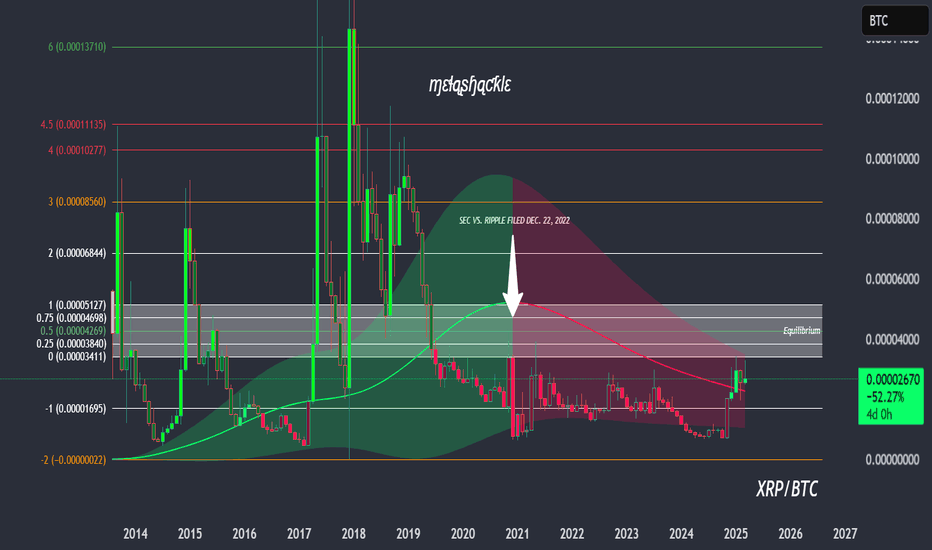

XRPBTC May Face Another Rally This YearXRPBTC pair can be trading in a larger weekly (A)(B)(C) flat correction, where wave (C) can be now in progress as a five-wave bullish impulse back to 2021 highs.

XRPBTC is currently slowing down due to BTC dominance, but notice that it's now testing February 2025 lows, so wave 4 correction can be coming to an end, which can extend the rally for wave 5 of (C) towards 0.000040 area and it can bring the ALTseason.

XRPBTC trade ideas

XRP Alert: $3 Bets Dominate as Massive "Wedge" Pattern SignalThe Anatomy of a Sleeper Awakened: Analyzing the $3 XRP Bet and the Decisive XRP/BTC Technical Pattern

In the relentless and often forgetful cycle of the cryptocurrency market, assets can fall into long periods of dormancy. They become laggards, overshadowed by newer, faster-growing projects, their communities tested, and their price action a flat line of disappointment on a chart full of parabolic curves. For years, XRP has been the quintessential example of such an asset. Plagued by a protracted legal battle with the U.S. Securities and Exchange Commission (SEC) and consistently underperforming its large-cap peers, it became the subject of both unwavering belief from its dedicated "XRP Army" and derision from the wider market.

However, the quietest corners of the market often hide the most tension. Beneath the surface of sideways price action, a confluence of powerful forces is beginning to emerge, suggesting that this slumbering giant may be on the verge of a violent awakening. This shift is not signaled by mainstream headlines or celebrity endorsements, but by the sophisticated and often predictive language of derivatives markets and inter-market technical analysis.

Two specific, potent signals have captured the attention of astute market observers. The first is a stunning development in the XRP options market, where call options with a $3 strike price are inexplicably dominating trading volumes. This is not a modest bet on a 20% gain; it is an audacious, seemingly irrational wager on a 500-600% price explosion. The second is a multi-year technical pattern on the XRP/BTC chart—a massive falling wedge that suggests XRP is coiling for a major rally, not just in dollar terms, but against the market's undisputed king, Bitcoin.

This analysis will conduct a deep dive into these two phenomena. We will dissect the implications of the $3 options bet, exploring the psychology and mechanics behind such speculative fervor. We will then meticulously break down the XRP/BTC wedge pattern, explaining its significance as a measure of relative strength and its potential to unleash a powerful wave of capital rotation. Finally, we will connect these market signals to the underlying fundamental drivers—the aftermath of the SEC lawsuit, Ripple's ongoing business development, and the broader market cycle dynamics—to construct a holistic thesis. While the road ahead is fraught with risk and uncertainty, the evidence suggests that the narrative surrounding XRP is undergoing a seismic shift, moving from a story of legal battles and stagnation to one of profound, speculative optimism.

________________________________________

Part 1: Decoding the Options Market Frenzy - The Audacity of the $3 Bet

To the uninitiated, the options market can seem like an esoteric and complex casino. In reality, it is a sophisticated mechanism for hedging risk and placing directional bets, and the data it generates provides an invaluable window into the collective mind of the market. The current activity in the XRP options market is not just a flicker of interest; it is a roaring fire of speculative conviction centered around a single, audacious number: $3.

Understanding the Language of Options

Before dissecting the significance of this event, it is crucial to understand the basic mechanics at play. A call option gives the buyer the right, but not the obligation, to purchase an asset at a predetermined price (the strike price) on or before a specific date (the expiration date).

For example, a trader buying an XRP call option with a $3 strike price is betting that the price of XRP will rise significantly above $3 before the option expires. If XRP were to reach, say, $4, the trader could exercise their option to buy XRP at $3 and immediately sell it for $4, pocketing the difference.

The key takeaway is that these options are leveraged instruments. A trader can control a large amount of XRP for a small upfront cost (the premium). However, if the price of XRP does not exceed the strike price by the expiration date, the option expires worthless, and the trader loses their entire premium. This makes buying far out-of-the-money (OTM) call options—where the strike price is significantly higher than the current market price—an extremely high-risk, high-reward strategy.

The Significance of the $3 Strike Price

The current market price of XRP hovers around $0.50 to $0.60. A $3 strike price, therefore, is not a bet on incremental gains. It is a bet on a monumental, life-changing rally of approximately 500%. This is what makes the situation so extraordinary. The fact that this specific strike price is the most traded in terms of volume indicates a massive concentration of speculative interest.

This phenomenon can be interpreted in several ways:

1. Extreme Bullish Conviction: The most straightforward interpretation is that a significant number of traders, from retail speculators to potentially larger funds, harbor a deep-seated belief that a major catalyst is on the horizon. This could be related to a final, favorable resolution in the SEC case, a major partnership announcement by Ripple, or the anticipated effects of a full-blown crypto bull market lifting all boats, with XRP expected to be a primary beneficiary. They are willing to risk a small premium for a chance at an exponential payout.

2. "Lottery Ticket" Mentality: A more skeptical view is that these are akin to lottery tickets. The premiums on these far OTM options are relatively cheap. A trader might spend a few hundred dollars on $3 calls, fully accepting that they will likely expire worthless. However, in the infinitesimally small chance that XRP does experience a black swan event to the upside, that small investment could turn into tens of thousands of dollars. It is a bet on volatility and a low-probability, high-impact event, rather than a nuanced analysis of fair value.

3. Potential for a Gamma Squeeze: This is a more complex but critical possibility. When a large number of call options are purchased, the market makers who sell these options are left with a short position. To hedge their risk, they must buy the underlying asset (XRP). As the price of XRP begins to rise and approach the strike price, the market makers' risk increases exponentially, forcing them to buy more and more XRP to remain hedged. This reflexive loop—rising prices forcing more buying, which in turn pushes prices even higher—is known as a gamma squeeze. The massive open interest at the $3 strike, while currently far away, builds a foundation of potential explosive fuel. If a rally were to gain serious momentum and push past $1, then $1.50, the hedging pressure on market makers would begin to mount, potentially turning a strong rally into a parabolic one.

4.

Analyzing the Volume and Open Interest

"Dominating trading volumes" means that more contracts for the $3 strike are changing hands daily than for any other strike price, whether it's a more conservative $0.75 or $1.00 call. This indicates active, ongoing betting. Open interest, on the other hand, refers to the total number of outstanding contracts that have not been settled. High open interest at the $3 strike signifies that a large number of participants are holding these positions, not just day-trading them. They are maintaining their bet over time, waiting for the anticipated price move.

The sheer concentration of both volume and open interest at such a high strike price is a powerful sentiment indicator. It tells us that the "smart money" or, at the very least, the most aggressive speculative capital, is not positioning for a minor recovery. It is positioning for a complete and total repricing of the asset. While this does not guarantee the outcome, it creates a self-fulfilling prophecy dynamic. The knowledge that this much speculative interest exists can itself attract more buyers, who want to front-run the potential squeeze.

________________________________________

Part 2: The Technical Tale of the Tape - XRP/BTC's Coiled Spring

While the options market provides a glimpse into the speculative sentiment surrounding XRP's dollar value, a far more profound story is being told on the XRP/BTC chart. This trading pair is arguably one of the most important long-term indicators for any altcoin, as it measures its performance not against a fiat currency, but against the crypto market's center of gravity: Bitcoin.

The Crucial Importance of the XRP/BTC Pair

When XRP/USD rises, it can simply mean the entire crypto market, led by Bitcoin, is in an uptrend. However, when XRP/BTC rises, it signifies something much more powerful: XRP is outperforming Bitcoin. This means that capital is actively rotating out of the market leader and into XRP, seeking higher returns. A sustained uptrend in the XRP/BTC pair is the hallmark of a true "altcoin season" for that specific asset and is often the precursor to the most explosive, parabolic moves in its USD valuation.

For the past several years, the XRP/BTC chart has been a painful sight for XRP holders. It has been in a brutal, grinding downtrend, meaning that even when XRP's dollar price rose, holding Bitcoin would have been a more profitable strategy. This long period of underperformance, however, has forged one of the most powerful bullish reversal patterns in technical analysis: a falling wedge.

Anatomy of the Falling Wedge

A falling wedge is a technical pattern that forms when an asset's price makes a series of lower highs and lower lows, with the two trendlines converging. The key characteristic is that the lower trendline (support) is less steep than the upper trendline (resistance).

• Psychology Behind the Pattern: The pattern represents a battle between buyers and sellers where the sellers are gradually losing their momentum. Each new push lower by the bears is met with more resilience from the bulls, and the price fails to fall as far as it did previously. The contracting range signifies that volatility is decreasing and energy is being stored. It is a period of consolidation that often precedes a major trend reversal. The bears are getting exhausted, and the market is coiling like a spring.

• The Breakout: The bullish signal is triggered when the price breaks decisively above the upper trendline (resistance) of the wedge. This breakout indicates that the balance of power has finally shifted from the sellers to the buyers. A valid breakout is typically accompanied by a significant increase in volume, confirming the conviction behind the move.

• Price Target: Technical analysts often measure the potential price target of a wedge breakout by taking the height of the wedge at its widest point and adding it to the breakout point. Given that the XRP/BTC wedge has been forming for several years, its height is substantial, suggesting that a successful breakout could lead to a rally of 200-300% or more against Bitcoin.

Analyzing the XRP/BTC Chart

The multi-year falling wedge on the XRP/BTC weekly and monthly charts is a textbook example of this pattern. It encapsulates the entire bear market and period of underperformance since the previous cycle's peak. The price has been tightening into the apex of this wedge for months, signaling that a resolution is imminent.

A breakout from this pattern would be a technical event of immense significance. It would signal the end of a multi-year bear market against Bitcoin and the beginning of a new cycle of outperformance. Traders and algorithms that monitor these patterns would interpret it as a major "buy" signal, potentially triggering a flood of new capital into XRP.

This technical setup provides a logical foundation for the seemingly irrational optimism seen in the options market. The traders betting on $3 XRP are likely looking at the XRP/BTC chart and seeing the same thing: the potential for a violent and sustained reversal. A 200% rally in XRP/BTC, combined with a rising Bitcoin price in a bull market, could easily provide the momentum needed to propel XRP's dollar valuation into the multi-dollar range. The two signals are not independent; they are two sides of the same coin, reflecting a deep and growing belief in an impending, historic rally.

________________________________________

Part 3: The Fundamental Undercurrents - The 'Why' Behind the 'What'

The explosive options activity and the powerful technical pattern are the "what." They are the observable phenomena. But to build a robust thesis, we must understand the "why." What fundamental shifts are occurring to justify this renewed optimism? The answer lies in a combination of legal clarity, steady business development, and predictable market cycle dynamics.

The Aftermath of the Ripple vs. SEC Lawsuit

The single greatest cloud hanging over XRP for years has been the SEC lawsuit, filed in December 2020, which alleged that XRP was an unregistered security. This created massive regulatory uncertainty, leading to its delisting from major U.S. exchanges and causing institutional capital to shun the asset.

In July 2023, a landmark summary judgment was delivered by Judge Analisa Torres. The key takeaways were:

1. Programmatic Sales of XRP on exchanges do not constitute securities transactions. This was a monumental victory for Ripple and the XRP community. It provided the legal clarity that exchanges needed to relist XRP, and it affirmed that for the average retail buyer, XRP is not a security. This removed the primary existential threat to the asset.

2. Institutional Sales of XRP were deemed securities transactions. This was a partial victory for the SEC, but it was confined to Ripple's direct sales to institutional clients in the past.

While the case is not fully over—with final remedies and penalties for institutional sales still being determined—the market has correctly interpreted the main ruling as a decisive win. The risk of XRP being declared a security across the board has been neutralized. This clarity is the single most important fundamental catalyst. It allows exchanges, investors, and partners to engage with XRP with a level of confidence that was impossible just a few years ago. The market is now looking past the remaining legal wrangling and focusing on the future.

Ripple's Unwavering Business Development

Throughout the entire legal battle, Ripple, the company, never stopped building. Its core mission is to use blockchain technology to improve cross-border payments, a multi-trillion dollar industry ripe for disruption. XRP, the digital asset, is central to its flagship product, Ripple Payments (formerly On-Demand Liquidity or ODL). This service uses XRP as a bridge currency to enable instant, low-cost international payments without the need for pre-funded nostro/vostro accounts.

Ripple has been steadily expanding its payment corridors, securing licenses in key jurisdictions like Singapore, Dubai, and Ireland, and forging partnerships with financial institutions around the globe. Furthermore, the company is actively involved in the development of Central Bank Digital Currencies (CBDCs), piloting its technology with several nations.

The recent announcement of a Ripple-issued stablecoin pegged to the U.S. dollar further expands its ecosystem. This move positions Ripple to compete in the massive and growing stablecoin market, leveraging the XRP Ledger's speed and efficiency.

This steady, behind-the-scenes progress provides a fundamental anchor to the speculative bets being placed. Unlike many crypto projects that are built on hype alone, Ripple has a real-world use case, a functioning business, and a clear strategy for capturing a share of the global payments market. The resolution of the SEC case allows this fundamental value proposition to finally come to the forefront.

The Inevitable Laggard Rotation

Finally, the optimism surrounding XRP can be explained by classic crypto market cycle dynamics. A typical bull market cycle follows a predictable pattern of capital rotation:

1. Bitcoin Leads: Capital first flows into Bitcoin, the market's most established and trusted asset.

2. Rotation to Ethereum: As Bitcoin's gains begin to slow, profits are rotated into Ethereum, the leading smart contract platform.

3. Large-Cap Altcoins: Capital then flows from Ethereum into other large-cap altcoins.

4. The Laggard Rally: Finally, in the latter stages of a bull run, traders seek out assets that have underperformed, or "lagged," the market. These laggards, often older coins with strong communities, can experience explosive catch-up rallies as a flood of speculative capital seeks the next big move.

XRP is the archetypal laggard. It has massively underperformed both Bitcoin and Ethereum for years. The bets being placed now—both in the options market and on the XRP/BTC chart—are a clear anticipation of this final, powerful stage of the market cycle. Traders are positioning themselves to front-run the great capital rotation into one of the market's most well-known but long-neglected assets.

________________________________________

Part 4: A Sobering Perspective - Risks and Counterarguments

No analysis would be complete without a balanced look at the potential risks that could invalidate the bullish thesis. While the confluence of signals is powerful, success is far from guaranteed.

1. The Options Trap: The most obvious risk is that the $3 call options are simply a mirage. The vast majority of far out-of-the-money options expire worthless. This could be nothing more than a wave of irrational exuberance from retail traders that ultimately amounts to nothing, leaving a trail of lost premiums.

2. The False Breakout: Technical patterns can fail. The XRP/BTC wedge could experience a "fakeout," where the price briefly breaks above the resistance line only to be aggressively sold back down, trapping hopeful buyers and resuming the downtrend.

3. Lingering Legal Headwinds: While the main ruling was a victory, the final penalty in the SEC case could be larger than anticipated, generating negative headlines and creating short-term selling pressure. Any future regulatory actions targeting other aspects of the crypto space could also have a chilling effect.

4. Adoption and Competition: Ripple's success is not preordained. The cross-border payments space is fiercely competitive, with traditional players like SWIFT innovating and other blockchain projects vying for market share. The ultimate success of Ripple's business model—and by extension, the utility-driven demand for XRP—is still a long-term question.

5. Centralization and Supply Concerns: A long-standing criticism of XRP is the centralized nature of its ledger and the large portion of the total XRP supply held in escrow by Ripple Labs. While Ripple has a predictable schedule for releasing this escrow, it represents a potential source of selling pressure and a point of concern for those who prioritize decentralization above all else.

Conclusion: The Convergence of Evidence

The case for a significant XRP rally is a tapestry woven from multiple, converging threads of evidence. It is not based on a single indicator but on a powerful confluence of speculative sentiment, technical structure, and fundamental catalysts.

The frenzied buying of $3 call options is the market screaming its ambition, a raw and unfiltered signal of extreme bullishness. It is a bet not just on recovery, but on a complete paradigm shift in the valuation of XRP. This audacious sentiment finds its technical justification in the multi-year falling wedge on the XRP/BTC chart—a coiled spring of potential energy that, if released, would signal a historic rotation of capital into the long-suffering asset.

Underpinning these market signals is a strengthening fundamental picture. The crucial legal clarity from the SEC lawsuit has removed the single greatest obstacle to XRP's progress, allowing the market to finally price in the steady, persistent work Ripple has done in building a global payments network. Combined with the predictable dynamics of a crypto bull cycle, where laggards eventually have their day in the sun, the stage appears to be set.

The journey to $3—and beyond—is still a marathon, not a sprint. It is fraught with the risks of failed patterns, expiring options, and the inherent volatility of the crypto market. However, for the first time in years, the narrative is not one of defense but of offense. The signals are clear: the market is no longer asking if the sleeper will awaken, but is now placing massive, leveraged bets on the magnitude of the roar it will make when it does. The current moment represents the starting gun, and for traders and investors who have been watching from the sidelines, the race for XRP's repricing may have just begun.

Chart history XRPThis analysis will take a lot of time because it is medium-term and the failure point is close and only when it is broken does the analysis fail. Other than that, it is in a downward trend and all the data is explained on the chart.

*In principle, I am not a supporter of any direction, but I am only giving my point of view, which may be right or wrong. If the analysis helps you, then this is for you. If you do not like this analysis, there is no problem. Just ignore it. My goal is to spread the benefit. I am not one of the founders of the currency.

XRP 4444 day mega pump/cycleI used geometric progression by cycles to gain a deeper understanding of what is happening on the graph, apart from what can be seen from the fractals. The fact that the graph repeats itself means that it is cyclical. Cyclicality in infinite time is infinite, which means it has no angles. The circle is the only thing in which one thing is known, namely the ratio of the circumference to its diameter, which allows us to extend the graph into the future using the number Pi. This can also be used in our work by applying mirror zones 69 96, calculating them from the circle.

I expect the start of strong growth on day 4444 in this time range and a breakout at zone 4144, followed by a retest with further growth, according to the fractal.

Translated with DeepL.com (free version)

XRP will start to outperform BTC in coming weeks.XRP will start to outperform BTC in coming weeks.

We have a golden cross on weekly timeframe and is reaching big support around 2000 sats also we had a nice reset on rsi levels between January and now.

On the montly timeframe we had nearly 6 months of consolidation. The next move will be a super explosive possibly a new all time high between xrp/btc.

Skeptic | XRP Analysis: Can It Hit $6 After Bitcoin’s $111k?Hey everyone, Skeptic here! Bitcoin just smashed through the $107K resistance, shaking up the whole crypto scene! Is XRP ready to rocket to $6 ? Curious about spot and futures triggers? Stick with me to the end of this analysis for the full breakdown. 😊 Let’s dive in with the Daily Timeframe. 📊

Daily Timeframe: The Big Picture

After an epic 500% rally , XRP has entered a consolidation phase, which we can spot from the decreasing volume. It’s too early to call this a distribution or re-accumulation, but I’m leaning toward re-accumulation for a few reasons:

Bitcoin’s Uptrend: The ongoing bullish trend in Bitcoin is fueling crypto market liquidity.

Positive XRP News:

Ripple and the U.S. SEC reached a settlement in early May 2025, ending a long legal battle over XRP’s status as a security. Ripple paid a $50 million fine, with $75 million of a $125 million escrow returned. This cleared major regulatory uncertainty, boosting investor confidence and paving the way for broader U.S. adoption.

XRP Spot ETF Speculation: BlackRock reportedly discussed an XRP ETF application with the SEC, and firms like Franklin Templeton and Bitwise have filed for XRP ETFs. With the SEC’s new crypto-friendly leadership, the odds of ETF approval are 80-85% by the end of 2025, potentially unlocking massive institutional capital.

Spot Trigger:

The main trigger is a break and consolidation above 3.3684 , which aligns with breaking the daily consolidation box.

This could kick off a new momentum wave. Expect a sharp breakout, so don’t miss it!

If you’re aiming for a long-term buy, I’ll share lower timeframe triggers to front-run this breakout.

First Target :

After breaking the box’s ceiling, aim for 6.64 . I cloned the box and placed it above, as this often works for target setting. 🙂

Tip: Pay close attention to Bitcoin and USDT.D for better target spotting.

4-Hour Timeframe: Long & Short Setups

On the 4-hour chart, price action is getting tighter and tighter, which is awesome. Why? The longer we range, the more liquidity builds up, setting us up for a sharp move with smaller stop losses compared to trending markets. Here’s the breakdown:

Market Context:

The 4-hour timeframe shows stronger bearish momentum, but remember: the major trend is uptrend, and the secondary trend is consolidation.

For shorts, keep position risk low since we’re in a bullish major trend.

For longs, hold positions longer and, if possible, lock in profits early without closing the entire position.

Long Setup:

Trigger : Open a long after a break above 2.4742 .

Key Notes:

Ensure the break comes with rising volume to avoid a fake breakout.

Reduce profit-taking on this position. Why? Higher levels have more liquidity, leading to sharp moves, making it harder to open new positions.

Short Setup:

Trigger: Open a short after a break below support at 2.2926 .

Advice: Take profits quickly and close the position when you hit your targets.

The current candle looks like it failed to break out and formed a shadow, which could increase the odds of a return to the ceiling and a resistance break.

Front-Running Spot Trigger:

To front-run the daily box breakout, open a position after breaking 2.9789 on the 4-hour timeframe.

XRP/BTC Analysis

XRP/BTC had a solid rally but is now in a price correction, and it’s a weak correction at that. Here’s what to watch:

Key Level : A break above resistance at 0.00002548 could bring back uptrend momentum to XRP/BTC.

Implication: If this breaks, buying XRP becomes more logical than Bitcoin, as XRP could outperform.

Until Then: Stick with longs on BTC, as liquidity is flowing more into Bitcoin, giving it stronger growth potential.

Pro Tip: Checking the BTC pair is a game-changer—trust me! 😎

💬 Let’s Talk!

If this analysis sparked some ideas, give it a quick boost—it really helps! 😊 Got a pair or setup you want me to dive into next? Drop it in the comments, and I’ll tackle it. Thanks for joining me—see you in the next one. Let's grow together! 🤍

Xrp will outperform btc in the coming months.Xrp/btc has double bottomed vs BTC for many years. At some point it will show and prove what it has lacked for almost a half decade. I myself am a long term investor who has called Xrp from the major lows and expect it to gain over btc in the next 6 months.

XRP Vs Bitcoin, A New All-Time High In 2025? Must Read!It is very interesting to see the difference between the BTC trading pairs of different big projects, they are all completely different and this can reveal quite a lot. Since the USDT pairs are all the same, lots of useful information can be extracted from the BTC pairs. We can learn a lot by studying these. We can know the real strength of a project, how people are behaving behind the scenes and support (or deny) our bias for future scenarios.

Here XRPBTC is so different compared to ETHBTC or ADABTC which I reviewed recently, three completely different charts.

Let's go straight to the point. XRPBTC is trading for the first time ever above MA200 on a stable basis. It pierced above in July 2023 but only momentarily, conditions now are completely different. It is above MA200 and to stay.

This is how I interpret this signal, XRPBTC is about to shoot up with major force, its biggest bullish wave since 2017 and possibly a new All-Time High. This is the only one, all the other BTC pairs look shaky for a new ATH because Bitcoin is so strong. This one seems to be able to do it easily, based on the chart.

The only way to keep it simple is by stopping now. But there are some long-term higher lows and the pair a good chart. The chart reveals long-term stability and a solid growing base. Something like this, "The project has been developing nicely and building a solid base in the background. This project is about to experience a major move that is likely to be out of proportion with the rest of the market."

This is likely due to new products XRP is launching. Whatever the reason, XRPBTC is to set to grow, long-term. The short-term can be anything this is not the focus here, the conclusion is a strong bullish wave alas 2017.

Namaste.

XRPBTCThe chart shows XRP/BTC on a logarithmic scale, which helps visualize percentage changes over time. XRP/BTC peaked around early 2018, reaching a value close to 0.0003500 BTC per XRP. This aligns with the crypto market's bull run during that period.

After the 2018 peak, XRP/BTC entered a prolonged downtrend, losing 99% of its value relative to Bitcoin by 2025, as noted in the chart's annotation. The price has been making lower highs and lower lows, indicating a strong bearish trend against BTC.

As of March 2025, the price is at 0.00000222 BTC, up 8.73% on the monthly candle, but still near historical lows.

XRP/BTC: Will XRP Break Out Against Bitcoin?The XRP/BTC pair is showing intriguing signs of potential as it tests key levels of support and resistance. XRP, known for its focus on cross-border payments and its partnerships with financial institutions, remains a widely discussed asset in the crypto space. While the market sentiment around XRP has been volatile due to legal battles and regulatory uncertainty, its fundamental use case in the financial sector continues to draw attention.

The broader market context is bullish for Bitcoin, but XRP's price action against BTC has shown periods of strength, suggesting that it may be ready to capitalize on any altcoin rotation. Technically, XRP is nearing critical price points that could indicate a breakout or a retracement. Keep an eye on market volume and any potential news regarding Ripple’s ongoing legal case, which could impact future price movements.

XRP is just getting started. XRPBTC chart has lots of room left.XRP has made some spectacular moves since the "Trump election pump" began on November 4, 2024, but we haven’t seen anything yet. Bitcoin has been absorbing hundreds of billions of crypto investment dollars during this timeframe, but when money starts fleeing Bitcoin in search of more undervalued assets, XRP will be the prime beneficiary.

Bitcoin is obsolete and is being rejected by countries around the world as a consideration for strategic crypto reserves. ETH is too energy-inefficient and costly to use. XRP is the only viable option. Plus, with RLUSD, the ability to on-ramp or off-ramp has never been easier or more efficient than it is right now.

Get ready!

Good luck, and always use a stop-loss!

You get this opportunity once in 4 yearsHelloOOoooo

this one of the safest entries for XRP

if you look at XRP/BTC chart you will see this is the most important level since 2014!

last time CRYPTOCAP:XRP bounced from it was in 2020 1400 days ago

also, we have bullish RSI and MACD divergence on weekly timeframe

imo XRP going to pump to 0.5 FIB level which is about 400% from here

good luck!

Ripple / BitcoinHere’s my XRP in sats targets. We’re breaking out from an overhead resistance, and we should retest the top of the range, before coming back down to retrace the breakout zone. It doesn’t mean it comes all the way down, but there is a target there, which is land on top of the prior overhead. Good luck. I’m calling $30, sell $28 on this initial pump