TOTAL3 trade ideas

Altcoins Recovering: TOTAL3 Bounces from Key Support ZoneIn my previous analysis on TOTAL3, I mentioned that I'm working with two possible bullish scenarios for altcoins. It now seems we're firmly in Scenario #2.

📉 The price dropped exactly into the highlighted support zone, then yesterday we saw a clean recovery and reversal starting right from that area — a textbook technical reaction.

📈 At the time of writing, TOTAL3 sits at $986B, and a break above the $995B–$1T resistance could trigger a new leg up for altcoins.

🎯 Short- and mid-term targets remain:

• $1.08T (recent top)

• $1.15T

• Potential for new all-time highs if momentum builds

✅ As long as price holds above the $920–$930B support zone, bulls remain in control. This keeps the door open for selective altcoin entries — ideally, projects with real structure, strong tokenomics, and clear momentum.

TOTAL 3 New Update (12H)This analysis is an update of the analysis you see in the "Related publications" section

This index has broken below the red zone; if a pullback to this area occurs, it may act as support again and the index could move upward

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

TOTAL 3 Analysis (1D)The TOTAL3 chart is currently retesting a key diagonal trendline that was broken previously. This is a classic bullish retest scenario.

If the current daily candle closes green, and is followed by a strong impulsive candle without invalidation, it could signal the start of a new leg upward, right from this zone.

The $900B market cap level remains the key support.

As long as TOTAL3 holds above this threshold, the bullish bias remains intact.

This structure could lead to momentum across the altcoin market.

The Growth Of Crypto Excluding BTC and ETHIn the world of cryptocurrencies, a remarkable tale of growth unfolded between 2020 and 2025. The total market capitalization of cryptocurrencies, excluding Bitcoin and Ethereum, embarked on an extraordinary journey from a modest $100 billion in 2020 to a staggering $1 trillion by 2025.

Now in 2025, the cryptocurrency market has become a diverse ecosystem. Stablecoins have solidified their role, achieving a market cap of over $200 billion and driving adoption in various sectors. The tokenization of real-world assets gained momentum, with approximately $12 billion in tokenized securities existing on blockchains.

Looking ahead, experts predict even more dramatic growth. With the potential for the total cryptocurrency market cap to reach $3.5 trillion in the near future. It's not far-fetched to imagine the market excluding Bitcoin and Ethereum could surge to $5 trillion before 2030

total 3 crypro cap without eth , bearish

Bearish harmonic patterns are advanced technical analysis tools used by traders to identify potential trend reversals to the downside. They are based on the principle that market movements often follow specific geometric and Fibonacci ratio relationships. When a price chart forms one of these patterns, it suggests that the current uptrend is losing momentum and a downward move is likely.

Here are three of the most well-known bearish harmonic patterns:

1. The Bearish Gartley Pattern

The Gartley is one of the oldest and most reliable harmonic patterns. It is a reversal pattern that looks like an "M" shape and forms after an uptrend.

Structure: The pattern is a five-point formation labeled X, A, B, C, and D.

Fibonacci Ratios: It is defined by these specific ratios:

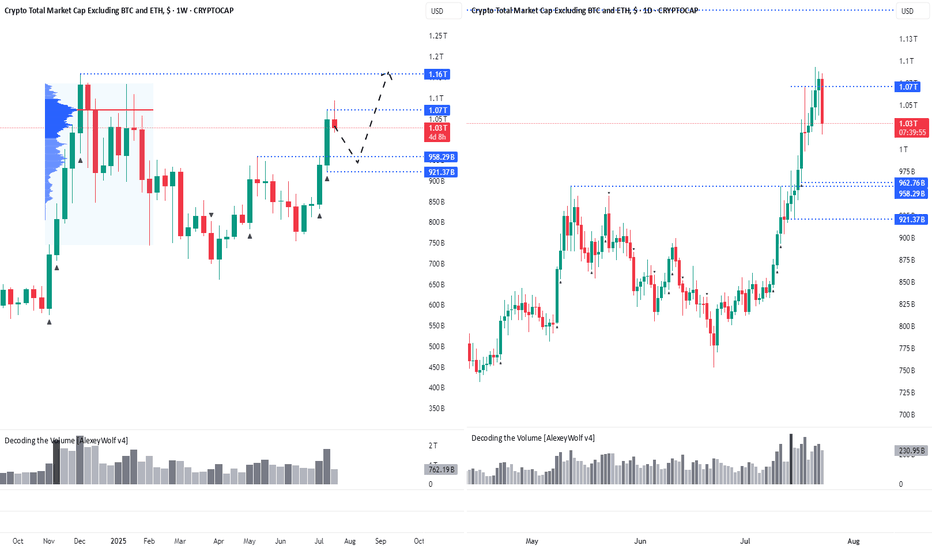

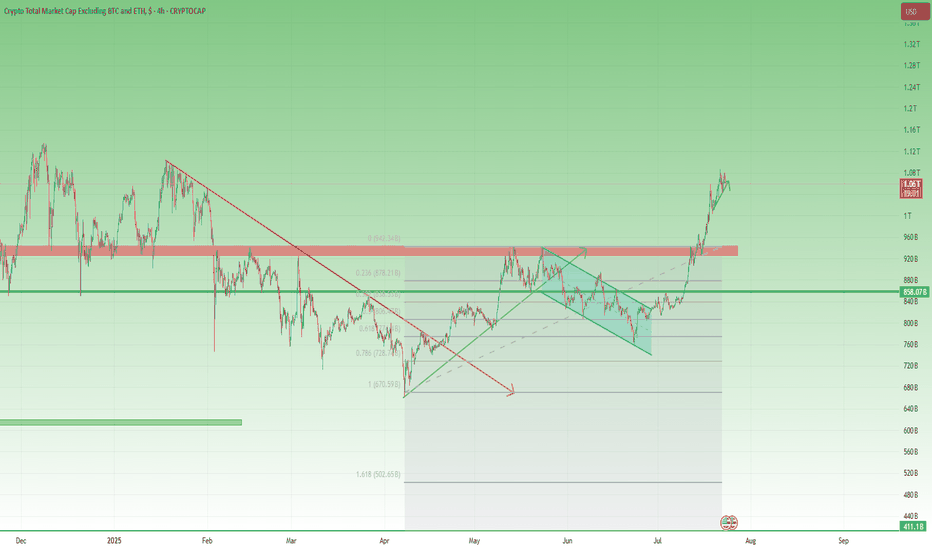

TOTAL3 – Still Bullish, But Waiting for Clarity

In my previous analysis on TOTAL3, I mentioned the high probability of a correction, but also noted that I didn’t expect the 925–940B zone to be reached.

And indeed, price reversed early — finding support around 975B before moving higher.

However, after a push up to 1.07T, the market has started to pull back again.

📊 Current Outlook – Two Scenarios I’m Watching:

Bullish Triangle:

Price may continue to consolidate into a symmetrical triangle, then resume the uptrend from there.

Deeper Pullback into Support:

The market could retest the 925–940B zone, a key support area, before bouncing back up.

⚠️ Bearish Reassessment?

Of course, if price breaks back below 925B and stays there, we’ll have to reconsider the bullish case.

But for now, the trend remains intact, and there’s no technical reason to panic.

📌 My Plan:

I already hold a bag of alts, and I’m not adding for now.

I’ll wait until the pattern becomes clearer — whether it’s a triangle breakout or a dip into support.

Until then, I’m sitting comfortably on what I already hold.

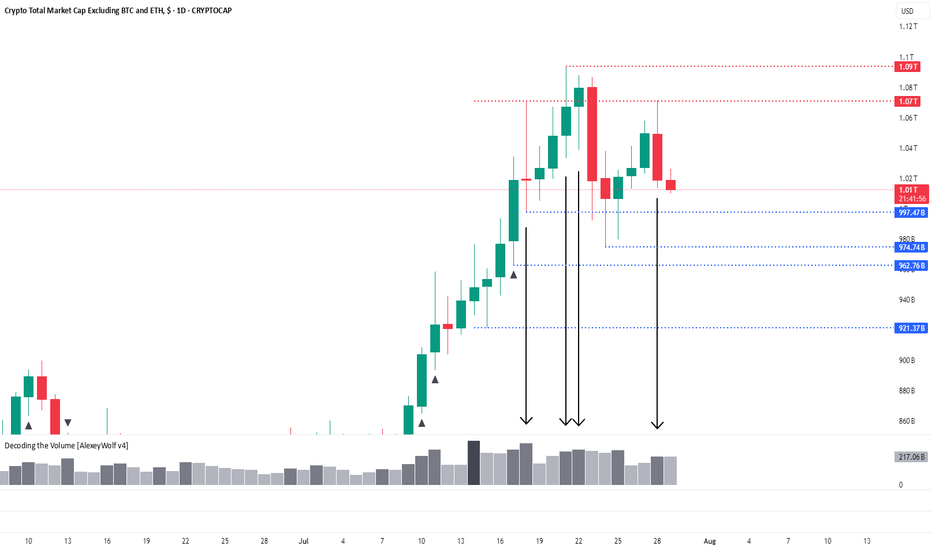

Total3: Fourth Interaction with 1.07 LevelHi traders and investors!

The altcoin market capitalization (Total3) is interacting with the 1.07T level for the fourth time — and once again, on increased volume. Yesterday’s price action formed a bearish candle after touching this level — a clear seller’s candle.

We’re now watching the 997.47B level closely. A reaction from this level could trigger a reversal in altcoins, with buyers potentially regaining initiative.

Since the last outlook, a new level has appeared at 974.74B — this could also serve as a strong support area and trigger a buyer response, aiming for a retest of the local high at 1.09T.

👉 If no bullish reaction follows at 997.47B, attention shifts to 974.74B.

👉 If that level also fails to hold, we return to the previously mentioned support zone between 921B and 963B — the optimal correction range for a potential new ATH scenario.

This analysis is based on the Initiative Analysis concept (IA).

Wishing you profitable trades!

TOTAL3 Approaches Key Resistance with $2.5T Target in FocusTOTAL3 is approaching a critical juncture as we head into year-end. The base case remains a move toward $2.5T, with the index currently around $1T and pressing against resistance from the January highs and 2021 cycle peak. A breakout from these levels could mark the start of a new phase in price discovery.

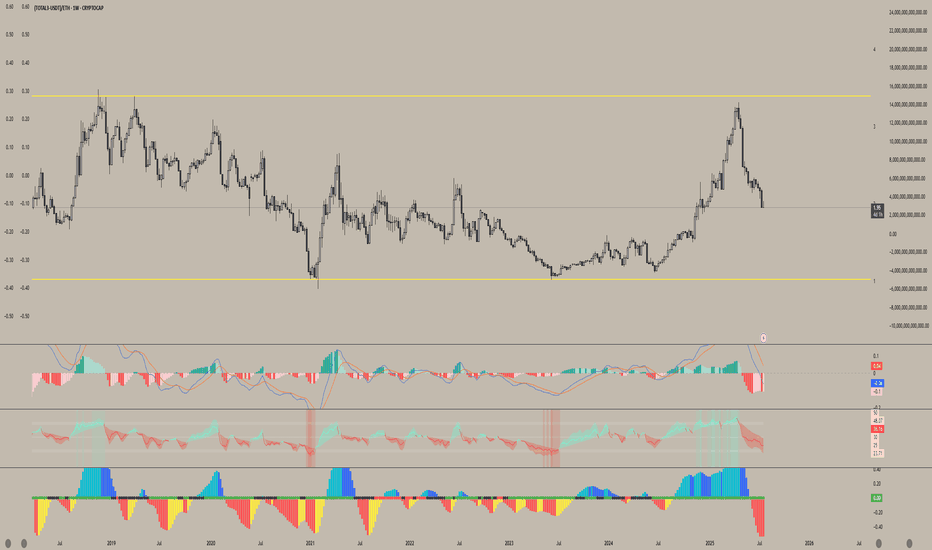

Altcoins are getting absolutely decimated relative to ETHWhile Ethereum has been on a massive run from its lows this year — pulling altcoins up with it — most alts are still lagging far behind.

This chart clearly shows how poorly altcoins are performing against ETH, reinforcing why, at least for now, ETH remains the better hold.

It also fits the classic money flow rotation: BTC → ETH → Large Caps → Small Caps — and right now, we're still in the ETH phase. Until we see strength return in these ETH pairs, chasing altcoins may just lead to more underperformance.

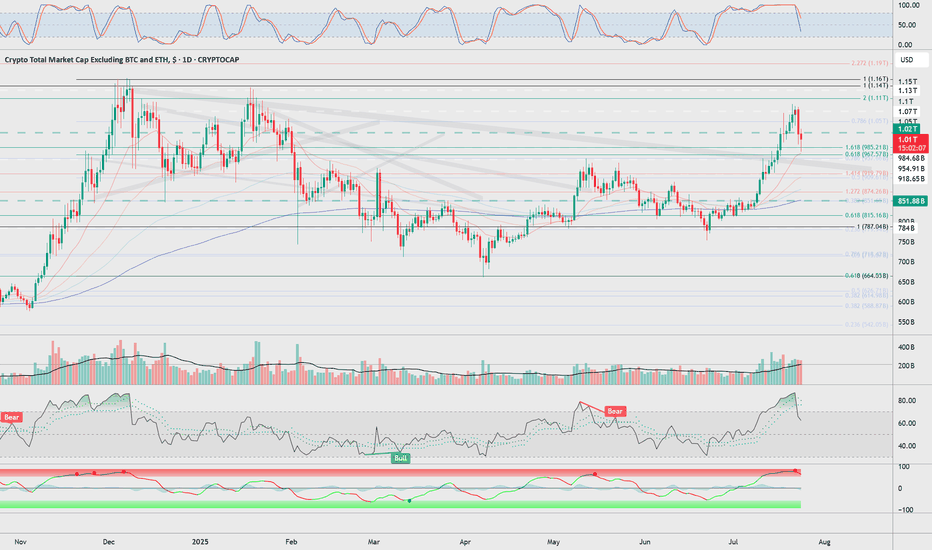

Altcoin Correction Scenario: Where to Look for EntriesHi traders and investors!

The market capitalization of Total3 has reached $1.07 trillion, marking the first major target for the altcoin market.

This level corresponds to the Point of Control (POC) from the previous bullish rally and the subsequent correction — a key area of traded volume and market interest.

Several factors now suggest the potential for a continued move higher. On the fundamental side, the recent signing of a pro-crypto bill by Donald Trump has boosted overall sentiment in the digital asset space, especially among altcoins. From a technical perspective, many leading altcoins are showing bullish continuation patterns.

Ideally, if the altcoin market corrects its capitalization (Total3) into the 963B–921B range, it would be a good zone to look for buying opportunities with the target of renewing the capitalization ATH.

Wishing you profitable trades!

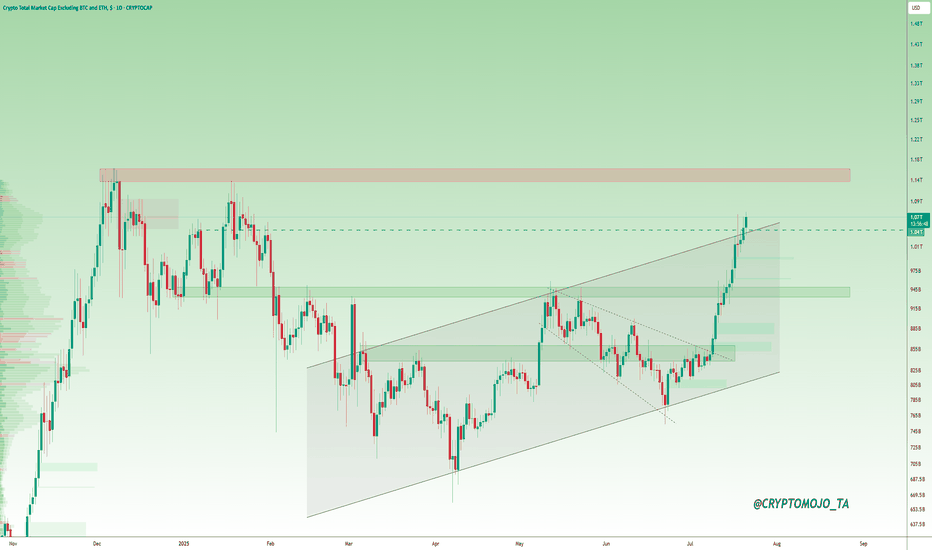

Total3 – Back Above 1T, but Will It Offer a Second Chance?📈 What happened since April?

After the sharp low in early April, Total3 began to recover steadily.

Toward the end of the month, it broke above the falling trendline that had been holding since January — a key technical shift.

This triggered a strong recovery rally, pushing total altcoin capitalization (excluding BTC & ETH) to the 930–940B resistance zone.

📉 Then came the pullback…

Price printed a double top near resistance, followed by a drop — but not a bearish one.

Instead, the correction was orderly, forming a bullish flag, with the low landing right on the 61.8% Fibonacci retracement. Classic healthy structure.

🚀 The latest breakout

Earlier this month, Total3 launched a very impulsive leg up, reclaiming the 1 trillion level with strength.

At the time of writing, we’re trading back above 1T, and momentum remains on the bulls’ side.

However, the chart does look a bit overextended in the short term, suggesting a correction could follow soon.

🧭 Trading Plan – Will We Get a Retest?

The textbook play would be to wait for a deep pullback toward previous support levels.

BUT – I don’t believe we’ll get a full retest of the breakout. Altcoins may stay elevated or correct only modestly.

Instead, I’ll be watching the 1T zone and slightly below — that’s where I’ll look to load up on interesting altcoins.

📌 Conclusion:

Total3 has broken structure, reclaimed key levels, and is showing classic bullish continuation behavior.

The market may not offer you the perfect entry — but small dips near 1T could be all we get before another move higher. 🚀

Be prepared. Don’t wait for perfection in a market because rarely gives it.

Multi-year Cup & Handle Formation for ALTS -Exclude ETH and BTCFour years in the making, the Alts are on the verge of forming a Multi-Year Cup and Handle. With ETH leading the charge, followed by significant and then mid-sized alts, the market is on the brink of a massive surge.

Once 1.15T is breached and a retest down to 1.15T is confirmed, the market is going to see some notable 'fireworks'. The charts are lining up with the Sep/Oct 25 time frame for a significant breakout.

Stay safe and enjoy the ride in the next few months !

ALT SEASON Cycle Finale Special | SOL/ETH & TOTAL3Our last analysis of BTC.D ⬇️ and ETH/BTC ⬆️ () is now playing out, and we are entering the final stage of the 4-year crypto cycle -- ESCAPE VELOCITY for the rest of the crypto market.

As money flows up the risk curve, expecting SOL to outperform ETH from here, and the rest of the crypto market to outperform majors.

Welcome to the cycle finale special!

Altcoin Market at a Make-or-Break Moment!TOTAL3 Update (Altcoin Market Cap)

The altcoin market has just moved above the $1.05T mark. If this level holds, we could see momentum push us toward the $1.14T resistance zone.

But if it fails to sustain, a drop back to $964B or even $850B is possible.

This is a key moment for alts.

The next move will decide whether the rally continues or pauses for a reset.

#Altseason2025

Altseason Bomb Start After $1.16T ? (VERY SOON!)The market structure remains bullish, supported by a strong upward trendline that has held firm since early 2024. Price continues to respect major support levels during pullbacks.

🔸 The key resistance level is at $1.16T, which has acted as a strong barrier in the past. A confirmed breakout above this zone could signal the beginning of a strong Altcoin Season, potentially leading to a large-scale rally in the altcoin market.

🟦 Daily Support Zone (in blue): 962B — a crucial area for potential bounce or retest in case of price cannot break the 1.05 - 1.16T

📈 Expected Scenarios:

A confirmed breakout above $1.16T will be the start of bomb of Altseason

If the price gets rejected at resistance, a retest of the daily support zone is likely before another breakout attempt.

✅ Conclusion: All eyes are on the $1.16T level — a decisive breakout above this resistance would likely mark the official start of Altcoin Season.

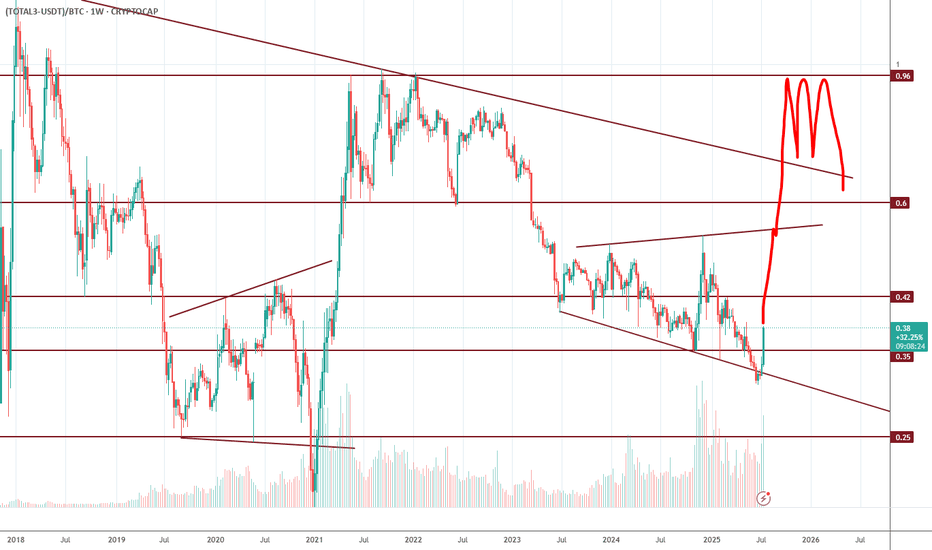

ALtseason-2025: where to exit?I have 2 metrics when I'm going to exit the market (with my profit):

1. When BTC.D falls to 40%;

2. When (Total3-USDT)/BTC = 1, in other words, when the amount of money in the altcoins is almost equal to the amount of money in Bitcoin and Ethereum.

When you see it happen, sell everything and exit the crypto market.