Akil_Stokes

WizardSimilar to the OANDA:GBPJPY that I shared, the OANDA:EURAUD has put in a pretty aggressive and direct move into a previous level of structure. However, what makes this opportunity different than "the beast" is that as price approach our level of resistance we started to put in a rising channel which is a loss of momentum pattern along with other clues such as...

Don't catch the falling knife! This is a common warning in the trading industry. Although i do agree with it (in some circumstances), I think what's more important is for us to perform analysis and be confident on where that knife may find a floor at. In the case of the OANDA:GBPJPY I think we've seen that floor which may present us with the opportunity to but...

After a pretty rough end to the week the FX:EURUSD has rallied up into an Ice Zone - Which is a previous price level that has acted as both support and resistance in the recent past. As we venture down to the lower timeframe we'll see that price action has also formed a double top level at that pattern which is a classic price pattern for a bearish reversal....

We had one on Silver last week that played out nicely, now we have another Daily Chore signal setting up on the $EURUSD. This is a short & sweet type of setup where we are looking for a test and rejection of a moving average an an opportunity to catch the next potential move upwards. As mentioned in the video, we have A LOT of high impact news events happening...

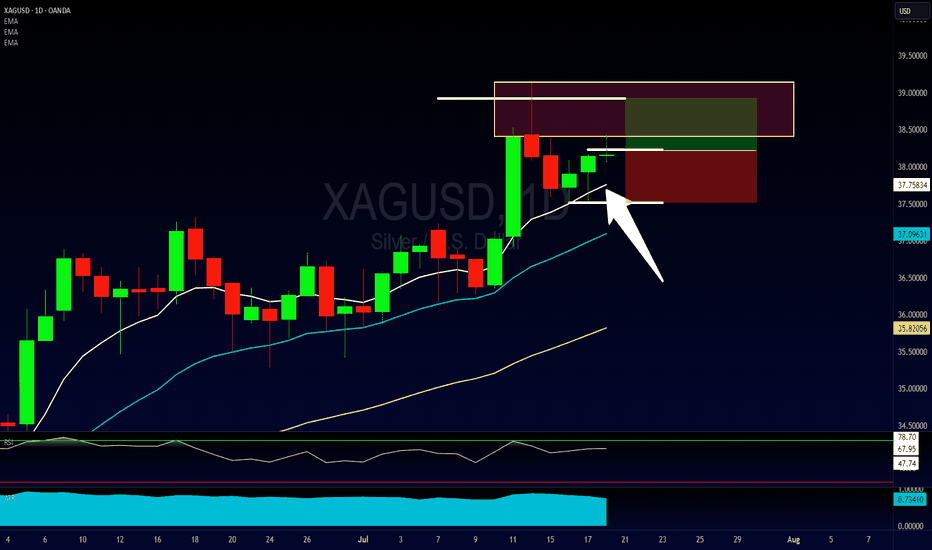

When we last visited Silver we were looking at a Bullish Daily Chore opportunity. That opportunity played out nicely and now that we've officially violated the most recent structure high, it should be relatively smooth sailing to our next level of structure from back in 2011. I say relatively, because the most conservative target area is right above current...

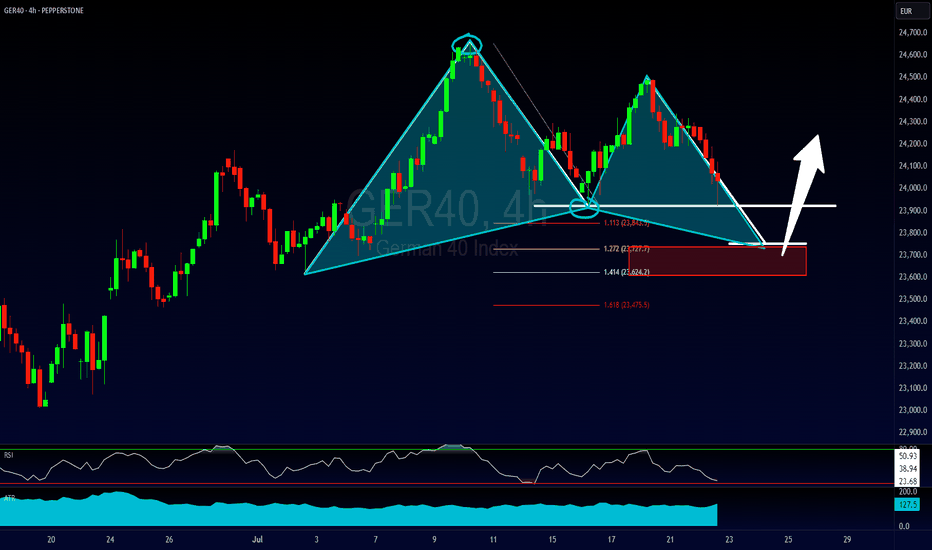

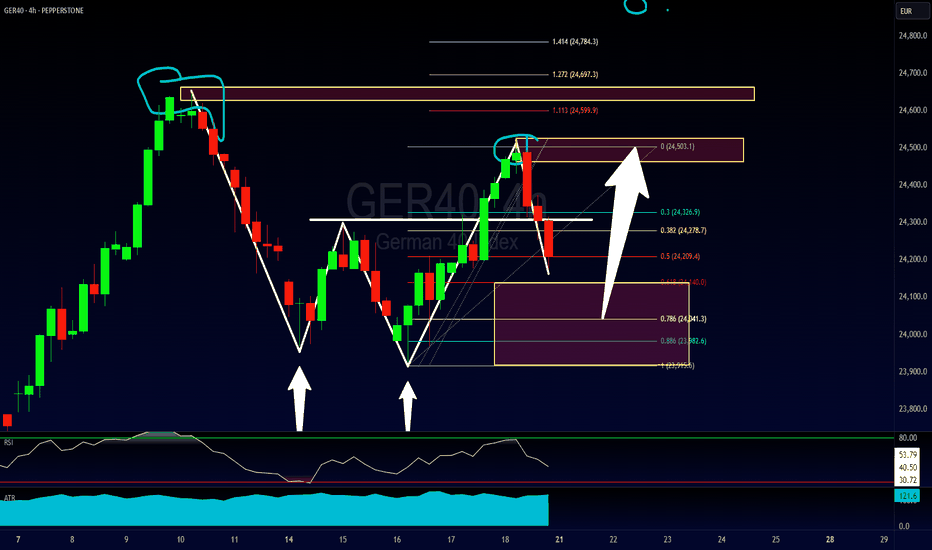

Following up on the 2618 opportunity that we looked at on the FOREXCOM:GER40 this past weekend the market has now created more potential trading opportunities to get involved. 1) A bullish bat pattern that has completed due to a result of a complex pullback into the original double bottom. 2) A potential Kiss of Death trading opportunity 3) A bigger...

A walkthrough of the 2618 Trading Strategy which is a secondary or more conservative way to enter a double top/bottom. In this case, due to the overall directional analysis of the Dax, this also might be a good opportunity to hop on a pullback for a larger bullish trend continuation trade. 2618 RULES Step 1 - Look for double top or double bottom. Step 2 - Wait...

First time I've spoken about this strategy here (as I don't personally trade it myself), but the "Daily Chore" is a very popular one amongst the traders I work with. Essentially what we're looking for is for price action to be on the correct side of our 3 EMA's (8, 20 & 50), and for those EMA's to be running in the correct order. If so, we are then looking for...

The setup that we're looking at in this video is going to be a potential bearish bat pattern on GOLD. However, what's more important is the lesson that I wanted to cover on different tactics for adjusting your stop/loss & dig into the pro's and con's of each. I'd love to hear which way you guys would choose in this particular situation (or in general) so...

Over the weekend we took a look at Silver and predicted that we'd probably see an emotional reaction on the open where a lot of (casual traders) look to get involved (due to the headlines) and unfortunately, pay the price for being late. Now that, that initial group has been shaken out of the market, I want to revisit the metal and show my preferred area for...

Following up a MASSIVE win on the OANDA:EURJPY we may now have a similar trading opportunity setting up on the OANDA:GBPJPY The premise is the same for this one as we're looking at a potential violation of structure followed by a Bullish continuation setup. In this video, we'll look at where we think price can extend to, what needs to happen before we can...

A good trading idea on the GBPUSD, looking at a potential bearish trend continuation trade using a breakout & pullback technique. But an even better trading lesson on the importance of having rules for how to analyze the market so that you can avoid confusion and/or conflicting signals. If you have any questions or comments please leave them below. Akil

A walkthrough of a potential Bearish Cypher pattern & a look at another opportunity that has recently popped up ahead of the potential pattern setup. Questions or Comments - Leave them below! Akil

Despite being a technical trader, there are some fundamental factors floating in the background of today's trading idea. 1) We saw weakness on the GBP today due to some political uncertainty & investors having concerns over the stability of the UK's leadership and economic direction. 2) We saw a drop in the ADP Non-Farm Employment Change for the US Dollar today...

In this video we're taking a look at the OANDA:USDCHF , looking at the idea of this pair being overextended to the bearish side and looking to take advantage of potential bullish relief. There are 3 main signals that we're looking for in this trading example. 1) The Relative Strength Index (RSI) being extremely oversold (currently around 12) 2) Price action...

A look at a potential bearish cypher pattern on gold and an opportunity to trade while the market is stuck in a holding pattern. Akil

A few weeks ago we made an amazing bearish call of the $USDCAD. Now that it's come to an end, the market is showing signs of a potential reversal. In this video we're going to talk about how to identify a potential reversal in trend and of course show you how I'm looking to trade it. Please leave any questions, comments or shared ideas below. Akil

The EURJPY has recently violated an important level of structure leading us to make the prediction of price continuing to go higher. In this video we'll take a look at where the next stopping point may be and what I'm waiting for the market to do in order to get involved in the trade. If you have any questions, comments or just want to share your...