Trade ideas

UNISWAP Potential Long Is ComingI'm currently observing a potential trading setup in COINBASE:UNIUSD that mirrors historical patterns we've analysed. A review of seven similar past movements provides us with a data-driven framework for what we might expect.

Historical Performance Snapshot:

• Back testing Win Rate: 100% (7 out of 7 historical setups resulted in upward moves)

• Average Gain: 60.71%

• Average Duration: 48 days

Key Statistical Insights:

• Duration Consistency: The duration of these movements has been moderately consistent, with a standard deviation of 18 days. This suggests a typical timeframe of 30-67 days for a move to play out.

• Gain Variability: It is crucial to note that the gains have been highly variable, with a standard deviation of 34.30%. Past movements have ranged from a 31% gain to as high as 135%.

Back testing Results: Our back testing of this setup shows a 100% win rate across all seven historical instances. Every time this pattern has appeared, it has resulted in an upward move. However, while the direction has been consistent, both the magnitude of gains and the duration have shown significant variability.

Interpretation: The data suggests that while the directional outcome has been reliable, the journey is less predictable than in other assets. A move could last anywhere from one to two months, and the profit potential has a very wide range of outcomes.

My Approach: Given the high variability in both gains and duration, I’ll be watching this setup with an even stronger focus on risk management. This pattern demands flexible profit targets and a clear invalidation level. This is not financial advice, but an observation based on statistical analysis. Please conduct your own research and manage your risk accordingly.

The long signal has not appeared as yet and might only come in a few weeks. I will update this idea when it does show. The momentum for UNI is still high and I will probably wait for the Long Indicator Stoch RSI to come down to at least 40 it is currently around 60. Therefore we need to wait!!

Have a blessed day!

Uniswap (UNI): Expecting a Good +180% Movement Soon | BullishUNI is sitting near its local bottom and liquidity zone, where buyers have shown signs of pressure previously. What we’re waiting for here is a proper BOS to confirm a potential reversal.

Once that happens, we could be looking at a clean long setup with a strong R:R, especially if buyers manage to push above the EMAs.

Swallow Academy

UNI/USDT – Bullish Setup as Uniswap Expands Cross-Chain AccessUniswap just integrated Solana into its Web App, enabling swaps across Ethereum and 13+ other networks. This move significantly expands Uniswap’s ecosystem and could drive a surge in DEX volumes, adding fundamental strength to UNI.

Technically, UNI is trading near a key accumulation zone between $4.80–$5.10. A sustained hold within this range offers a potential long opportunity, especially as momentum picks up with this major protocol update.

🔹 Entry Zone: $4.80–$5.10

🔹 Targets: $6.00, $7.09

🔹 Stop Loss: Below $4.00

UNIUSDT — at Golden Zone: Major Reversal or the Final Breakdown?Main Narrative

UNI is currently trading at one of the most decisive levels in its entire price history — the $4.0–$5.0 zone, a multi-year fortress of demand that has repeatedly triggered strong rebounds since 2021.

Each time price entered this zone, buyers stepped in aggressively. However, this time the structure looks different — lower highs have been forming consistently, indicating sustained selling pressure.

This is a make-or-break moment for UNI: either it defends this golden zone and starts a new uptrend, or it breaks down into uncharted territory.

---

Technical Analysis

Timeframe: Weekly (mid-to-long-term structure).

Current price: Around $6.39, sitting just above the critical golden zone.

Key levels:

Support zone: $4.0–$5.0 → major historical accumulation area since 2021–2024.

Resistance levels: $8.77 → $11.04 → $14.31 → $18.33 → $26.41 → $42.82.

All-Time High: $45.00.

Price structure:

Continuous lower highs since early 2024, showing sustained bearish control.

Price is moving within a multi-year accumulation range roughly between $4 and $18 — forming a type of megaphone compression that’s nearing its resolution point.

Notice the long lower wick below the current range — a clear liquidity sweep or stop-hunt, often a precursor to trend reversals.

Main pattern formation:

Descending structure (lower highs) → bearish compression.

Potential double bottom / spring setup → if a bullish candle forms in this zone, a macro reversal may begin.

Long-term accumulation range → suggests the market is building energy for a large move soon.

---

Bullish Scenario

Major Reversal Setup (Reclaim from the Golden Zone)

If UNI holds the $4.0–$5.0 zone and forms a strong bullish weekly candle, key upside targets are:

Target 1: $8.77 (first major resistance reclaim)

Target 2: $11.04

Target 3: $14.31

Extended target: $18.33 if momentum builds.

Additional confirmation: weekly bullish divergence on RSI or MACD, and a break above the first lower high structure.

This would signal the start of a potential mid-term reversal trend — possibly marking this zone as the golden bottom for UNI.

---

Bearish Scenario

Breakdown Continuation (Collapse Below Multi-Year Support)

A weekly close below $4.0 would confirm a breakdown from a 3-year accumulation structure.

Consequences could be severe:

Next support levels: $2.5 → $1.7 → $0.85.

Likely panic sell-off or capitulation wave.

However, such a breakdown could also serve as a final shakeout before a large-scale reversal — watch the weekly close, not just intraday wicks.

---

Sentiment & Context

UNI is standing at a psychological and structural crossroads.

Long-term holders have been defending this area for years, making it a critical liquidity zone.

If the zone breaks, stop losses and long-term positions could be flushed — but if it holds, UNI could become one of the strongest DeFi rebound plays in the next cycle.

This is the kind of setup where patience and confirmation matter far more than prediction.

---

Conclusion

The $4.0–$5.0 zone is not just support — it’s UNI’s lifeline.

Hold above = possible start of a new bullish era.

Break below = risk of a deeper bearish expansion.

Everything now depends on how the weekly candle closes.

The best traders will wait for confirmation rather than chase the wick.

> “This golden zone will decide UNI’s destiny — rebirth from the ashes, or another chapter in its decline.”

---

#UNI #UNIUSDT #Uniswap #CryptoAnalysis #TechnicalAnalysis #DeFi #SupportZone #WeeklyChart #TrendReversal #BreakdownAlert #SwingTrading #CryptoMarket #ChartAnalysis #CryptoOutlook

$UNIUSDT a good long oppotunity.The market is expected to cool down a bit after the recent CRYPTOCAP:BTC rally — that’s our chance to catch a solid long setup. Check the green box for the entry zone!

Entry in the green box as low as possible.

🎯 Target: $8.4, $9.7, $10+

If CRYPTOCAP:BTC corrects to around $120,000, it could drag altcoins lower, giving us a perfect opportunity for a juicy long position.

Always DYOR! 💪 #Crypto #Altcoins #BTC #Trading #TechnicalAnalysis #MarketUpdate #DYOR

TradeCityPro | UNI: Key Levels and Bullish Continuation Setup👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review UNI, one of the most popular DEX projects within the Ethereum ecosystem, with a market cap of $4.93 billion, ranking 28th on CoinMarketCap.

📅 Daily Timeframe

This coin has shown a strong upward move reaching 11.449 and then started a correction. After the failure at this level, a downward move began.

🧩 An important support zone around $8.5 has formed, which after breaking, is now acting as resistance.

✅ During this downward movement, the volume has been decreasing. Despite having two down legs so far, it can be said that the overall trend for this coin is still bullish.

📊 For a long position, the first trigger we have is the break of the Maker Seller level. Breaking this level will remove a lot of selling pressure, which could cause a sharp upward move in price.

🛒 The spot trigger for UNI is at 11.449. I recommend opening a long position after breaking the level, and using the profits from that position to buy this coin when the spot trigger is activated.

💥 For a short position, the trigger is 7.447. If the price ranges a bit longer in this area and then breaks the low, it would make a great position. However, if the price breaks the level right now, it would be a risky trigger.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

A $300 $UNI token?so it might sound unrealistic — until it’s not. That’s essentially a 10x from here followed by another 3x extension. With altseason approaching, DEX tokens deserve a spot in every serious portfolio. These platforms can easily spark momentum through new airdrops, fee-sharing models, or expanded token utility.

Uniswap Holding above $7 — Bullish Setup AheadAfter the massive 90% drop from its 2021 peak, Uniswap has been consolidating within a wide range. Each attempt to break higher has so far been followed by a return toward the lower end of the structure — a clear sign of prolonged accumulation.

What’s particularly interesting is how the $7 zone has consistently acted as a median level. Every time price dipped below it, UNI found demand and reversed back up. Recently, a solid support base has been confirmed around $5, further strengthening the bullish technical structure.

With the majority of altcoins now positioned for potential upward continuation, Uniswap could also be preparing for a significant leg higher, with a medium-term target around $14 per coin.

However, negation of this bullish setup would come with a clear breakdown below the $7 zone, which could open the way for a retest of the $5 support once again.

From a trading perspective, this setup offers an attractive 1:5 risk-to-reward ratio, making it an opportunity worth keeping on the radar — provided the $7 level holds.

Uniswap approaches key support, potential 20% surge to 11$Hello✌️

Let’s analyze Uniswap’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

A new proposal could send 65% of Uniswap fees to UNI stakers, making the token yield-bearing.

If approved, UNI may see strong demand, but delays could slow momentum.

📊Technical analysis:

BINANCE:UNIUSDT is approaching two key support zones while testing the psychological resistance at 10. A clear breakout above this level could signal a continuation move of around 20%, with price targeting the 11 area. 📊🚀

📈Using My Analysis to Open Your Position:

You can use my fundamental and technical insights along with the chart. The red and green arrows on the left help you set entry, take-profit, and stop-loss levels, serving as clear signals for your trades.⚡️ Also, please review the TradingView disclaimer carefully.🛡

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

UNI/USDT – Daily OutlookUNI is approaching the 7.7 – 7.8 demand zone after significant bearish pressure. This zone will act as a crucial decision point.

If demand holds, UNI may rebound and retest the 10.3 resistance, which also serves as the validation level for the Head and Shoulders pattern. A breakout above this level would invalidate the HnS scenario and open the door for further bullish continuation.

If demand breaks, the bearish structure could extend lower, potentially targeting the 6.5 – 6.7 region.

At this stage, the demand zone will be the key level to watch, as it will decide whether UNI maintains its medium-term bullish outlook or shifts into a deeper bearish trend.

Uniswap (UNI): 2 Bullish CME Gaps To Fill SoonUNI update: we’re still waiting for a clean BOS. The bullish CME gaps are yet to be filled—first around 10.2 and the bigger one near 11.3–11.5.

As long as buyers defend the EMAs and we see that breakout, we’ll look for continuation into those levels. Patience is key here; the gameplan stays the same.

Swallow Academy

UNIUSDT About to Explode or Break Traders’ Dreams?Yello Paradisers, is #UNIUSDT quietly preparing for its next major rally, or are we sitting right on the edge of a painful trap for impatient traders? Let’s break it down.

💎#UNI has been holding within its ascending channel, bouncing consistently from its demand zone around $9–$9.50. Every retest of this area has brought buyers back into the game, showing strong defense by bulls. Right below, the major demand zone at $7–$8 remains the key level where long-term buyers are waiting, meaning this area acts as a foundation for continuation.

💎On the upside, if #UNI holds current structure and builds momentum, the first challenge is the minor resistance near $14. Breaking through this opens the door toward the strong resistance zone at $18–$19, where profit-taking will likely be aggressive.

💎However, there’s no free ride. A failure to hold the current demand zone could trigger a drop into the $7–$8 major demand area. If that level also gives up, the structure is invalidated, and UNI could revisit much deeper lows around $5–$6, wiping out weak hands before any real recovery.

💎Right now, #UNI is at a pivotal point: defend support and aim for $14–$18, or lose footing and fall into heavy liquidation territory.

Strive for consistency, wait for clear confirmations, and remember that discipline always beats chasing quick profits.

MyCryptoParadise

iFeel the success🌴

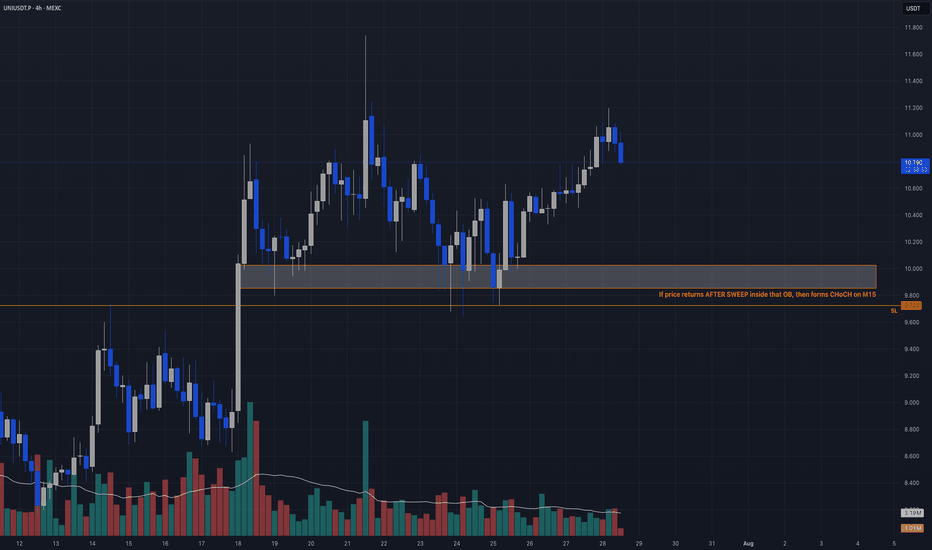

Liquidity Sweep + OB Retest → CHoCH TriggerCandle Craft fam — we’ve got a clean and calculated setup unfolding on UNIUSDT.P (4H). This one fits our criteria perfectly: structure, sweep, and planned trigger. No rush. We wait for the market to show its hand.

⸻

📈 Bias: Long

🧠 Strategy: Liquidity Sweep + OB Retest → CHoCH Trigger

📍 Entry Plan:

▫️ Entry Zone: 9.80 – 10.00 (after sweep)

🛡️ Stop Loss: 9.724

🎯 Take Profits:

• TP1: 10.85

• TP2: 11.20

• TP3: 12.00+

⸻

🧠 Why This Trade?

– Price approaching 4H OB with prior impulse support

– Eyes on liquidity sweep under $10.00

– Looking for M15 CHoCH after sweep for confirmation

– HTF bias remains bullish → continuation expected on reclaim

⚠️ This is a reactive setup — no blind entries. Let the trap trigger the trade.

⸻

Trade clean. Execute with intent.

We don’t guess. We wait, we strike.

—

Candle Craft | Signal. Structure. Execution.