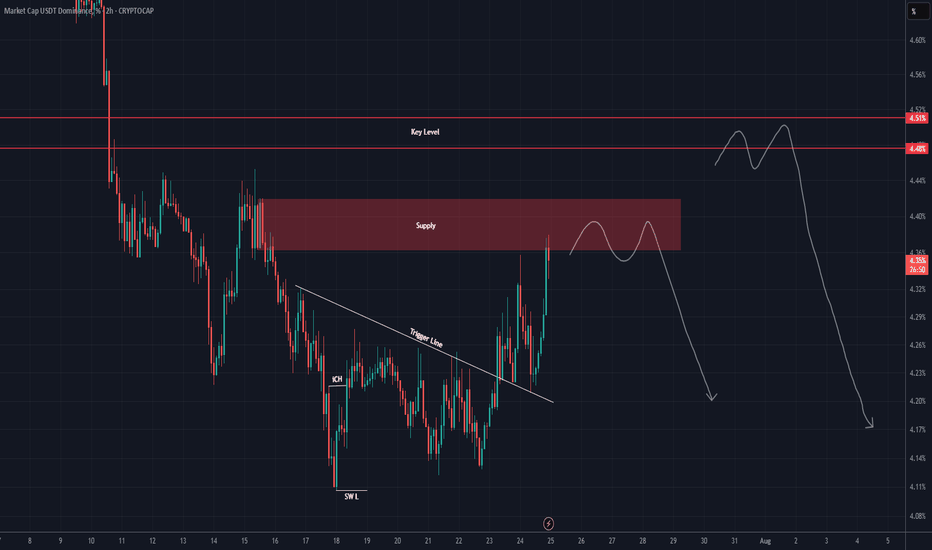

Will a Drop Below 4.12 Push BTC to New Highs ?👋 Hello, and welcome to Satoshi Frame .

📊 USDT Dominance , after a sharp move toward 6% , got rejected strongly from that level with a powerful candle .

🔻 Following that , it lost its key support and entered a deep corrective phase .

🚀 During this period, Bitcoin and altcoins experienced a strong upward trend , and 🟠 Bitcoin even recorded a new all-time high .

📉 The key support level for USDT Dominance is at 4.12% .

⚠️ If this level is broken, Bitcoin could potentially reach a new all-time high again .

📐 I’ve drawn my Fibonacci from the point where the support was lost , the structure broke , and the previous uptrend turned into a corrective or bearish trend .

🔽 The breakdown of that key support pushed USDT Dominance down to 4.12% , where we saw strong buying pressure in Bitcoin and altcoins, leading to a sharp upward movement.

🔄 Price then retraced to the 0.382 Fibonacci level (4.61%) , acting as a corrective pullback within the ongoing downtrend.

❌ However , this area triggered a rejection , and now we are witnessing another decline in USDT Dominance.

💡 Disclaimer : This analysis is for educational purposes only and should not be considered financial advice . Always do your own research and manage your risk before making any trading decisions .

Market insights

USDT + USDC Dominance🦇 Bearish Bat Pattern Forming :

A potential Bearish Bat is developing, with price nearing the final zone where reversals typically occur — the Potential Reversal Zone (PRZ).

What to watch:

🔻 If the pattern completes and gets rejected in the PRZ:

That could signal a shift away from stables and back into riskier assets — a bullish sign for altcoins and the broader crypto market.

🔼 If price breaks through the PRZ:

The pattern fails. That would point to continued risk-off behavior — more capital flowing into stables and away from alts.

🧠 Pattern isn't confirmed yet — the key move is still ahead. Watch price closely as it enters the PRZ. The reaction there will shape the next major trend.

Tether Rakes in $4.9B Q2 Profit, Cementing Its Reign as Crypto’sTether Q2 Net Profit Hits $4.9 Billion, Pushing Total Earnings to $5.7 Billion: What It Means for the Crypto Industry

Tether Holdings Ltd., the issuer of the world’s largest stablecoin USDT, has once again made headlines with its Q2 2025 earnings report, revealing a staggering net profit of $4.96 billion. This brings the company’s total profits for the first half of the year to $5.7 billion—a record-breaking milestone for both the company and the broader stablecoin ecosystem.

This article explores the implications of Tether’s Q2 performance, the sources of its revenue, its impact on the crypto markets, and the growing significance of stablecoins in the evolving financial landscape.

________________________________________

A Record-Setting Quarter for Tether

Tether’s Q2 2025 results have astonished even seasoned analysts. The company’s reported $4.96 billion in net profit in a single quarter represents one of the most profitable periods in the history of any fintech or crypto-native company. What’s even more remarkable is that this profit was not driven by speculative trading or token sales, but by conservative, yield-generating strategies rooted in traditional finance.

The company’s Q1 earnings were already impressive at $0.76 billion, but Q2’s results eclipse those numbers entirely. Tether’s cumulative profit year-to-date now stands at $5.72 billion, putting it on track to potentially exceed $10 billion in earnings for the full year if current trends continue.

________________________________________

What’s Driving Tether’s Massive Profit?

Tether’s incredible profitability is primarily fueled by one key factor: the interest earned on its reserves. As the issuer of USDT, Tether is responsible for maintaining a 1:1 backing of every token in circulation. These reserves are primarily held in short-term U.S. Treasury Bills (T-Bills), reverse repos, and cash equivalents.

Here’s a breakdown of the main profit drivers:

1. High Interest Rates on U.S. Treasuries

With the U.S. Federal Reserve maintaining elevated interest rates to combat inflation, short-term T-Bills have become highly lucrative. Tether holds tens of billions of dollars in these instruments, generating billions in annual interest income.

For example, the yield on a 3-month Treasury bill in Q2 2025 averaged around 5.2%, and Tether’s reserve base has hovered near $90 billion to $100 billion. Even a conservative allocation can earn several billion dollars in annual yield.

2. Reverse Repurchase Agreements (Reverse Repos)

Tether has also expanded its use of reverse repos, which allow it to lend cash to counterparties in exchange for securities, earning a premium on the transaction. This has contributed significantly to its earnings, especially in a high-yield environment.

3. Gold Holdings and Bitcoin Exposure

Tether has acknowledged that a small portion of its reserves includes gold and Bitcoin holdings. These assets appreciated in Q2, contributing to the overall profit. While not the primary revenue source, their performance added notable value during the quarter.

4. Equity Investments

The company has begun investing in infrastructure and technology firms related to blockchain and AI. While these investments are not liquid, mark-to-market gains may have also contributed to the net profit figure.

________________________________________

A Closer Look at Tether’s Reserve Report

Tether’s Q2 attestation report, published alongside its earnings update, provides transparency into how its assets are allocated. Here are some highlights:

• Over 85% of reserves are held in U.S. Treasury instruments

• $5.4 billion in excess reserves—a buffer above the value of circulating USDT

• $3.3 billion in gold and Bitcoin holdings

• Minimal exposure to unsecured commercial paper or riskier debt instruments

Tether has continuously emphasized its commitment to transparency and risk management. Unlike in its early years, when it faced criticism over opaque reserve practices, the company now releases quarterly attestations audited by third-party firms such as BDO Italia.

________________________________________

USDT’s Growing Dominance

Tether’s profits are closely tied to the growth of its flagship product: USDT, the world’s largest stablecoin by market cap. As of August 2025, USDT has a circulating supply exceeding $110 billion, giving it a dominant share of the stablecoin market.

This growth can be attributed to several factors:

1. Increased Adoption in Emerging Markets

USDT is widely used in countries with unstable fiat currencies, such as Argentina, Nigeria, and Turkey. For many users, USDT represents a dollar-denominated safe haven in environments plagued by inflation and capital controls.

2. DeFi and Cross-border Payments

USDT continues to be a core asset in decentralized finance (DeFi) protocols, serving as a stable medium of exchange and collateral. It's also a preferred tool for cross-border remittances, given its speed and low transaction costs compared to traditional banking systems.

3. Institutional Integration

Major crypto exchanges, custodians, and payment processors have incorporated USDT into their platforms, driving further liquidity and utility. In many cases, USDT is preferred over fiat due to its 24/7 availability and blockchain-native nature.

________________________________________

What Does This Mean for the Crypto Industry?

Tether’s Q2 performance is more than just a corporate milestone—it’s a bellwether moment for the crypto industry. It signifies the maturation and institutionalization of digital assets and stablecoins. Here’s what it means for the broader ecosystem:

1. Stablecoins as Profitable Financial Products

Tether’s profitability proves that stablecoins are no longer just “crypto plumbing.” They are now financial products generating billions in yield, much like money market funds. This is reshaping how investors and regulators think about stablecoins—not as speculative tools, but as interest-bearing assets backed by real-world securities.

2. Regulatory Scrutiny Will Intensify

With Tether generating profits that rival traditional banks, expect regulators to increase oversight. Stablecoins have long been in the crosshairs of the U.S. Treasury, SEC, and global central banks, and Tether’s dominant market share will likely place it under further examination.

However, Tether’s transparency efforts, including quarterly attestations and reserve disclosures, may help it navigate these regulatory waters more effectively than in the past.

3. Competition Will Escalate

Tether’s extraordinary profits will likely attract new entrants and existing competitors to the stablecoin arena. Circle’s USDC, PayPal’s PYUSD, and even central bank digital currencies (CBDCs) are all vying for market share.

Tether’s early-mover advantage, global reach, and deep liquidity make it hard to displace, but increased competition could pressure margins in the long term.

4. Decentralized Alternatives Will Seek Market Share

Decentralized stablecoins like DAI, FRAX, and USDD aim to offer alternatives to centralized issuers like Tether. While they remain relatively small, the ethos of decentralization might gain appeal, especially in regulatory-heavy environments.

Still, decentralized stablecoins have struggled to maintain pegs during market stress, giving Tether an edge in terms of trust and resilience.

________________________________________

The Road Ahead for Tether

As Tether moves into the second half of 2025, several strategic themes will define its trajectory:

Continued Profitability

If interest rates remain elevated and USDT circulation continues to grow, Tether’s annual profit could reach or exceed $10 billion—putting it in league with the most profitable fintech firms globally. This surplus could be reinvested in:

• Infrastructure expansion

• Strategic acquisitions

• Reserve diversification

• R&D for stablecoin innovation

Expansion into Emerging Markets

Tether has hinted at expanding its presence in Latin America, Africa, and Southeast Asia, where demand for dollar-denominated assets is high and banking infrastructure is limited. Expect to see more localized partnerships and on-ramp/off-ramp solutions.

Embracing Blockchain Innovation

Tether is already deployed on multiple blockchains—Ethereum, Tron, Solana, and more. The company is likely to support new Layer 1s and Layer 2s to enhance speed, reduce costs, and maintain competitiveness in the DeFi space.

There are also rumors that Tether may be exploring tokenized asset offerings and programmable money features, allowing USDT to integrate more deeply with smart contracts and enterprise use cases.

________________________________________

Criticisms and Controversies: Still Lingering?

Despite its success, Tether continues to face criticism from parts of the crypto community and regulatory world. Concerns include:

• Lack of full audits (attestations are not the same as full financial audits)

• Opaque ownership structure

• Past legal issues, including settlements with the New York Attorney General and the U.S. CFTC

However, it’s worth noting that Tether has addressed many of these concerns over the past two years. Its transparency has improved, and its operations have become more conservative and professional.

Still, its scale and impact on the crypto market mean that any misstep could have systemic consequences. Investors and regulators alike will continue to scrutinize its activities.

________________________________________

Final Thoughts: Tether’s Moment of Ascendance

Tether’s Q2 2025 net profit of $4.96 billion doesn’t just reflect a successful quarter—it marks a paradigm shift in crypto finance. What began as a controversial stablecoin project has evolved into a global financial powerhouse, rivaling traditional banks and asset managers in profitability.

More than just a win for Tether, this moment signals the growing legitimacy of stablecoins in the global financial system. It shows that crypto-native firms can not only survive but thrive in traditional financial environments, leveraging yield, transparency, and blockchain infrastructure to create sustainable business models.

As the world watches, Tether’s next chapters will likely be shaped by innovation, regulation, and global expansion. But for now, with $5.7 billion in profits in just six months, one thing is clear:

Tether is no longer just a stablecoin issuer—it’s one of the most powerful financial entities

in the digital age.

________________________________________

Disclaimer: This article is for informational purposes only. It does not constitute financial advice. Always conduct your own research before making investment decisions.

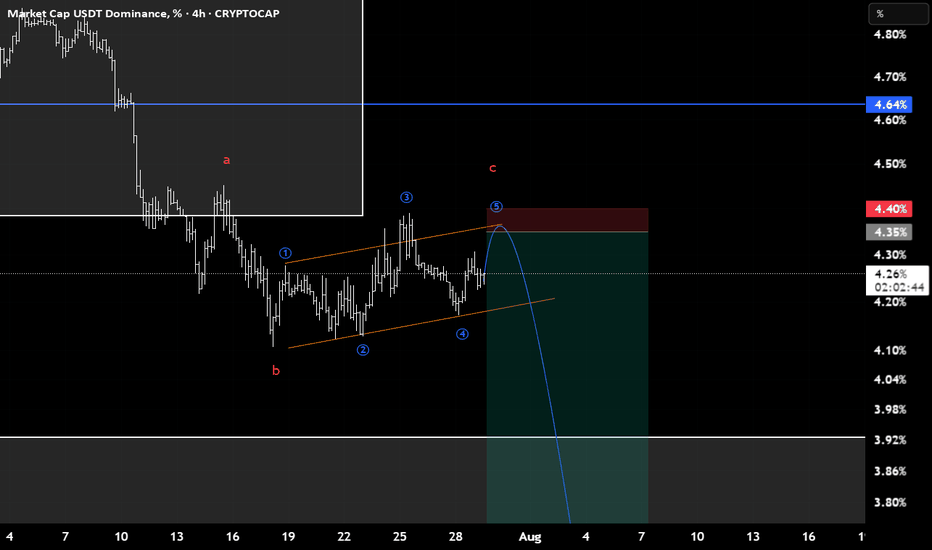

USDT Dominance – Potential Wave F Reversal?

We are tracking a NeoWave Diametric formation (7-leg corrective structure: A–B–C–D–E–F–G) on the USDT Dominance chart. Recently, price reached the projected resistance zone of wave E, and early signs of reversal are emerging.

⸻

🧠 Structural Analysis:

• The structure has developed with alternating legs in price and time, consistent with the symmetrical diametric rules.

• Wave E has likely completed, reacting from prior supply and resistance.

• A pullback from here can mark the beginning of Wave F, which in diametrics tends to retrace significantly toward the internal balance of the structure.

⸻

🔍 What to Watch:

• Confirmation of bearish intent via a break of internal supports or lower-timeframe BOS.

• Possible retracement targets: 4.2% → 3.95%, depending on momentum.

• A decisive break below 4.00% would reinforce the wave F scenario.

⸻

⚠️ Implications for the Crypto Market:

A drop in USDT Dominance typically indicates rotation into risk assets (alts/BTC/ETH). However, context matters — if the drop happens during a general market sell-off, it may reflect risk-off unwinding into fiat, not risk-on rotation.

⸻

🔄 Strategy Note:

• Avoid premature shorts or longs; wait for structure to confirm.

• Watch for smart money traps (e.g., false breakouts or liquidity grabs) around the recent highs.

⸻

📌 This is a high-risk zone for entering long USDT.D — be cautious with stablecoin bias.

📊 Analysis by CryptoPilot – Precision through structure.

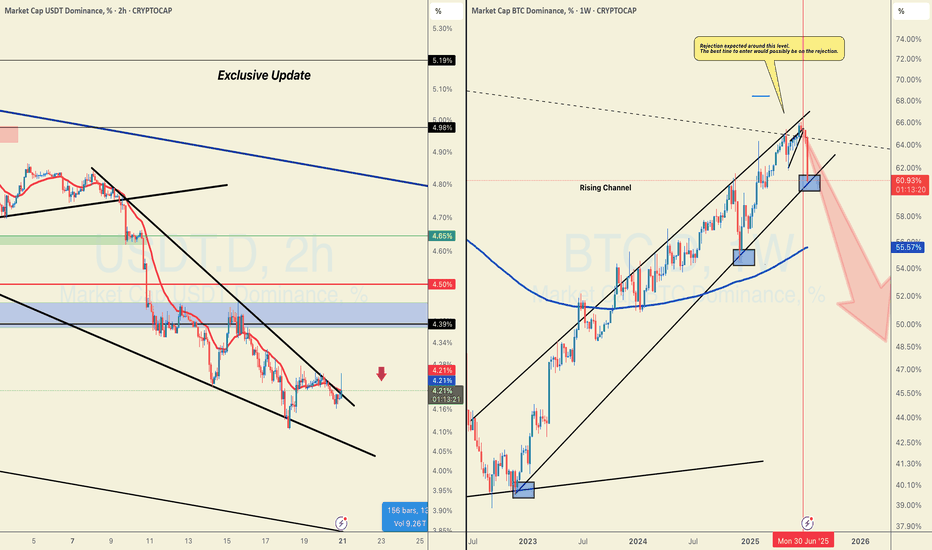

USDT DOMINANCE Update (2H)After losing important levels, the price has now started to pull back, and it seems that some of the market’s major players have taken profits.

On the chart, the price faces two key levels ahead, from which it could be rejected at either one.

There is also a possibility that the price will reach the key level zone.

We are waiting for the reaction to these levels.

A daily candle close above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

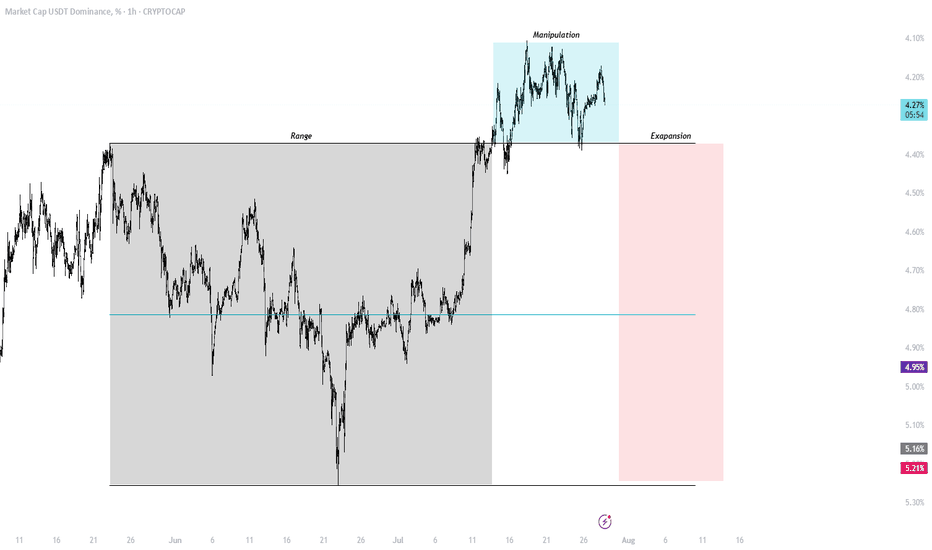

USDT.D | Macro Breakdown on the Horizon?From a monthly perspective, CRYPTOCAP:USDT.D is showing a textbook bearish descending triangle at the top — right after a decade-long uptrend. Price has repeatedly failed to break above resistance, forming a series of lower highs and consistent support.

Scenario:

If the support gives way and this pattern confirms, we could see a multi-year unwind, with the next major target down at 1.9–2.0%.

The first zone to watch for a reaction is around 3.7–3.8%, but the main macro demand sits much lower.

Why this matters:

A breakdown in USDT dominance typically coincides with a massive rotation into risk-on assets and altcoins — the end of a cycle in stablecoins often sparks the next big phase of the crypto bull market.

Plan:

Watch for confirmation of the breakdown on a monthly close below 3.7%.

Until then, this is just a setup — not a trigger.

$USDT Dominance Breakdown Soon?Here’s a quick take on the CRYPTOCAP:USDT.D 1H chart: USDT dominance is bumping into a key trendline around 4.28%, right below strong resistance at 4.30%.

If it gets rejected here, we could see a drop toward 4.18%, which would be a healthy sign for altcoins.

But if dominance breaks above 4.30% with a strong candle close, that bearish setup gets invalidated.

Keep an eye on this zone, it’s a make-or-break moment.

DYOR, NFA

USDT Dominance – Updated Elliott Wave & ICT AnalysisYesterday, we anticipated a bullish reaction from the 4.20%–4.22% support zone, and the market followed through perfectly. The current structure is forming a contracting triangle (ABCDE), and we are now likely heading into wave E.

🔹 Wave Structure (NeoWave View):

Wave D has reacted sharply from the expected support.

Wave E is now in progress, targeting the 4.42%–4.44% resistance zone.

This could complete the triangle structure and signal a potential trend reversal.

🔸 From ICT/Smart Money Perspective:

The market tapped into a clean bullish Order Block.

Below the support zone, there was clear liquidity sweep followed by a strong BOS (Break of Structure) upward.

All signs point to short-term strength in USDT.D.

📌 Scenarios:

Bullish case (primary): Wave E completes around 4.43%–4.44%, followed by possible reversal.

Invalidation: A break below 4.20% with no bullish defense would invalidate this triangle and require reassessment.

🧠 Takeaway:

This structure could mark a temporary market top for altcoins as USDT.D pushes higher. Keep an eye on the 4.43% level.

📡 Analysis by CryptoPilot – navigating the market with precision.

#CryptoPilot #USDT.D #Elliot #NeoWave #MarketStructure #TrendChannel #BOS #Altcoins #CryptoTrading

NeoWave Analysis – USDT Dominance (4H Timeframe)We are currently observing a Symmetrical Diametric correction pattern unfolding in the USDT Dominance chart. The wave structure labeled A–B–C–D–E shows clear evidence of this complex formation.

✅ Reasons for Diametric Labeling:

• Wave A and B initiated the pattern with a sharp drop (A), followed by wave B extending lower than A’s starting point – an early sign of a non-classical corrective structure.

• Waves C and D developed with alternating strength and duration, reflecting the expanding and contracting rhythm typical of diametric formations.

• Time and Price Alternation between segments is clearly visible, especially the extended duration between waves B and D compared to the earlier legs.

• The current price action is sitting right at the D wave bottom, which acts as a key structural support zone.

🔄 What’s Next?

• From this support, we expect wave E to initiate. In symmetrical diametrics, wave E typically reaches or slightly exceeds the top of wave C.

• A break below the D wave low doesn’t immediately invalidate the diametric scenario but may call for a re-evaluation toward an Expanded or Terminal Diametric.

• Confirmation of wave E may come with a bullish BOS (Break of Structure) on lower timeframes.

📌 Conclusion: We are likely at the early stage of wave E. If this interpretation holds, a bullish move should develop soon.

📡 Analysis by CryptoPilot – navigating the market with precision.

#CryptoPilot #USDT.D #Elliot #NeoWave #MarketStructure #TrendChannel #BOS #Altcoins #CryptoTrading

#BTC.D Just Hit the DAILY SUPPORT, WILL THERE BE A PULLBACK?CRYPTOCAP:USDT is breaking out on LTF while BTC.D just hit support that looks ready to break down.

Not a short call, but if you've been trading well, this is when you reduce margin and cut leverage.

Although I could be wrong about USDT here but profit-taking matters.

We will probably get a pullback this week to enter again.

It's better to watch coins rise a few more waves without you than to give it all back in a few reckless trades.

Spot bags? HODL and DCA.

Futures? Trade cautiously.

DYOR. NFA.

Do show your support with your likes if this post adds any value, and hit the like button.

Thank You

#PEACE

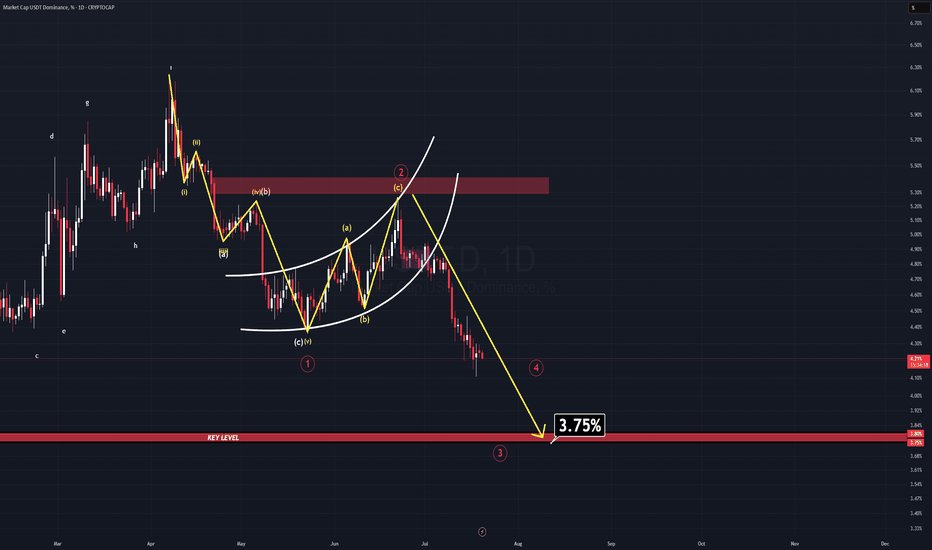

USDT DOMINANCE NEW UPDATE (1D)In a previous analysis, I mentioned that the long-term outlook for this parameter (USDT.D) remains extremely bearish. At the time, a bear flag was clearly visible—but it hadn’t been broken yet.

Well, now it has.

The breakdown confirms the bearish continuation, and there’s still more room to fall. As USDT.D continues to descend towards the projected target for Wave 3, we are likely to see a new All-Time High in Bitcoin, accompanied by a strong rally in many altcoins.

The main target for Wave 3 sits at 3.75%—a historically critical level. For years, USDT.D has never fallen below this zone, making it an extremely strong support area.

⚠️ Reminder: Consider taking profits when USDT.D approaches the 3.80–3.75% region. A reversal or temporary bounce is highly likely there.

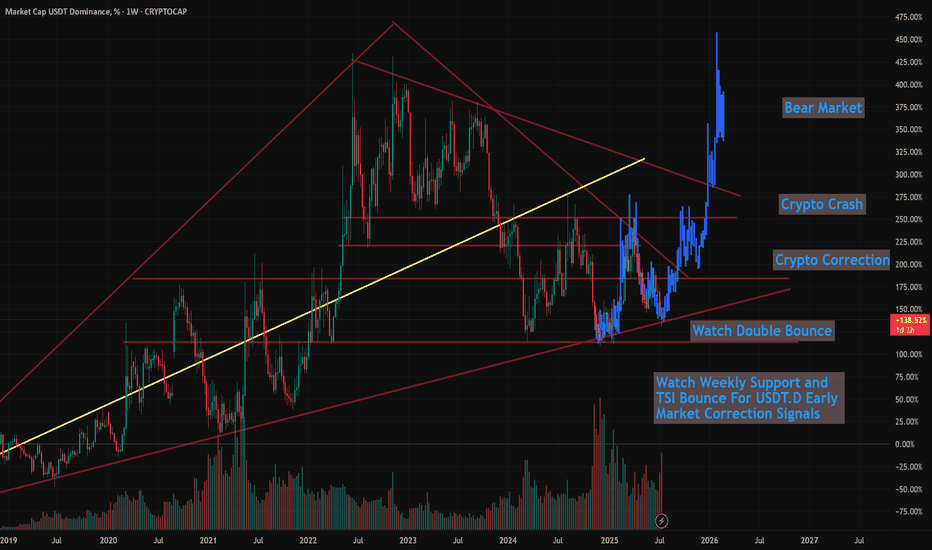

USDT.D Showing Troubling Signs of a Market Top SoonIn this video, I revist the USDT.D study I've talked about a few times before showing that when Tether Dominance comes down to this multi-year trendline support (since 2018), that's typically the beginning of a correction.

It's inversely related for obvious reasons. Money flowing out of Bitcoin and crypto flows into stablecoins (Like Tether), so when one is up and peaking, the other is down and correcting.

This video shows the relationship between both, and how we are likely setting up for a near term correction in the coming weeks.

My best guess is we continue to rally hard into early to mid-August, potentially getting close to $150k, followed by a 20-25% correction into September.

The BIG question is...

Will that mark the top, or will get a 2nd (and maybe 3rd) pump to $200k - $245k as my other models have been showing.

Let me know what you think!