Asif_Brain_Waves

PremiumTrade Plan: GBP/JPY — 4H Analysis Market Context Pair: GBP/JPY Timeframe: 4H Date: 6th August 2025 Key Observation: Price attacked weekly sell-side liquidity (PML). CISD (Closed Inside Swing Demand) formed, showing bullish reaction. Higher timeframe weekly buyside liquidity (PMH) is intact and a potential long-term target. Bias: Bullish Key Levels PML...

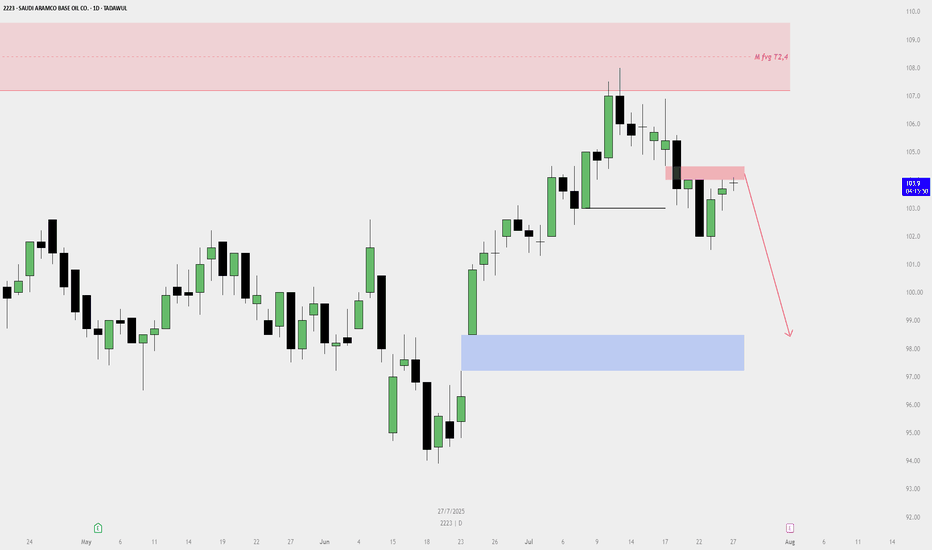

Here’s a **Buy Plan** based on your weekly chart for **Saudi Aramco Base Oil Co. (2223 – Tadawul)**: --- ## 🟢 **Buy Plan: Aramco Base Oil (2223) – Weekly Chart** ### 📊 **Current Market Context:** * **Current Price:** 92.55 SAR * **Recent Swing Low:** 89.00 SAR * **Fair Value Gap (Support Zone):** 100 – 105 SAR (Approximate) * **Major Resistance Zones:** *...

🔻 Sell Plan Summary 🔴 Key Supply Zones: Monthly Fair Value Gap (FVG) / Premium Supply Zone — (Red Box around 108–110 SAR) Labeled as “M fvg T2,4” on your chart. Price previously reversed from this zone, indicating strong selling pressure. Daily Bearish FVG / Rejection Zone — (Red Zone around 104.5 SAR) Price is reacting to this short-term supply area. It...

📊 HBL Analysis – Smart Entry Matters 🎯 Target is Clear: HBL has a well-defined upside target based on our analysis. The overall structure supports a bullish outlook. 💰 Cheap Entry is Key: Ideally, we want to catch an entry from a lower price level to make it a cost-effective and high-probability trade — what we call a “sasta sauda”. 📈 Current Price...

🔍 Mughal Steel – Multi-Timeframe Technical Analysis I’ve been closely analyzing Mughal Steel, and the current structure across Yearly and Monthly timeframes is showing a strong bullish setup with significant upside potential. Here's a quick breakdown: 📅 Yearly Timeframe Insights: Price has reacted from a Yearly Bullish Fair Value Gap (FVG) — a key zone where...

🔍 Multi-Timeframe Market Analysis – Bullish Opportunity Setting Up? I’ve been closely tracking a potential bullish setup using a multi-timeframe approach. Here’s a quick breakdown: 📅 Weekly Timeframe: Price is currently trading inside a Weekly Type 2 Bullish Fair Value Gap (FVG) — a key higher timeframe support zone. No bearish break on weekly structure yet, so...

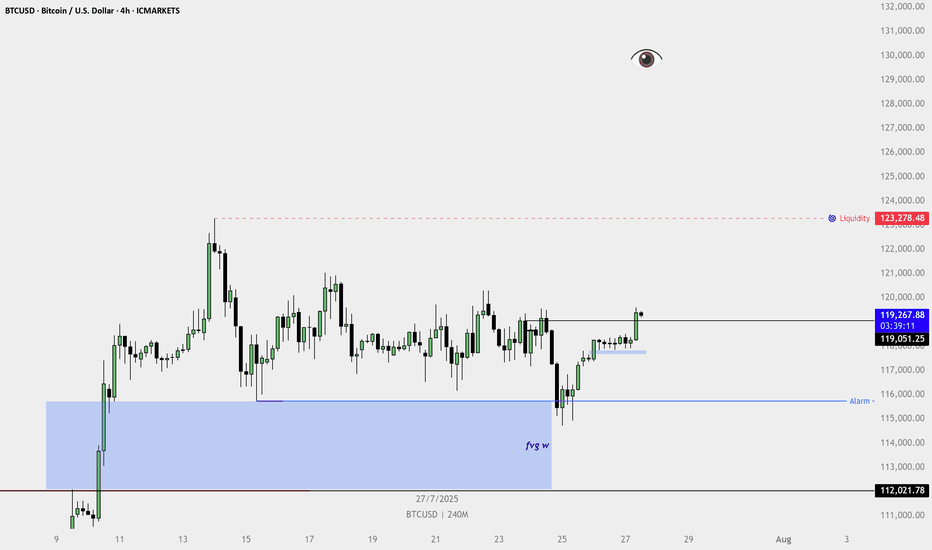

🔍 Technical Highlights: HTF FVG Tap (Marked as "fvg w"): Price reacted strongly from the weekly fair value gap, indicating institutional buying interest from a higher timeframe demand zone. Higher Low + Bullish Break: Price formed a higher low and broke above the recent swing high, confirming a shift to bullish structure. 4H Bullish FVG Formed: After the...

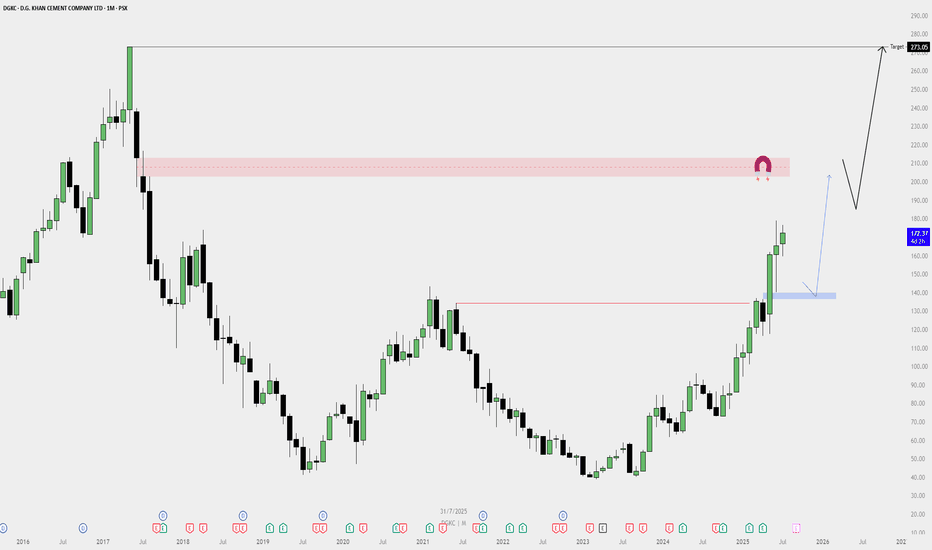

📈 DGKC Monthly Buy Plan — Bullish Outlook ✅ Bias: Strongly Bullish Price has broken major resistance levels with high momentum, forming a big bull trend on the monthly timeframe. 🔍 Key Observations: Break of Structure: Price broke past a major resistance zone (previous high). Strong monthly green candles show institutional interest. Demand Zone (Blue Box): A...

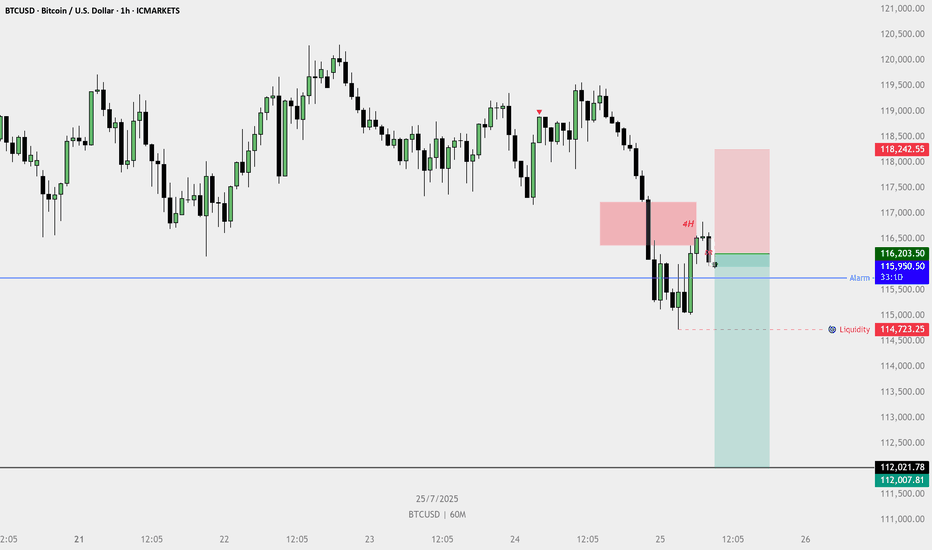

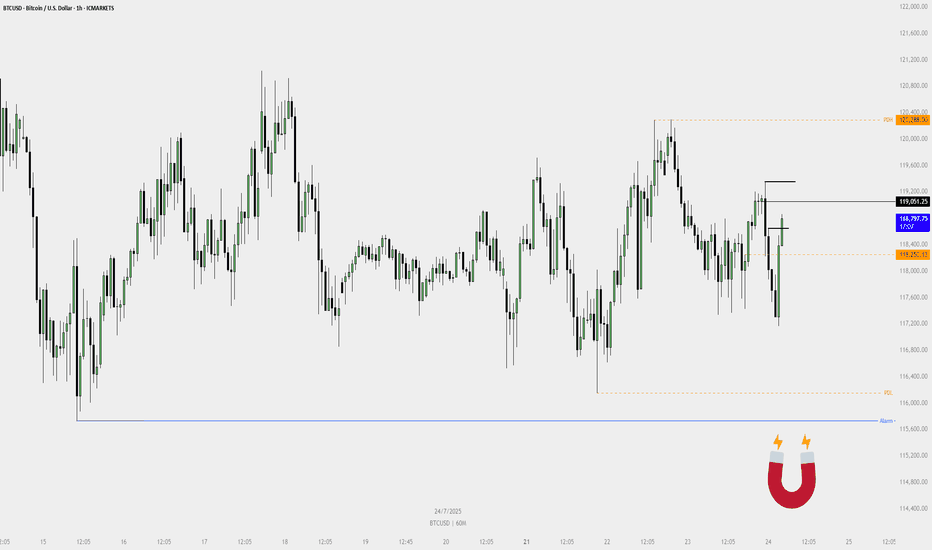

🔍 Trade Idea: SELL BTCUSD (1H) 🔴 Context: Price reacted from a 4H bearish Fair Value Gap (FVG). Formed a lower high after retracement. Price is now respecting the FVG and showing signs of rejection. 🔽 Entry Confirmation: Bearish candle formed inside the 1H structure resistance. Price rejected the 4H FVG and failed to break above. Entry near 116,203.50...

📉 BTCUSD Sell Plan – 1H Chart Previous Day High (PDH) has been swept. A Bearish Fair Value Gap (FVG) has already formed on the H4 timeframe, signaling potential reversal. Price has been struggling to push higher for several days, indicating exhaustion in bullish momentum. A Weekly Bullish FVG lies below, acting as a strong magnet—drawing price toward it. If a...

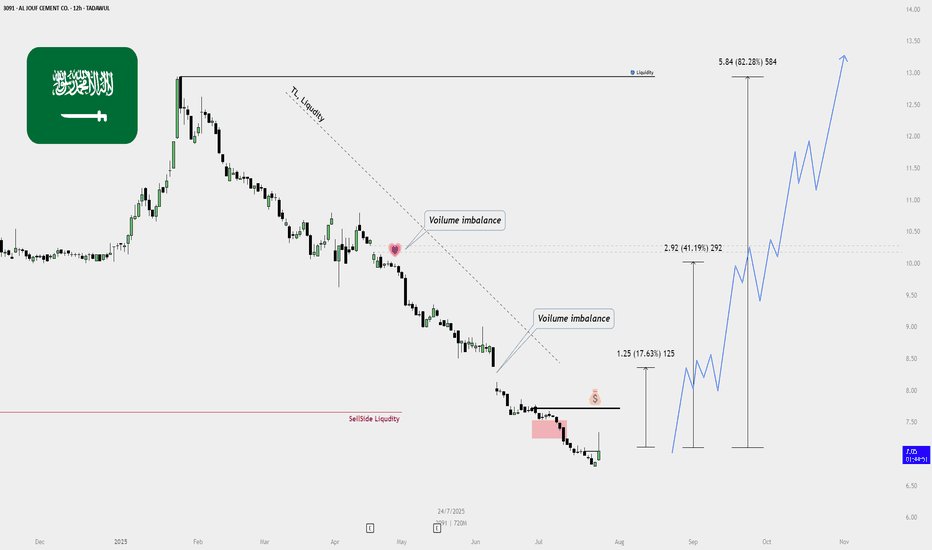

📈 AL JOUF CEMENT – BUY PLAN (TADAWUL: 3091) ✅ Current Status: Price: 7.09 SAR Action: Initial entry taken — some shares added to My portfolio. 🔍 Technical Overview: Sell-side Liquidity Cleared: Previous lows taken out, triggering liquidity sweep. Strong reversal suggests potential shift in market sentiment. Volume Imbalances (Voids): Bullish targets marked...

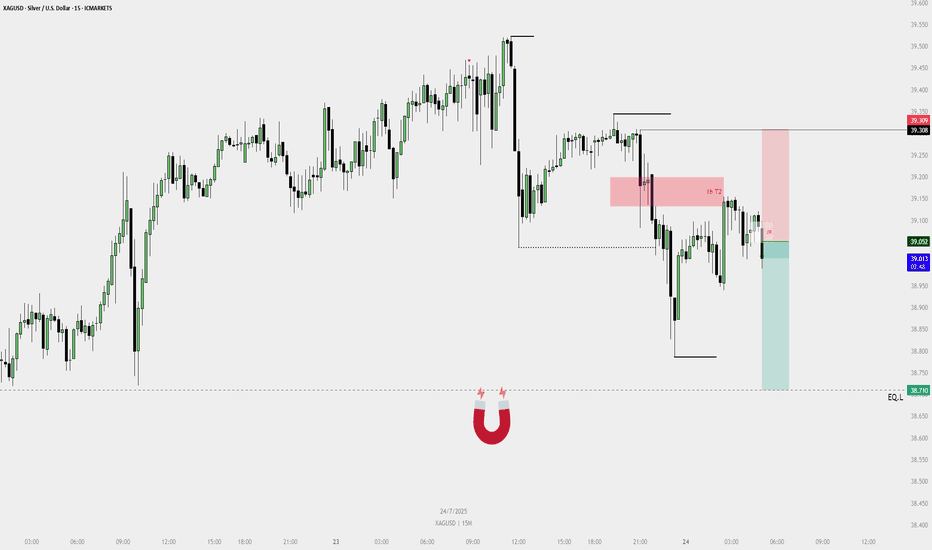

🟥 Sell Plan – XAGUSD (15M) Context: Price swept liquidity from the previous swing high near the red FVG zone. Reacted from H1 T2 bearish FVG. Dealing Range (DR) confirmed in the 15M timeframe. Bearish FVG formed, followed by a break of internal structure to the downside. 🔻 Trade Narrative: After sweeping the short-term high, price tapped into the 1H T2...

📈 Weekly Buy Plan – TASI Context: Price has made a deep pullback into a higher timeframe discount zone (highlighted in blue). A sweep of 2024 low has occurred — clearing out liquidity and triggering a potential reversal. After the sweep, price showed strong rejection and formed a Weekly Bullish Fair Value Gap (FVG). A valid bullish Dealing Range has now formed...

📉 XAGUSD Sell Plan – 15M Bias: Bearish Timeframe: 15-Minute Date: July 23, 2025 🧠 Reasoning Liquidity Grab: Price is sweeping short-term highs during New York open. No More FVGs Above: Price seems to be exhausting upward momentum. Magnet Below: Equal lows (EQ_L) acting as a liquidity pool. Tokyo low also lies below current price — another liquidity...

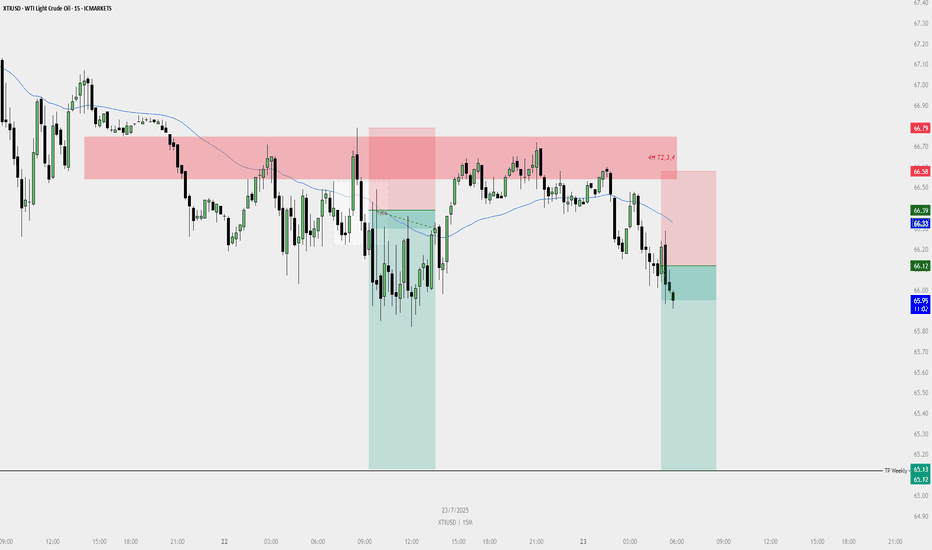

📉 SELL PLAN – XTIUSD (15M) 🗓️ Date: 23 July 2025 ⏱️ Timeframe: 15-Minute 🔍 Context & Reasoning: HTF Supply Zone (Red Zone) Price entered the red HTF zone (noted as “4H T2,3,4”) and showed rejection. This zone aligns with potential 4H Fair Value Gaps / Supply. Sweep & Rejection Liquidity sweep above previous highs followed by immediate bearish reaction. Entry...

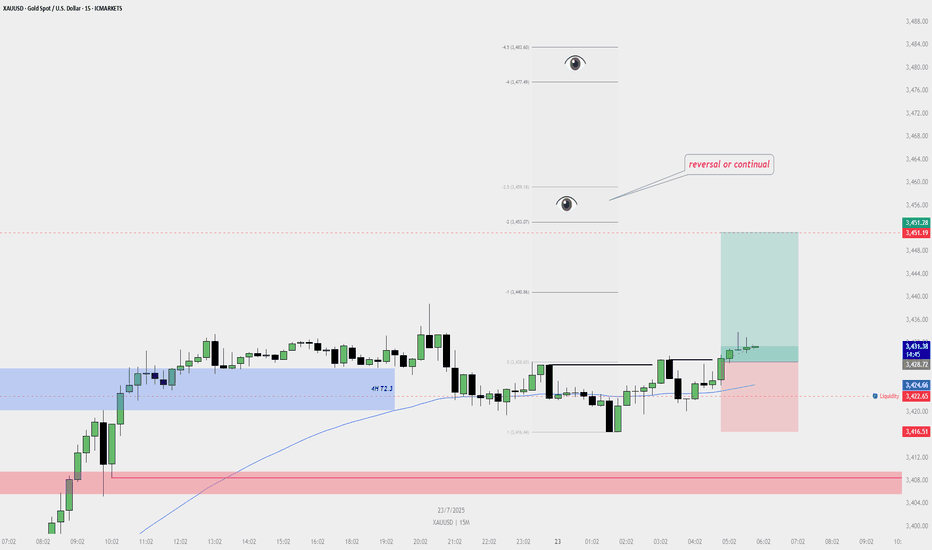

📈 Buy Plan – XAUUSD (Gold Spot) | 15M Chart Entry Reason: Price reclaimed liquidity below the internal range and formed a bullish shift in structure. A valid bullish dealing range was confirmed, supported by the 200 EMA and 4H T2.3 zone. ✅ Entry Zone: ➤ Entry taken after confirmation above short-term swing high ➤ Liquidity sweep confirmed below M15...

📈 MERIT – Buy Plan Timeframe: Daily Chart | Dealing Range Formation: H4 🔷 Buy Confirmation Conditions: Price must close above the black candle series A bullish Fair Value Gap (FVG) must form after that closure H4 Dealing Range must be valid and confirmed (details below) ✅ Valid Bullish Dealing Range – 5 Points: Attacking HTF POI: Price reacts from a Higher...

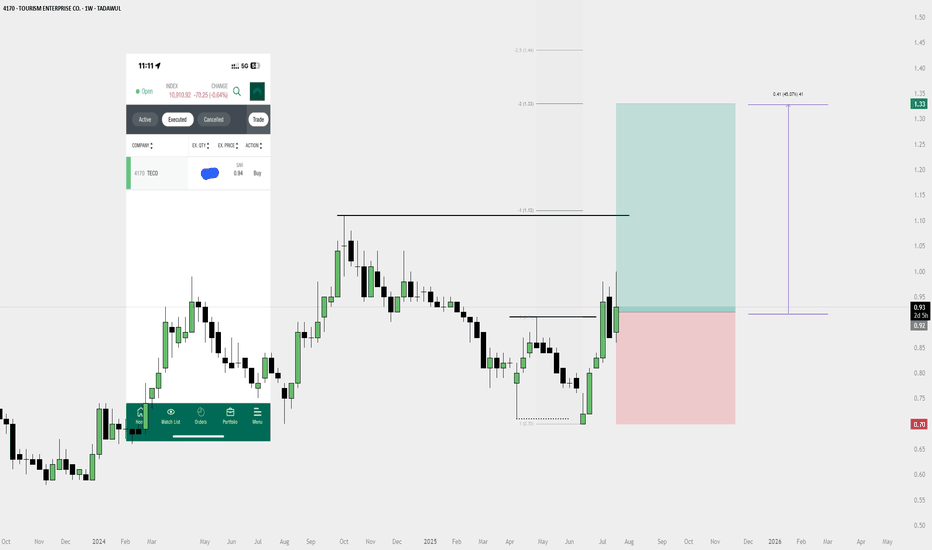

📈 Weekly Buy Plan – 4170 (Tourism Enterprise Co.) Bias: Bullish Entry: 0.93 Stop Loss: 0.70 Target: 1.33 (2R) Target Gain: +45% Reasoning: ✅ Weekly structure break ✅ Bullish FVG respected ✅ Strong impulse move ✅ Pullback to FVG + BOS = High-probability setup Holding for higher timeframe continuation. Invalidation below 0.70.