable coin Impact

Total stable coin market cap (USDT + USDC) grew from approximately $154.3B to $228.8B, a 48.3% increase.

This growth suggests significant new capital entered the cryptocurrency ecosystem during this period.

The ratio of stable coin market cap to total market cap decreased slightly from 7.5% to 6.0%, indicating that volatile assets grew at a faster rate than stable coins.

Individual Volatile Asset Performance

Bitcoin (BTC)

Price Range: $60,459 to $120,998 (July 2024 - July 2025)

Overall Growth: 94.2%

Key Support Zones: $80,000-$84,000, $95,000-$97,000, $103,000-$105,000

Key Resistance Zones: $120,000-$122,000, $130,000-$135,000

Future Target: Based on established support levels and growth trajectory, BTC could target the $125,000-$135,000 range in the next cycle, with potential for $150,000 if market conditions remain favourable.

Ethereum (ETH)

Price Range: $2,330 to $3,941 (July 2024 - July 2025)

Overall Growth: 57.8%

Key Support Zones: $2,800-$3,000, $3,200-$3,300, $3,500-$3,600

Key Resistance Zones: $4,000-$4,100, $4,500-$4,700

Future Target: ETH could target the $4,200-$4,800 range, with potential for $5,500 if it breaks historical resistance levels.

Finance Coin (BNB)

Price Range: $544 to $861 (July 2024 - July 2025)

Overall Growth: 45.7%

Key Support Zones: $650-$680, $720-$750, $800-$820

Key Resistance Zones: $860-$880, $900-$950

Future Target: BNB could reach $900-$1,000 based on its established support levels and growth patterns.

Solana (SOL)

Price Range: $135.52 to $224 (July 2024 - July 2025)

Overall Growth: 33.8%

Key Support Zones: $140-$150, $175-$185, $200-$210

Key Resistance Zones: $220-$230, $250-$270

Future Target: SOL could target $230-$280 range if market conditions remain favourable.

Cardano (ADA)

Price Range: $0.3315 to $1.3264 (July 2024 - July 2025)

Overall Growth: 136.7%

Key Support Zones: $0.70-$0.75, $0.85-$0.90, $1.05-$1.10

Key Resistance Zones: $1.30-$1.35, $1.50-$1.60

Future Target: ADA could target $1.40-$1.80 based on its growth trajectory and previous resistance levels.

XRP

Price Range: $0.486 to $3.6607 (July 2024 - July 2025)

Overall Growth: 501.1%

Key Support Zones: $2.00-$2.20, $2.50-$2.70, $3.00-$3.20

Key Resistance Zones: $3.60-$3.80, $4.00-$4.50

Future Target: XRP could target $3.80-$4.50 if its growth momentum continues.

TRON (TRX)

Price Range: $0.1531 to $0.351 (July 2024 - July 2025)

Overall Growth: 104.4%

Key Support Zones: $0.25-$0.27, $0.30-$0.32

Key Resistance Zones: $0.35-$0.37, $0.40-$0.42

Future Target: TRX could target $0.36-$0.45 based on its established growth pattern.

Dogecoin (DOGE)

Price Range: $0.10311 to $0.48 (July 2024 - July 2025)

Overall Growth: 117.9%

Key Support Zones: $0.16-$0.18, $0.20-$0.22, $0.25-$0.27

Key Resistance Zones: $0.40-$0.45, $0.50-$0.55

Future Target: DOGE could target $0.45-$0.60 during the next market cycle, with potential for higher spikes based on its historical volatility patterns.

Market Capitalization Analysis

Total Market Cap vs. Total Market Cap 3 (Excluding BTC and ETH)

Total Market Cap: Increased from $2.06T to $3.82T (+85%)

Total Market Cap 3: Increased from $579B to $1.01T (+74.4%)

This comparison reveals that BTC and ETH slightly outperformed the broader altcoin market in percentage terms, suggesting a preference for established cryptocurrencies during this period.

Capital Flow Analysis

Stable coin to Volatile Asset Flow:

The data shows clear patterns of capital moving from stable coins to volatile assets during bullish phases.

USDT market cap growth often preceded major market rallies by 2-4 weeks, suggesting accumulation phases.

USDC showed more pronounced growth during institutional adoption phases, particularly in Q4 2024.

Bitcoin Dominance Trend:

Bitcoin maintained or slightly increased its market share relative to altcoins.

During market corrections (particularly January 2025), capital flowed from altcoins to BTC, reinforcing its status as a "crypto safe haven."

Altcoin Rotation:

Clear evidence of capital rotation among altcoins, with ADA, XRP, and DOGE experiencing periods of significant outperformance.

SOL showed high correlation with overall market sentiment, amplifying both upward and downward movements.

DOGE experienced significant volatility, with its price movements often lagging BTC rallies but showing stronger percentage gains during peak market euphoria.

Meme Coin Impact:

DOGE's market cap fluctuated between $13.8B and $33.8B, representing a significant but volatile portion of the market.

DOGE price movements often signalled market cycle extremes, with major rallies in DOGE coinciding with broader market tops.

Correlation Analysis

High Correlation Assets: BTC, ETH, and Total Market Cap showed the strongest correlations (>0.9), indicating that these assets move largely in tandem.

Moderate Correlation Assets: BNB, SOL, and ADA showed moderate correlations with BTC (0.7-0.85), suggesting they follow broader market trends but with greater independent movement.

Lower Correlation Assets: XRP, TRX, and DOGE showed the lowest correlations with BTC (<0.7), indicating more independent price action potentially driven by project-specific factors or retail sentiment.

Stable coin Correlations: USDT and USDC market caps showed weak negative correlation with volatile asset prices during extreme market movements, confirming their role as counter-cyclical safe havens.

Price Zone Analysis and Future Targets

Bitcoin (BTC)

Current Support Zones: $103,000-$105,000, $95,000-$97,000

Current Resistance Zones: $120,000-$122,000

Future Target Zones: $125,000-$135,000 (primary), $150,000-$160,000 (extended)

Key Insight: BTC has established strong support around the $100,000 psychological level, which could serve as a foundation for future growth.

Ethereum (ETH)

Current Support Zones: $3,500-$3,600, $3,200-$3,300

Current Resistance Zones: $4,000-$4,100

Future Target Zones: $4,200-$4,800 (primary), $5,000-$5,500 (extended)

Key Insight: ETH needs to decisively break the $4,000 level to confirm its next major uptrend.

Binance Coin (BNB)

Current Support Zones: $800-$820, $720-$750

Current Resistance Zones: $860-$880

Future Target Zones: $900-$1,000 (primary), $1,100-$1,200 (extended)

Key Insight: BNB has shown resilience during market corrections, suggesting strong holder conviction.

Solana (SOL)

Current Support Zones: $175-$185, $150-$160

Current Resistance Zones: $220-$230

Future Target Zones: $230-$280 (primary), $300-$350 (extended)

Key Insight: SOL's volatility makes it susceptible to sharp corrections but also enables rapid recoveries.

Cardano (ADA)

Current Support Zones: $0.85-$0.90, $0.70-$0.75

Current Resistance Zones: $1.30-$1.35

Future Target Zones: $1.40-$1.80 (primary), $2.00-$2.20 (extended)

Key Insight: ADA has shown strong percentage growth from its lows, suggesting potential for continued outperformance.

XRP

Current Support Zones: $3.00-$3.20, $2.50-$2.70

Current Resistance Zones: $3.60-$3.80

Future Target Zones: $3.80-$4.50 (primary), $5.00-$5.50 (extended)

Key Insight: XRP's price action appears heavily influenced by regulatory developments, making it more unpredictable than other assets.

TRON (TRX)

Current Support Zones: $0.30-$0.32, $0.25-$0.27

Current Resistance Zones: $0.35-$0.37

Future Target Zones: $0.36-$0.45 (primary), $0.50-$0.55 (extended)

Key Insight: TRX has shown steady growth with lower volatility compared to other altcoins.

Dogecoin (DOGE)

Current Support Zones: $0.20-$0.22, $0.16-$0.18

Current Resistance Zones: $0.40-$0.45

Future Target Zones: $0.45-$0.60 (primary), $0.70-$0.80 (extended)

Key Insight: DOGE price movements often signal retail sentiment and can be leading indicators for market cycle extremes.

Future Outlook

Based on the comprehensive data analysis, several key trends may continue:

Bitcoin's Continued Dominance: BTC is likely to maintain its position as the market leader, with potential targets in the $125,000-$135,000 range in the near term, and possibility of $150,000-$160,000 in an extended bull market.

Stablecoin Growth: The continued expansion of stablecoin market caps suggests ongoing new capital inflows to the cryptocurrency ecosystem, which could fuel further price appreciation across volatile assets.

Altcoin Selectivity: The data suggests increasing selectivity in altcoin performance, with projects like ADA, XRP, and SOL showing potential for continued outperformance based on their specific adoption metrics.

Meme Coin Volatility: DOGE and similar assets may continue to experience extreme volatility, with their performance often signaling market cycle extremes.

Market Maturation: The overall market shows signs of maturation, with less extreme volatility in established assets compared to previous market cycles, suggesting growing institutional involvement.

Conclusion

The cryptocurrency market from July 2024 to July 2025 demonstrated significant growth with varying performance across assets. Bitcoin maintained its dominance while select altcoins showed remarkable growth. The inclusion of stablecoins in the analysis reveals important capital flow patterns that help explain market movements.

The data suggests a maturing market with increasing differentiation between assets based on their fundamental value propositions and adoption metrics. Stablecoins continue to play a crucial role in providing liquidity and serving as temporary safe havens during market volatility.

Future price targets should be considered in the context of broader market conditions, regulatory developments, and technological advancements that could significantly impact individual asset performance. The identified support and resistance zones provide valuable reference points for potential entry and exit levels.

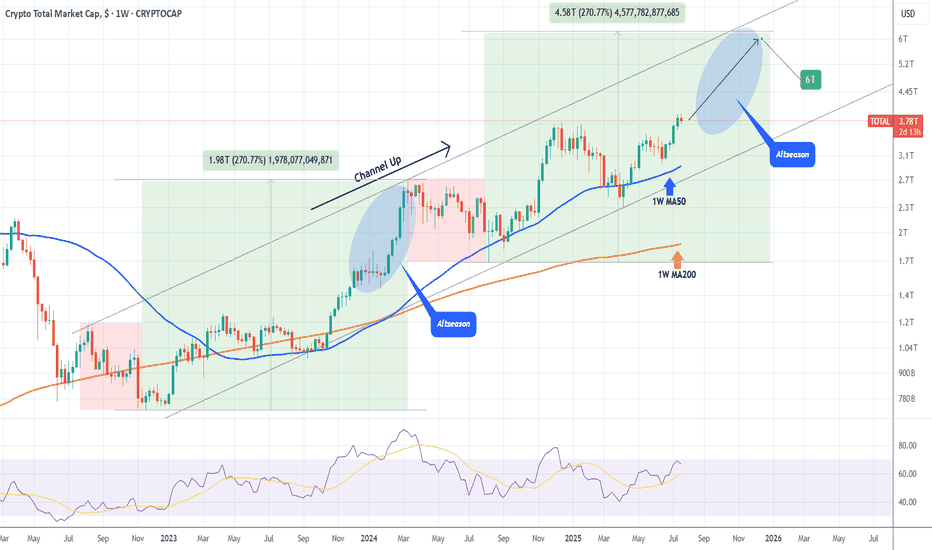

TOTAL CRYPTO MARKET CAP expected to hit $6 Trillion!The Crypto Total Market Cap (TOTAL) has been on a Channel Up since the 2022 market bottom and since the April 07 2025 Low (Higher Low for the pattern), it's initiated the new Bullish Leg, already turning the 1W MA50 (blue trend-line) into Support.

As long as this holds, we expect it to complete a +270% rise from the August 05 2024 Low, similar to the Bull Cycle's first Green Phase, and reach at least a $6 Trillion Market Cap!

More importantly, we expect this final part (blue ellipse) to be what is commonly known as an Altseason, where the lower cap coins show much higher returns and disproportionate gains to e.g. Bitcoin.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Crypto Total Market Cap (TOTAL) | 1WThe crypto market cap represented by the symbol TOTAL can be considered the most important index for analyzing the cryptocurrency market, although I believe that analyzing Bitcoin itself, given its strong positive correlation with the TOTAL index, would yield similar results. In the attached image, the red line actually indicates the overall resistance level of the symbol, and the drawn parallel channel illustrates the current upward trend of the TOTAL symbol, which is now on the verge of encountering its round resistance at 4 trillion dollars. While we should expect a correction around this level, breaking through the 4 trillion dollar resistance could likely lead to a market cap of 6 to 7 trillion dollars in the next phase. On the other hand, with support at 2.4 trillion dollars based on the 100-week SMA on the weekly timeframe, the 750 billion dollar level—marked by a green zone in the image—can still be considered the most important long-term market support, even before the fifth halving.

I will try to continuously update this analysis of the TOTAL symbol according to market changes and developments. Also, I welcome reading your critiques and comments, so don’t forget to leave a comment!

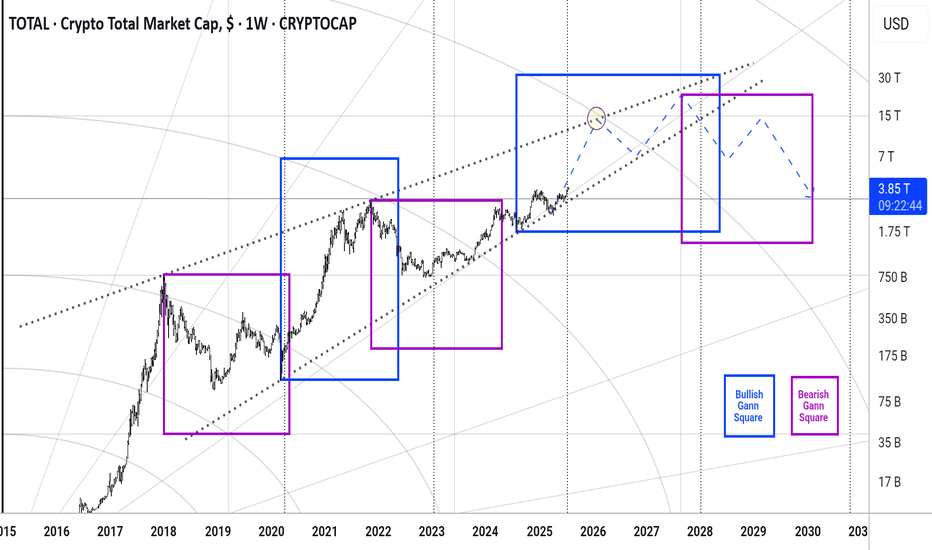

Total #002 ( Look at the Future !!! )Hello dear traders.

Good days.

First of all thanks for your comment and support.

---------------------------------------------------

In beautiful rising wedge of total market cap , the total market in this month broken 0.5 monthly Gann Square price level which means will be ready for test and retest 0.618 for final round befor market collapse.

With refer to the daily Bullish Gann Square ( Blue Square ) and Bearish Gann Square it is expected to within a year market will grow fast .

Safe trades and good luck.

MARKETS week ahead: July 27 – August 2Last week in the news

Trade tariff (un)certainties shaped market sentiment during the previous week. The US-Japan trade deal was settled which brought some relaxation among investors. The US equities continued with a positive trend, with the S & P 500 reaching fresh all time highest level, ending the week at 6.388. On the same ground the price of gold turned a bit toward the downside, closing the week at $3.336. The relaxation was evident also in 10Y US Treasury yields, which closed Friday trading session at 4,38%. BTC had a short liquidation session on Friday, shortly reaching the $115K level, however, swiftly returned back toward the $118K.

The European Central Bank (ECB) held its July meeting during the previous week, where it held interest rates steady after seven consecutive cuts, signalling a more cautious approach going forward. While its macroeconomic outlook remains unchanged, the ECB sees downside risks to growth, including global trade tensions and weak market sentiment. President Lagarde downplayed concerns about the stronger euro and minor inflation undershooting, emphasizing a data-dependent, meeting-by-meeting policy stance. Although the ECB appears comfortable with its current position, a final rate cut in September is still possible if inflation or macro data disappoint.

President Trump announced a major trade deal with Japan this week, featuring a 15% reciprocal tariff, marking a shift in bilateral trade relations. The U.S. also reached a framework agreement with Indonesia, reinforcing efforts to strengthen trade ties across Asia. Trump signalled that more deals may be finalized before the August 1 tariff deadline, including potential progress with the EU, as a meeting with Commission President von der Leyen is set for Sunday in Scotland. These developments have been well received by investors, easing concerns over trade uncertainty and potential supply chain disruptions.

China unveiled a global AI action plan at the World Artificial Intelligence conference in Shanghai, calling for international cooperation on technology development and governance. Premier Li Qiang proposed establishing a global AI cooperation organization to coordinate regulation and infrastructure, emphasizing equitable access. The plan positions China in contrast to the U.S., favoring multilateralism over America's more block-oriented approach to AI strategy. Featuring participation from over 800 companies including domestic giants Huawei and Alibaba, the conference showcased thousands of AI innovations and signals China's ambition to challenge U.S. dominance in the field.

Palantir's stock achieved a new record high last Friday, rising over 2% and lifting its market cap to around $375B. With the latest move, the company is now holding 20th place as the most valuable U.S. company. The company's shares have more than doubled this year as investors' enthusiasm grows around its AI capabilities and government contract momentum. Analysts attribute the rally to Palantir's strengthened role in AI analytics and expansion in defence-related software and data contracts.

CRYPTO MARKET

The crypto market was traded in a mixed mode during the previous week. Some liquidations were made in BTC, followed by altcoins, however, there were also coins with relatively solid weekly performance. Total crypto market capitalization was increased by 1% on a weekly basis, adding total $39B to its market cap. Daily trading volumes were modestly decreased to the level of $275B on a daily basis, from $333B traded a week before. Total crypto market capitalization increase from the beginning of this year currently stands at +19%, with a total funds inflow of $600B.

BTC had a relatively flat week, with only $3B of funds inflow. On the other hand ETH continues to perform strongly, with another week in a positive territory of 5,3%, increasing its cap by $23B. XRP did not perform well on a weekly basis, as the coin had a drop in value of 7,4% and outflow of $15B. Some of the significant weekly gainers include Litecoin, with a surge of 13% on a weekly basis, Maker was traded higher by 14%, BNB gained 7%, while Solana was higher by 5% same as Uniswap. Other altcoins were traded either with a modest drop in value or with a modest increase in value.

There has been increased activity with circulating coins. Another week in a row, IOTA is increasing the number of coins on the market by 0,8% w/w. EOS had an increase of 0,6%, same as Polkadot. The majority of other altcoins had a modest increase of circulating coins of 0,1%, including XRP.

Crypto futures market

This week the crypto futures market reflected perfectly developments on the spot market, with ETH long term futures managed to pass the $4K level.

BTC futures were traded mostly flat compared to the previous week. Futures maturing in December this year closed the week at $120.810, and those maturing in December 2026 were last traded at $127.500. At the same time, ETH futures were traded around 2,5% higher for all maturities. Futures ending in December 2025 reached the last price at $3.779, while those maturing in December 2026 for the first time ended the trading week at $4.058.

Now We WaitTrading Fam,

In my last video, I mentioned how I had been learning to trade more patiently, giving myself those high-quality, high-probability winning trades. This is a perfect time to illustrate that strategy.

With our altcoin market overheated, I am expecting more rest, accumulation, and pullback in many of our alts. The selection of even decent entries is very slim. It's time for us to sit back, wait, and let the trades come to us again.

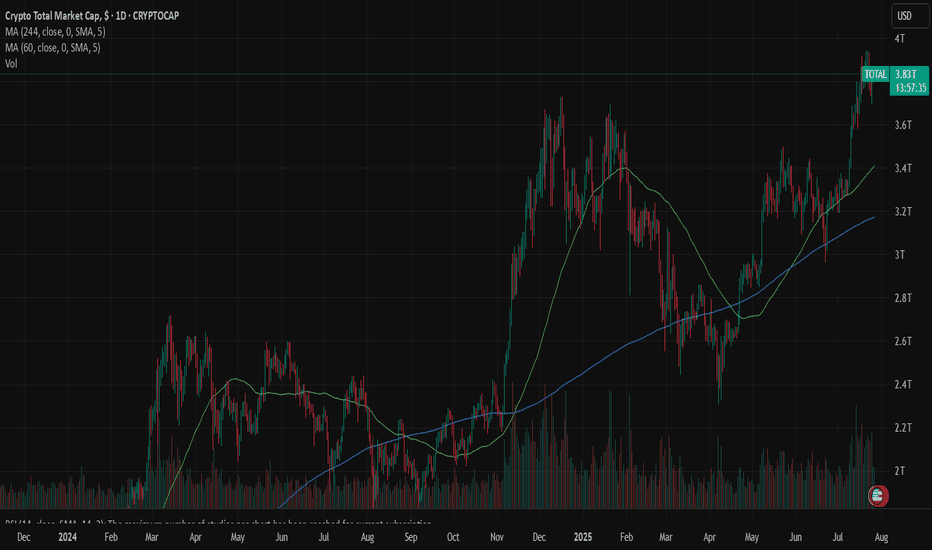

The TOTAL chart shows us more clearly what may occur. Let's discuss a few important indicators on this chart.

First of all, we see my indicator popped a BUY signal right around 3T. We had a safe bet at that point; we were going to see quite a bit of buying action in the altcoin space. Indeed, we did. The altcoin market increased by about 25 percent and went all the way to 4T, at which point the sellers came back in. Now, we are in the middle of a little bit of a pullback, and I think there could be more to come. I am expecting at least a touch of that rising 50-day SMA, currently at 3.4T.

Supporting my thesis here are the crossover of the RSI to the downside of its 14-day MA, the MACD cross, the Chalkin money flow decrease, and the HMV indicating high volume during these sell-offs. Leverage is being liquidated. This is healthy!

It is possible that the total market cap could drop even further, all the way down to that 3.24T PoC on the VRVP. That is where we see most of our volume in alts has occurred. Keep these two targets in mind. Once hit, I will begin looking for more trade entries once again.

✌️Stew

Looks like $ investors switch possible - Crypto rules??Hello fellow traders,

Just looking at the chart of total market cap and based on trend line weekly focus- this is it- a point at which crypto market might start to recover and go for 2 x what it has in total, heading for 5t?? Let me know in your comments what do you think? Also, many investors might start diversifying their portfolio since Fridays 'crash' hence I wouldn't be really surprised if next week brings some $ into crypto !

It's just my idea don't copy think and do your own stuff

Roadmap for $TOTAL aligned with the $444K $BTC price forecastThis idea outlines a projected roadmap for CRYPTOCAP:TOTAL (Total Crypto Market Cap) based on my $444,000 Bitcoin price forecast. As BTC climbs toward this long-term target, CRYPTOCAP:TOTAL is expected to follow a corresponding macro growth trajectory. This roadmap explores potential milestones, correction zones, and acceleration phases within the crypto market as capital flows increase.

🔍 This analysis is a continuation of my $444K BTC thesis, which you can find on my profile for context.

📈 Key highlights:

• Correlation between BTC and CRYPTOCAP:TOTAL historical growth patterns

• Projected market cap targets in alignment with BTC reaching $444K

• Technical and macroeconomic confluence zones

• Strategic outlook for altcoins as CRYPTOCAP:TOTAL expands

🧠👇💬 Any thoughts?

$TOTAL Market Cap Highest Weekly Close - Bearish Divergence?!Once again, highest Weekly Close on the Crypto CRYPTOCAP:TOTAL Market Cap ever.

PA continues to trend above the EMA9 and POI.

It’s worth noting Bearish Divergence on this local level.

I do not believe this is much to worry about however and have discussed this in prior analysis which I will post in the comments.

Strong Volume has shifted in the Bulls favor.

Bulls want to keep PA above $3.7T

H100 Group Raises SEK 109M to Expand Bitcoin Treasury StrategyIn a bold vote of confidence for digital assets, Swedish investment firm H100 Group has successfully raised SEK 109 million (approximately $10.2 million USD) to expand its Bitcoin treasury strategy, joining a growing cadre of companies leveraging BTC as a core long-term asset.

The capital raise, led by Nordic institutional investors and several strategic family offices, marks the second round of treasury-focused fundraising by H100 in less than 18 months. The firm has already allocated more than 1,300 BTC to its balance sheet since Q1 2024—now aiming to double that exposure over the next 12 months.

Institutionalizing Bitcoin Holdings

Unlike earlier corporate adopters of Bitcoin who emphasized defensive hedging against fiat devaluation, H100 Group frames its BTC allocation as a forward-looking capital optimization strategy.

“Our focus isn’t on hedging inflation—it’s on positioning for structural monetary transformation,” said Henrik Larsson, CEO of H100 Group. “We believe Bitcoin is not just a store of value, but a sovereign-free liquidity reserve for a new financial paradigm.”

Larsson added that Bitcoin offers asymmetric upside relative to traditional risk-adjusted asset classes and is increasingly relevant as macro correlations shift in a post-rate-hike global economy.

Nordic Appetite for Crypto Exposure

The raise underscores growing appetite for crypto asset exposure among Nordic investors, who are traditionally conservative but increasingly open to alternative asset classes amid global uncertainty. According to data from the Stockholm Blockchain Association, institutional allocations into digital assets in Sweden have grown by 63% year-over-year.

H100’s model also differs from U.S.-based firms like MicroStrategy in that it pairs BTC holdings with structured hedging instruments, including futures and options overlays to reduce downside volatility.

Strategic Expansion and Custody Infrastructure

A portion of the newly raised funds will be allocated to enhancing H100’s custody and compliance infrastructure. The firm is reportedly in advanced talks with Anchorage Digital and a local fintech consortium to build a regulated BTC trust structure, enabling third-party investors to co-invest alongside H100’s balance sheet.

This move aims to convert the treasury approach into an institutional investment vehicle, opening doors to pension funds and family offices seeking exposure without direct custody risks.

Looking Ahead

As more companies globally begin to treat Bitcoin as a strategic treasury reserve—not a speculative asset—H100 Group is positioning itself at the frontier of this financial shift. With capital in hand, institutional backing, and a regulatory-first approach, the firm may soon become a Nordic benchmark for corporate Bitcoin adoption.

In Larsson’s words: “The future belongs to balance sheets that evolve. We’re not just holding Bitcoin—we’re building around it.”

TOTALCRYPTO MARKET CAPAs we can see the curve support has been broken but this can be a fake move ( manipulation zone ) and we can be manipulated further more till the next rectangle box as mentioned on the chart. Or you can say its a retracement as per previous market action we are the 50% of the previous downfall and exactly from 50% we got some bullish momentum but still the retest of the 50% has not been done so we cannot trust this zone. Let the price retest the zone and than we will have a clear path to upside.

My analysis is till the level i marked for now.

We are Bullish until we have some serious break down with strong red candles.