USD/CHF - H1 - Channel Breakout (NFP) (05.09.2025)The USD/CHF Pair on the H1 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 0.8011

2nd Support – 0.7988

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF trade ideas

USDCHF Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring USDCHF for a selling opportunity around 0.79950 zone, USDCHF was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 0.79950 support and resistance area.

Trade safe, Joe.

USD/CHF — classic FRL setupHello, dear traders!

The main trend on this pair remains bearish. Inside it, we had a corrective move in the form of a rising channel

On this local rally, a Double Top reversal pattern has formed, which perfectly aligns with:

• MACD divergence on H1,

• the 100 MA running right along the neckline.

This is a textbook setup according to my methodology FRL (Fractal Reversal Law): a neckline breakout = phase shift and the start of a new impulse.

Target - the lower boundary of the broader descending channel.

Do you think USD/CHF will hold the 0.8010 support, or is further downside ahead?

USDCHF Massive Long! BUY!

My dear subscribers,

My technical analysis for USDCHF is below:

The price is coiling around a solid key level - 0.7975

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 0.8006

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDCHF Fresh Breakdown Opens the Door for Deeper LossesUSDCHF has cracked below the 0.8000 handle with strong bearish momentum. The pair has been grinding lower in a descending channel, and this latest push confirms sellers are in control. With the market leaning toward further Fed easing and the Swiss franc supported by safe-haven demand, the path of least resistance points lower, with room to test key support zones ahead.

Current Bias

Bearish downside momentum accelerating after a clean break below 0.8000.

Key Fundamental Drivers

U.S.: August NFP showed softer jobs growth and unemployment ticking up to 4.3%. Core PCE eased to 2.9%, keeping the Fed on track for cuts.

Switzerland: CPI cooled to 1.0% y/y, giving the SNB room to stay neutral. However, CHF continues to benefit from haven flows tied to Middle East and trade tensions.

Risk Sentiment: Heightened geopolitical uncertainty (Israel–Hamas tensions, OPEC+ supply moves, Trump tariff push) supports CHF demand.

Macro Context

Interest Rates: Fed cuts priced in for late 2025, while SNB keeps policy cautious but stable.

Economic Growth: U.S. growth slowing; Swiss growth steady but muted.

Commodities/Flows: Oil’s weakness pressures USD indirectly via risk sentiment, while CHF gains from capital inflows in risk-off environments.

Geopolitics: Middle East conflict headlines, U.S.–China trade disputes, and Russia sanctions remain CHF-positive.

Primary Risk to the Trend

A sharp rebound in U.S. inflation or CPI surprise could stall Fed cut bets, boosting USD.

Rapid de-escalation in geopolitical tensions could unwind CHF safe-haven flows.

Most Critical Upcoming News/Event

U.S. CPI release will set the tone for Fed rate expectations.

SNB September policy meeting — potential signals on FX intervention or inflation outlook.

Leader/Lagger Dynamics

USDCHF is a lagger, often following broader USD direction (DXY) and global risk sentiment. CHF strength typically mirrors moves in gold and JPY, especially during periods of geopolitical stress.

Key Levels

Support Levels: 0.7949, 0.7918

Resistance Levels: 0.8010, 0.8070

Stop Loss (SL): 0.8010

Take Profit (TP): 0.7949 (first), 0.7918 (extended)

Summary: Bias and Watchpoints

USDCHF has turned decisively bearish with momentum pressing the pair below 0.8000. The trade setup favors selling rallies with a stop above 0.8010 and targets at 0.7949 and 0.7918. Fundamentals back the downside as Fed cut expectations weigh on the dollar and safe-haven demand keeps CHF supported. The key watchpoint is the upcoming U.S. CPI release, which could make or break the move softer inflation would accelerate the drop, while a strong surprise could provide USD relief. Until then, the bias stays bearish.

Lingrid | USDCHF Reached Demand Zone: Potential Rebound The price perfectly fulfilled my previous idea . FX:USDCHF has tested the demand zone around 0.7913 and is showing signs of holding above this key support. The structure suggests a potential rebound as price deceleration aligns with the higher probability of a corrective move toward the 0.7984 resistance. A break above the downward trendline would confirm strength and open the way toward the 0.8050 region. As long as the 0.7900 level remains defended, buyers retain the advantage with room for continuation higher.

💡 Risks:

A decisive close below 0.7900 would invalidate the demand-zone setup and trigger deeper losses.

Upcoming US data releases such as CPI or NFP may spark volatility and disrupt the bullish scenario.

Unexpected hawkish commentary from the SNB could strengthen CHF and cap upside momentum.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

USD/CHF: Holding Key Support with Rebound Potential BuildingUSD/CHF has tested the demand zone near 0.7913 and is beginning to show signs of stability above this key support level. The current price action reflects deceleration, which supports the likelihood of a corrective move toward the 0.7984 resistance.

A confirmed break above the downward trendline would strengthen the bullish case, potentially opening the path toward the 0.8050 region. As long as the 0.7900 level holds, buyers maintain a clear advantage, with the structure favoring a continued recovery in the near term.

USD-CHF Local Short! Sell!

Hello,Traders!

USD-CHF is trading in a

Downtrend but the pair

Is making a bullish rebound

So after the retest of the

Horizontal resistance above

At 0.7992 we will be

Expecting a local

Bearish correction

On Monday!

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

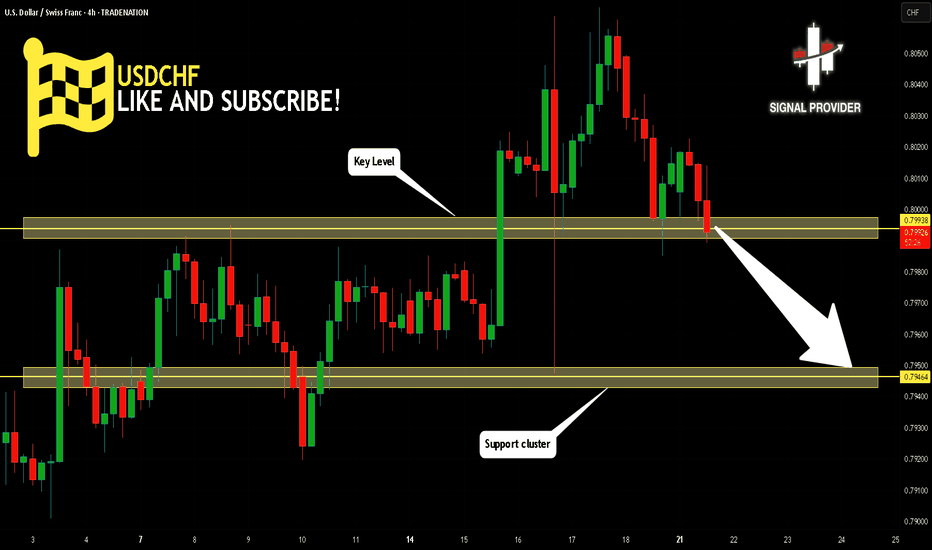

USDCHF Will Move Lower! Sell!

Here is our detailed technical review for USDCHF.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.799.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.794 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USD/CHF - Wedge Breakout (02.09.2025)The USD/CHF pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.8048

2nd Resistance – 0.8067

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish reversal from key support?The Swissie (USD/CHF) is falling towards the pivot and could bounce to the 1st resistance, which aligns with the 50% Fibonacci retracement.

Pivot: 0.7921

1st support: 0.7872

1st Resistance: 0.7995

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish reversal at pullback resistance?The Swissie (USD/CHF) is rising toward the pivot, which acts as a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse to the 1st support.

Pivot: 0.8000

1st Support: 0.7944

1st Resistance: 0.8031

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USDCHF – Liquidity Sweep + FVG Entry (Counter-Trend Long to PDH)Idea:

Price swept previous day’s low (PDL), tapping into an Extreme Daily POI.

We then saw a CHOCH on LTF, confirming rejection.

A clean 5M FVG entry formed, giving a precise long setup.

Bias: Intraday bullish (HTF still bearish).

Entry: 5M FVG inside Daily POI.

SL: Below swept low.

TP1: 2R (partial exit).

TP2: Previous Day High (PDH liquidity magnet).

Notes:

This is a buy-to-sell setup — valid for intraday longs up into PDH, but watch for shorts if HTF structure rejects at PDH.

USDCHF H1 | Falling towards major supportUSD/CHF is falling towards the buy entry which acts as an overlap support that aligns with the 50% Fibonacci retracement and could bounce from this level to the upside.

Buy entry is at 0.8027, which is an overlap support that aligns with the 50% Fibonacci retracement.

Stop loss is at 0.8008, which is a pullback support that is slightly above the 78.6% Fibonacci retracement.

Take profit is at 0.8067, which is a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDCHF 4HTrading Outlook for the Upcoming Week

In this series of analyses, we review trading perspectives and short-term outlooks.

As can be seen, in each analysis there is a key support/resistance zone near the current price of the asset. The market’s reaction to—or breakout from—this zone will determine the next price movement toward the specified levels.

Important Note: The purpose of these trading outlooks is to highlight key levels ahead of the price and the market’s potential reactions to them. The analyses provided are by no means trading signals!

USDCHF 1H longThe sceenshot is on the 4 H tf for better visibility,

But the usdchf is falling nice and clean into the support zone.

No good pullbacks happened yet so I expect a good bounce in the support zone.

We, thu and fri usd high impact news so that will have some impact on the usd.

The plan is simple:

I have 3 limit buy orders with 25 pips difference placed in the support zone

I wait for them to trigger and aim for a 2R total profit

Nice to have: rsi gets oversold again because of the news

Let’s see what the week will bring

USDCHF daily chart ,the corridor paysThe USDCHF daily chart looks like a corridor battle the price continues to move between support at 0.7910 and resistance at 0.8170 and as long as these levels hold the swing trading strategy remains valid buying near support and taking profits near resistance works textbook style if resistance at 0.8170 is broken the next logical target shifts to the 0.8440 zone where significant volume is concentrated technically the structure still points to a sideways market with possible false breakouts fundamentally the pair remains driven by the US dollar index and Fed policy while the franc traditionally acts as a safe haven any shifts in Fed rhetoric or SNB actions could trigger a breakout from the range in conclusion as long as USDCHF trades in this corridor it is a convenient instrument for range trading and breakouts should only be traded with volume confirmation and price consolidation above key levels