USDNZD trade ideas

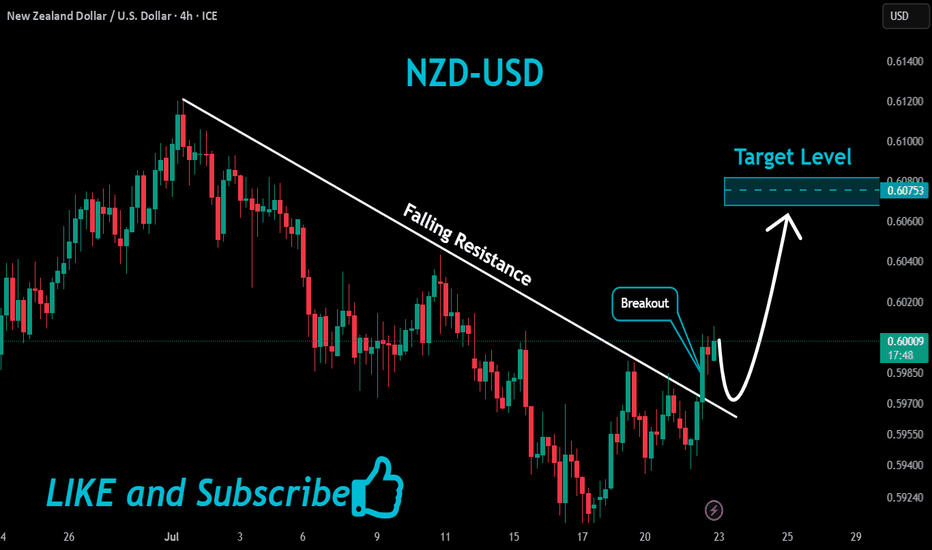

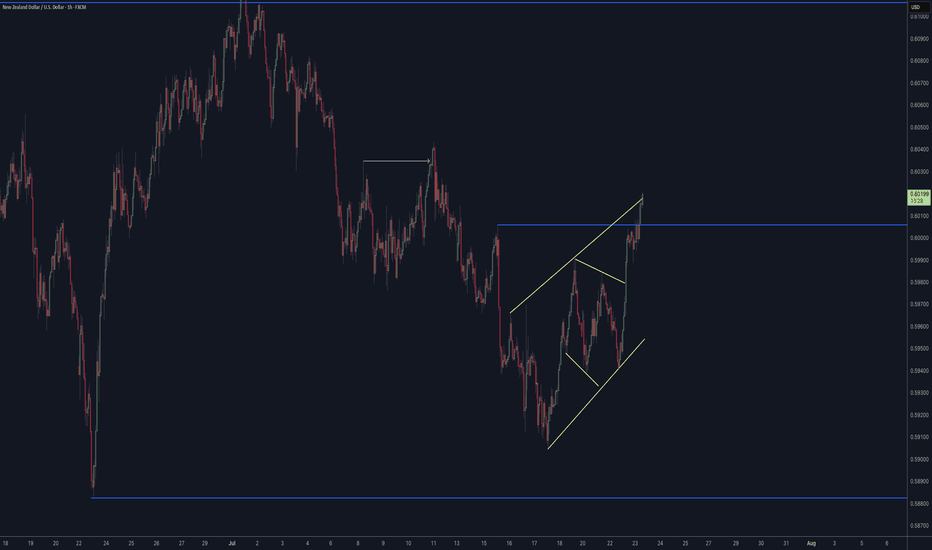

NZDUSD Massive Bullish Breakout!

HI,Traders !

#NZDUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

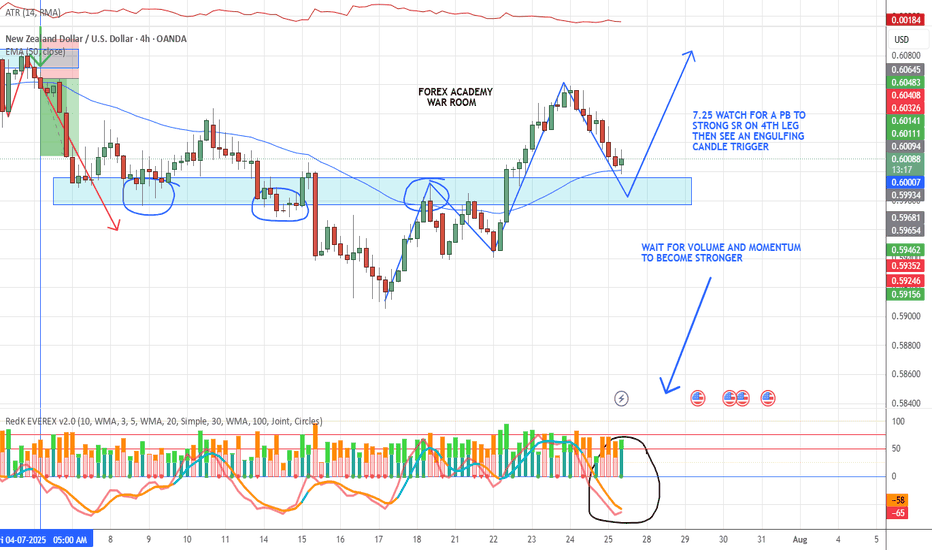

7.25 NZD/USD ADDED TO WATCHLIST👀 NZD/USD – Watchlist Setup Forming (VMS Strategy)

Monitoring NZD/USD as it pulls back toward a key support/resistance zone.

What we need to see for a valid setup:

✅ Price to reach the S/R zone

✅ Strong volume building in the trade direction

✅ Momentum aligned or hooking down

✅ A clean engulfing candle near the 50EMA

📌 The setup isn’t ready yet—but it’s developing. Patience pays.

We’ll keep watching and follow the VMS rules without compromise.

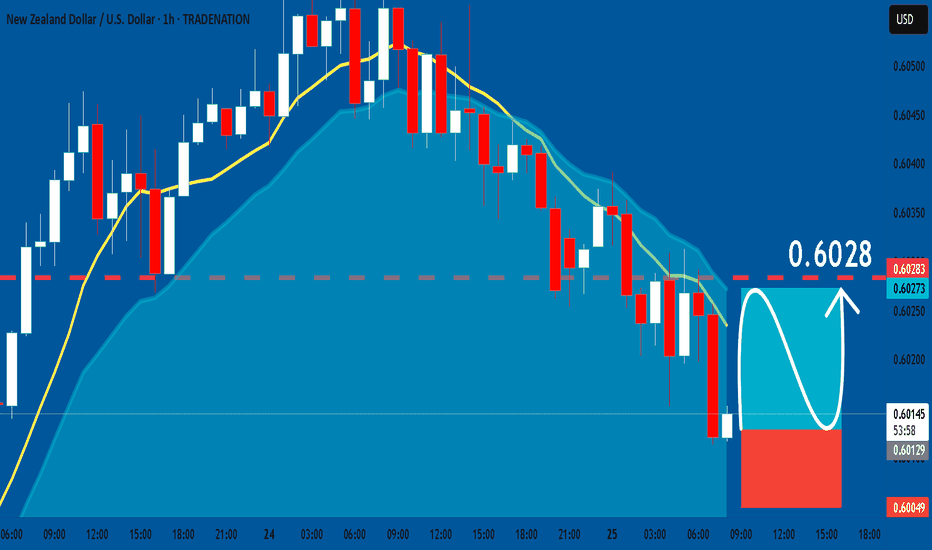

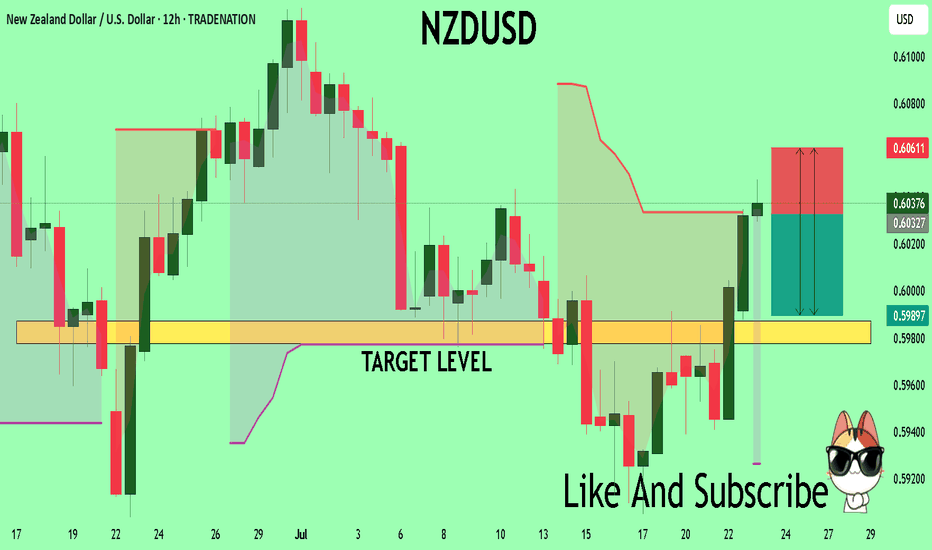

NZDUSD: Free Trading Signal

NZDUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NZDUSD

Entry Point - 0.6013

Stop Loss - 0.6004

Take Profit - 0.6028

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

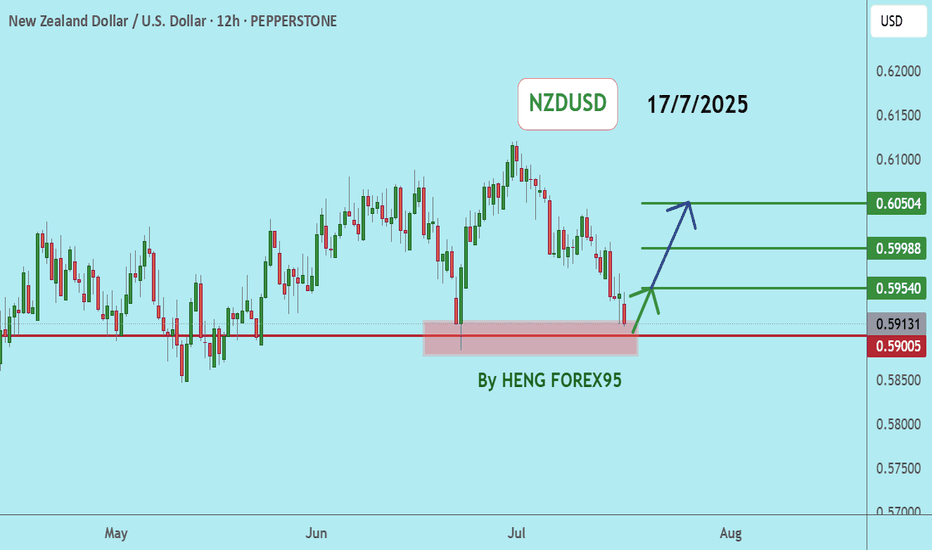

NZDUSDNZDUSD price is near the support zone 0.59197-0.58790. If the price cannot break through the 0.58790 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

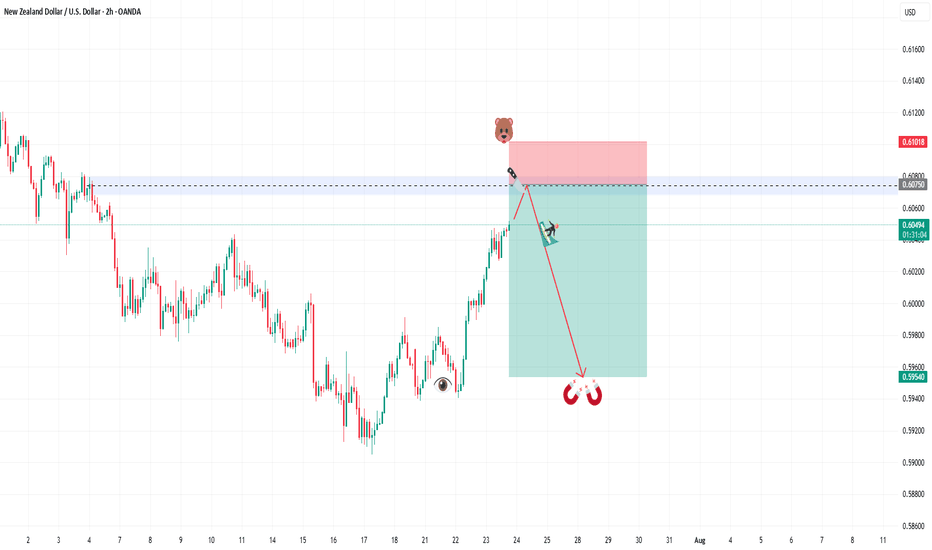

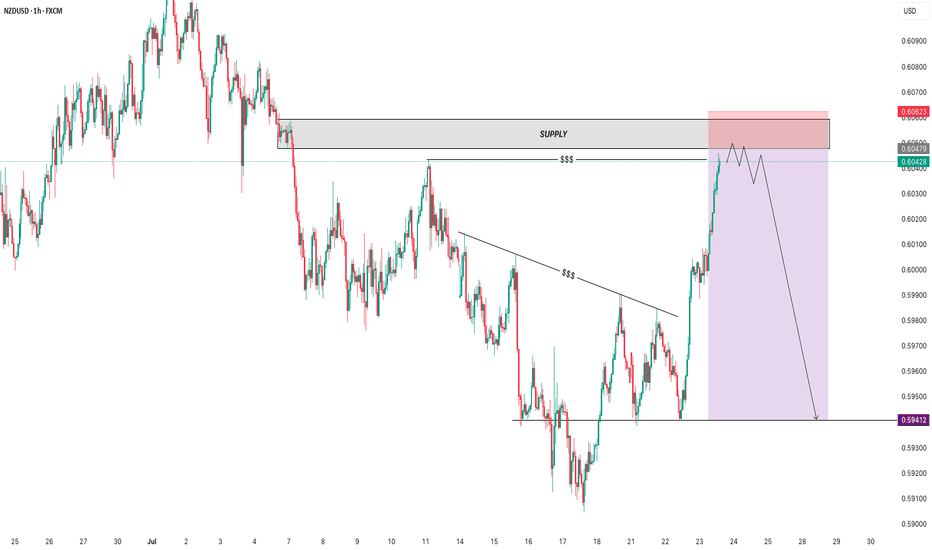

SELL NZDUSDIn todays session we are actively monitoring NZDUSD for selling opportunity. Our first entry in ASIA session is at 0.60478 we anticipate a short rally up to our second re-entry at 0.60750. Our stops are above 0.6100 and our targets are at 0.59540. Use your own risk management and entry criteria and best of luck.

New algo entry model is under testing.

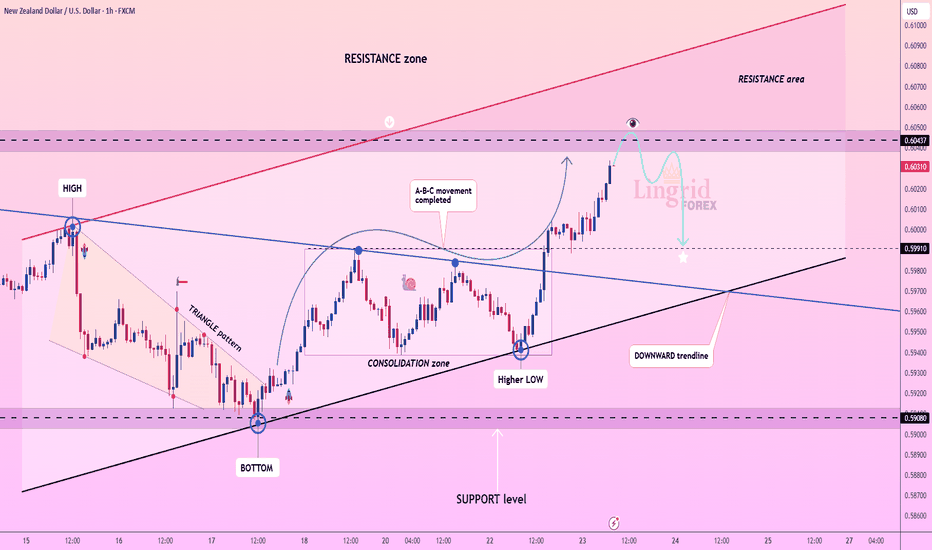

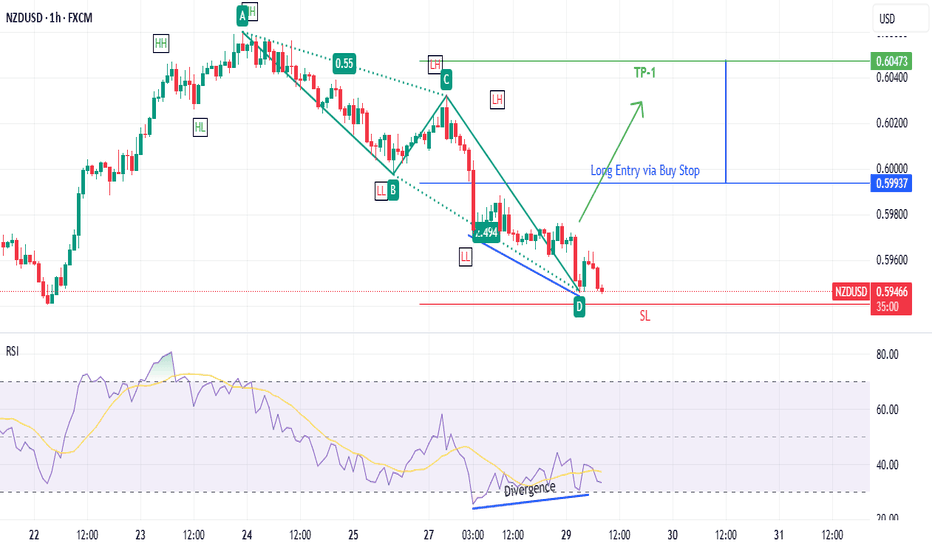

Lingrid | NZDUSD Potential Market Correction From ResistanceFX:NZDUSD has approached a key resistance zone at 0.6040 after completing an A-B-C upward move and forming a potential lower high. Price is testing both horizontal and trendline resistance, suggesting exhaustion within the broader upward move. A failure to hold above the 0.6040 area may trigger a reversal toward the 0.5991 support zone. The structure favors a bearish pullback if the breakout is rejected.

📉 Key Levels

Sell trigger: Rejection from 0.6045

Sell zone: 0.6035–0.6045

Target: 0.5991

Invalidation: Close above 0.6055

💡 Risks

Clean breakout above resistance zone

Strengthening NZD from risk sentiment shift

Holding above upward trendline support

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

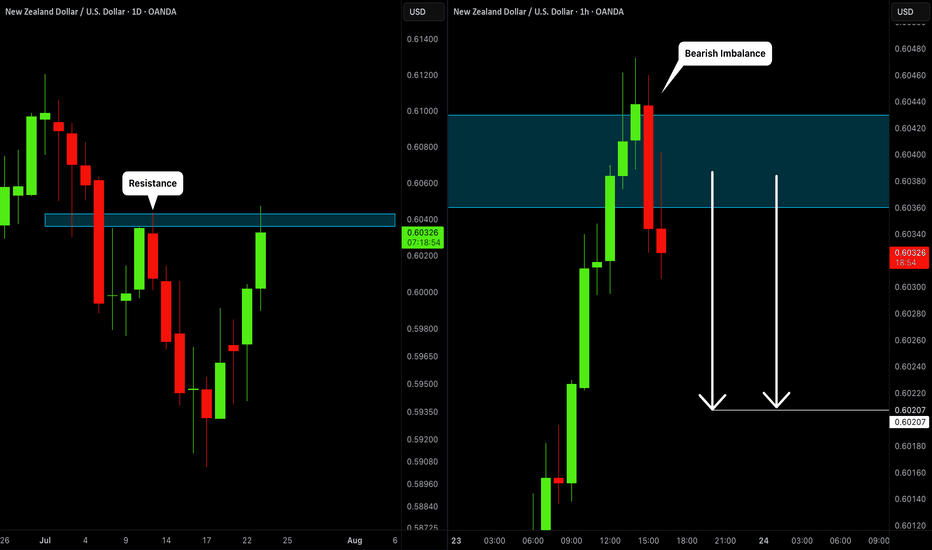

NZDUSD What Next? SELL!

My dear subscribers,

This is my opinion on the NZDUSD next move:

The instrument tests an important psychological level 0.6033

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.5987

My Stop Loss - 0.6061

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SELL NZDUSD SELL NZDUSD , without negleting the power of barish movement in NZDUSD the market has managed to make a maium retst towards a POI with liquidty swap where i expect the market to tur into a very shapbearish movement

remember to manage ur trades , use proper risk management and good luck family

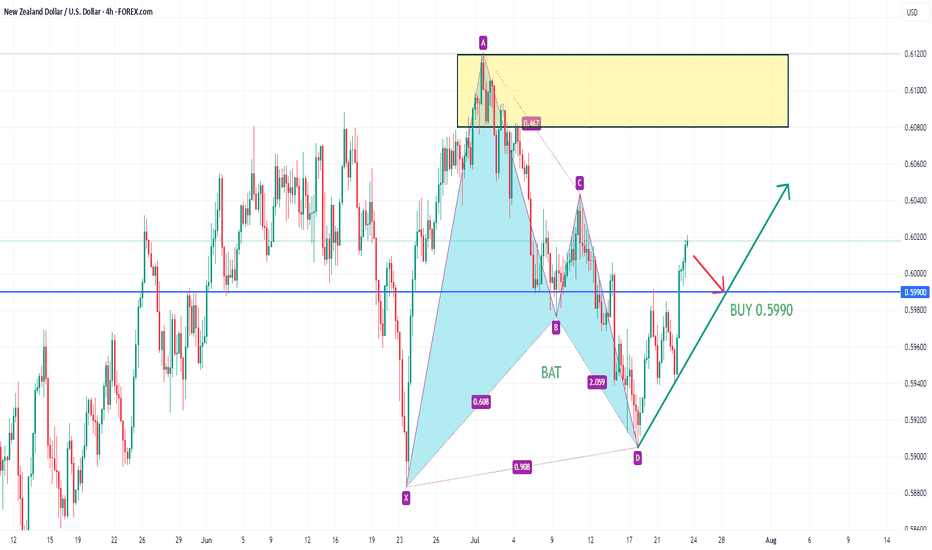

NZDUSD BUY 0.5990On the 4-hour chart, NZDUSD formed a bullish bat pattern and then stabilized and rebounded, and short-term bulls have the upper hand. Currently, you can pay attention to the support near 0.5990. If it stabilizes, you can consider going long. The upper resistance is 0.6080-0.6120 area.

NZDUSD Stuck with Conflicting SignalsNZDUSD is at a key technical junction. The previously broken and retested head and shoulders formation is exerting downward pressure, but the important support zone between 0.5825 and 0.5850 is holding for now. The 100-day and 200-day moving averages have also formed a tight support-resistance range, causing the currency to remain trapped in a narrow range.

Both the Federal Reserve and the Reserve Bank of New Zealand are expected to cut rates twice this year. Growth expectations for 2025 are closely aligned, with only a 0.3-point advantage for the U.S., and the gap is narrowing. Inflation expectations are also similar, with U.S. figures slightly higher, mirroring the GDP trend.

The 2-year bond yield spread between the U.S. and New Zealand has remained flat since April. During that time, NZDUSD climbed from 0.55 to 0.61 before pulling back to the current level near 0.5890.

Similar fundamental statistics and conflicting technical signals have caused NZDUSD to form an uncertain range between 0.5930 on the upside and the 0.5825–0.5850 support zone on the downside. If either of these key levels breaks, volatility may return quickly.

A break above 0.5930, which coincides with both the broken neckline and the 100-day moving average, could push the price toward the descending trendline from the 2021 top (highlighted in blue on the chart). On the other hand, a break below the 0.5825–0.5850 zone which also includes the 200-day moving average, could trigger a move toward the head and shoulders pattern target, currently near 0.57.

The first two weeks of August will be crucial for the dollar index, following the sharp downward revision in payrolls data. Market reaction, revisions to expectations, commentary from Federal Reserve members, and the release of July inflation data will provide greater clarity. This wave of information could finally break NZDUSD out of its current indecisive range.

NZD/USD Analysis Based on Volume, Fibonacci & Stochastic

This NZD/USD setup is developed using:

Volume analysis to highlight market participation zones

Fibonacci levels to confirm technical structure

Stochastic indicator to find precise entry timing

🔹 Entry: 0.5892

🔹 Take-Profit: 0.5864

🔹 Stop-Loss: 0.5909

🔹 Risk-to-Reward Ratio: 1.64

⚠️ Disclaimer: This analysis is for educational purposes only and is not financial advice. Always trade with proper risk management.

NZD/USDThis analysis is based on a combination of volume analysis, Fibonacci retracement levels, and Stochastic oscillator signals to identify a high-probability entry point. The trade setup suggests a potential bearish move following confirmation from volume patterns and momentum indicators.

Entry: 0.5907 area

Stop-Loss: 0.5916 area

Take-Profit: 0.5893 area

This setup targets a short-term downward correction within a key Fibonacci zone, supported by weakening volume and an overbought signal from the Stochastic indicator.

⚠️ Disclaimer:

This is not financial advice. Trading involves risk and may not be suitable for all investors. Always conduct your own analysis and use proper risk management.

NZDUSD BUY TRADE PLAN (PULLBACK)📋 TRADE PLAN – NZDUSD (SHORT-TERM BUY SCENARIO)

📅 Date Issued: August 4, 2025

🔍 1. TOP-DOWN STRUCTURAL CONTEXT

🟣 D1 TIMEFRAME

Price has printed a strong rejection wick near 0.5885 support zone.

Structure: Currently in a D1 pullback phase within broader bearish context.

Reaction: First clean bullish candle printed after 3 consecutive bearish days.

🔵 H4 TIMEFRAME

Bullish engulfing printed (August 2, 12:00) from support at ~0.5880.

Price is now consolidating above this reaction zone, respecting structure.

Micro higher low formed; potential to extend pullback toward 0.5950–0.5975 range.

🟢 H1 TIMEFRAME

Retest structure forming between 0.5895 – 0.5908.

Multiple wick rejections showing buyers defending liquidity pocket.

Price forming tight intraday range post bullish impulse.

🧠 2. INSTITUTIONAL ZONE CLASSIFICATION

Type Level Status Freshness RR Quality Origin Timeframe

Demand (Primary) 0.5880–0.5890 ✅ Mitigated Clean Good H4

Supply (Target Zone) 0.5950–0.5970 🟡 Pending Fresh High H4

Demand (Backup) 0.5850 🟡 Untapped Fresh Moderate D1

✅ 3. TRADE PLAN STATUS:

🟢 ACTIVE – Confirmation Printed

H4 Bullish Engulfing confirmed on August 2 (12:00 candle) from 0.5880 zone.

H1 is consolidating post-impulse, showing compression + wick defense.

Structure supports short-term pullback upside.

🧭 4. EXECUTION DETAILS

Parameter Value

Entry Zone 0.5900 – 0.5908 (H1 compression)

Stop Loss 0.5875 (below H4 demand wick)

TP1 0.5950 (first H4 supply)

TP2 0.5970 (full imbalance fill)

Risk Model 0.5–1.0% per entry

Trade Type Pullback Continuation (Intraday)

🔁 5. CONFIRMATION DETAILS

Candle Type: H4 Bullish Engulfing

Candle Time: H4, August 2 @ 12:00

Behavior: Large rejection wick + body close above previous structure

Volume Context: Expansion candle → first impulsive buy leg from demand

🧠 6. RISK NOTES

This is not a long-term reversal, but a pullback trade.

Invalidation on clean close below 0.5875.

Failure to break 0.5950 decisively may indicate early reversal or range continuation.

🔄 7. ZONE ESCALATION REMINDER

📌 High-Probability Sell Zone (Future Conditional Setup)

Zone: 0.5975–0.5995 (D1–H4 origin supply)

Status: 🟡 Conditional – Awaiting price arrival

Setup Type: HTF Mean Reversion (probability increase if compression into zone)

✅ FINAL TRADE LABEL

🟢 NZDUSD INTRADAY BUY PLAN

Entry: 0.5900–0.5908 | SL: 0.5875 | TP1: 0.5950 | TP2: 0.5970

Status: ACTIVE – H4 Bullish Engulfing confirmed

Context: Short-term continuation from demand. Risk managed pullback play.