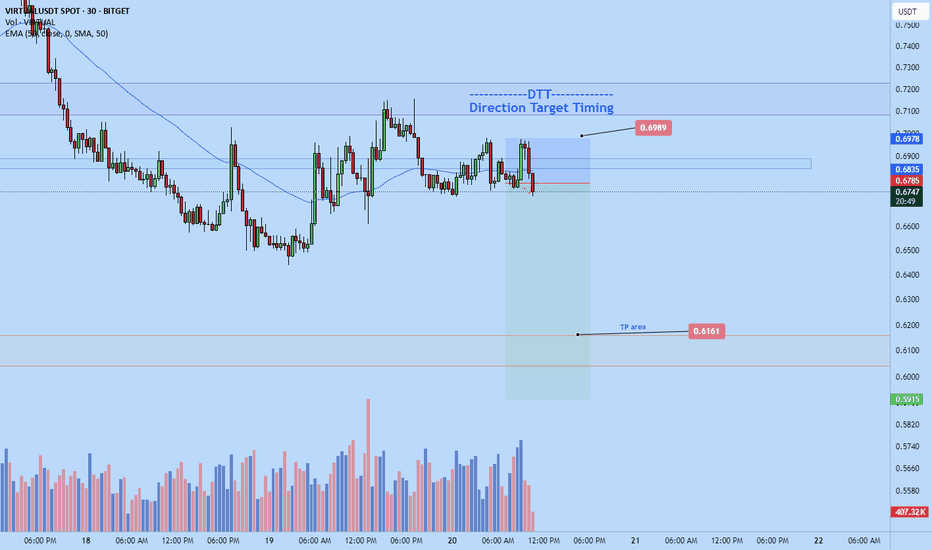

VIRTUALA very interesting project to me, looks like VIRTUAL it will be a good player during the bull market cycle, but at this moment, i think that price correction for Virtual should start now slowly to reach the marked area into the chart.

When reaching that level i will enter into Spot trade for this project.

Good Luck to everyone.

NFA

DYOR

VIRTUALUSDT.P trade ideas

VIRTUALUSDT → Rebound from resistance. Trend break, U-turn?BINANCE:VIRTUALUSDT.P is pausing within an uptrend and forming a range within which signals of a possible reversal and decline are appearing.

Bitcoin is pausing its rally and moving into correction. This is a negative development for altcoins, which will not grow without the flagship.

VIRTUAL is consolidating, but pressure is building in the market (as can be seen from the cascade of resistance levels within the range). Another prerequisite for a breakdown of the market structure is a downward exit from the upward channel (a break of the trend support). Another retest of support at 1.581 could trigger a breakout and a fall. There is a fairly free zone below, and the nearest target is located in the 1.178 zone.

Resistance levels: 1.72, 1.829

Support levels: 1.581, 1.416, 1.178

Focus on the current range of 1.581 - 1.829. The chart shows that the price continues to storm and test support, which is an important signal against the backdrop of a broken uptrend. A break of support at 1.581 and consolidation below this level could trigger liquidation and a fall to the fvg zone or the liquidity zone at 1.178.

Best regards, R. Linda!

VIRTUAL - There will be a correction.Dear my fiends,

In this section, shorting is very risky, everyone. However, after looking at the price movement chart of Virtual/USDT, I’m quite interested in the 1-hour timeframe. Because when drawing the extended Fibonacci, I see it has reached an absolute peak. I’ll try using Elliott Wave to find the price correction area. I’ll only draw short correction waves since this is a correction wave. The price might still surge strongly after completing the correction. So, don’t expect the price to drop too deeply, okay? Oh, I’m not drawing RSI divergence, because you can already clearly see the divergence on the chart.

Best Regards,

Virtuals Protocol VIRTUAL price analysisThe price of #Virtual is approaching $1.60, the price at which trading began almost six months ago.

It will be harder and harder to push the price of OKX:VIRTUALUSDT.P upward, because just look at the chart and see how much it was bought earlier and at what trading vol it is now growing.

And what will happen to the #Virtual price if it starts selling off "to zero", those who believed in the "marketing prospects" of #VirtualsProtocol at the time - and as it turned out - bought at highs... ?

The levels shown on the chart are working quite well and can serve as a good guide for making trading decisions.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Breaking: Virtual Protocol ($VIRTUAL) Spike 29% Today Built on the Ethereum chain, Virtual protocol's native token ( SPARKS:VIRTUAL ) saw a noteworthy uptick of 29% today albeit the crypto market growth was modest today.

With the RSI at 75 and momentum growing, SPARKS:VIRTUAL seems poised to break the pass the $1.60 resistant zone and reclaim the $1 Billion market cap eventually.

On a bearish tone, failure to break pass the 1-month high pivot could resort to a consolidatory move to the 38.2% Fibonnaci retracement point a level technically seen as the support point.

What is Virtuals Protocol?

Virtuals Protocol (VIRTUAL) is an innovative cryptocurrency that aims to revolutionize virtual interactions through its AI and Metaverse protocol. Serving as the infrastructure layer for co-owned, human-curated, plug-and-play gaming AIs, Virtuals Protocol is at the forefront of integrating artificial intelligence with immersive virtual environments.

Virtuals Protocol Price Data

The Virtuals Protocol price today is $1.36 USD with a 24-hour trading volume of $410,193,840 USD. Virtuals Protocol is up 32% in the last 24 hours. The current CoinMarketCap ranking is #73, with a market cap of $886,828,030 USD. It has a circulating supply of 652,196,092 VIRTUAL coins and a max. supply of 1,000,000,000 VIRTUAL coins.

Virtual Protocol (VRT) | Low Data Play | (April 2025)Virtual Protocol (VRT) | Short Bias | Structure + Low Data Play | (April 27, 2025)

1️⃣ Insight Summary:

Virtual Protocol, a new AI-driven project, is catching attention, but there's limited fundamental data available. We’re mainly focusing on technical structure and market flow to guide this idea.

2️⃣ Trade Parameters:

Bias: Short

Entry Zone: Watching for structure confirmation below $1

Stop Loss: To be placed above recent structure highs (adjust depending on breakout behavior)

TP1: $1.00

TP2: $1.50

Partial Exits: Optional partials once we break through major support zones under $1

3️⃣ Key Notes:

✅ Limited fundamental backing at the moment — mainly a technical play.

✅ Structure looks fragile; awaiting a clean breakdown to confirm.

✅ Watch correlation and sentiment in AI/crypto sectors — strength in related assets might delay breakdowns.

❌ Risk if structure holds above key support or if macro sentiment flips bullish.

4️⃣ Follow-up:

I’ll keep monitoring this setup and will update if we see a clean break or if sentiment shifts dramatically!

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

VIRUAL/USDT: Bearish Triangle Pattern with Attractive On the 1-hour chart of VIR/USDT (Virtuals Protocol) on MEXC exchange, we can observe the formation of a bearish triangle pattern indicating a probable continuation of the downtrend.

Technical Analysis:

The coin has formed two significant peaks and is now on a downward trajectory

Current price: 0.54424 with a change of -0.34% in the recent trading session

Breaking the support line around 0.54 could pave the way for further downward movement

Trading Strategy:

Entry price: 0.54424

Price target: 0.05768 (potential profit of 10.58%) with a quantity of 5,768 and position size of 1620.48

Stop loss: 0.02324 (risk of 4.26%) with a quantity of 2,324 and position size of 750

Attractive risk to reward ratio: 2.48

Looking at the indicators, we can observe that the downtrend is gaining strength, and the probability of a downside breakout is very high. It is recommended that traders pay attention to temporary resistances in the downward path and always use a stop loss.

This trading idea is suitable for individuals with moderate risk tolerance, and it is recommended to allocate a maximum of 5% of your capital to this trade. Also, pay attention to the overall market trend and news related to the Virtuals Protocol.

VIRTUAL/USDT: Key Breakout With Target at 0.6835After consolidating between 0.56-0.62 for several days, VIRTUAL is showing strong bullish momentum with a recent 1.03% gain. The current price of 0.6072 sits at a critical decision point with potential to test the upper resistance level at 0.6835.

Technical analysis shows increasing buying pressure with rising volume and strengthening RSI, suggesting continuation of the uptrend that began on the 14th. My strategy involves entering this long position at the current level with a clearly defined stop loss at 0.5820 to limit downside risk.

Profit target is set at 0.6835, providing a favorable risk-reward ratio of approximately 1:2.5. Key levels to watch include immediate resistance at 0.6200 and support at the recent low of 0.5820. This setup provides a calculated risk approach with significant upside potential as VIRTUAL appears to be gaining momentum.

Virtual seems undeniable....BYBIT:VIRTUALUSDT.P

Virtuals Protocol seems to be on the horizon. Before I have my say I just want to make it clear that researching companies or businesses in the trades/coins that I trade actually have nothing to do with my technical strategy but fundamentally I research every coin ill trade... the reason why would be is say if a chart looked like it had potential and I went over to CMC and found out that this company had nothing going or was flat or just simply didn't interest me. I don't trade it.

Here is a comment i seen was made on CMC "A crypto whale lost $4.46M trading SPARKS:VIRTUAL , then reinvested $1.85M despite prior setbacks, sparking market speculation and strategy concerns."

This is an insight... virtual is like an AI manager doing things that humans can't achieve in the time frame (managing wallets, swapping assets etc)

Good trade forming ill update this.

#VIRTUALUSDT - Head and Shoulders Formation and Targets! Hey there, everyone! Next up, we’re looking at the position for #VIRTUALUSDT. When I combine the volume and RSI components and consider the price being very close to the trendline (with a small breakout on lower timeframes), I’m expecting an Inverse Head and Shoulders formation.

The exact targets will change depending on the breakout confirmation level, but I’ve tried to provide approximate targets in this analysis.

Wishing you all a green-filled day with my best wishes. 🌱

What do you think about my analysis? Drop your thoughts in the comments and let’s discuss!

#AlyAnaliz #TradeSmart #CryptoVision #VIRTUALUSDT