Andrea_Russo_SwipeUP

PremiumToday I want to show you this long investment opportunity by placing a BUY LIMIT order on CHF/JPY. Hello, I'm Forex Trader Andrea Russo, an independent trader and prop trader with $200,000 in capital under management. Thank you in advance for your time. The CHF/JPY pair is building an extremely interesting technical pattern, which could offer one of the best...

Today I want to talk to you about the latest relevant news of the week, focusing on US tariffs and the jobs data sinking the dollar and their overall impact on forex. Hello, I'm Forex Trader Andrea Russo, an independent trader and prop trader with $200,000 in capital under management. Thank you in advance for your time. Let's get started: 1. Disappointing US...

Hello readers, I'm Forex Trader Andrea Russo, and today I'd like to share this SHORT investment opportunity I've identified in the USD/CHF pair. In recent days, USD/CHF has exhibited typical technical exhaustion behavior near key dynamic resistance. The area between 0.81300 and 0.81650 represented a significant supply zone, previously tested with an extended...

Hello, I'm Forex Trader Andrea Russo, and today I want to talk to you about this week's latest geopolitical tensions. 1. The Russian ruble in crisis, weakening against the USD and CNY The ruble fell 1.5% against the dollar and 0.8% against the yuan, following a US ultimatum to Moscow for an immediate truce in Ukraine. FX Impact: The ruble remains vulnerable,...

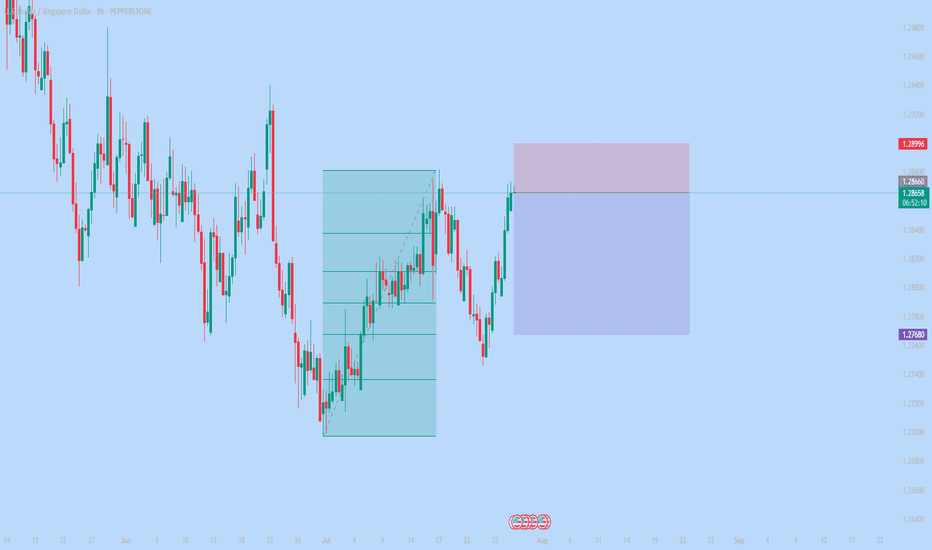

In recent days, an extremely interesting window has opened on the USD/SGD exchange rate, a pair often overlooked by retail traders but highly sensitive to Asian institutional flows. I decided to open a short position, betting on a decline in the US dollar against the Singapore dollar, for a series of structural, real, and measurable reasons. The US dollar has...

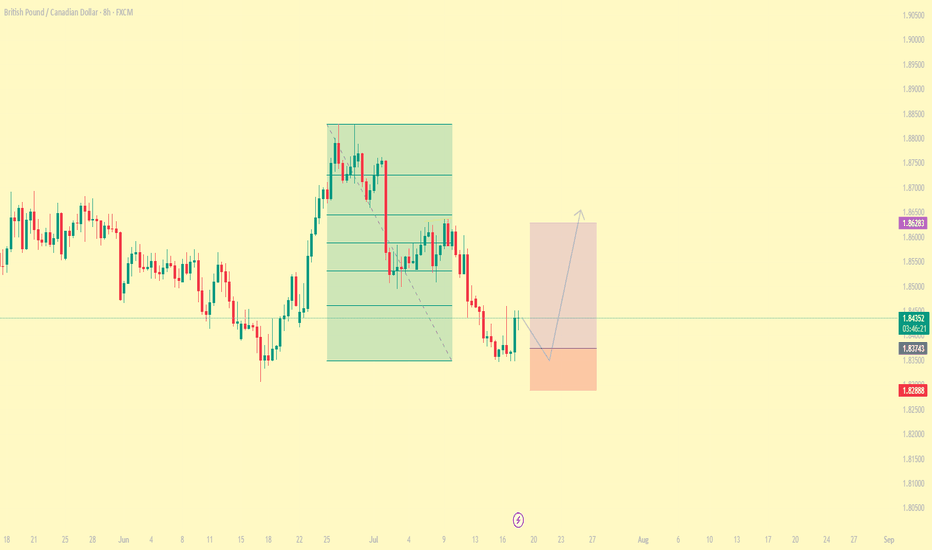

After weeks of compression, GBP/CAD is showing clear signs of institutional accumulation. The price recently released a false bearish breakout below 1.8400, followed by a reabsorption and spike with decreasing volumes: a typical "retail flush" structure. Added to this are clear macro elements: The pound is supported by a still-tight monetary policy, with the...

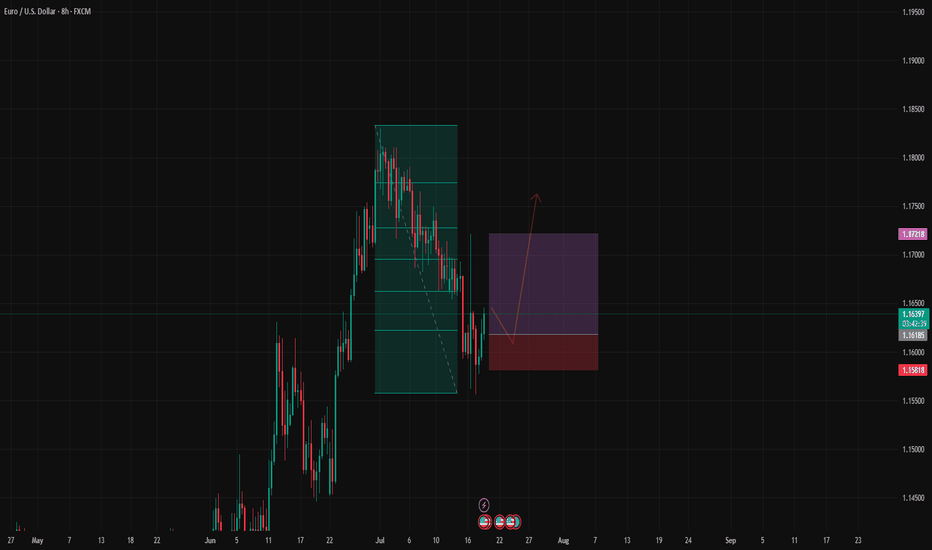

In this scenario, I placed a passive long order on EUR/USD at a key zone that has shown signs of accumulation and institutional defense in recent days. The price showed bearish manipulation followed by a sharp rebound with a V-shaped pattern, often indicative of stop-loss hunting. In these phases, a direct entry is less effective than a passive strategy aimed...

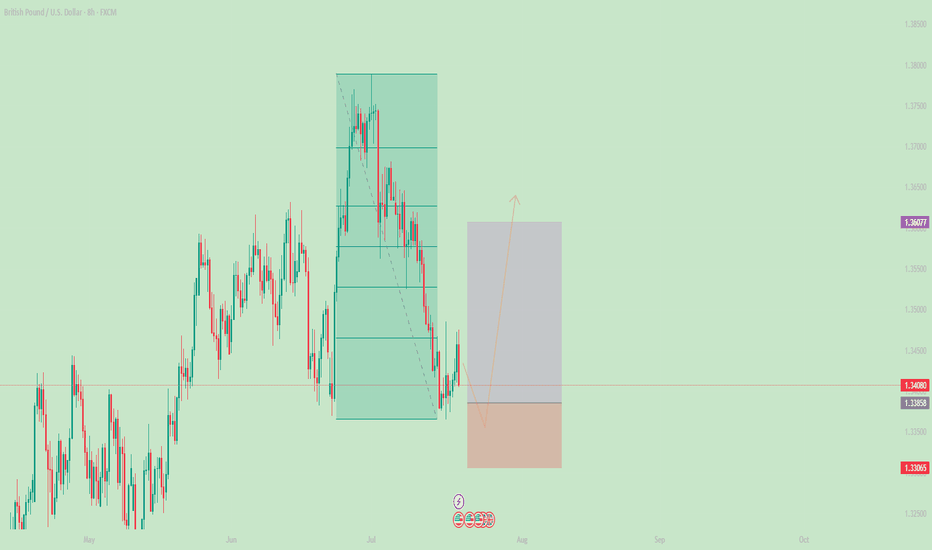

In this article, I want to share the complete trading logic that led me to place a long order on GBP/USD, applying my proprietary SwipeUP v9.3.1 Elite FX model. I won't discuss specific levels, but only the logical structure, because the goal is to demonstrate how hedge funds think and why waiting is sometimes more profitable than impulsive entry. 🔍 Phase 1 –...

We placed a buy limit order at 1,776, waiting for a bearish spike that would allow us to enter alongside the institutions, not against them. Why this entry? 🔻 We're waiting for a false breakout at 1,776, a key level where big players are accumulating liquidity with technical stop hunts. 🔐 The SL is below the levels where banking systems have protective orders...

Global markets are waking up to a currency cold war. Hi, I'm Trader Andrea Russo, and today I want to share the latest news with you. Donald Trump set the day alight, launching a barrage of threats from a rally in Ohio: "If re-elected, I will impose 60% tariffs on all of China, 20% on Mexico, and 10% on the European Union. And I'm telling Putin clearly: if you...

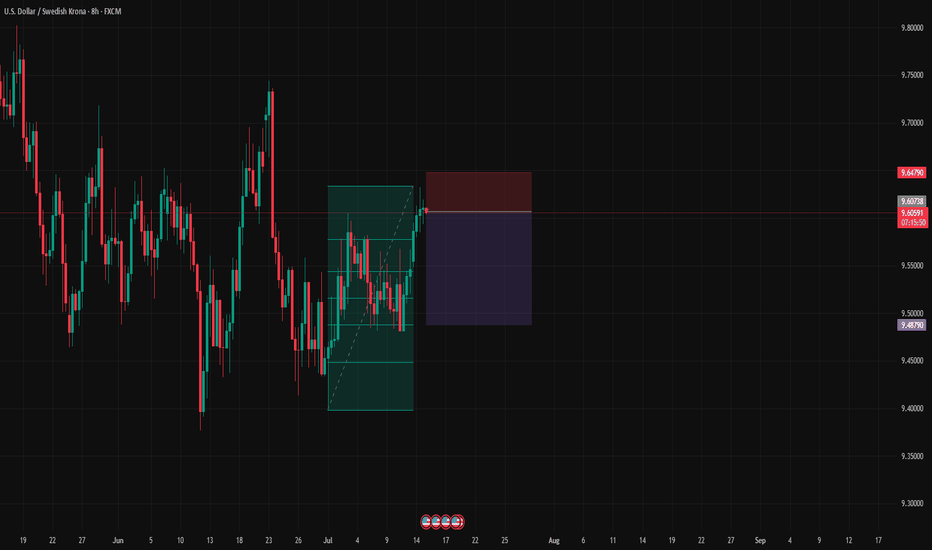

At the opening of the 8-hour candle, the price touched the 200-mark moving average with surgical precision on volume compression, signaling the exhaustion of the bullish movement underway since the end of June. 🔍 What strengthened the short position: The price hit a key area defended by institutions, confirmed by increased open interest and compression in FX...

1. New US Tariff Threats Against the EU and Canada Over the weekend, President Trump announced the sending of formal letters introducing new tariffs: 35% on Canadian goods and potential tariffs for the EU as well (15-20%). Context: The return of protectionism fuels uncertainty. Market Impact: Shift to safe-haven currencies — the US dollar gains ground, while...

Hi, I'm Forex Trader Andrea Russo and today I want to show you this GBP/NOK SHORT opportunity. After a strong upside extension, GBP/NOK is showing signs of exhaustion just below the key resistance zone of 13.83. I thank in advance my Official Broker Partner PEPPERSTONE for the support in writing this article. 📍 Technical Context The pair has recently formed a...

How the world of official digital currencies (CBDCs) is already impacting Forex, opening up new opportunities rarely considered elsewhere. Hello, I'm Forex Trader Andrea Russo. On the one hand, Shanghai is evaluating countermeasures against stablecoins and cryptocurrencies, including yuan-backed currencies, while China is moving closer to a reasonable...

In recent days, the forex world has experienced a sequence of key events that could redefine the global currency landscape in the coming months. Risk to the dollar has become structural, the threat of tariffs is multiplying again, and the combination of geopolitical uncertainty and monetary policy creates an extremely risky mix for exchange rates. Let's start...

In the world of Forex, many retail traders are accustomed to seeking surgical precision in technical levels. Clear lines, pinpoint support, geometric resistance. But the truth is that the market doesn't move in such an orderly fashion. I'm Forex Trader Andrea Russo, and I thank my Official Broker Partner in advance for supporting us in writing this...

Markets have taken a cautious tone this week, as investors digest new developments on global trade and central bank prospects. A mix of US tariff threats, higher OPEC+ oil production and surprisingly strong eurozone investor sentiment is shaping currency flows. I'm Forex Trader Andrea Russo, and I want to thank our Official Broker Partner PEPPERSTONE in advance...

Hello, I am Forex trader Andrea Russo and today I want to talk to you about the week full of tensions and opportunities in global currency markets. The new tariff threats from the United States, the strategic moves of OPEC + and the growing instability in the British government bond market are shaking up the entire Forex landscape, with direct implications on...