USD/PJY | Going higher? (READ THE CAPTION)As you can see in the 2H chart of USDJPY, it has gone through the FVG and hit the supply zone, but it has dropped to the high of the FVG after reaching the supply zone, trying to bounce back up and not return to the FVG. I expect it to retest the supply zone again.

For the time being, the targets fo

U.S. Dollar / Japanese Yen

No trades

About U.S. Dollar / Japanese Yen

Also known as trading the “gopher” the USDJPY pair is one of the most traded pairs in the world. The value of these currencies when compared to each other is affected by the interest rate differential between the Federal Reserve and the Bank of Japan.

Related currencies

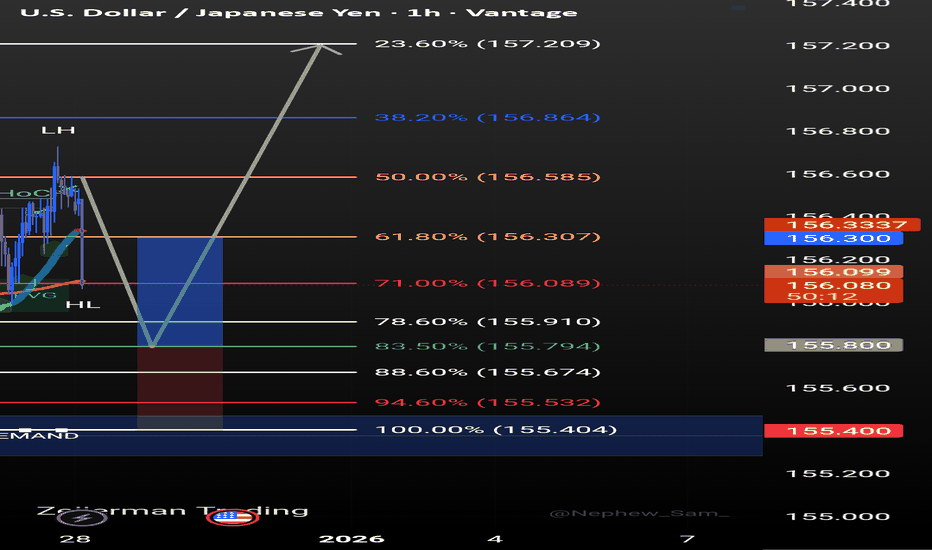

USD/JPY | Next targets ahead! (READ THE CAPTION)By analysing the 2H chart of USDJPY, we can see that after reaching the FVG zone at 156.484-156822 twice, and sweeping the BuySide Liquidity above 156.545 level, it has dropped in price all the way to 155.856 and it is currently being traded at 155.930.

For the time being, USDPJY Bullish Targets are

TheGrove | USDJPY buy | Idea Trading Analysis USD/JPY is trading within a rising channel, with price holding above the ascending support line after a clear bullish and is moving on support line.

The chart is above the support level, which has already become a reversal point twice.

We expect a decline in the channel after testing the current le

USDJPY is Nearing a Strong Resistance!Hey Traders,

In today’s trading session, we are monitoring USDJPY for a potential selling opportunity around the 156.200 zone.

Technically, the pair remains in a broader downtrend and is currently in a corrective move, retracing back toward the 156.20 area, which aligns with trend resistance and a

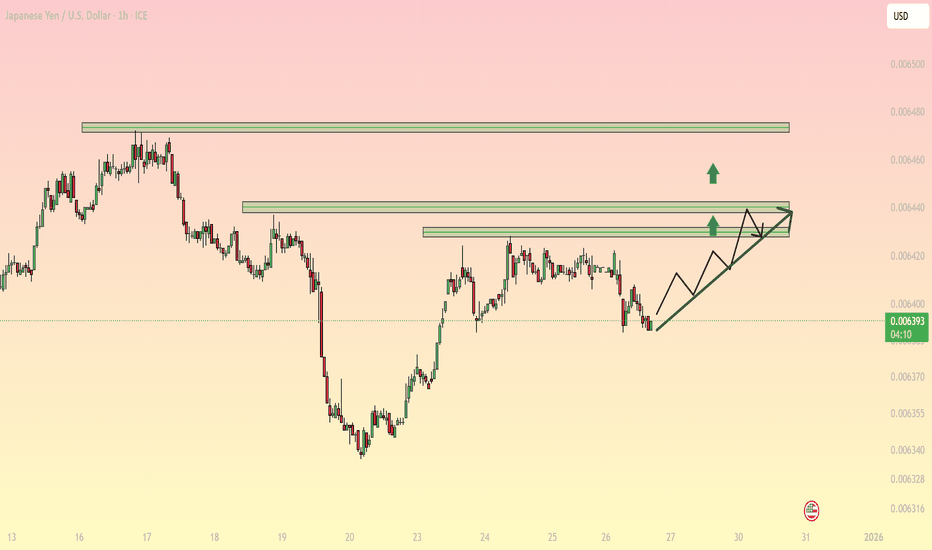

JPYUSD (ICE) H1 OutlookJPYUSD (ICE) H1 Outlook: Rising Trendline Pressing Into Multi-Layer Supply at 0.00643–0.00644

JPYUSD is recovering from the sharp selloff into the 0.00634 area and has built a clean higher-low sequence on H1. Price is now trading around 0.006392, climbing along a rising trendline toward a stacked su

USD/JPY)Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of USDJPY – 4H chart using SMC + Fibonacci OTE + EMA support.

⸻

Market Context (4H)

• Primary bias: Bullish continuation

• Higher-timeframe structure remains bullish

• Price is holding above EMA 200, confirming HTF trend

• Recent drop is a correc

USDJPY after BOJ direction changeLast week BOJ decided to raise interest rates to 0,75 after 30 years. Market misunderstood and couldn't see meeting after the rate desicion was pretty hawkish. Market manipulatied itself all JPY Pairs fake brake out but came back in the day after when Kazuo Ueda BOJ chairman said "we wont allow any

JPYUSD 1H Technical AnalysisJPYUSD 1H Technical Analysis: Range Compression Near 0.00638, Bounce-Then-Drop Scenario in Play

JPYUSD (Japanese Yen vs U.S. Dollar) on the 1H chart is moving in a tight, choppy range after a strong impulse earlier in the session. Price is now sitting directly on a clearly defined base support aroun

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of USDJPY is 156.805 JPY — it has decreased by −0.03% in the past 24 hours. See more of USDJPY rate dynamics on the detailed chart.

The value of the USDJPY pair is quoted as 1 USD per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 USD.

The term volatility describes the risk related to the changes in an asset's value. USDJPY has the volatility rating of 0.28%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The USDJPY showed a 0.54% rise over the past week, the month change is a 1.03% rise, and over the last year it has decreased by −0.46%. Track live rate changes on the USDJPY chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

USDJPY is a major currency pair, i.e. a popular currency paired with USD.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with USDJPY technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the USDJPY shows the buy signal, and 1 month rating is buy. See more of USDJPY technicals for a more comprehensive analysis.